Is Kwakol Markets safe?

Pros

Cons

Is Kwakol Markets A Scam?

Introduction

Kwakol Markets is a multi-asset brokerage firm that has gained attention in the forex market, particularly among traders in Nigeria and other regions. Established in 2020, the broker positions itself as a provider of diverse trading opportunities, including forex, CFDs, cryptocurrencies, and commodities. However, the rapid growth of online trading has led to an influx of brokers, making it essential for traders to conduct thorough evaluations before committing their funds. This article aims to assess the legitimacy of Kwakol Markets by examining its regulatory status, company background, trading conditions, customer fund security, and user experiences. Our evaluation is based on a comprehensive review of available information, including regulatory documentation, customer feedback, and industry standards.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for ensuring the safety of traders' funds and maintaining market integrity. Kwakol Markets claims to be regulated by several authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). However, the credibility of these claims warrants scrutiny.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001295040 | Australia | Verified |

| FINTRAC | M22600427 | Canada | Verified |

| NFA | Not Registered | USA | Not Verified |

While Kwakol Markets is registered with ASIC and FINTRAC, it is essential to note that the National Futures Association (NFA) in the USA does not recognize Kwakol Markets as a registered entity. This absence of NFA registration raises concerns about the broker's legitimacy in the US market. Furthermore, the lack of a specific investor protection fund associated with these regulators may leave clients vulnerable in case of disputes or financial difficulties. Overall, while the presence of ASIC and FINTRAC licenses adds a layer of credibility, the incomplete regulatory picture necessitates caution from potential investors.

Company Background Investigation

Kwakol Markets is headquartered in Nigeria, with claims of operational offices in the USA, Canada, and Australia. The company was founded by Yakubu Ishaku Teri, although detailed information about the management team remains scarce. The broker's website offers limited transparency regarding its ownership structure and operational history.

In the financial industry, a transparent company history is crucial for building trust with clients. Unfortunately, the lack of detailed disclosures about the management team and their professional backgrounds raises red flags. The absence of a robust corporate governance framework can lead to potential mismanagement or unethical practices. Furthermore, the company's relatively short operational history since 2020 may not provide sufficient evidence of its reliability or commitment to regulatory compliance.

Trading Conditions Analysis

Kwakol Markets offers a variety of trading accounts, each with different minimum deposit requirements and trading conditions. The broker's fee structure includes spreads, commissions, and overnight financing charges, which can significantly impact a trader's profitability.

| Fee Type | Kwakol Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.8 pips | 0.5 - 1.0 pips |

| Commission Model | $2 - $5 per lot | $0 - $3 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Kwakol Markets are competitive, especially for higher-tier accounts, which can offer spreads as low as 0.0 pips. However, the commission structure for various account types is higher than some industry standards, which could deter cost-sensitive traders. Additionally, the broker's policy of charging overnight financing fees on most accounts, except for Islamic accounts, may further complicate trading strategies for those who hold positions overnight.

Overall, while Kwakol Markets presents attractive trading conditions, the higher-than-average commissions and potential hidden fees could pose challenges for traders seeking cost-effective solutions.

Customer Fund Security

The security of customer funds is paramount when choosing a broker. Kwakol Markets claims to prioritize client safety by holding funds in segregated accounts with top-tier banks and offering negative balance protection. However, the effectiveness of these measures remains uncertain.

Kwakol Markets does not provide specific details about its fund segregation policies or the banks it partners with, which complicates the assessment of its security measures. Furthermore, the lack of an investor compensation scheme could leave clients vulnerable in the event of insolvency or financial mismanagement. Although the broker asserts that it conducts regular risk assessments, the absence of transparency regarding its risk management framework raises concerns about the adequacy of its protective measures.

Customer Experience and Complaints

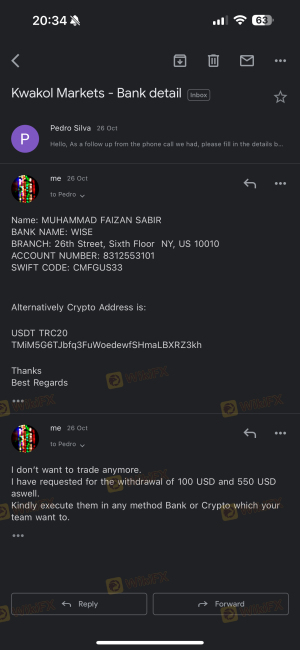

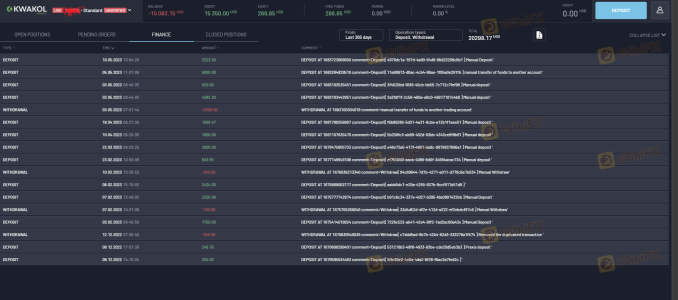

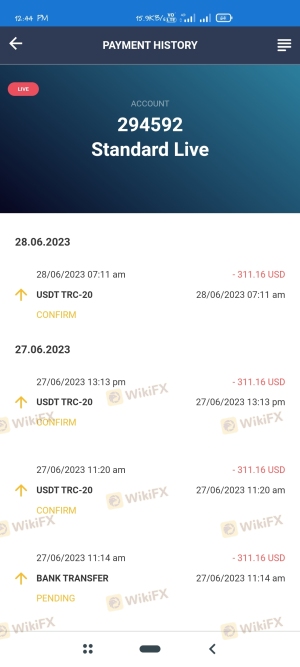

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of Kwakol Markets reveal a mixed bag of experiences, with some traders praising the platform's features and others expressing frustration over withdrawal issues and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Unhelpful |

| Account Freezing | High | No clear explanation |

Common complaints include delayed withdrawals, unresponsive customer support, and account freezing without prior notice. For instance, several users reported being unable to access their funds after making withdrawal requests, leading to significant financial distress. The slow response times from customer support further exacerbate these issues, leaving traders feeling neglected and frustrated.

Platform and Trade Execution

Kwakol Markets offers access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are known for their user-friendly interfaces and robust features. However, the performance and reliability of these platforms are critical for ensuring a positive trading experience.

Traders have reported mixed experiences regarding order execution quality, with some noting instances of slippage and re-quotes during volatile market conditions. While the broker claims to provide ultra-fast execution speeds, the reality may differ for some users, particularly those trading during peak market hours.

Risk Assessment

Engaging with Kwakol Markets entails several risks that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unverified claims of NFA registration. |

| Fund Security Risk | Medium | Lack of transparency in fund management. |

| Customer Service Risk | High | Frequent complaints regarding withdrawal issues. |

To mitigate these risks, traders are advised to conduct thorough research and consider using only funds they can afford to lose. Additionally, diversifying trading portfolios and maintaining a cautious approach to leverage can help manage potential losses.

Conclusion and Recommendations

In conclusion, while Kwakol Markets presents itself as a legitimate forex broker with regulatory oversight from ASIC and FINTRAC, several factors raise concerns about its credibility. The lack of NFA registration, mixed customer reviews, and issues related to fund security and customer service suggest that traders should exercise caution.

For those considering trading with Kwakol Markets, it is essential to be aware of the potential risks involved. Traders, particularly novices, may want to explore alternative brokers with stronger regulatory frameworks, such as Pepperstone or IC Markets, which are known for their reliability and robust customer support. Ultimately, thorough research and careful evaluation are paramount in navigating the complexities of the forex market.

Is Kwakol Markets a scam, or is it legit?

The latest exposure and evaluation content of Kwakol Markets brokers.

Kwakol Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Kwakol Markets latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.