xChief 2025 Review: Everything You Need to Know

Summary

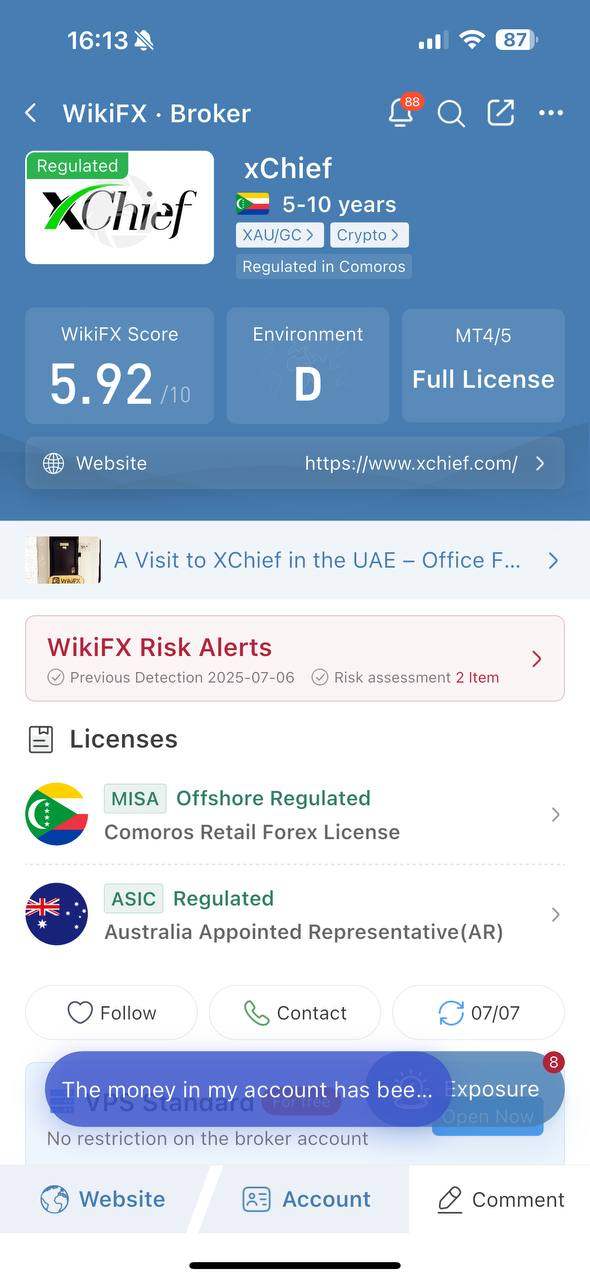

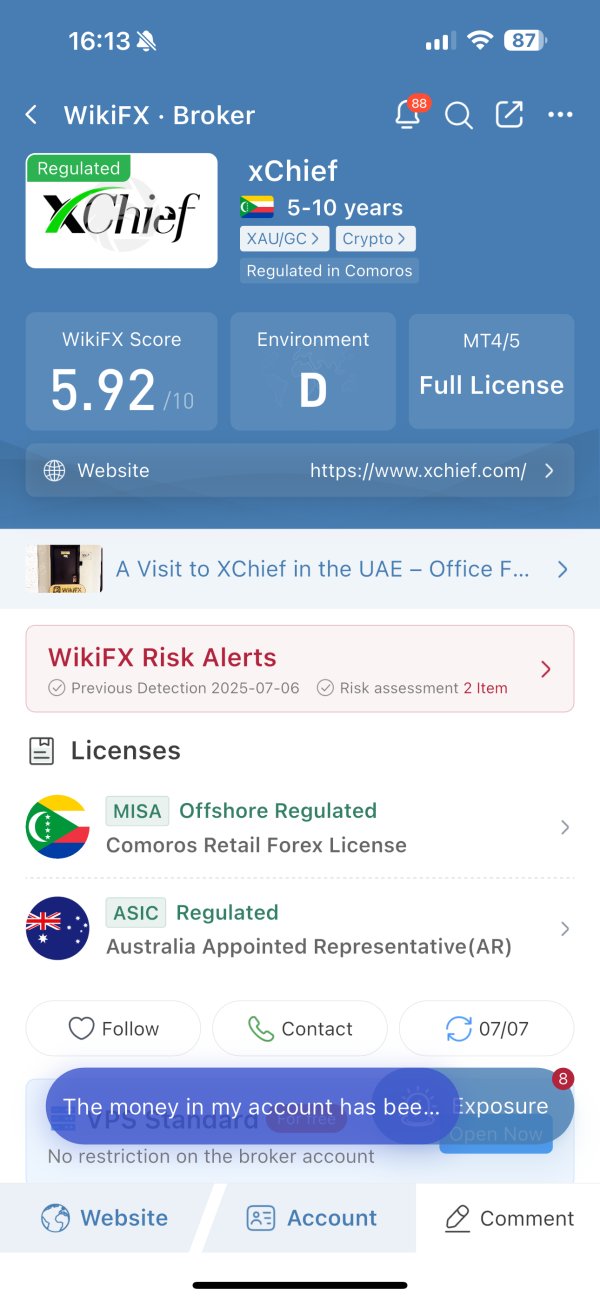

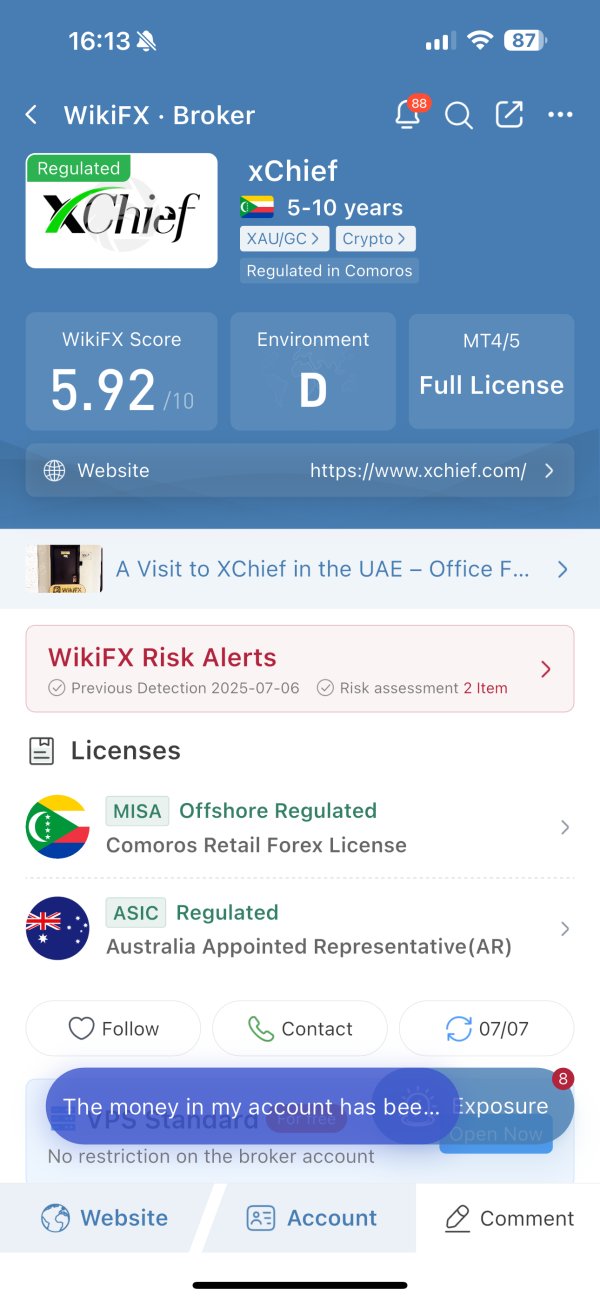

This comprehensive xchief review looks at a broker that has caused big debates in the trading community. xChief operates from Comoros and shows mixed user experiences, with feedback going from positive to very critical. The broker's user reviews show a clear split: 24 positive reviews, 3 neutral, and 8 negative reviews, which means traders strongly disagree about their services.

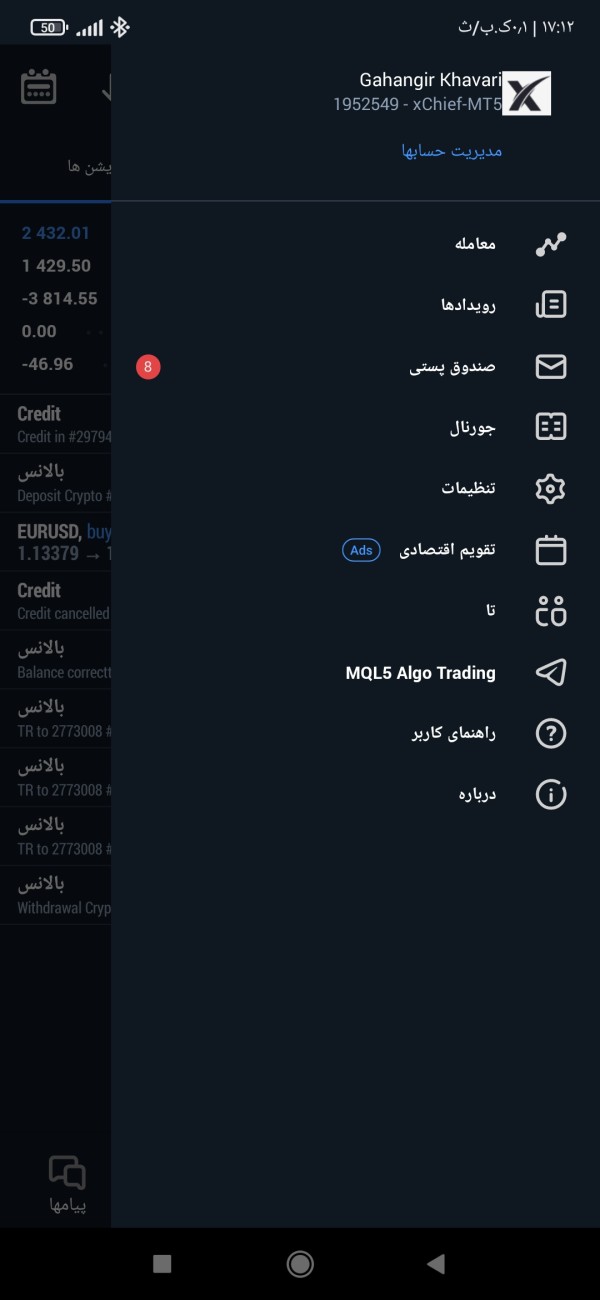

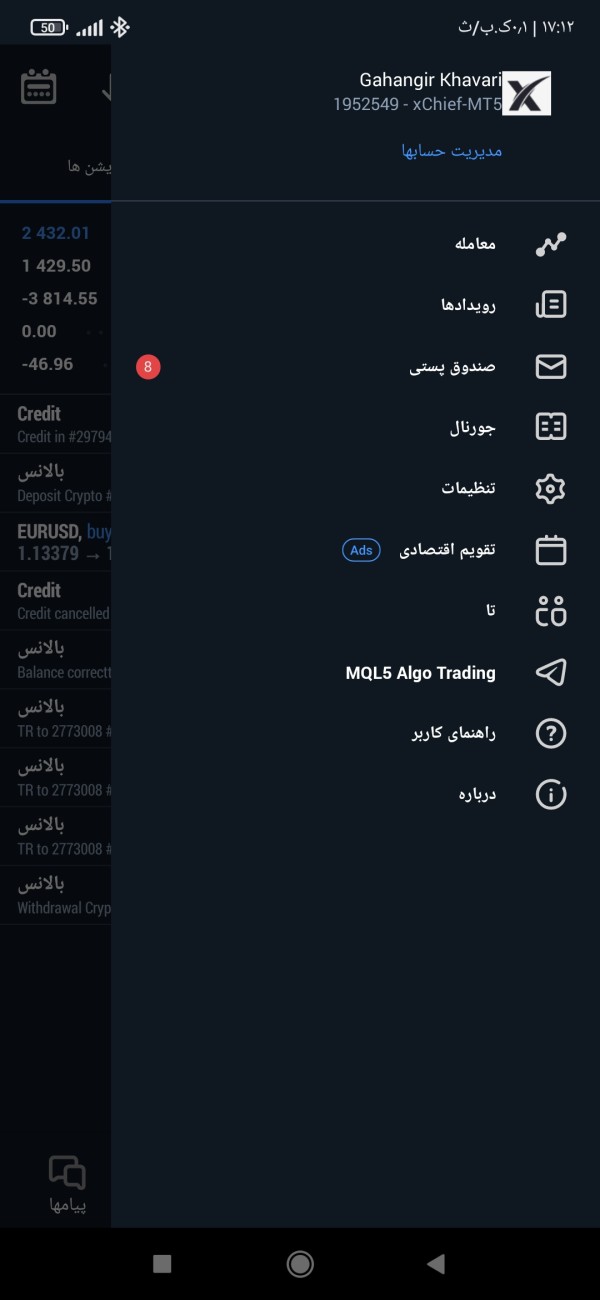

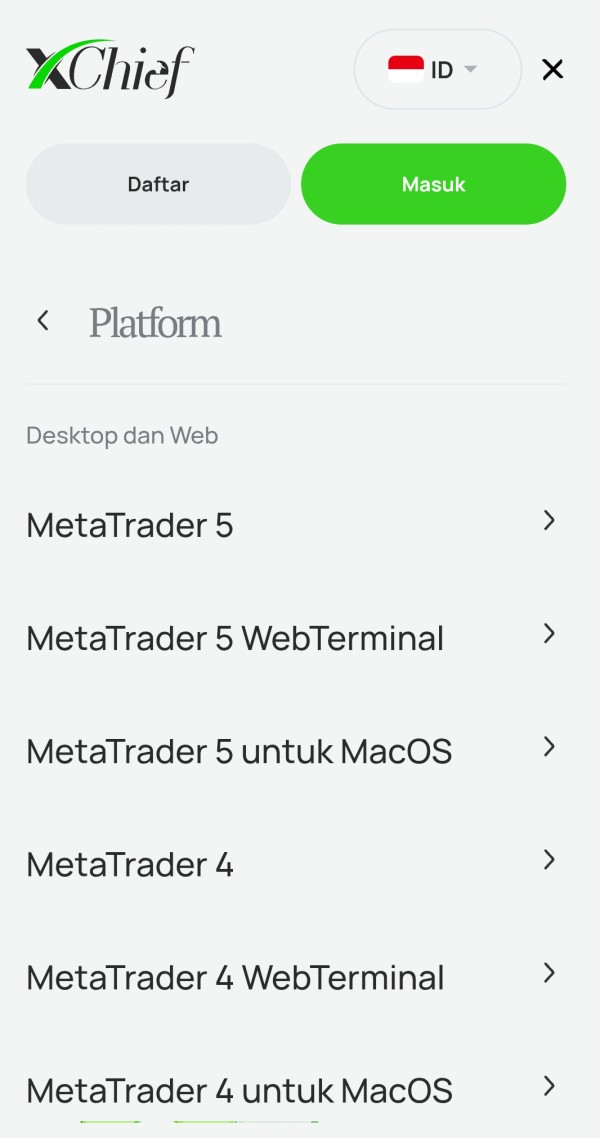

Two key features make xChief stand out in the competitive forex world. First, the broker gives traders both MetaTrader 4 and MetaTrader 5 trading platforms, offering flexibility in platform choice. Second, xChief supports automated trading through VPS server services, which appeals to algorithmic traders and those who want non-stop trading abilities.

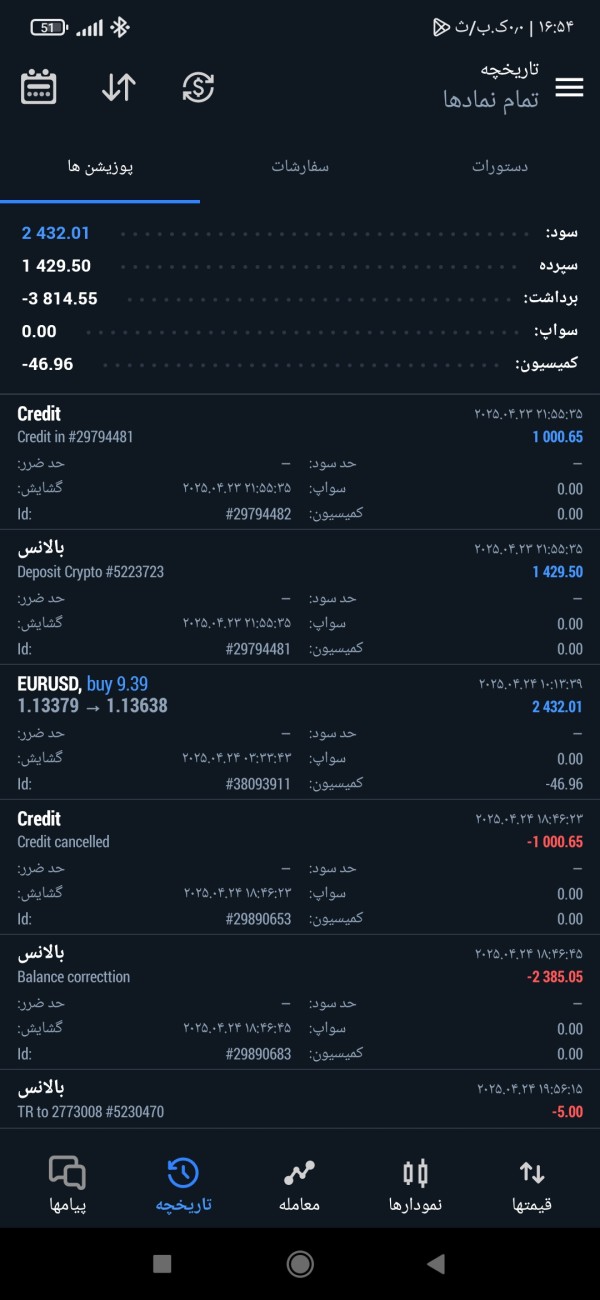

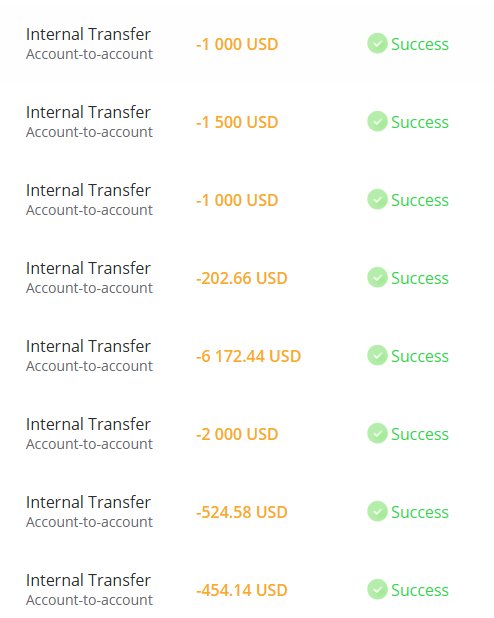

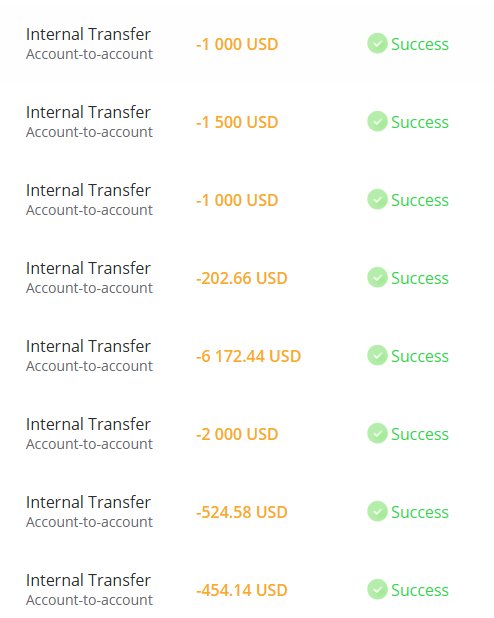

The main users of xChief seem to be traders who want flexible trading tools and those with specific technical analysis needs. However, worrying feedback shows that users have lost money that is reportedly 2 to 3 times larger compared to other platforms, which raises important questions about trading conditions and execution quality that potential clients should carefully think about before opening accounts.

Important Notice

xChief operates from Comoros, and our research shows a clear absence of regulatory information in available public materials. This lack of clear regulatory oversight is a big consideration for potential traders, especially those who prioritize regulatory protection and compliance standards.

This evaluation is based on available user feedback, public information, and accessible data sources. Given the limited regulatory transparency and mixed user experiences, traders should do additional research and consider their risk tolerance carefully before engaging with this broker.

Rating Framework

Broker Overview

xChief presents itself as a forex and CFD broker operating from Comoros, though specific founding details remain unclear from available sources. The company has built itself in the competitive online trading space by focusing on giving access to popular trading platforms and supporting automated trading strategies. According to available information, xChief's business model centers around offering forex and CFD trading services to international clients.

The broker's operational approach emphasizes technological infrastructure, particularly through its provision of MetaTrader 4 and MetaTrader 5 platforms. This xchief review finds that the company has invested in supporting automated trading capabilities, offering VPS services that allow traders to run expert advisors and automated strategies without interruption. The broker appears to target traders who prioritize platform flexibility and technical trading tools over other factors such as extensive educational resources or premium customer service features.

Regulatory Status: xChief operates from Comoros, with regulatory information not clearly specified in available materials, representing a significant transparency gap for potential clients.

Deposit and Withdrawal Methods: Specific payment method details are not fully outlined in accessible source materials.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in the available information reviewed.

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not detailed in source materials.

Tradeable Assets: The broker provides access to forex currency pairs and CFD instruments, though the complete range of available assets requires direct verification with the broker.

Cost Structure: Detailed information about spreads, commissions, and additional fees is not fully available in reviewed sources, requiring direct inquiry for complete cost analysis.

Leverage Ratios: Specific leverage offerings are not detailed in available materials.

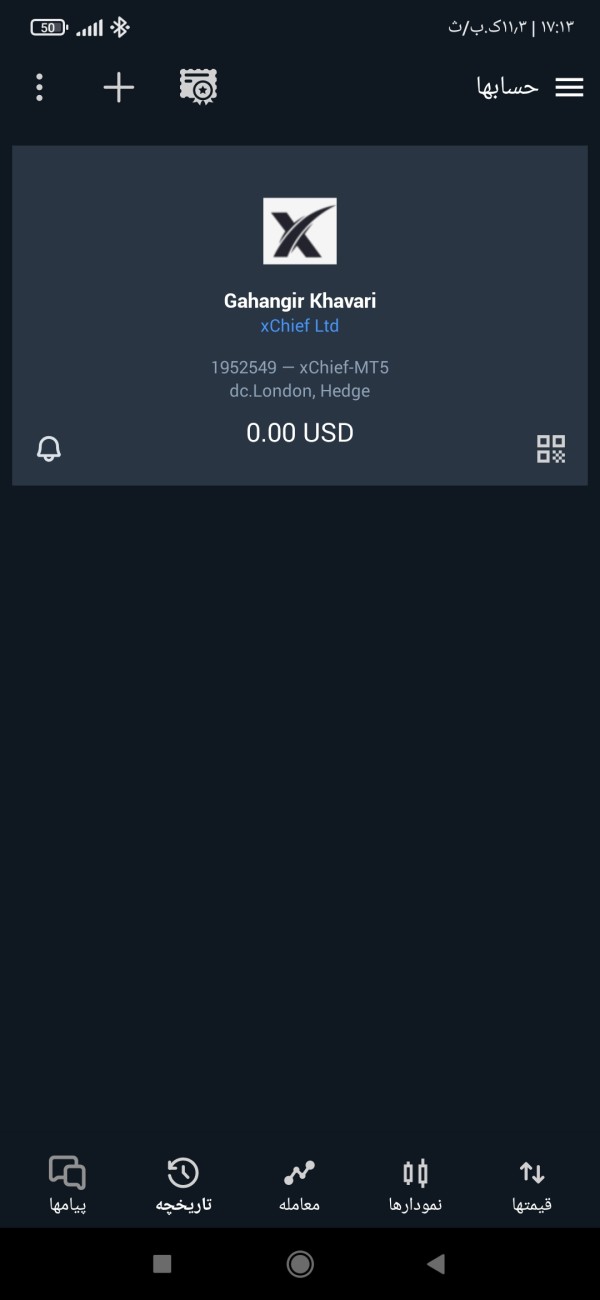

Platform Options: xChief provides MetaTrader 4 and MetaTrader 5 platforms, complemented by user-friendly mobile applications for on-the-go trading.

Geographic Restrictions: Information about regional limitations is not specified in available sources.

Customer Support Languages: Available language support options are not detailed in accessible materials.

This xchief review highlights the importance of getting detailed information directly from the broker due to limited comprehensive public documentation.

Detailed Rating Analysis

Account Conditions Analysis

The account structure and conditions offered by xChief remain largely undefined in available public materials, making it hard to provide a full assessment of their account offerings. Without specific information about account types, minimum deposit requirements, or special account features, potential traders face uncertainty about what to expect when opening an account.

The absence of detailed account information in public sources suggests that xChief may provide account details primarily through direct contact or their website platform. This approach, while not uncommon among smaller brokers, can create challenges for traders who prefer to compare account conditions before committing to a particular broker.

For traders considering Islamic accounts or other specialized account types, the lack of publicly available information means direct communication with xChief would be necessary to understand available options. This xchief review cannot provide specific guidance on account opening procedures or requirements due to insufficient available data.

The unclear account structure information represents a transparency concern that potential clients should address through direct inquiry before making account opening decisions.

xChief demonstrates strength in its platform offerings, providing both MetaTrader 4 and MetaTrader 5 to accommodate different trader preferences and strategies. These industry-standard platforms offer comprehensive charting tools, technical indicators, and automated trading capabilities that appeal to both novice and experienced traders.

The broker's VPS server support represents a significant advantage for traders utilizing automated trading strategies or expert advisors. This infrastructure ensures continuous platform operation even when traders' personal computers are offline, addressing a critical need for algorithmic trading enthusiasts.

The availability of user-friendly mobile applications extends trading accessibility, allowing traders to monitor positions and execute trades while away from desktop platforms. However, detailed information about additional research tools, market analysis resources, or educational materials is not readily available in reviewed sources.

While the core platform infrastructure appears solid, the absence of comprehensive information about analytical tools, market research, or educational resources suggests that xChief may focus primarily on platform provision rather than comprehensive trading support services.

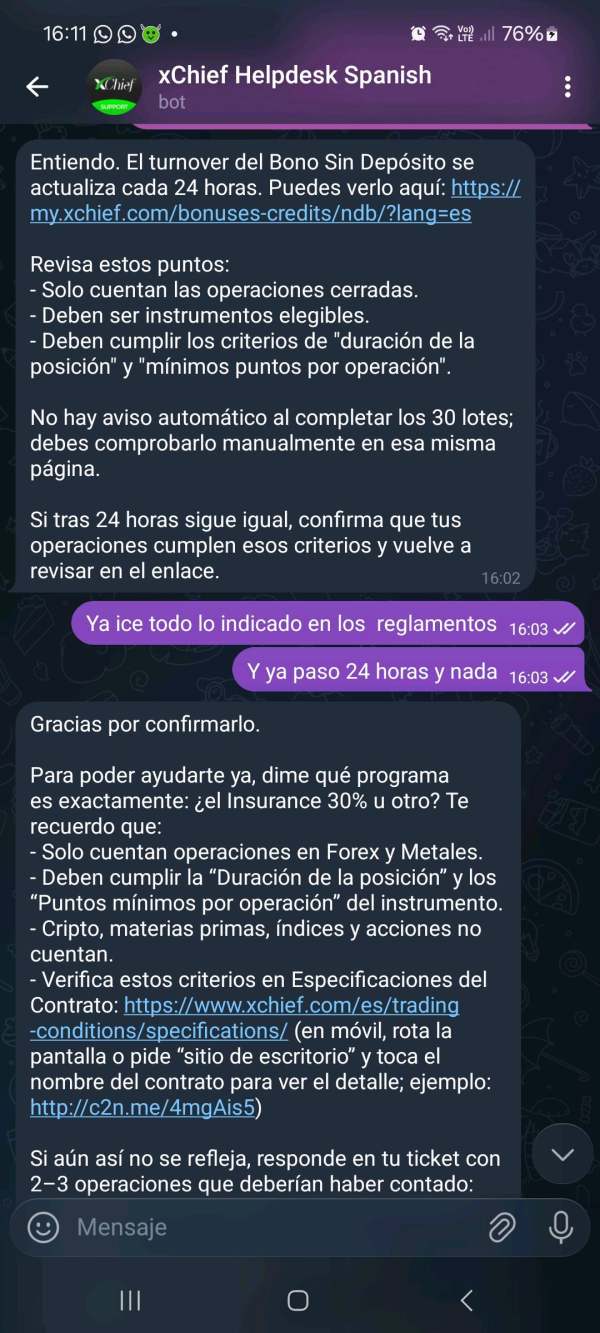

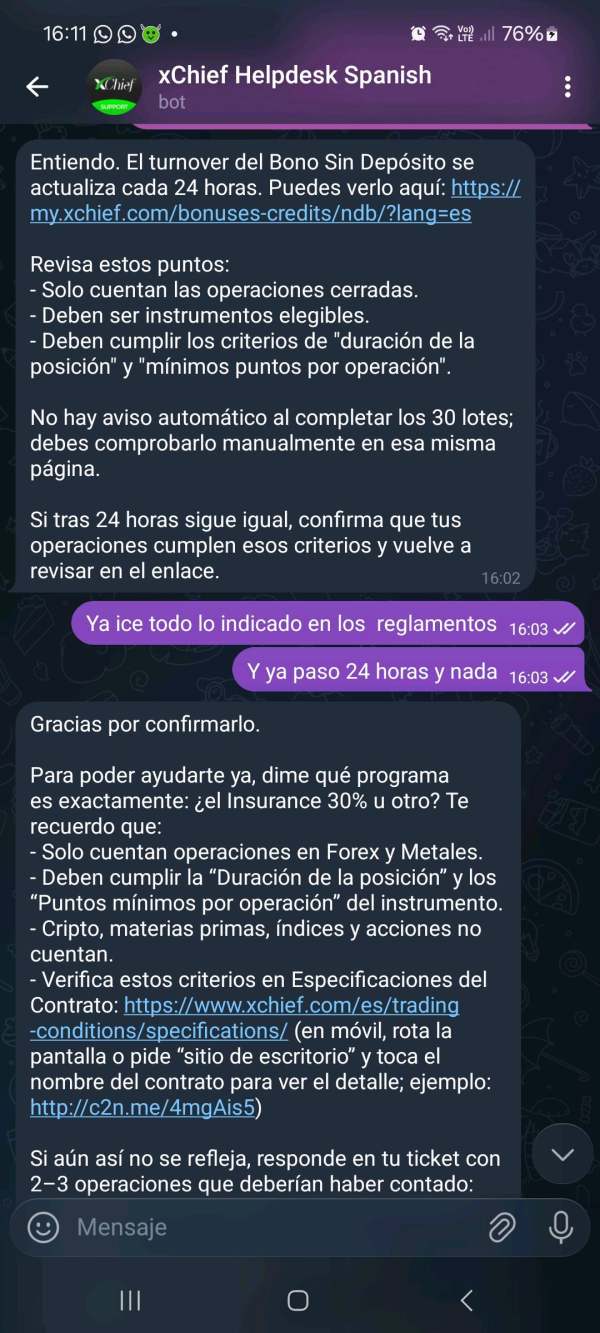

Customer Service and Support Analysis

Customer service information for xChief is notably limited in available public sources, creating uncertainty about support quality and availability. The absence of detailed information about customer service channels, response times, and support quality represents a significant gap in publicly available broker information.

Without specific data about available communication methods, operating hours, or multilingual support capabilities, potential clients cannot adequately assess whether xChief's support infrastructure meets their requirements. This lack of transparency about customer service capabilities may concern traders who prioritize responsive and accessible support.

The limited availability of customer service information in public sources suggests that traders would need to test support responsiveness and quality through direct contact before committing to the broker. This approach places additional due diligence burden on potential clients.

Given the importance of reliable customer support in forex trading, the absence of comprehensive support information represents a notable consideration for traders evaluating xChief against other broker options.

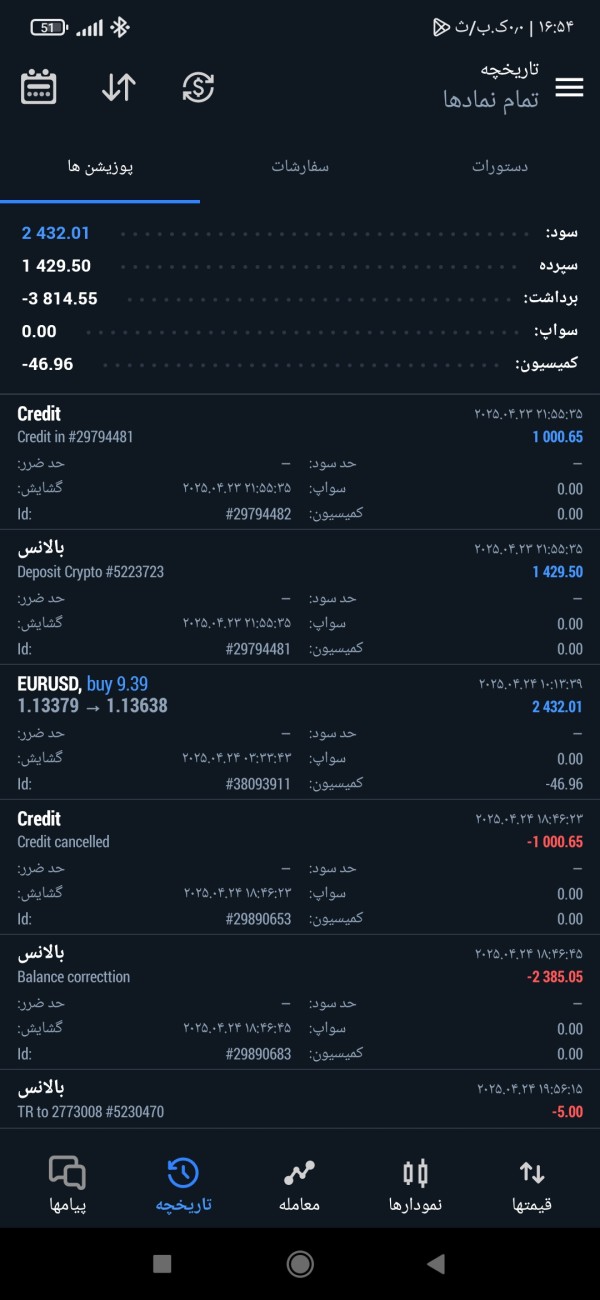

Trading Experience Analysis

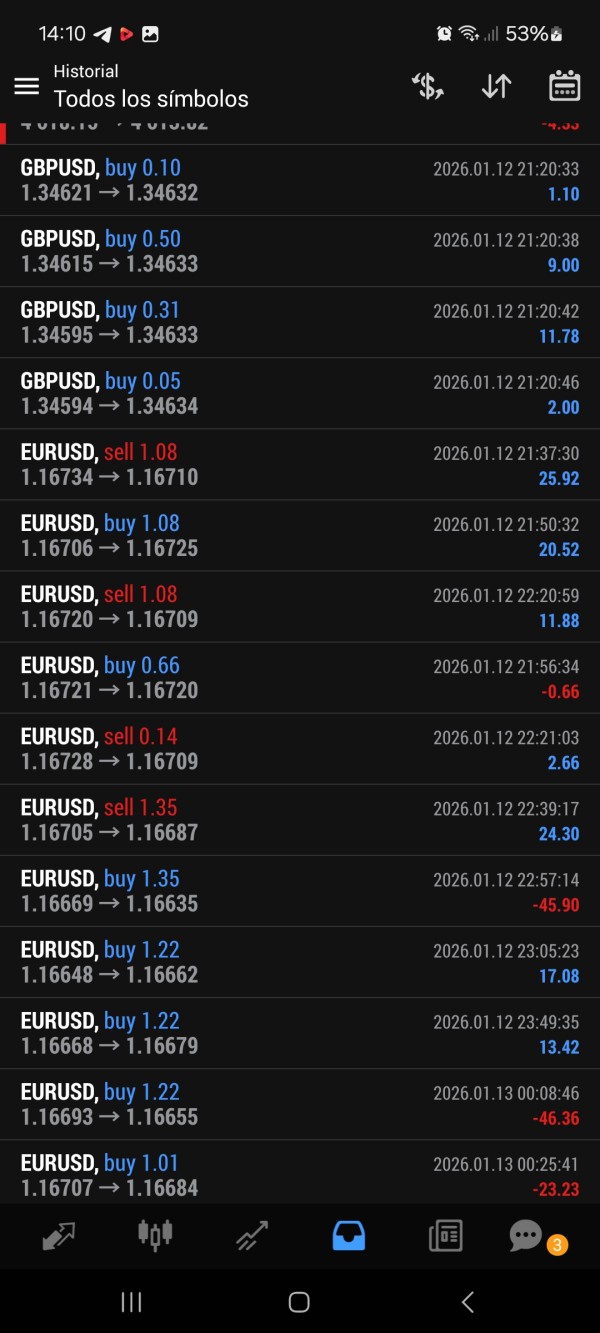

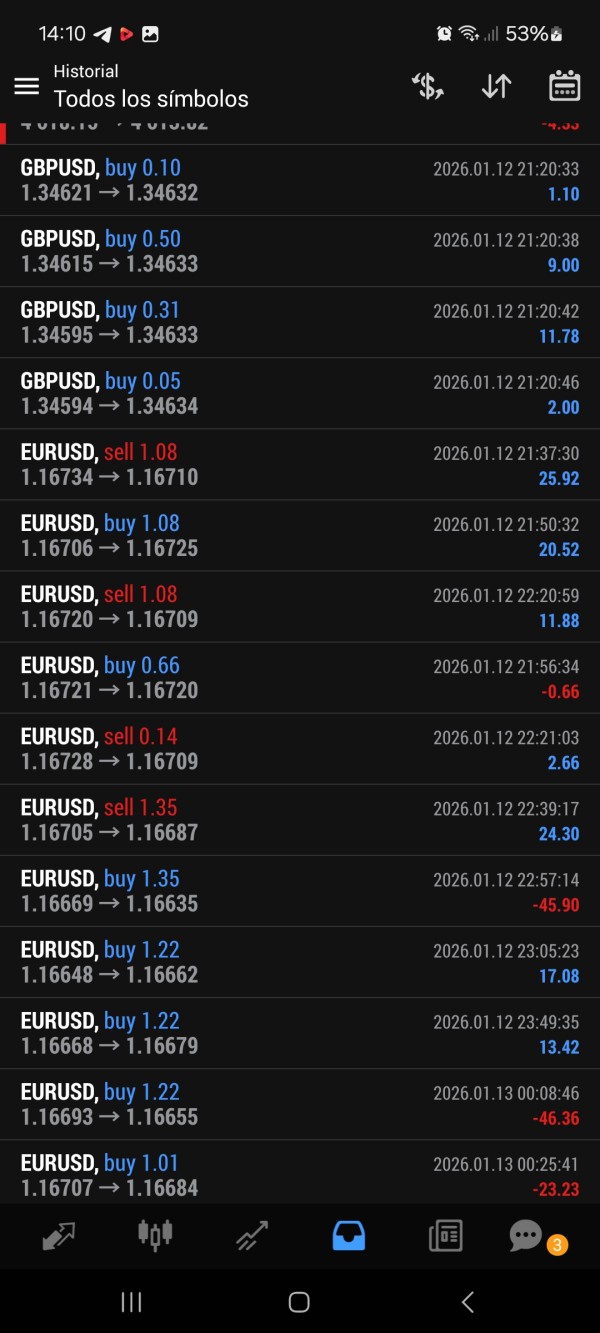

User feedback regarding trading experience with xChief presents concerning information that potential traders should carefully consider. According to available reports, users have experienced losses that are 2 to 3 times larger on xChief compared to other platforms, suggesting potential issues with trading conditions or execution quality.

Despite these concerning reports about trading outcomes, the broker's platform infrastructure appears stable, with MetaTrader 4 and MetaTrader 5 providing reliable trading environments. The availability of VPS services supports uninterrupted automated trading, which can be crucial for algorithmic strategies.

The mobile application receives positive mentions for user-friendliness, indicating that xChief has invested in mobile trading experience. However, the significant disparity in trading outcomes reported by users raises questions about execution quality, spreads, or other factors that could impact trading profitability.

This xchief review emphasizes the importance of understanding why users report substantially larger losses, as this could indicate underlying issues with trading conditions that potential clients should investigate thoroughly before opening accounts.

Trust and Reliability Analysis

Trust and reliability represent significant concerns in this xChief evaluation, primarily due to the absence of clear regulatory information in available sources. Operating from Comoros without transparent regulatory oversight creates uncertainty about client protection and compliance standards.

The lack of detailed information about fund security measures, segregated accounts, or regulatory compliance represents a substantial transparency gap that impacts overall trustworthiness assessment. Without clear regulatory protection, traders face increased risk regarding fund safety and dispute resolution mechanisms.

User feedback indicating substantially larger losses compared to other platforms further impacts trust considerations, as these reports suggest potential issues with trading conditions or business practices. The absence of comprehensive information about company background and operational transparency compounds these reliability concerns.

For traders prioritizing regulatory protection and operational transparency, the limited regulatory information and concerning user reports about trading outcomes represent significant red flags that require careful consideration and additional due diligence.

User Experience Analysis

User experience with xChief shows significant polarization, with feedback ranging from positive to highly negative, indicating inconsistent service delivery or varying user expectations. The distribution of 24 positive, 3 neutral, and 8 negative reviews suggests that while some traders find value in xChief's services, others experience substantial dissatisfaction.

The reported issue of losses being 2 to 3 times larger than other platforms represents a critical user experience concern that potential clients must consider. This feedback suggests that trading with xChief may result in different outcomes compared to other brokers, though the specific reasons for this disparity require further investigation.

The broker appears to attract traders seeking flexible trading tools and technical analysis capabilities, suggesting that xChief may serve specific trader segments effectively while potentially falling short for others. The availability of multiple MetaTrader platforms and mobile applications indicates investment in user interface quality.

However, the significant variance in user satisfaction levels suggests that xChief's services may not consistently meet trader expectations across different user types or trading strategies, requiring potential clients to carefully assess their specific needs against available feedback.

Conclusion

This xchief review reveals a broker with significant controversy and mixed user experiences that potential traders should approach with considerable caution. While xChief offers solid platform infrastructure through MetaTrader 4 and MetaTrader 5, along with VPS support for automated trading, substantial concerns about trading outcomes and regulatory transparency overshadow these technical advantages.

The broker may suit traders specifically seeking diverse trading platform options and automated trading support, particularly those less concerned about regulatory oversight. However, the reported issue of users experiencing losses 2 to 3 times larger than other platforms represents a critical warning that requires thorough investigation.

The primary advantages include comprehensive platform offerings and VPS support, while significant disadvantages encompass limited regulatory information, concerning user loss reports, and insufficient transparency about business operations and account conditions.