Is Lilium safe?

Pros

Cons

Is Lilium Safe or Scam?

Introduction

Lilium, a trading name of Lilium Markets Ltd, has emerged as a player in the forex and online trading markets since its establishment in 2019. The broker claims to offer a diverse range of tradable assets, including stocks, ETFs, forex, indices, and commodities. However, with the rise of online trading, it has become crucial for traders to evaluate the legitimacy and safety of brokers before committing their funds. The forex market is notorious for its volatility and the presence of unscrupulous entities, making it imperative for traders to engage with reliable and well-regulated brokers. This article aims to assess the safety of Lilium by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory environment is a cornerstone of trust in the financial services industry. A broker's regulatory status can significantly influence its credibility and the safety of clients' funds. Lilium is reportedly registered in the United Kingdom but lacks oversight from top-tier regulatory bodies, which raises concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Unregulated |

| NFA | N/A | US | Unregulated |

Lilium has been flagged as an unregulated entity, which means it does not adhere to the stringent requirements set by reputable authorities like the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US. The lack of regulatory oversight is a significant red flag, as it suggests that the broker may not be held accountable for its actions or business practices. Moreover, historical compliance issues and expired licenses further contribute to doubts about Lilium's operational integrity. Traders should be cautious, as engaging with unregulated brokers can expose them to risks such as fraud or mismanagement of funds.

Company Background Investigation

Lilium's journey began in 2019, and its corporate structure indicates a relatively young company in the trading sector. While the broker claims to provide a wide array of services, the transparency surrounding its ownership and management team is limited. The lack of publicly available information on key executives and their backgrounds raises questions about the company's governance.

The management team's experience in the financial sector is critical for ensuring operational competence and customer trust. Without detailed information on their qualifications, it becomes challenging to assess whether Lilium is equipped to navigate the complexities of the trading environment. Furthermore, the company's transparency in disclosing operational practices and financial health is vital for building trust with potential clients. A broker that lacks clear communication about its practices may not be a safe option for traders.

Trading Conditions Analysis

Understanding the trading conditions offered by Lilium is essential for evaluating its overall safety and reliability. The broker presents a range of trading instruments and accounts, but the fees associated with trading can significantly impact profitability.

| Fee Type | Lilium | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 0.5 pips |

| Commission Model | From $0.00/lot | $5.00/lot |

| Overnight Interest Range | N/A | 2-3% |

Lilium advertises competitive spreads and a commission-free model for certain account types, which may initially appear attractive. However, the absence of clarity regarding overnight interest rates and potential hidden fees could lead to unexpected costs for traders. Additionally, some users have reported issues with withdrawal processes, indicating that Lilium may not have the most favorable trading conditions. Therefore, traders should approach this broker with caution, as the trading conditions may not be as beneficial as they seem at first glance.

Client Fund Safety

The safety of client funds is paramount when assessing a broker's reliability. Lilium claims to implement various measures to protect client funds, but the lack of regulatory oversight raises concerns about the effectiveness of these measures.

The broker's approach to fund security includes claims of segregated accounts for client funds, which is a standard practice in the industry. However, without regulatory oversight, there is no guarantee that these measures are being implemented effectively. Furthermore, the absence of investor protection schemes, such as those provided by the FCA or NFA, leaves traders vulnerable to potential losses. Historical complaints regarding fund withdrawals and issues with account management have been reported, indicating that Lilium may not provide the level of security that traders expect.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a broker's reliability. Lilium has received mixed reviews from users, with several complaints highlighting issues related to withdrawal difficulties and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited availability |

| Account Management | High | Unresolved issues |

Many users have reported being unable to withdraw their funds in a timely manner, which is a significant concern for any trader. Additionally, complaints about the quality of customer support suggest that Lilium may not prioritize client satisfaction. While some traders have had positive experiences, the prevalence of negative reviews warrants caution.

Platform and Trade Execution

The performance of a trading platform directly influences user experience and satisfaction. Lilium offers access to popular trading platforms such as WebTrader and MetaTrader 5. However, the stability and execution quality of these platforms are crucial factors to consider.

Traders have reported varying experiences with order execution, including instances of slippage and rejected orders. Such issues can have serious implications for a trader's strategy and profitability. Furthermore, any signs of platform manipulation or irregularities in trade execution should raise red flags for potential users.

Risk Assessment

Using Lilium as a trading platform presents several risks that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker status |

| Fund Safety Risk | High | Lack of investor protection |

| Customer Service Risk | Medium | Complaints about support |

| Platform Stability Risk | Medium | Reports of execution issues |

Traders should approach Lilium with a clear understanding of these risks and consider implementing risk mitigation strategies, such as setting strict stop-loss orders and diversifying their trading activities across multiple brokers.

Conclusion and Recommendations

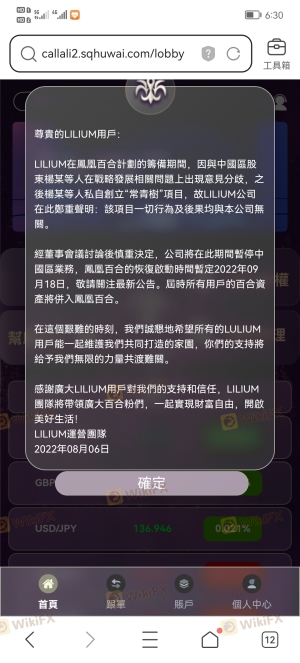

In conclusion, the investigation into Lilium raises several concerns regarding its legitimacy and safety. The broker's unregulated status, lack of transparency about its management, and numerous customer complaints suggest that traders should exercise caution. While Lilium offers a range of trading instruments and competitive conditions, the potential risks associated with engaging with this broker may outweigh the benefits.

For traders seeking reliability and security, it may be prudent to consider regulated alternatives that offer robust investor protections and a proven track record of customer satisfaction. Brokers such as Interactive Brokers, eToro, and XTB provide a more secure trading environment, ensuring that traders can navigate the forex market with confidence. Ultimately, it is crucial for traders to conduct thorough research and remain vigilant when selecting a broker to ensure their investments are safe.

Is Lilium a scam, or is it legit?

The latest exposure and evaluation content of Lilium brokers.

Lilium Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Lilium latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.