Is STUNWILL safe?

Business

License

Is Stunwill Safe or Scam?

Introduction

Stunwill is an online forex broker that has recently emerged in the competitive landscape of foreign exchange trading. As traders consider engaging with this platform, it is crucial to assess its legitimacy and safety. The forex market is rife with both opportunities and risks, making it imperative for traders to thoroughly evaluate any broker they intend to work with. In this article, we will explore whether Stunwill is a safe trading option or if it raises red flags that could indicate a scam. Our investigation will utilize a comprehensive framework that includes regulatory status, company background, trading conditions, customer feedback, and risk assessments to provide a well-rounded perspective.

Regulatory Status and Legitimacy

Regulatory oversight is a vital factor in determining the safety of any forex broker. A regulated broker is usually seen as more trustworthy, as they are required to adhere to strict guidelines designed to protect investors. Unfortunately, Stunwill's regulatory status raises concerns. According to our findings, Stunwill is not regulated by any prominent financial authority, which is a significant red flag for potential traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation means that Stunwill does not have to comply with the stringent requirements that regulated brokers must follow. This absence of oversight can lead to potential risks for traders, as there may be fewer protections in place for their investments. Furthermore, unregulated brokers often have a history of questionable practices, making it essential for traders to exercise caution. Without regulatory backing, it is challenging to ascertain the broker's legitimacy, which contributes to the ongoing debate about whether Stunwill is safe or a scam.

Company Background Investigation

To further understand Stunwill, it is essential to delve into its history and ownership structure. Stunwill was established in 2021, making it a relatively new player in the forex market. The company claims to offer a wide range of trading instruments, including forex pairs, commodities, and cryptocurrencies. However, the lack of transparency regarding its ownership and management team raises additional concerns.

The management teams background is crucial in evaluating a broker's credibility. Unfortunately, there is limited information available about the individuals behind Stunwill, which could indicate a lack of transparency. A reputable broker typically provides details about its management team and their professional experiences, enhancing the trustworthiness of the platform. In this case, the absence of such information could lead to skepticism about the broker's intentions and capabilities.

Moreover, the company's website appears poorly designed and lacks essential metadata that would typically enhance its online presence. This could potentially diminish the credibility of Stunwill and further complicate the decision-making process for traders assessing whether Stunwill is safe or a scam.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is vital. This includes the cost structure, which can significantly impact a trader's profitability. Stunwill's fees are not clearly outlined, making it challenging for traders to assess whether they offer competitive rates compared to industry standards.

| Fee Type | Stunwill | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not specified | Varies (0 - 10 USD per lot) |

| Overnight Interest Range | Not disclosed | 2.5% - 4.5% |

The lack of clarity regarding spreads and commissions is concerning, as traders might encounter unexpected costs that could affect their trading experience. Additionally, any unusual fees or hidden charges can be detrimental to a trader's success. Without transparent trading conditions, it becomes increasingly difficult to determine whether Stunwill is a safe option for forex trading.

Customer Funds Safety

The safety of customer funds is paramount when selecting a forex broker. Stunwill's website does not provide sufficient information regarding its safety measures for client funds. It is essential for brokers to implement stringent security protocols, such as segregating client accounts and offering investor protection schemes.

A reputable broker typically keeps client funds in separate accounts to ensure that they are not used for operational expenses. Furthermore, negative balance protection is a critical feature that protects traders from losing more than their initial investment. Unfortunately, Stunwill has not clearly communicated its policies regarding fund security, leaving potential clients in the dark about the safety of their investments.

Historically, brokers that lack robust safety measures have faced significant issues, including fund mismanagement and insolvency. Therefore, the absence of clear information about Stunwill's customer fund safety raises concerns and calls into question whether it is indeed safe or potentially a scam.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews and testimonials provide insights into the experiences of other traders, helping prospective clients make informed decisions. However, the available feedback on Stunwill is mixed, with several users expressing concerns regarding the platform's responsiveness and support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

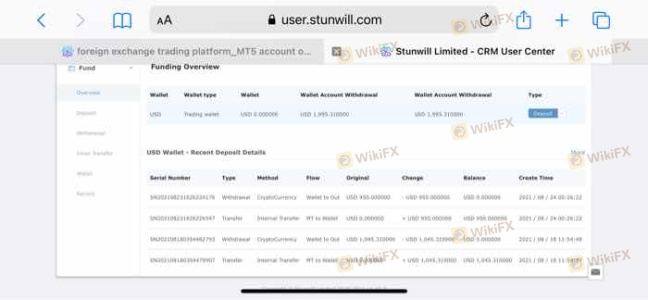

| Withdrawal Issues | High | Unresponsive |

| Customer Support Delay | Medium | Slow response |

| Account Verification | High | Poor communication |

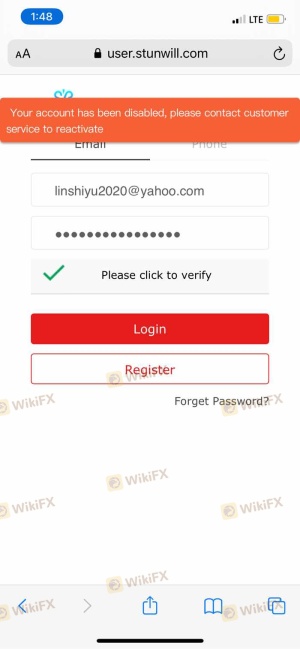

Common complaints include difficulties with fund withdrawals and slow customer support. These issues are significant as they directly affect a trader's ability to access their funds and receive timely assistance. The lack of effective communication from Stunwill's support team raises further doubts about the broker's commitment to customer service.

In one case, a trader reported that their withdrawal request took an unusually long time to process, leading to frustration and concerns about whether Stunwill is safe or a scam. Such experiences highlight the importance of evaluating customer service quality when assessing a broker's overall reliability.

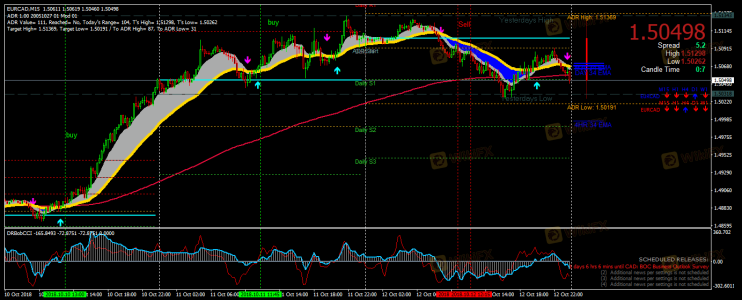

Platform and Execution

The quality of the trading platform and execution speed is critical for successful trading. Stunwill claims to offer a user-friendly platform; however, user reviews suggest that the platform may not perform consistently. Issues such as slippage and order rejections have been reported, which can significantly impact trading outcomes.

A reliable trading platform should provide stable performance, fast execution speeds, and minimal slippage. Unfortunately, the lack of detailed information about Stunwill's platform capabilities raises concerns about its reliability. Traders need to be cautious, as any signs of platform manipulation could indicate deeper issues within the broker's operations.

Risk Assessment

Engaging with any broker comes with inherent risks. For Stunwill, the risks are compounded by its lack of regulation, unclear trading conditions, and mixed customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | Unclear fee structure |

| Operational Risk | High | Poor platform performance |

To mitigate these risks, traders should conduct thorough research and consider using alternative brokers with established reputations. It is crucial to prioritize brokers that are regulated and have a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence suggests that Stunwill raises several red flags that warrant caution. The lack of regulatory oversight, unclear trading conditions, and mixed customer feedback contribute to concerns about whether Stunwill is safe or a scam. Traders should be vigilant and consider these factors before deciding to engage with this broker.

For those seeking reliable trading options, it is advisable to explore alternative brokers that are well-regulated and have a strong reputation for customer service and transparency. Always prioritize safety and due diligence when selecting a forex broker, as this can significantly impact your trading experience and financial security.

Is STUNWILL a scam, or is it legit?

The latest exposure and evaluation content of STUNWILL brokers.

STUNWILL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

STUNWILL latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.