FXOpulence 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive FXOpulence review examines a forex and cryptocurrency broker that has generated significant controversy within the trading community. The company was founded in 2018. It operates from Saint Vincent and the Grenadines and presents itself as a multi-asset trading platform offering forex, cryptocurrencies, commodities, indices, and CFDs. Multiple sources indicate serious concerns about the platform's legitimacy and operational practices.

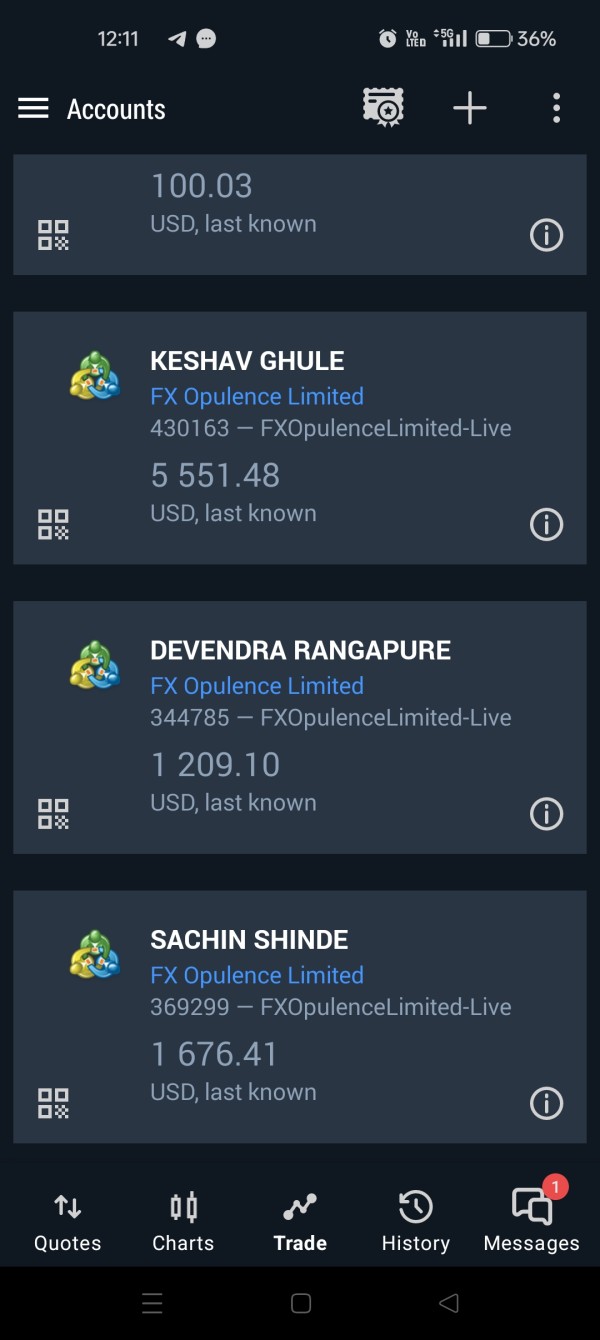

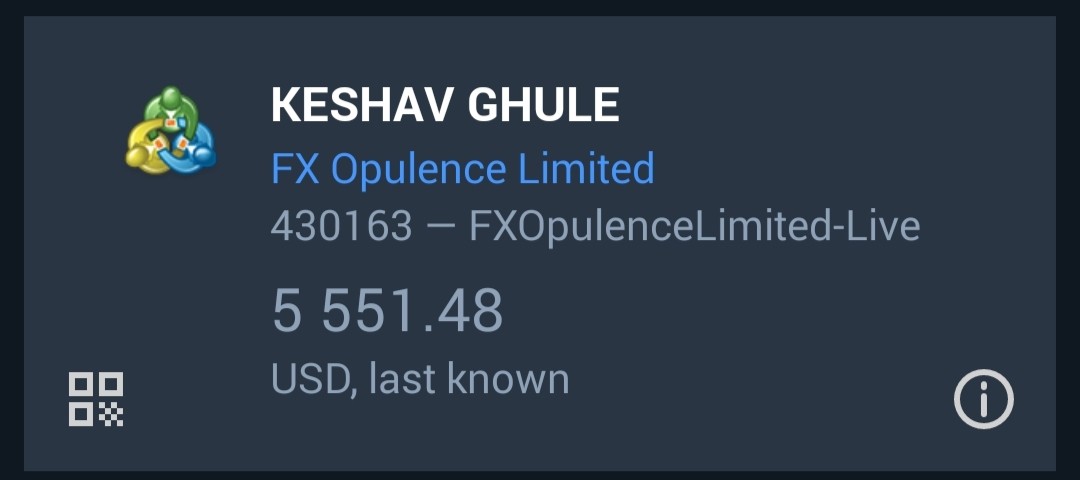

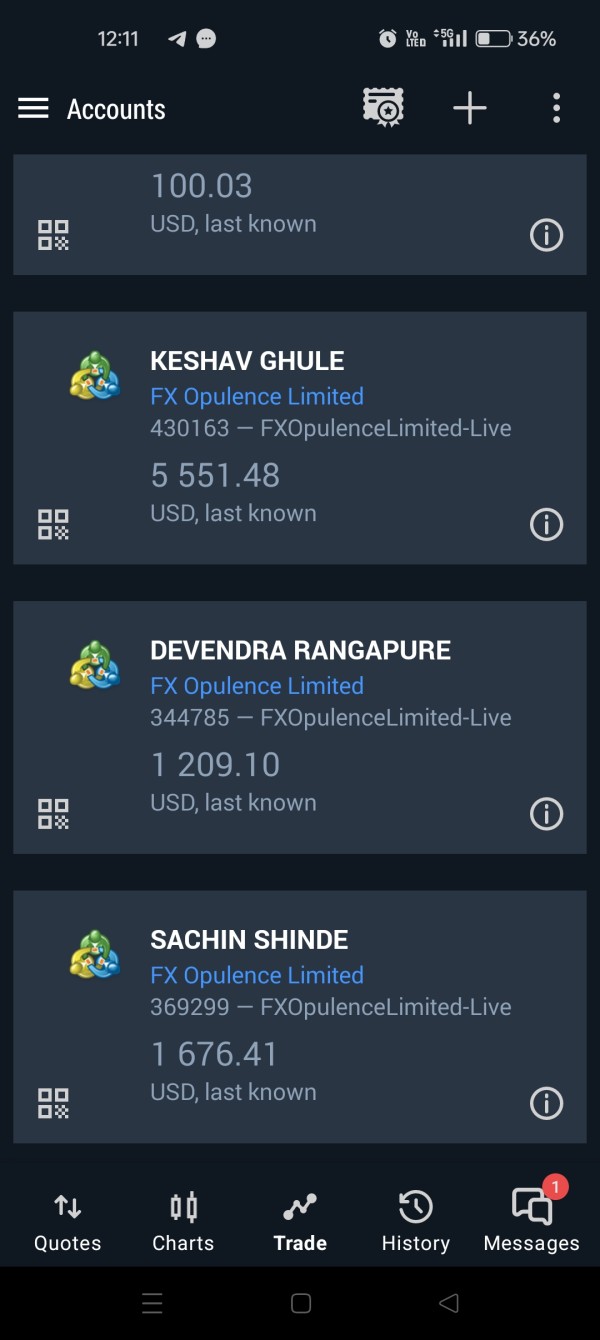

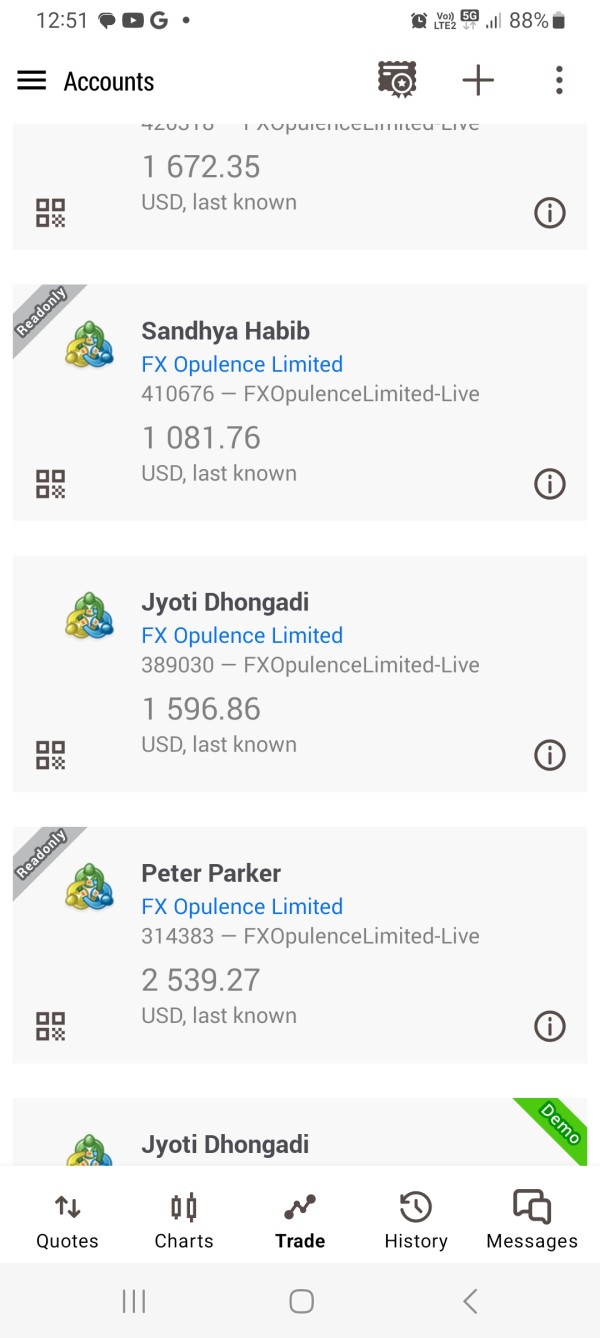

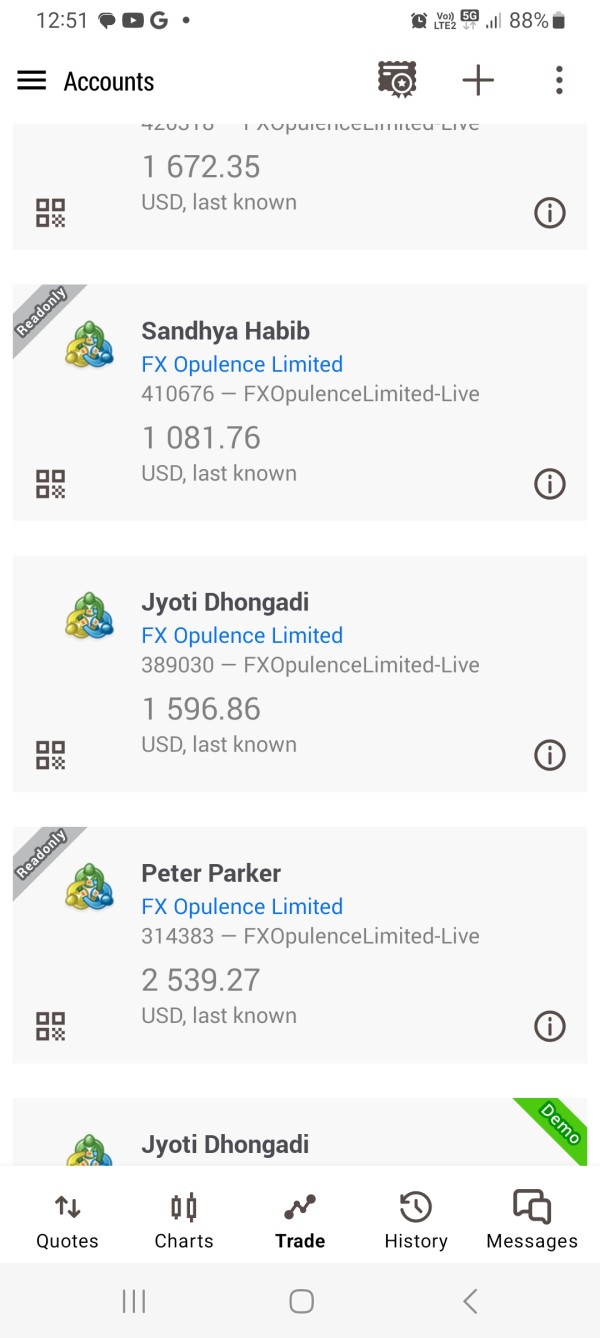

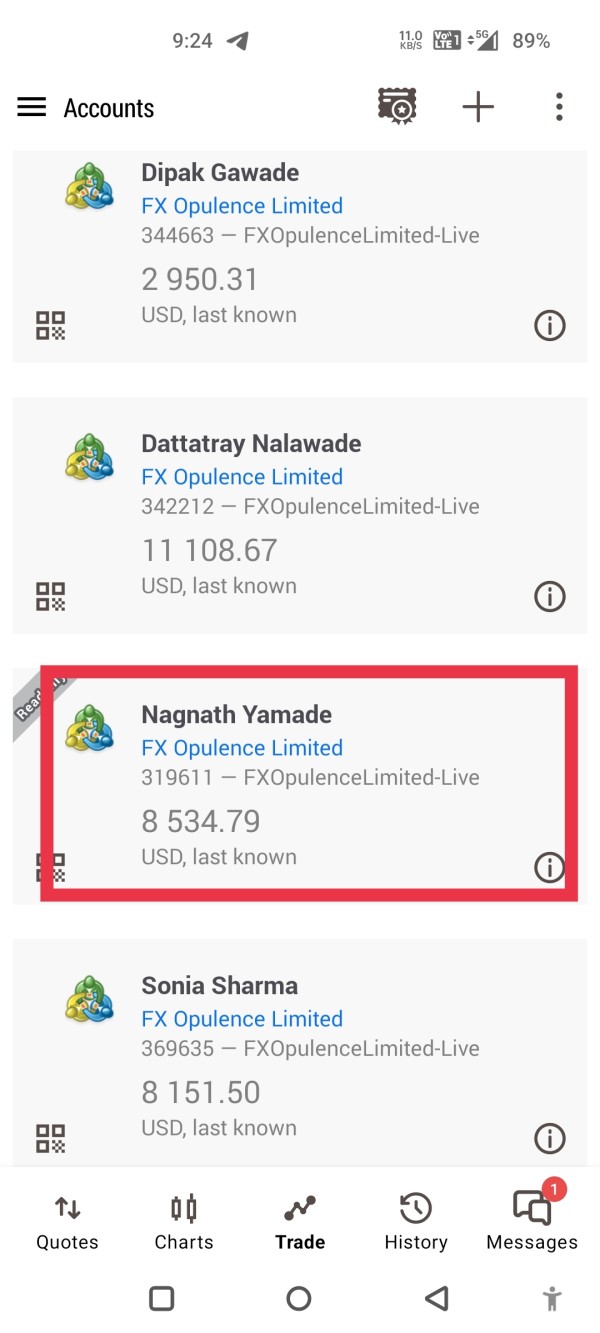

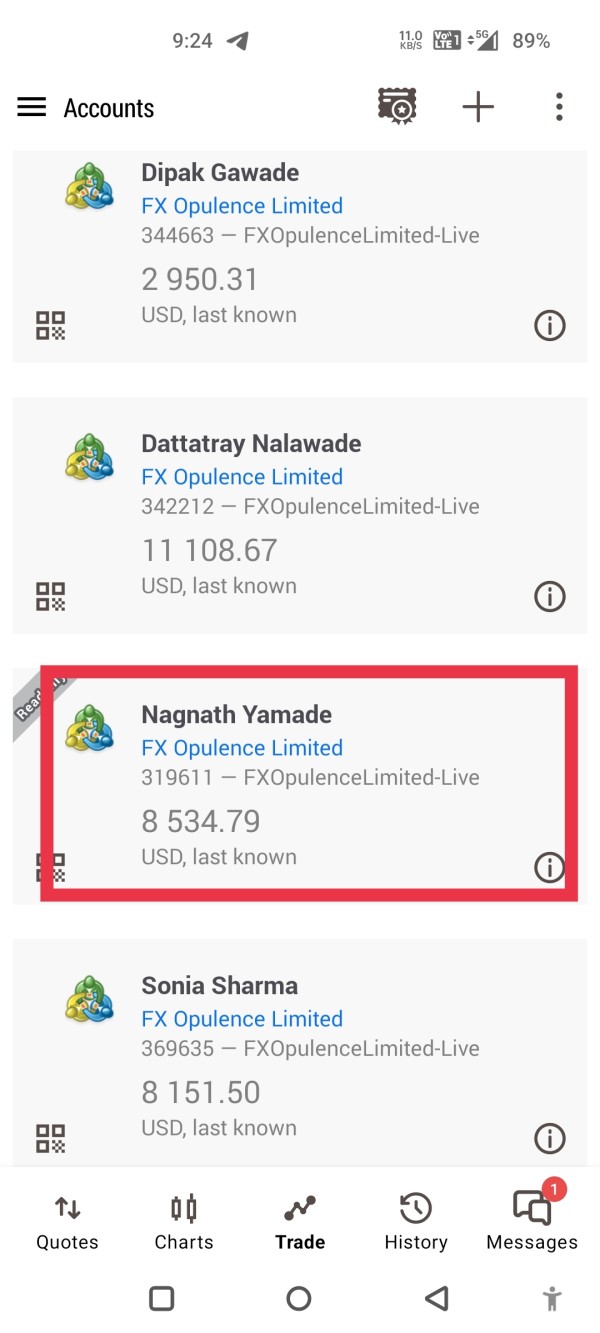

According to fraud recovery experts and consumer review platforms, FXOpulence has been associated with numerous scam complaints and negative user experiences. The broker claims to offer high leverage up to 500:1. It supports trading in over 28 currency pairs and positions itself particularly toward the Indian market and traders seeking high-leverage opportunities. Despite claiming regulatory oversight from the Financial Services Authority (FSA) and the Australian Securities and Investments Commission (ASIC), the platform's credibility remains questionable due to persistent allegations of fraudulent activities and poor customer service experiences reported across multiple review platforms.

Important Notice

Regional Entity Differences: FXOpulence operates across different jurisdictions, and regulatory compliance may vary significantly between regions. Traders should be aware that the level of protection and regulatory oversight differs substantially depending on their location and the specific entity they are dealing with.

Review Methodology: This evaluation is based on publicly available information, user feedback from various review platforms, and reports from fraud recovery specialists. Given the limited transparency from the company and conflicting information across sources, some details may be incomplete or subject to change.

Rating Framework

Broker Overview

FXOpulence emerged in the forex trading landscape in 2018, establishing itself as a forex and cryptocurrency broker based in Saint Vincent and the Grenadines. The company positions itself as a multi-asset trading platform. It targets traders interested in forex, cryptocurrencies, commodities, indices, and CFD trading. According to company information, FXOpulence has gained particular traction in the Indian market, where it markets high-leverage trading opportunities to retail investors.

The broker's business model centers around providing access to global financial markets through online trading platforms. However, specific details about the trading technology and platform infrastructure remain limited in available documentation. FXOpulence review sources indicate that the company has faced significant challenges in maintaining a positive reputation within the trading community, with multiple allegations of fraudulent practices and customer service failures affecting its market position.

The regulatory landscape surrounding FXOpulence appears complex. The company claims oversight from multiple jurisdictions including the Financial Services Authority (FSA) and the Australian Securities and Investments Commission (ASIC). However, the authenticity and scope of this regulatory coverage have been questioned by industry observers and fraud recovery specialists, contributing to the overall uncertainty surrounding the platform's legitimacy.

Regulatory Jurisdictions: FXOpulence claims regulatory oversight from the Financial Services Authority (FSA) and the Australian Securities and Investments Commission (ASIC). However, verification of these regulatory claims remains challenging. Traders should conduct independent verification before engaging with the platform.

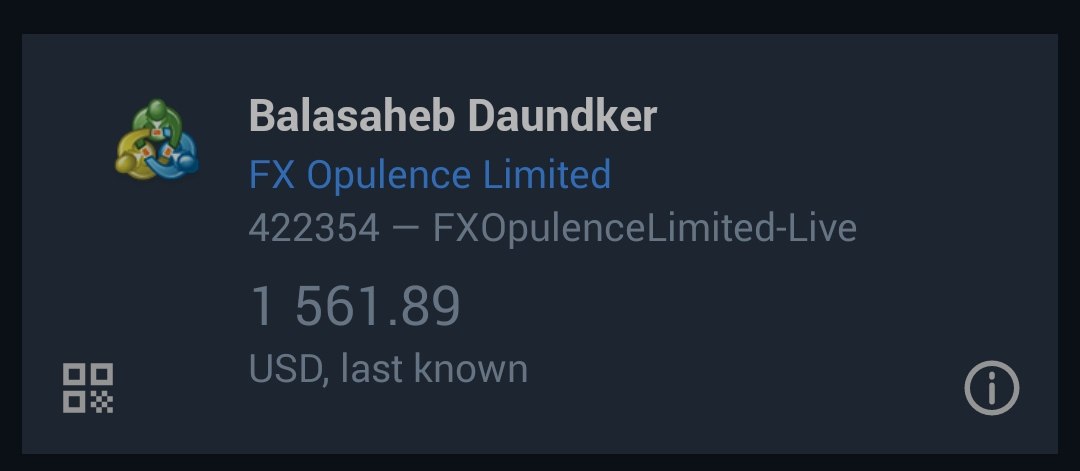

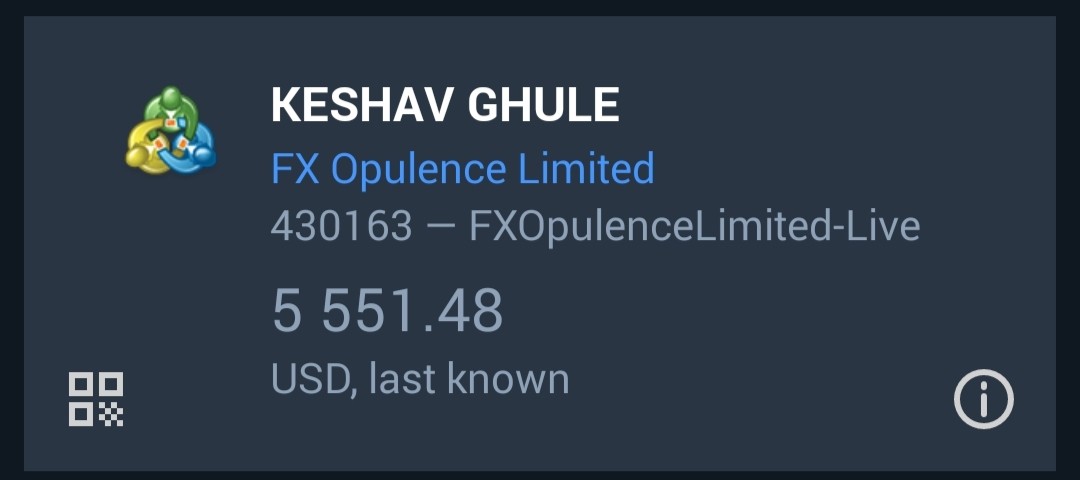

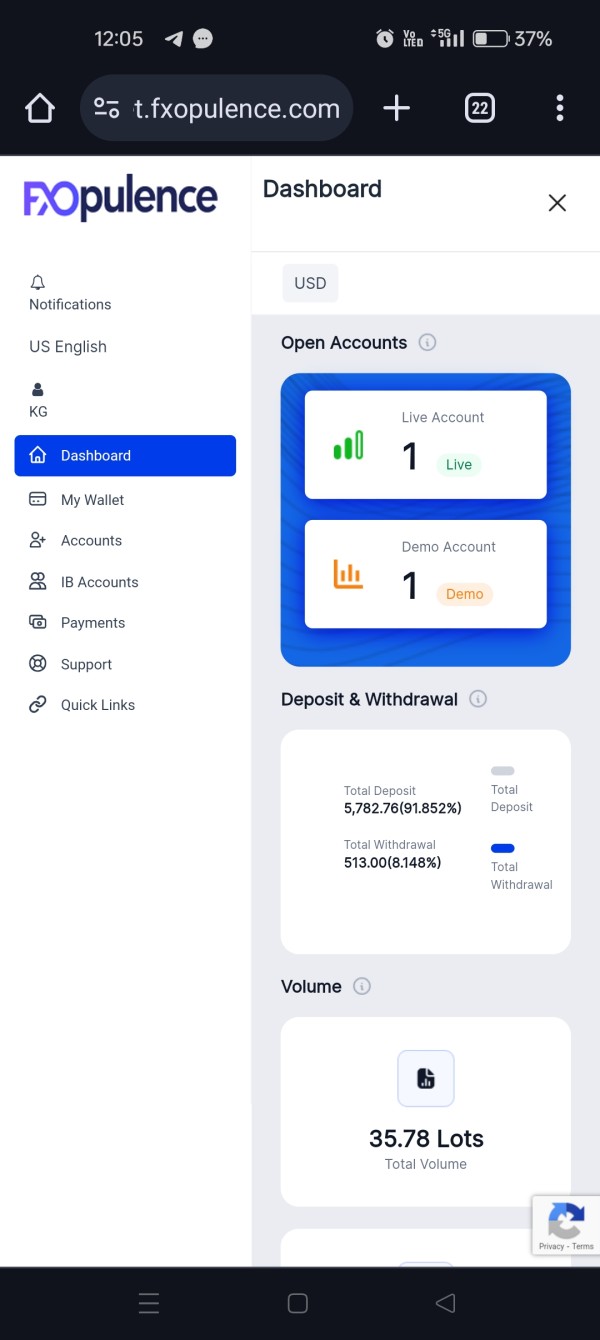

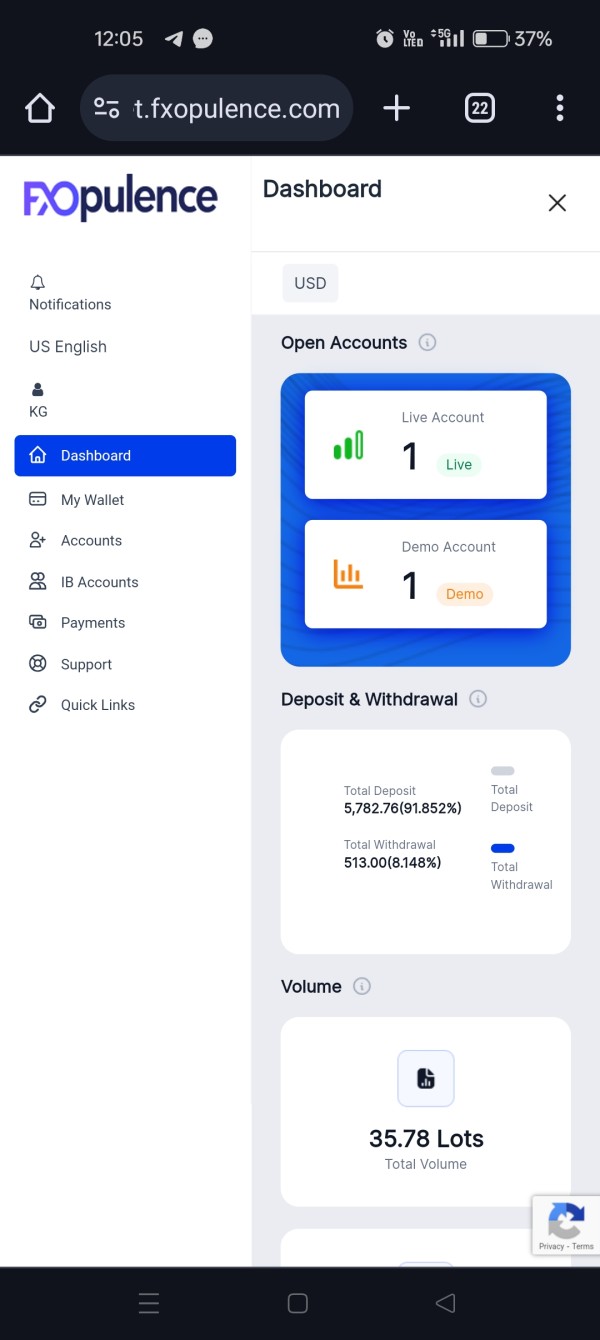

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. This represents a significant transparency gap for potential traders.

Minimum Deposit Requirements: The minimum deposit requirement is not specified in available documentation. This makes it difficult for traders to assess accessibility.

Bonus and Promotions: Information about promotional offers and bonus structures is not mentioned in available sources.

Tradeable Assets: The platform offers trading in over 28 currency pairs, along with access to cryptocurrencies, commodities, indices, and CFDs. This provides a diverse range of trading opportunities.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in current sources. This makes cost comparison challenging for potential users.

Leverage Ratios: FXOpulence offers high leverage up to 500:1, which may appeal to traders seeking amplified market exposure but also increases risk significantly.

Platform Options: Specific trading platform information is not detailed in available sources. This leaves questions about the technological infrastructure and user interface.

Geographic Restrictions: Regional limitations and availability restrictions are not specified in current documentation.

Customer Support Languages: Information about multilingual support options is not mentioned in available sources.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by FXOpulence remain largely opaque, contributing to the low rating in this category. Available sources do not provide specific information about different account types, their respective features, or the requirements for accessing various service levels. This lack of transparency makes it extremely difficult for potential traders to make informed decisions about which account structure might best suit their trading needs.

The absence of clearly stated minimum deposit requirements further complicates the evaluation process. Most reputable brokers prominently display their account opening requirements, fee structures, and account benefits. The fact that this FXOpulence review cannot identify these basic parameters raises significant concerns about the platform's transparency and professional standards.

User feedback suggests that the account opening process may be problematic. Some traders report difficulties in verification procedures and unclear communication about account status. The lack of information about specialized account types, such as Islamic accounts for Muslim traders or professional accounts for qualified investors, indicates a limited service offering compared to established industry players.

FXOpulence's trading tools and educational resources appear to be significantly underdeveloped compared to industry standards. Available sources do not mention comprehensive market analysis tools, advanced charting capabilities, or sophisticated trading indicators that experienced traders typically expect from a professional trading platform.

The absence of detailed educational resources represents a particular weakness for a broker targeting retail traders. Most reputable platforms offer extensive educational materials including webinars, trading guides, market analysis, and economic calendars. The lack of mention of such resources in available documentation suggests that FXOpulence may not prioritize trader education and development.

Research and analysis capabilities appear limited. There is no specific mention of market research teams, daily market commentary, or fundamental analysis resources. This deficiency could significantly impact traders' ability to make informed decisions and develop their trading skills over time.

Customer Service and Support Analysis (3/10)

Customer service represents one of the most concerning aspects of FXOpulence's operations, based on user feedback and review platform reports. Multiple sources indicate that traders have experienced significant difficulties in reaching customer support representatives and receiving timely responses to their inquiries.

The quality of customer service appears to be inconsistent. Users report long wait times, unhelpful responses, and in some cases, complete lack of communication from the support team. This is particularly problematic when traders encounter technical issues, account problems, or withdrawal difficulties that require immediate attention.

Language support options are not clearly specified, which could create additional barriers for international traders who require assistance in their native languages. The lack of comprehensive support channels, such as live chat, phone support, or detailed FAQ sections, further undermines the overall customer service experience.

Trading Experience Analysis (5/10)

The trading experience offered by FXOpulence receives a moderate rating due to limited available information about platform performance and execution quality. While the broker offers high leverage up to 500:1 and access to multiple asset classes, the lack of detailed information about trading platform technology raises questions about execution speed and reliability.

Order execution quality, including potential issues with slippage and requotes, is not addressed in available sources. These factors are crucial for traders, particularly those employing scalping strategies or trading during high-volatility periods. The absence of this information makes it difficult to assess whether the platform can meet the demands of active traders.

Mobile trading capabilities and platform stability are not specifically mentioned in current FXOpulence review sources. This represents significant gaps in understanding the overall trading environment. Modern traders expect seamless access across multiple devices and reliable platform performance during market hours.

Trustworthiness Analysis (2/10)

Trustworthiness represents the most significant concern regarding FXOpulence, earning the lowest rating in this evaluation. Multiple fraud recovery specialists and review platforms have raised serious questions about the broker's legitimacy and operational practices. Reports of scam allegations and fraudulent activities have created substantial doubt about the platform's reliability.

The regulatory claims made by FXOpulence require independent verification. The authenticity of stated oversight from the FSA and ASIC has been questioned by industry observers. The lack of transparent communication about regulatory compliance and the absence of clear regulatory license numbers further undermine confidence in the platform's legitimacy.

User reports of withdrawal difficulties, account closure issues, and unresponsive customer service contribute to the overall trust deficit. The handling of customer complaints and negative publicity appears inadequate. There is limited evidence of the company addressing concerns or improving operational standards.

User Experience Analysis (3/10)

Overall user satisfaction with FXOpulence appears to be predominantly negative, based on available feedback from review platforms and fraud recovery reports. Users have expressed frustration with various aspects of the platform, from account management to customer service interactions.

The registration and verification process effectiveness is not clearly documented. User feedback suggests potential complications in these initial steps. Account funding and withdrawal experiences appear to be particular pain points for users, with reports of delays and difficulties in accessing funds.

The user interface design and platform usability are not detailed in available sources. This makes it impossible to assess whether the platform provides an intuitive and efficient trading environment. The lack of positive user testimonials or success stories further indicates limited user satisfaction with the overall experience.

Conclusion

This comprehensive FXOpulence review reveals significant concerns about the broker's operations, transparency, and user satisfaction. While the platform offers high leverage trading and claims access to multiple asset classes, the numerous red flags regarding trustworthiness and regulatory compliance make it difficult to recommend for most traders.

The broker might potentially appeal to traders with extremely high risk tolerance who prioritize leverage over regulatory protection. However, the predominant negative feedback, scam allegations, and lack of transparency suggest that most traders would be better served by choosing more established and properly regulated alternatives.

The main advantages include high leverage offerings and multi-asset access. These benefits are significantly outweighed by concerns about legitimacy, poor customer service, withdrawal difficulties, and overall platform reliability. Potential traders should exercise extreme caution and conduct thorough due diligence before considering any engagement with this platform.