Is SyncMarkets safe?

Business

License

Is Sync Markets A Scam?

Introduction

Sync Markets, a forex broker established in 2024, has entered the competitive landscape of the foreign exchange market offering various trading instruments including forex, commodities, stocks, cryptocurrencies, and indices. As trading becomes increasingly accessible, it is crucial for traders to meticulously evaluate the legitimacy and reliability of brokers like Sync Markets. The forex market, while offering lucrative opportunities, is also rife with potential scams and unregulated entities. Therefore, traders must approach their choice of broker with caution, ensuring they are not falling victim to fraudulent practices.

This article aims to provide a comprehensive analysis of Sync Markets by exploring its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and overall risk assessment. The evaluation is based on data gathered from various online resources, including reviews and regulatory databases, to present a balanced perspective on whether Sync Markets is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the legitimacy of a forex broker. Sync Markets claims to be regulated under the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulations. The importance of regulation lies in the protection it offers to traders, ensuring that brokers adhere to specific operational standards and ethical practices.

Core Regulatory Information

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001310454 | Australia | Verified |

Sync Markets is listed as an appointed representative under ASIC, which generally indicates a level of oversight. However, it is important to note that the company is relatively new, having been registered in 2024, raising questions about its operational history and compliance track record. The broker's claims of being registered under the Australian Financial Services (AFS) further enhance its credibility, but traders should remain vigilant as the broker's short operating history might not provide enough assurance of long-term reliability.

The quality of regulation is paramount; ASIC is considered a top-tier regulator, providing a higher level of investor protection compared to brokers regulated by lower-tier authorities. Nevertheless, the broker's recent establishment means it has yet to build a comprehensive compliance history, which could be a point of concern for potential clients.

Company Background Investigation

Sync Markets Ltd. was founded in April 2024 and is based in Adelaide, Australia. Despite its recent inception, the company claims to offer a range of financial services and trading options. The ownership structure and management team details remain somewhat opaque, which is not uncommon for newer brokers. A transparent company profile typically includes information about its founders, management experience, and operational history, all of which are essential for establishing trust.

The management teams background is particularly relevant; experienced professionals in the trading and finance sectors can lend credibility to a brokerage. However, as of now, there is limited public information available about the individuals behind Sync Markets. This lack of transparency can be a red flag for potential investors, as it becomes challenging to assess the broker's reliability without knowing who is at the helm.

Moreover, the level of information disclosure can significantly impact a trader's perception of a broker's trustworthiness. A broker with clear, accessible information about its operations, management, and financial health is generally viewed more favorably than one that is less forthcoming. Sync Markets' website provides basic information, but the absence of detailed disclosures regarding its management team and operational history could deter cautious traders.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital. Sync Markets provides various account types, including standard, premium, and pro accounts, each with different features tailored to traders' needs. The broker advertises competitive trading conditions, including spreads starting from as low as 0.1 pips and leverage of up to 1:500, which can be enticing for traders looking to maximize their potential returns.

Core Trading Cost Comparison

| Cost Type | Sync Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 1.0 pips |

| Commission Structure | $0 | $5-10 |

| Overnight Interest Range | Variable | Variable |

Sync Markets claims to have a commission-free structure, which is appealing for traders who prefer to avoid additional costs. However, the lack of a demo account may hinder new traders from testing the platform and the trading conditions before committing real funds. Additionally, while low spreads and high leverage can enhance trading potential, they also increase risk, especially for inexperienced traders who may not fully understand the implications of using high leverage.

Moreover, traders should be aware of any hidden fees or unusual policies that could affect their trading experience. For instance, brokers sometimes impose withdrawal fees or inactivity charges, which can significantly impact overall profitability. It is essential for potential clients to thoroughly review the terms of service and fee schedules before opening an account.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Sync Markets claims to implement various security measures to protect client funds, including segregated accounts and investor protection policies. Segregation of funds means that client deposits are kept separate from the broker's operational funds, which is a standard practice among reputable brokers.

However, the effectiveness of these measures can only be assessed through historical performance and any past incidents involving fund security. As a relatively new broker, Sync Markets has not yet faced significant scrutiny regarding its fund safety practices. Traders should remain cautious and inquire about the specific measures the broker has in place to ensure their funds are protected.

Additionally, the absence of a clear investor compensation scheme could be a concern. Such schemes are designed to protect clients in case the broker faces financial difficulties or insolvency. A lack of such protections may expose traders to higher risks, making it essential for them to consider this aspect when evaluating the safety of their investments with Sync Markets.

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing a broker's reliability. Reviews and testimonials can provide insight into the quality of service and any recurring issues faced by clients. Sync Markets has received mixed reviews, with some traders praising its competitive trading conditions while others have raised concerns about customer support and withdrawal processes.

Common Complaint Analysis

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Limited availability |

| Platform Stability Issues | Medium | Ongoing improvements |

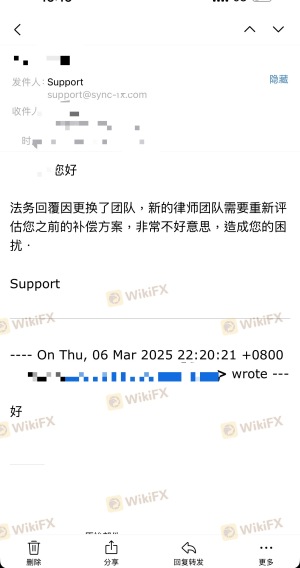

One of the most common complaints involves withdrawal delays, which can be a significant red flag for traders. A broker's ability to process withdrawals promptly is crucial for maintaining trust. Additionally, the quality of customer support is often highlighted, with reports of limited availability and slow response times. This can lead to frustration among clients, particularly during critical trading moments.

A notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and a sense of distrust towards the broker. While the company eventually resolved the issue, the initial response time raised concerns about its operational efficiency. Such experiences can deter potential clients from considering Sync Markets as a viable trading option.

Platform and Trade Execution

The trading platform's performance is a critical factor in a trader's overall experience. Sync Markets utilizes the MT5 platform, which is known for its robust features and user-friendly interface. However, the platform's stability and execution quality are essential to evaluate.

A well-functioning platform should ensure quick order execution, minimal slippage, and a low rejection rate. Traders have reported mixed experiences with Sync Markets' platform performance, with some noting occasional slippage during volatile market conditions. These issues can impact trading outcomes, particularly for those employing high-frequency trading strategies.

Furthermore, any signs of platform manipulation, such as frequent re-quotes or unjustified trade rejections, can indicate underlying problems with the broker's operations. Traders should remain vigilant and monitor their trading experiences closely, especially during high-impact news events that can lead to increased volatility.

Risk Assessment

Trading with any broker involves inherent risks, and Sync Markets is no exception. Evaluating the overall risk associated with using this broker is vital for making an informed decision.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | New broker with limited history |

| Fund Safety | Medium | Segregated accounts in place |

| Customer Support Reliability | High | Complaints about slow response |

| Platform Stability | Medium | Occasional slippage reported |

Traders should be aware of the potential risks associated with using Sync Markets, particularly regarding regulatory compliance and customer support reliability. While the broker is regulated by ASIC, its short operational history raises questions about its long-term stability and commitment to compliance. Additionally, the reported issues with customer support can exacerbate the risks traders face, particularly in critical trading situations.

To mitigate these risks, traders are advised to start with a small investment and closely monitor their experiences with the broker. Conducting thorough research and remaining informed about market conditions can also help traders make better decisions.

Conclusion and Recommendations

In conclusion, while Sync Markets is regulated by ASIC, its relatively short operational history and the mixed reviews from clients suggest that traders should exercise caution. The broker offers competitive trading conditions and claims to implement security measures for client funds, but concerns regarding customer support and withdrawal processes cannot be overlooked.

Traders looking for a broker should consider their experience level and risk tolerance. For those who are new to trading, it may be prudent to explore more established brokers with a proven track record and clearer transparency regarding their operations. On the other hand, experienced traders who are comfortable navigating potential risks may find Sync Markets to be an option worth considering, provided they remain vigilant and informed.

For those seeking reliable alternatives, brokers such as IG, OANDA, and FXCM are known for their strong regulatory frameworks, robust customer support, and transparent operations. Ultimately, conducting thorough research and due diligence is essential for ensuring a safe and successful trading experience.

Is SyncMarkets a scam, or is it legit?

The latest exposure and evaluation content of SyncMarkets brokers.

SyncMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SyncMarkets latest industry rating score is 1.23, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.23 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.