Kwakol Markets Review 13

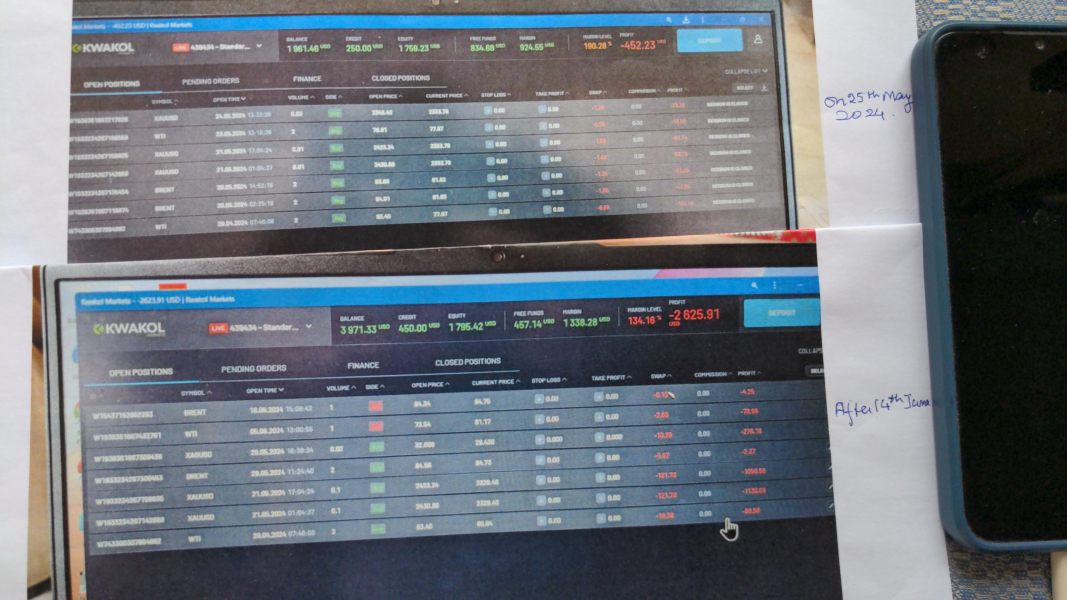

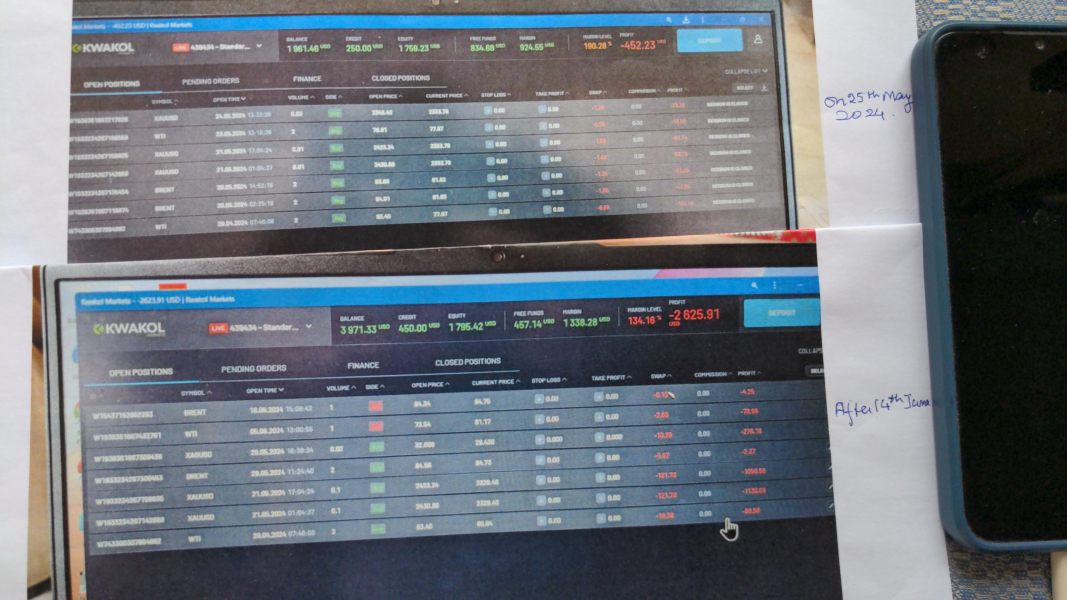

On 21st May XAUUSD with volume 0.01 bought at 2423.24 and 2430.80. On 17 th June the losses were about 218 dollars.But Mr David Miller of Kwakol market increased VOLUME 10 times to 0.10 .LOSS JUMPED TO MORE THAN 2000 DOLLARS.Harassed to freeze my account if $2000 is not deposited. Refusing to change Volume even after showing screen shot .

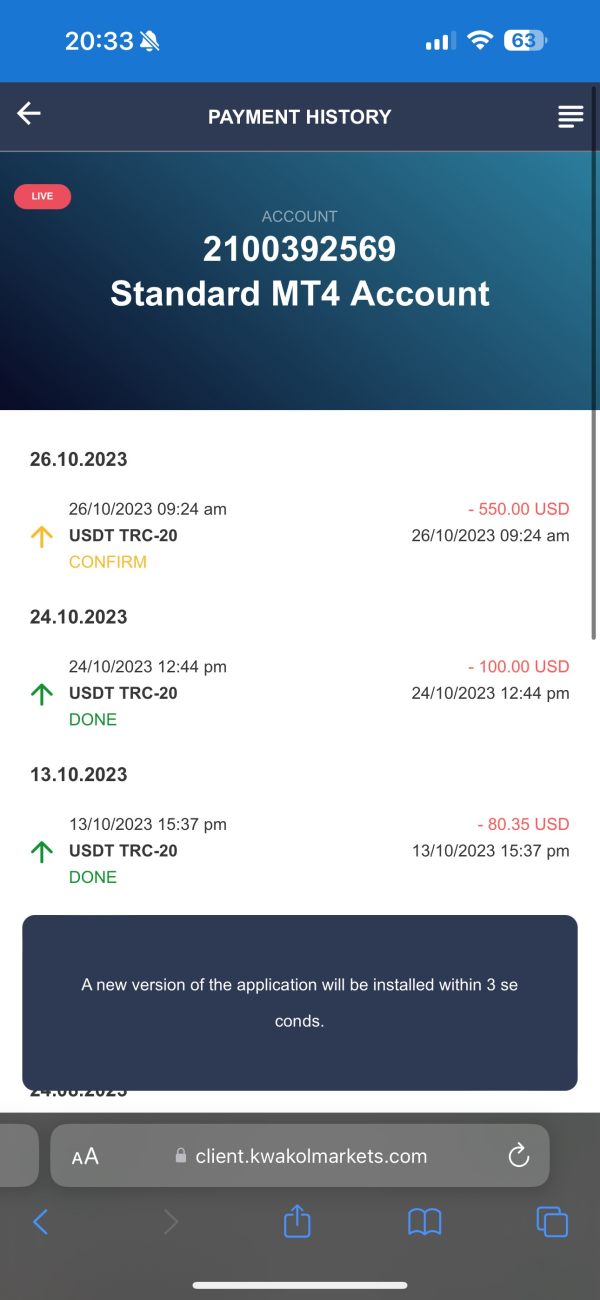

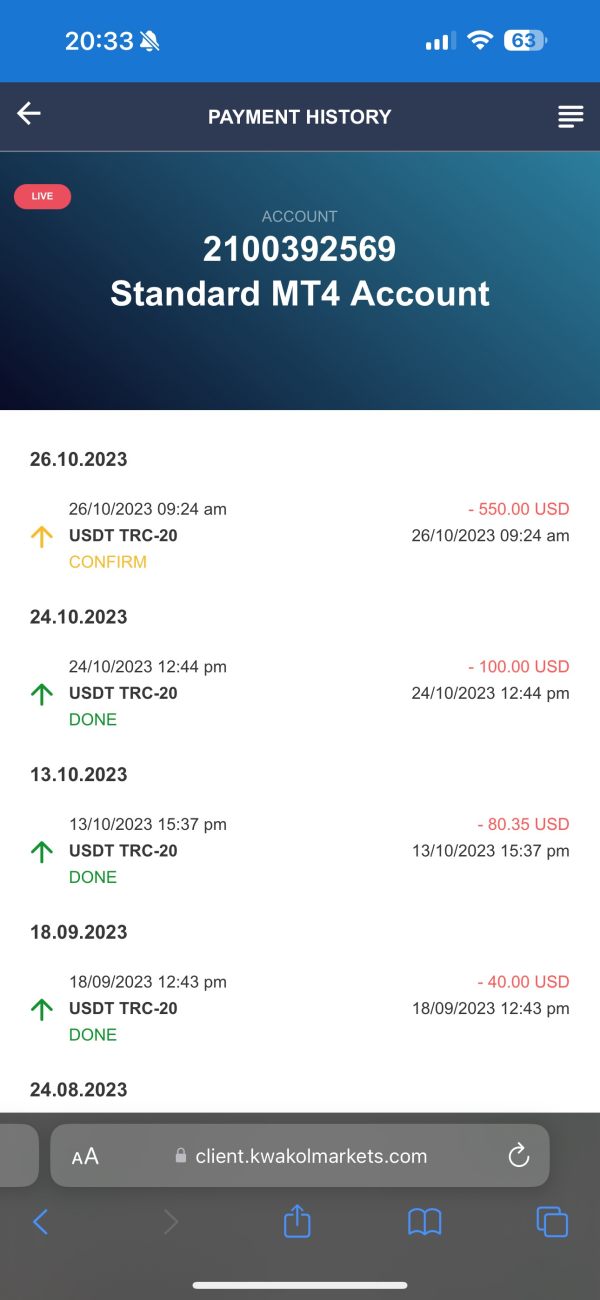

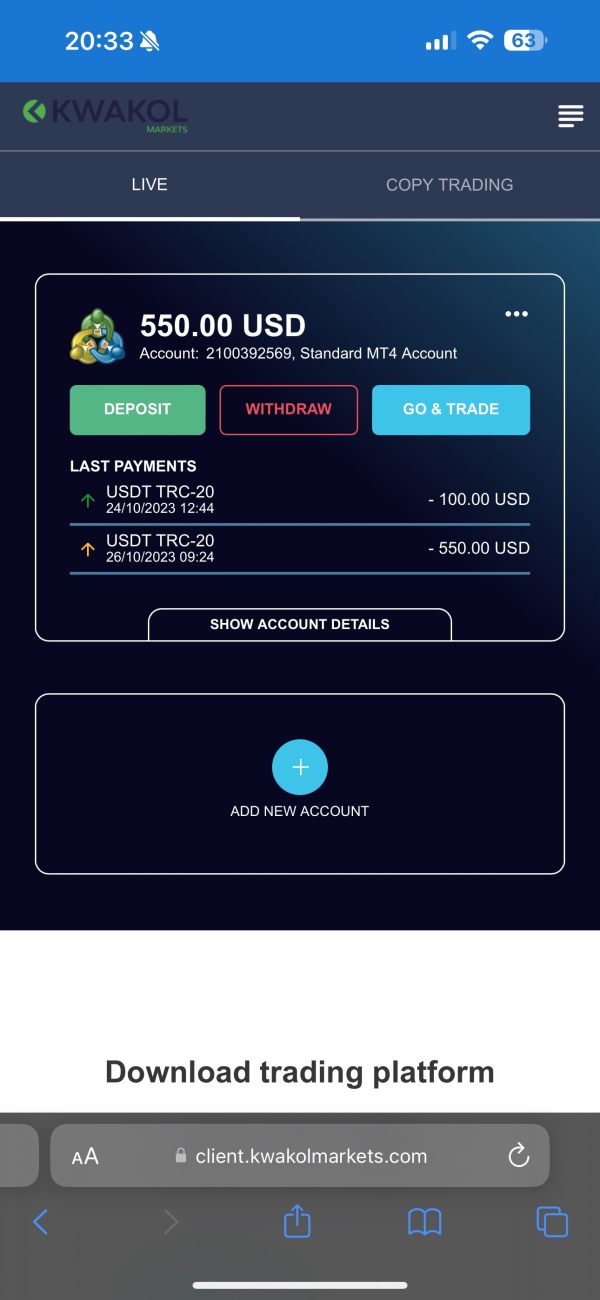

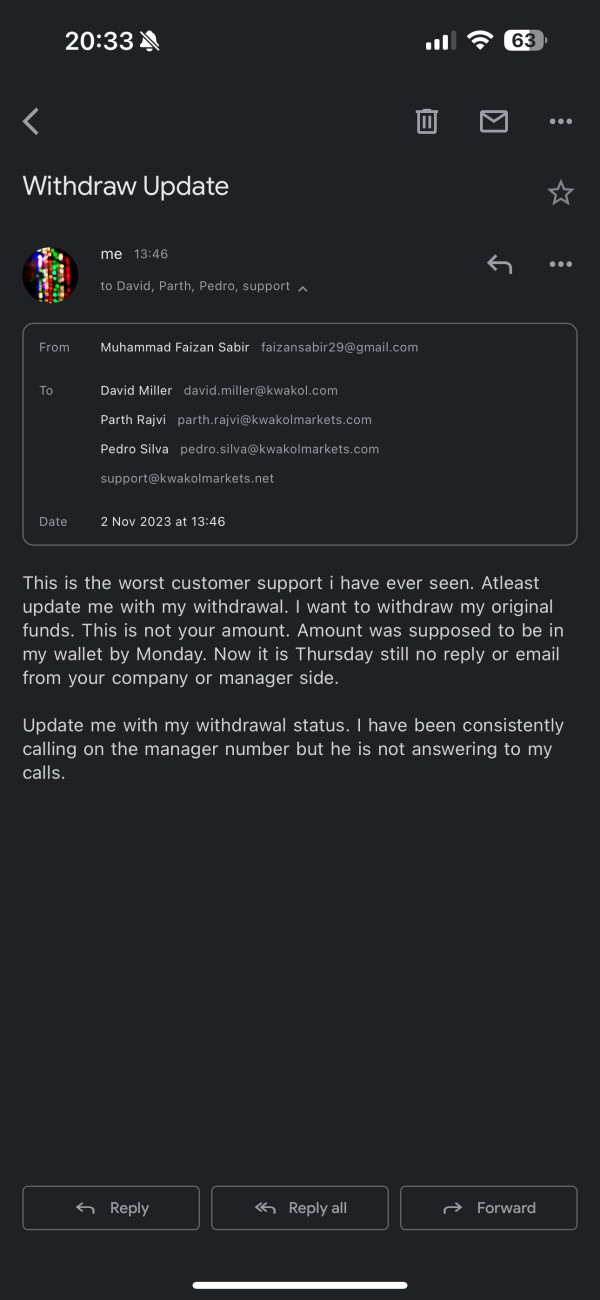

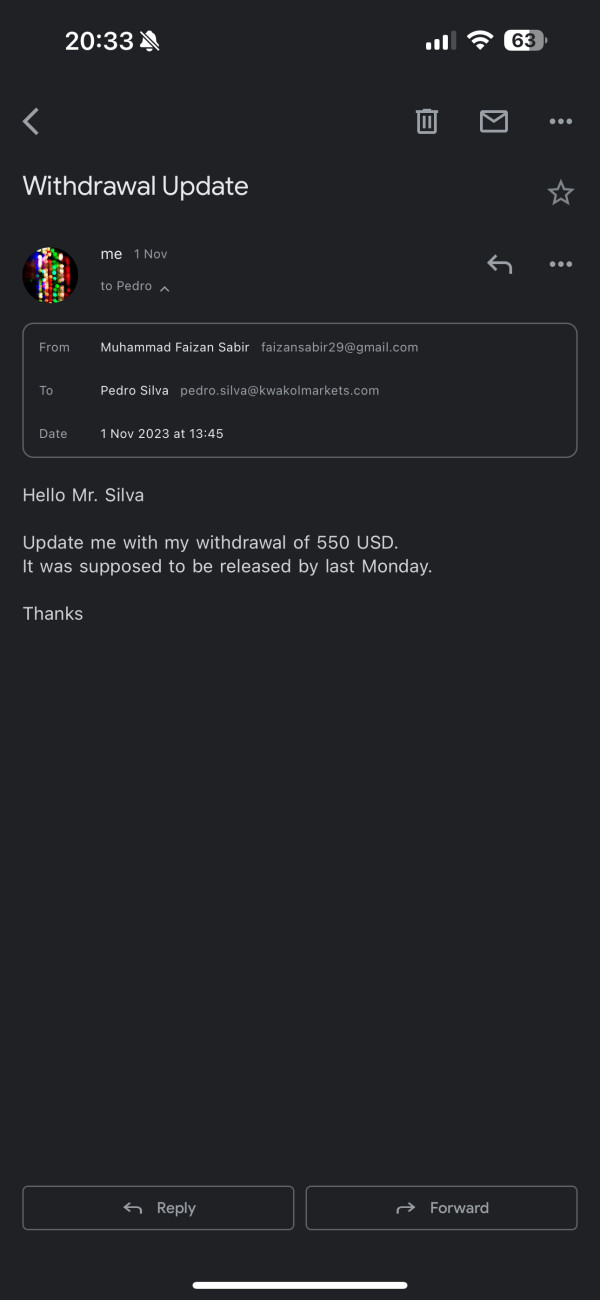

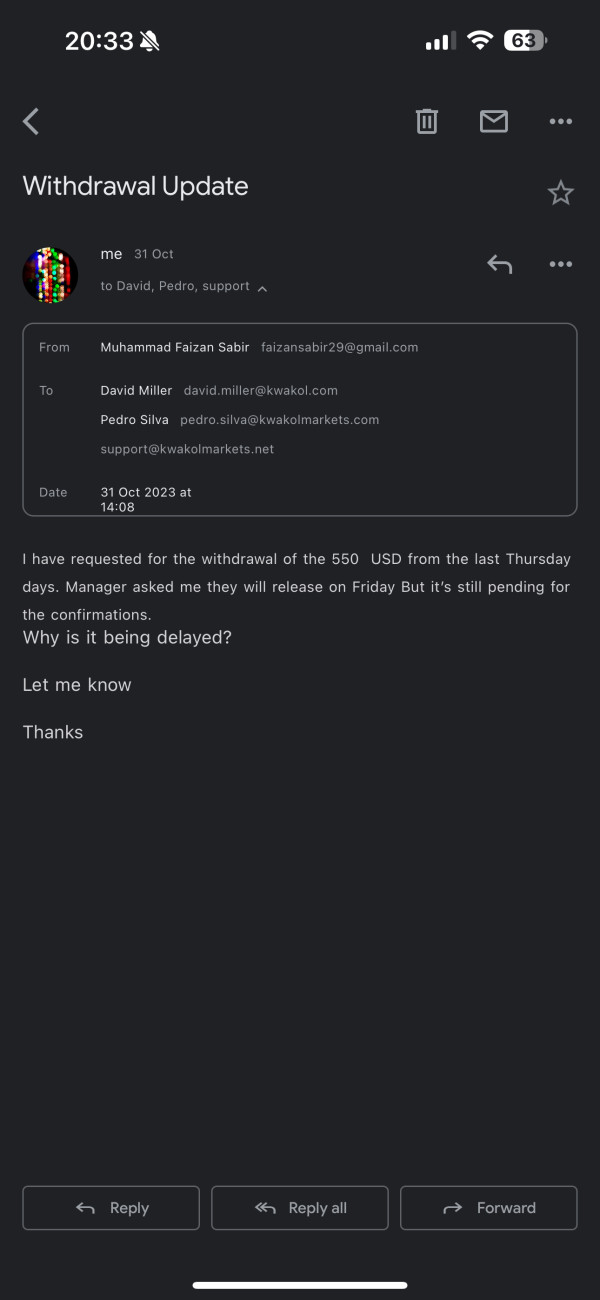

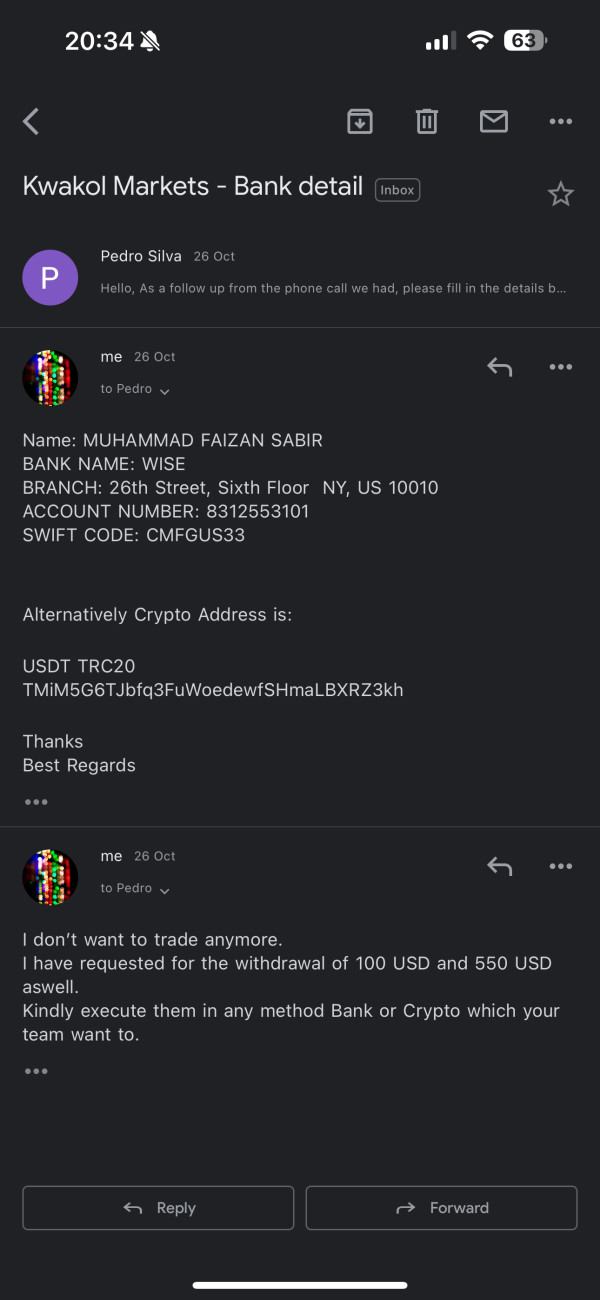

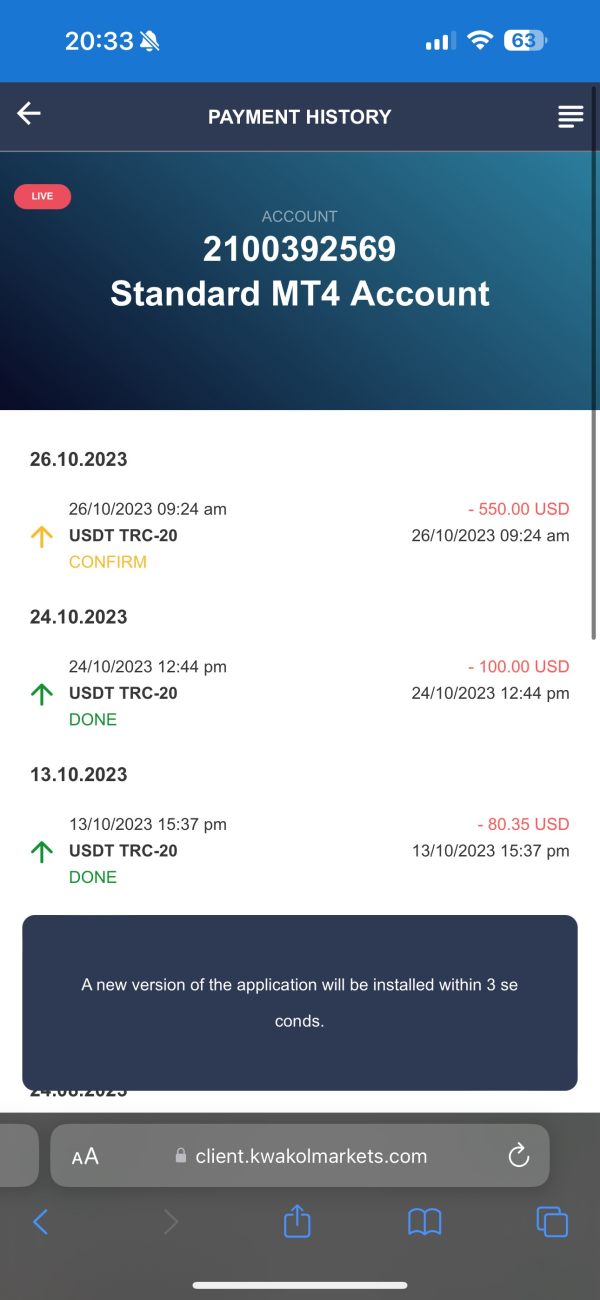

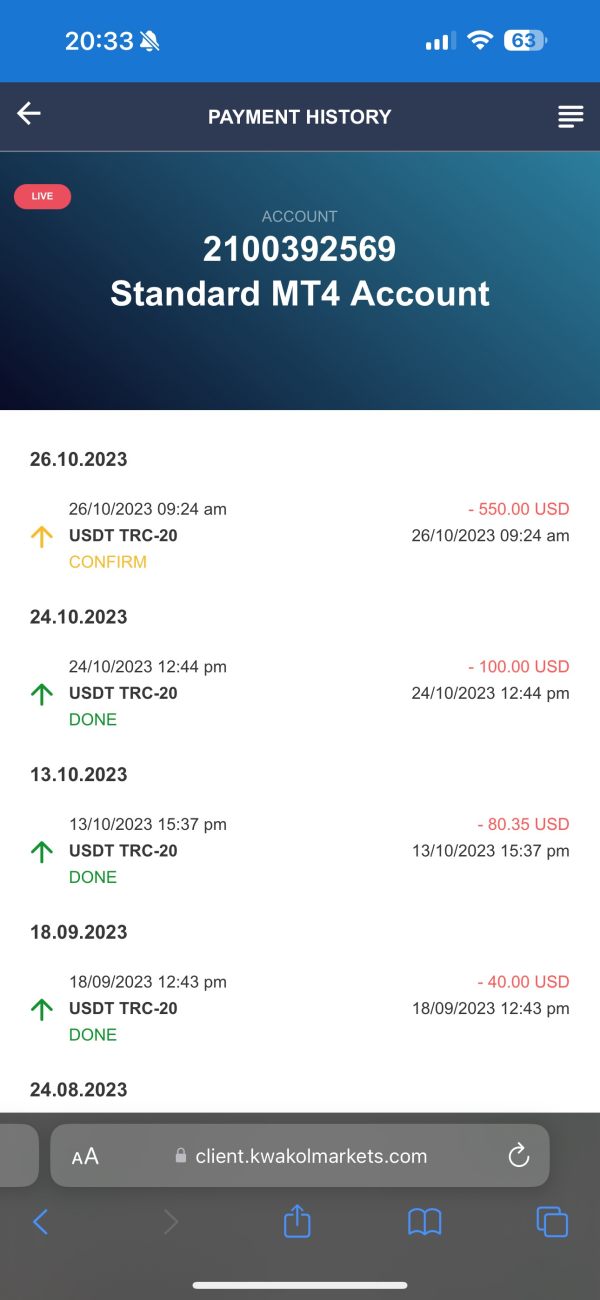

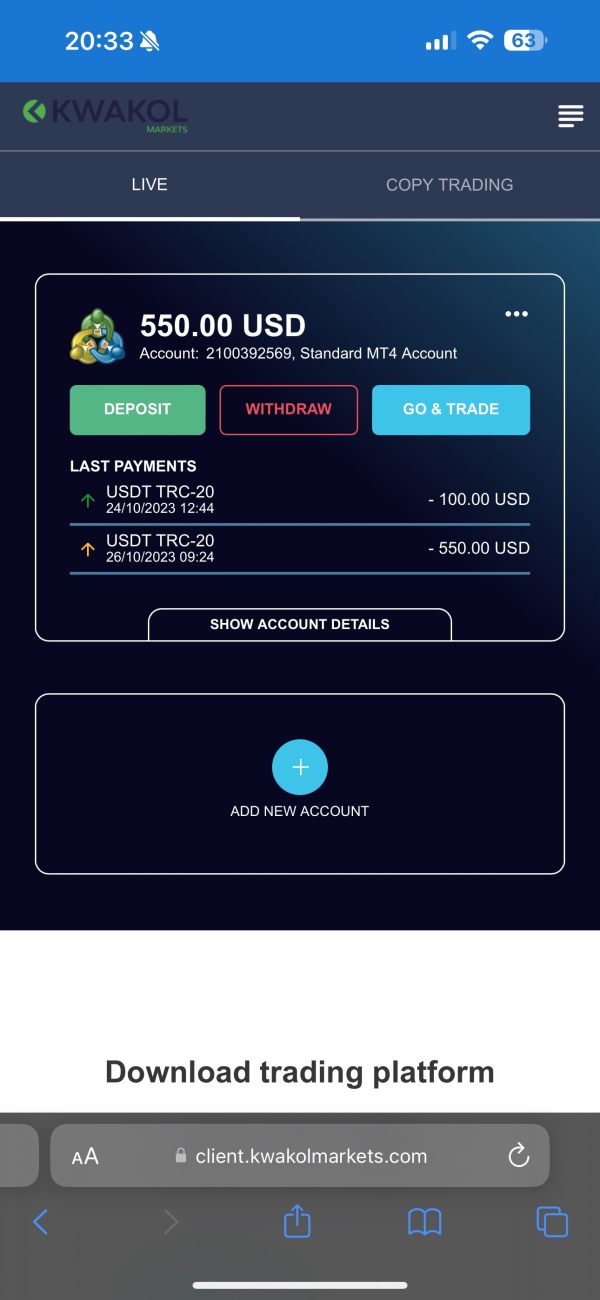

Very bad experience with this company. Trust me all the positive reviews here are fake. I have the my original my own deposit balance of 650 USD in my mt4 account. I have not traded in my account. I requested for the withdrawal of 100 USD. Which their account manager Silva released after so many emails. After this horrible experience i want to withdraw my other 550 USD. Its been more than a week. Neither the customer support reply to my email nor the account manager. I have tried on their phone numbers as well. But they are not responding. My amount supposed to be come in my wallet by Monday . But now it’s Thursday 02 November 2023. At least they should reply or update me about my withdrawal. Scammers

This broker i requested a withdrawal a month ago and they don't process it. i can see is on hold without a reason and they don't reply to emails. no live chat. scammers

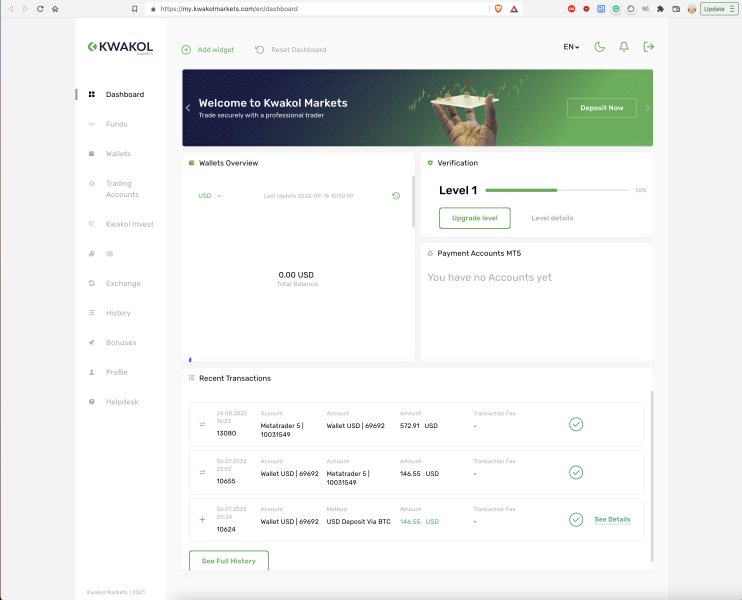

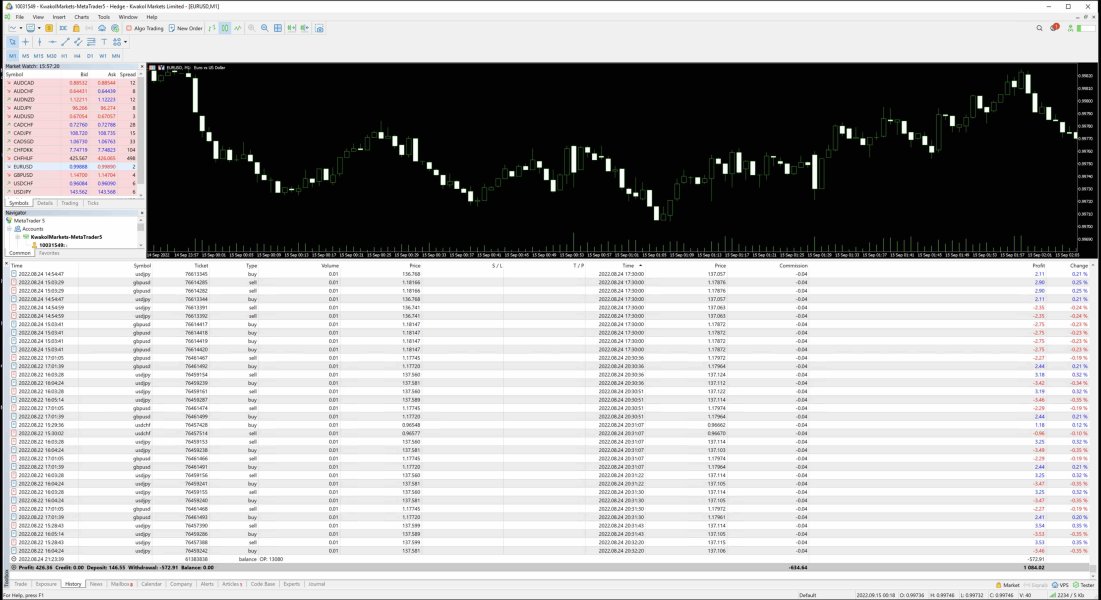

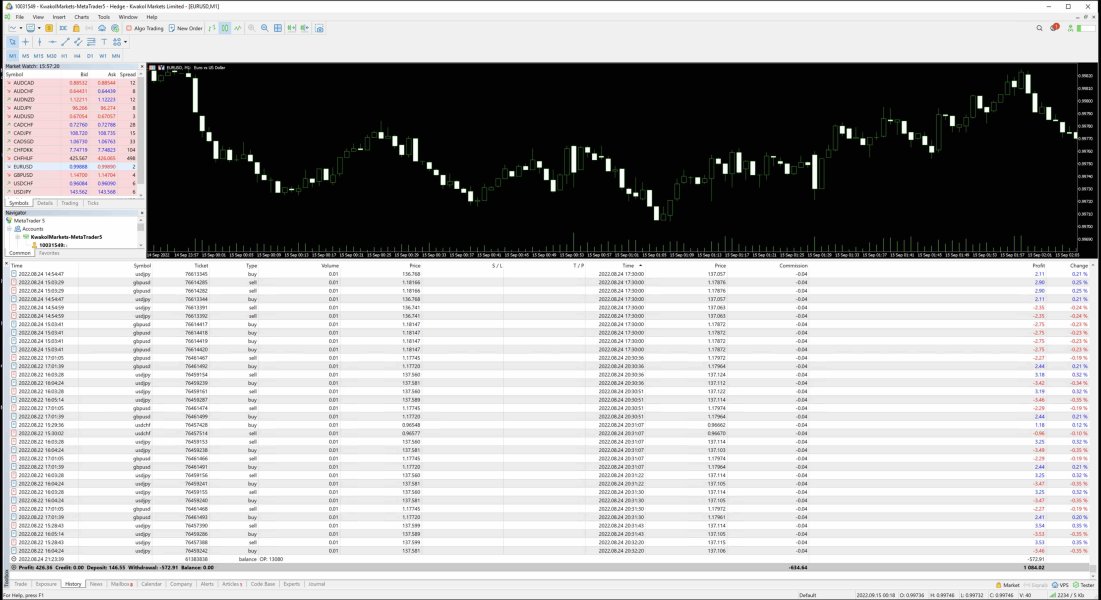

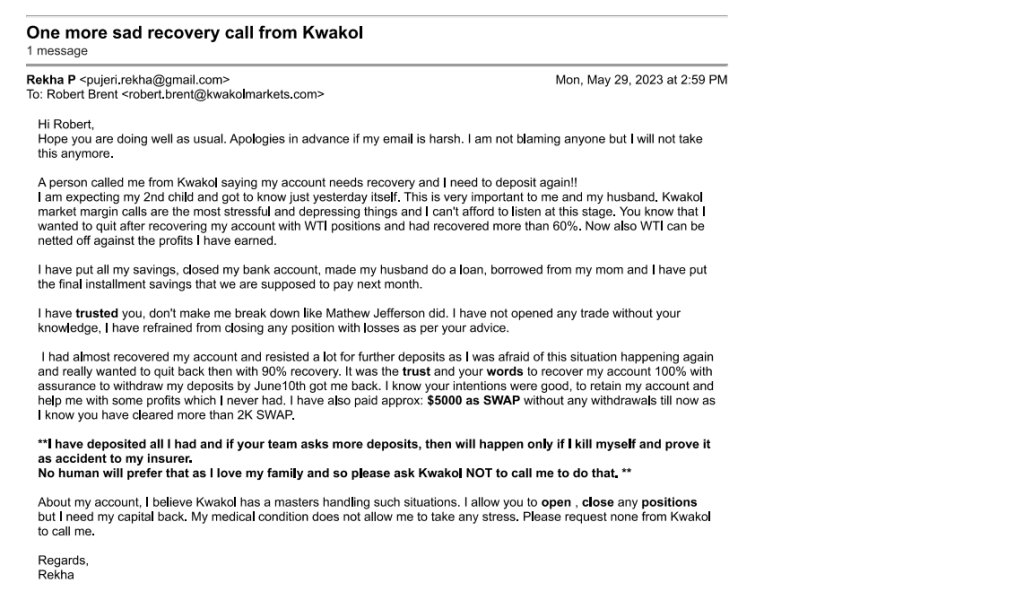

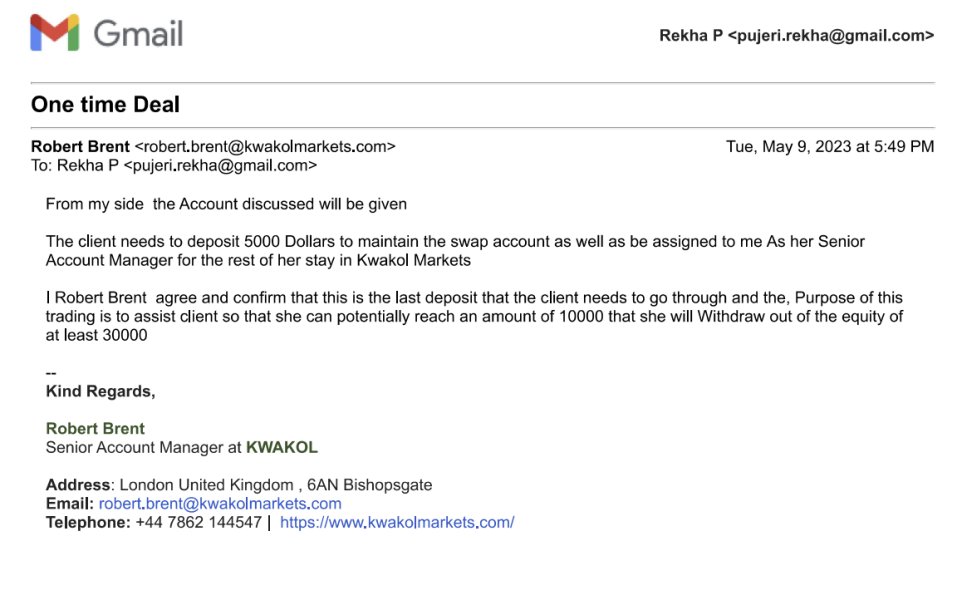

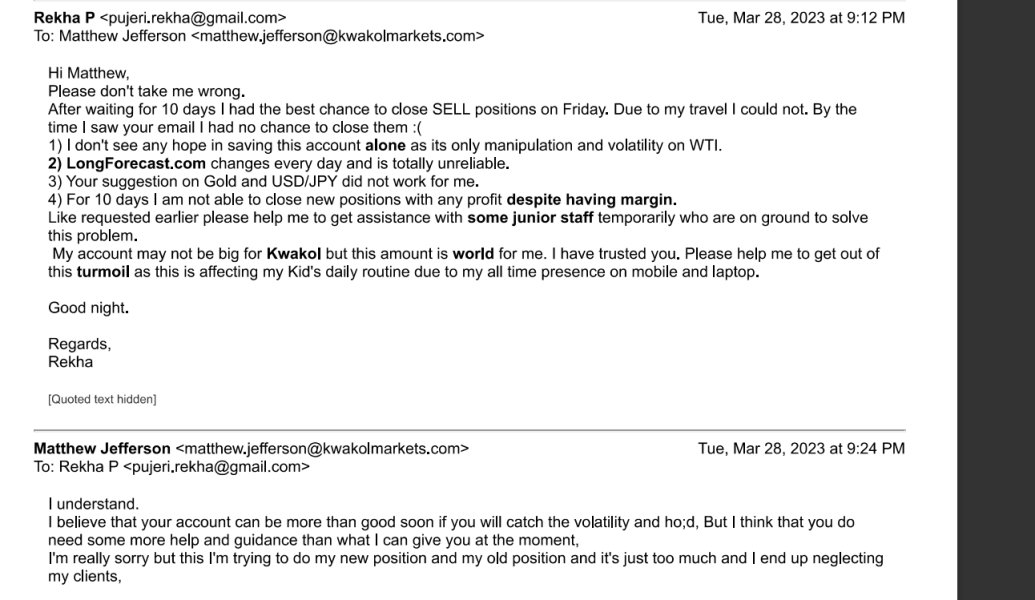

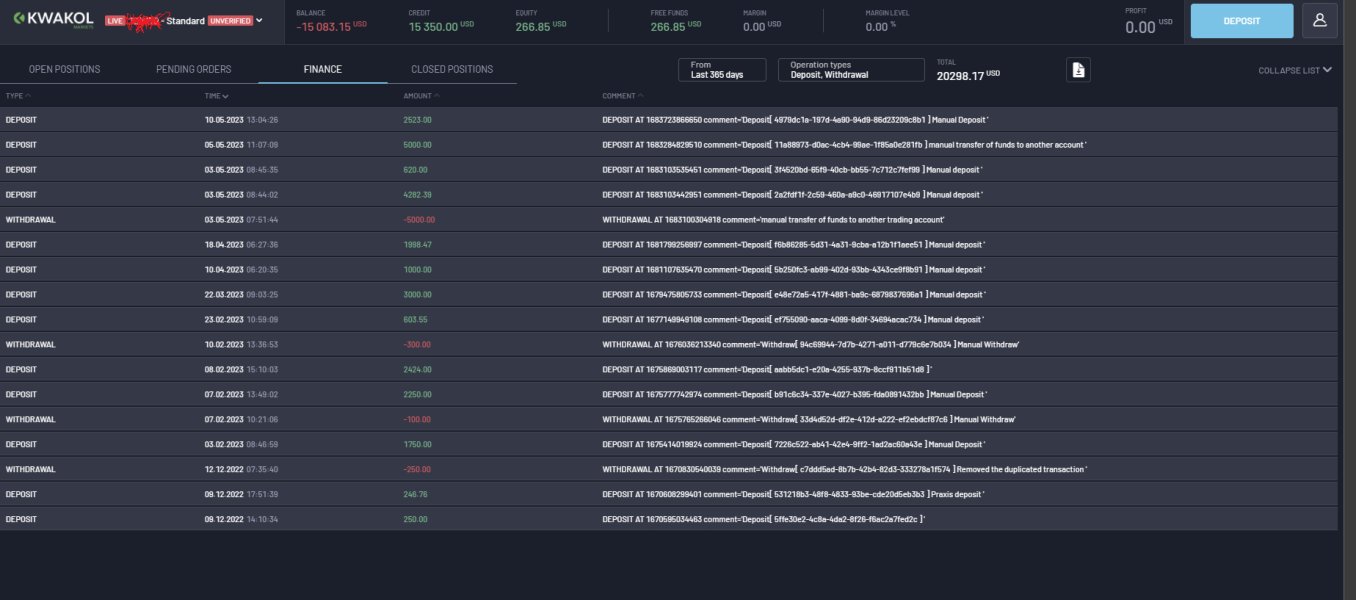

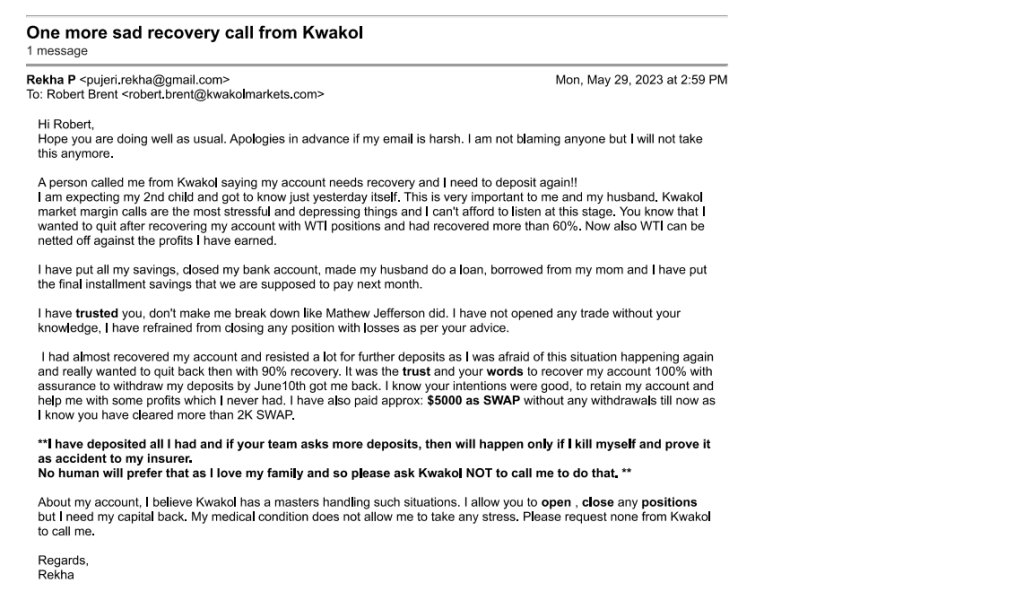

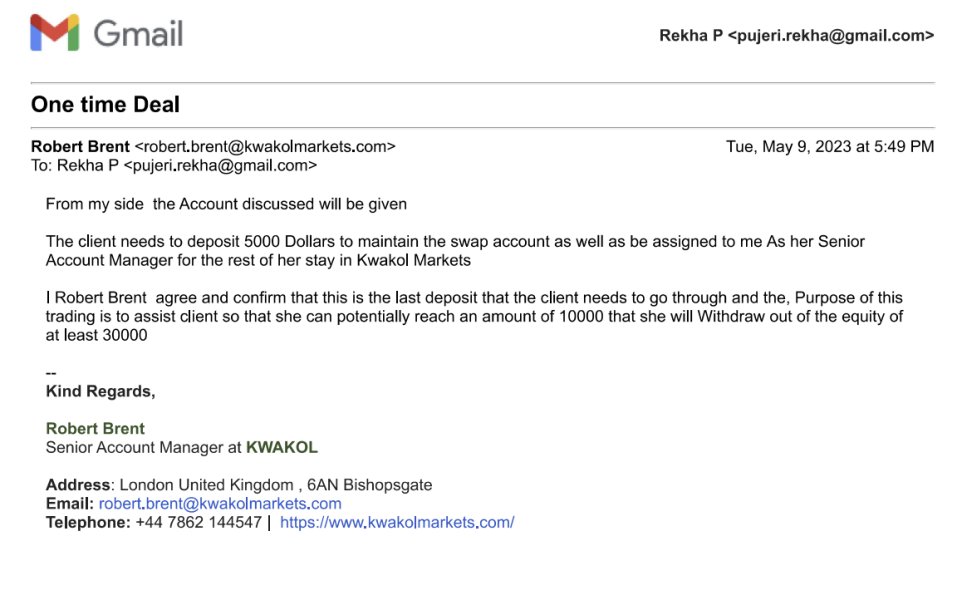

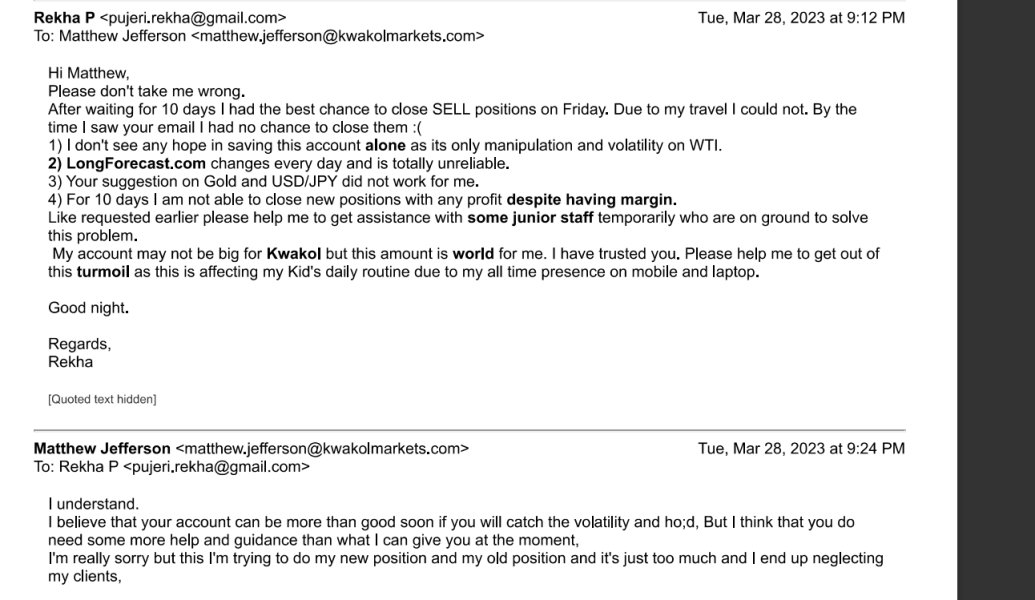

I got some AD on Robotic trading and clicked on link, immediately got call from Kwakol (phillip.williams@kwakolmarkets.com) and person asked me to invest refundable deposit of $250 where robot will do its job of trading will have every day profit as they scheduled and programmed. I was also assigned Finance advisor called Alexandar who said will teach me trading. Few trades they did where my account showed profit of $50+ profit and later there were some trades that were going negative, and they were positions were not stopped. I followed up and there was no response. I left for month due to my exams this happened DEC2022 month. Later person named Mathew called me on Jan 26th 2023 (Mathew.Jefferson@kwakolmarkets.com). He introduced himself well and said he is 10-15 yrs experienced in this field and can teach me trading and I will also earn profit and will withdraw twice a month etc. He also told he has never traded with $250 and would need more than $1K in my account. He convinced me to put $1750 where he said will add some bonus that I can use for trading. First thing he asked me to trade was WTI, most volatile and risky instrument. I was completely newbie and it was my first time in trading. He showed me Inventory report and asked me to trade accordingly. Few trades worked and few did not. I also made some test withdrawal of $300+$100.Later all my trades started going in negative. He asked me to open WTI trades with volume 100 max, told not to be afraid and keep opening the trade till my margin is 200%. I just followed and later when trades went opposite direction margin started going down and some I closed loss trades against profits. I approached Mr.Mathew for help and he advised me not to close with losses instead to deposit more. In order to save $1750, I deposited $2250 and till e assured he will work and save my account. Did not turn up after several emails. He replied saying he is busy with his new position would assign someone to help me and never did. I have his email where he clearly says he has been ignoring his clients due to his new role and responsibility else my account could have been recovered with minimal help. After point he stopped replying and I again got margin call :-( I can't explain the stress I went through, and I have 3 yrs old kid to look after. By then I had deposited $10,028 to recover my capital :-(. Trust me I did not have any withdrawal apart from the test withdrawal of $300+$100=$400. Later person called Robert pitched in "robert.brent@kwakolmarkets.com" said he is recovery manager for Kwakol and they are only 4 people in entire company and will help me recover my account as it was in RED Alert. He spoke for more than 2hrs and end of conversation same thing, asked me to deposit more to recover :-(. He suggested 3K deposit I did not have and he put some $500 as bonus and kept insisting me to deposit. He took one week showing his expertise, skills, placed some trades and showed me how profit can be made. He said Mr.Mathew was sales agent whose job is to get more deposits from client while Mr.Robert is permanent employee and very senior person. He assured these things will not happen and I will recover my account if I listen to him. It was so stressful, and I did not want to loose $10,028 so I had to deposit $3K(First I did 1K and after seeing he has tine for my account, I did 2K) to save my account. Started doing small trades where my margin moved to 400%. Equity started showing 40 to 50% recovery. Robert kept believing only one thing that is US Recession is coming and Gold will move up and Nasdaq will drop down. He showed some web links which did not clearly say though. Also he said never trade on WTI and half hedged WTI positions (Bought when it was 80+) and told not to trade on WTI as its volatile. Did not allow me to close BUY positions even though WTI was moving down. All he said was we will make good profit and then close the trades with losses :-( Slowly he started saying as am recovering my account I will be handed over back to someone and he is afraid I will get back to same situation. For that I told I will close my account once I recover my capital, I am not even looking for single dollar profit. I said I will come back only when I learn. He said, "He does not want to lose such potential client like me and showed how much Gold can make for me and I will be out of this mess in month if I listen to him". His proposal was to put 5K more when I had already put 15K+.He said I will be assigned to someone else as he handles people only with 50K+ deposits as he being senior account manager and told I would continue with his account ship if my total deposit is 10K under him.He kept calling me, following up. I denied over call, over emails and stopped picking few times, gave some excuses too. Finally, one fine day he gave written confirmation that by June 10th I will withdraw 10K amount and my equity will be 30K. He also ensured over call I will not have single trade in Loss (Kwakol has recorded calls they can always review). He also gave me confirmation that apart from 10K I will withdraw twice month, I will be completely out of this mess. I had second baby plan hence me and my husband took call to get over this mess as Robert seemed genuine, God believing person, told he would swear on his daughter etc. He also advised to use credit card or do loan as its matter of just one month. So I went extreme closing my bank account, one of fixed deposit, borrowed from my mom and my husband made some personal loan as well. We accumulated and did multiple deposits. USD to my country currency is 82.X hence its huge huge amount I risked. I still remember Robert was awake around 2.30am of his time until I made my last deposit :-( ($20452 is the total deposit I made till now apart from my initial $250 refundable deposit)This dedication was never there after I deposited. He asked me to open Gold BUY position when it was already at its resistance. He kept saying its recession time, keep buying on dips (I have emails). Asked me to SELL Nasdaq as recession would make companies fall, kept saying its similar to 2008 recession etc :-(. He also said he has witnessed 2008 recession and spoke for hours until I am convinced. Gave me Google hang out Chat and asked me to keep updating my account with screen shot, assured me he is closely watching my account, asked me not to hedge, not to take any position in opposite direction, not to close any position. I did everything he said. One fine day I got margin call again where new person called and told in absence of Mr.Robert he is handling, asked me for one more deposit. I broke down emotionally and wrote back to Robert. Next day Mr.Robert called me saying saying he was unwell,so it was temporary person who called and would not happen again as he is one of the Boss and nothing will happen to my account. The person who told not to hedge and not to take any trades in opposite direction he himself asked me to open hedge position to save my account, it was already June 10th, promised day where I was supposed to recover my account :-(. He asked me again 3k I started crying, so he said he will put from his bonus and made me feel guilty and he put some 3K+1K bonus opened some trades on hedge. Told he is monitoring again. Now I see all my trades closed, my all capital is GONE :-( He was not even aware that my account is washed out, said sorry and told me to come back fresh. There is interest rates coming in US and he will open trades on GOLD sell asking me to deposit again :-( I have put everything I had listening to these people advise who claim to be professionals, god believers, competent and gave me written assurance. Please help me to get my deposit as its not my fault. I have put everything I had where I can survive($20.452k capital) more than 7yrs in my country without earning anything. Please help me to fight against the fraud. I got my case reviewed from expert traders and academy they said its a trend and totally scam. They said any professional or real finance broker will never advise first trade on WTI, will never buy when instrument is already priced, will never do biased trading (Believing on recession etc). He asked me to keep selling Silver as GOLD was going down, but Gold and Silver dont necessarily move in same direction.

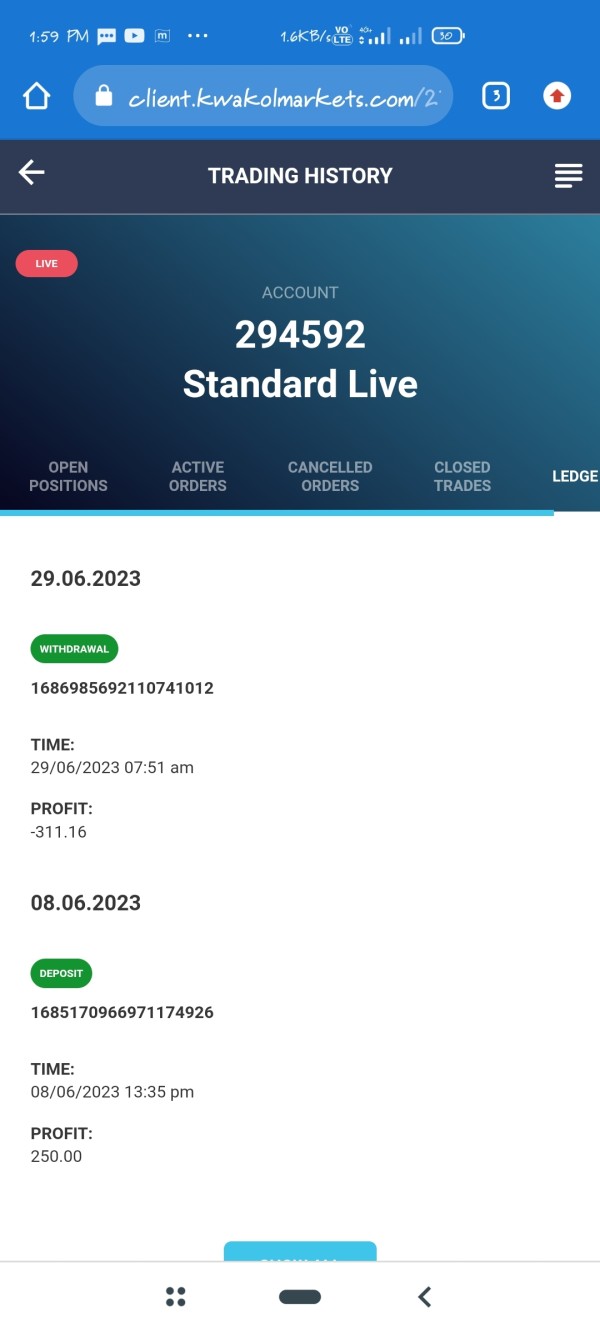

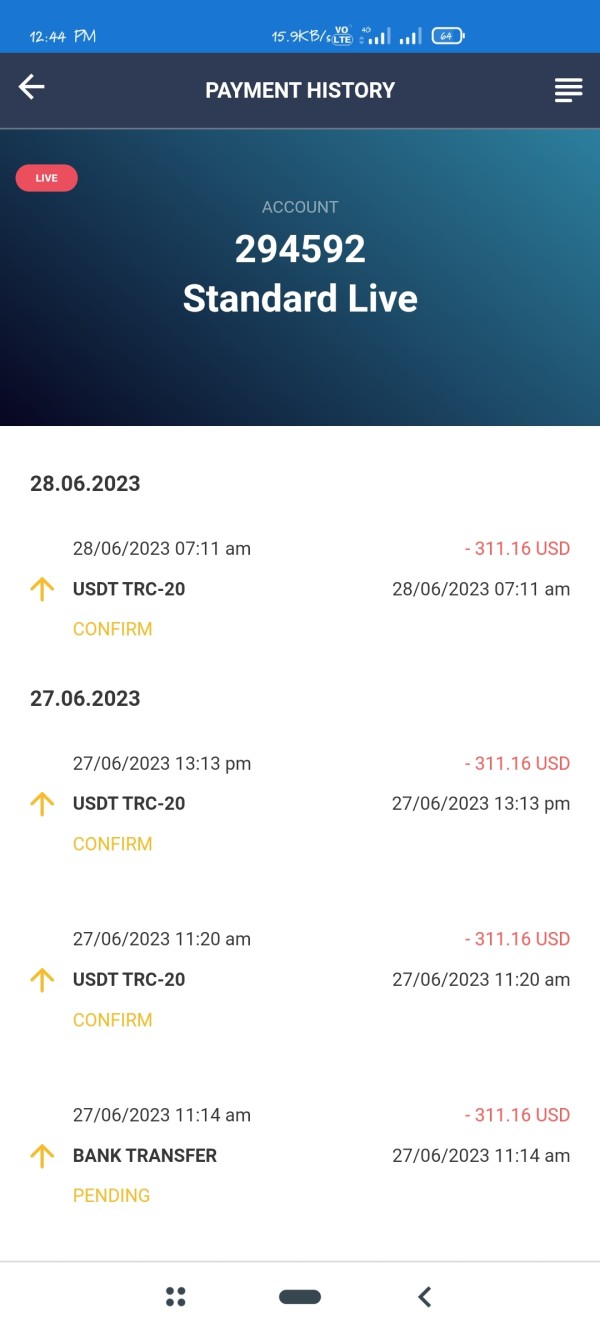

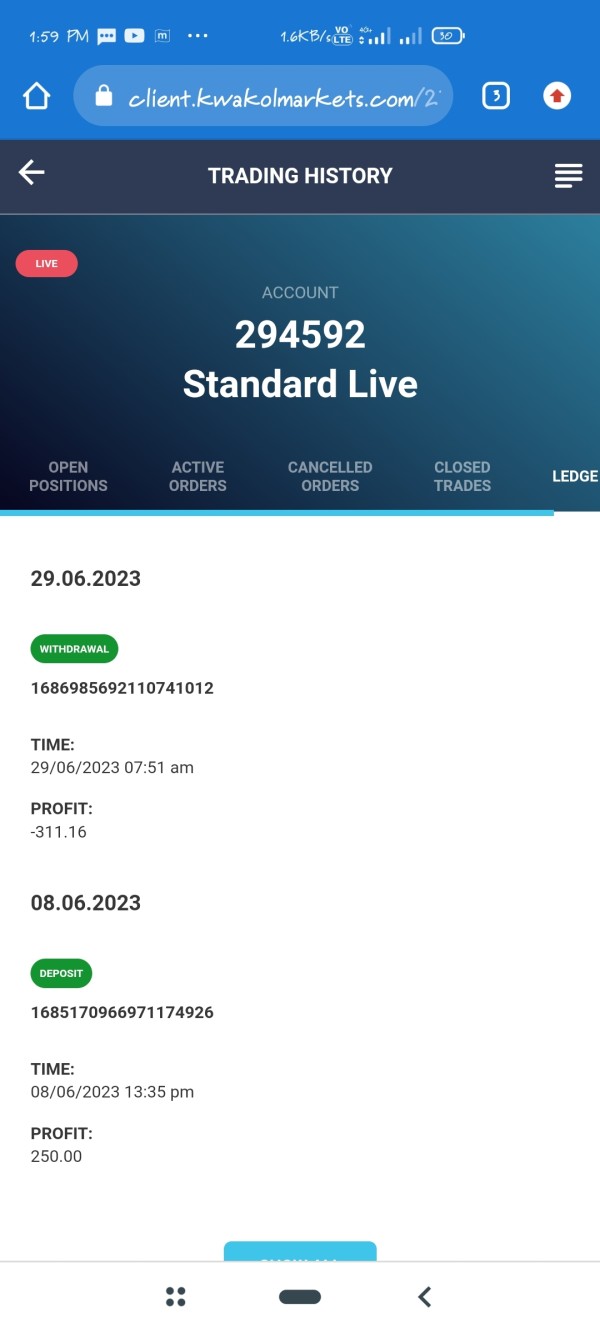

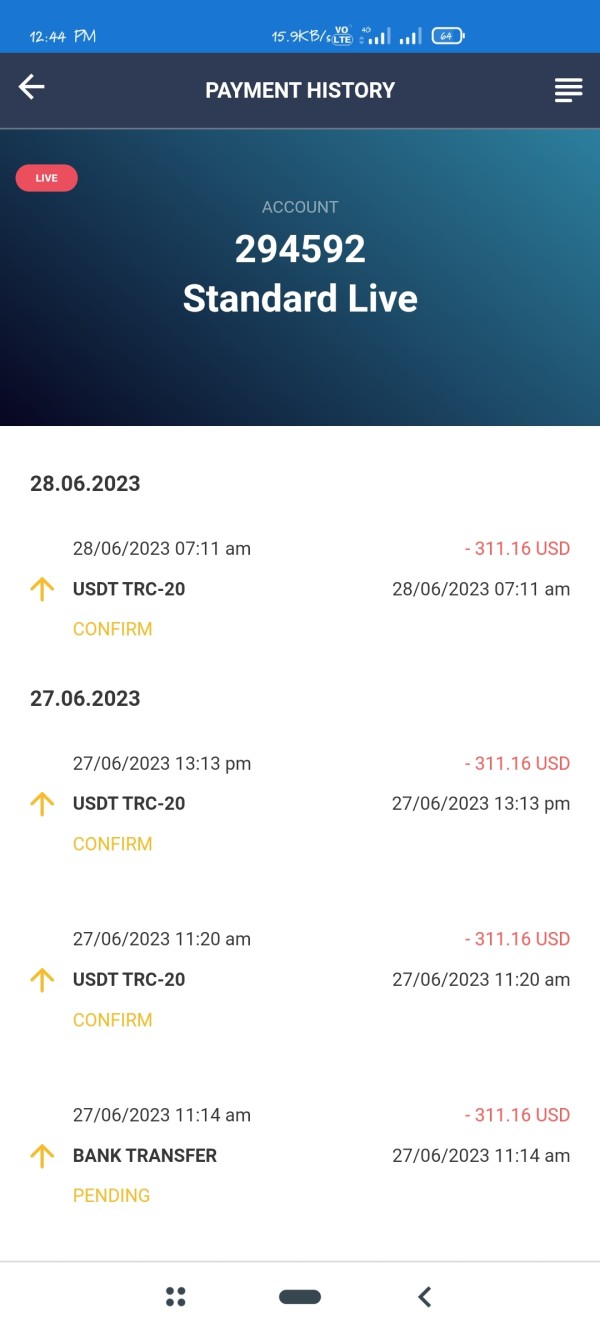

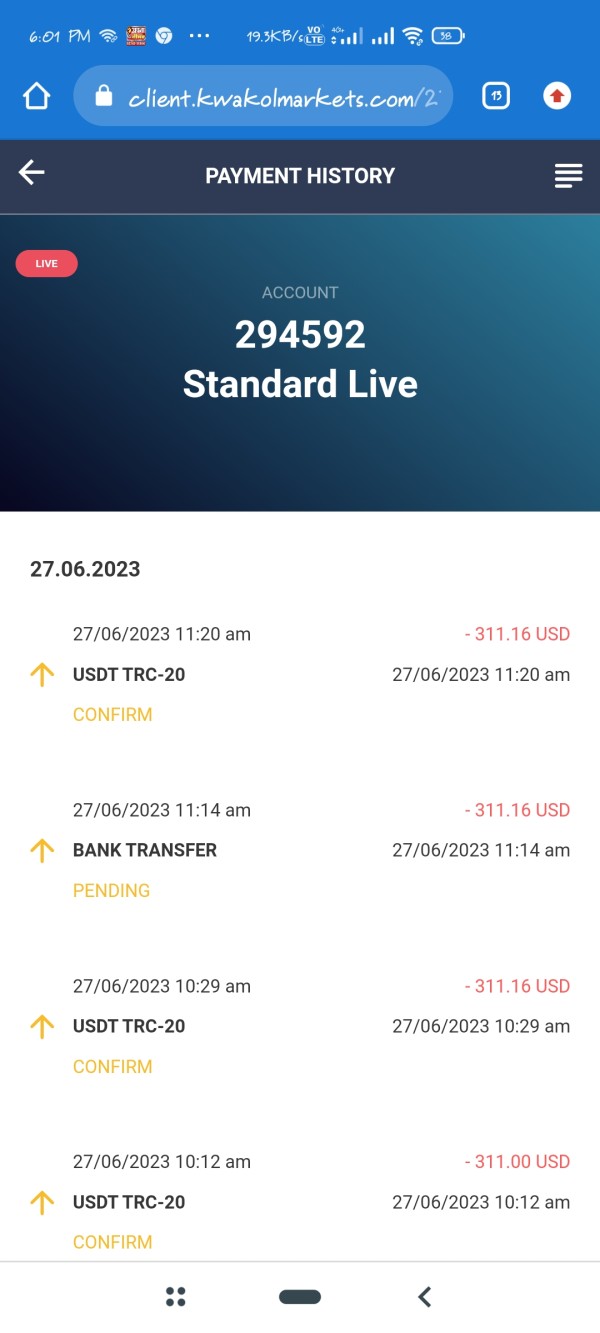

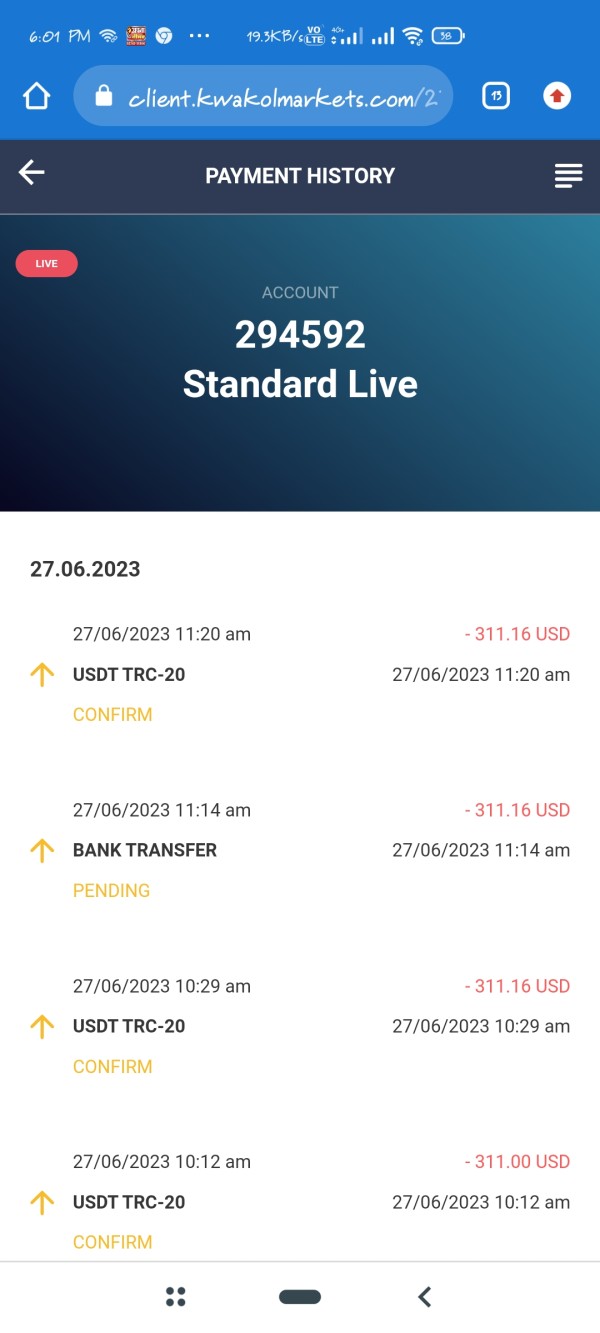

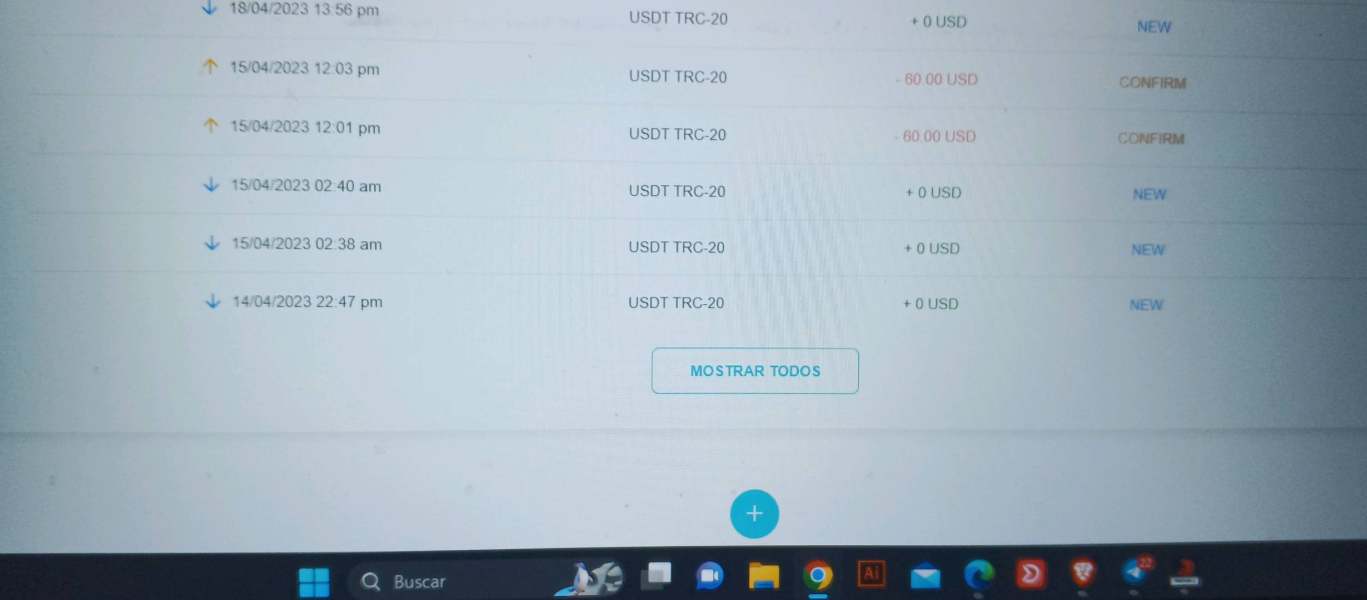

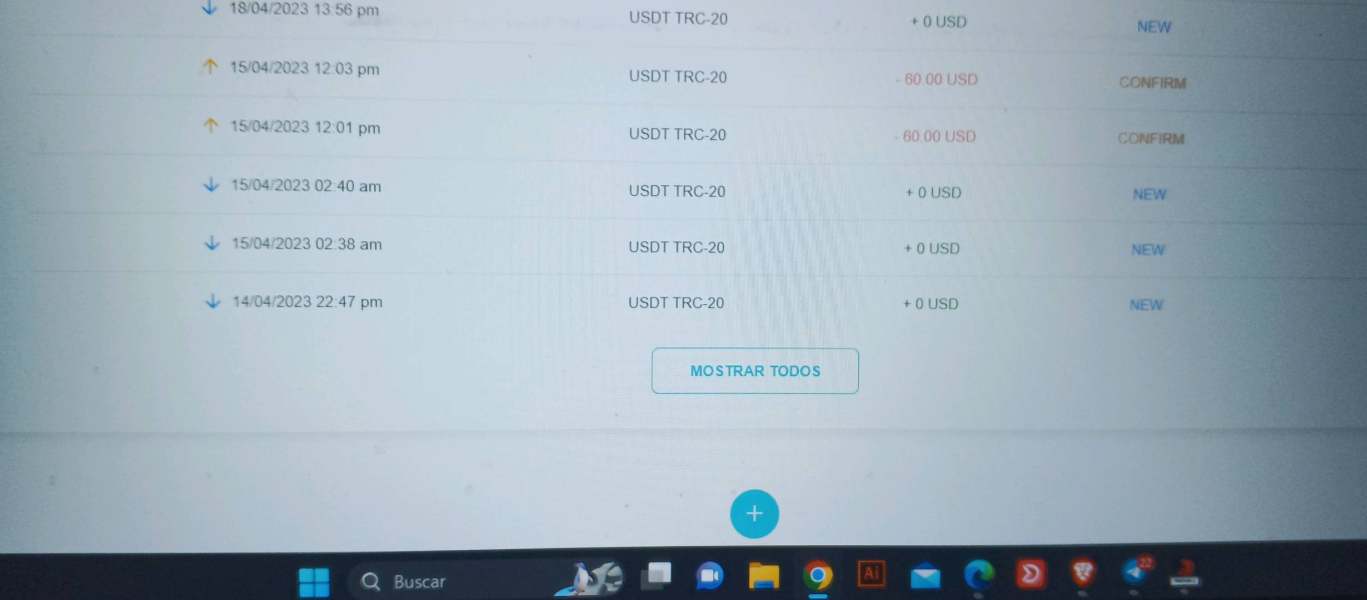

I have also complained about that but till now there is no solution. I sent withdrawal request only on 28/06/2023 from market app but still not paid. Please help me.

hello sir my name is mahesh i sent withdrawal request of $311.16 not yet process confirmed from company side

they don't answer the messages to the brokers neither in the chat... I don't recommend this broker.

I deposited money into my account with this broker I never get the money and I chatted with customer service no reply send emails no response