Sandwind 2025 Review: Everything You Need to Know

Executive Summary

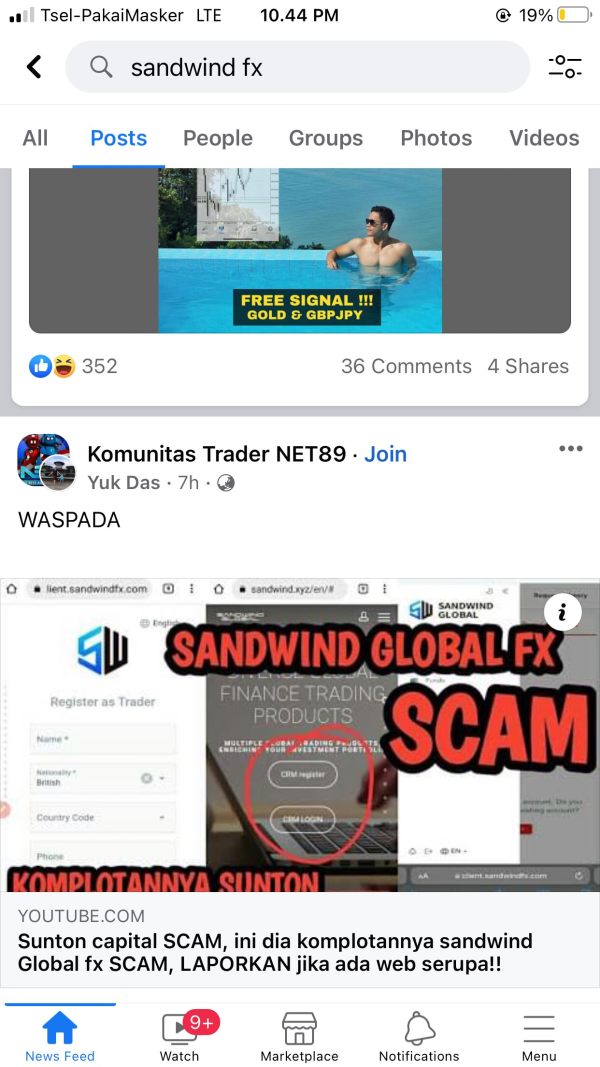

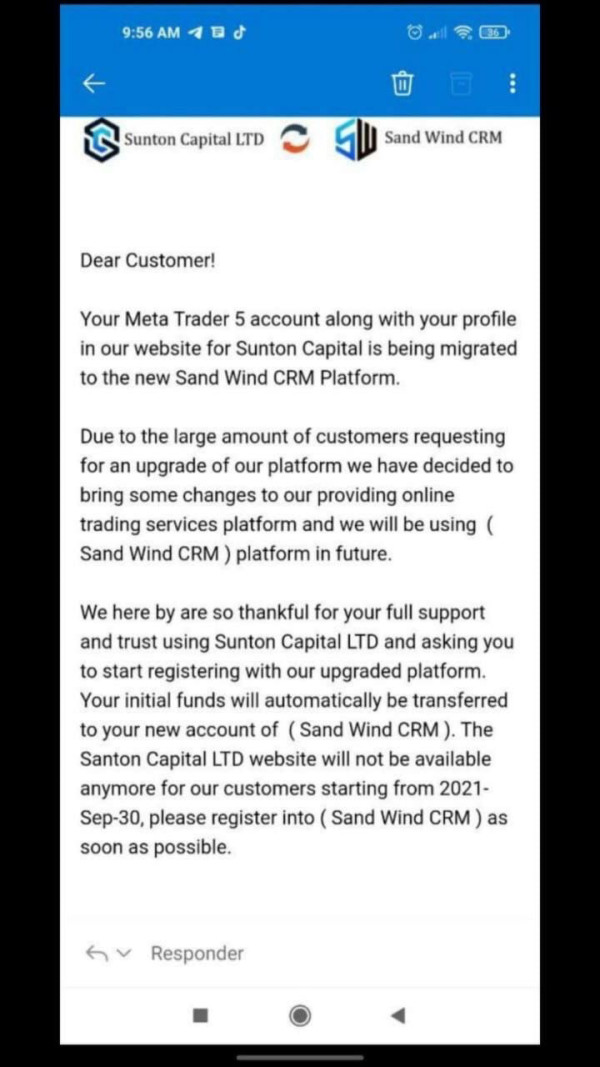

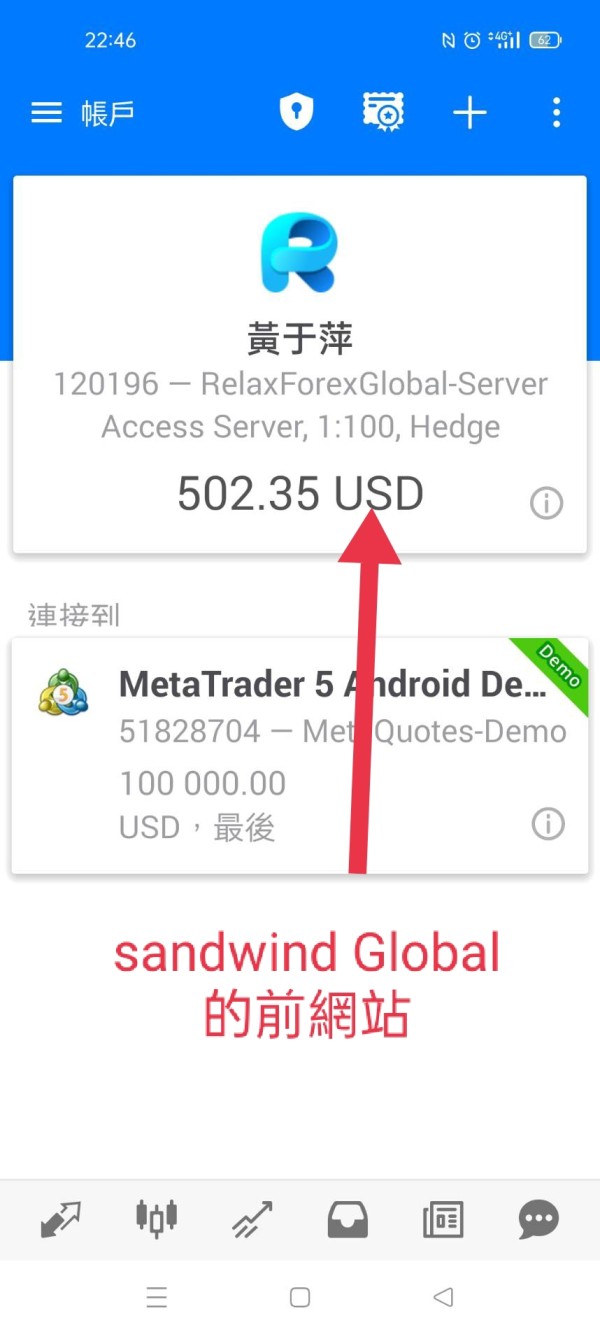

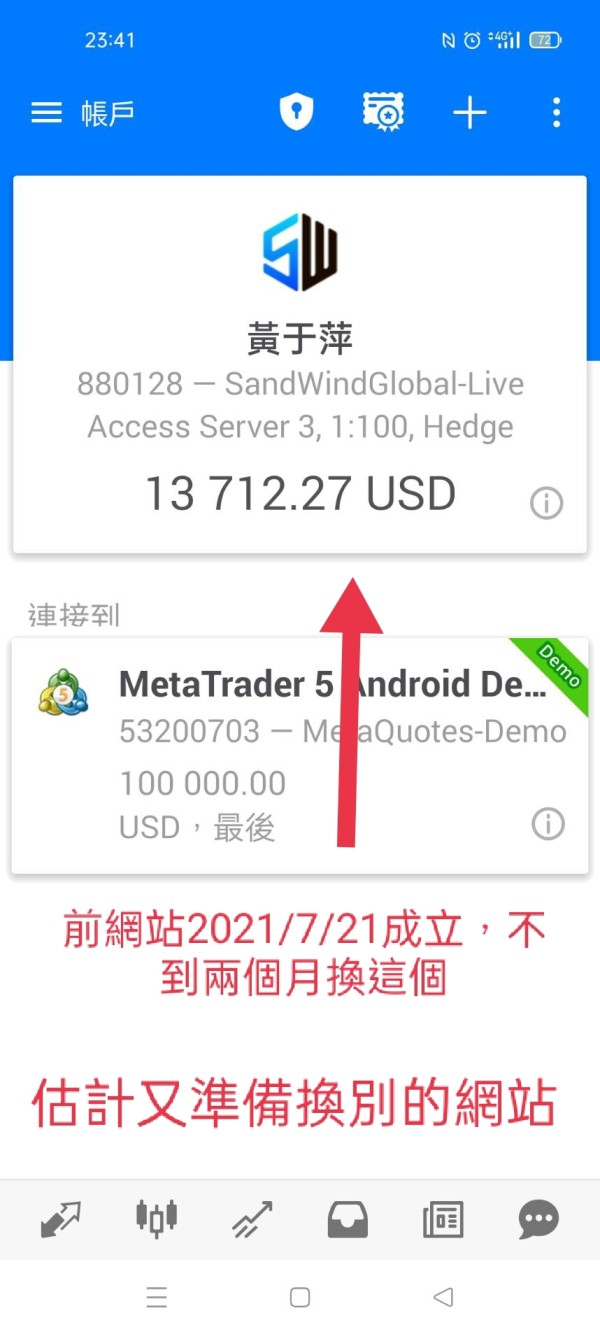

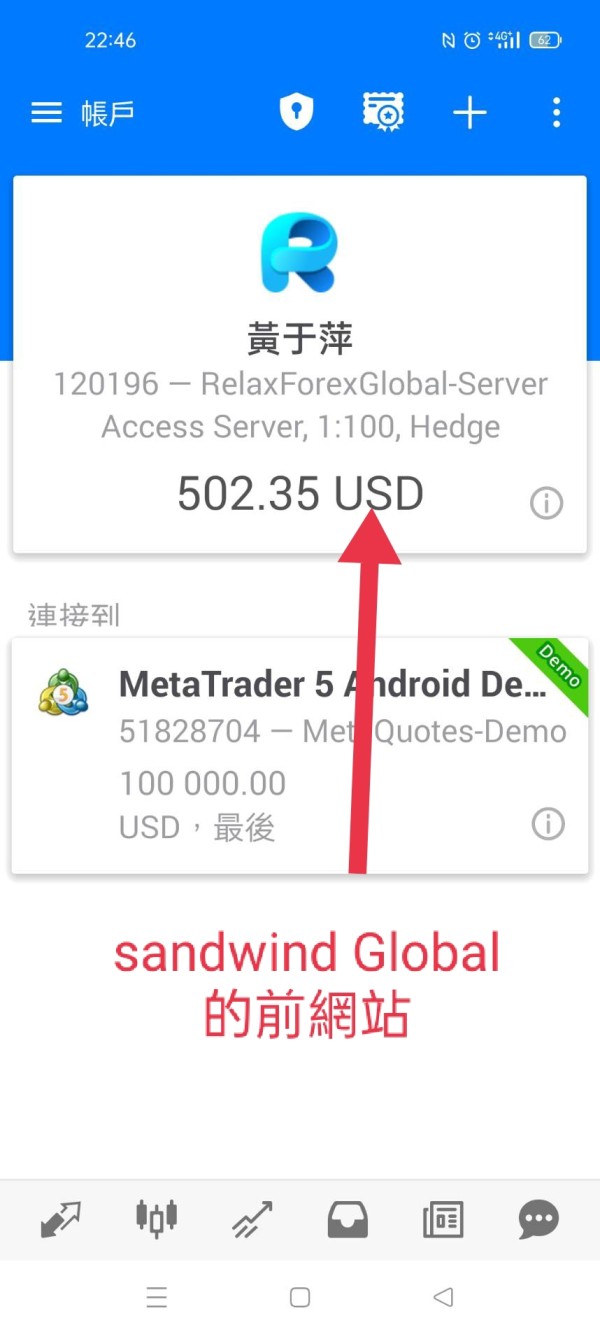

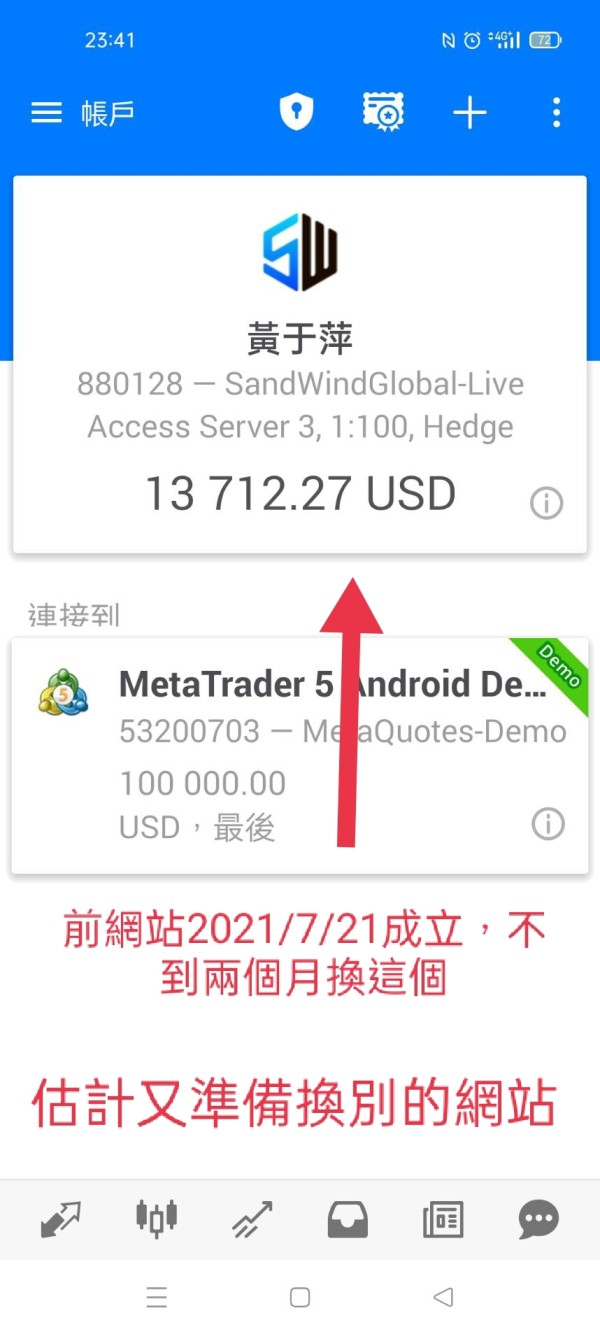

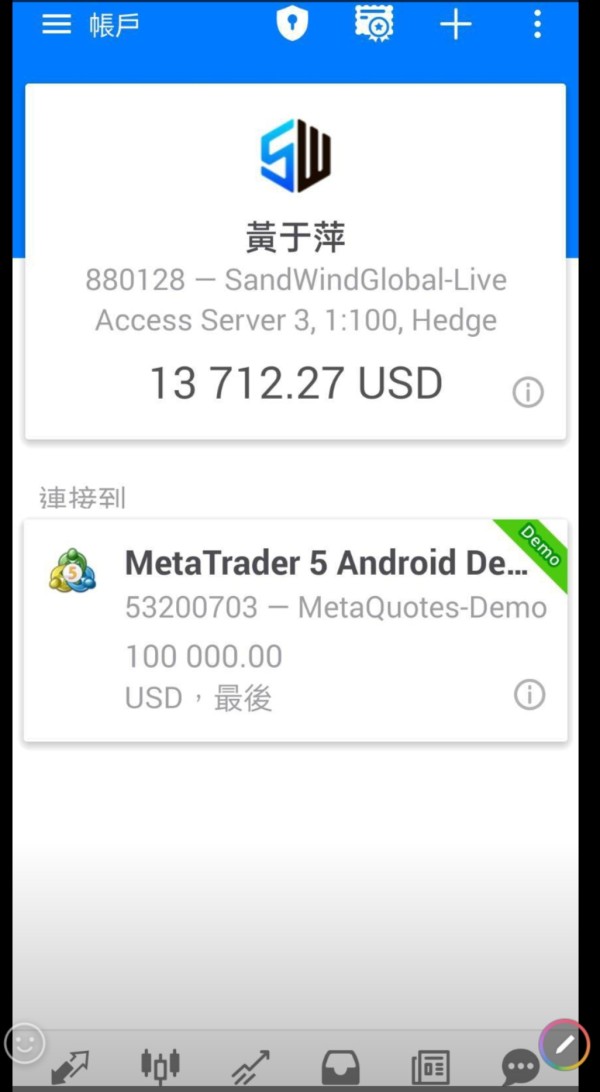

This comprehensive sandwind review examines a forex broker that presents significant concerns for potential traders. Sandwind Capital was established in 2021 and reportedly has its headquarters in Australia. The company operates as an offshore forex and CFD broker with notable transparency issues. The broker offers MT5 and MT Mobile trading platforms across multiple asset classes including forex pairs, CFDs, indices, commodities, gold, and oil.

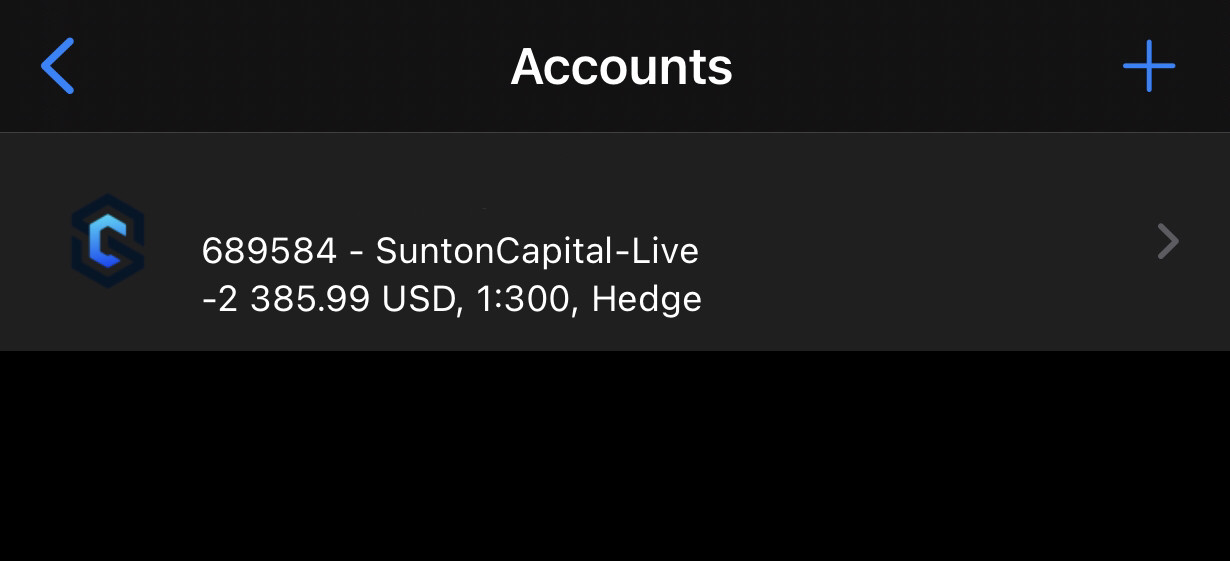

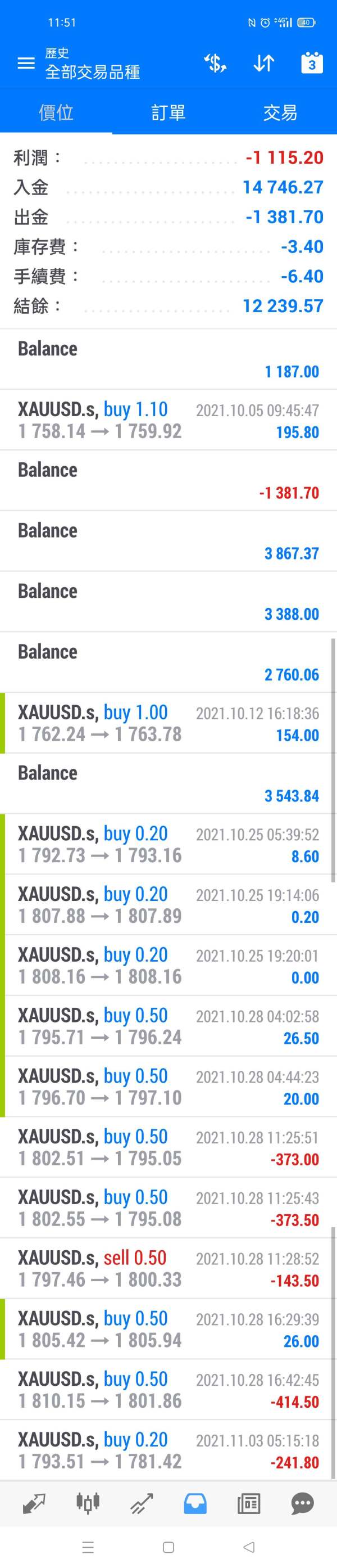

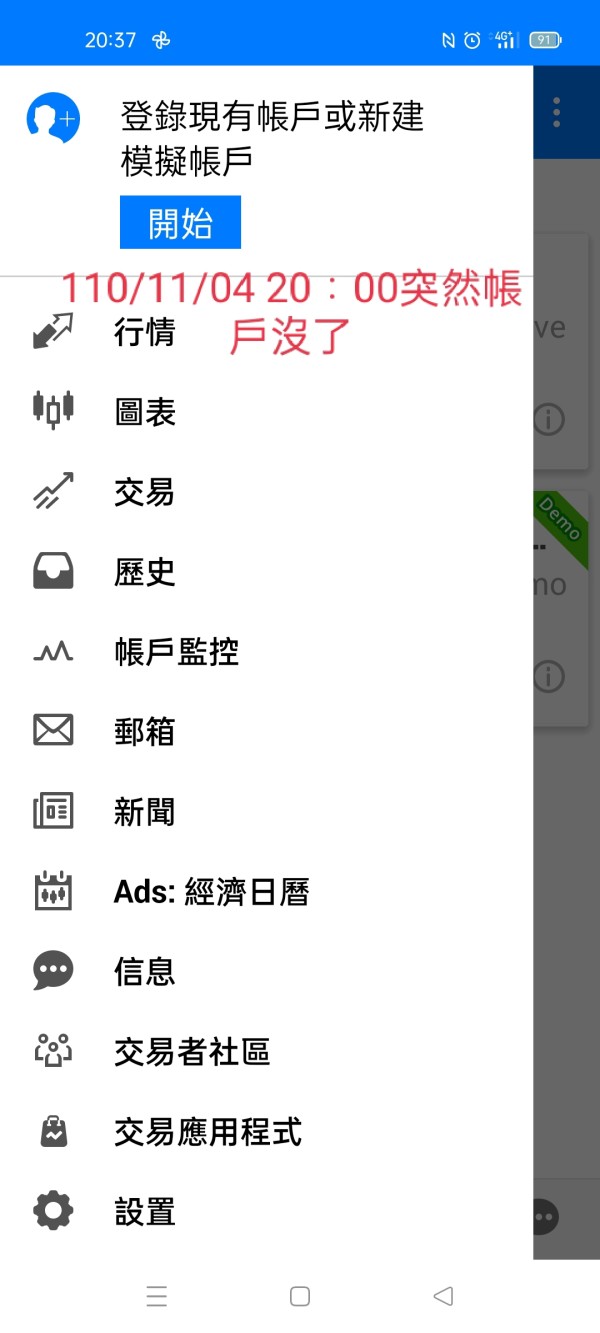

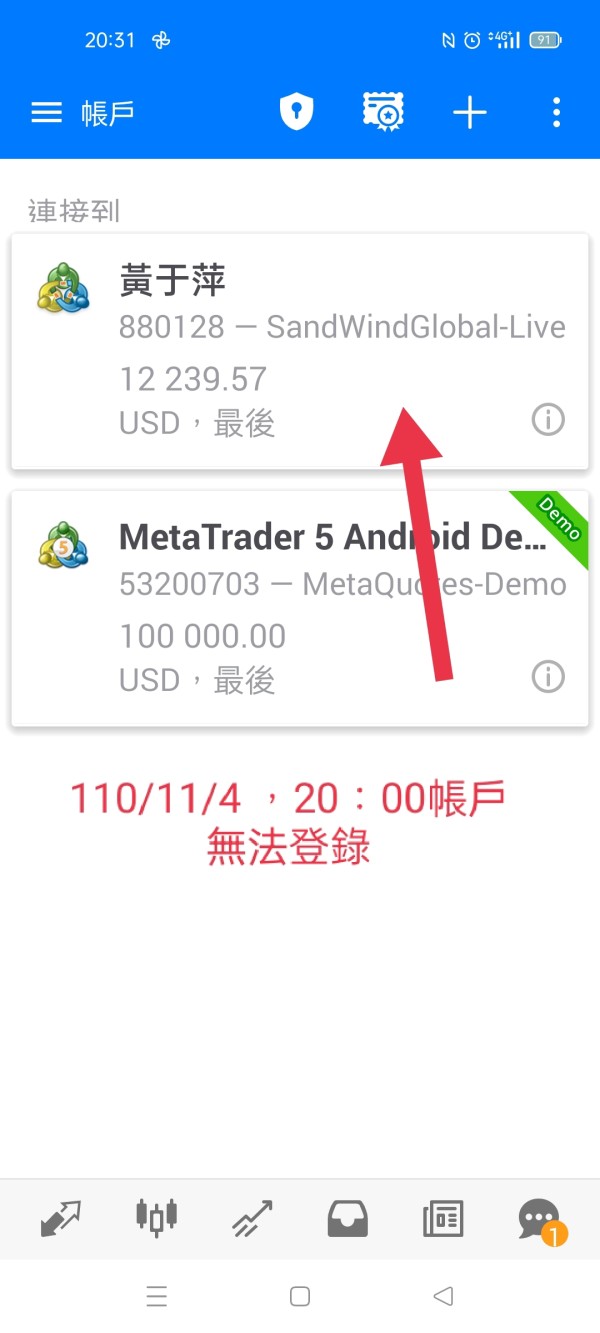

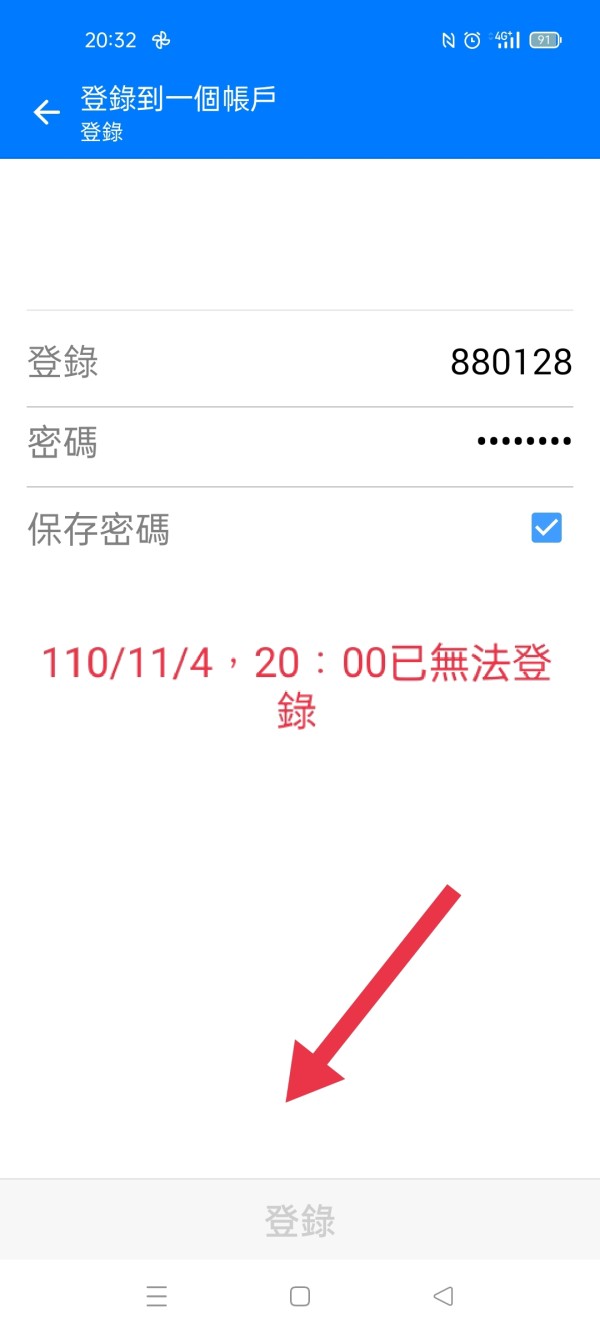

However, our analysis reveals substantial red flags that potential users must consider. The broker lacks proper regulatory oversight, with no verified licensing information available from major financial authorities. User feedback has been predominantly negative, reflected in a concerning 1.44 rating on WikiFX with nine formal complaints registered against the company. The absence of clear account conditions, fee structures, and deposit requirements further undermines confidence in this broker's legitimacy.

While Sandwind may appeal to traders seeking diverse asset exposure through established platforms like MetaTrader 5, the significant regulatory and transparency concerns make it suitable only for highly experienced traders who fully understand offshore broker risks. Most retail traders would benefit from choosing more established, properly regulated alternatives.

Important Notice

Regional Entity Differences: Sandwind operates as an offshore broker, which inherently carries additional risks compared to regulated entities. The company's lack of clear regulatory oversight means traders may have limited recourse in case of disputes or operational issues. Different jurisdictions may have varying levels of access to Sandwind's services, though specific regional restrictions are not clearly documented in available materials.

Review Methodology: This evaluation is based on publicly available information, user feedback, and industry standard assessment criteria. Given the limited transparency from Sandwind itself, some information gaps exist that are clearly noted throughout this review.

Rating Framework

Broker Overview

Sandwind Capital emerged in the forex market in 2021. The company positions itself as a multi-asset broker offering trading services across various financial instruments. Based on available information, the company claims Australian headquarters, though verification of this claim proves challenging due to limited regulatory transparency. The broker operates primarily in the offshore space, targeting traders seeking access to global markets through established trading platforms.

The company's business model centers on providing access to forex and CFD markets through popular platforms. The company particularly focuses on MetaTrader 5 and mobile trading solutions. However, unlike established brokers, Sandwind's operational transparency remains questionable, with crucial information about company structure, regulatory compliance, and financial backing either unavailable or inadequately disclosed.

Sandwind offers trading across multiple asset classes. These include major and minor forex currency pairs, contracts for difference, global indices, commodities, precious metals like gold, and energy products including oil. The broker utilizes MT5 and MT Mobile platforms to facilitate these trading activities, though specific details about execution models, liquidity providers, and trading conditions remain unclear. Notably absent from available materials are details about regulatory oversight, with no verifiable licensing information from recognized financial authorities such as ASIC, FCA, or other major regulatory bodies.

Regulatory Status: Available information does not specify any regulatory authority overseeing Sandwind's operations. This absence of clear regulatory oversight represents a significant concern for potential traders. Regulated brokers typically provide greater consumer protections and operational transparency.

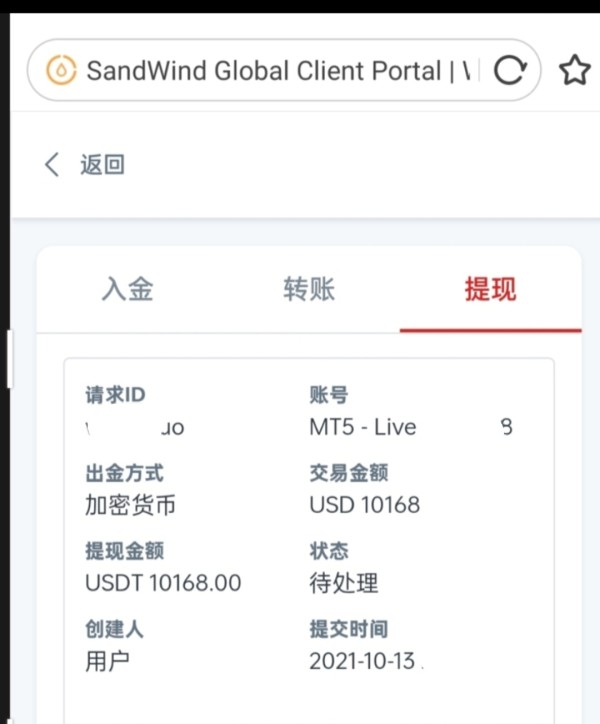

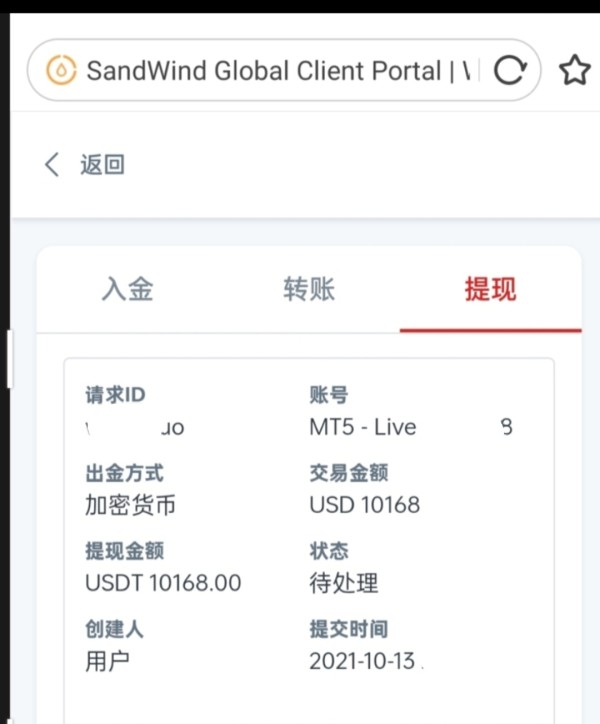

Deposit and Withdrawal Methods: Specific information about funding methods is not detailed in available materials. This leaves potential traders uncertain about transaction processes, processing times, and associated fees.

Minimum Deposit Requirements: Concrete minimum deposit information is not provided in accessible documentation. This makes it difficult for traders to understand entry-level account requirements.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs are not specified in available materials.

Tradeable Assets: The broker provides access to forex currency pairs, CFDs across various markets, major global indices, commodity markets, precious metals including gold, and energy products such as oil. This diverse asset selection represents one of the broker's more attractive features.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not clearly documented. This creates uncertainty about the true cost of trading with Sandwind.

Leverage Ratios: Maximum leverage levels and margin requirements are not specified in available documentation.

Platform Options: Sandwind offers MT5 and MT Mobile platforms. These provide traders with both desktop and mobile trading capabilities.

Geographic Restrictions: Specific country or regional restrictions are not clearly outlined in available materials.

Customer Support Languages: The range of supported languages for customer service is not specified in accessible documentation.

This sandwind review highlights significant information gaps that potential traders should consider carefully before engaging with this broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

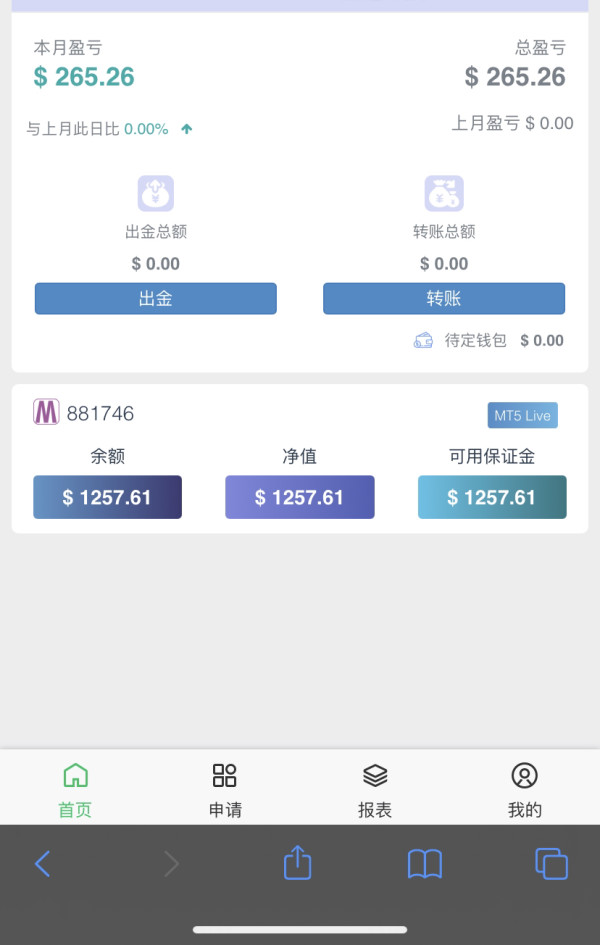

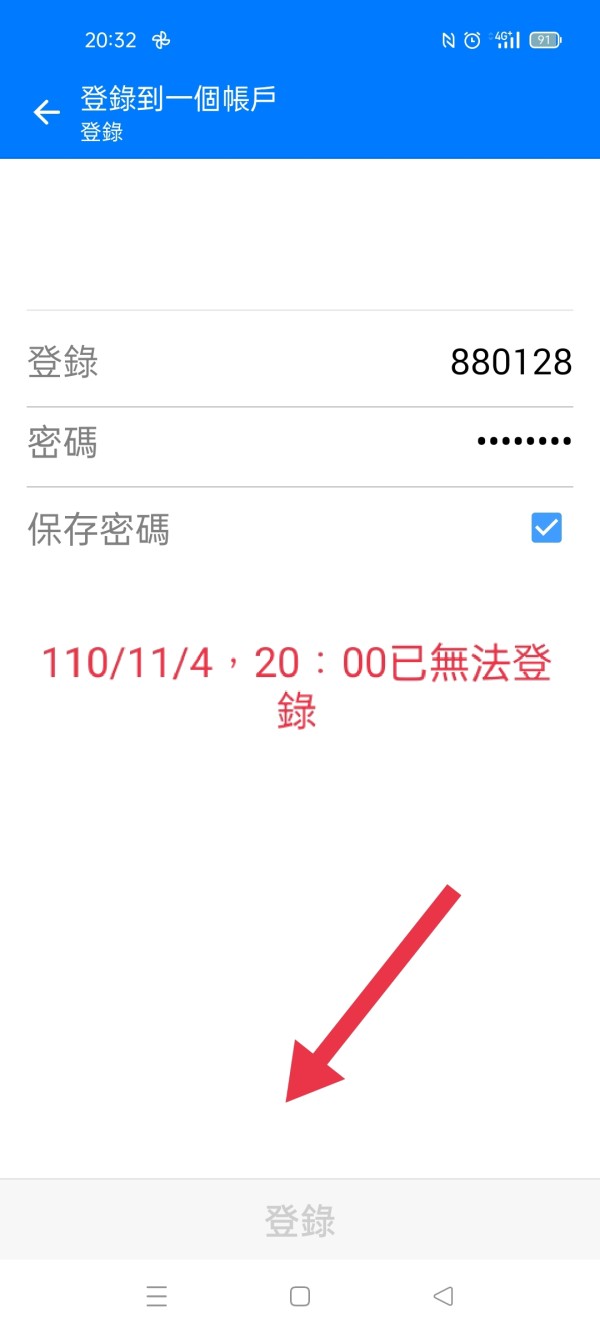

Sandwind's account conditions receive a poor rating primarily due to the complete lack of transparency regarding fundamental account details. Available materials provide no specific information about account types, minimum deposit requirements, or tiered account structures that traders typically expect from legitimate brokers. This absence of basic account information makes it impossible for potential clients to make informed decisions about whether the broker meets their trading needs.

The broker fails to disclose critical details such as account opening procedures, verification requirements, or special account features like Islamic accounts for Muslim traders. Without clear information about deposit minimums, traders cannot determine if the broker is accessible to their budget level. Additionally, the lack of detailed fee structures means traders cannot calculate the true cost of maintaining an account with Sandwind.

User feedback indicates concerns about account transparency. Several complaints highlight difficulties in understanding account terms and conditions. Compared to established brokers who typically offer detailed account specifications, fee schedules, and clear terms of service, Sandwind's opacity represents a significant disadvantage. This sandwind review emphasizes that the absence of clear account conditions should be considered a major red flag for potential traders.

Sandwind achieves a fair rating in tools and resources primarily due to its provision of MetaTrader 5 and mobile trading platforms. MT5 is widely recognized as a professional-grade trading platform offering advanced charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. The inclusion of mobile trading through MT Mobile ensures traders can access markets and manage positions while away from desktop computers.

However, the broker's tool offering appears limited beyond these platform basics. Available information does not mention additional research resources, market analysis tools, economic calendars, or educational materials that many traders value. The absence of proprietary tools, trading signals, or enhanced market research capabilities limits the overall value proposition for traders seeking comprehensive trading support.

While MT5 provides robust functionality for experienced traders, the lack of supplementary educational resources may disadvantage newer market participants. Most established brokers complement their platform offerings with market commentary, webinars, tutorials, and analytical tools that help traders develop their skills and stay informed about market conditions.

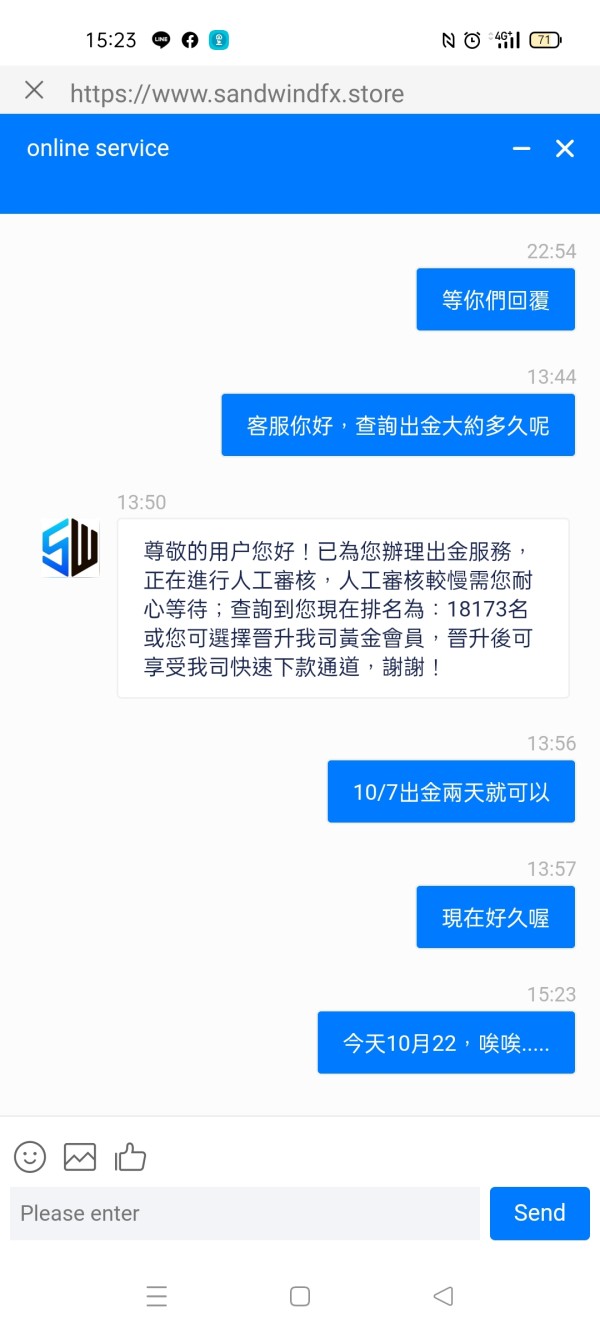

Customer Service and Support Analysis (Score: 3/10)

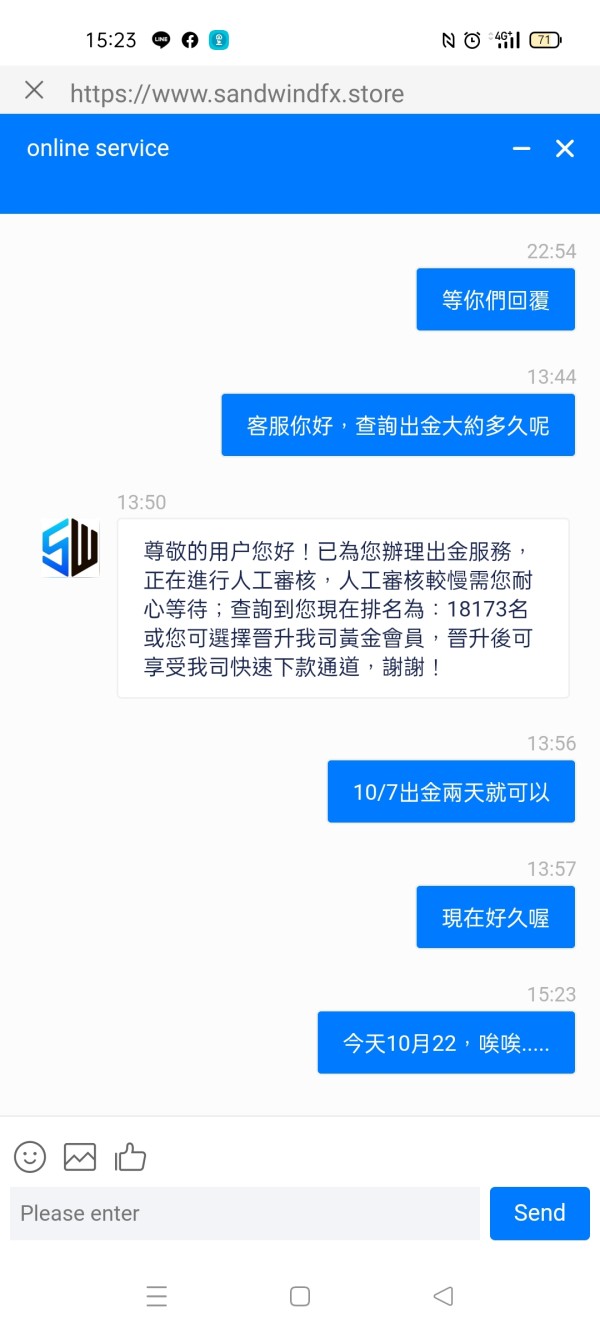

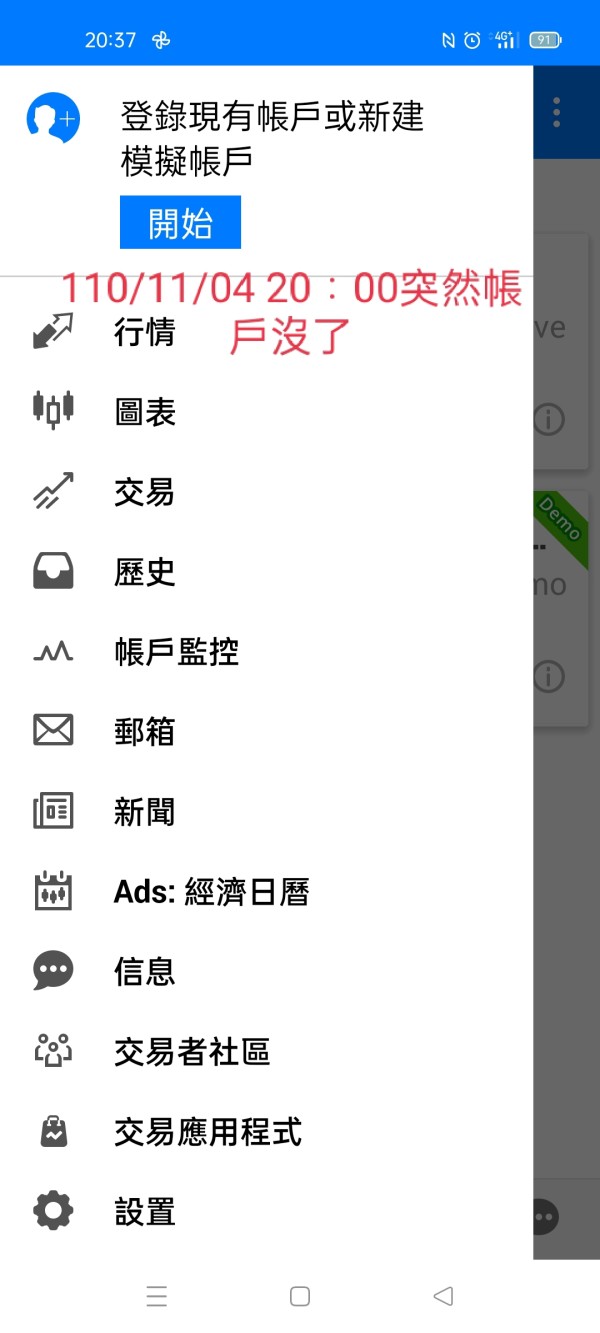

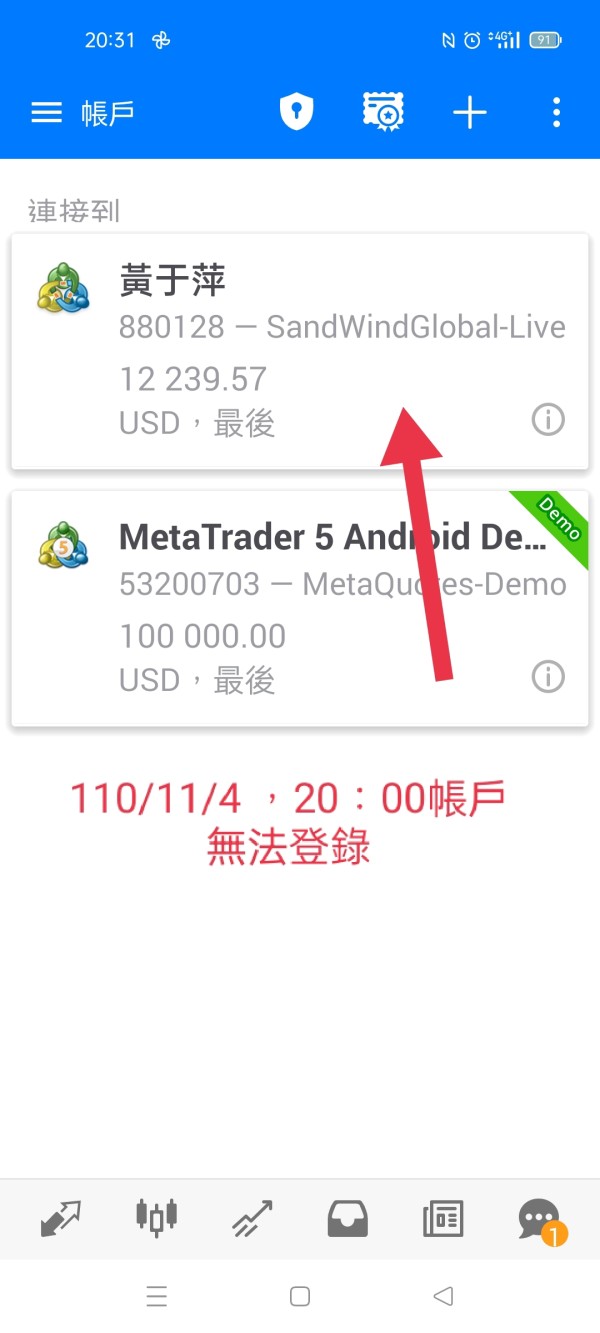

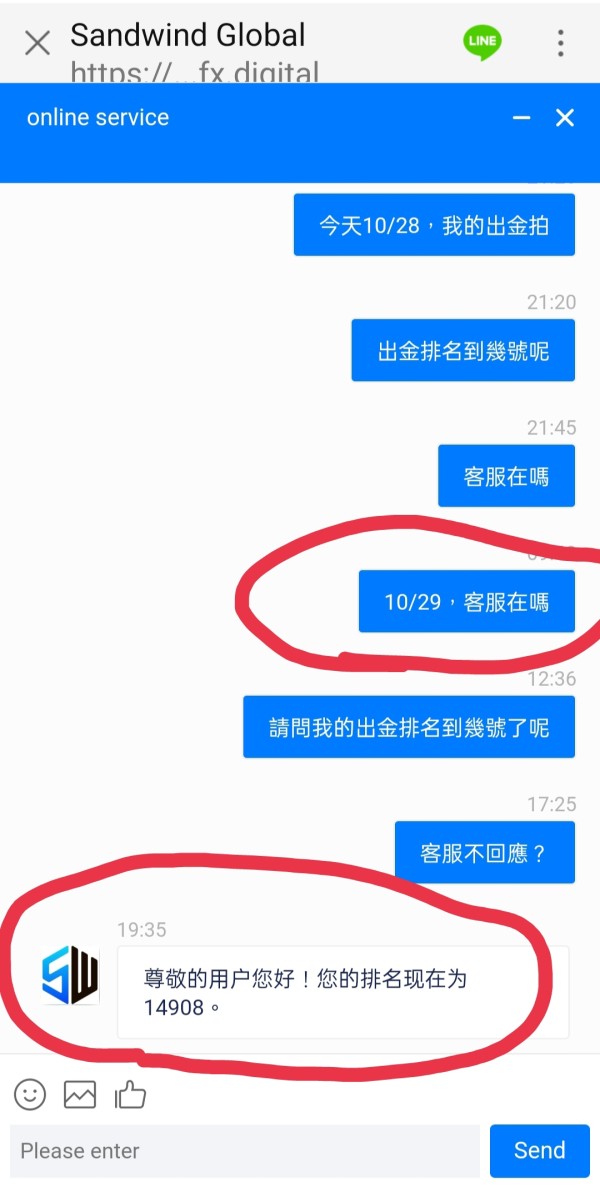

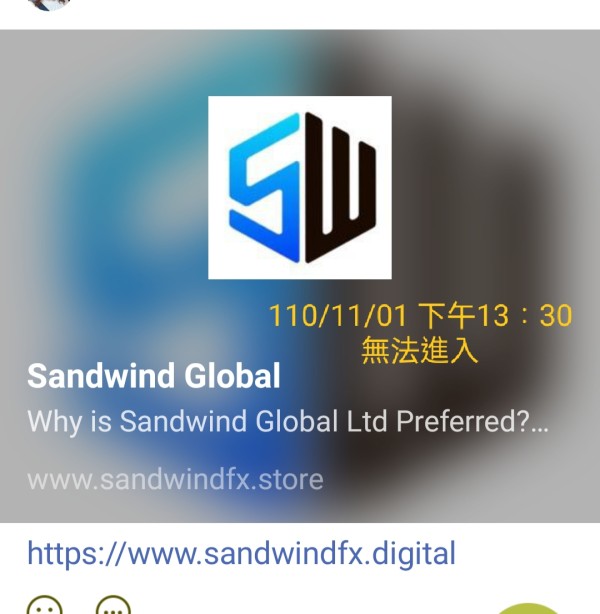

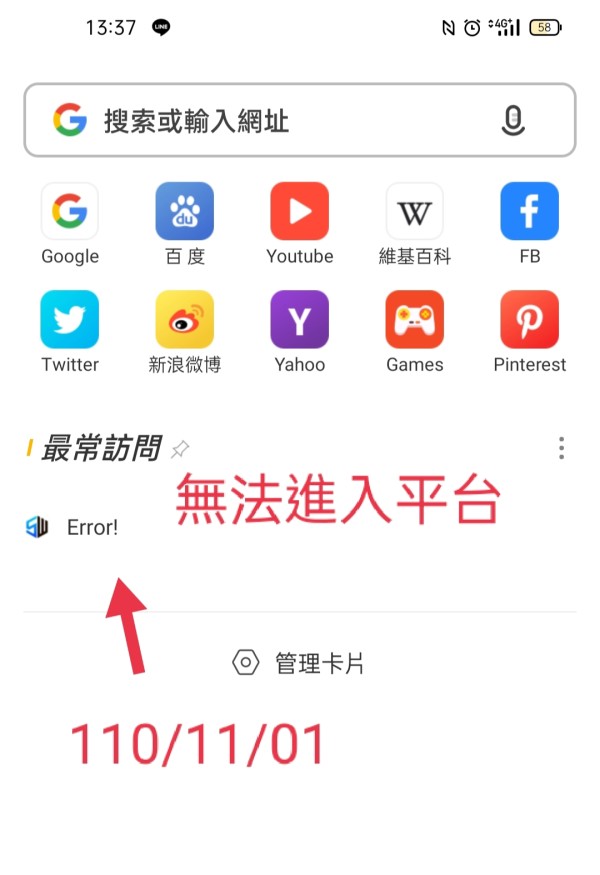

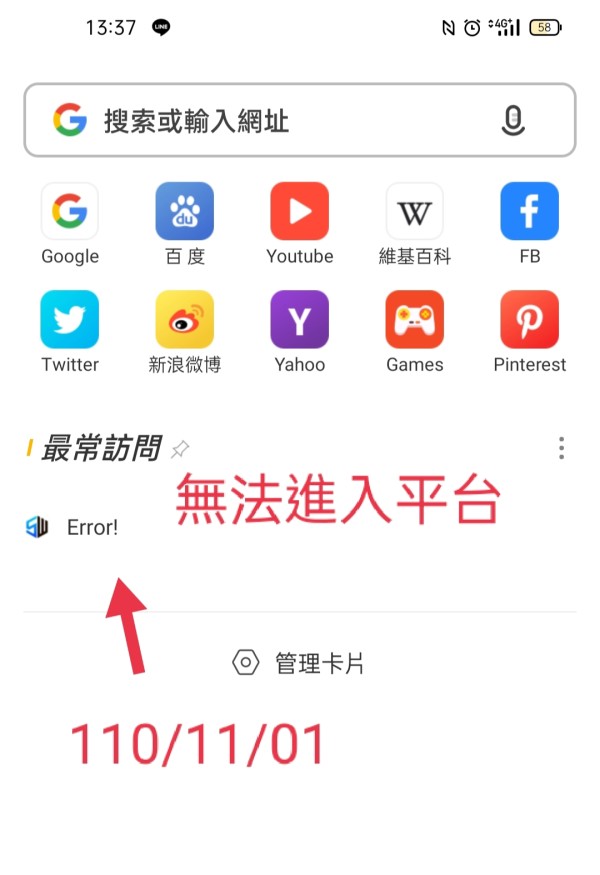

Customer service receives a poor rating based on available user feedback and the broker's limited transparency about support offerings. With nine formal complaints registered on WikiFX and an overall rating of 1.44, user experiences with Sandwind's customer support appear predominantly negative. These complaints suggest issues with responsiveness, problem resolution, and overall service quality.

Available materials do not specify customer support channels, operating hours, or response time commitments. The absence of clear contact information, live chat availability, or dedicated account management services further undermines confidence in the broker's support capabilities. Users report difficulties in reaching support representatives and receiving timely responses to inquiries.

The lack of multilingual support information also suggests limited accessibility for international traders. Most reputable brokers provide comprehensive support infrastructure including multiple contact methods, extended operating hours, and support in various languages. Sandwind's apparent deficiencies in these areas contribute to the overall poor user experience reflected in available feedback.

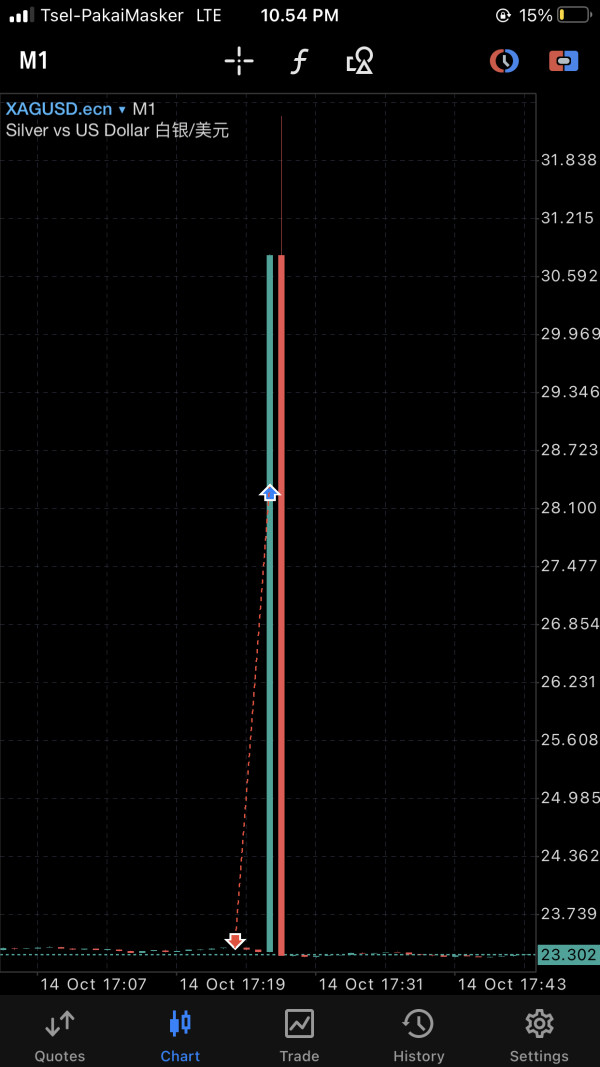

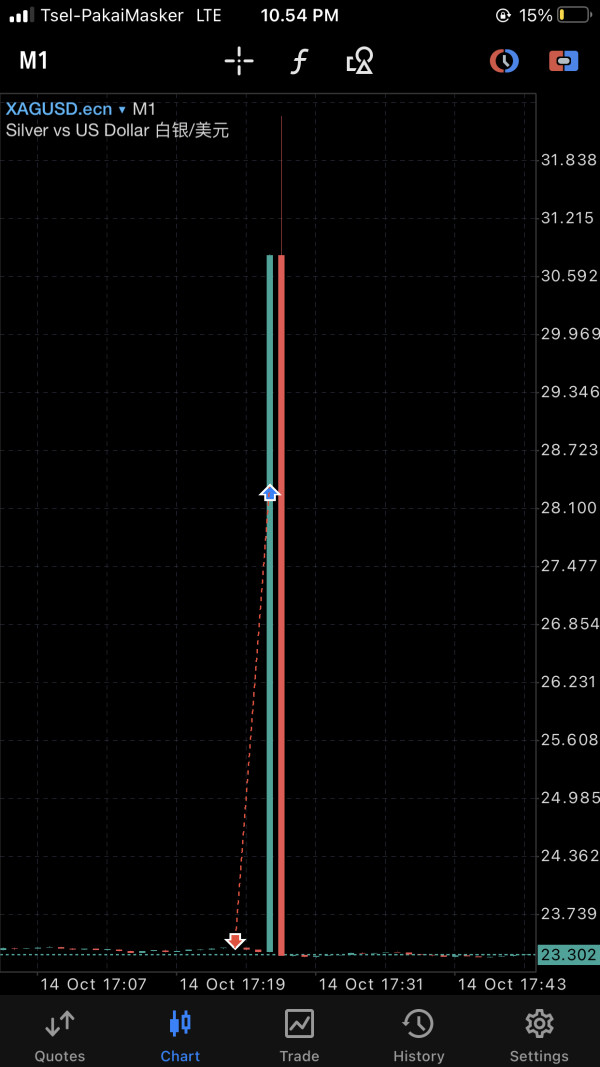

Trading Experience Analysis (Score: 5/10)

The trading experience with Sandwind receives an average rating. This rating is primarily supported by the availability of established platforms like MT5. MetaTrader 5 provides reliable order execution, advanced charting capabilities, and comprehensive technical analysis tools that experienced traders expect. The platform's stability and feature set help maintain acceptable trading functionality despite other broker limitations.

However, crucial details about execution quality, spread competitiveness, and liquidity provision are not available in accessible materials. Without information about order execution speeds, slippage rates, or market depth, traders cannot assess whether Sandwind provides competitive trading conditions. The absence of execution statistics or third-party verification of trading performance creates uncertainty about actual trading quality.

User feedback does not highlight severe technical issues with platform functionality. This suggests that basic trading operations work adequately. However, the lack of detailed performance metrics, execution transparency, and competitive trading conditions prevents a higher rating. This sandwind review notes that while the platform infrastructure appears functional, the overall trading environment lacks the transparency and competitive features that characterize leading brokers.

Trust and Safety Analysis (Score: 2/10)

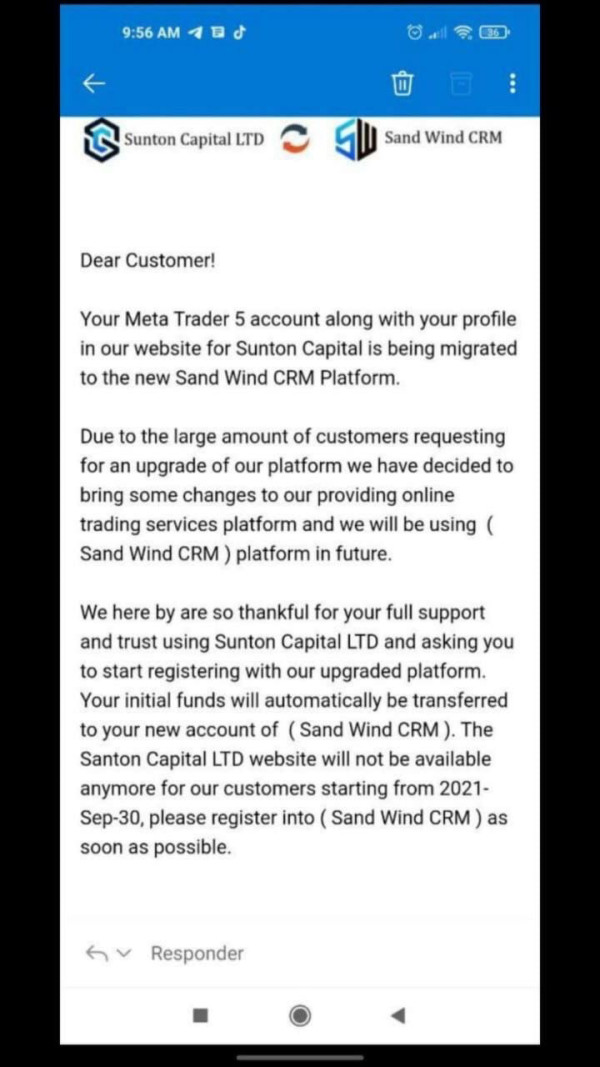

Trust and safety receive the lowest rating due to fundamental concerns about regulatory oversight and operational transparency. The absence of verifiable regulatory licensing from recognized authorities like ASIC, FCA, CySEC, or other major financial regulators represents a critical safety concern. Regulated brokers typically provide client fund segregation, compensation schemes, and regulatory oversight that protect trader interests.

Sandwind's 1.44 rating on WikiFX, combined with multiple user complaints, indicates significant trust issues within the trading community. The broker's offshore status without clear regulatory backing means traders have limited recourse in case of disputes or operational problems. Available materials provide no information about client fund protection, segregated accounts, or insurance coverage that regulated brokers typically offer.

The lack of transparency about company ownership, financial backing, and operational procedures further undermines trust. Without audited financial statements, regulatory filings, or third-party verification of business practices, traders cannot assess the broker's financial stability or operational integrity. These fundamental trust and safety concerns make Sandwind unsuitable for most retail traders.

User Experience Analysis (Score: 4/10)

Overall user experience receives a below-average rating based on available feedback and the broker's operational limitations. The low WikiFX rating and multiple complaints suggest that users encounter significant difficulties with various aspects of the trading experience. While some traders may find the platform functionality adequate, the broader user experience appears compromised by poor customer service, limited transparency, and trust concerns.

The broker's interface design and platform usability benefit from MT5's established functionality. Most traders find this platform familiar and efficient. However, account opening procedures, verification processes, and funding operations lack the clarity and efficiency that users expect from professional brokers. The absence of detailed onboarding information suggests potential difficulties for new users.

Common user complaints appear focused on transparency issues, customer service responsiveness, and general broker reliability. While not all feedback is negative, the preponderance of concerns suggests that most users would benefit from choosing more established alternatives. Improvements in transparency, customer service quality, and regulatory compliance would be necessary to enhance the overall user experience significantly.

Conclusion

This comprehensive sandwind review reveals a broker with significant limitations that outweigh its few positive attributes. While Sandwind offers access to established trading platforms like MT5 and provides trading across multiple asset classes, the fundamental concerns about regulatory oversight, transparency, and customer service quality make it a risky choice for most traders.

The broker may be suitable only for highly experienced traders who fully understand offshore broker risks and can navigate the challenges associated with limited regulatory protection. However, most retail traders would benefit significantly from choosing regulated alternatives that provide greater transparency, better customer protection, and more comprehensive support services.

The main advantages include platform diversity and multi-asset trading capabilities. However, these are overshadowed by critical disadvantages including lack of regulatory oversight, poor customer service feedback, and insufficient operational transparency. Potential traders should carefully consider these factors and explore regulated alternatives before committing funds to Sandwind.