Zarvista 2025 Review: Everything You Need to Know

Executive Summary

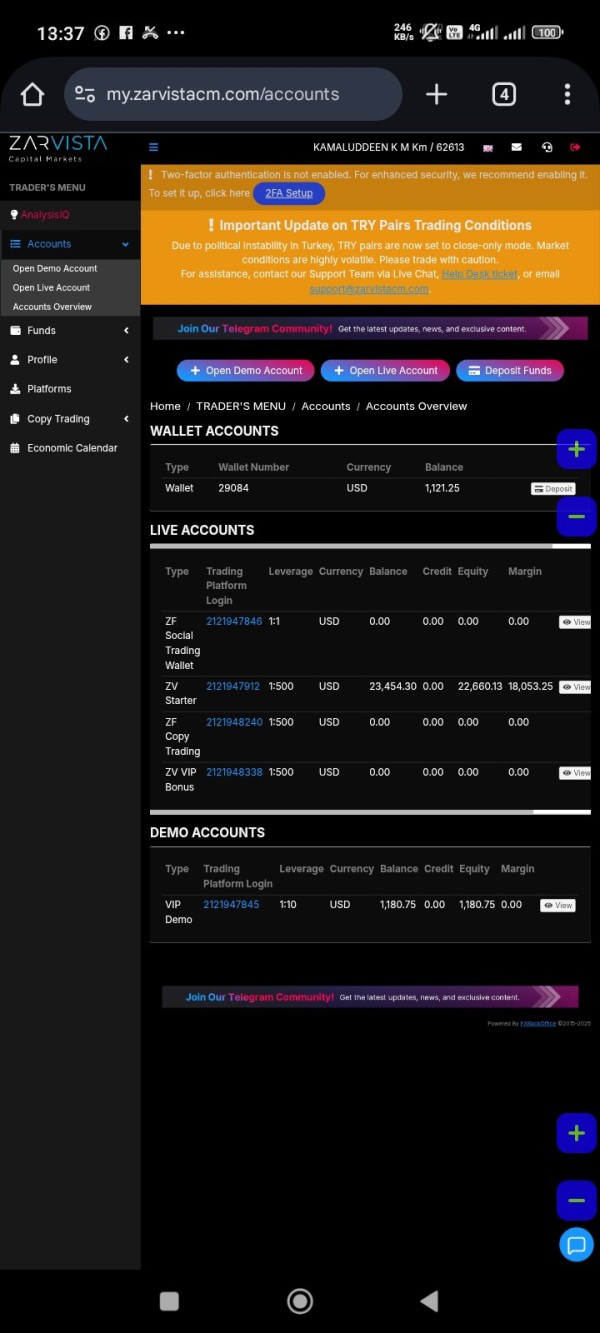

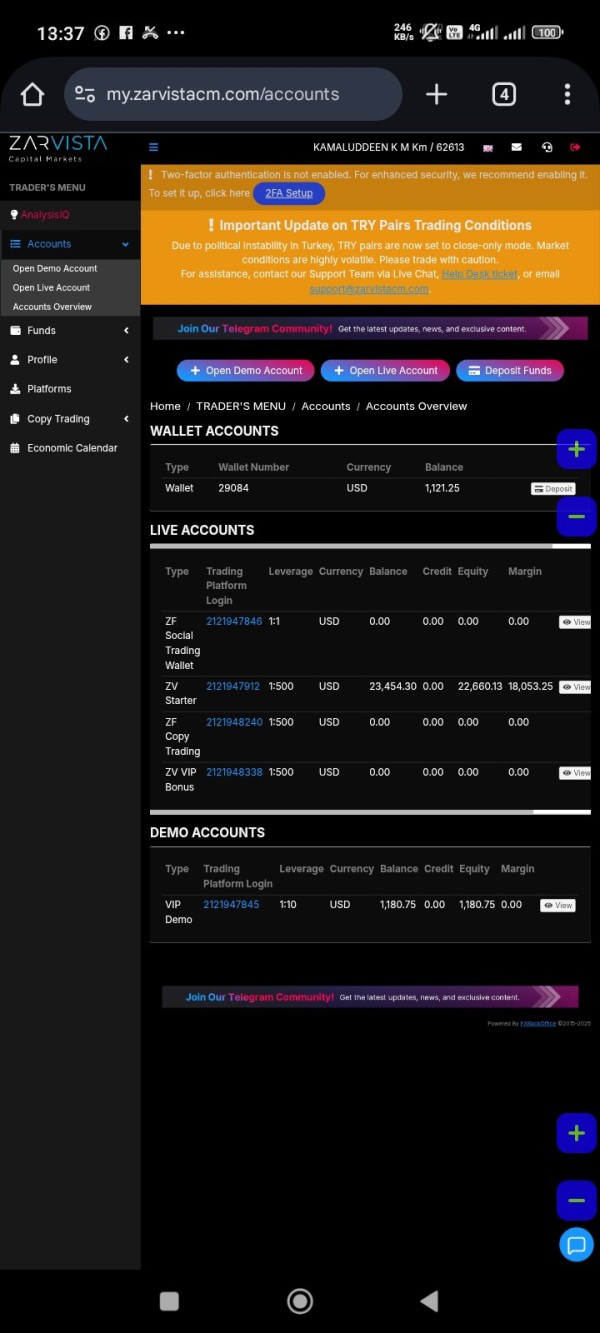

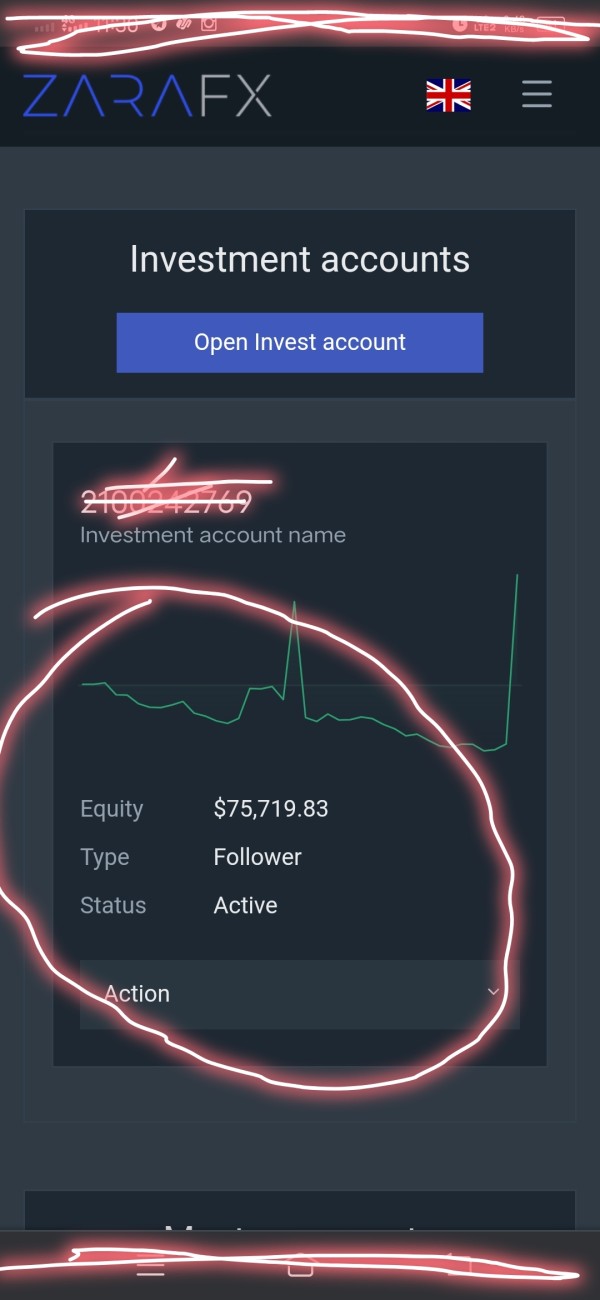

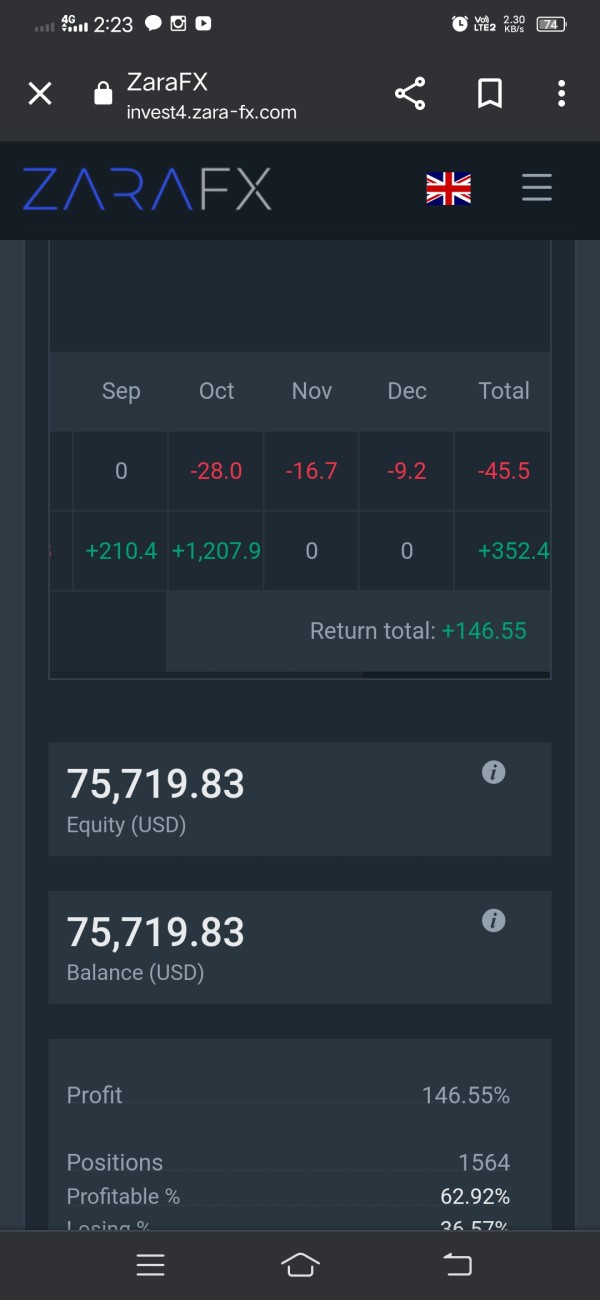

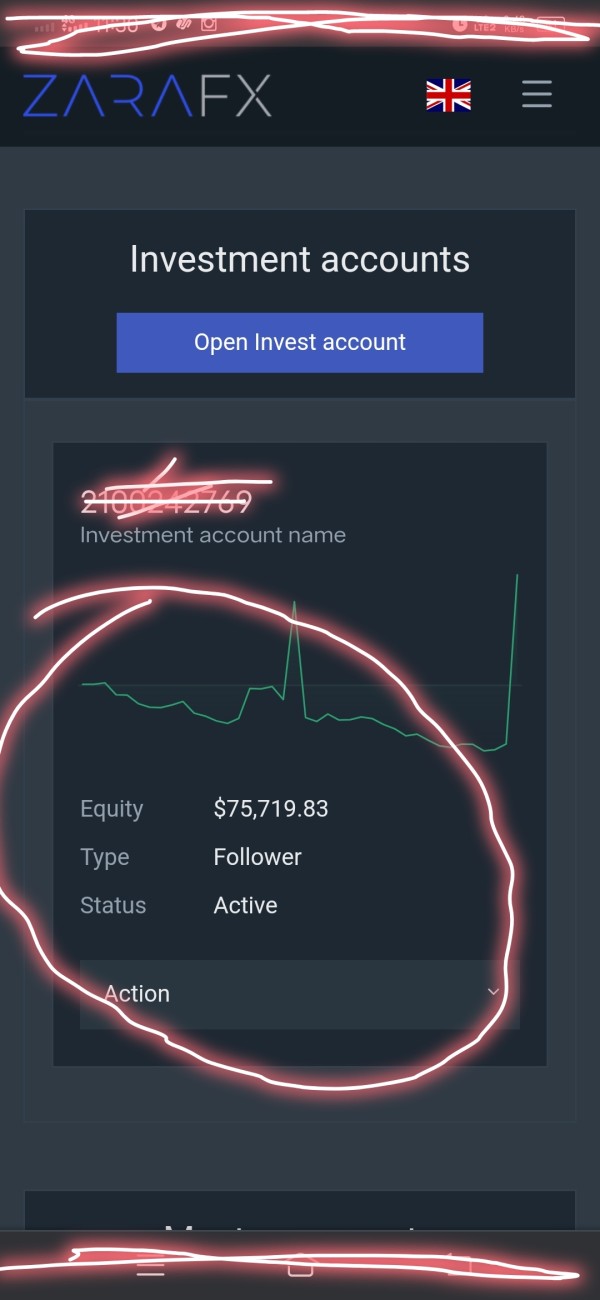

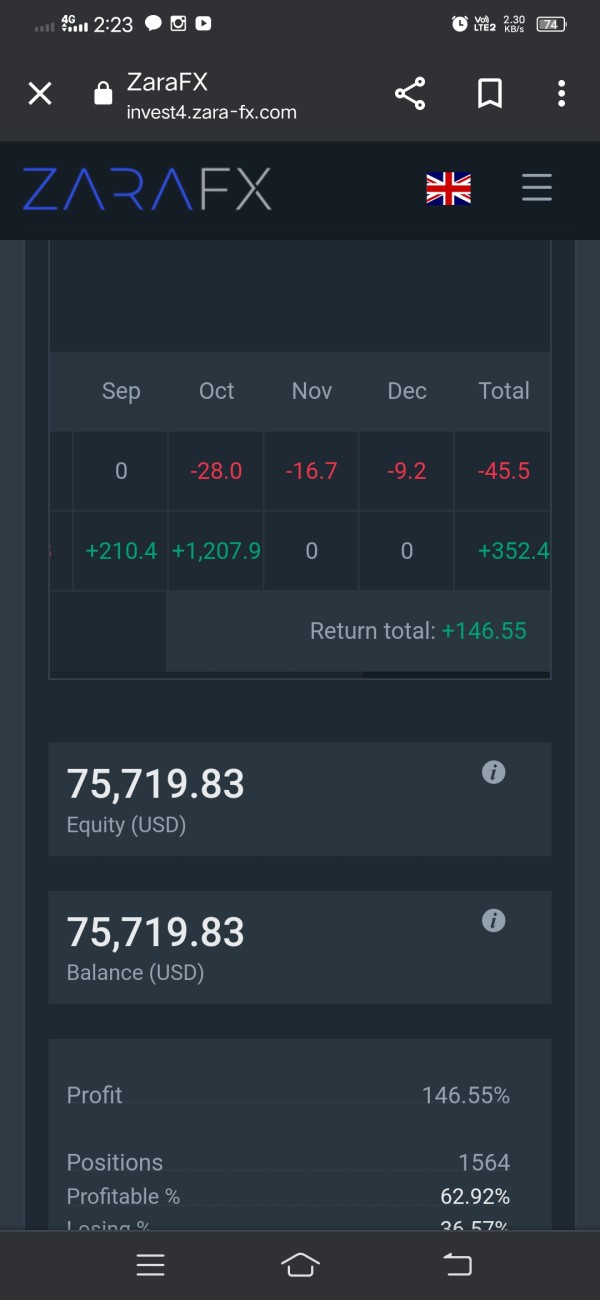

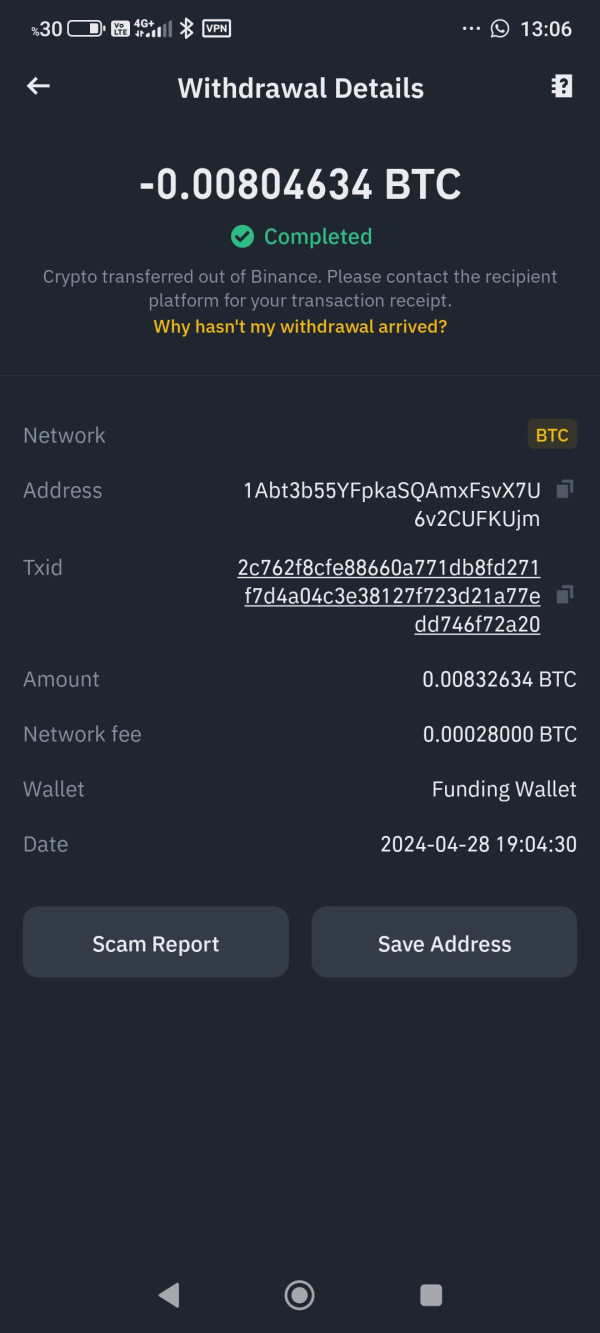

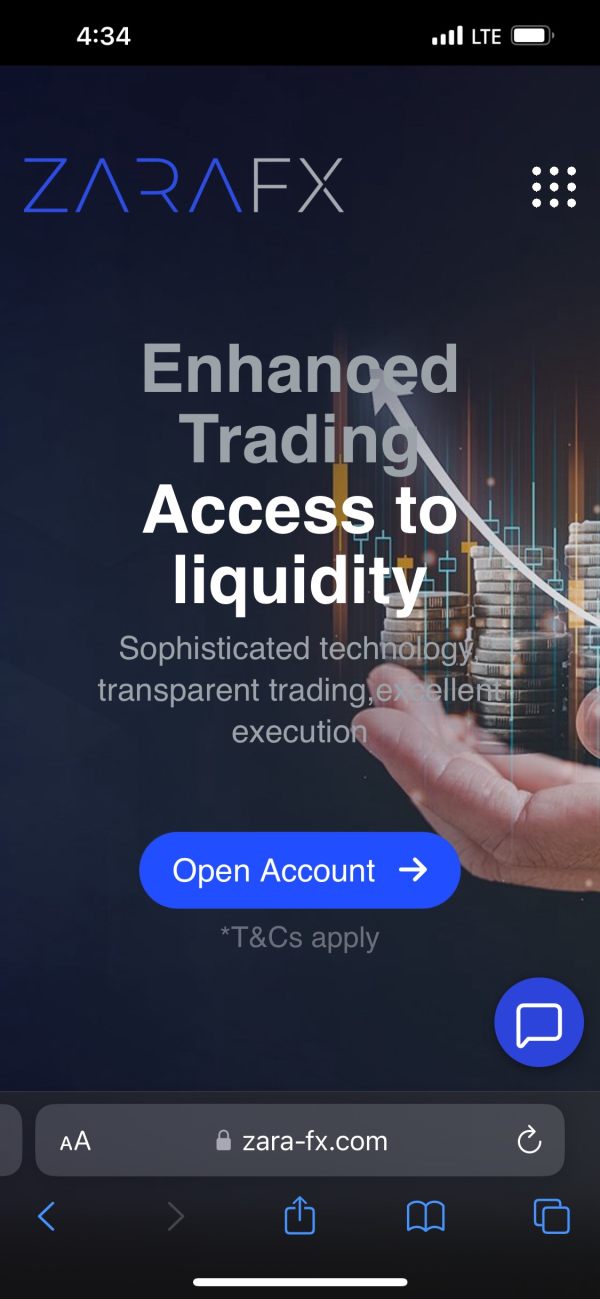

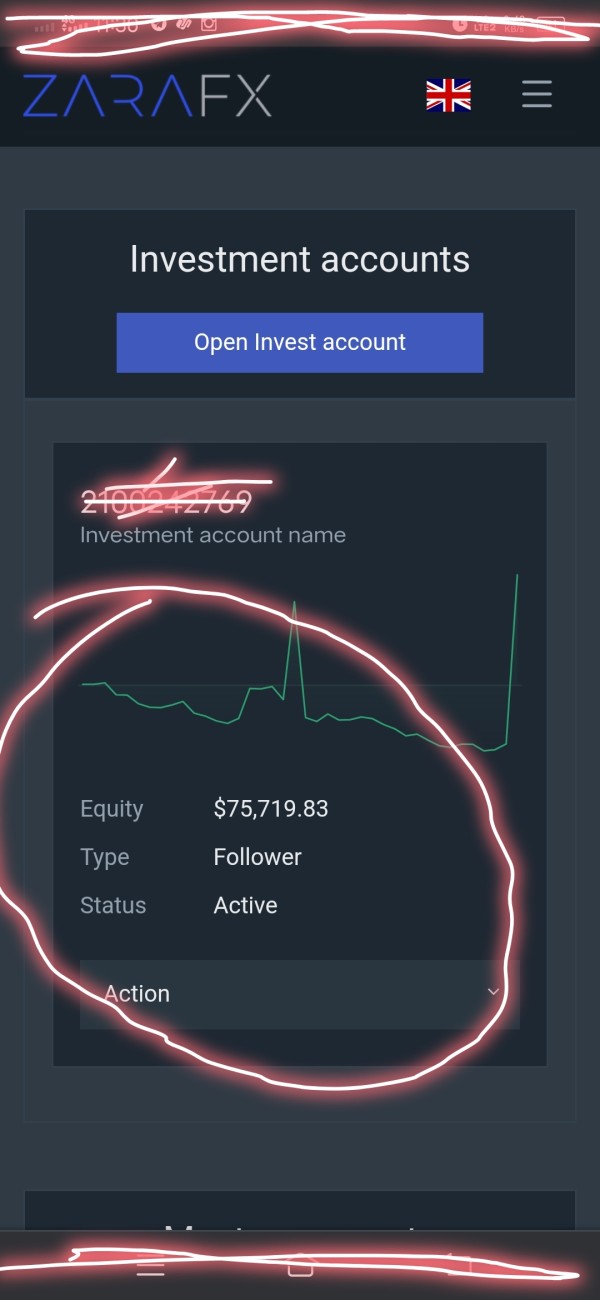

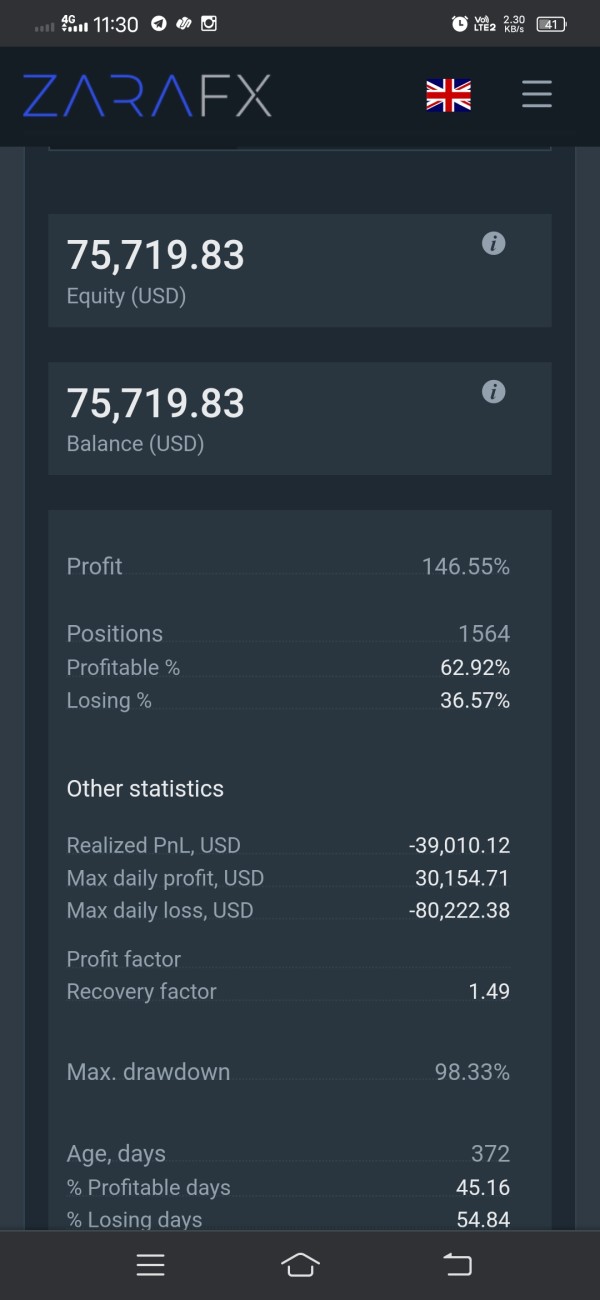

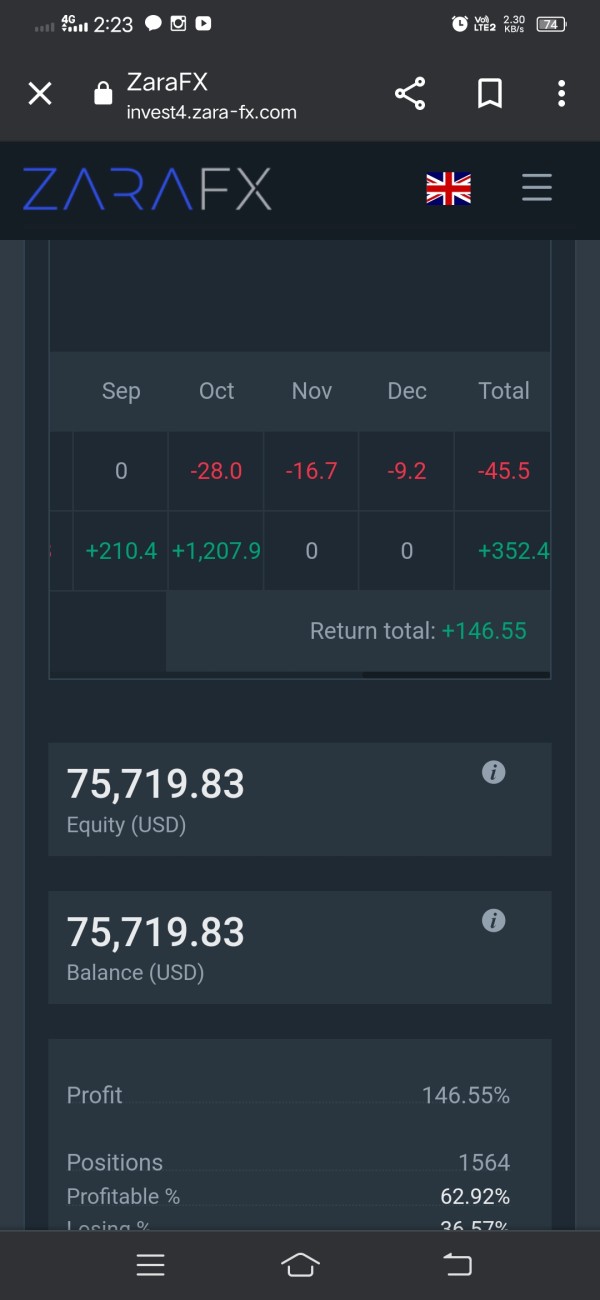

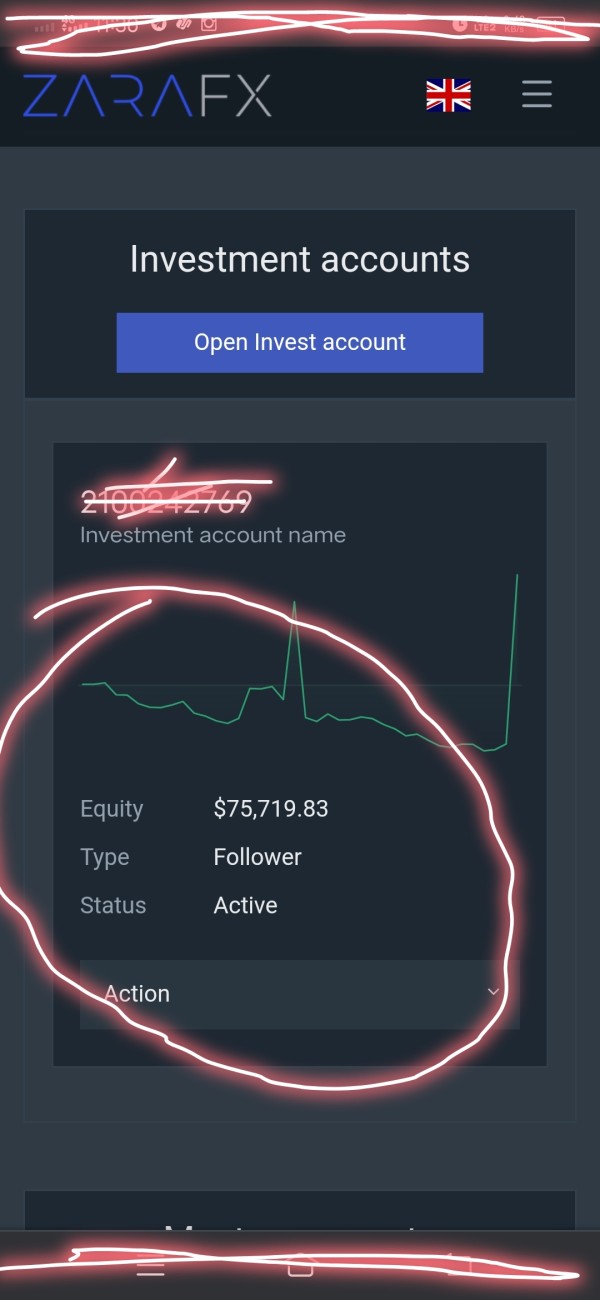

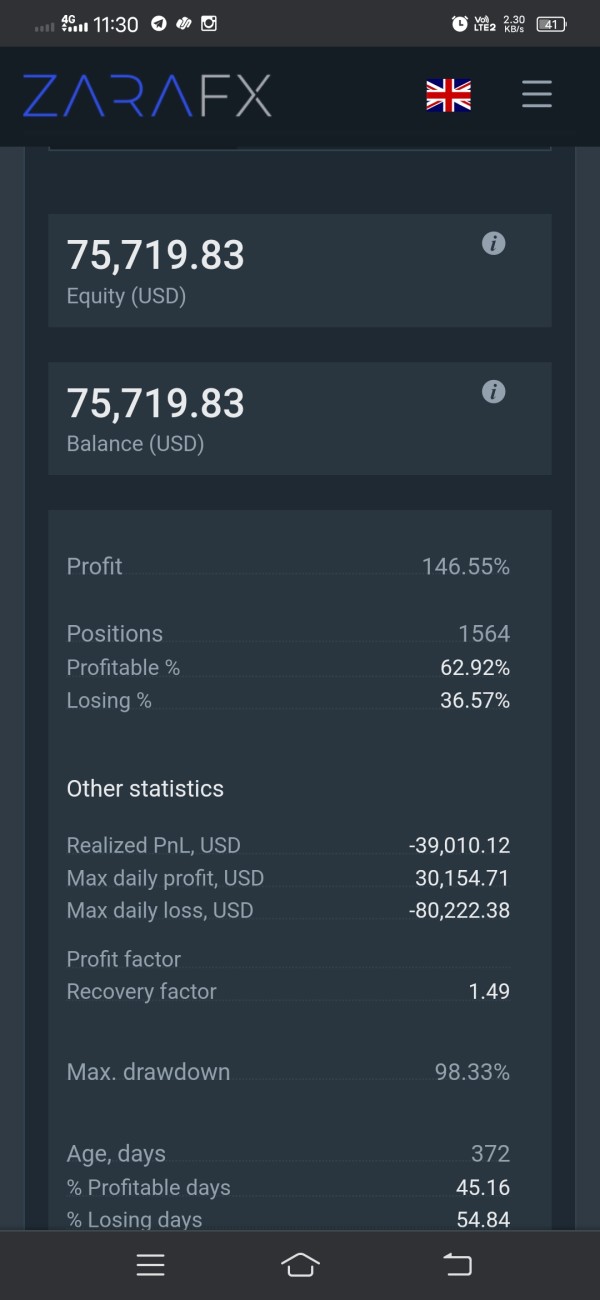

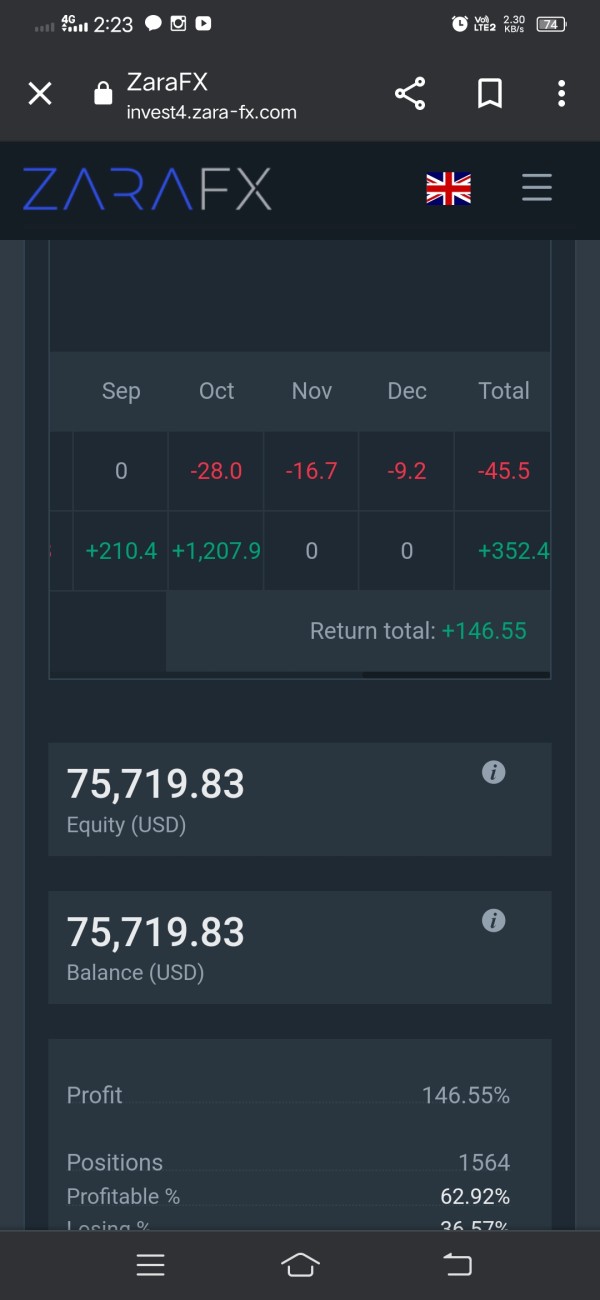

Zarvista Capital Markets is a rebranded CFD broker. The company has changed a lot in recent years to build a stronger presence in global markets. FX News Group reports that the offshore CFD broker used to be called ZaraFX. The company finished rebranding to Zarvista Capital Markets in 2024, promising better services and a modern approach for traders worldwide. This zarvista review shows a broker that offers four different account types. Their VIP account has competitive 0-pip spreads and charges $5 per lot in commissions. The platform also offers swap-free accounts that follow Islamic trading rules. This makes the broker available to more international traders. Zarvista Capital Markets focuses on traders who want different trading tools and good service across many asset types like forex, indices, stocks, and commodities. But user reviews on sites like Trustpilot show mixed feelings about service quality and how open the company is about its operations. This shows areas where the broker is still working to build a better reputation.

Important Notice

Zarvista Capital Markets works under different rules in different countries. The main company is registered in Mauritius and regulated by the Financial Services Commission (FSC). Related company operations may involve entities registered in Cyprus. This review uses information that anyone can find and user feedback from many sources like trading industry publications and review platforms. The goal is to give an objective look at the broker's services. Traders should still do their own research before making investment decisions. The website clearly states it is not for EU residents. This shows there are limits on where the service is available.

Rating Framework

Broker Overview

Zarvista Capital Markets came from the rebranding of ZaraFX. Stock Broker Chooser reported that the company finished this change in 2024. The company sees itself as a CFD broker that wants to provide complete trading services across many financial tools. After changing its brand, Zarvista aims to build a stronger global presence while making service quality and operations better. The broker works mainly as a contracts for difference (CFD) provider. This lets clients trade on price movements of different financial tools without owning the actual assets. This business model allows traders to use leverage across different markets while needing less money compared to traditional investment methods.

The company's services include foreign exchange trading, stock indices, individual stocks, and commodity markets. Available regulatory information shows that Zarvista Capital Markets works under Financial Services Commission (FSC) oversight in Mauritius. This provides a regulatory framework for its operations. The broker targets international traders who want different trading opportunities with competitive prices. But specific details about trading platform technology and advanced trading tools are limited in available documents. This suggests areas where the broker may need to be more open and provide better information for potential clients.

Regulatory Jurisdiction: Zarvista Capital Markets is registered in Mauritius and works under Financial Services Commission (FSC) regulation. This provides offshore regulatory oversight for its CFD trading services.

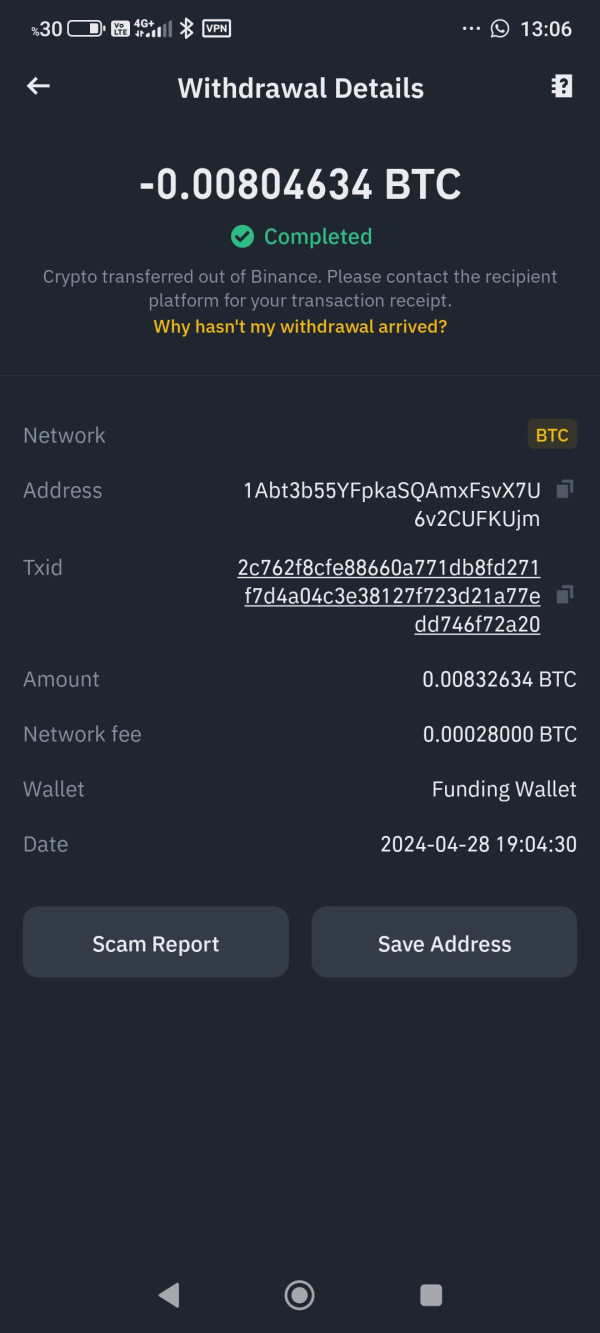

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. Traders need to contact the broker directly for complete payment processing information.

Minimum Deposit Requirements: Available documents do not specify minimum deposit requirements for different account types. This information requires direct verification with the broker.

Bonus and Promotions: Current promotional offers and bonus structures are not mentioned in available sources. Traders should contact the broker directly for information about any available incentives.

Tradeable Assets: The broker offers trading opportunities across four main asset categories. These include foreign exchange pairs, stock indices, individual stocks, and commodity instruments, providing different market exposure for traders.

Cost Structure: Pricing begins at 1.7 pips for standard accounts. The VIP account tier offers 0-pip spreads with a commission structure of $5 per lot, providing competitive pricing for high-volume traders.

Leverage Ratios: Specific leverage ratios are not detailed in available documents. Traders need to contact the broker directly for accurate leverage information.

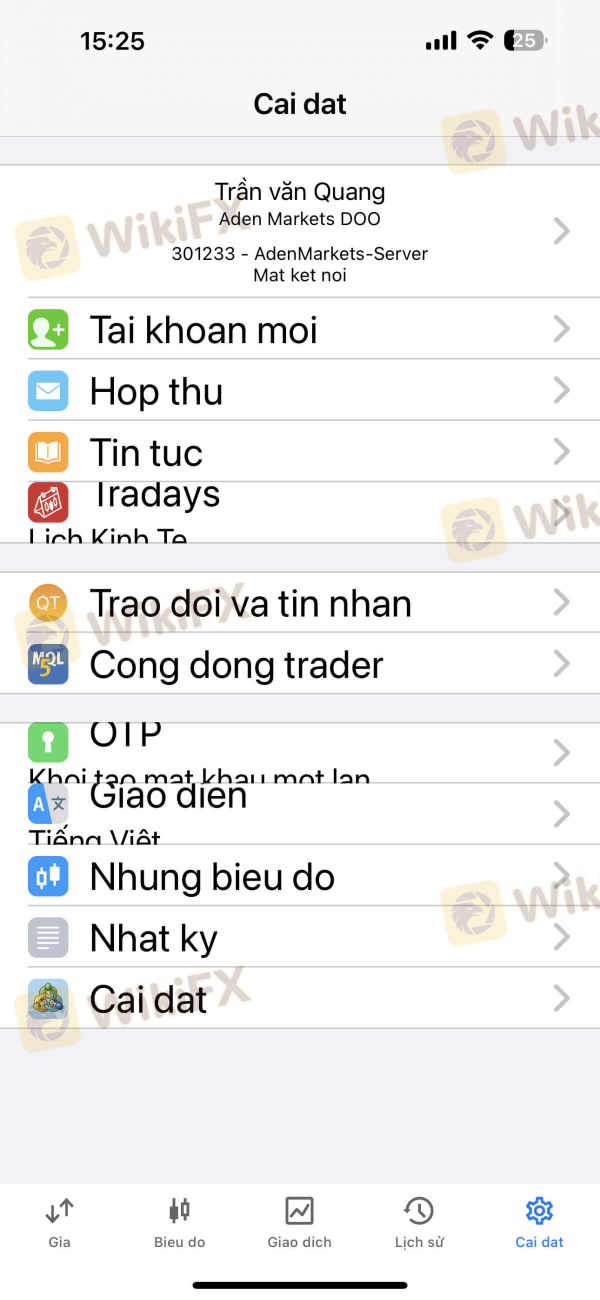

Platform Options: Available sources do not specify which trading platforms are offered by zarvista review subjects. This shows potential information gaps in platform technology disclosure.

Geographic Restrictions: The service clearly excludes EU residents from accessing their trading platform. This shows compliance with regional regulatory requirements.

Customer Service Languages: Available documents do not specify supported languages for customer service communications.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Zarvista Capital Markets shows competitive account structure through its four-tier account system. The broker has particular strength in its VIP account offering. The broker's pricing model shows consideration for different trader segments, from retail participants to high-volume institutional clients. The VIP account's 0-pip spread structure combined with clear $5 per lot commission represents competitive pricing in the CFD market space. But the lack of publicly available minimum deposit requirements creates uncertainty for potential clients planning their account funding strategies. The inclusion of swap-free accounts specifically addresses Islamic trading principles. This shows cultural sensitivity and market inclusivity that expands the broker's potential client base.

User feedback about account opening procedures and ongoing account management remains limited in available sources. This makes it difficult to assess the practical aspects of account maintenance and client onboarding processes. The account structure appears designed to accommodate different trading styles and volume levels. Specific feature comparisons between account tiers require additional clarification. When compared to industry standards, Zarvista's VIP account pricing structure offers competitive advantages. This is particularly true for traders who generate enough volume to justify commission-based pricing over spread-based costs. This zarvista review shows that while account conditions show promise, better transparency about account requirements and features would benefit prospective clients' decision-making processes.

The broker's trading tools and resources present a mixed picture based on available information. Zarvista offers access to multiple asset classes including forex, indices, stocks, and commodities. But specific details about analytical tools, research resources, and trading utilities remain unclear in available documents. This information gap significantly impacts the assessment of the broker's technological capabilities and support resources for trader decision-making. The absence of detailed platform specifications or advanced trading tool descriptions suggests either limited resource availability or insufficient marketing communication about existing capabilities.

Educational resources are increasingly important for broker competitiveness but are not mentioned in available sources. This potentially shows a weakness in client development support. Market analysis tools, economic calendars, and research reports are standard industry offerings that appear to lack clear documentation in Zarvista's public materials. The broker's approach to automated trading support, expert advisors, and algorithmic trading capabilities remains unspecified. This creates uncertainty for traders who rely on these advanced features. Industry feedback suggests neutral positioning for Zarvista's tools and resources. This shows neither particular strength nor significant weakness compared to market competitors. Better transparency about available trading tools and educational resources would significantly improve this assessment category.

Customer Service and Support Analysis (5/10)

Customer service represents an area of concern based on available user feedback and limited information disclosure. User reviews present mixed opinions about service quality. Some express skepticism about the broker's customer support capabilities and responsiveness. The absence of specific information about customer service channels creates uncertainty about support accessibility. This includes phone support, live chat availability, or email response times. This lack of transparency about customer service infrastructure suggests potential weaknesses in client communication and problem resolution processes.

Response time expectations and service quality standards are not clearly communicated in available materials. This makes it difficult for potential clients to understand support availability during critical trading situations. Multilingual support capabilities remain unspecified. This could limit accessibility for international traders who require native language assistance. User feedback shows concerns about service quality consistency. Specific examples of problem resolution or customer satisfaction improvements are not documented in available sources. The geographic restriction excluding EU residents may also impact customer service complexity. The broker must navigate different regulatory and communication requirements across jurisdictions. Better customer service transparency and improved user feedback management would significantly benefit this assessment area.

Trading Experience Analysis (6/10)

The trading experience assessment faces significant limitations due to insufficient information about platform technology and execution capabilities. Available sources do not specify which trading platforms Zarvista offers. This includes whether they use proprietary or third-party solutions, creating uncertainty about user interface quality and functionality. Platform stability, execution speed, and order processing capabilities are critical factors for trading experience that remain undocumented in available materials. This information gap significantly impacts the ability to assess practical trading conditions and platform reliability under different market conditions.

Mobile trading capabilities are essential for modern trading flexibility but are not mentioned in available documents. This potentially shows limited mobile platform development or insufficient marketing communication about existing capabilities. Order execution quality, including slippage rates and requote frequency, lacks specific documentation that would enable accurate assessment of trading environment quality. User feedback about trading experience shows varied opinions. Specific technical performance data or user satisfaction metrics are not available in reviewed sources. The absence of detailed platform specifications or execution statistics suggests either limited platform sophistication or insufficient transparency about trading infrastructure capabilities. This zarvista review shows that better platform information disclosure would significantly improve trading experience assessment accuracy.

Trustworthiness Analysis (6/10)

Zarvista Capital Markets' trustworthiness profile presents mixed indicators requiring careful consideration. The broker's regulation by the Financial Services Commission (FSC) in Mauritius provides regulatory oversight. Offshore regulation may carry different implications compared to major financial centers' regulatory frameworks. User feedback about the broker's legitimacy and service quality shows polarized opinions. Some users express skepticism about operational transparency and service delivery. This divergence in user opinions suggests either inconsistent service quality or varying client expectations and experiences.

Fund safety measures and client protection protocols are not detailed in available documents. This creates uncertainty about investor protection standards and segregated account practices. Company transparency about ownership structure, financial statements, and operational procedures appears limited based on available public information. The rebranding from ZaraFX to Zarvista Capital Markets may be positive for brand development but also creates questions about operational continuity and the reasons behind the brand transformation. Third-party review platforms show mixed ratings. This shows varied client experiences and satisfaction levels. The absence of detailed information about negative event handling or dispute resolution procedures suggests potential weaknesses in crisis management and client protection protocols. Better transparency about regulatory compliance, fund safety measures, and operational procedures would significantly improve trustworthiness assessment.

User Experience Analysis (5/10)

Overall user satisfaction presents a polarized picture based on available feedback and review platform ratings. User reviews on Trustpilot and other platforms show contrasting opinions. Some clients express satisfaction while others voice concerns about service quality and operational transparency. This divergence suggests inconsistent user experience delivery or varying client expectations and trading requirements. Interface design and platform usability information is not available in reviewed sources. This limits assessment of practical user interaction quality and ease of use.

Account registration and verification processes are not detailed in available documents. This creates uncertainty about onboarding efficiency and client authentication procedures. Fund operation experiences, including deposit and withdrawal processing times and methods, lack specific documentation that would enable accurate assessment of financial transaction convenience. Common user complaints appear to focus on service quality and legitimacy concerns. Specific resolution examples or improvement initiatives are not documented in available sources. The target user profile appears to include traders seeking different trading instruments. Specific user demographic data or satisfaction metrics are not available. User feedback polarization shows either significant service quality variations or diverse client expectations that the broker may struggle to meet consistently. Better user experience consistency and improved feedback management would significantly benefit this assessment category.

Conclusion

Zarvista Capital Markets presents a developing broker with potential strengths in account structure diversity and competitive VIP pricing. The broker faces challenges in transparency, customer service consistency, and user satisfaction uniformity. The broker's four-tier account system and competitive VIP account conditions show understanding of different trader segments. Swap-free account availability shows cultural market sensitivity. But significant information gaps about platform technology, customer service infrastructure, and operational procedures limit comprehensive assessment and may concern potential clients seeking detailed broker evaluation.

The mixed user feedback and polarized review ratings suggest inconsistent service delivery that requires attention for long-term market success. Suitable user types include traders seeking different asset access and specific account features like Islamic-compliant trading. Those requiring comprehensive platform information and consistent customer service may find alternatives more appropriate. Primary advantages include competitive VIP pricing and account diversity. Disadvantages include limited transparency, mixed user feedback, and insufficient operational information disclosure for thorough due diligence.