sync markets 2025 Review: Everything You Need to Know

1. Abstract

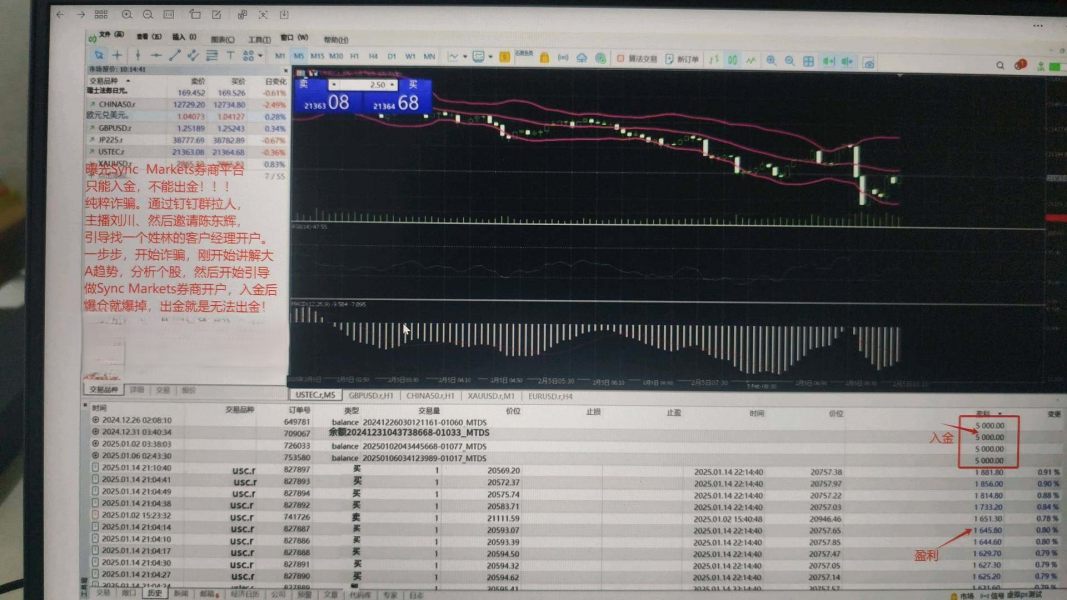

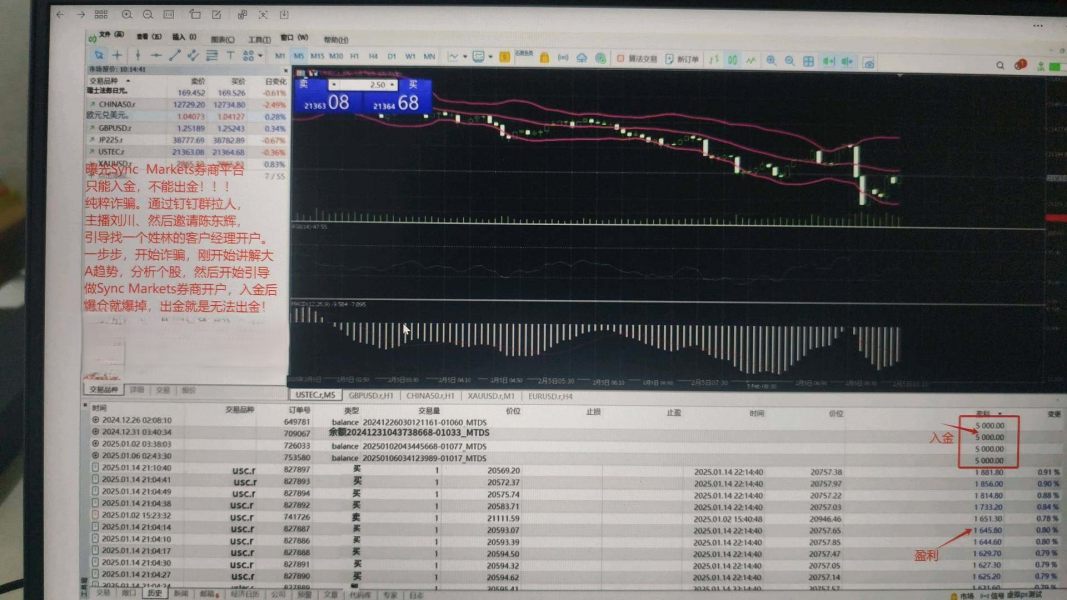

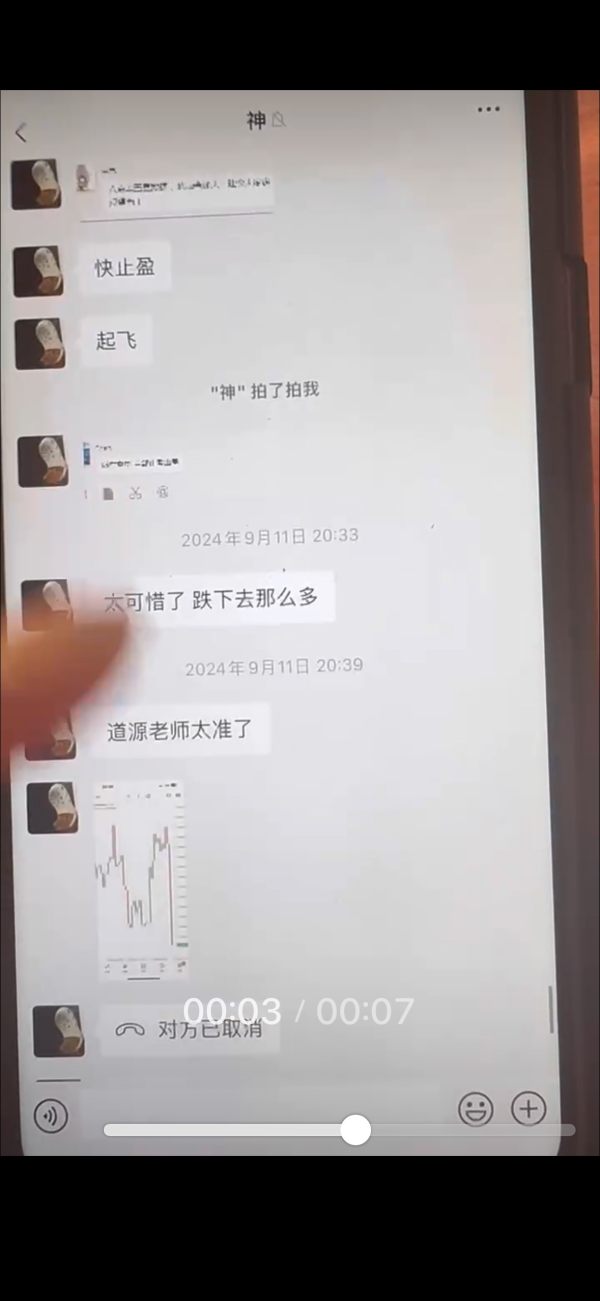

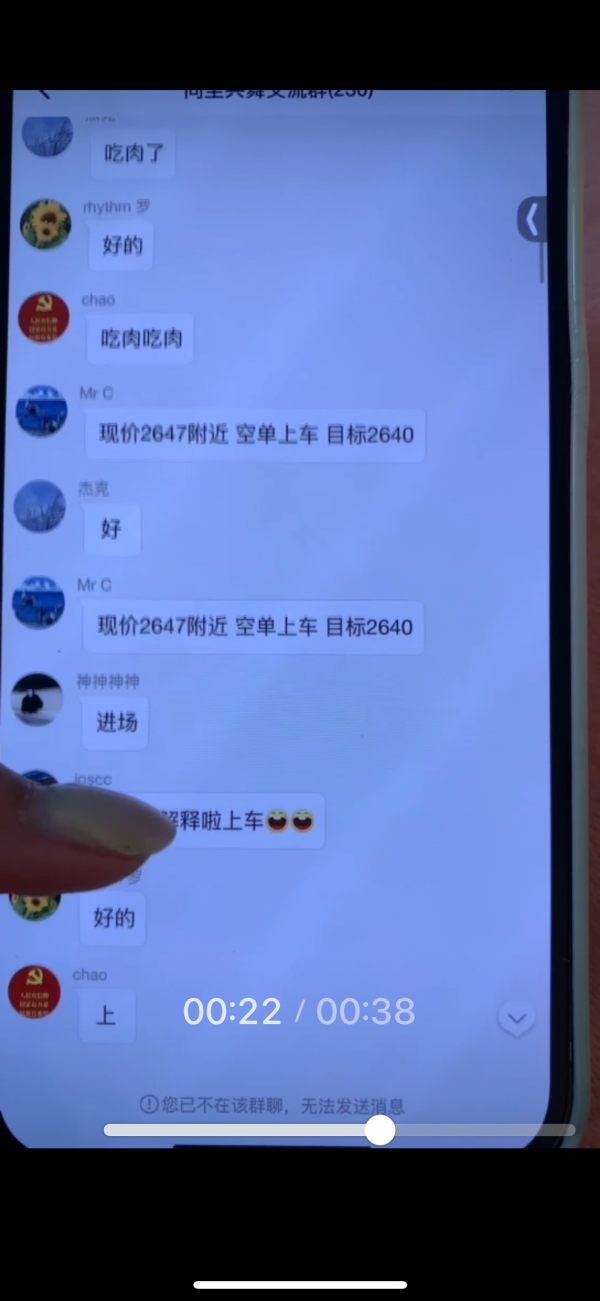

In this sync markets review, we take a critical look at the broker's overall performance. The results are far from positive. Despite offering attractive features such as a maximum leverage of 1:500 and spreads starting from 0, the broker is burdened by a wave of negative user feedback, including multiple scam complaints and cautionary warnings. The broker targets users interested in trading forex, commodities, stocks, and cryptocurrencies. However, the allure of high leverage and low spreads is outweighed by the consistently poor service and overall dubious operational practices. In our investigation, we found that while some traders may be initially drawn by these enticing trading conditions, the negative reputation and reports of potential fraudulent activity raise significant concerns. Various user experiences have highlighted issues such as inadequate account transparency, subpar customer service, and problematic trade executions, including excessive slippage. Overall, this sync markets review underscores that potential clients should proceed with caution and conduct further due diligence before committing funds to this platform.

2. Notice

This review is based on publicly available user feedback and market data, merged with insights extracted from various online sources. It is important to note that certain critical information, such as regional entity differences and specific regulatory details, has not been explicitly outlined in the source materials. As such, this analysis focuses on the experiences shared by users and market observations, rather than official disclosures from the broker. The absence of comprehensive regulatory details and confirmed information concerning the broker's operational background further necessitates a cautious approach when interpreting the data provided herein. Readers should be aware that while the review attempts to remain objective, the limited scope of available data reinforces the need for personal verification before engaging with the broker. The review rests solely on the accessible information and we strongly advise potential traders to consult additional sources before making any decisions.

3. Scoring Framework

4. Broker Overview

Sync Markets is a broker with a highly questionable reputation. Although the precise formation year is not provided in the available materials, the company is reported to have its headquarters in Geneva, Switzerland – a location traditionally associated with financial services. However, several indicators suggest that the company operates through non-traditional and potentially questionable channels. This has raised significant concerns among traders, with numerous user accounts alleging fraudulent practices and scam-like behaviors. Despite the enticing promise of high leverage up to 1:500 and spreads starting at 0, the broker's operational model has led to widespread dissatisfaction. According to various online discussions and market analyses, the background and overall transparency of sync markets have not instilled confidence among market participants, thus necessitating further investigation before any trading decision is made.

Additionally, sync markets offers a diverse array of tradable asset classes, including forex, commodities, stocks, cryptocurrencies, and indices. While these options theoretically promise a broad spectrum of investment opportunities, the actual execution and user experience, as detailed in multiple sync markets review articles, remain marred by negative reports. The lack of confirmation regarding the specific trading platform type, regulatory oversight, and robust customer support further worsens potential risks for traders. Prospective users are cautioned to examine the platform carefully, as the merging of high-risk factors such as low spreads and potential operational irregularities could lead to adverse trading outcomes. Overall, the sync markets review highlights a scenario where the attractive trading conditions are overshadowed by severe reputation issues and operational uncertainties, urging investors to exercise significant caution.

The regulatory region for sync markets remains unclear, with available sources noting that precise regulatory oversight is "information not provided in available summary." Similarly, the deposit and withdrawal methods are not explicitly detailed, leaving traders to assume generic bank transfers and electronic payment methods; however, specific information remains undisclosed. The minimum deposit requirement is also not mentioned, which further complicates the transparency of account opening processes. Regarding bonuses and promotions, our sources indicate that such offers are not well publicized and remain "information not provided."

In terms of tradable assets, sync markets offers a wide range including forex, commodities, stocks, cryptocurrencies, and indices. However, while these asset classes provide diversified trading options, the accompanying cost structure details are concerning – with a maximum leverage of 1:500 and spreads starting from 0, which appear attractive at first glance. In reality, these conditions often come with hidden risks and additional costs that are not explicitly stated. The leverage ratio, confirmed at a maximum of 1:500, may entice risk-tolerant individuals, but it ultimately contributes to a volatile trading environment for less experienced investors. Regarding platform choice, detailed information on the specific trading technology and platform functionality remains "information not provided." Similarly, area-related restrictions and supported customer service languages have not been thoroughly explained, leaving many essential operational aspects ambiguous. Overall, this detailed sync markets review underscores significant gaps in credibility and operational clarity that warrant cautious consideration by potential traders.

6. Detailed Scoring Analysis

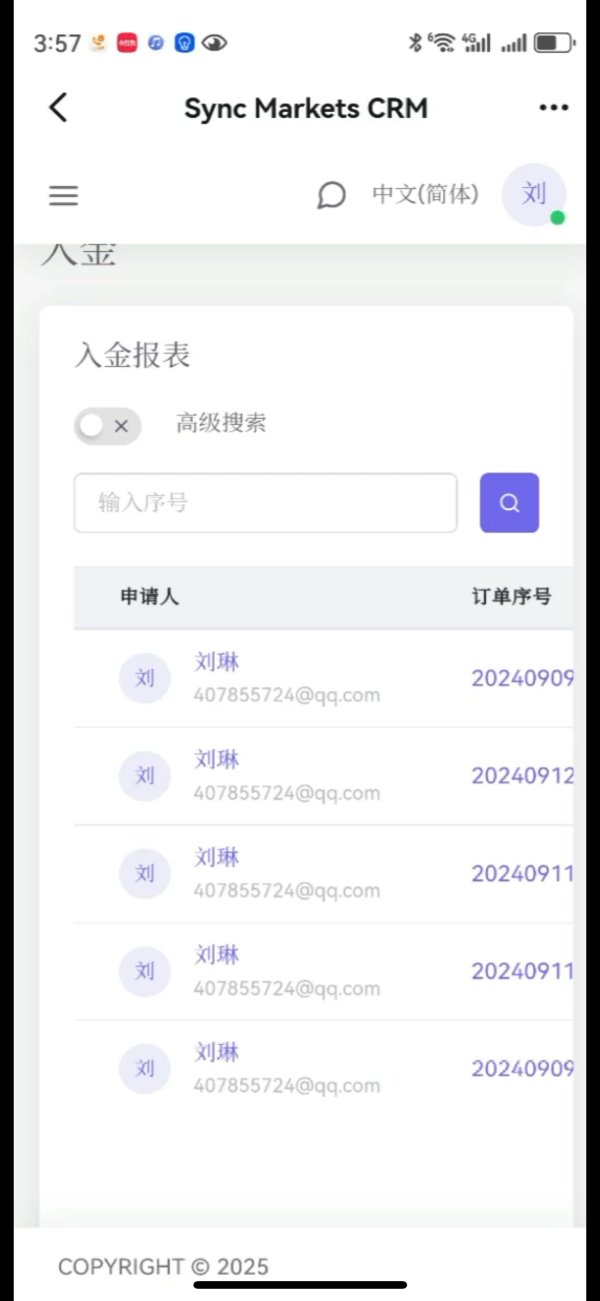

6.1 Account Conditions Analysis

In the realm of account conditions, sync markets falls short of meeting industry standards based on available data. The absence of information regarding minimum deposit requirements shows a significant gap in transparency that may discourage potential traders. Although the broker boasts a high leverage ratio of 1:500 and advertises spreads starting from 0, these features are overshadowed by the lack of clarity on associated account fees and account opening procedures. The account types available remain unclear, with no clear distinction between different trading accounts or special features such as Islamic accounts. Numerous user testimonies reflect discontent over the unclear terms and conditions, with many indicating that a transparent disclosure of fees and costs was never provided. Compared to other brokers with well-documented account conditions, the deficiencies witnessed here render sync markets less competitive and riskier. The prevailing dissatisfaction among users, as gathered from multiple online reviews and forum discussions, firmly impacts the overall rating in this dimension. As highlighted by the sync markets review, potential investors are urged to conduct further inquiry into account-related policies before proceeding with any investments.

The analysis of the tools and resources provided by sync markets reveals another critical shortcoming. The platform falls short in offering a comprehensive suite of trading tools and analytical resources, such as advanced charting software, automated trading functionalities, and educational materials. In many industry comparisons, sync markets has been noted for its lack of investment in research and development that typically supports effective decision-making in volatile markets. The available information does not detail specifics regarding the trading platforms used, leaving traders without a clear picture of the technological capabilities of the broker. In expert reviews, the limited toolset provided by the broker has been directly connected with the inability of traders to execute informed trading strategies. Additionally, the alleged absence of educational resources and research insights further compounds the challenges faced by users. According to a recent sync markets review, traders have consistently reported that the trading interface and available tools do not match the expectations set by competing brokers in the industry. This shortage in quality and quantity of resources significantly diminishes the overall suitability of the platform for serious traders, making it imperative for potential users to seek alternative brokers with more robust technological support.

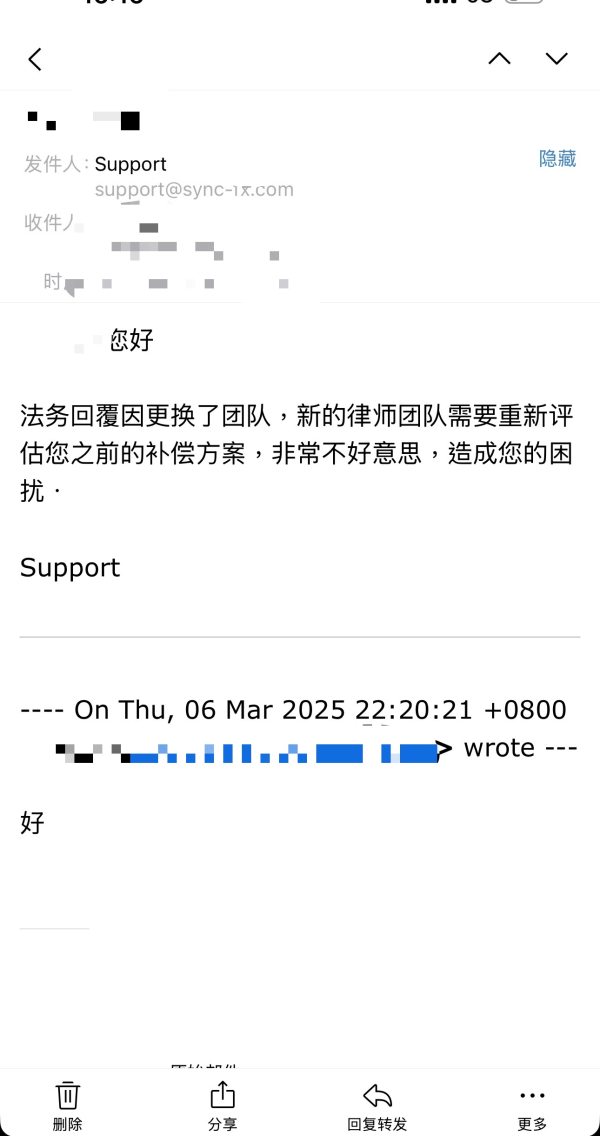

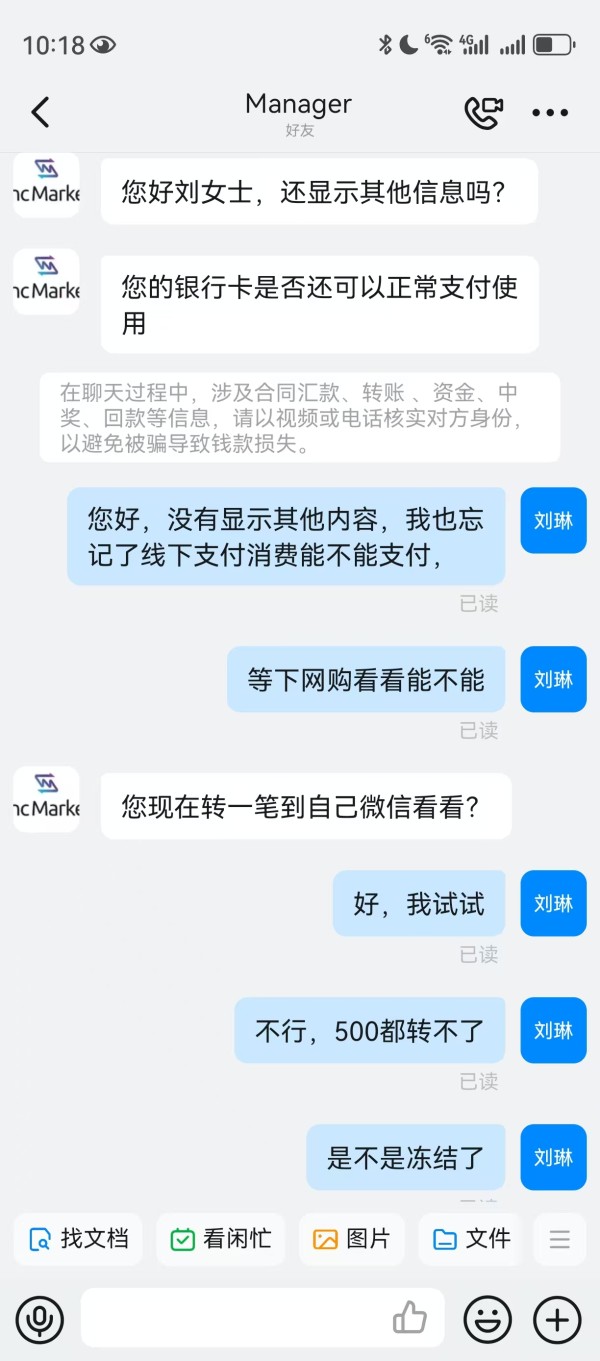

6.3 Customer Service & Support Analysis

The findings regarding customer service and support at sync markets are particularly concerning. Multiple user accounts indicate that the broker's customer support channels are poorly staffed and overly slow in addressing client queries or issues. Reports suggest that when users attempted to resolve disputes or technical problems, they encountered long response times and unsatisfactory resolutions, which has severely tarnished the broker's reputation. The information available does not clarify the specific modes of contact available to users, such as live chat, email, or telephone support, nor does it specify the language options supported by the service. User feedback consistently points to inadequate support during critical trading periods, with many complaints focusing on the lack of timely help and inefficient problem resolution. Experts echo these observations, with several industry analyses and the sync markets review repeatedly noting that poor customer service is among the top factors driving traders away from the platform. The lack of accessible, multilingual, and responsive support channels has a direct impact on client satisfaction and confidence in the broker, and it remains a significant drawback when compared to more established and customer-focused competitors in the trading industry.

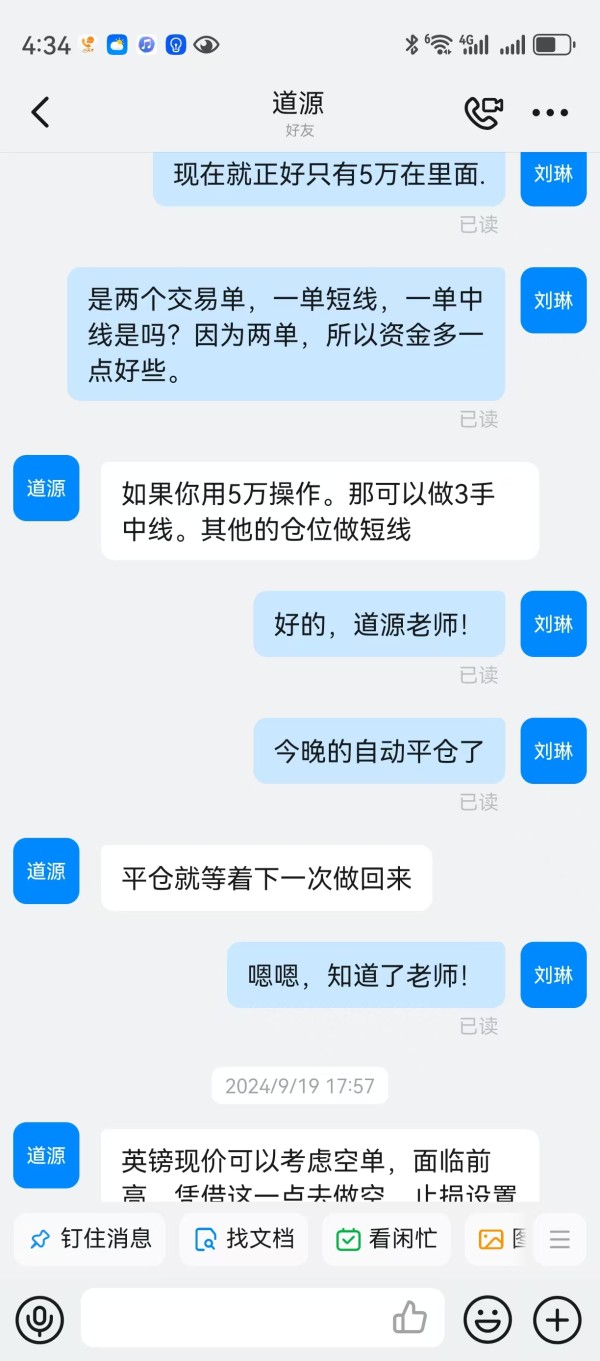

6.4 Trading Experience Analysis

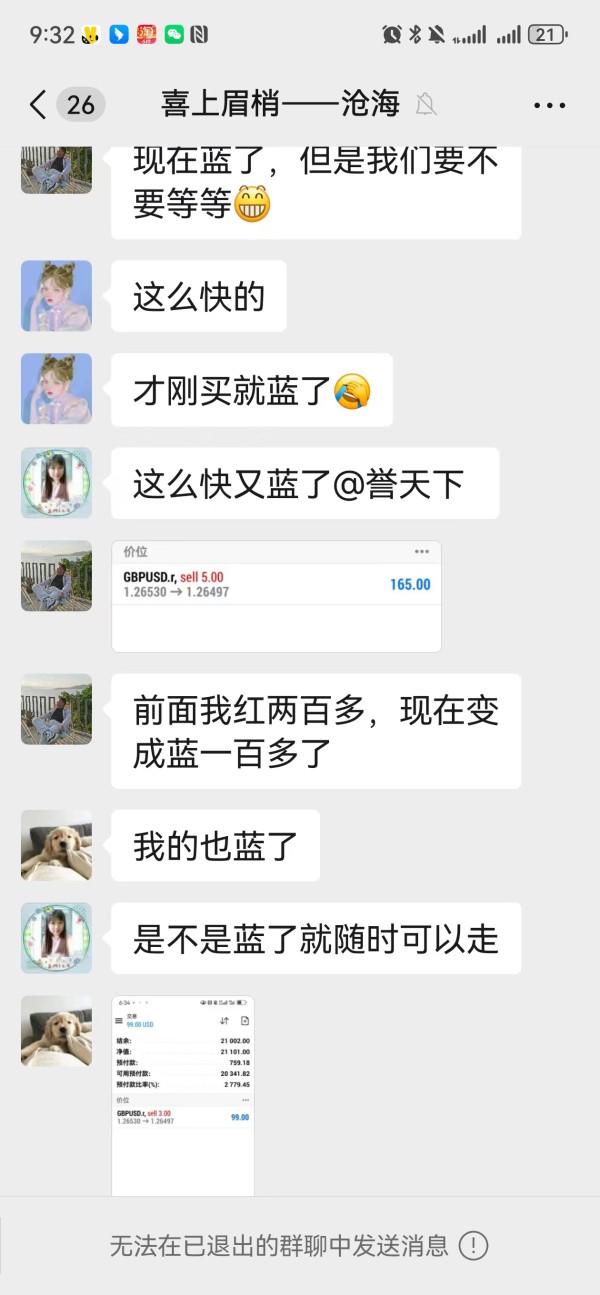

The trading experience provided by sync markets is marred by several critical issues. Although the broker advertises attractive conditions such as spreads beginning at 0 and high leverage of 1:500, user feedback raises serious concerns about order execution and overall platform reliability. Many traders have reported persistent issues with slippage, which adversely affects the profitability and predictability of trade executions. The actual trading environment appears to lack the robustness required for a seamless trading experience, as evidenced by frequent complaints about delayed order processing and occasional platform instability. Furthermore, the absence of detailed performance metrics and technical data on platform operation makes it difficult to verify the advertised benefits. This concern is compounded by the fact that the platform's internal tools and functionalities necessary for optimal trade management are not clearly detailed in the available documentation. According to multiple comments and analyses found in the sync markets review, the disparities between what is advertised and the real-world trading conditions contribute significantly to user dissatisfaction. Overall, despite the lure of low spreads and high leverage, the compromised trading environment undermines confidence and limits the platform's viability for executing efficient and effective trading strategies.

6.5 Trustworthiness Analysis

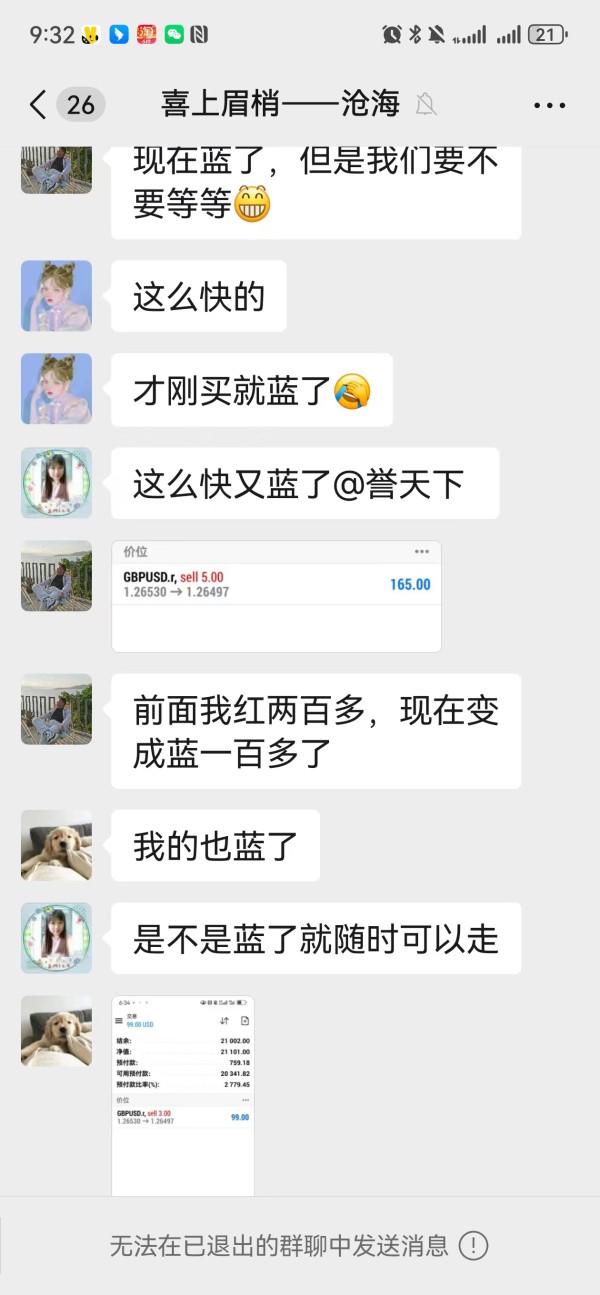

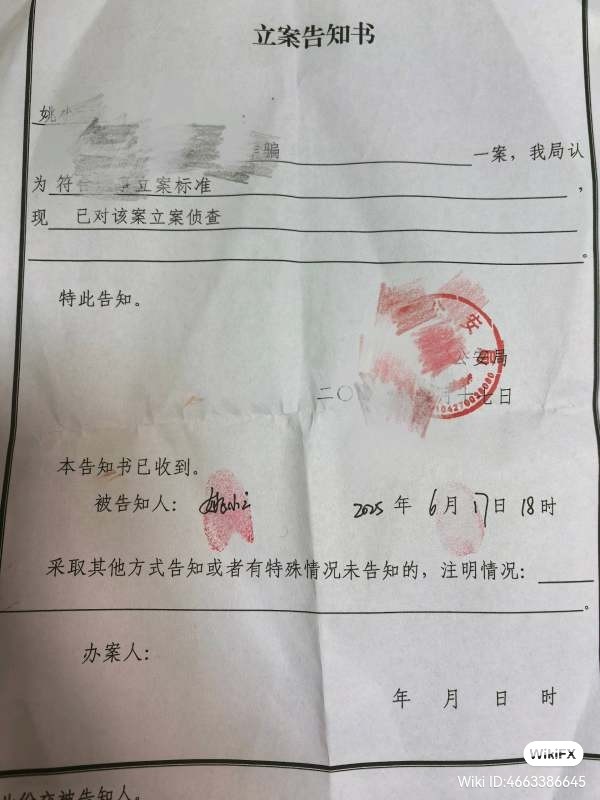

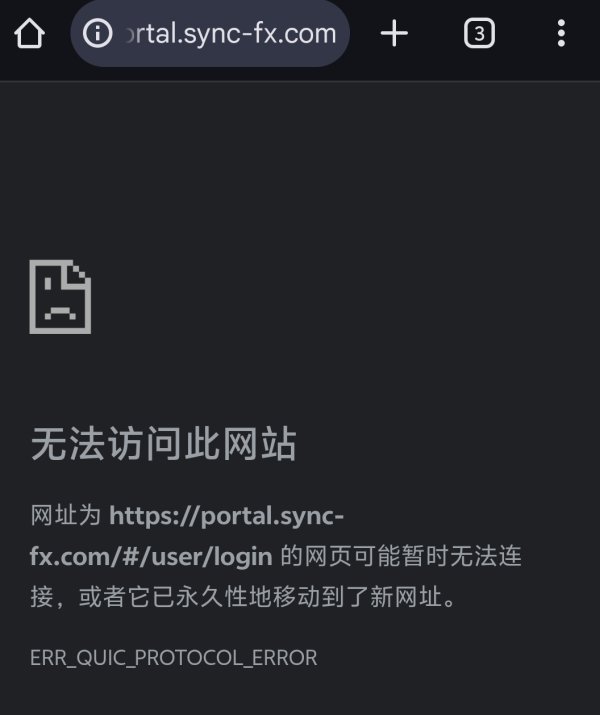

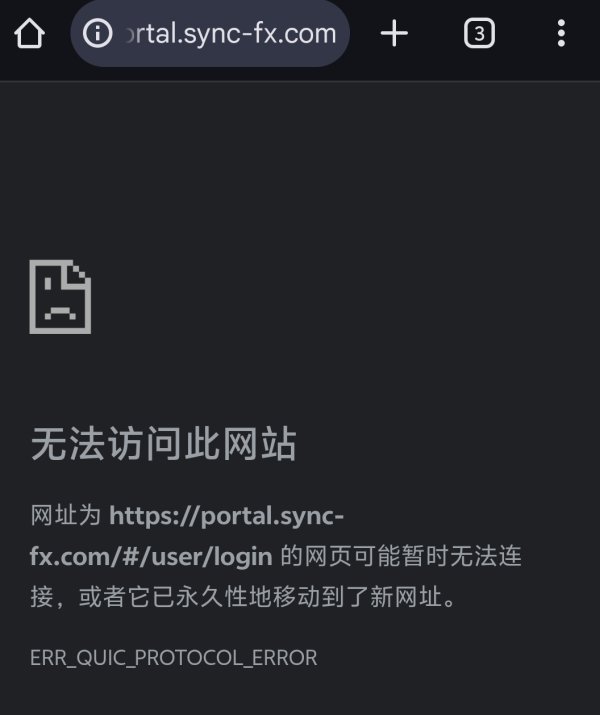

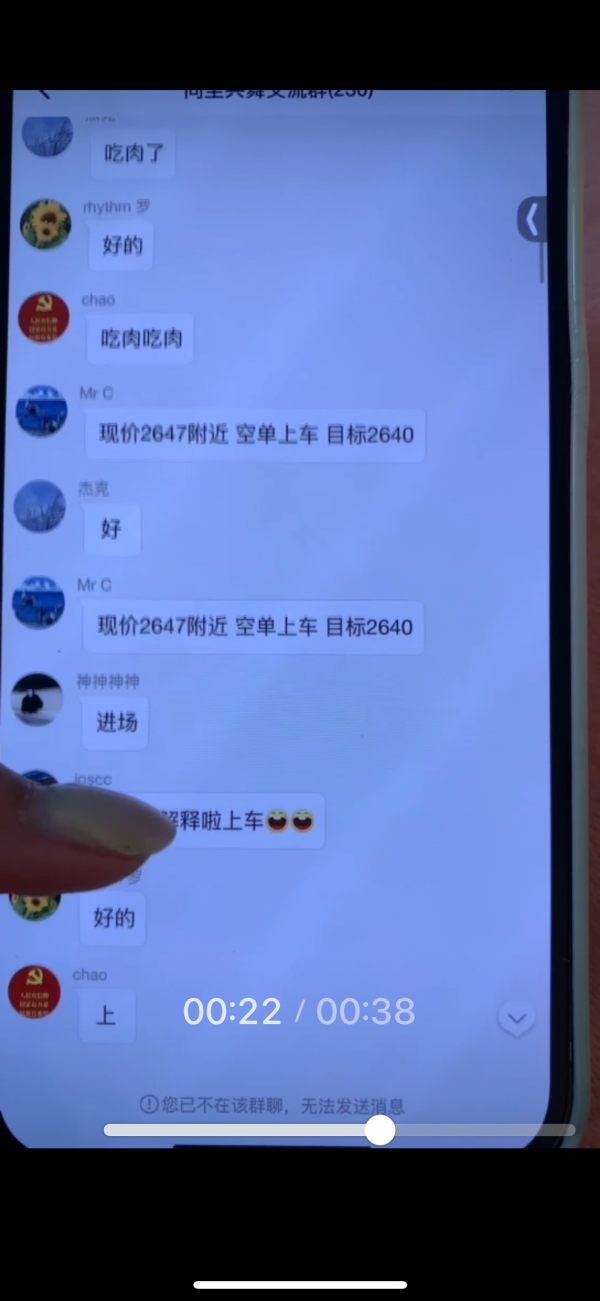

The trustworthiness of sync markets is perhaps the most contentious issue highlighted in numerous reviews. The absence of clear regulatory information, coupled with allegations of fraudulent behavior, severely undermines confidence in the broker. There is scant evidence of rigorous oversight from recognized financial regulatory bodies, and as a result, the security measures designed to protect client funds remain ambiguous and poorly documented. Company records and user testimonials indicate that there is a disturbing pattern of complaints related to unauthorized practices and potential scam activities. The overall opacity of the broker's operational processes raises significant red flags, especially when compared to industry standards, where transparency and stringent regulatory adherence are critical. Multiple user complaints, as cited in recent sync markets review articles, emphasize that funds are not safeguarded to the degree expected, and customer recourse in the event of disputes is minimal. Additionally, the overall reputation of the broker in online trading communities is overwhelmingly negative, with few redeeming factors. This environment of uncertainty and risk greatly diminishes the likelihood of gaining the trust of potential clients, making the broker largely unsuitable for those who prioritize safety and credibility in their trading endeavors.

6.6 User Experience Analysis

A closer examination of the user experience reveals that sync markets struggles to deliver an acceptable level of overall client satisfaction. The platform's design, navigation, and usability are adversely affected by a lack of clear, user-focused planning – issues that have been repeatedly mentioned in customer feedback. Potential clients have expressed frustration over the registration and verification process, which appears unnecessarily complex and unclear. Moreover, the overall interface design shows little consideration for ease of navigation, particularly for novice traders who require clear and intuitive steps. Financial operations, such as deposit and withdrawal procedures, are also reported to be cumbersome and lacking in transparency, further diminishing user confidence. Despite the broker's provision of a range of asset classes and attractive trading conditions on paper, the negative user testimonials focus on the low quality of service, persistent technical glitches, and the absence of user-friendly features. This dissatisfaction is further reflected in the very low ratings for user experience, as highlighted in several sync markets review reports. It is evident that, without significant improvements in customer interface and operational clarity, the broker will continue to struggle in attracting and retaining a satisfied client base.

7. Conclusion

In summary, the overall assessment of sync markets reveals a platform that, despite offering seemingly attractive features such as high leverage and zero starting spreads, is marred by negative user experiences and significant trust issues. The persistent reports of poor customer service, unreliable execution, and potential scam activities have culminated in a markedly low overall rating. While the broker might appear tempting to those looking for diverse trading opportunities in forex, commodities, stocks, and cryptocurrencies, the inherent risks far outweigh any potential benefits. This sync markets review makes it clear that cautious consideration and extensive due diligence are imperative. Ultimately, ordinary retail investors and risk-averse traders are strongly discouraged from engaging with the broker until substantial improvements are made.