Regarding the legitimacy of GEMFOREX forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is GEMFOREX safe?

Business

License

Is GEMFOREX markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

GEMFOREX LIMITED

Effective Date: Change Record

--Email Address of Licensed Institution:

info@gemforexglobal.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.gemforexglobal.comExpiration Time:

--Address of Licensed Institution:

Unit S43, Espace Building, Le Chemin De La Fraternite, Ile Du Port, SeychellesPhone Number of Licensed Institution:

248 2561932Licensed Institution Certified Documents:

Is GemForex A Scam?

Introduction

GemForex, a forex and CFD broker established in 2010, is primarily known within the Asian trading community, particularly in Japan. The broker aims to provide a range of trading services, including competitive trading conditions and access to popular trading platforms such as MetaTrader 4 and MetaTrader 5. However, the growing number of unregulated brokers in the forex market has raised concerns among traders regarding the safety and legitimacy of their investments. As such, it is crucial for traders to thoroughly evaluate the trustworthiness of any broker before committing their funds. This article employs a comprehensive investigation method, utilizing data from multiple sources, including regulatory filings, user reviews, and expert analyses, to assess whether GemForex is a safe trading platform or a potential scam.

Regulation and Legitimacy

The regulatory framework governing a broker's operations is fundamental to ensuring the safety and security of client funds. GemForex operates under the jurisdiction of the Seychelles Financial Services Authority (FSA), which is considered an offshore regulatory body. While this provides some level of legitimacy, it lacks the stringent oversight found in more reputable jurisdictions like the UK (FCA) or Australia (ASIC).

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 116 | Seychelles | Valid but Offshore |

The FSA's regulatory standards are often viewed as less rigorous, allowing brokers to operate with minimal capital requirements and oversight. Reports indicate that GemForex has been operating without a serious license for an extended period, raising questions about its compliance history and overall regulatory quality. Although the broker claims to adhere to the FSA's guidelines, the lack of a robust regulatory framework poses significant risks to traders, particularly in terms of fund protection and dispute resolution.

Company Background Investigation

GemForex was founded in 2010 and has since positioned itself as a broker catering to the Asian market, particularly Japan. The company operates under the ownership of GemForex Limited, which is registered in Seychelles. The management team consists of professionals with experience in trading and finance, yet there is limited publicly available information about their backgrounds or the company's operational history.

Transparency is a vital component of trust in the financial services sector. Unfortunately, GemForex has faced criticism for its lack of comprehensive information disclosure, including details about its management team and operational practices. This opacity raises red flags for potential investors, as it becomes challenging to assess the broker's credibility and operational integrity.

Trading Conditions Analysis

GemForex presents a variety of trading conditions, including competitive spreads and leverage options. However, the overall fee structure may not be as transparent as it appears, with some users reporting hidden fees and unfavorable trading conditions.

| Fee Type | GemForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.3 pips | From 1.0 pips |

| Commission Model | Variable | Variable |

| Overnight Interest Range | Not Specified | 0.5% - 1.5% |

The spreads offered by GemForex, while competitive, may not reflect the true cost of trading, as some reports indicate that users experienced slippage and unexpected fees during their trading activities. Additionally, the minimum deposit requirement for certain account types is relatively high compared to industry standards, which could deter new traders from entering the market.

Client Funds Security

The security of client funds is paramount when evaluating a broker's reliability. GemForex claims to implement measures to protect client funds, such as segregating client accounts from operational funds. However, the lack of a robust regulatory framework raises concerns about the effectiveness of these measures.

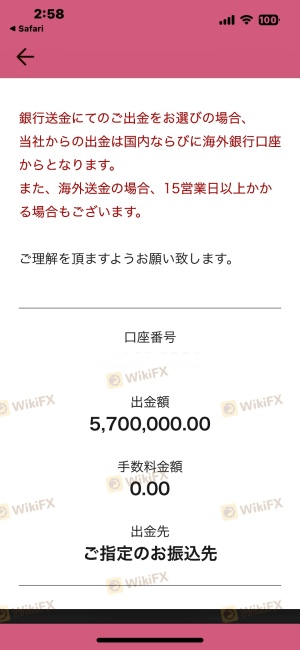

The absence of negative balance protection is another significant risk factor, as traders could potentially lose more than their initial investment. Historical complaints regarding withdrawal delays and issues with fund access further exacerbate concerns about the broker's ability to safeguard client assets.

Client Experience and Complaints

User feedback regarding GemForex is mixed, with some clients praising the trading conditions and platform usability, while others report serious issues, particularly concerning withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow, Unresponsive |

| Account Freezing | High | Inadequate Support |

| Profit Cancellation | Medium | Inconsistent Replies |

Several users have shared experiences of being unable to withdraw funds or facing significant delays in processing withdrawal requests. For instance, one user reported waiting for months to access their funds, while another mentioned that their profits were canceled without clear justification. These complaints highlight a troubling pattern that potential clients should consider before trading with GemForex.

Platform and Execution

GemForex offers access to the widely-used MetaTrader 4 and MetaTrader 5 platforms, which are known for their user-friendly interfaces and advanced trading tools. However, the performance of these platforms can vary, with some users reporting issues related to execution speed and slippage.

The quality of order execution is critical for traders, as delays or rejections can impact profitability. Reports of high slippage and instances of order rejections raise concerns about the broker's execution quality. Such issues could indicate potential manipulation or operational inefficiencies, which are particularly alarming for traders relying on precise execution for their strategies.

Risk Assessment

Engaging with GemForex presents a range of risks that traders must consider carefully. The offshore regulatory status, combined with reports of withdrawal issues and client complaints, suggests that the overall risk level is elevated.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under lax offshore regulations |

| Fund Security Risk | High | Lack of negative balance protection |

| Execution Risk | Medium | Reports of slippage and order rejections |

To mitigate these risks, traders should conduct thorough due diligence before engaging with GemForex. It may be prudent to start with a small investment, utilize demo accounts for practice, and be prepared for potential challenges related to withdrawals and customer support.

Conclusion and Recommendations

In conclusion, while GemForex has established itself as a broker within the forex market, significant concerns regarding its regulatory status, client fund security, and customer service persist. The combination of an offshore regulatory framework, historical complaints about withdrawal issues, and mixed user feedback paints a concerning picture.

For traders considering GemForex, it is essential to weigh these risks carefully. If you are a novice trader seeking a reliable and secure trading environment, it may be wise to explore alternatives with stronger regulatory oversight and better reputations. Recommended alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide greater security and investor protection.

Is GEMFOREX a scam, or is it legit?

The latest exposure and evaluation content of GEMFOREX brokers.

GEMFOREX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GEMFOREX latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.