Is RenHe safe?

Business

License

Is Renhe Safe or Scam?

Introduction

Renhe is a forex brokerage that has positioned itself within the competitive landscape of online trading, offering a variety of financial instruments and services to traders around the globe. With its operational base in the Bahamas and a registered address in Dubai, Renhe presents itself as a viable option for traders seeking access to forex, commodities, and indices. However, the need for traders to carefully evaluate the legitimacy and safety of such brokers cannot be overstated, particularly in a market rife with scams and unregulated entities. This article aims to provide a comprehensive analysis of Renhes regulatory status, company background, trading conditions, customer fund security, and overall user experience, drawing on various credible sources to ensure an objective assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy and the safety of client funds. Renhe claims to be regulated by the Securities Commission of the Bahamas (SCB), which is a notable aspect of its operations. However, potential clients must be aware that offshore regulation often lacks the stringent oversight found in more established jurisdictions. Below is a summary of Renhes regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities Commission of the Bahamas (SCB) | SIA-F-211 | Bahamas | Active |

While being regulated by the SCB lends some credibility to Renhe, it is essential to recognize that the quality of oversight from offshore regulators can vary significantly. Many brokers operating under such regulations have been known to exploit the lax regulatory environment, leading to potential risks for traders. Historical compliance records for Renhe reveal no significant regulatory disputes; however, the absence of a robust regulatory framework raises questions about the safety of client funds and the broker's accountability.

Company Background Investigation

Renhe was established in 2018 and has since developed a presence in the forex market. The company is registered under the name Renhe Financial Services Limited, with its operational headquarters located in Nassau, Bahamas. The ownership structure of the company remains somewhat opaque, with limited information available regarding its management team and their backgrounds. A transparent company profile is crucial for building trust with clients, and Renhe's lack of detailed information in this regard is a cause for concern.

The management team‘s professional experience is vital in assessing the broker's reliability. However, the available data does not provide insights into the qualifications or previous experiences of the team members. Furthermore, Renhe’s website lacks comprehensive disclosures about its corporate structure, which can be a red flag for potential investors looking for transparency. The overall opacity surrounding its operations diminishes confidence in the broker's commitment to regulatory compliance and ethical trading practices.

Trading Conditions Analysis

An evaluation of trading conditions is essential for understanding the costs associated with trading through a broker. Renhe offers a variety of trading instruments, including forex, commodities, and indices, through the popular MetaTrader 4 (MT4) platform. However, the overall fee structure and trading conditions warrant careful scrutiny.

| Fee Type | Renhe | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Structure | None | $3 - $7 per lot |

| Overnight Interest Range | Not specified | Varies by broker |

While Renhe advertises zero commissions, traders should be cautious, as such claims can often be misleading. The spreads offered by Renhe can vary significantly, and the lack of clarity regarding overnight interest rates may lead to unexpected costs. This ambiguity in the fee structure can create challenges for traders in accurately calculating their trading expenses, potentially impacting their overall profitability.

Client Fund Security

The safety of client funds is a critical consideration when selecting a forex broker. Renhe states that it employs measures to protect client funds, including segregating client accounts from company funds. However, the effectiveness of these measures must be assessed in light of the broker's regulatory status.

Renhe does not provide clear information regarding investor protection schemes or negative balance protection, which are crucial for safeguarding traders' investments. Historical reports of fund security issues or disputes involving Renhe are limited, but the lack of a stringent regulatory framework raises concerns about the actual implementation of these safety measures. Traders should always prioritize brokers that offer robust fund protection policies and are regulated by reputable authorities.

Customer Experience and Complaints

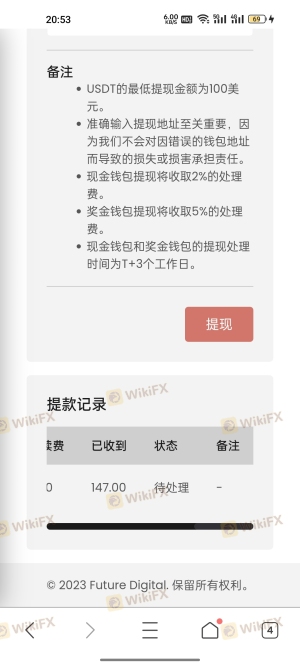

Analyzing customer feedback can provide valuable insights into a broker's reliability and the quality of its services. Reviews of Renhe reveal a mixed bag of experiences, with some users praising the trading platform's functionality, while others report issues with fund withdrawals and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response, unresolved |

| Customer Support | Medium | Delayed replies |

| Platform Performance | Low | Generally satisfactory |

Common complaints include difficulties in withdrawing funds, with some users reporting prolonged delays in processing withdrawal requests. The quality of customer support has also been called into question, with many users experiencing long wait times for responses. Notably, there are instances where clients feel their issues remain unresolved, which can significantly impact trust in the broker.

One typical case involves a trader who attempted to withdraw funds after a profitable trading period but faced delays exceeding a month, leading to frustration and concerns about the broker's legitimacy. Such experiences highlight the importance of evaluating a broker's customer service quality before committing funds.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a successful trading experience. Renhe utilizes the MT4 platform, which is widely regarded for its user-friendly interface and robust features. However, the platform's stability and execution quality must also be evaluated.

Users have reported satisfactory experiences with the MT4 platform in terms of its features and usability. However, concerns have been raised regarding order execution quality, including instances of slippage and rejections during volatile market conditions. Although these issues are not uncommon in the forex trading environment, frequent occurrences can lead to negative trading experiences.

Risk Assessment

Engaging with any forex broker entails inherent risks, and Renhe is no exception. A comprehensive risk assessment is essential to gauge the potential pitfalls associated with trading through this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack oversight. |

| Fund Security Risk | Medium | Segregated accounts, but no investor protection. |

| Withdrawal Risk | High | Reports of delayed withdrawals and customer complaints. |

Given the findings, the overall risk level associated with trading through Renhe is significant. Traders are advised to exercise caution and consider alternative brokers with more robust regulatory frameworks and clearer client protection policies.

Conclusion and Recommendations

In conclusion, while Renhe presents itself as a legitimate forex broker, several factors warrant caution. The offshore regulation by the SCB does provide some level of oversight, but it lacks the stringent protections offered by more reputable jurisdictions. The company's opacity regarding its management, coupled with reported issues in fund withdrawals and customer support, raises significant red flags.

For traders considering Renhe, it is crucial to weigh the potential risks against the benefits. Those who prioritize safety and regulatory compliance may wish to explore alternative brokers with stronger reputations and clearer protections for client funds. Recommended alternatives include brokers regulated by the FCA, ASIC, or CySEC, which offer more comprehensive investor safeguards and a proven track record of reliability.

Is RenHe a scam, or is it legit?

The latest exposure and evaluation content of RenHe brokers.

RenHe Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RenHe latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.