Is Wilter safe?

Pros

Cons

Is Wilter Safe or a Scam?

Introduction

In the dynamic world of forex trading, choosing a reliable broker is paramount for traders seeking to maximize their investment potential. Wilter, established in 2015, positions itself as an international broker with a presence in 19 countries, particularly in the Asia-Pacific region. It offers access to a variety of financial instruments, including forex, commodities, and cryptocurrencies. However, the influx of brokers in the market raises concerns about their legitimacy and safety. Traders must exercise caution and conduct thorough evaluations before committing their funds. This article aims to investigate whether Wilter is a safe trading option or a potential scam. Our analysis is based on a comprehensive review of regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. Wilter operates under an appointed representative (AR) license authorized by the Australian Securities and Investments Commission (ASIC). This regulatory body is known for its stringent requirements, which adds a layer of credibility to the broker.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001293885 | Australia | Verified |

While Wilter holds an AR license, it is essential to note that this does not equate to full regulation, which typically involves direct oversight of the broker's operations. The quality of regulation is significant, as it impacts the broker's adherence to compliance standards and investor protection measures. Although Wilter claims to cooperate with top liquidity providers and financial institutions, the lack of direct regulation may raise concerns among potential clients regarding the broker's operational transparency and accountability.

Company Background Investigation

Wilter Management Ltd. was founded in 2015, and its ownership structure remains somewhat opaque, which can be a red flag for potential clients. The broker claims to have partnerships with over 30 well-known financial institutions, suggesting a robust operational framework. However, the absence of detailed information about the management team and their professional backgrounds leaves much to be desired.

Transparency is a crucial aspect of any financial entity, and Wilter does not provide comprehensive insights into its operational practices or ownership. This lack of disclosure can lead to skepticism among traders who prioritize safety and accountability. The company's website provides limited information, which does not foster confidence in its legitimacy. In summary, while Wilter has made strides in establishing its presence in the forex market, the opacity surrounding its ownership and management raises questions about its reliability.

Trading Conditions Analysis

When assessing whether Wilter is safe, one must consider its trading conditions, including fees, spreads, and commissions. The broker offers two account types: a standard account for investments below $2,000 and an ECN account for investments over $20,000. However, the broker does not disclose essential information regarding trading costs, such as spreads and commissions, which can be detrimental to traders seeking transparency.

| Cost Type | Wilter | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The absence of clear information on trading costs suggests a lack of transparency, which is a significant concern for potential clients. Traders may encounter unexpected fees, which could impact their overall profitability. The lack of competitive spreads and commissions compared to industry standards further emphasizes the need for potential clients to approach Wilter with caution.

Client Fund Security

The safety of client funds is paramount when evaluating a broker's reliability. Wilter claims to implement various security measures, including segregated accounts to protect client funds. However, the broker's website lacks detailed information regarding investor protection policies, such as negative balance protection or compensation schemes in case of insolvency.

The absence of specific information on these critical safety measures raises concerns about the level of protection afforded to clients. Traders should be wary of brokers that do not clearly outline their fund security protocols, as this could expose them to significant financial risk. Furthermore, any historical issues related to fund safety or disputes should be thoroughly investigated to assess the broker's track record in safeguarding client assets.

Customer Experience and Complaints

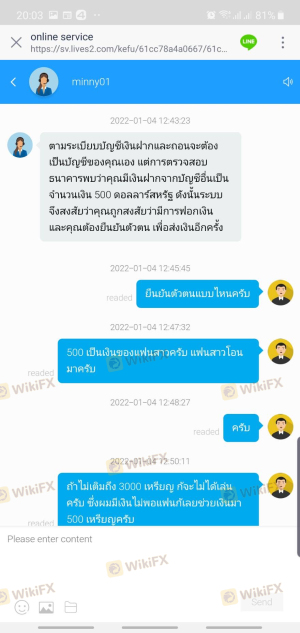

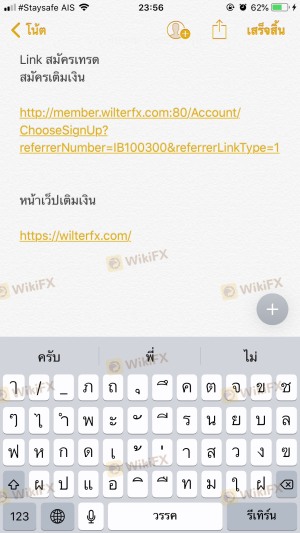

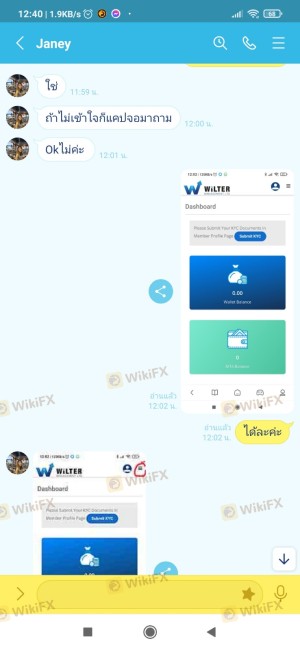

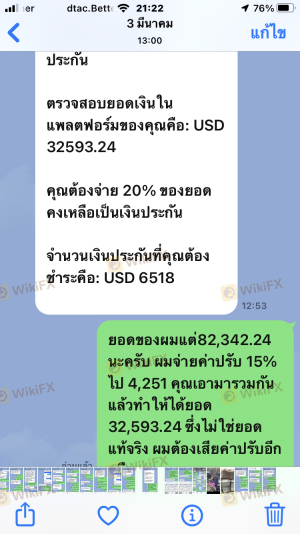

Customer feedback is a vital component of evaluating a broker's reliability. Reviews of Wilter reveal a mixed bag of experiences, with some users praising its platform while others express dissatisfaction with customer service and withdrawal processes. Common complaints include delayed withdrawals, lack of responsiveness from support staff, and unclear communication regarding fees.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Average |

| Fee Transparency | High | Poor |

Two notable cases illustrate these concerns. One trader reported a significant delay in fund withdrawal, which took over a month to resolve, while another expressed frustration over the lack of clarity regarding trading fees. These issues highlight the importance of a broker's responsiveness to client concerns, which can significantly impact overall trustworthiness.

Platform and Trade Execution

The trading platform offered by Wilter is based on the widely used MetaTrader 4 (MT4) interface, known for its user-friendly design and extensive features. However, the performance and stability of the platform are crucial factors in determining whether Wilter is safe for traders. Reports of slippage and order rejections have surfaced, raising concerns about the broker's execution quality.

Traders have expressed dissatisfaction with the speed of order execution, particularly during high-volatility events, which can significantly affect trading outcomes. If traders experience frequent slippage or rejected orders, it could indicate potential manipulation or inefficiencies in the trading environment.

Risk Assessment

Using Wilter poses several risks that traders should carefully consider. The lack of comprehensive regulatory oversight, combined with unclear trading costs and customer service issues, contributes to an overall risk profile that may be deemed high for many traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited regulatory oversight |

| Financial Risk | Medium | Unclear fee structure and withdrawal issues |

| Operational Risk | High | Reports of execution problems |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Wilter. This includes reading user reviews, understanding the fee structure, and considering the potential impact of regulatory limitations on their trading activities.

Conclusion and Recommendations

In conclusion, while Wilter presents itself as a legitimate forex broker, several factors raise concerns about its safety and reliability. The lack of comprehensive regulatory oversight, unclear trading costs, and mixed customer feedback suggest that traders should approach this broker with caution.

For those considering trading with Wilter, it is advisable to start with a minimal investment to assess the platform's performance and customer service. Additionally, traders may wish to explore more reputable alternatives with stronger regulatory frameworks and transparent fee structures. Brokers such as IG, OANDA, and Forex.com are known for their robust regulatory compliance and positive user experiences, making them safer choices for traders seeking a reliable trading environment. In the end, conducting thorough research and staying informed is crucial for ensuring a safe trading experience in the forex market.

Is Wilter a scam, or is it legit?

The latest exposure and evaluation content of Wilter brokers.

Wilter Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Wilter latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.