Is SANDWIND safe?

Pros

Cons

Is Sandwind Safe or a Scam?

Introduction

Sandwind is a relatively new player in the forex market, positioning itself as an online trading platform that promises attractive trading conditions and a wide range of financial instruments. As the forex market continues to grow, traders are increasingly drawn to various brokers that offer unique features and competitive pricing. However, with this growth comes the necessity for traders to exercise caution and conduct thorough evaluations of any broker they consider. The forex landscape is fraught with potential scams, making it essential for traders to discern which brokers are trustworthy and which may pose risks to their investments.

This article aims to evaluate Sandwind's legitimacy by examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk factors. The analysis is based on a review of multiple resources, including user feedback, regulatory databases, and expert reviews, to provide a comprehensive understanding of whether Sandwind is safe or if it raises red flags.

Regulation and Legitimacy

The regulatory environment is a crucial aspect of assessing any forex broker's credibility. Regulation serves as a form of oversight, ensuring that brokers adhere to specific standards that protect traders. In the case of Sandwind, it is important to investigate its regulatory status to determine if it operates within a legally recognized framework.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

Unfortunately, Sandwind appears to lack any regulatory oversight, which is a significant concern. The absence of a valid license from recognized financial authorities means that there is no official body to hold Sandwind accountable for its operations. This lack of regulation raises serious questions about the safety of traders' funds and the overall reliability of the broker. Unregulated brokers are often associated with higher risks of fraud and mismanagement, making it imperative for traders to approach such platforms with caution.

The quality of regulation is often a determining factor in the safety of trading environments. Reputable brokers are typically licensed by well-known regulatory bodies such as the FCA in the UK or ASIC in Australia, which impose strict rules regarding capital requirements and client fund protection. In contrast, the absence of such oversight in Sandwinds case is a major red flag, indicating that Sandwind may not be safe for traders.

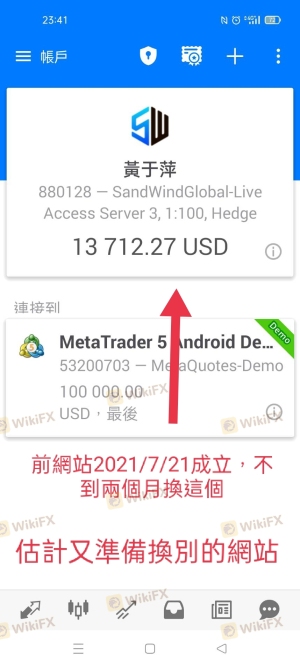

Company Background Investigation

Understanding the history and ownership structure of a broker can provide valuable insights into its legitimacy. Sandwind's company information is sparse, and there is little publicly available data regarding its establishment, ownership, or operational history. This lack of transparency is concerning, as reputable brokers usually provide detailed information about their founders, management team, and corporate structure.

The management team‘s background is another critical factor to consider when evaluating a broker’s credibility. A team with extensive experience in finance and trading can instill confidence in potential clients. However, Sandwind's lack of information about its management team raises questions about the expertise guiding its operations. Without clear disclosure of the individuals behind the broker, it becomes difficult for traders to assess the reliability of the firm.

Furthermore, the level of transparency regarding company operations and financial health is essential. Legitimate brokers typically provide detailed information about their business practices, trading conditions, and any potential conflicts of interest. In the case of Sandwind, the opacity surrounding its operations does not inspire confidence and suggests that traders should be wary, as Sandwind may not be safe.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. This includes the fee structure, spreads, and overall trading environment. Sandwind claims to offer competitive trading conditions, but a closer examination reveals a lack of clarity in its pricing model.

| Fee Type | Sandwind | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

The absence of specific information regarding spreads and commissions is troubling. Traders typically expect to find clear details about the costs associated with trading on a platform. Without this information, it becomes challenging to determine whether Sandwind offers competitive pricing or if there are hidden fees that could erode potential profits. Additionally, if a broker does not provide a transparent fee structure, it raises concerns about the potential for unethical practices.

Moreover, unusual or excessive fees can often indicate that a broker may not have the best interests of its clients at heart. Sandwinds lack of clarity in this area suggests that traders should be cautious and conduct further research before engaging with the platform, as Sandwind may not be safe.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Traders need to ensure that their money is protected through appropriate measures such as segregated accounts and investor protection schemes. In the case of Sandwind, there is little information available regarding its policies on fund safety.

A reputable broker typically maintains client funds in segregated accounts, ensuring that traders' money is kept separate from the broker‘s operational funds. This practice provides an additional layer of security in the event of financial difficulties. Furthermore, many regulated brokers participate in compensation schemes that protect traders in case of insolvency. However, Sandwind’s lack of regulatory oversight raises concerns about whether it implements similar safety measures.

Additionally, the absence of clear policies regarding negative balance protection is alarming. This feature is crucial for preventing traders from losing more money than they have deposited, especially in volatile market conditions. Without such protections in place, traders face significant risks when trading with Sandwind, further indicating that Sandwind may not be safe.

Customer Experience and Complaints

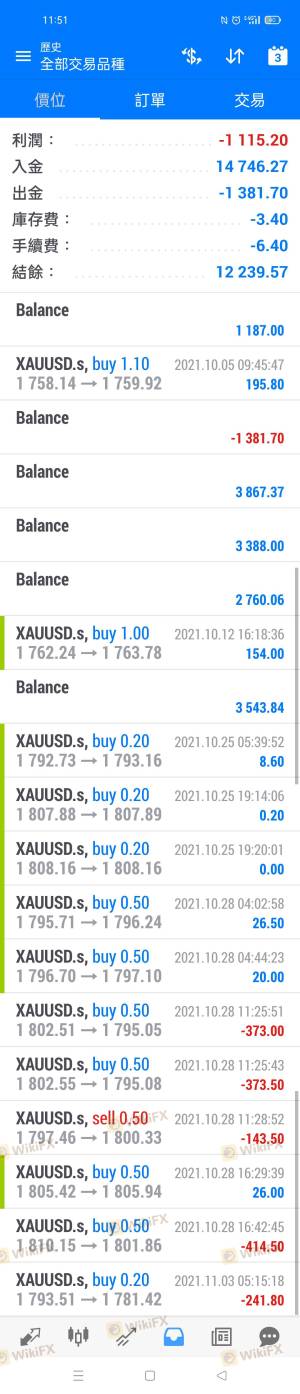

User feedback is a valuable resource for assessing the reliability of a broker. Analyzing customer experiences can reveal common patterns of complaints and the broker's responsiveness to issues. In the case of Sandwind, numerous complaints have been reported by users, particularly regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

Many users have expressed frustration over their inability to withdraw funds from their accounts, often citing blocked communication channels and unresponsive customer support. Such complaints are significant red flags, as they indicate systemic issues within the broker's operations. In one instance, a user reported being unable to access their account after multiple attempts, highlighting the potential risks associated with trading on Sandwind.

The severity of these complaints and the company's inadequate responses suggest that traders may face challenges in resolving issues effectively. This lack of support and responsiveness further reinforces the notion that Sandwind may not be safe for traders looking for a reliable trading environment.

Platform and Execution

The performance of a trading platform is critical for a positive trading experience. Traders expect a stable, user-friendly interface that allows for efficient order execution. Sandwind claims to offer a robust trading platform, but user feedback suggests otherwise.

Issues such as slippage, order rejections, and platform instability have been reported by users. Slippage occurs when an order is executed at a different price than expected, which can significantly impact trading results. Additionally, reports of high rejection rates for trades raise concerns about the broker's execution quality.

A reliable trading platform should facilitate smooth order execution without unnecessary delays or complications. However, the feedback surrounding Sandwind indicates that traders may experience challenges in this area, further suggesting that Sandwind may not be safe.

Risk Assessment

Overall, trading with Sandwind presents multiple risks that potential clients should consider. The lack of regulation, transparency, and user-friendly trading conditions are significant concerns that could jeopardize traders' investments.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight raises concerns. |

| Financial Risk | High | Lack of fund safety measures could lead to losses. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders should conduct thorough research before engaging with Sandwind. It is advisable to consider alternative brokers that are regulated and have a proven track record of client satisfaction and fund safety.

Conclusion and Recommendations

In conclusion, the evidence suggests that Sandwind may not be safe for forex trading. The absence of regulatory oversight, transparency issues, and a history of customer complaints raise significant concerns about the broker's legitimacy. Traders should exercise caution and consider these red flags before making any deposits.

For those seeking a reliable trading environment, it is recommended to explore alternatives that are regulated and have a solid reputation in the industry. Brokers with established track records and robust safety measures can provide a more secure trading experience. Ultimately, ensuring the safety of your funds and the quality of your trading experience should be the top priority when choosing a forex broker.

Is SANDWIND a scam, or is it legit?

The latest exposure and evaluation content of SANDWIND brokers.

SANDWIND Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SANDWIND latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.