Harbor FX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Established in 2020, Harbor FX positions itself as a promising online broker that offers a wide array of trading instruments including forex, commodities, and cryptocurrencies. Catering primarily to beginner and intermediate traders, it emphasizes competitive trading conditions characterized by low commissions and a user-friendly mobile platform. However, potential customers must weigh this against significant scrutiny concerning regulatory compliance, particularly regarding the legitimacy of its licensing from the Vanuatu Financial Services Commission (VFSC) and alarming reports from users about fund safety and withdrawal issues. Beginner traders seeking cost-effective trading solutions may find Harbor FX appealing, but its mixed user feedback signals that a cautious approach is warranted.

⚠️ Important Risk Advisory & Verification Steps

Risk Advisory:

- Harbor FX has faced serious regulatory concerns, particularly regarding its claimed license with the VFSC, raising questions about its legitimacy.

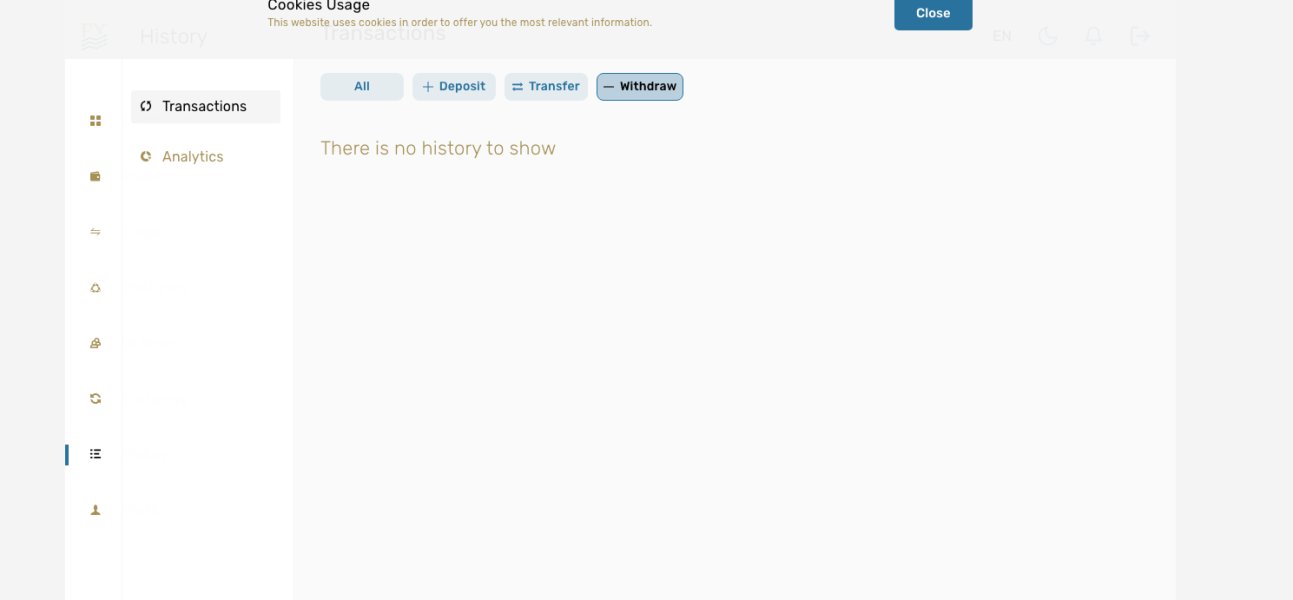

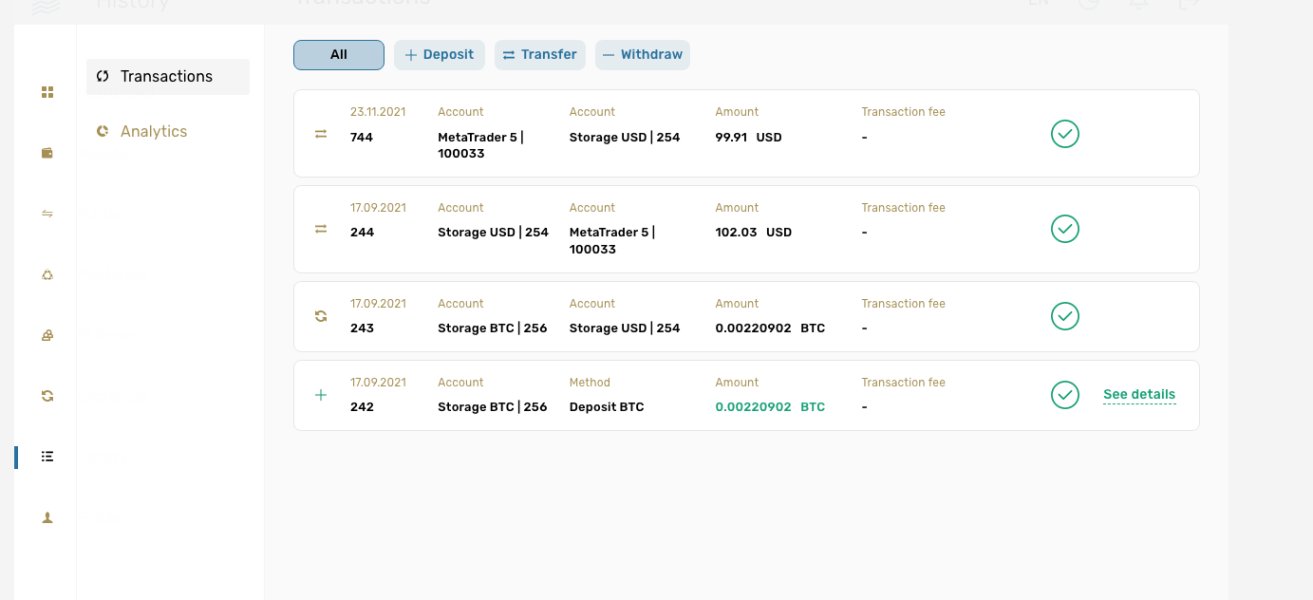

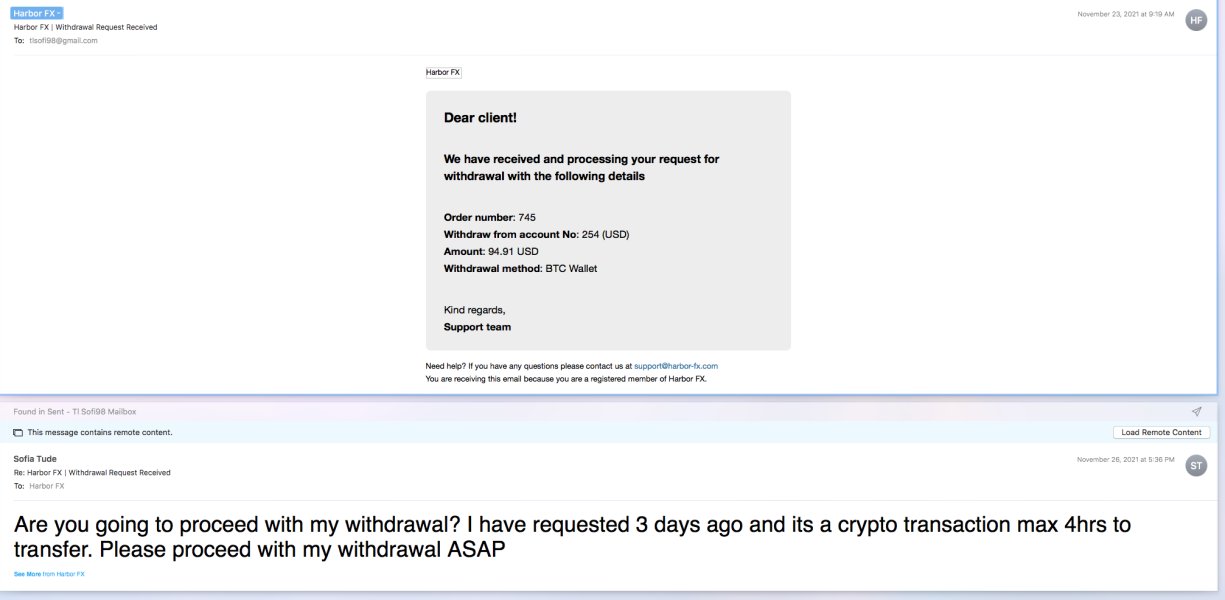

- Numerous user reports indicate significant withdrawal challenges, suggesting potential risks to fund safety.

- Mixed reviews label the broker as a potential scam, leading to widespread distrust among experienced traders.

Potential Harms:

- Loss of deposited funds due to regulatory inadequacies.

- Difficulty in accessing funds should withdrawal requests be denied.

Self-Verification Steps:

- Research the Broker: Visit the official regulatory sites like the VFSC and cross-check Harbor FX's claimed status.

- Seek User Reviews: Look for real-user feedback on trading forums and review platforms for first-hand experiences.

- Test the Withdrawal Process: Before making a significant investment, start with a small amount to ensure the withdrawal process works smoothly.

Rating Framework

Broker Overview

Company Background and Positioning

Harbor FX, launched in 2020, is headquartered in Vanuatu and claims regulation under the Vanuatu Financial Services Commission (VFSC). As a newly established broker, it enters a competitive market aiming to attract traders by providing diverse trading instruments. However, its recent history is marred by allegations regarding the effectiveness and legitimacy of its regulatory status, with recurring user reports that question its business practices.

Core Business Overview

The broker markets itself as a comprehensive trading platform for forex, commodities, cryptocurrencies, and other assets. Scripts include its in-house mobile trading platform tailored for accessibility and user engagement. While Harbor FX boasts features such as maximum leverage of 1:400 and spreads starting at 0.1 pips, the claimed regulatory cover from the VFSC should be carefully scrutinized given concerns about its actual enforcement capabilities.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

In assessing Harbor FX's trustworthiness, several contradictions in regulatory information arise.

Regulatory Information Conflicts:

Reports indicate that the Vanuatu Financial Services Commission's oversight might not provide robust security, with claims of licenses being revoked. This uncertainty heightens the perceived risk for prospective traders relying on regulatory backing.

User Self-Verification Guide:

- Visit the VFSC Website: Search for Harbor FX in their license registry.

- Check Other Regulatory Bodies: Use resources like the NFA's BASIC database to cross-verify claims.

- Follow Community Feedback: Visit trading forums and social platforms to gather opinions from current or former traders.

Industry Reputation and Summary:

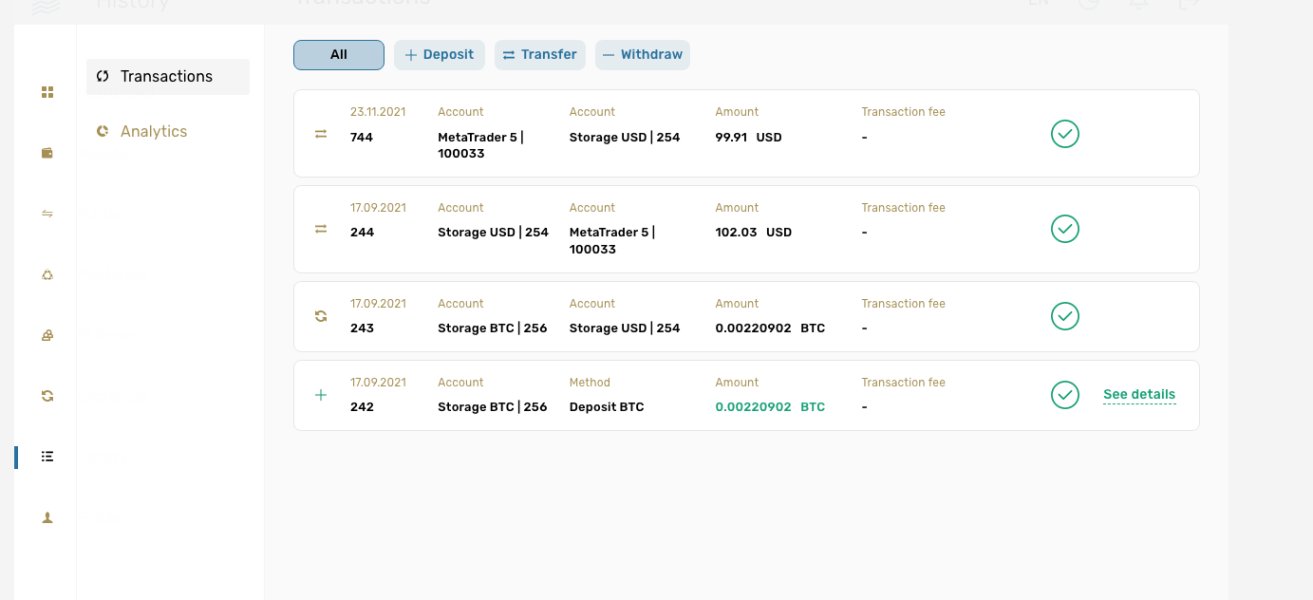

Feedback from users highlights significant concerns about fund safety. For instance,

“I faced withdrawal issues, and the support was unresponsive. It feels risky.”

This sentiment needs to be considered when evaluating the brokers legitimacy and trust factor.

Trading Costs Analysis

Harbor FX provides an attractive commission structure but also conceals potential pitfalls.

Advantages in Commissions:

The broker offers competitive commissions, making it an appealing choice for cost-conscious traders. Spreads reportedly start from as low as 0.1 pips, alleviating the financial burden for frequent traders.

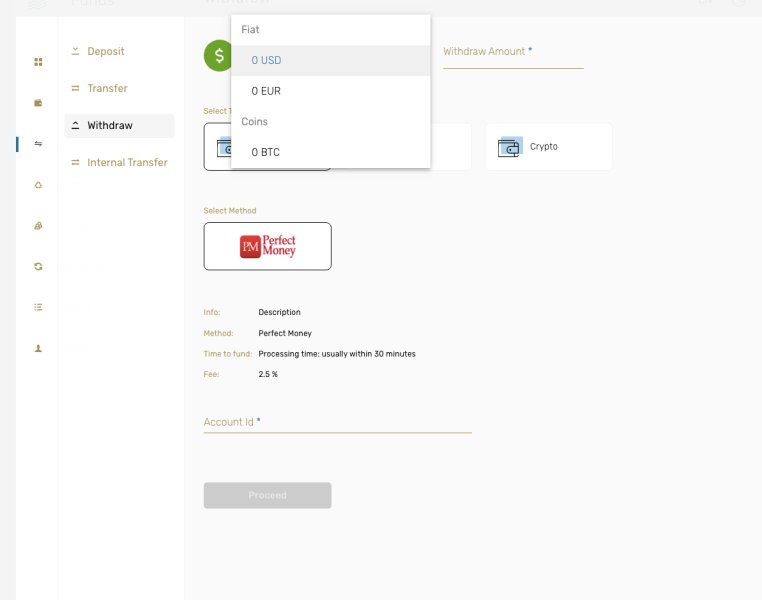

The "Traps" of Non-Trading Fees:

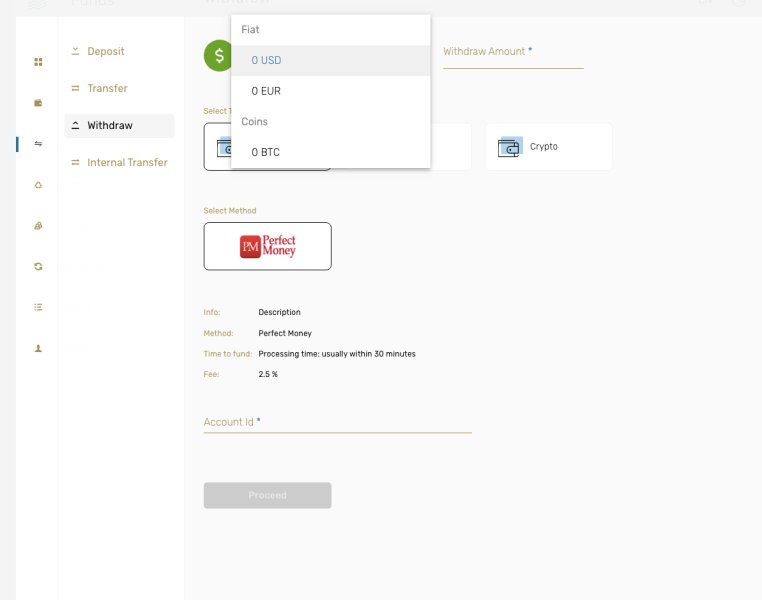

Despite the low trading costs, users have reported $30 withdrawal fees, which can significantly impact profitability.

“I didn't expect the hidden fees. $30 for a withdrawal eats away at my profits.”

Cost Structure Summary:

While beginner traders may find the commission rates advantageous, those with larger trading volumes or withdrawal needs should tread carefully due to the unanticipated costs associated with withdrawals.

Analyzing the platforms and tools provided by Harbor FX reveal a sharp focus on mobile technology.

Platform Diversity:

Harbor FX operates exclusively with a mobile trading application that allows traders to manage their accounts and execute trades on-the-go. While this is advantageous for mobile users, it limits accessibility for those preferring desktop trading.

Quality of Tools and Resources:

The proprietary platform lacks advanced analytics compared to industry competitors. Although it includes basic features like stop-loss and take-profit orders, comprehensive charting tools are glaringly absent, requiring reliance on external resources for informed decision-making.

Platform Experience Summary:

User experiences are mixed regarding the app's usability and functionality. Several people express satisfaction with the interface, while others note troubling performance issues.

"The app is easy to use, but it crashes more than Id like."

User Experience

Focusing on user experience reveals the mobile nature of Harbor FX's offering.

Mobile Usability:

The application is generally well-received for its intuitive design, helping beginner traders navigate through its features effectively.

Social Trading Features:

Harbor FX promotes social trading elements where users can follow and mimic top-performing traders. While marketed as a key feature, effectiveness can vary based on engaged trader profiles.

Overall User Experience Summary:

Despite the user-friendly experience of the mobile application, the mixed reviews regarding its functionality and performance raise legitimate concerns for potential users regarding reliability.

Customer Support

Examining customer support can considerably impact user satisfaction.

Availability and Responsiveness:

Harbor FX offers round-the-clock support, a significant advantage, especially for international traders. However, reports indicate variability in responsiveness.

Quality of Support:

User feedback suggests that while the support team is friendly, they often lack timely solutions, affecting overall confidence in the broker.

Summary of Support Experience:

Strengths in 24/7 availability are countered by reports of delayed interactions, prompting potential clients to consider the need for effective support before opening an account.

Account Conditions

Assessing account conditions provides insight into user accessibility.

Account Types and Features:

Harbor FX has limited account offerings, all built around the mobile experience with a minimum deposit of $100, catering chiefly to novice traders.

Minimum Deposit and Accessibility:

With a low barrier to entry, it attracts a variety of traders. However, the lack of diverse account types may deter experienced traders in search of specific account features and trading instruments.

Summary of Account Conditions:

The conditions appear favorable for beginners but can pose limitations for those aspiring to access a broader range of trading options and strategies.

Conclusion

In revisiting Harbor FX, it becomes clear that while it offers competitive trading options and a user-friendly mobile platform for newcomer traders, substantial risks, particularly around regulatory oversight, fund safety, and withdrawal issues loom large. As potential users evaluate their next trading platform, a careful consideration of the highlighted risks and self-verification steps will be crucial in determining if Harbor FX is an opportunity or a trap.