Regarding the legitimacy of Tradeview forex brokers, it provides CIMA and WikiBit, .

Is Tradeview safe?

Business

License

Is Tradeview markets regulated?

The regulatory license is the strongest proof.

CIMA Derivatives Trading License (EP)

Cayman Islands Monetary Authority

Cayman Islands Monetary Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Tradeview Ltd

Effective Date:

2012-04-04Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Tradeview A Scam?

Introduction

Tradeview is a multi-asset broker established in 2004, primarily known for offering forex, CFDs, and stock trading services. With its headquarters in the Cayman Islands and additional regulatory licenses from entities like the Malta Financial Services Authority (MFSA) and the Cayman Islands Monetary Authority (CIMA), Tradeview positions itself as a reputable player in the online trading landscape. However, the forex market is notoriously rife with scams and unreliable brokers, making it essential for traders to conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive evaluation of Tradeview, assessing its legitimacy, regulatory compliance, trading conditions, and user experiences. Our investigation is based on a review of multiple sources, including regulatory databases, customer feedback, and expert analyses, ensuring a balanced and objective assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor that can significantly impact its legitimacy and the safety of client funds. Tradeview operates under several regulatory jurisdictions, which is a positive sign, but its essential to analyze the quality of these regulations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MFSA | IS/93990 | Malta | Verified |

| CIMA | 585163 | Cayman Islands | Verified |

| FSC | GB20025800 | Mauritius | Verified |

| FSA | LL15870 | Labuan | Verified |

The MFSA is known for its stringent regulatory framework, requiring brokers to adhere to high standards of transparency and client protection. This includes maintaining segregated accounts for client funds and providing negative balance protection. However, it is important to note that while Tradeview is regulated by these authorities, its operations in offshore jurisdictions may pose certain risks. Offshore regulations often lack the stringent oversight found in top-tier jurisdictions like the UK's Financial Conduct Authority (FCA) or the US Securities and Exchange Commission (SEC).

Despite these concerns, Tradeview has maintained a good reputation over the years, with no significant regulatory infractions reported. However, potential clients should remain cautious and consider the implications of trading with a broker that operates under multiple regulatory frameworks, especially those in less stringent jurisdictions.

Company Background Investigation

Tradeview has been operational since 2004, originally founded to provide direct market access (DMA) for retail and institutional traders. The company has grown significantly since its inception, serving over 100,000 clients globally. Its ownership structure appears transparent, with the broker operating as Tradeview Europe Ltd. in Malta and Tradeview Ltd. in the Cayman Islands, among other entities.

The management team at Tradeview is composed of seasoned professionals with extensive experience in financial markets. This expertise is crucial for maintaining a broker's operational integrity and ensuring compliance with regulatory requirements. The company's commitment to transparency is reflected in its detailed disclosures regarding trading conditions, regulatory status, and customer service policies.

Moreover, Tradeview offers a range of educational resources aimed at enhancing traders' knowledge and skills. This commitment to trader education indicates a focus on fostering a knowledgeable trading community, which is a positive aspect for potential clients.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and spreads, is essential. Tradeview offers a competitive fee structure, which is attractive to both novice and experienced traders. However, its important to scrutinize any unusual or potentially problematic fee policies.

| Fee Type | Tradeview | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 1.2 pips |

| Commission Model | $2.50 per lot | $5.00 per lot |

| Overnight Interest Range | Varies by asset | Varies widely |

The spreads offered by Tradeview are notably low, starting from 0.1 pips for major currency pairs, which is below the industry average. This can be particularly advantageous for high-frequency traders. However, the commission structure, while competitive, may still be a concern for some traders, especially those who trade in high volumes.

Additionally, traders should be aware of any hidden fees associated with withdrawals or inactivity. While Tradeview does not charge deposit fees, some withdrawal methods incur charges, which could affect overall profitability. It is advisable for traders to familiarize themselves with the complete fee structure before opening an account.

Client Fund Safety

The safety of client funds is paramount when selecting a broker. Tradeview implements several measures to protect client funds, including segregated accounts. This means that client funds are kept separate from the broker's operational funds, reducing the risk of misappropriation.

Tradeview also offers negative balance protection, which ensures that clients cannot lose more than their deposited amount. This is particularly important in the volatile forex market, where rapid price movements can lead to significant losses.

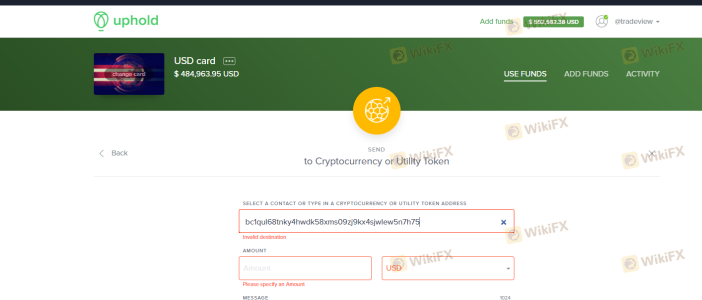

However, there have been some historical concerns regarding fund safety, particularly related to withdrawal issues and customer complaints about delays. While these issues are not uncommon in the industry, they warrant attention and caution from potential clients.

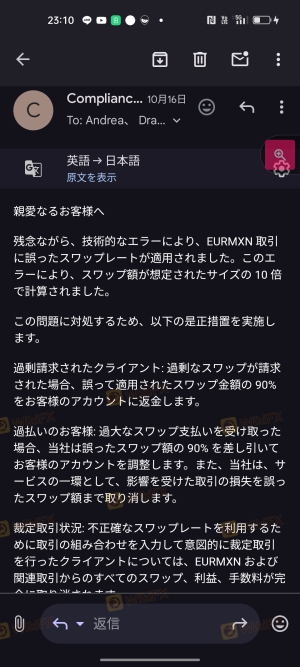

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. Tradeview has received mixed reviews from users, with some praising its low spreads and diverse trading instruments, while others have raised concerns about withdrawal difficulties and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Verification Issues | Medium | Moderate response |

| Customer Support Availability | Medium | Inconsistent |

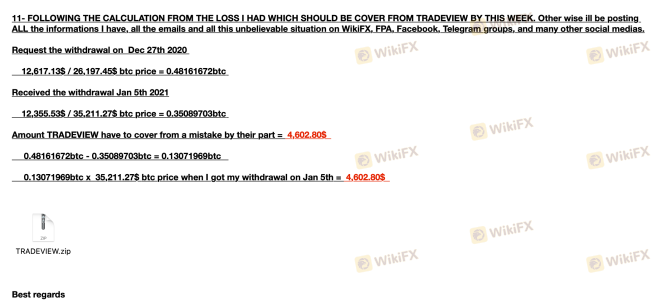

Common complaints include issues with fund withdrawals, where users have reported delays and difficulties in accessing their money. Additionally, some traders have expressed frustration with the company's customer support, citing slow response times and inadequate assistance. These issues highlight the importance of evaluating a brokers customer service capabilities before committing funds.

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and concerns about the broker's reliability. While Tradeview has made efforts to address these issues, it is essential for potential clients to consider these factors when deciding whether to engage with the broker.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for traders. Tradeview offers several platforms, including MetaTrader 4, MetaTrader 5, cTrader, and Currenex. These platforms are known for their robust features, including advanced charting tools and automated trading capabilities.

However, the quality of order execution is equally important. Tradeview claims to provide fast execution speeds, but some users have reported instances of slippage and order rejections. This can be particularly concerning during volatile market conditions, where timely execution is crucial.

Overall, while Tradeview's platforms are well-regarded, potential clients should be aware of the importance of testing the platform through a demo account before committing real funds.

Risk Assessment

Engaging with any broker involves inherent risks, and it is crucial to evaluate these risks comprehensively.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Operating under multiple jurisdictions can pose risks. |

| Fund Withdrawal Risk | High | Historical complaints about withdrawal delays. |

| Platform Stability Risk | Medium | Reports of slippage and execution issues. |

To mitigate these risks, it is advisable for traders to maintain a diversified portfolio and avoid investing more than they can afford to lose. Additionally, utilizing demo accounts can help traders familiarize themselves with the platform and trading conditions without financial risk.

Conclusion and Recommendations

In conclusion, while Tradeview is a regulated broker with a long history in the forex market, it is essential for potential clients to approach with caution. The broker offers competitive trading conditions and a diverse range of instruments, but there are notable concerns regarding fund withdrawal processes and customer service responsiveness.

For traders seeking a reliable broker, it may be prudent to consider alternatives with stronger regulatory oversight and better customer feedback. Recommended alternatives include brokers with top-tier regulation, such as IG or OANDA, which have established a reputation for reliability and customer support.

Ultimately, conducting thorough research and considering personal trading needs will help traders make informed decisions in their quest for a trustworthy trading partner.

Is Tradeview a scam, or is it legit?

The latest exposure and evaluation content of Tradeview brokers.

Tradeview Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradeview latest industry rating score is 1.84, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.84 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.