Regarding the legitimacy of ZarVista forex brokers, it provides FSC and WikiBit, (also has a graphic survey regarding security).

Is ZarVista safe?

Pros

Cons

Is ZarVista markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

Zarvista Capital Markets (MU) Ltd

Effective Date:

2024-01-19Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Rue de La Democratie Office 306, 3rd Floor, Ebene Junction Ebene, Q. Bornes Wd. 1, Mauritius, 33, Edith Cavell Street C/o IQ EQ Fund Services (Mauritius) Ltd Port-Louis,, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Zarvista A Scam?

Introduction

Zarvista, a relatively new player in the forex market, has garnered attention since its establishment in 2019. Operating under the name Zarvista Capital Markets Ltd, this broker aims to provide a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. However, with the rise of online trading, potential traders must remain vigilant and conduct thorough assessments of brokers to avoid falling victim to scams. The forex market is fraught with risks, and choosing a reliable broker is crucial for safeguarding investments. This article employs a comprehensive evaluation framework, analyzing Zarvista's regulatory status, company background, trading conditions, customer experiences, and overall risk profile to determine whether it is a trustworthy trading platform or a potential scam.

Regulation and Legitimacy

One of the most critical aspects of any trading broker is its regulatory status. Zarvista is regulated by the Mwali International Services Authority (MISA) in Comoros, which is considered an offshore regulatory body. While having any regulation is better than none, the credibility of the regulating authority plays a significant role in assessing the safety of a broker. Below is a summary of Zarvista's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Mwali International Services Authority (MISA) | T2023293 | Comoros | Verified |

The MISA is known for its lenient regulatory framework, which may not provide the same level of investor protection as stricter regulators like the FCA or ASIC. While Zarvista does hold a license, the offshore nature of its regulation raises concerns about the quality of oversight. Historical compliance records show that offshore brokers often face fewer obligations, which can lead to potential issues around transparency and accountability. Traders should be cautious, as the lack of stringent regulations may expose them to higher risks, including potential fraud or mismanagement of funds.

Company Background Investigation

Zarvista Capital Markets Ltd was founded in 2019, and its headquarters is located in Ebene, Mauritius. The broker primarily targets traders in the MENA and Asia regions. The ownership structure of Zarvista is not entirely transparent, with limited information available about its founders and management team. However, it is noted that the company is run by Indian national Jamsheer Thazhe Veet Til, who has experience in the financial sector.

The management team‘s background is crucial in assessing the broker's reliability. A team with a solid track record in finance and trading can enhance a broker's credibility. Unfortunately, Zarvista's lack of disclosure regarding its leadership raises questions about its transparency. The company’s website provides basic information but lacks deeper insights into its operational practices and governance structure. Without clear information, potential clients may find it challenging to gauge the broker's reliability and overall trustworthiness.

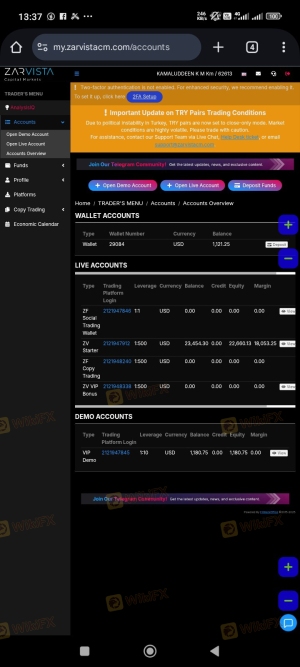

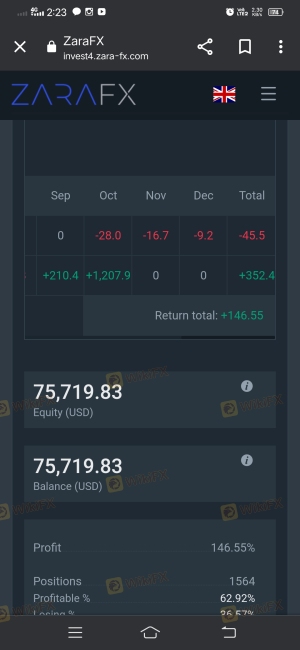

Trading Conditions Analysis

Zarvista offers a variety of trading accounts, each with different conditions. The broker claims to provide competitive spreads and various trading instruments. However, it is important to scrutinize the fee structure to understand the true cost of trading. Below is a comparison of Zarvista's core trading costs with industry averages:

| Fee Type | Zarvista | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | 1.2 - 2.0 pips |

| Commission Model | Varies by account type | Varies by broker |

| Overnight Interest Range | Varies | Varies |

While Zarvista offers spreads starting from 1.5 pips, which are relatively competitive, traders should be aware of potential additional costs associated with commissions, especially on certain account types. The commission structure can vary significantly, and hidden fees can erode profits. It is essential for traders to read the fine print and understand all associated costs before committing to a broker.

Client Fund Security

The security of client funds is paramount when evaluating a broker. Zarvista claims to implement several measures to protect client funds, including the segregation of client accounts and negative balance protection. Segregation is a crucial practice that ensures client funds are kept separate from the broker's operational funds, reducing the risk of misappropriation.

However, the effectiveness of these measures largely depends on the regulatory framework under which the broker operates. Given that Zarvista is regulated by MISA, the level of protection may not be as robust as that offered by brokers regulated by more stringent authorities. Moreover, there have been reports of client complaints regarding withdrawals and fund accessibility, which raise red flags about the broker's operational integrity. Traders should carefully consider these factors before deciding to deposit significant amounts of capital.

Customer Experience and Complaints

Customer feedback plays a vital role in understanding a broker's reliability. Zarvista has received mixed reviews from users, with some praising its trading platform and customer service, while others have reported issues related to fund withdrawals and account management. Below is a summary of the primary types of complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Platform Stability | Medium | Generally positive |

| Customer Service | Medium | Mixed reviews |

One notable case involved a trader who reported difficulties withdrawing funds, claiming that the broker delayed responses and provided vague explanations. Such experiences can be indicative of underlying issues within the broker's operational practices. It is essential for potential clients to weigh these complaints against the broker's overall reputation and consider whether they are comfortable proceeding.

Platform and Execution

Zarvista offers the popular MetaTrader 5 (MT5) trading platform, known for its advanced features and user-friendly interface. The platform provides traders with various tools for analysis, automated trading, and real-time market data. However, the quality of order execution is also a critical factor in assessing a broker's performance.

Users have reported generally positive experiences regarding platform stability, with minimal slippage and downtime. However, there are concerns about the execution speed during high volatility periods, which can significantly impact trading outcomes. Traders should be aware of the potential for slippage and rejected orders, particularly in fast-moving markets, as this can affect their overall trading performance.

Risk Assessment

Using Zarvista as a trading platform carries certain risks that potential clients should consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lead to inadequate oversight. |

| Fund Security Risk | Medium | Segregated accounts, but regulatory framework is weak. |

| Withdrawal Risk | High | Complaints about withdrawal delays and issues. |

To mitigate these risks, traders should start with a small initial deposit, thoroughly review the broker's terms and conditions, and maintain open communication with customer service. Additionally, it is advisable to stay informed about the broker's performance by following online reviews and feedback from other traders.

Conclusion and Recommendations

In conclusion, while Zarvista presents itself as a legitimate forex broker, several factors warrant caution. The offshore regulation, coupled with mixed customer feedback and reports of withdrawal issues, raises significant concerns about its reliability. Potential traders should carefully evaluate their risk tolerance and consider the implications of trading with an offshore broker.

For those seeking a more secure trading environment, it may be prudent to explore alternative brokers regulated by top-tier authorities such as the FCA or ASIC. These brokers typically offer stronger investor protections and a more transparent operational framework. Ultimately, thorough research and due diligence are essential for any trader considering Zarvista or similar brokers in the forex market.

Is ZarVista a scam, or is it legit?

The latest exposure and evaluation content of ZarVista brokers.

ZarVista Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZarVista latest industry rating score is 2.07, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.07 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.