CKB 2025 Review: Everything You Need to Know

Executive Summary

This ckb review presents a comprehensive analysis of what appears to be a unique entity operating in the climate knowledge brokerage space rather than traditional financial services. CKB stands for Climate Knowledge Brokers. The Climate Knowledge Brokers Group has been active since 2011, regularly convening meetings and facilitating collaboration among climate-focused professionals.

However, our analysis reveals significant information gaps regarding traditional brokerage services such as trading platforms, account conditions, and regulatory oversight. The available documentation primarily focuses on CKB's role as a climate knowledge facilitator rather than a financial services provider. This creates challenges in providing a standard brokerage evaluation. The entity appears to operate in a specialized niche that bridges climate science and knowledge dissemination rather than traditional forex or securities trading.

The organization's strength lies in its collaborative approach to climate knowledge sharing. It offers support through various channels including peer-exchange sessions and educational publications. For investors interested in climate-related initiatives or blockchain technology supporters, CKB may represent an interesting area of focus, though specific investment or trading opportunities remain unclear from available sources.

Important Notice

This evaluation is conducted based on publicly available information and limited documentation about CKB's operations. The analysis methodology relies on official publications and organizational materials. However, comprehensive trading-related information typically expected in brokerage reviews is not readily available.

Readers should note that CKB appears to operate primarily as a knowledge-sharing network rather than a traditional financial services provider. The review framework has been adapted to accommodate the unique nature of this entity. We focus on available information while clearly identifying areas where standard brokerage metrics cannot be adequately assessed due to insufficient data.

Rating Framework

Broker Overview

The Climate Knowledge Brokers Group represents a distinctive network that has been operating since 2011. It focuses on the intersection of climate science and knowledge dissemination. According to the Climate Knowledge Brokers Manifesto, this organization was developed through a collaborative process by professionals dedicated to improving climate knowledge quality and application in decision-making processes.

The manifesto was published in 2015. It outlines the essential role of climate knowledge brokers in achieving informed decision-making for a climate-resilient future. The organization's business model centers around facilitating connections between climate knowledge producers and users, rather than traditional financial trading services.

CKB operates through multiple channels, offering both online and offline support formats. Notable activities include peer-exchange sessions called "climate knowledge sharing clinics" held during workshops, and the development of educational materials including videos and publications hosted on their website. From 2014 to 2017, CKB demonstrated significant activity in creating connections and facilitating cooperation within the climate knowledge community.

The organization has shown commitment to innovation in climate knowledge brokerage. However, specific details about trading platforms, asset classes, or regulatory oversight typically associated with financial brokerages are not mentioned in available documentation. This suggests CKB operates in a specialized sector focused on climate-related knowledge rather than traditional financial markets.

Regulatory Oversight: Available materials do not specify traditional financial regulatory authorities overseeing CKB's operations. This aligns with its focus on knowledge brokerage rather than financial services.

Deposit and Withdrawal Methods: Standard banking and payment processing information is not detailed in the source materials. This suggests different operational structures than traditional brokerages.

Minimum Deposit Requirements: Specific financial entry requirements are not mentioned in available documentation. This indicates a different engagement model than conventional trading platforms.

Promotional Offers: No traditional trading bonuses or promotional structures are referenced in the organizational materials reviewed.

Available Assets: Rather than traditional financial instruments, CKB appears to focus on climate knowledge assets and educational resources. However, specific details require further clarification.

Cost Structure: Fee structures and pricing models are not detailed in available materials. This suggests a different operational framework than commission-based trading platforms.

Leverage Options: Traditional leverage ratios and margin requirements are not addressed in the documentation. This is consistent with the organization's apparent focus outside conventional trading.

Platform Selection: Specific trading platform options are not mentioned. However, the organization maintains online presence through their website hosting educational materials.

Geographic Restrictions: Regional limitations are not specifically addressed in available materials. The organization appears to have international scope.

Customer Service Languages: Multilingual support details are not specified in the reviewed documentation.

This ckb review highlights the unique nature of this entity. It operates outside traditional brokerage parameters while focusing on climate knowledge facilitation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for CKB presents unique challenges due to the organization's apparent focus on climate knowledge brokerage rather than traditional financial services. Available documentation does not provide information about standard account types, minimum deposit requirements, or account opening procedures typically associated with trading platforms. This absence of conventional account structure details suggests CKB operates through different engagement models.

The organization possibly focuses on membership or participation-based access to climate knowledge resources. The Climate Knowledge Brokers Manifesto indicates that engagement occurs through collaborative processes and network participation rather than individual trading accounts. Without specific user feedback regarding account setup experiences or comparative analysis with similar organizations, it becomes difficult to assess the accessibility and user-friendliness of joining the CKB network.

The organization appears to prioritize knowledge sharing and professional collaboration over individual account management. This represents a fundamental difference from traditional brokerage operations. Special features such as different account tiers, Islamic finance compliance, or premium membership options are not detailed in available materials.

This ckb review must note that standard account condition metrics cannot be adequately assessed without more comprehensive information. We need more details about user onboarding, access requirements, and participation structures within the CKB network.

CKB's approach to tools and resources differs significantly from conventional trading platforms. It focuses instead on climate knowledge dissemination and educational materials. According to available documentation, the organization provides support through multiple channels including peer-exchange sessions during workshops and educational publications.

The "climate knowledge sharing clinics" represent a unique resource for professionals seeking to improve their climate knowledge application capabilities. The organization's website serves as a hosting platform for various educational materials, including introductory videos and publications developed by the CKB network. These resources appear designed to enhance climate knowledge quality and usage rather than providing traditional market analysis or trading tools.

The collaborative nature of resource development suggests a community-driven approach to knowledge creation and sharing. However, specific details about the depth, quality, and accessibility of these educational resources remain limited in available materials. User feedback regarding the effectiveness and comprehensiveness of CKB's educational offerings is not provided in the source documentation.

Without information about automated systems, research capabilities, or advanced analytical tools typically expected in financial services, this analysis must focus on the organization's stated commitment to knowledge facilitation. The organization emphasizes professional development in climate-related fields.

Customer Service and Support Analysis

Assessment of CKB's customer service and support capabilities is constrained by the limited information available in source materials. The organization's operational model appears to emphasize peer-to-peer support and collaborative problem-solving rather than traditional customer service structures. The peer-exchange sessions and workshop formats suggest a community-based approach to addressing member needs and questions.

Response times, service quality metrics, and availability schedules are not specified in the reviewed documentation. The collaborative nature of the organization implies that support may be provided through network members and community interaction rather than dedicated customer service representatives. This model could offer advantages in terms of specialized expertise and peer learning.

However, it may present challenges for immediate issue resolution. Multilingual support capabilities and global accessibility remain unclear from available materials. Without specific user testimonials or service quality indicators, it is difficult to assess the effectiveness of CKB's support mechanisms.

The organization's international scope, evidenced by participation from multiple countries since 2011, suggests some level of cross-cultural communication capability. However, specific language support details are not provided in the source documentation.

Trading Experience Analysis

Traditional trading experience metrics cannot be applied to CKB due to its apparent focus on climate knowledge brokerage rather than financial markets. The organization does not appear to offer conventional trading platforms, order execution services, or market access typically associated with brokerage firms. Instead, CKB facilitates knowledge exchange and professional collaboration in climate-related fields.

Platform stability and execution speed, while relevant concepts, apply differently in CKB's context of knowledge sharing and educational resource delivery. The organization's online presence through website-hosted materials suggests some level of digital platform management. However, specific performance metrics are not available in source materials.

Mobile accessibility and user interface design details are not addressed in the reviewed documentation. The "trading experience" in CKB's context relates more to the exchange of climate knowledge and professional insights rather than financial instruments. User feedback regarding the effectiveness of knowledge sharing sessions and the quality of collaborative experiences would be valuable for assessment.

However, such detailed user experiences are not provided in available materials. This ckb review must acknowledge that conventional trading experience evaluation criteria do not align with CKB's operational model and objectives.

Trust and Reliability Analysis

Evaluating CKB's trustworthiness requires consideration of its unique position as a climate knowledge network rather than a regulated financial services provider. The organization's longevity, operating since 2011, suggests some level of stability and sustained community engagement. The collaborative development of the Climate Knowledge Brokers Manifesto indicates transparent communication of organizational objectives and methodologies.

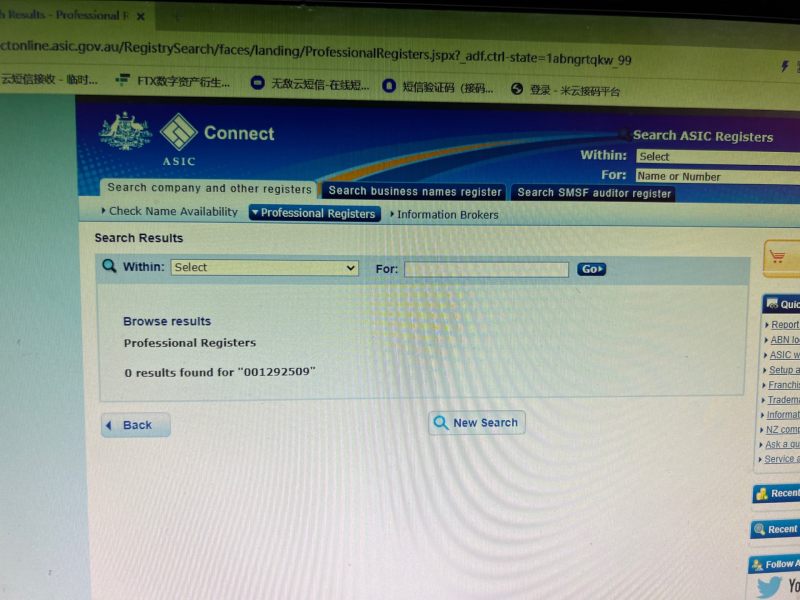

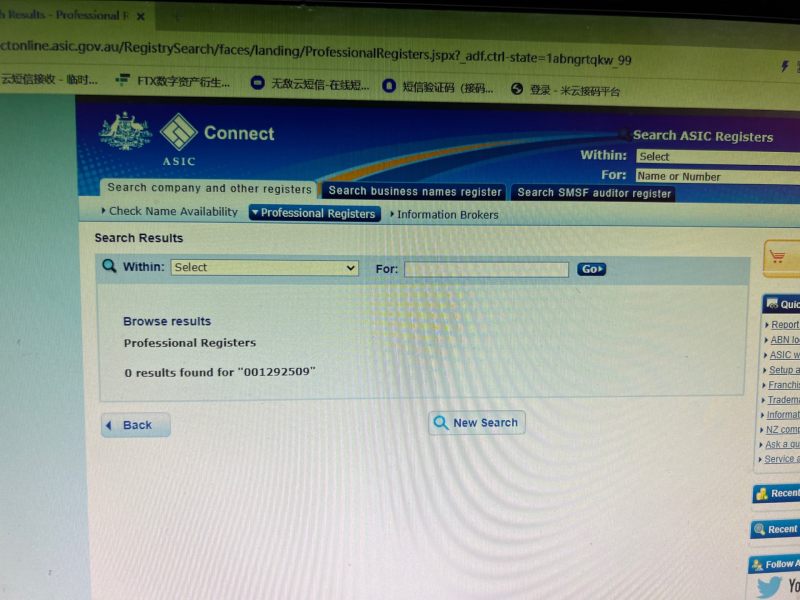

Traditional regulatory oversight from financial authorities is not mentioned in available materials. This aligns with CKB's apparent focus outside conventional financial services. However, this absence of regulatory framework may raise questions for users accustomed to traditional brokerage protections.

The organization's association with established entities, as indicated by the manifesto's publication details, may provide some credibility through institutional connections. Third-party evaluations, industry ratings, or independent assessments of CKB's operations are not referenced in source materials. User testimonials regarding security, reliability, or satisfaction with services are not provided in the reviewed documentation.

Without specific information about data protection measures, financial safeguards, or dispute resolution mechanisms, this analysis cannot provide definitive conclusions about CKB's trustworthiness. We cannot use conventional brokerage evaluation standards.

User Experience Analysis

User experience assessment for CKB must consider the organization's unique operational model focused on climate knowledge sharing rather than traditional financial services. The available materials suggest that user interaction occurs primarily through workshops, peer-exchange sessions, and access to educational resources. This differs from individual platform navigation or trading interfaces.

The organization's emphasis on collaborative processes and community engagement indicates a user experience centered on professional networking and knowledge development. The "climate knowledge sharing clinics" and workshop formats suggest interactive, educational experiences rather than self-directed platform usage. However, specific user satisfaction metrics, interface design quality, or usability feedback are not provided in source materials.

Registration and onboarding processes for joining the CKB network are not detailed in available documentation. This makes it difficult to assess accessibility and user-friendliness. The organization's international scope and sustained operation since 2011 suggest some level of user satisfaction and engagement.

However, quantitative measures are not available. Common user concerns, improvement suggestions, or satisfaction surveys are not referenced in the reviewed materials. This limits the scope of user experience evaluation in this analysis.

Conclusion

This ckb review reveals a unique entity that operates outside traditional brokerage parameters. It focuses on climate knowledge facilitation rather than conventional financial services. Due to the comprehensive lack of information regarding standard trading conditions, regulatory oversight, and user experiences typically associated with financial brokerages, a definitive evaluation using conventional metrics proves challenging.

CKB appears most suitable for professionals and organizations interested in climate change knowledge sharing, collaborative learning, and professional development in climate-related fields. The organization's strengths lie in its established network, collaborative approach, and sustained operation since 2011. However, the absence of detailed operational information, user feedback, and traditional brokerage features represents significant limitations for those seeking conventional trading services.

The primary disadvantage for potential users is the lack of transparency regarding specific services, costs, and engagement procedures. The advantage lies in the organization's specialized focus on climate knowledge and professional networking opportunities in this important field.