Is Swiss Investment safe?

Pros

Cons

Is Swiss Investment Safe or a Scam?

Introduction

Swiss Investment has emerged as a notable player in the Forex market, claiming to offer a range of trading services and investment opportunities. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with such firms. The Forex market is rife with potential pitfalls, including scams and unregulated brokers, which can lead to significant financial losses for unsuspecting traders. Therefore, understanding the legitimacy of a broker like Swiss Investment is essential for safeguarding one's investments.

In this article, we will explore various aspects of Swiss Investment, including its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment. Our investigation is based on a comprehensive review of multiple online sources, regulatory databases, and user feedback to provide a well-rounded perspective on whether Swiss Investment is indeed a safe option for traders.

Regulation and Legitimacy

One of the primary indicators of a broker's trustworthiness is its regulatory status. Regulatory bodies enforce strict standards to protect investors and ensure fair trading practices. Unfortunately, Swiss Investment has not been able to secure regulation from any top-tier financial authority. This lack of oversight raises significant red flags regarding its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of a valid regulatory license means that Swiss Investment operates in a legal gray area. This situation is particularly concerning given that many reputable brokers are overseen by esteemed regulatory authorities like the Financial Conduct Authority (FCA) in the UK or the Swiss Financial Market Supervisory Authority (FINMA). Without such oversight, traders have little recourse in the event of disputes or issues related to fund safety.

Moreover, the quality of regulation is paramount. Brokers regulated by top-tier authorities are subject to rigorous compliance checks, including regular audits, mandatory capital reserves, and investor protection schemes. Swiss Investment's lack of regulation suggests that it does not adhere to these stringent standards, which could expose clients to various risks, including fraud and mismanagement of funds.

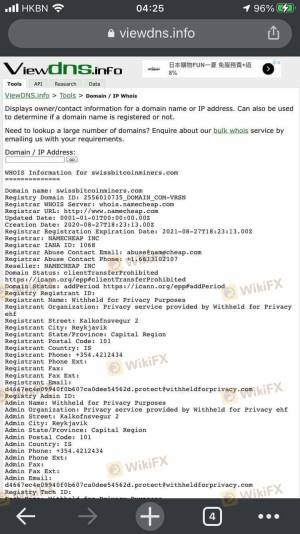

Company Background Investigation

Swiss Investment claims to have a solid foundation in the Forex trading arena. However, a closer examination of its history and ownership structure reveals a lack of transparency. The company appears to be registered in the Marshall Islands, a jurisdiction known for its lenient regulatory framework and low operational costs. This raises concerns about the legitimacy of its claims and the potential for unscrupulous business practices.

The management team behind Swiss Investment is another area of concern. Limited information is available regarding their professional backgrounds and experience in the financial sector. A robust management team typically possesses a wealth of industry knowledge and a track record of ethical practices, which can significantly enhance a broker's credibility. Swiss Investment's lack of information on its leadership further complicates the assessment of its reliability.

Additionally, the company's transparency regarding its operations and financial disclosures is questionable. A reputable broker should provide clear and accessible information about its services, fees, and operational practices. In contrast, Swiss Investment has been criticized for providing minimal information, which can leave potential clients feeling uncertain and vulnerable.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital for assessing the overall cost of trading. Swiss Investment presents a standard fee structure; however, the lack of specific details on spreads and commissions can be alarming. Traders need to be aware of all potential costs associated with their trades to avoid unexpected expenses.

| Fee Type | Swiss Investment | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | 0 - 0.1% |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

The absence of clear information regarding key trading costs raises suspicions about the broker's practices. If Swiss Investment employs hidden fees or unfavorable spreads, traders could face significant losses that are not immediately apparent. Furthermore, the lack of a commission structure makes it difficult to compare their offerings with industry standards, potentially leaving traders at a disadvantage.

Moreover, any unusual or problematic fee policies should be scrutinized. In many cases, brokers with hidden fees or complex pricing structures can exploit traders, leading to unexpected charges that diminish profitability. The lack of transparency in Swiss Investment's fee structure is a cause for concern, as it may indicate a lack of commitment to fair trading practices.

Client Fund Safety

The safety of client funds is paramount when choosing a Forex broker. Swiss Investment's policies regarding fund protection and segregation are critical factors in determining whether it is a safe option for traders. Unfortunately, the broker lacks clear information on its fund safety measures, which raises significant concerns.

A reputable broker typically employs strict measures to safeguard client funds, including segregating client accounts from operational funds and participating in investor compensation schemes. However, Swiss Investment's lack of transparency on these issues leaves traders vulnerable. The absence of information about negative balance protection further exacerbates the risk, as traders could potentially lose more than their initial investment.

Additionally, any historical issues related to fund safety or disputes should be carefully examined. Without a solid track record of protecting client funds, traders may find themselves at risk of losing their investments without any recourse. The absence of regulatory oversight adds another layer of risk, as traders have little protection against potential fraud or mismanagement.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall reputation of a broker. Unfortunately, reviews of Swiss Investment indicate a mixed bag of experiences, with several users expressing dissatisfaction with the service. Common complaints include issues related to withdrawal delays, unresponsive customer support, and unclear fee structures.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | Medium | Fair |

| Unclear Fee Structures | High | Poor |

These complaints highlight significant areas of concern for potential clients. Withdrawal delays can be particularly alarming, as they may indicate potential liquidity issues or even fraudulent practices. A broker that does not prioritize timely withdrawals can leave traders feeling trapped and frustrated.

Moreover, the quality of customer support plays a crucial role in a trader's overall experience. A responsive and helpful support team can make a significant difference when issues arise. In contrast, Swiss Investment's reported lack of responsiveness raises red flags about its commitment to client satisfaction.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for successful trading. Swiss Investment's platform has received mixed reviews, with some users reporting issues related to stability and execution quality. Traders require a platform that facilitates smooth and efficient trading, as delays or technical glitches can result in missed opportunities.

Moreover, the quality of order execution, including slippage and rejection rates, is vital for assessing a broker's reliability. If Swiss Investment has a high rate of rejected orders or significant slippage, traders may find it challenging to execute their strategies effectively. This can lead to frustration and financial losses, further eroding trust in the broker.

Risk Assessment

Using Swiss Investment poses several risks that traders must consider before opening an account. The lack of regulation, transparency, and a solid track record raises significant concerns about the broker's legitimacy and reliability.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from a recognized authority. |

| Financial Risk | High | Unclear fee structure and withdrawal issues. |

| Operational Risk | Medium | Mixed reviews on platform stability. |

To mitigate these risks, traders should approach Swiss Investment with caution. It is advisable to conduct thorough research, seek alternative brokers with strong regulatory backing, and consider using demo accounts to test trading conditions before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Swiss Investment raises several red flags regarding its legitimacy and safety. The lack of regulation, transparency, and mixed customer feedback indicate that traders should exercise caution when considering this broker. There are numerous reputable alternatives available that offer stronger regulatory oversight and a commitment to client safety.

For traders seeking reliable options, it is recommended to consider brokers regulated by top-tier authorities, such as the FCA or FINMA. Brokers like Interactive Brokers or Saxo Bank provide robust trading environments with clear fee structures and strong investor protections. Ultimately, ensuring the safety of your investments should be the top priority when choosing a Forex broker.

In summary, Is Swiss Investment Safe? The answer appears to lean towards caution, and potential clients should be wary of engaging with this broker without further investigation and consideration of safer alternatives.

Is Swiss Investment a scam, or is it legit?

The latest exposure and evaluation content of Swiss Investment brokers.

Swiss Investment Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Swiss Investment latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.