Is Oks Markets Limited safe?

Business

License

Is Oks Markets Limited Safe or a Scam?

Introduction

Oks Markets Limited is a Hong Kong-based forex broker that has gained attention for its diverse trading options, including cryptocurrencies, futures, and precious metals. Established in 2021, it positions itself as a player in the competitive forex market. However, traders must exercise caution when evaluating the credibility of any forex broker, especially given the prevalence of scams and unregulated entities in the industry. This article aims to provide a thorough analysis of Oks Markets Limited, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk assessment. The evaluation draws from a variety of sources, including user reviews, regulatory databases, and expert analyses to offer a comprehensive understanding of whether Oks Markets Limited is safe for trading.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for assessing its legitimacy. Oks Markets Limited currently operates without valid regulation, which significantly raises concerns about its trustworthiness. The absence of oversight from recognized financial authorities can lead to a lack of accountability and increased risk for traders. Below is a summary of the regulatory status of Oks Markets Limited:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC (Revoked) | 001292759 | Australia | Not Valid |

The Australian Securities and Investments Commission (ASIC) had previously revoked Oks Markets Limited's license, which is a significant red flag. The lack of regulatory oversight means that traders have limited recourse in case of disputes or issues related to fund management. Furthermore, the broker's website has been reported as inaccessible, compounding concerns about its operational legitimacy. In the forex trading landscape, a broker's regulatory status is a fundamental indicator of safety, and the lack of a valid license raises serious questions about whether Oks Markets Limited is safe for traders.

Company Background Investigation

Oks Markets Limited was founded in 2021 and is based in Hong Kong. The company claims to offer a range of trading services across various asset classes. However, the companys ownership structure and management team remain largely opaque, which raises concerns about transparency. A broker's credibility is often tied to the experience and qualifications of its management team, and in this case, there is little publicly available information regarding the backgrounds of the individuals running Oks Markets Limited.

The overall transparency of the company is questionable, as it does not provide sufficient information about its operational practices or the identities of its key personnel. This lack of disclosure can be a significant warning sign for potential investors. Effective communication and transparency are essential for building trust in the financial services sector, and Oks Markets Limited appears to fall short in these areas. Therefore, when considering whether Oks Markets Limited is safe, traders should be wary of the company's ambiguous operational framework and lack of clear information.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its reliability. Oks Markets Limited claims to have a flexible fee structure, but the absence of clear information regarding spreads, commissions, and other trading costs raises concerns. Below is a comparison of the core trading costs associated with Oks Markets Limited against industry averages:

| Cost Type | Oks Markets Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Not Disclosed | Varies by broker |

| Overnight Interest Range | Not Disclosed | 0.5% - 2.0% |

The lack of transparency around the fee structure is troubling. Reports indicate that users have faced issues with withdrawals, which suggests that the broker may have hidden fees or unfavorable trading conditions that are not disclosed upfront. Such practices can be indicative of a broker that is not committed to fair trading conditions, making it essential for traders to carefully consider whether Oks Markets Limited is safe for their trading activities.

Customer Funds Security

The security of customer funds is paramount when evaluating any trading platform. Oks Markets Limited has been criticized for its lack of clear information regarding fund protection measures. Effective brokers typically employ segregated accounts to ensure that client funds are kept separate from operational funds, thereby providing an additional layer of security. However, there is no evidence to suggest that Oks Markets Limited practices this level of fund segregation.

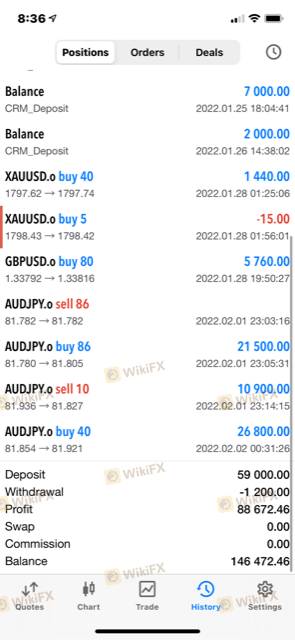

Moreover, the absence of investor protection policies raises alarms about the safety of funds deposited with this broker. Historical complaints regarding withdrawal issues have surfaced, indicating that traders have struggled to access their funds. Such incidents not only highlight potential operational inefficiencies but also suggest that Oks Markets Limited may not prioritize the safety and security of its clients investments. Therefore, traders should be cautious and consider whether Oks Markets Limited is safe, especially in light of these significant concerns.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding a broker's operational integrity. Oks Markets Limited has received mixed reviews from users, with many expressing concerns over withdrawal difficulties and customer service responsiveness. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support | Medium | Limited to Email Only |

One notable case involved a trader who reported being unable to withdraw funds despite multiple requests, leading to frustration and loss of trust in the broker. Such complaints are indicative of potential systemic issues within the company, raising further doubts about whether Oks Markets Limited is safe for trading. The lack of effective customer support channels, limited to email communication, exacerbates these concerns, as traders may find it difficult to resolve issues in a timely manner.

Platform and Trade Execution

The performance of a broker's trading platform plays a vital role in the overall trading experience. Oks Markets Limited claims to offer the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, reports of platform instability, including issues with order execution and slippage, have surfaced among user reviews.

Traders have expressed concerns about the quality of order execution, with some claiming that they experienced significant slippage during volatile market conditions. Additionally, there are allegations of potential platform manipulation, which can severely impact trading outcomes. Given these factors, it is essential to scrutinize whether Oks Markets Limited is safe for trading, as the reliability of the trading platform is a critical component of a trader's success.

Risk Assessment

Evaluating the overall risk associated with trading through Oks Markets Limited is essential for making informed decisions. Below is a simple risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Security Risk | High | Reports of withdrawal issues |

| Operational Risk | Medium | Limited customer support and transparency |

| Platform Risk | High | Allegations of execution issues |

The comprehensive risk analysis suggests that trading with Oks Markets Limited carries significant risks, particularly due to its lack of regulatory oversight and reported issues with fund withdrawals. Traders should consider implementing strict risk management strategies if they choose to engage with this broker.

Conclusion and Recommendation

In conclusion, the investigation into Oks Markets Limited raises significant concerns about its safety and reliability as a forex broker. The absence of valid regulation, combined with reports of withdrawal issues and limited customer support, paints a troubling picture. Therefore, it is reasonable to conclude that Oks Markets Limited may not be safe for traders.

For those considering trading options, it is advisable to seek out brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Alternatives such as well-regulated brokers with proven track records should be explored to ensure a safer trading environment. Always conduct thorough research and consider the risks involved before committing to any trading activity.

Is Oks Markets Limited a scam, or is it legit?

The latest exposure and evaluation content of Oks Markets Limited brokers.

Oks Markets Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Oks Markets Limited latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.