Wilter 2025 Review: Everything You Need to Know

Summary

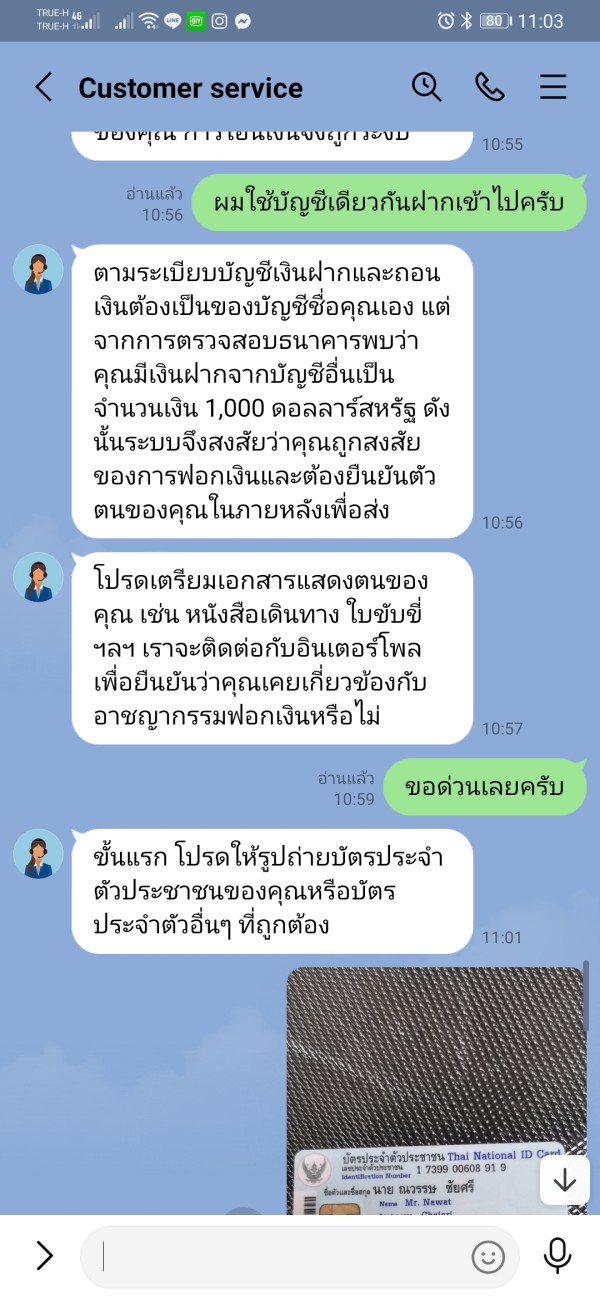

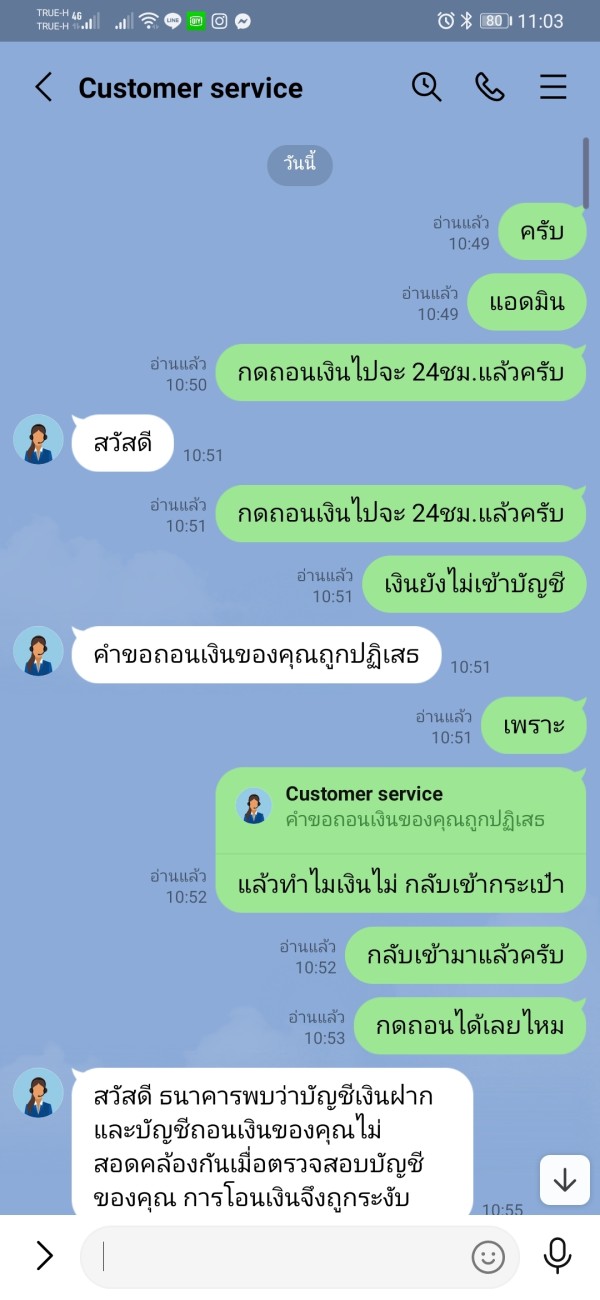

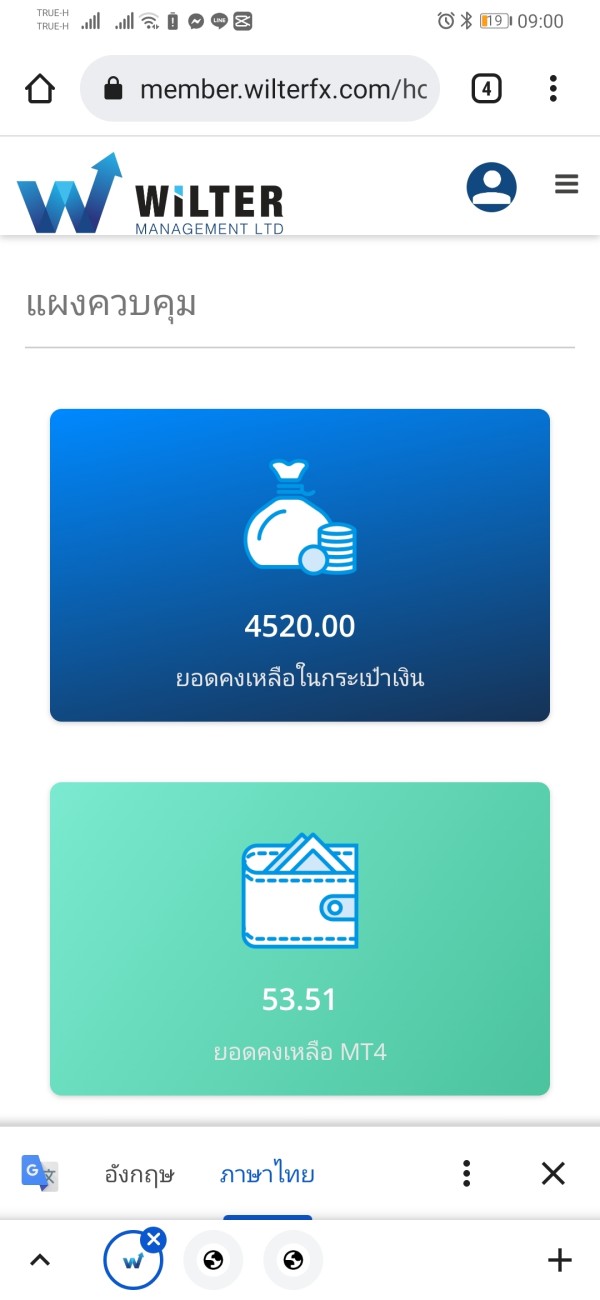

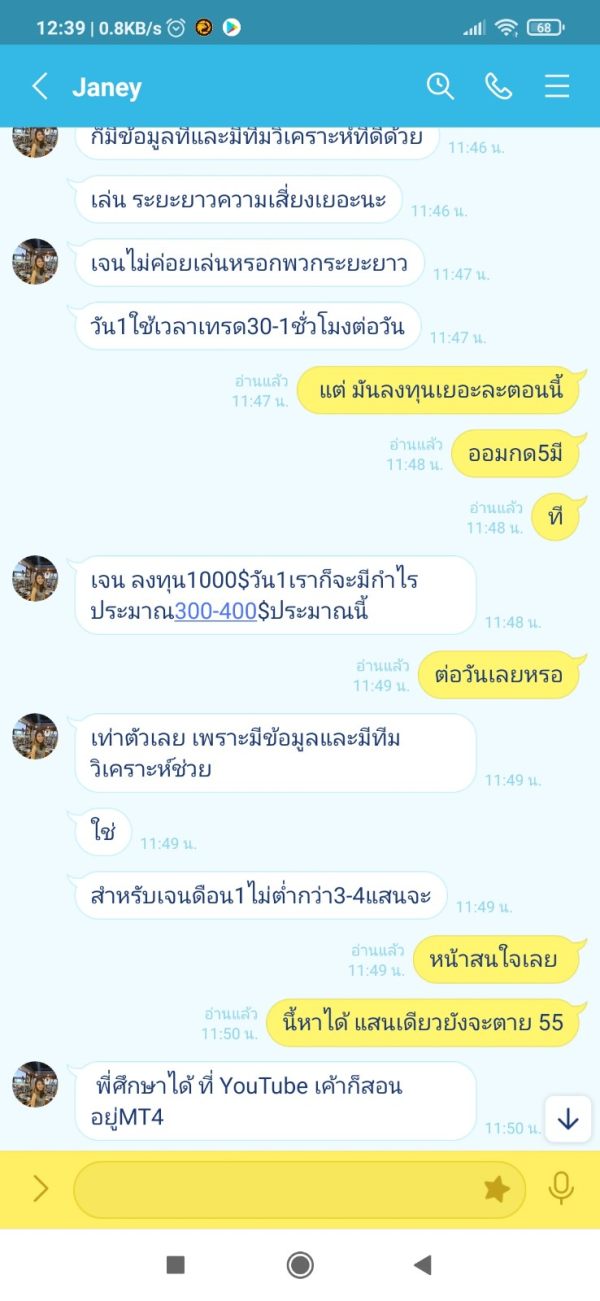

This Wilter review examines a forex broker that has operated since 2015 under the name Wilter Management. The company has established a multi-year presence in the forex market and offers cash rebate services to traders, but significant concerns arise from its lack of regulatory oversight and limited transparency regarding trading conditions. The broker appears to focus primarily on providing forex trading services with a cash-back incentive program. It targets traders who prioritize rebate opportunities over comprehensive trading features.

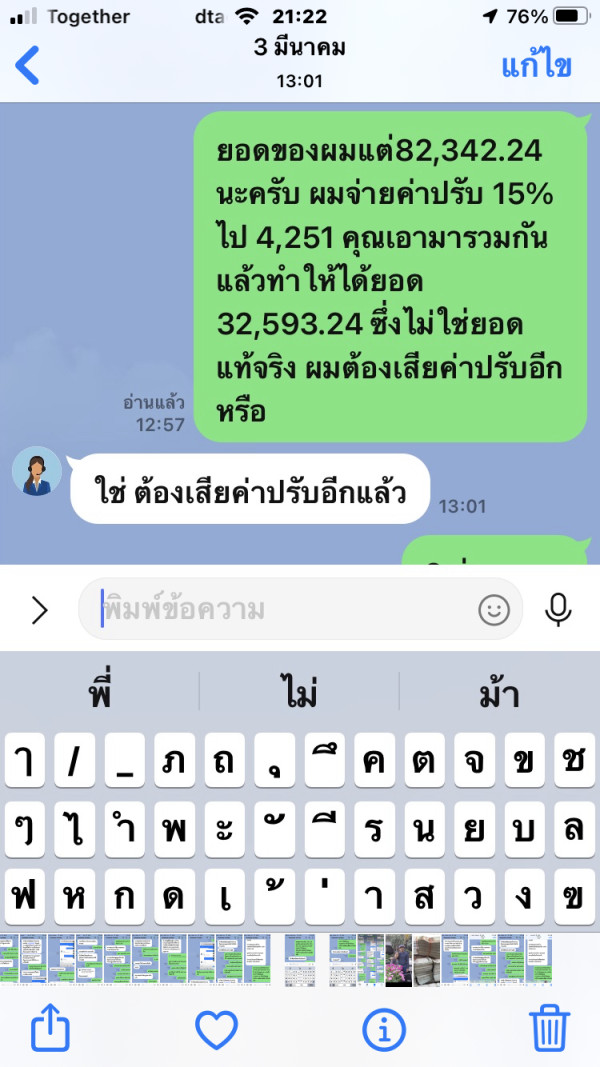

Wilter Management's main attraction lies in its cash rebate program. This program appeals to cost-conscious traders seeking to reduce their overall trading expenses. However, the absence of detailed information about trading conditions, platform specifications, and user feedback raises questions about the broker's overall service quality and reliability. The company's unregulated status presents additional risks. Potential clients must carefully consider these risks before engaging with their services.

Important Notice: This review is based on limited available information about Wilter Management. The company currently appears to operate without regulatory oversight from any recognized government authority, which may expose traders to increased risks. Our evaluation reflects the scarcity of detailed trading conditions, user reviews, and operational transparency typically expected from established forex brokers.

Readers should note that this assessment relies on publicly available information summaries. We were unable to access comprehensive user testimonials or detailed trading specifications that would provide a more complete picture of the broker's services and performance.

Broker Overview

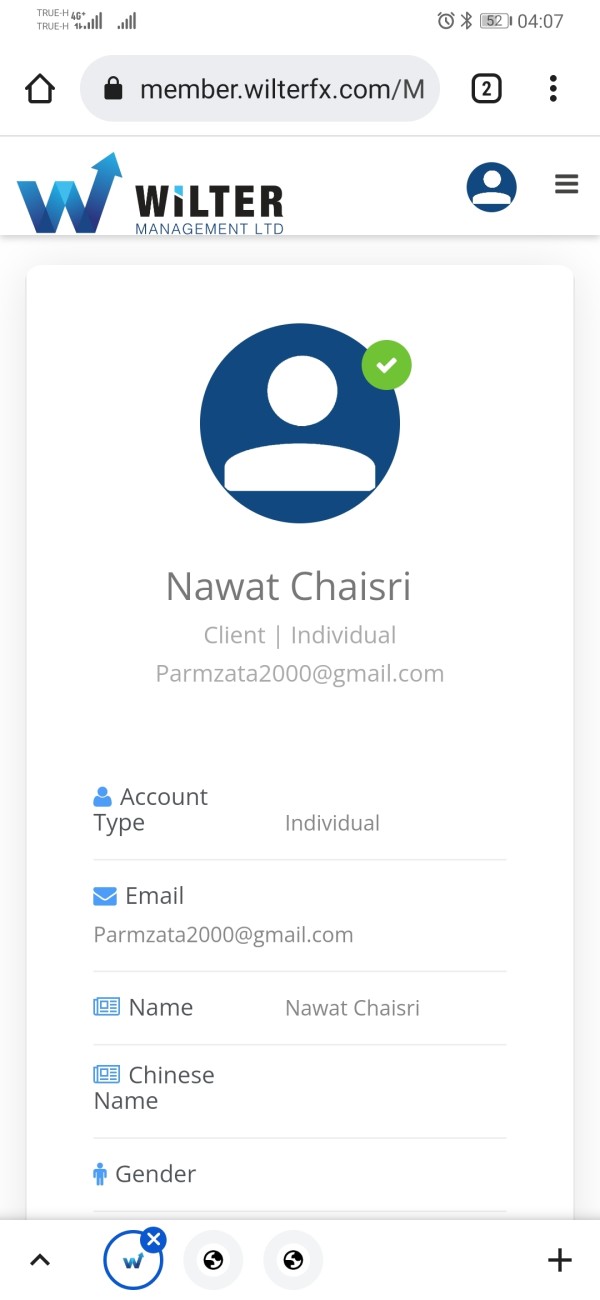

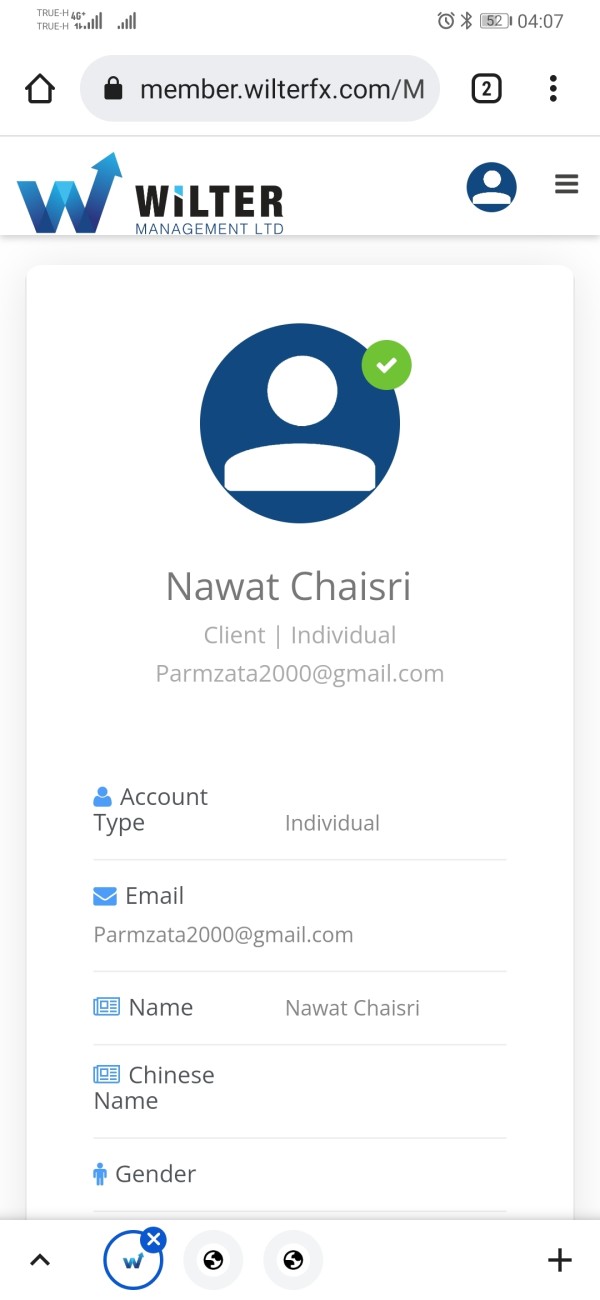

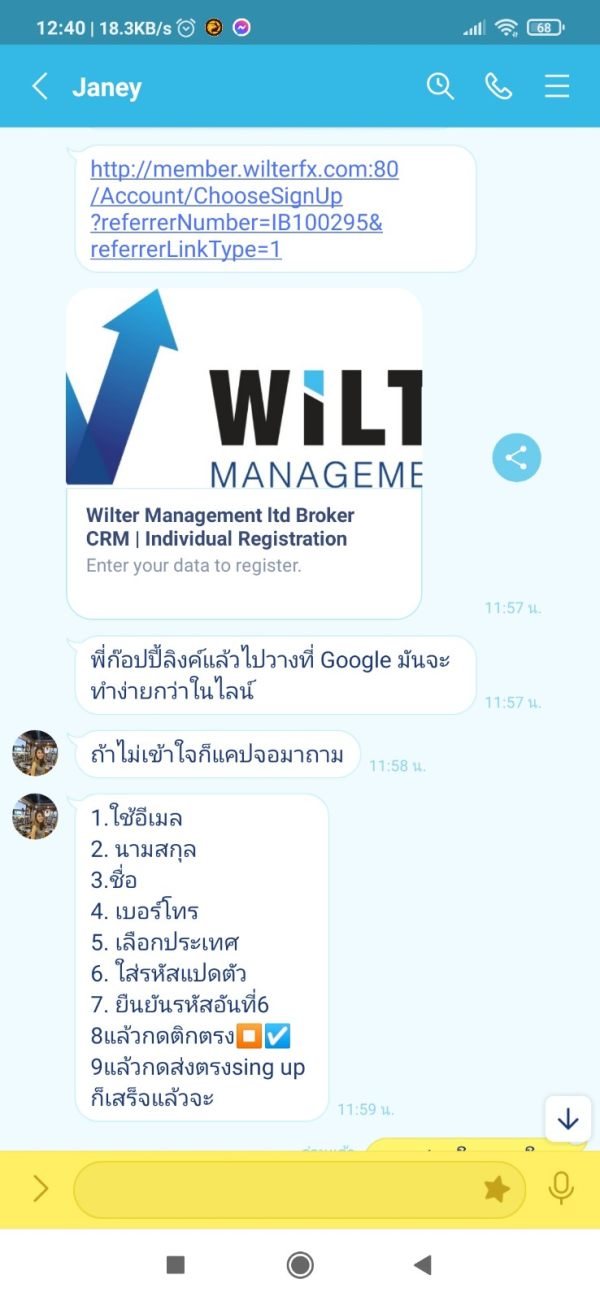

Wilter Management entered the forex brokerage industry in 2015. The company established itself as a service provider focused on foreign exchange trading. The company has maintained operations for nearly a decade, suggesting some level of business continuity in the competitive forex market. As a forex broker, Wilter Management positions itself to serve traders seeking access to currency markets. However, specific details about their operational scope and geographic reach remain limited in available documentation.

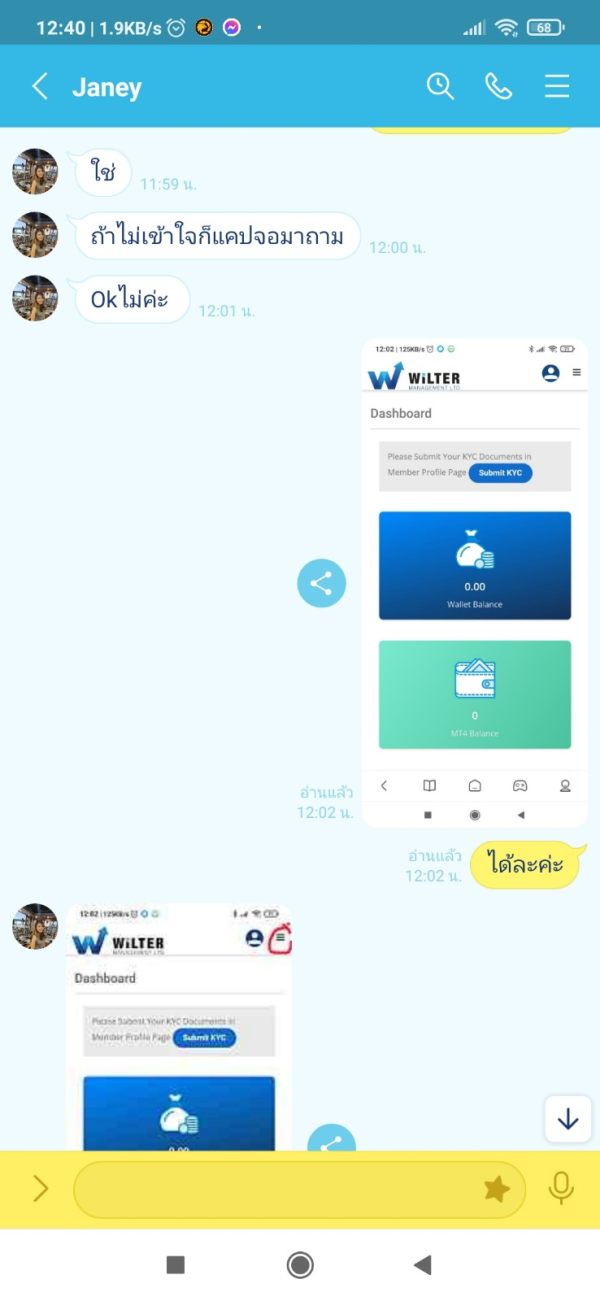

The broker's primary business model revolves around traditional forex brokerage services. It connects clients to currency trading opportunities. However, unlike many established competitors, Wilter Management has not provided extensive public information about their trading infrastructure, technological capabilities, or comprehensive service offerings. This Wilter review finds that while the company offers cash rebate services as a distinguishing feature, the lack of detailed operational information makes it challenging to assess their full service portfolio.

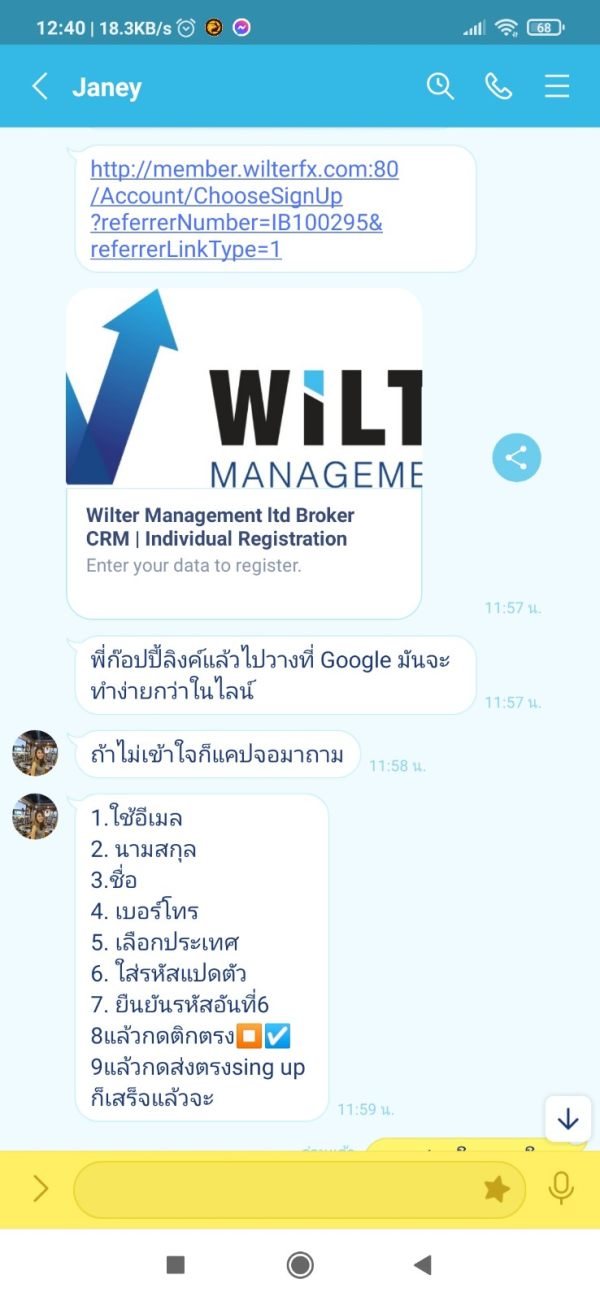

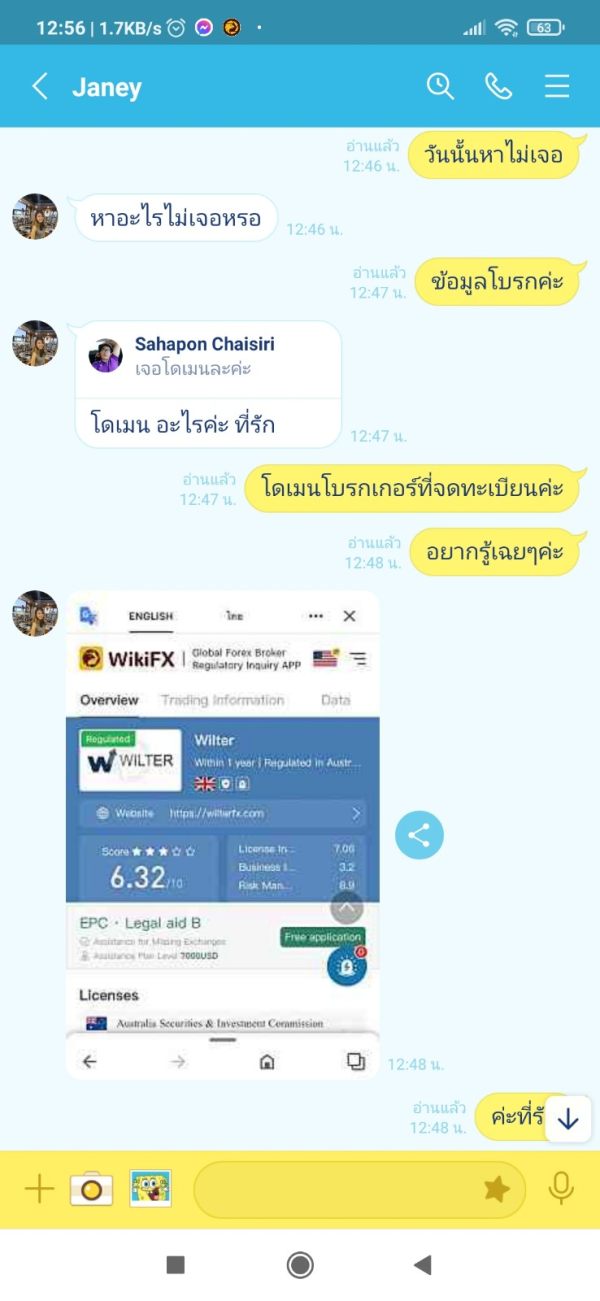

According to available information, the broker operates without specific regulatory oversight. This distinguishes it from many mainstream forex brokers who typically seek licensing from recognized financial authorities. The company's website infrastructure and online presence suggest they maintain active operations. However, the extent of their client base and trading volume remains undisclosed in public materials.

Regulatory Status: Available information indicates that Wilter Management currently operates without regulation from recognized government financial authorities. This unregulated status means the broker does not fall under the oversight of major regulatory bodies such as the FCA, ASIC, or CySEC. These bodies typically provide investor protection frameworks and operational standards.

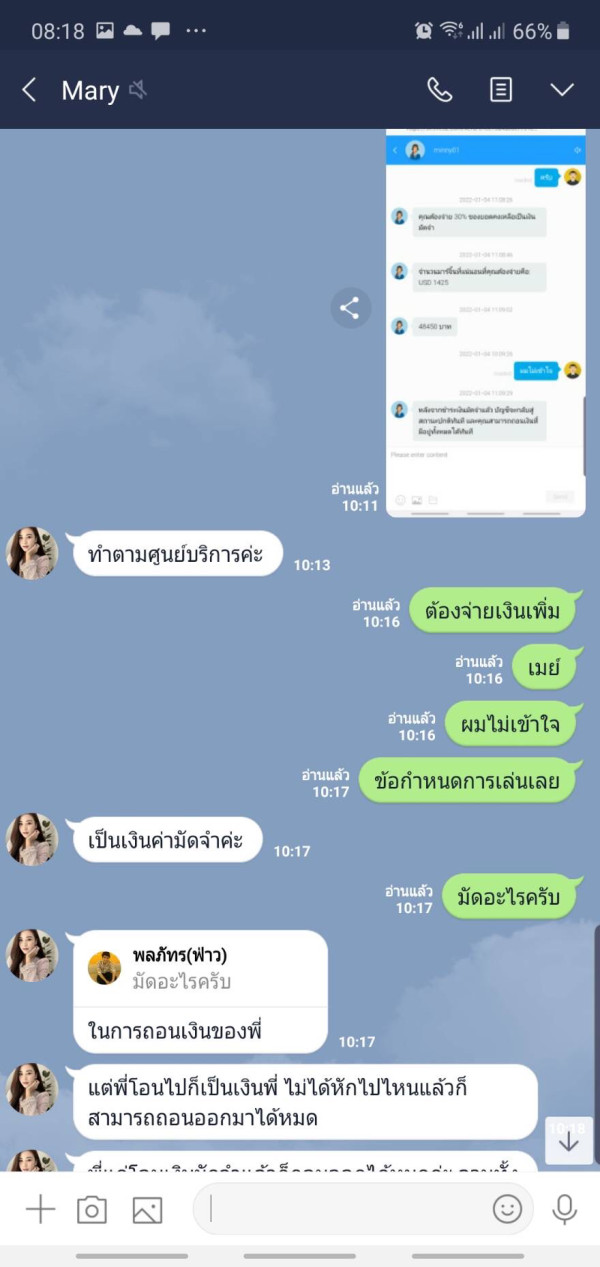

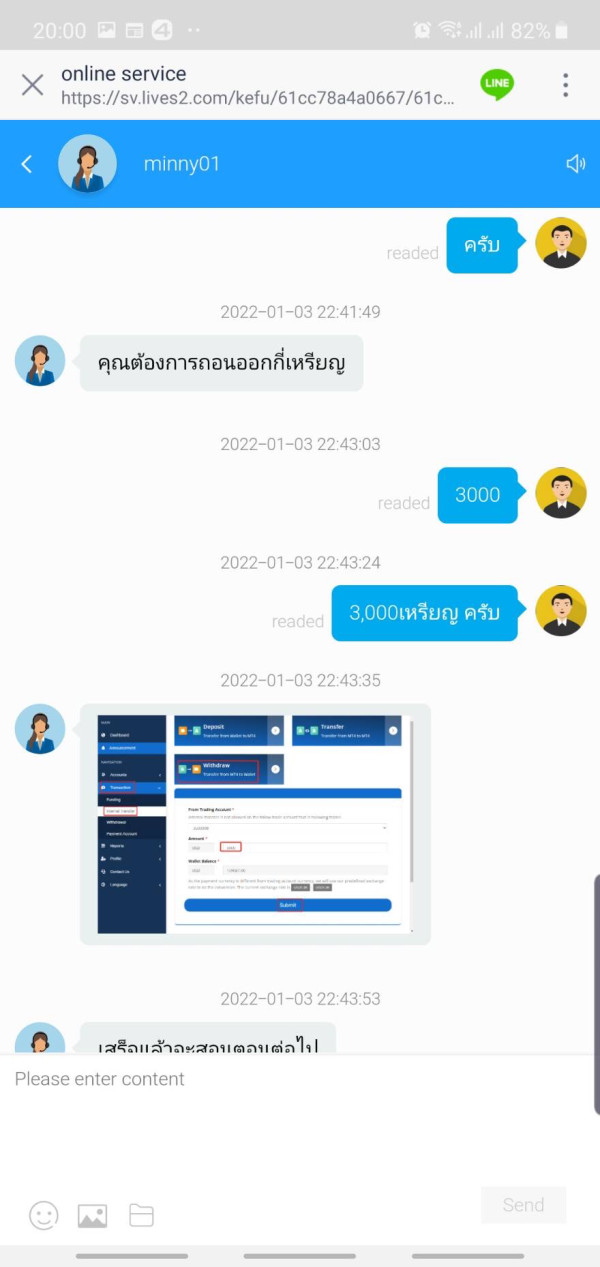

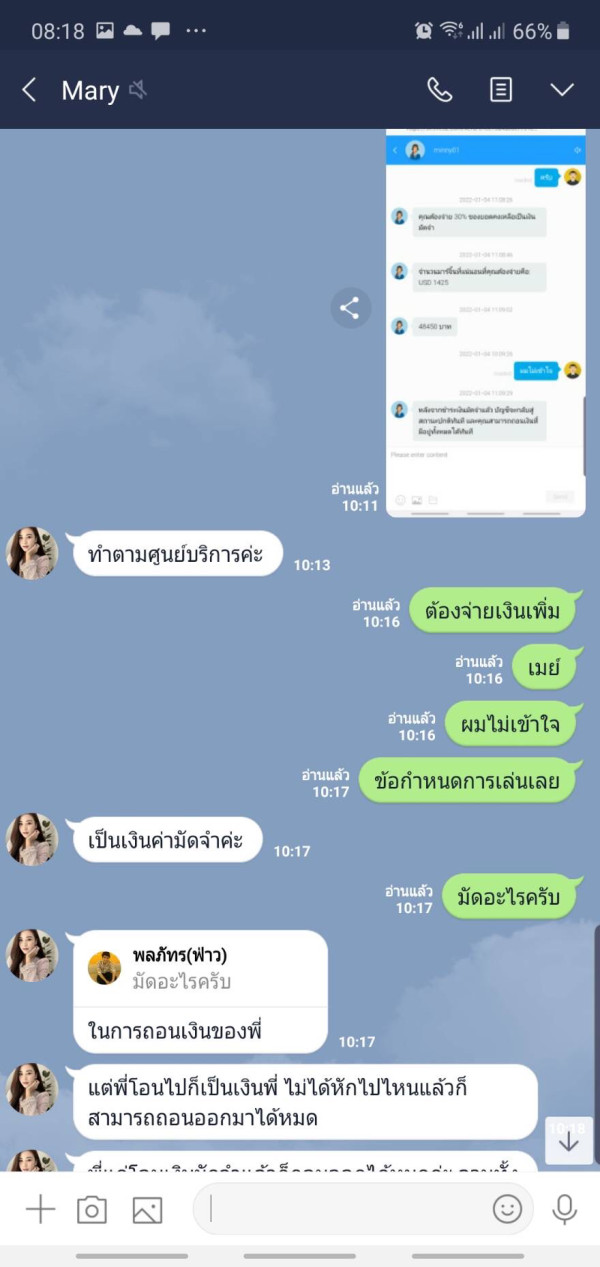

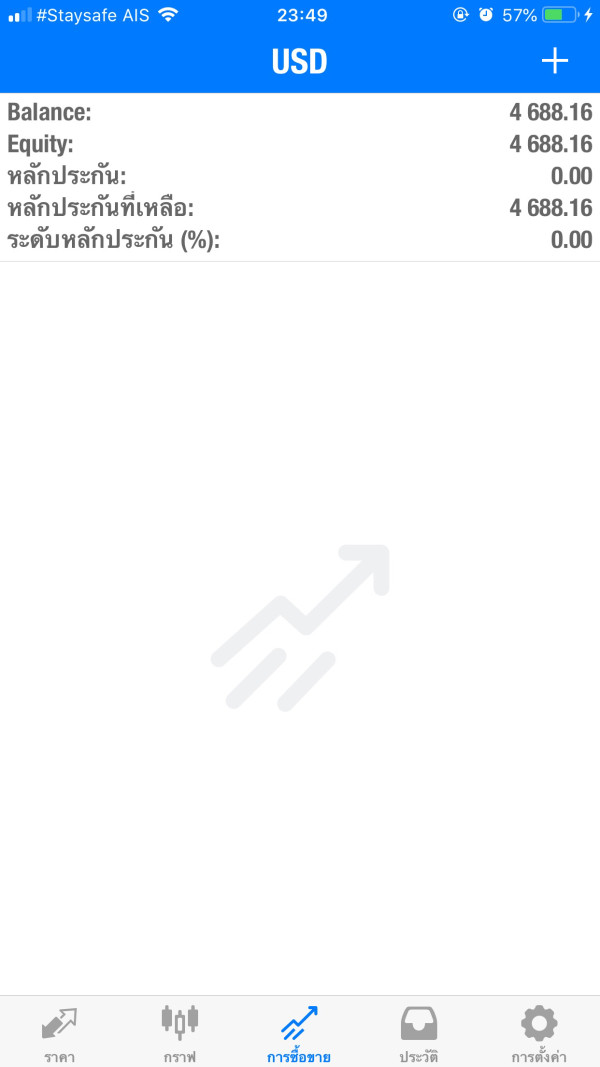

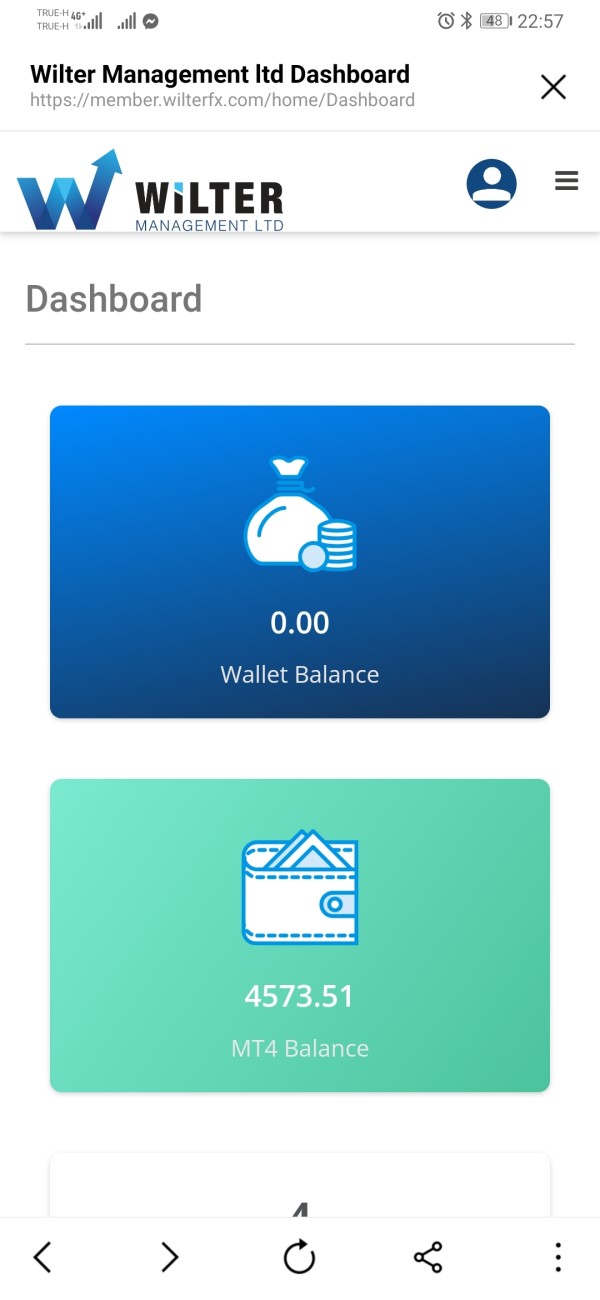

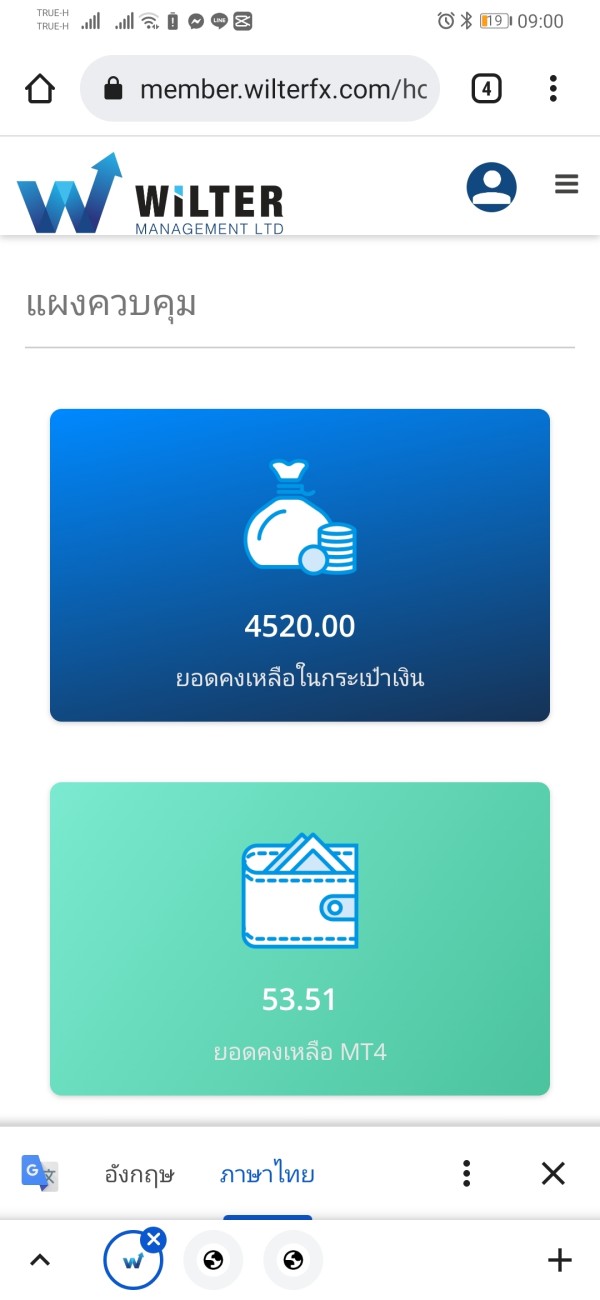

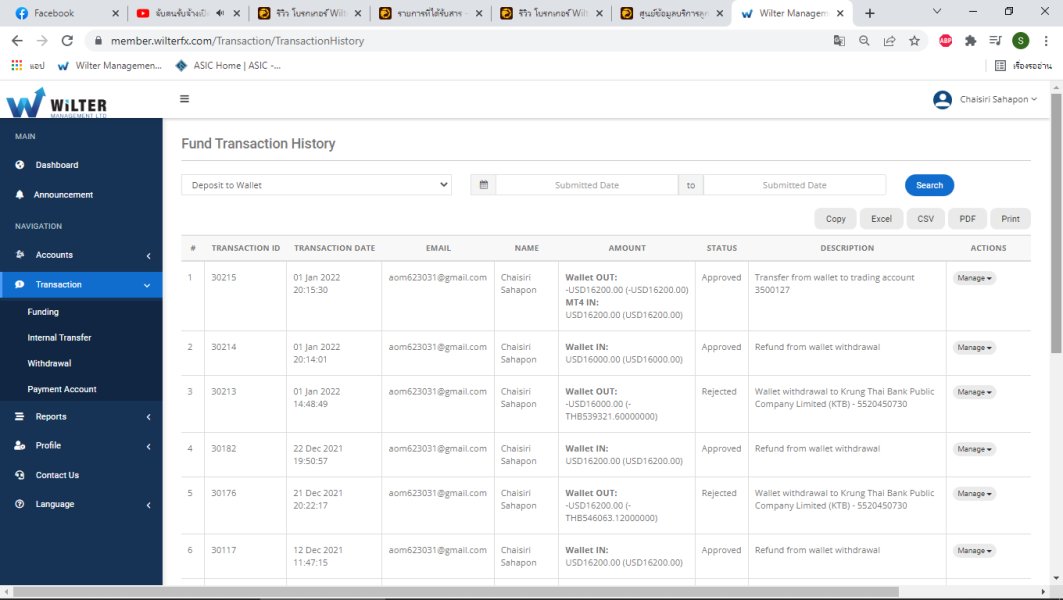

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available materials. The absence of clear payment method information represents a significant gap for potential clients evaluating the broker's accessibility and convenience.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with Wilter Management is not specified in available documentation. This makes it difficult for prospective traders to assess the financial commitment needed to begin trading.

Promotional Offers: The broker's primary promotional feature appears to be their cash rebate service. This service provides traders with cash-back opportunities on their trading activities. However, specific terms, conditions, and rebate percentages are not detailed in accessible information.

Trading Assets: Wilter Management focuses on forex trading. The complete range of available currency pairs and any additional asset classes remain unspecified in current documentation. The broker has not provided comprehensive information about exotic pairs, major currencies, or other financial instruments.

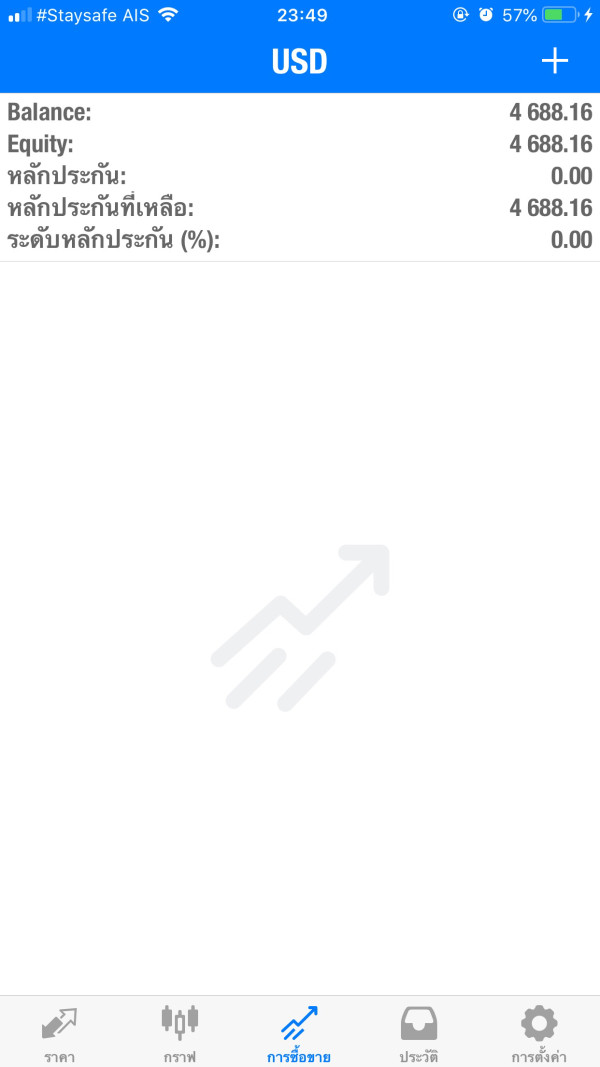

Cost Structure: Details regarding spreads, commissions, overnight fees, and other trading costs are not available in current information sources. This lack of pricing transparency makes it challenging for traders to evaluate the competitiveness of the broker's fee structure.

Leverage Options: Information about maximum leverage ratios, margin requirements, and leverage policies is not provided in available materials. This represents another significant information gap for potential clients.

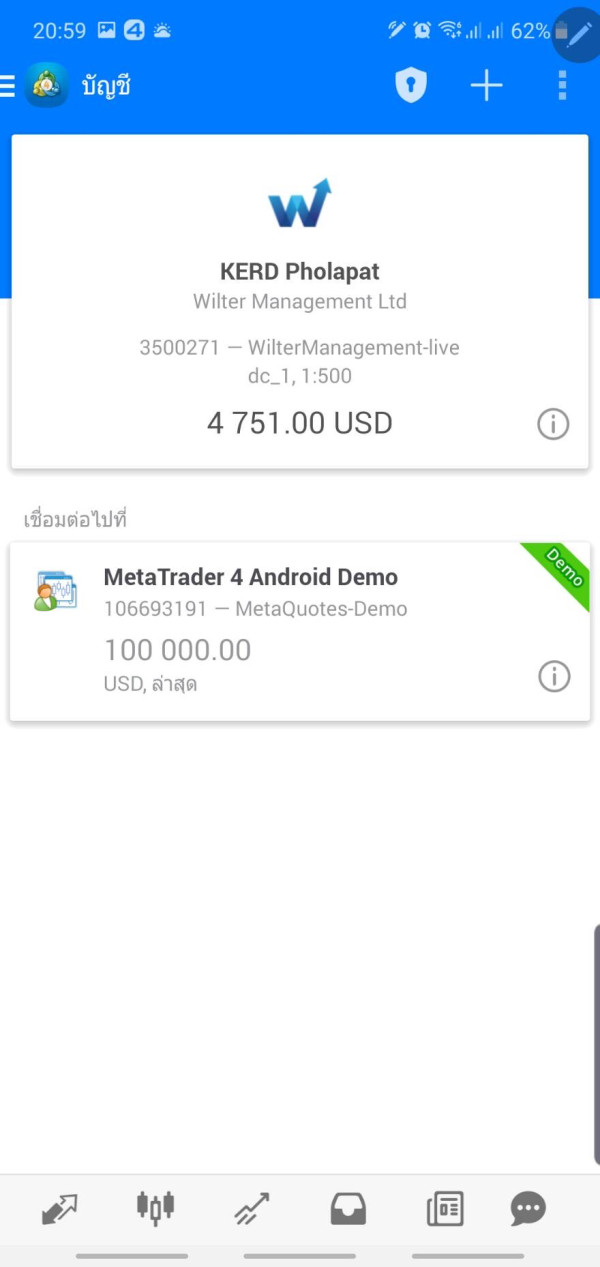

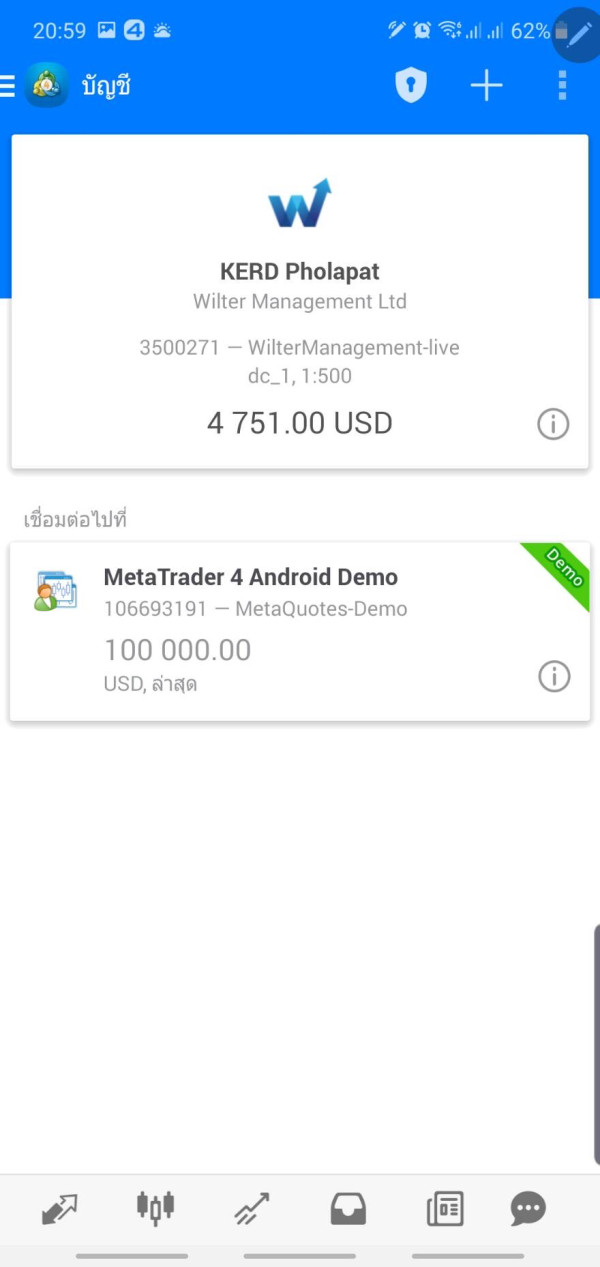

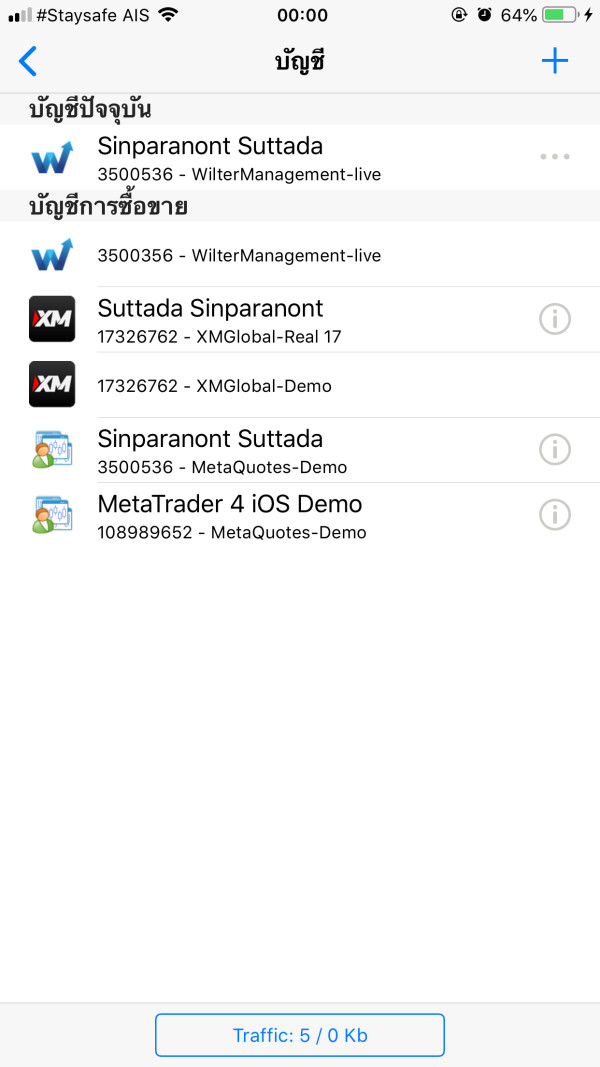

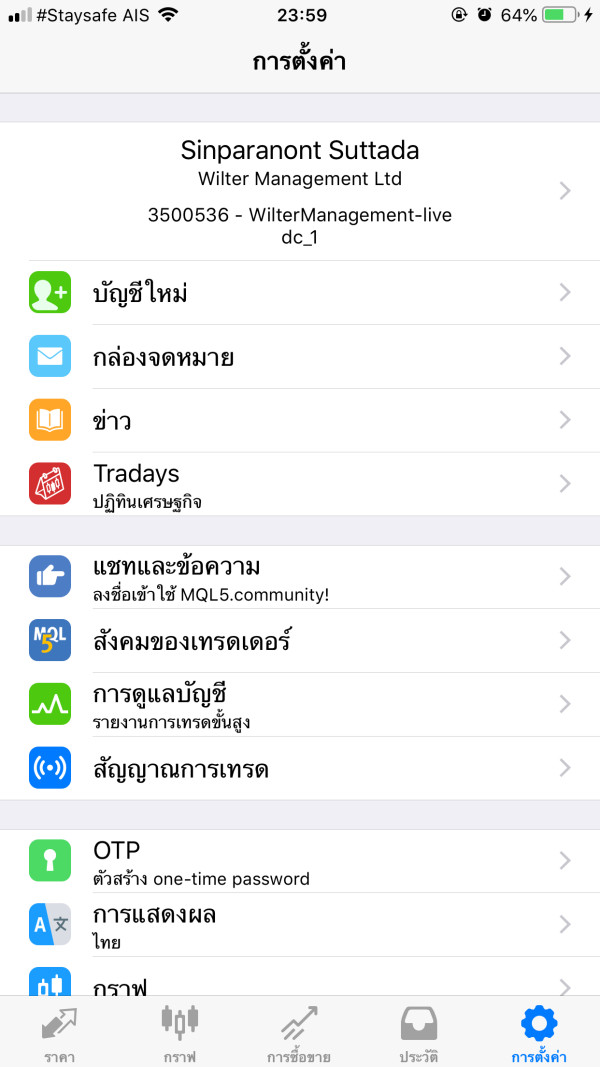

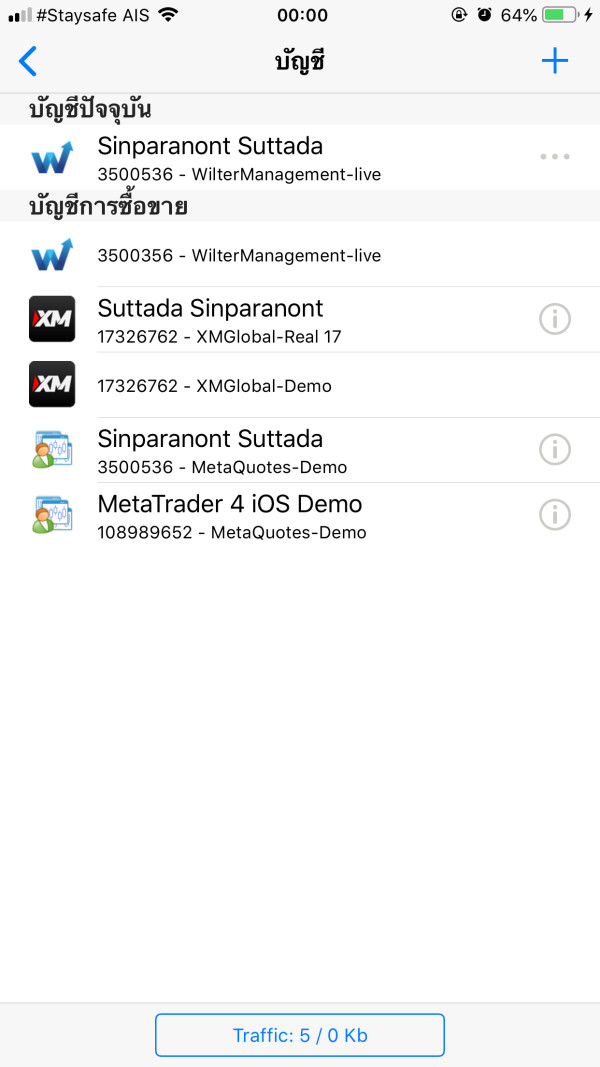

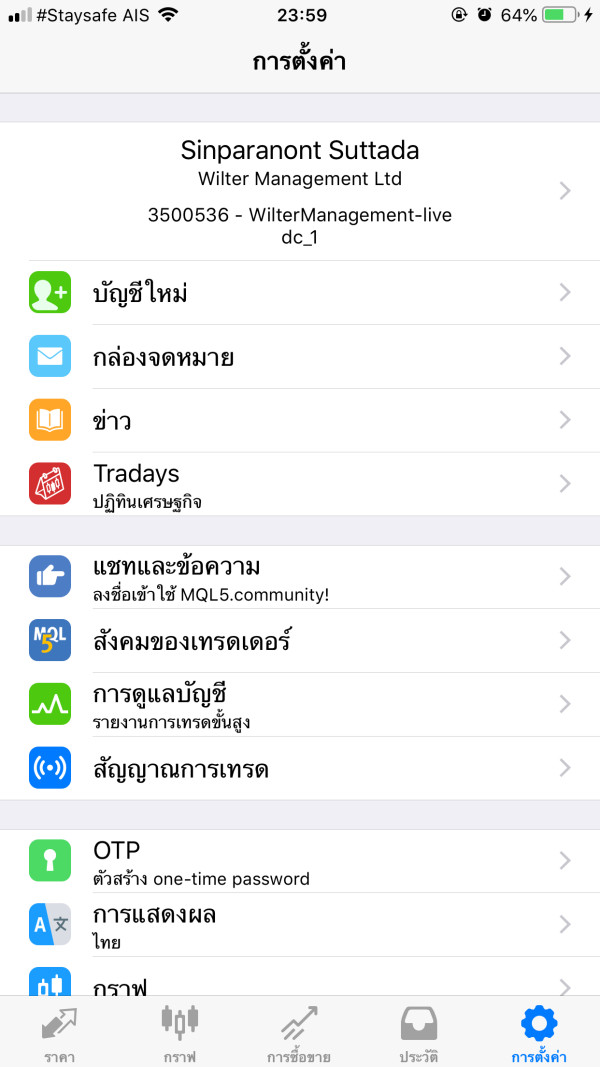

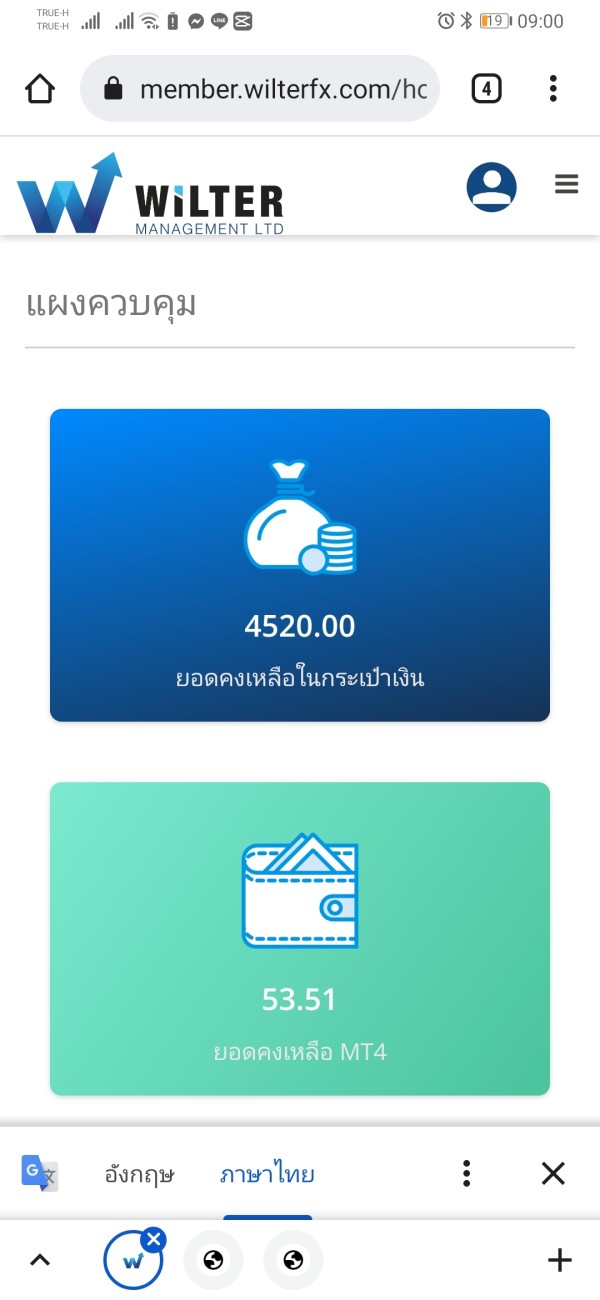

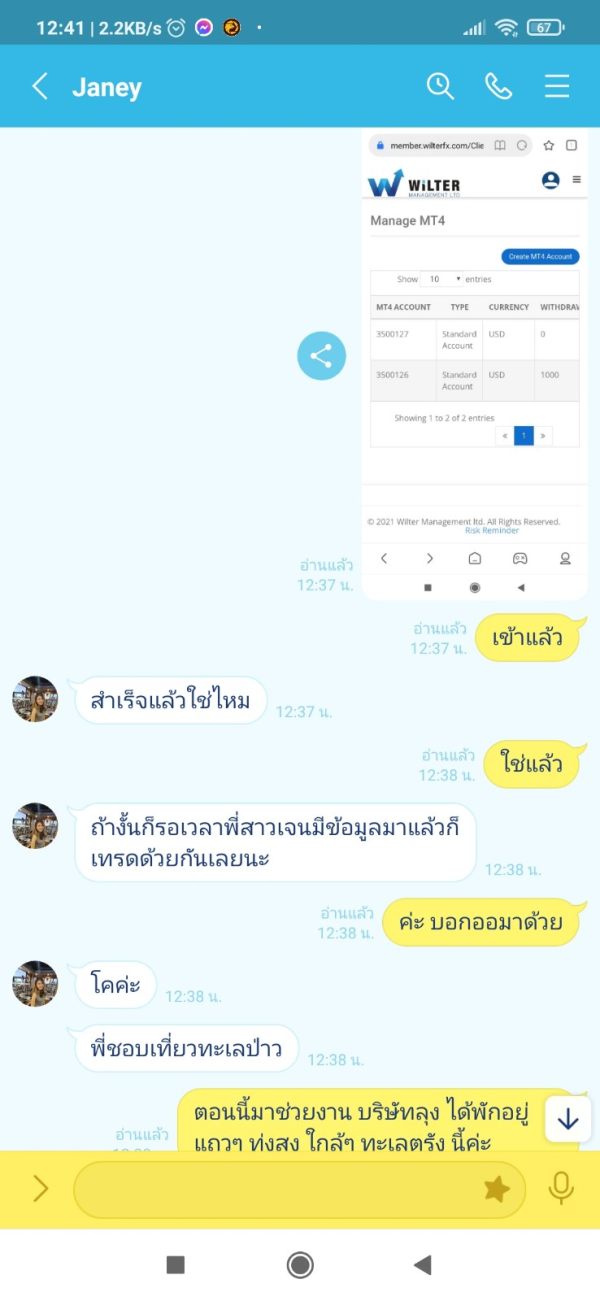

Trading Platforms: The specific trading platforms offered by Wilter Management are not detailed in current documentation. Whether the broker provides MetaTrader 4, MetaTrader 5, proprietary platforms, or web-based solutions remains unclear.

This Wilter review highlights the substantial information gaps that potential clients would encounter when evaluating the broker's services. It emphasizes the need for direct contact with the company to obtain essential trading details.

Rating Analysis

Account Conditions Analysis

The account conditions offered by Wilter Management receive a low rating. This is due to the significant lack of available information about account types, features, and requirements. In this Wilter review, we find that essential details such as account tier structures, minimum deposit requirements, and special account features are not disclosed in accessible documentation. This absence of transparency makes it extremely difficult for potential traders to understand what they can expect when opening an account.

Traditional forex brokers typically offer multiple account types with varying features, minimum deposits, and trading conditions. However, Wilter Management has not provided clear information about whether they offer standard, premium, or VIP account tiers. The lack of details about Islamic accounts, demo account availability, or special features for different trader segments further compounds the information deficit.

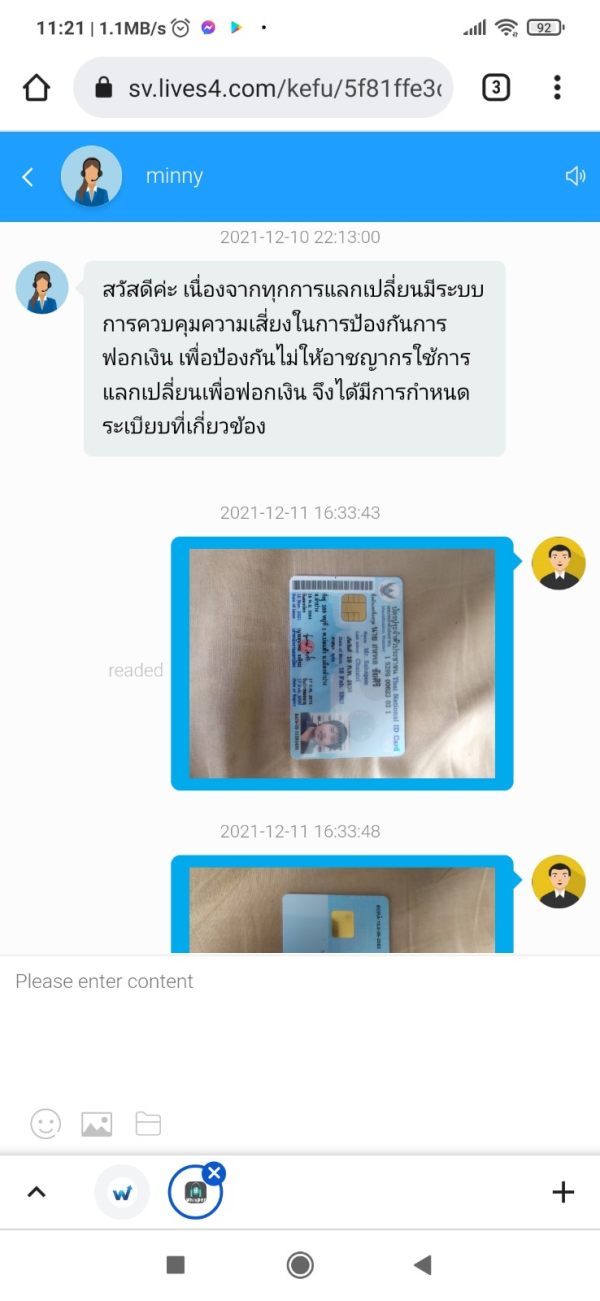

The account opening process, verification requirements, and timeline for account activation are also not specified in available materials. Without clear information about documentation requirements, identity verification procedures, or account approval timeframes, prospective clients cannot adequately prepare for the registration process or set realistic expectations for account setup.

Wilter Management's tools and resources receive a minimal rating. This is due to the complete absence of information about trading tools, analytical resources, or educational materials. Most established forex brokers provide comprehensive suites of trading tools including technical indicators, charting software, economic calendars, and market analysis resources. However, this broker has not disclosed any specific tools or resources available to their clients.

The lack of information about research capabilities, market analysis, daily reports, or expert commentary suggests either a limited offering in this area or poor communication of available resources. Educational resources, which are crucial for trader development, are not mentioned in available documentation. This includes the absence of information about webinars, tutorials, trading guides, or other learning materials that help traders improve their skills.

Automated trading support, which has become increasingly important in modern forex trading, is not addressed in available information. Whether the broker supports Expert Advisors, algorithmic trading, or copy trading services remains unknown. This information gap significantly impacts the broker's appeal to traders who rely on automated strategies or social trading features.

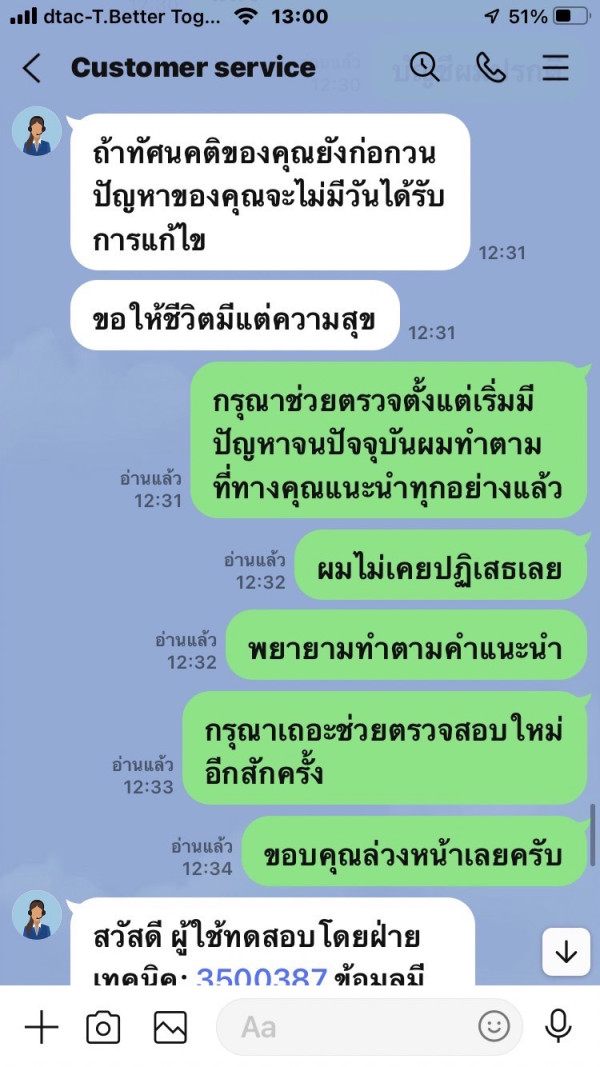

Customer Service and Support Analysis

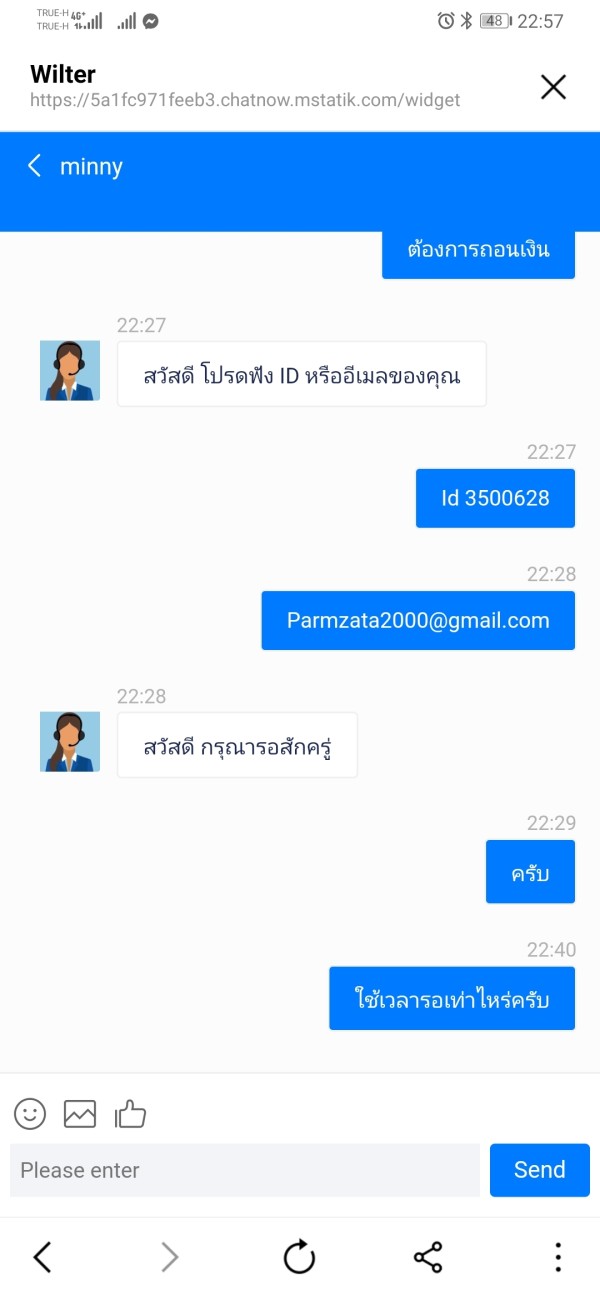

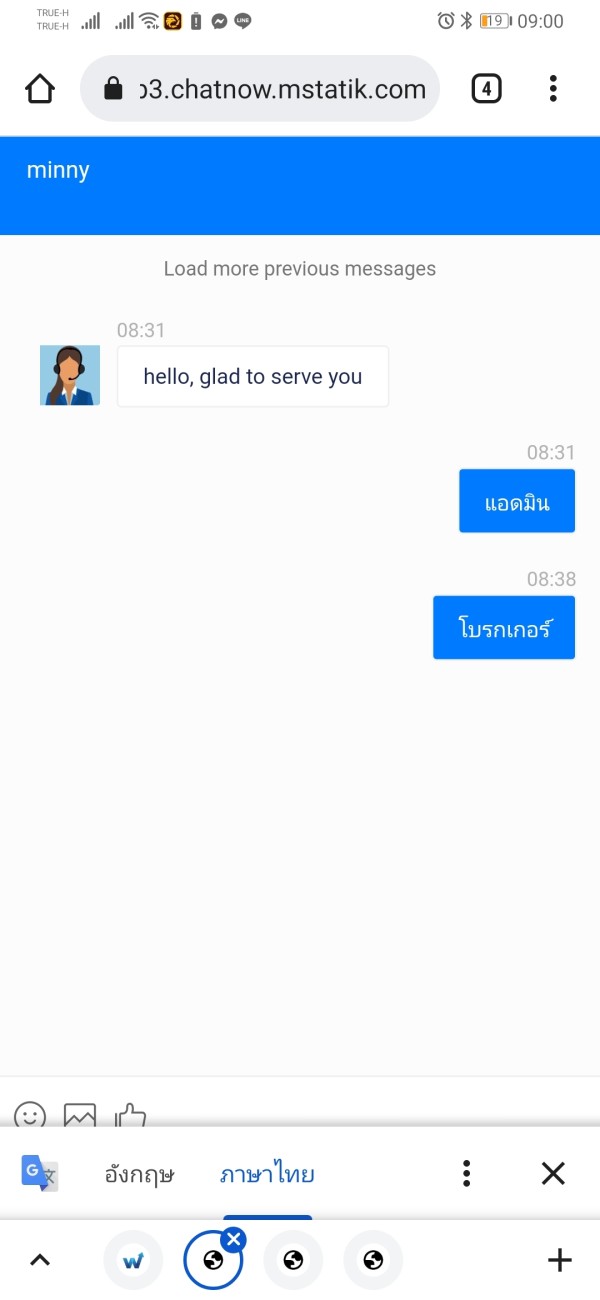

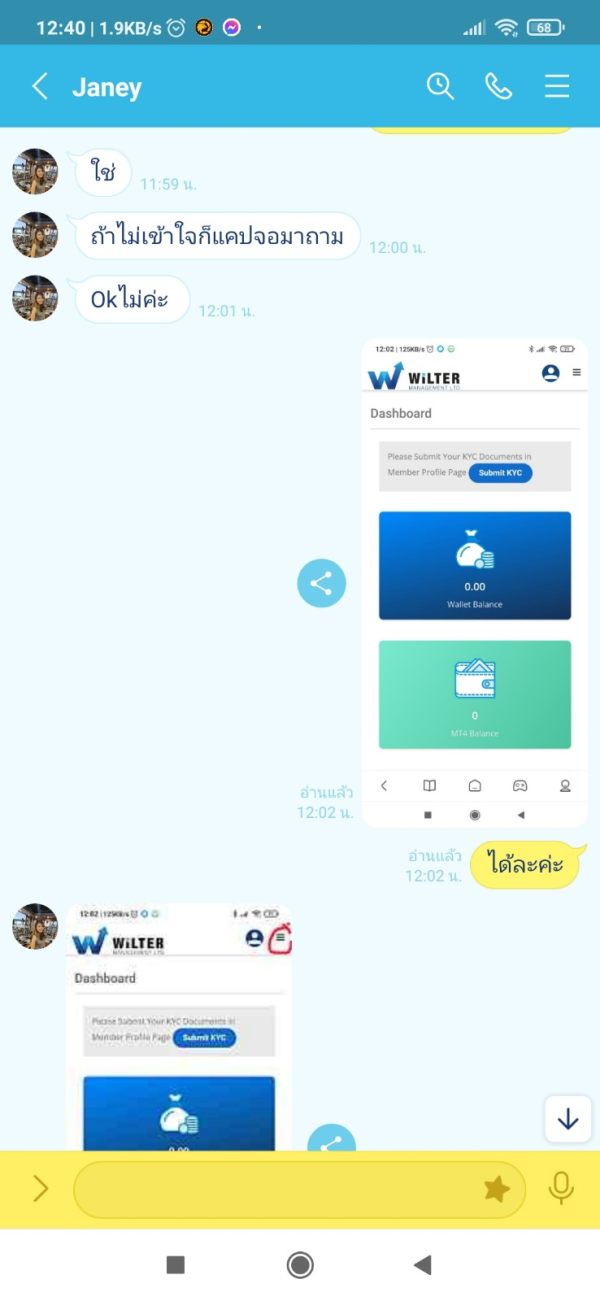

The customer service evaluation for Wilter Management is severely limited. This limitation comes from the lack of available information about support channels, response times, and service quality. Professional forex brokers typically provide multiple contact methods including live chat, phone support, email assistance, and comprehensive FAQ sections. However, specific details about Wilter Management's customer support infrastructure are not provided in accessible materials.

Response time expectations, which are crucial for traders who may need urgent assistance during market hours, are not specified. The availability of 24/7 support, which is standard for many forex brokers due to the global nature of currency markets, cannot be confirmed based on available information. Additionally, the quality and expertise level of support staff remain unknown.

Multilingual support capabilities, which are important for brokers serving international clients, are not detailed beyond a basic indication of English language support. The absence of information about support in other major languages may limit the broker's accessibility to non-English speaking traders. Without user testimonials or service quality reviews, it's impossible to assess the actual effectiveness of their customer support operations.

Trading Experience Analysis

The trading experience with Wilter Management cannot be adequately assessed. This is due to insufficient information about platform performance, execution quality, and overall trading environment. This Wilter review finds that critical aspects of the trading experience, including platform stability, order execution speed, and system reliability, are not documented in available materials.

Platform functionality, which directly impacts trader success, remains largely unknown. Whether the broker provides advanced charting capabilities, one-click trading, mobile trading apps, or other essential trading features cannot be determined from current information. The absence of details about platform customization options, interface design, and user-friendly features further limits the ability to evaluate the trading experience.

Order execution quality, including information about slippage rates, requote frequency, and execution speed during volatile market conditions, is not provided. These factors are crucial for traders, particularly those employing scalping strategies or trading during high-impact news events. Without this information, traders cannot assess whether the broker's execution capabilities align with their trading style and requirements.

Trust Factor Analysis

The trust factor rating for Wilter Management is significantly impacted by the broker's unregulated status and limited transparency. Operating without oversight from recognized financial regulatory authorities raises substantial concerns about investor protection, fund security, and operational standards. Regulated brokers typically must adhere to strict capital requirements, maintain segregated client accounts, and follow established dispute resolution procedures.

The absence of regulatory oversight means that traders have limited recourse in case of disputes. They may not benefit from compensation schemes that are typically available with regulated brokers. Additionally, the lack of detailed information about fund protection measures, such as segregated accounts or insurance coverage, further diminishes the trust factor score.

Company transparency, which includes clear communication about business operations, financial stability, and corporate governance, appears limited based on available information. The absence of detailed company information, executive profiles, or corporate financial disclosures contributes to uncertainty about the broker's stability and long-term viability. Without third-party audits or independent verification of business practices, potential clients must rely on limited available information when assessing the broker's trustworthiness.

User Experience Analysis

The user experience evaluation for Wilter Management is constrained by the lack of user feedback and detailed information about interface design and operational processes. User satisfaction typically depends on factors such as ease of account opening, platform usability, customer service responsiveness, and overall service quality. However, comprehensive user reviews and testimonials are not available in current documentation.

Interface design and platform usability cannot be assessed without access to detailed platform information or user interface demonstrations. The registration and verification process, which forms the first impression for new clients, is not described in available materials. This includes uncertainty about the complexity of the signup process, document requirements, and verification timeframes.

Fund management experiences, including deposit and withdrawal processes, processing times, and fee structures, are not documented in available information. These operational aspects significantly impact user satisfaction and overall experience with the broker. Without user feedback about common issues, service quality, or areas for improvement, it's impossible to provide a comprehensive assessment of the user experience.

Conclusion

This Wilter review reveals a forex broker with a decade-long operational history but significant transparency limitations that impact its overall evaluation. While Wilter Management offers cash rebate services that may appeal to cost-conscious traders, the lack of regulatory oversight and comprehensive service information raises important considerations for potential clients.

The broker appears most suitable for traders who prioritize rebate opportunities and are comfortable operating with unregulated service providers. However, the substantial information gaps regarding trading conditions, platform capabilities, and user experiences suggest that prospective clients would need to conduct extensive due diligence before engaging with the broker's services.

The primary advantage of Wilter Management lies in its cash rebate program. The main disadvantages include unregulated status, limited transparency, and insufficient publicly available information about essential trading conditions and service quality.