Is Prorods safe?

Business

License

Is Prorods Safe or a Scam?

Introduction

Prorods is a relatively new player in the forex market, having been established in 2021. Positioned as a broker operating out of the United Kingdom, it aims to provide various trading services to forex traders. However, the influx of new brokers often raises concerns among traders regarding their legitimacy and reliability. It is vital for traders to conduct thorough assessments of forex brokers before committing their funds, as the market is rife with scams and poorly regulated entities. This article aims to investigate whether Prorods is a safe trading option or if it raises red flags that warrant caution. The evaluation will be based on regulatory status, company background, trading conditions, customer experiences, and risk assessments, utilizing multiple sources of information to provide a comprehensive overview.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is crucial for assessing its safety. A well-regulated broker is generally seen as more trustworthy than one without oversight. Prorods claims to have regulatory affiliations with the Australian Securities and Investments Commission (ASIC) and the National Futures Association (NFA). However, it is essential to verify the validity of these claims.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| ASIC | 001292774 | Australia | Revoked |

| NFA | 0538567 | USA | Active |

Despite its claims, it is concerning that Prorods' ASIC regulation has been revoked, which casts doubt on its operational legitimacy. The revocation of a license is a significant warning sign, indicating potential compliance issues or fraudulent activities. Furthermore, the absence of any strong regulatory oversight from a reputable body such as the Financial Conduct Authority (FCA) in the UK raises additional concerns about the broker's legitimacy.

The quality of regulation is paramount; brokers regulated by top-tier authorities are typically subject to stringent compliance requirements, ensuring a higher level of investor protection. In contrast, Prorods' regulatory status, particularly the revocation by ASIC, suggests that it may not adhere to the necessary standards, prompting potential risks for traders. Therefore, assessing the regulatory framework is essential when determining if Prorods is safe or a scam.

Company Background Investigation

Prorods was founded in 2021, making it a relatively new entrant in the forex trading space. The company claims to operate from the United Kingdom, yet the lack of detailed information regarding its ownership structure and management team raises transparency concerns. A reputable broker typically provides comprehensive information about its history, ownership, and the qualifications of its key personnel.

The management teams background is crucial in evaluating the broker's credibility. In cases where the team lacks experience or a solid track record in the financial sector, this may indicate potential risks. Transparency in operations and information disclosure is equally important; brokers that fail to provide clear information about their operations may be trying to hide something.

Furthermore, the overall stability of the company can be assessed by looking at its business model and any historical compliance issues. Prorods has received multiple complaints regarding delayed payments and withdrawal issues, which can be indicative of underlying operational problems. Thus, the lack of transparency surrounding Prorods ownership and management, combined with its short history, raises significant questions about whether it is a safe broker.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, play a critical role in attracting and retaining traders. Prorods offers a variety of trading options; however, the overall fee structure and any hidden costs need to be analyzed thoroughly. A transparent fee structure is essential for traders to make informed decisions.

| Fee Type | Prorods | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | None | 0.1-0.5% |

| Overnight Interest Range | 0.5-1% | 0.5-1% |

Prorods appears to offer competitive spreads on major currency pairs, but the lack of clarity regarding commissions and overnight interest rates raises concerns. Traders should be wary of any fees that may not be clearly disclosed upfront. There have been reports of unexpected charges, which can significantly affect trading profitability.

Additionally, the absence of a clear commission structure may lead traders to question the broker's transparency. Traders should always seek brokers with clearly defined fee structures to avoid unpleasant surprises. Overall, while Prorods may present itself as an appealing option, the ambiguity surrounding its trading conditions could indicate potential risks, making it crucial for traders to evaluate whether Prorods is safe or a scam.

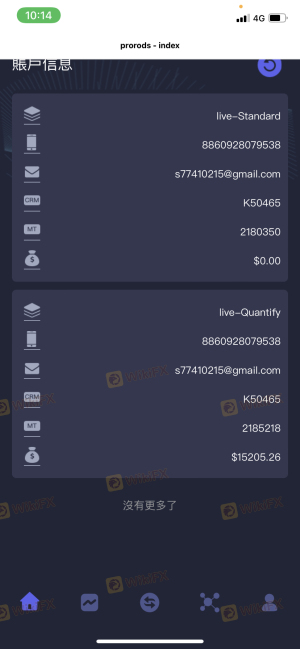

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Brokers must implement robust measures to protect client deposits and ensure their funds are managed securely. Prorods claims to maintain client funds in segregated accounts, which is a standard practice among reputable brokers. This measure helps to ensure that client funds are not used for the company's operational expenses.

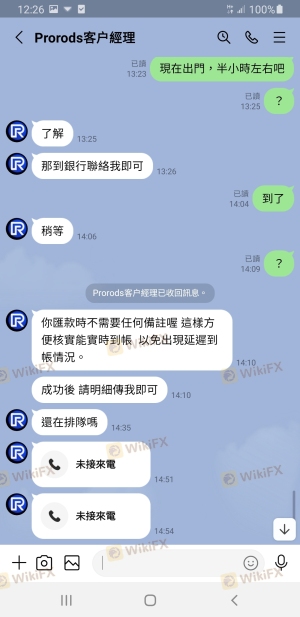

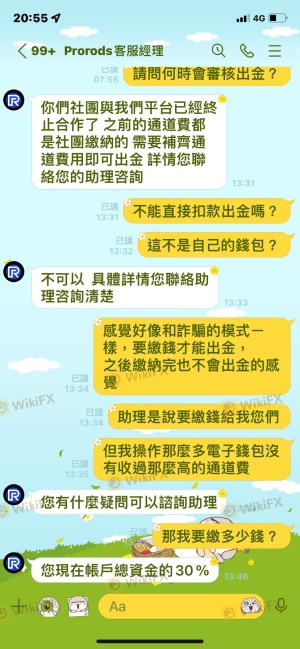

However, the effectiveness of these measures can only be assessed through historical performance and any reported incidents of fund mismanagement. Prorods has faced complaints from users regarding delayed withdrawals and requests for additional fees, which raises concerns about the actual safety of client funds.

Investors should also consider whether the broker offers negative balance protection, which ensures that traders cannot lose more than their initial investment. This safeguard is particularly important in the volatile forex market, where sudden price movements can lead to significant losses.

In summary, while Prorods claims to implement standard safety measures, the existence of complaints regarding fund accessibility and management raises significant concerns about whether it is truly safe for traders to invest their money.

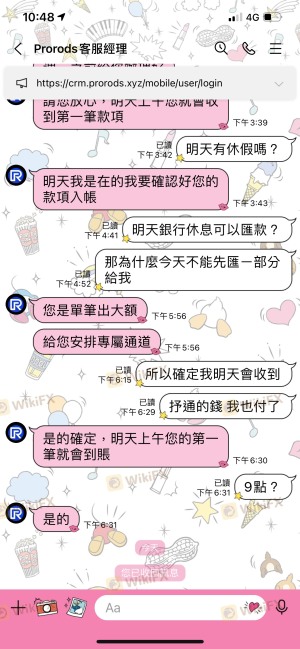

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and overall service quality. Prorods has received numerous complaints, with users reporting issues related to delayed payments, withdrawal difficulties, and unresponsive customer service. These patterns of complaints are alarming and warrant careful consideration.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Delayed Withdrawals | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

| Additional Fee Requests | High | Poor |

The severity of complaints, particularly regarding withdrawal issues, suggests that traders may face significant challenges when trying to access their funds. In one case, a user reported being asked to pay additional fees before being allowed to withdraw, which is a common tactic used by scam brokers.

The company's response to these complaints has also been criticized, with many users expressing frustration over the lack of timely support. This highlights a concerning trend that could indicate systemic issues within the broker's operations. Given the volume of complaints and the seriousness of the issues raised, it is essential for potential clients to consider whether Prorods is safe or a scam.

Platform and Trade Execution

The trading platform and execution quality are critical components of a trader's experience. Prorods provides a trading platform that claims to be user-friendly, but user experiences suggest otherwise. Many traders have reported issues with platform stability and execution speed, which can have a direct impact on trading performance.

The quality of order execution, including slippage and rejection rates, is another area of concern. Traders expect their orders to be executed quickly and at the desired price, but complaints about frequent slippage and rejected orders have surfaced. Such issues can significantly hinder a trader's ability to capitalize on market opportunities.

In conclusion, while Prorods markets itself as a reliable trading platform, the negative feedback regarding execution quality and platform stability raises serious questions about its operational integrity. Traders need to evaluate whether they can trust Prorods to provide a reliable trading environment.

Risk Assessment

Using Prorods for trading involves several risks that potential clients should be aware of. The lack of strong regulatory oversight, coupled with numerous complaints regarding fund withdrawals and trading conditions, presents a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Revoked ASIC license raises concerns. |

| Fund Security | Medium | Complaints about delayed withdrawals. |

| Trading Conditions | High | Ambiguous fees and execution issues. |

To mitigate these risks, traders should consider starting with a small deposit, ensuring they have a clear understanding of the broker's fee structure, and closely monitoring their trading activities. Additionally, seeking out brokers with robust regulatory oversight and positive customer feedback can significantly reduce risk exposure.

Conclusion and Recommendations

In summary, Prorods presents several red flags that warrant caution. The revocation of its ASIC license, numerous complaints regarding fund accessibility, and concerns about trading conditions all suggest that potential traders should approach with care. While it may offer attractive trading conditions, the underlying issues raise significant doubts about its safety.

For traders seeking reliable alternatives, consider brokers regulated by top-tier authorities such as the FCA or ASIC, with strong customer support and transparent trading conditions. Brokers with established reputations and positive user feedback provide a safer trading environment and can help mitigate the risks associated with forex trading. Ultimately, thorough research and due diligence are essential in ensuring a safe trading experience.

Is Prorods a scam, or is it legit?

The latest exposure and evaluation content of Prorods brokers.

Prorods Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Prorods latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.