Atrade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive atrade review examines a forex broker that has created mixed reactions in the trading community. Atrade was established in 2007 and registered in Israel. The company presents itself as an online trading platform offering multiple asset classes including forex, indices, commodities, and stocks. The broker claims to provide low trading fees and diverse trading options. It positions itself primarily toward small to medium-sized traders and forex beginners.

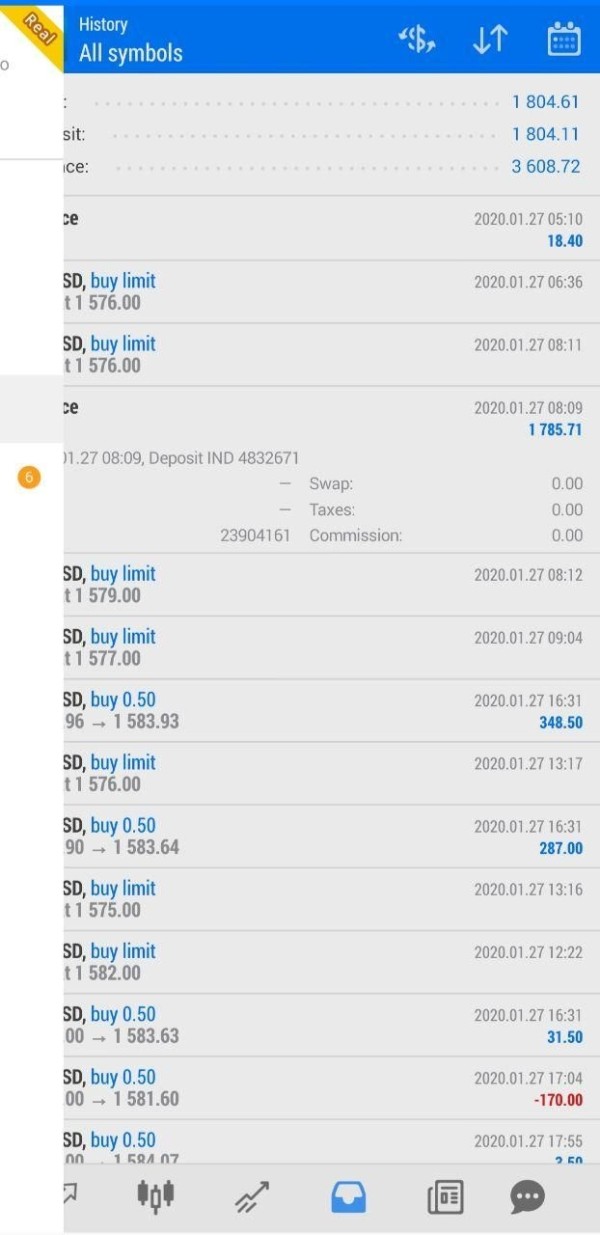

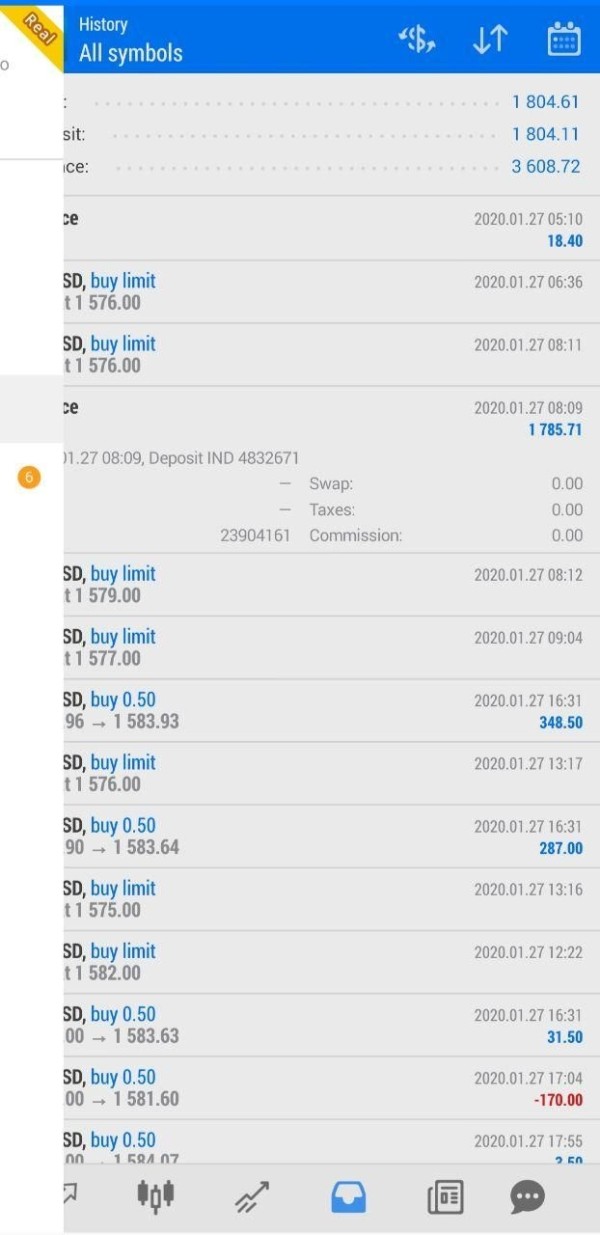

However, our analysis reveals significant concerns about the broker's credibility and service quality. User reviews on platforms like Trustpilot highlight issues related to fraudulent behavior and poor customer service. These problems substantially impact the broker's overall trustworthiness. While Atrade advertises advanced trading platforms like MetaTrader 4, users report receiving access to only basic web-based trading interfaces. These interfaces fail to meet modern trading standards.

The broker's target demographic appears to be novice traders and those seeking entry-level trading services. However, potential clients should exercise considerable caution given the negative feedback patterns observed across multiple review platforms.

Important Notice

This evaluation is based on available user reviews, company background information, and publicly accessible trading conditions. Atrade is registered in Israel. Traders should be aware that regulatory standards and investor protections may vary significantly across different jurisdictions. The regulatory framework governing this broker may differ from those in other regions. This difference could potentially affect the level of consumer protection available to international clients.

Our assessment methodology incorporates user feedback from various platforms, company-provided information, and industry-standard evaluation criteria. However, prospective traders should conduct their own due diligence and consider consulting with financial advisors before making any investment decisions.

Rating Framework

Broker Overview

Atrade entered the online trading market in 2007. The company established itself as an Israel-registered financial services provider. The company positions itself within the competitive forex and CFD trading space, offering access to multiple asset classes including foreign exchange pairs, stock indices, commodities, and individual equities. The broker's business model centers around providing retail traders with access to global financial markets through online trading platforms.

The company's operational structure suggests a focus on serving individual traders rather than institutional clients. It pays particular attention to those new to forex trading. Atrade's marketing materials emphasize accessibility and simplified trading processes. However, the actual delivery of these promises has come under scrutiny from the user community.

From a technical standpoint, Atrade claims to offer MetaTrader 4 access, which would align with industry standards for professional trading platforms. However, user reports consistently indicate that the actual trading environment consists of basic web-based interfaces. These interfaces lack the sophisticated features typically associated with MT4. This discrepancy between advertised and delivered services represents a significant concern for potential clients seeking professional-grade trading tools.

The broker's asset coverage spans major forex pairs, global stock indices, precious metals, energy commodities, and selected individual stocks. This diversification appears designed to attract traders interested in portfolio diversification across multiple asset classes. However, the quality of execution and pricing competitiveness across these instruments requires careful evaluation.

Regulatory Status: Atrade operates under Israeli registration. However, specific regulatory authority details are not clearly specified in available documentation. This regulatory ambiguity raises questions about oversight and consumer protection standards.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees is not detailed in available source materials. This represents a significant transparency gap.

Minimum Deposit Requirements: The broker's minimum account opening requirements are not specified in accessible documentation. This makes it difficult for potential clients to assess entry-level accessibility.

Promotional Offers: Information regarding welcome bonuses, trading incentives, or promotional campaigns is not available in current source materials.

Tradeable Assets: The platform provides access to foreign exchange pairs, stock market indices, commodity markets including precious metals and energy products, and individual equity securities across global markets.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs is not comprehensively available in current documentation. This limits transparent cost comparison.

Leverage Options: Specific leverage ratios offered across different asset classes are not detailed in available source materials.

Platform Selection: While MetaTrader 4 is advertised as available, user reports indicate access is limited to simplified web-based trading interfaces. These interfaces lack advanced functionality.

Geographic Restrictions: Specific information about service availability across different countries and jurisdictions is not detailed in current documentation.

Customer Support Languages: Available customer service language options are not specified in accessible source materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Atrade's account conditions faces significant limitations due to insufficient publicly available information. Standard industry practices would typically include multiple account tiers designed to accommodate different trader profiles. These range from beginner-friendly accounts with basic features to premium accounts offering enhanced services and tools.

Without specific details about minimum deposit requirements, account types, or special features such as Islamic accounts for Muslim traders, it becomes challenging to assess how competitive Atrade's offerings are within the current market landscape. This lack of transparency itself represents a concerning factor. Reputable brokers typically provide clear, detailed information about their account structures.

The absence of information regarding account opening procedures, verification requirements, and timeline expectations further complicates the assessment. Modern forex brokers generally streamline these processes to enhance user experience. The lack of available information suggests potential deficiencies in customer communication.

Professional traders often require specific account features such as dedicated relationship managers, institutional-grade execution, or customized trading conditions. The unavailability of such information in this atrade review indicates either limited service offerings or inadequate transparency in communicating available options to potential clients.

Atrade's technological infrastructure presents significant concerns based on user feedback and available information. While the broker advertises access to MetaTrader 4, which is considered an industry standard for professional forex trading, actual user experiences reveal a substantial gap between marketing claims and delivered services.

Users consistently report receiving access to basic web-based trading platforms that lack the sophisticated features, analytical tools, and customization options that characterize professional trading environments. This discrepancy raises questions about the broker's commitment to providing competitive trading technology.

The absence of detailed information about research resources, market analysis tools, economic calendars, or educational materials further limits the platform's appeal to serious traders. Modern forex brokers typically provide comprehensive market research, technical analysis tools, and educational resources to support trader development and decision-making.

Automated trading support, which is crucial for many professional traders, appears to be limited or non-existent based on available information. The lack of API access, expert advisor support, or algorithmic trading capabilities significantly restricts the platform's utility for advanced trading strategies.

Customer Service and Support Analysis

Customer service quality represents one of Atrade's most significant weaknesses based on available user feedback. Multiple reports across review platforms highlight concerns about service responsiveness, professionalism, and problem resolution effectiveness. These patterns suggest systemic issues within the broker's customer support infrastructure.

User reports indicate difficulties in reaching customer service representatives, extended response times, and inadequate resolution of account-related issues. Such problems are particularly concerning in the forex trading environment. Timely support can be crucial for managing trading positions and resolving technical difficulties.

The availability of multilingual support, which is essential for international brokers, is not clearly documented in available materials. This lack of clarity about language support options may indicate limited international service capabilities. It might also show insufficient attention to diverse client needs.

More concerning are user reports suggesting fraudulent behavior and unethical practices in customer interactions. While individual experiences may vary, patterns of similar complaints across multiple platforms raise serious questions about the broker's business practices and commitment to client welfare.

Trading Experience Analysis

The trading experience offered by Atrade appears to fall short of modern industry standards based on user feedback and available information. While the broker offers access to multiple asset classes, the quality of execution and platform functionality receives mixed to negative reviews from actual users.

Platform stability and execution speed are critical factors in forex trading, where market movements can occur rapidly. User reports suggest inconsistencies in platform performance. However, specific data about execution speeds, slippage rates, or uptime statistics are not available in current documentation.

The mobile trading experience, which is increasingly important for modern traders, is not well-documented in available materials. This lack of information about mobile platform capabilities may indicate limited development in this crucial area of trading technology.

Order execution quality, including the handling of market orders, limit orders, and stop-loss instructions, lacks detailed documentation or user feedback patterns that would allow for comprehensive assessment. This atrade review notes that transparent execution statistics are typically provided by reputable brokers to demonstrate their commitment to fair trading conditions.

Trustworthiness Analysis

Trustworthiness represents Atrade's most significant challenge based on available evidence and user feedback. The broker's registration in Israel provides some regulatory framework. However, specific oversight details and regulatory compliance measures are not clearly documented in accessible materials.

User reviews on platforms like Trustpilot contain serious allegations regarding fraudulent behavior and unethical business practices. While individual complaints should be evaluated carefully, patterns of similar concerns across multiple users and platforms create substantial credibility issues for the broker.

The lack of transparent information about client fund protection measures, segregated accounts, or insurance coverage further undermines confidence in the broker's financial safeguards. Reputable forex brokers typically provide clear documentation about how client funds are protected and separated from company operating capital.

Company transparency, including the availability of financial reports, regulatory filings, or third-party audits, appears limited based on publicly accessible information. This opacity contrasts with industry best practices where established brokers provide substantial transparency about their financial condition and regulatory compliance.

User Experience Analysis

Overall user satisfaction with Atrade presents a complex picture characterized by significant negative feedback balanced against some positive experiences. The broker appears to attract primarily novice traders and those seeking entry-level trading services. However, even within this demographic, satisfaction levels appear inconsistent.

Interface design and platform usability receive criticism for being overly simplified and lacking the features that modern traders expect. While simplicity can benefit beginners, the absence of scalable functionality limits the platform's long-term utility as traders develop more sophisticated needs.

The account registration and verification process lacks detailed documentation in available materials. This makes it difficult to assess the convenience and efficiency of onboarding new clients. Streamlined account opening procedures are increasingly important in the competitive forex broker landscape.

Common user complaints center around service quality, platform limitations, and concerns about business practices. The frequency and consistency of these complaints across multiple review platforms suggest systemic issues rather than isolated incidents. This indicates fundamental challenges in the broker's service delivery model.

Conclusion

This comprehensive atrade review reveals a broker facing significant challenges across multiple dimensions of service delivery and client satisfaction. While Atrade offers access to diverse trading instruments and positions itself toward beginning traders, substantial concerns about trustworthiness, customer service quality, and platform functionality limit its appeal to serious traders.

The broker may be suitable for novice traders seeking basic market access. However, even this demographic should exercise considerable caution given the negative feedback patterns and transparency issues identified in this evaluation. More experienced traders would likely find the platform's limitations and service quality concerns incompatible with their trading requirements.

The primary advantages include diverse asset class availability and apparent accessibility for beginners. However, significant disadvantages encompass poor customer service, limited platform functionality, and serious trustworthiness concerns that potential clients must carefully consider before committing funds to this broker.