Oks Markets Limited 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive oks markets limited review reveals significant concerns about this Hong Kong-based broker. These issues warrant serious consideration from potential traders who might want to use their services. Founded in 2021, Oks Markets Limited operates in the online trading space, offering access to cryptocurrencies, futures, precious metals, and forex markets. However, our analysis uncovers troubling issues that overshadow any potential benefits the broker might offer.

The broker's regulatory status presents the most alarming red flag. Its ASIC license has been suspended, creating substantial uncertainty about trader protection and fund security. Additionally, multiple user reports indicate persistent withdrawal difficulties, suggesting operational problems that could impact client funds. While the platform offers high leverage of 1:400, which may attract experienced traders seeking amplified market exposure, this comes with an exceptionally high minimum deposit requirement of $10,000 USD. This amount is significantly above industry standards and creates barriers for most retail traders.

The combination of suspended regulatory oversight, withdrawal complaints, and limited transparency makes Oks Markets Limited a high-risk choice. This review examines all available evidence to provide traders with the critical information needed to make informed decisions about this broker.

Important Notice

Traders should exercise extreme caution when considering Oks Markets Limited due to significant regulatory and operational concerns. The broker's ASIC license suspension means clients may lack standard regulatory protections typically available through licensed brokers, which creates serious risks for anyone who deposits money with them. Different regulatory entities may have varying oversight capabilities, and the current suspended status creates uncertainty about dispute resolution mechanisms and fund safety protocols.

This review is based on available public information, user feedback, and regulatory data current as of 2025. Given the dynamic nature of regulatory statuses and the reported operational issues, potential clients should conduct additional due diligence and consider the heightened risks associated with trading through an entity with suspended regulatory authorization before making any financial commitments.

Rating Framework

Broker Overview

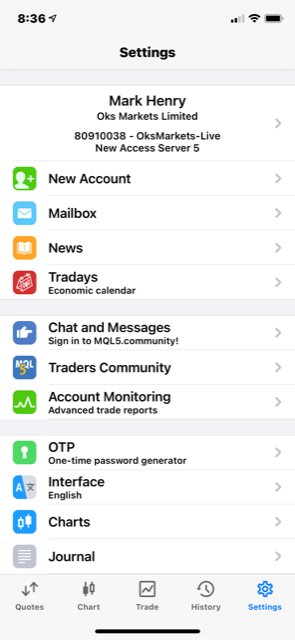

Oks Markets Limited entered the competitive online trading landscape in 2021. The company established its headquarters in Hong Kong with ambitions to serve traders seeking access to diverse financial markets. The company positioned itself as a provider of multi-asset trading services, focusing on delivering access to cryptocurrency markets, futures contracts, precious metals, and traditional forex pairs. Despite its relatively recent establishment, the broker attempted to attract traders with high leverage offerings and comprehensive market access, though these efforts have been undermined by significant operational problems.

The company's business model centers on providing online trading services across multiple asset classes. It targets traders interested in diversified portfolio opportunities and markets itself as capable of serving both retail traders and sophisticated investors. Oks Markets Limited markets itself as a platform capable of serving both individual retail traders and more sophisticated investors seeking advanced trading conditions. However, the broker's operational history has been marked by significant challenges that have undermined its market position and trader confidence in fundamental ways.

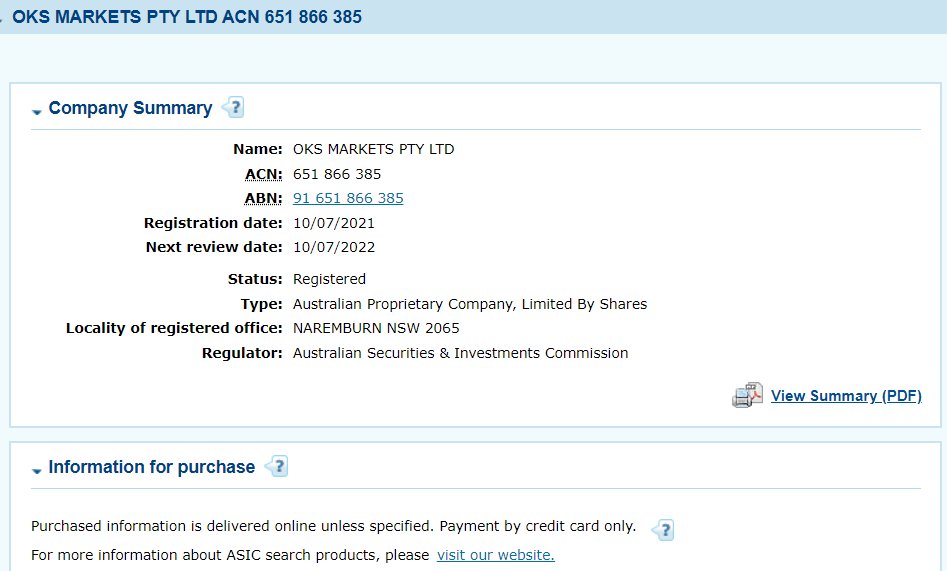

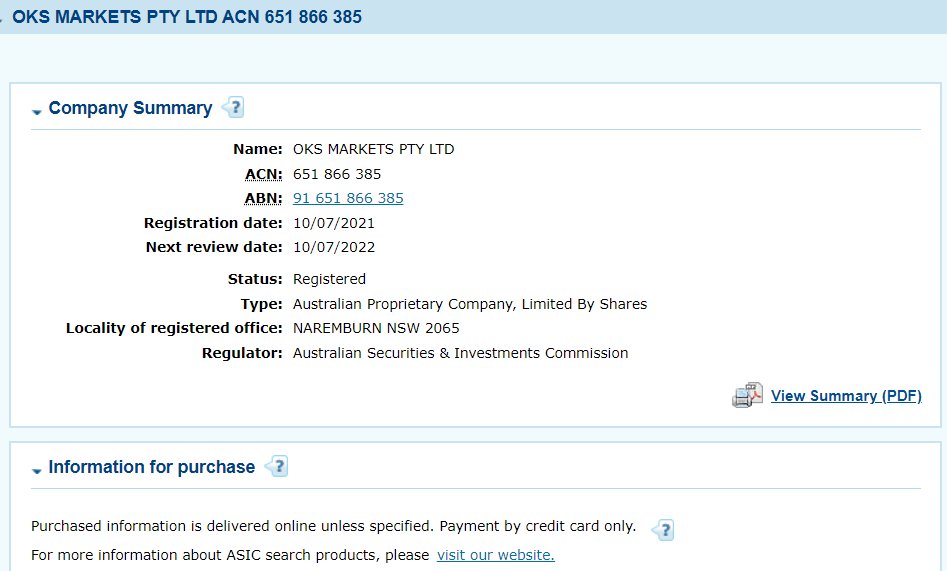

From a regulatory perspective, Oks Markets Limited initially operated under ASIC oversight, which typically provides traders with important protections. These protections include segregated client funds and dispute resolution mechanisms that help ensure trader safety. Unfortunately, this oks markets limited review must note that the broker's ASIC license has been suspended, creating substantial uncertainty about ongoing operations and client protection. The suspended regulatory status represents a critical factor that potential traders must carefully consider when evaluating this broker's suitability for their trading needs.

Regulatory Status: Oks Markets Limited previously held authorization from ASIC, but this license has been suspended. This suspension significantly impacts the broker's credibility and raises questions about client fund protection and regulatory compliance that potential traders should take seriously.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in available sources. However, user reports suggest difficulties with withdrawal processing that have created frustration among clients and raised concerns about fund accessibility.

Minimum Deposit Requirements: The broker requires a substantial minimum deposit of $10,000 USD. This amount places it well above typical industry standards and may limit accessibility for many retail traders who cannot afford such large initial investments.

Bonuses and Promotions: No specific information about bonus offerings or promotional campaigns was found in available sources. This suggests the broker may not actively promote incentive programs to attract new clients.

Tradable Assets: The platform provides access to multiple asset classes including cryptocurrencies, futures contracts, precious metals, and foreign exchange pairs. These offerings provide traders with diversified market exposure opportunities across different financial instruments.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not available in reviewed sources. This makes it difficult for potential clients to assess the true cost of trading with this broker and compare it to competitors.

Leverage Ratios: Oks Markets Limited offers leverage up to 1:400, which provides significant market exposure amplification. However, this high leverage also increases risk levels substantially for traders who may not fully understand the potential for amplified losses.

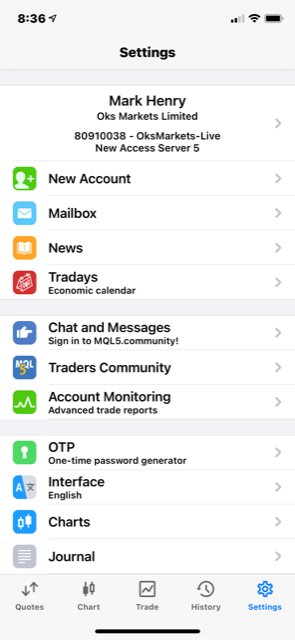

Platform Options: Specific trading platform information was not detailed in available sources. This leaves questions about the technological infrastructure and trading tools available to clients unanswered.

This oks markets limited review highlights significant information gaps that potential traders should address through direct inquiry before considering this broker.

Account Conditions Analysis

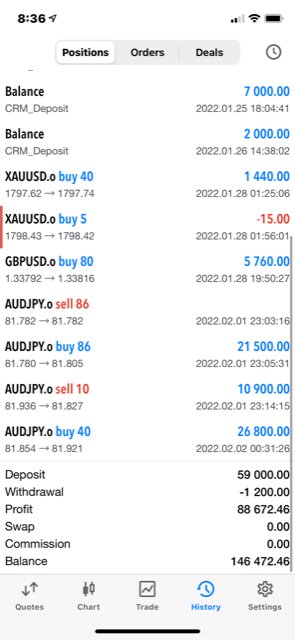

The account structure at Oks Markets Limited presents several concerning elements that potential traders must carefully evaluate. The most immediately striking aspect is the exceptionally high minimum deposit requirement of $10,000 USD, which significantly exceeds industry norms where many reputable brokers offer account access with deposits as low as $100-$500, making trading accessible to a much broader range of people. This substantial barrier to entry effectively excludes many retail traders and suggests the broker may be targeting a very specific, affluent client base.

Available information does not provide details about different account types or tiered service levels. This absence is unusual for modern brokers who typically offer multiple account categories to serve diverse trader needs. The absence of clear account differentiation raises questions about service customization and whether clients receive appropriate support based on their trading volume and experience levels.

User feedback indicates significant difficulties with account funding and withdrawal processes, which represents a fundamental operational failure. According to reports from traders, withdrawal requests have faced unexplained delays and complications, creating serious concerns about fund accessibility that affect the basic ability to access one's own money. These issues suggest systemic problems with the broker's financial operations that could impact any trader regardless of account size.

The account opening process details were not specified in available sources. However, given the regulatory license suspension, potential clients should expect additional scrutiny and possible complications during account verification procedures. This oks markets limited review emphasizes that the combination of high minimum deposits and reported withdrawal difficulties creates an unfavorable account condition environment that traders should approach with extreme caution.

The trading tools and resources offered by Oks Markets Limited represent a significant weakness in the broker's service proposition. Available information reveals a concerning lack of detail about specific trading platforms, analytical tools, and educational resources that modern traders expect from professional brokers, which suggests either inadequate offerings or poor communication about available features. This absence of comprehensive tool information suggests either limited platform capabilities or poor communication about available features.

Market analysis and research resources appear to be minimal or non-existent based on available information. Professional traders typically rely on economic calendars, market commentary, technical analysis tools, and fundamental research to make informed trading decisions that can significantly impact their success. The apparent lack of these essential resources places traders at a significant disadvantage and suggests the broker may not prioritize supporting client success through comprehensive market intelligence.

Educational resources, which are crucial for trader development and risk management, were not mentioned in available sources. Reputable brokers typically provide webinars, tutorials, trading guides, and market education materials to help clients improve their trading skills and understanding of market dynamics. The absence of such resources indicates a potentially limited commitment to client education and development.

Automated trading support and advanced charting capabilities were also not detailed in available information. Modern trading environments increasingly rely on algorithmic trading tools, expert advisors, and sophisticated technical analysis platforms that help traders execute more effective strategies. The lack of information about these capabilities suggests potential limitations in the technological infrastructure available to traders.

User feedback reinforces concerns about inadequate tools and resources, with traders expressing frustration about the limited support for their trading activities. The combination of minimal tool information and negative user experiences creates a concerning picture of the broker's commitment to providing professional-grade trading resources that traders need to succeed.

Customer Service and Support Analysis

Customer service quality at Oks Markets Limited represents one of the broker's most significant operational failures. Traders have consistently reported poor responsiveness from support staff, with many indicating that their inquiries and concerns receive inadequate attention or resolution that leaves them frustrated and without answers. This pattern of unsatisfactory customer service creates serious concerns about the broker's commitment to client satisfaction and problem resolution.

Response times appear to be problematic, with users reporting extended delays in receiving answers to important questions. These delays affect questions about their accounts, trading conditions, and withdrawal requests that require timely responses. In the fast-paced trading environment, delayed customer service responses can result in missed opportunities and increased frustration for traders who need timely assistance with their accounts and positions.

The quality of service provided by available support staff has been questioned by users. They report interactions with representatives who appear to lack sufficient knowledge about trading procedures, regulatory requirements, and problem-solving capabilities that customers expect from professional support teams. Professional customer service should provide knowledgeable, helpful assistance that resolves client concerns efficiently and effectively.

Available information does not specify the languages supported by customer service representatives or the hours of operation for support services. This lack of clarity about service availability creates additional uncertainty for international clients who may need assistance outside standard business hours or in languages other than English, which can be particularly problematic for traders in different time zones.

Most concerning are the numerous reports of customer service's inability to resolve withdrawal-related issues. This represents a fundamental failure in client support that goes beyond typical service problems. When traders cannot access their funds and customer service cannot provide effective assistance, it creates a crisis of confidence that undermines the entire client relationship and suggests serious operational deficiencies.

Trading Experience Analysis

The trading experience at Oks Markets Limited appears to be significantly compromised by various operational and technical issues. These problems impact client satisfaction and trading effectiveness in ways that can affect profitability and confidence. While specific information about platform stability and execution speed was not detailed in available sources, user feedback suggests concerning problems with overall trading conditions and platform reliability.

Order execution quality has been questioned by traders who report issues with slippage and execution delays. These problems can negatively impact trading results and create frustration for traders who expect reliable performance. Professional trading requires reliable, fast execution at quoted prices, and any problems in this area can significantly affect trader profitability and confidence in the platform.

Platform functionality appears limited based on the lack of detailed information about charting tools, technical indicators, and advanced trading features. Modern traders expect sophisticated platforms with comprehensive analytical capabilities, multiple timeframes, and extensive customization options that help them make better trading decisions. The absence of detailed platform information suggests potential limitations in the trading infrastructure available to clients.

Mobile trading experience details were not provided in available sources. This omission is concerning given the importance of mobile platforms in contemporary trading where flexibility and accessibility are crucial. Traders increasingly rely on mobile applications for market monitoring, position management, and trade execution while away from their primary trading stations.

The trading environment is further compromised by concerns about spreads and liquidity, though specific details about these crucial factors were not available in reviewed sources. User feedback indicates general dissatisfaction with trading conditions, primarily stemming from withdrawal difficulties that overshadow other aspects of the trading experience and create an atmosphere of uncertainty. This oks markets limited review emphasizes that the combination of operational problems and limited platform information creates an unsatisfactory trading environment for serious traders.

Trust and Reliability Analysis

Trust and reliability concerns represent the most critical issues facing Oks Markets Limited. The suspended ASIC license serves as the primary red flag for potential clients who need regulatory protection. Regulatory oversight provides essential protections for traders, including fund segregation requirements, dispute resolution mechanisms, and operational standards that protect client interests in fundamental ways. The suspension of this regulatory authorization eliminates these crucial protections and creates significant uncertainty about the broker's operational legitimacy.

Fund safety measures, which should be clearly communicated and rigorously implemented, were not detailed in available sources. Reputable brokers typically maintain segregated client accounts, provide clear information about fund protection schemes, and demonstrate transparency about their financial safeguards that help ensure client money remains secure. The absence of such information, combined with user reports of withdrawal difficulties, creates serious concerns about fund security.

Company transparency appears limited, with insufficient information available about the broker's financial condition, operational procedures, and management structure. Professional brokers typically provide comprehensive information about their operations, regulatory compliance, and corporate governance to build client confidence and demonstrate accountability to their customers. This lack of transparency makes it difficult for potential clients to assess the broker's true operational status and financial stability.

Industry reputation has been significantly damaged by user reports of withdrawal problems and the regulatory license suspension. Online reviews and trader feedback consistently highlight concerns about fund access and operational reliability, creating a negative perception that affects the broker's credibility in the trading community and makes it difficult to attract new clients. The handling of negative events, particularly withdrawal complaints and regulatory issues, appears inadequate based on available information.

Professional brokers should address client concerns promptly and transparently, providing clear communication about problem resolution and steps taken to prevent future issues. The persistence of withdrawal complaints suggests insufficient attention to client problem resolution and operational improvement that could help restore confidence.

User Experience Analysis

Overall user satisfaction with Oks Markets Limited appears to be significantly below industry standards. The majority of available feedback highlights serious concerns about fund accessibility and operational reliability that affect the fundamental user experience. Traders consistently report frustration with withdrawal processes, customer service quality, and the general lack of transparency about broker operations and policies.

Interface design and platform usability information was not detailed in available sources. However, user feedback suggests that any positive aspects of the platform experience are overshadowed by fundamental operational problems that make the overall experience unsatisfactory. Modern traders expect intuitive, responsive platforms that facilitate efficient trading and account management, but the focus on withdrawal difficulties indicates these basic expectations may not be met.

Registration and account verification processes were not specifically detailed in available information. Given the regulatory license suspension, potential clients should expect additional complexity and potential delays in account setup procedures that could frustrate new users. The high minimum deposit requirement also creates barriers to entry that may frustrate traders seeking to test the platform with smaller initial investments.

Fund operation experience represents the most significant source of user dissatisfaction across all aspects of the broker's services. Multiple reports of withdrawal delays and complications prevent traders from accessing their money, which creates fundamental trust issues. This fundamental failure in financial operations creates a negative user experience that undermines confidence in all other aspects of the broker's services.

Common user complaints center primarily on withdrawal processing and customer service responsiveness. Many traders express regret about choosing this broker and warn others to avoid making the same mistake. The pattern of negative feedback suggests systemic problems rather than isolated incidents, indicating fundamental operational deficiencies that affect the majority of clients.

The user profile most suited to this broker would theoretically be experienced traders seeking high leverage opportunities. However, the significant operational and regulatory concerns make it difficult to recommend this broker to any trader category regardless of experience level. The risks associated with the suspended license and withdrawal difficulties outweigh any potential benefits from the high leverage offering.

Conclusion

This comprehensive oks markets limited review reveals a broker facing serious operational and regulatory challenges. These problems create substantial risks for potential traders who might consider using their services. The suspension of the ASIC license, combined with persistent user reports of withdrawal difficulties and poor customer service, indicates fundamental problems that compromise the broker's reliability and trustworthiness.

While the broker offers high leverage of 1:400 that might appeal to experienced traders seeking amplified market exposure, this potential advantage is significantly outweighed by the regulatory uncertainty and operational deficiencies. The exceptionally high minimum deposit requirement of $10,000 USD further limits accessibility while exposing traders to greater potential losses given the withdrawal difficulties reported by users, which creates an unacceptable risk-reward ratio for most traders.

Based on the available evidence, Oks Markets Limited cannot be recommended for traders seeking a reliable, secure trading environment. The combination of suspended regulatory oversight, withdrawal processing problems, and limited transparency creates an unacceptable risk profile that prudent traders should avoid at all costs.