Is ATRADE safe?

Pros

Cons

Is Atrade Safe or Scam?

Introduction

Atrade is a forex broker that has gained attention in the trading community for its range of services and competitive trading conditions. As traders increasingly seek opportunities in the foreign exchange market, the need for due diligence has never been more critical. Evaluating whether a broker is trustworthy is essential for protecting one's investments and ensuring a secure trading environment. In this article, we will investigate Atrade's legitimacy, regulatory status, trading conditions, and overall reputation based on multiple sources and user experiences. Our evaluation will follow a structured framework, addressing key aspects such as regulation, company background, trading conditions, customer fund safety, and user feedback.

Regulation and Legitimacy

When assessing the safety of a forex broker, regulation is a primary concern. Atrade claims to be regulated by the Israel Securities Authority (ISA), which is a tier-1 regulatory body. However, the effectiveness of this regulation can vary based on the specific protections it offers. Below is a summary of Atrade's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ISA | 514666577 | Israel | Verified |

The ISA's oversight is crucial for ensuring that Atrade adheres to financial standards and provides a degree of investor protection. However, it is essential to note that while Atrade is regulated, the absence of an investor compensation fund raises concerns about the safety of client funds in case of insolvency. Historically, brokers with tier-1 regulation tend to offer better protection against fraud and mismanagement, but the lack of additional safeguards can be a red flag. Thus, while Atrade does have regulatory oversight, the overall quality of that regulation and its implications for trader safety must be carefully considered.

Company Background Investigation

Atrade was established in 2007 and operates primarily out of Israel. The company is owned by Atrade Ltd, which has been involved in the forex and CFD trading industry for over a decade. The management team comprises professionals with backgrounds in finance and trading, contributing to the company's operational integrity. However, the transparency regarding the company's ownership structure and detailed management profiles is somewhat limited.

The lack of comprehensive information about the company's history and its operational practices can be concerning for potential clients. Atrade's website does provide some basic information, but it lacks detailed disclosures that are often expected from reputable brokers. This lack of transparency can lead to questions about the company's commitment to ethical practices and its readiness to protect client interests. Overall, while Atrade has been operational for several years, the limited transparency raises questions about its legitimacy, making it crucial for traders to approach with caution.

Trading Conditions Analysis

Atrade offers a variety of trading conditions that can be appealing to both novice and experienced traders. However, the overall fee structure is a critical aspect that traders must understand before committing their funds. Atrade provides competitive spreads and leverages, but there are reports of hidden fees that can affect profitability. The following table summarizes the core trading costs associated with Atrade:

| Fee Type | Atrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.9 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.01% - 0.02% | 0.02% - 0.05% |

While Atrade presents attractive spreads, the potential for hidden fees related to withdrawals or inactivity can impact overall trading costs. Furthermore, the commission structure appears to be variable, which can lead to confusion among traders regarding the actual costs they may incur. Understanding these fees is crucial for assessing whether Atrade's trading conditions are indeed favorable or if they mask underlying costs that could diminish returns.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a forex broker. Atrade claims to implement several measures to protect client funds, including segregated accounts, which help ensure that client deposits are kept separate from the company's operational funds. However, the level of investor protection offered by the ISA is not as robust as that provided by some other tier-1 regulators, such as the FCA or ASIC, which feature investor compensation schemes.

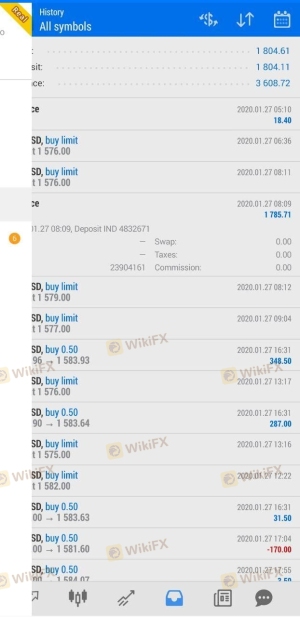

Additionally, Atrade does not explicitly state whether it offers negative balance protection, which can be a significant risk factor for traders, especially in volatile markets. Historical reports of fund security issues related to Atrade have raised concerns among users, particularly regarding the withdrawal process and the potential for delays. These factors contribute to the overall assessment of whether Atrade is indeed safe for trading or poses risks that traders should be wary of.

Customer Experience and Complaints

Customer feedback is an essential element in assessing the reliability of a broker. Atrade has received mixed reviews from users, with several complaints highlighting issues related to fund withdrawals, customer support responsiveness, and unexpected fees. The following table summarizes the primary types of complaints reported by users:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Hidden Fees | Medium | Average |

| Customer Support Issues | High | Poor |

One notable case involved a trader who reported significant delays in processing a withdrawal request, leading to frustration and financial strain. This trader claimed that upon requesting their funds, they were informed of additional fees that had not been disclosed initially. Such complaints indicate a trend that can deter potential clients from engaging with Atrade, raising questions about the broker's commitment to customer satisfaction and transparency.

Platform and Trade Execution

Atrade utilizes the popular MetaTrader 4 (MT4) platform, which is well-regarded for its user-friendly interface and robust trading tools. However, user experiences regarding platform stability and execution quality have been varied. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The overall performance of Atrade's trading platform is crucial for traders, as it directly affects their ability to execute trades effectively and manage their portfolios. While MT4 is a trusted platform, any signs of manipulation or technical issues can raise serious concerns about the broker's integrity.

Risk Assessment

Engaging with Atrade comes with inherent risks that potential clients should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Regulated but lacks compensation fund |

| Fund Safety | High | Concerns about withdrawal processes |

| Customer Support | High | Reports of poor responsiveness |

| Trading Conditions | Medium | Hidden fees and variable commissions |

To mitigate these risks, traders should conduct thorough research, maintain realistic expectations regarding returns, and consider diversifying their investments across multiple brokers.

Conclusion and Recommendations

In conclusion, while Atrade is regulated by the Israel Securities Authority, several factors raise concerns about its overall safety. The lack of an investor compensation fund, transparency issues, and negative user feedback suggest that traders should approach Atrade with caution.

For traders seeking reliable options, it may be prudent to consider alternatives that offer stronger regulatory protections, clearer fee structures, and better customer support. Brokers regulated by tier-1 authorities like the FCA or ASIC may present safer trading environments with more robust investor protections. Ultimately, conducting thorough research and maintaining a cautious approach is essential for navigating the complexities of the forex market safely.

In summary, is Atrade safe? While it has regulatory oversight, the potential risks and negative user experiences indicate that traders should be vigilant and consider all aspects before engaging with this broker.

Is ATRADE a scam, or is it legit?

The latest exposure and evaluation content of ATRADE brokers.

ATRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ATRADE latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.