Regarding the legitimacy of HARBOR FX forex brokers, it provides VFSC and WikiBit, .

Is HARBOR FX safe?

Pros

Cons

Is HARBOR FX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

HARBOR FINANCIAL GROUP (V) LTD

Effective Date:

2021-07-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1st Floor, Govant Building, P.O. Box 1276, Port Vila, VanuatuPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Harbor Fx Safe or a Scam?

Introduction

Harbor Fx is a relatively new player in the forex market, aiming to provide a user-friendly trading experience primarily through its mobile platform. As more traders enter the forex market, the importance of evaluating the credibility and safety of brokers has never been more critical. With numerous scams and unregulated entities in the industry, traders must conduct thorough research before committing their funds. This article investigates the safety and legitimacy of Harbor Fx by examining its regulatory status, company background, trading conditions, client fund security, user experiences, and risk factors.

Regulation and Legitimacy

Regulation serves as a crucial pillar of trust in the financial services industry. Harbor Fx claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC), which is known for its stringent regulatory framework. Below is a table summarizing key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 230/14 | Cyprus | Verified |

The significance of this regulation cannot be overstated. CySEC requires brokers to maintain a minimum capital of €730,000 and keep client funds in segregated accounts. Additionally, all licensed brokers are part of the Investor Compensation Fund, which provides a safety net for clients in case of broker insolvency, covering up to €20,000 per person. However, it is essential to consider that while CySEC is a reputable authority, it does not have the same global recognition as other top-tier regulators like the FCA in the UK or the SEC in the US. This raises questions about the overall regulatory quality and historical compliance of Harbor Fx.

Company Background Investigation

Founded in 2013, Harbor Fx has positioned itself as a fintech company focusing on mobile trading solutions. Its headquarters are located in Cyprus, with a technical office in Hong Kong. The company's ownership structure and management team are not extensively disclosed, which can be a red flag for potential investors. Transparency is key in building trust, and a lack of information about the management team can lead to concerns regarding accountability and operational integrity.

The absence of publicly available information about the management's professional background and experience raises questions about the company's transparency. A broker with a well-defined management structure and an experienced team often inspires more confidence among traders. Therefore, while Harbor Fx is regulated, the limited information available about its company background could be a cause for concern for potential clients.

Trading Conditions Analysis

Understanding the trading conditions offered by Harbor Fx is essential for evaluating its overall value proposition. The broker offers a single commission-free account type with a minimum deposit requirement of $50, which is relatively low compared to industry standards. Below is a comparison of core trading costs:

| Cost Type | Harbor Fx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 - 2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Variable | Variable |

While the spreads start at 2 pips, which is not significantly higher than the industry average, the absence of a commission model can be attractive for new traders. However, traders should remain cautious of any hidden fees or unfavorable conditions that could affect their trading profitability. The overall cost structure appears competitive, but potential clients should carefully read the terms and conditions to avoid unexpected charges.

Client Fund Security

The safety of client funds is paramount when assessing whether Harbor Fx is safe. The broker claims to implement various security measures, including segregated accounts for client funds. This practice is essential for protecting client money from being used for operational expenses. Furthermore, Harbor Fx adheres to the Investor Compensation Fund guidelines, which adds an extra layer of security for clients.

However, it is crucial to investigate any historical issues regarding fund security. While there have been no widely reported incidents of fund mismanagement or fraud associated with Harbor Fx, the lack of extensive client reviews and testimonials makes it challenging to ascertain the broker's reliability fully. Therefore, potential clients should approach with caution and consider the overall security measures in place.

Customer Experience and Complaints

User feedback is a valuable indicator of a broker's reliability. Analyzing customer experiences with Harbor Fx reveals a mixed bag of opinions. While some users praise the mobile platform's user-friendly interface, others have raised concerns about customer support and withdrawal delays. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

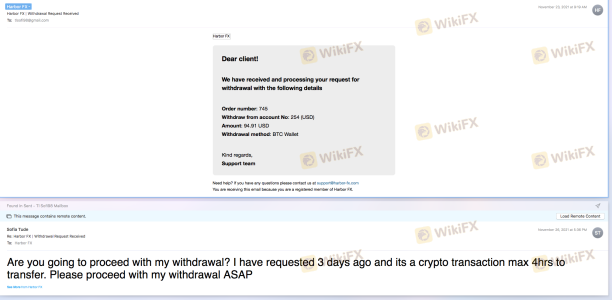

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Mixed Feedback |

| Platform Stability | Low | Generally Positive |

Two notable cases highlight these issues. One user reported a significant delay in processing their withdrawal request, leading to frustration and concerns about fund security. Another trader mentioned difficulties in reaching customer support, which hindered their trading experience. While these complaints may not represent the entire user base, they warrant attention and indicate areas for improvement within the company.

Platform and Execution

Harbor Fx operates exclusively through a mobile trading platform, which may appeal to traders who prefer on-the-go access. The platform is designed to be user-friendly and includes features such as market orders, stop-loss orders, and trade history tracking. However, the focus on mobile-only trading limits options for more experienced traders who may require advanced charting tools and desktop access.

Regarding order execution, the broker claims to utilize straight-through processing (STP) to minimize conflicts of interest. However, the absence of detailed information on order execution quality raises concerns about potential slippage and re-quotes. Traders should remain vigilant for any signs of order manipulation, as this could significantly impact their trading outcomes.

Risk Assessment

Trading with Harbor Fx presents a range of risks that potential clients should consider. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated but not top-tier |

| Operational Risk | Medium | Limited information on management |

| Fund Security | Medium | Segregated accounts, but mixed reviews |

| Customer Support | High | Complaints about slow response |

To mitigate these risks, traders should conduct thorough due diligence before opening an account. Additionally, starting with a smaller investment can help minimize potential losses while assessing the broker's reliability.

Conclusion and Recommendations

In conclusion, the investigation into Harbor Fx suggests that while it is a regulated entity, there are several areas of concern that potential clients should consider. The broker's regulatory status with CySEC provides a level of safety, but the lack of transparency regarding its management and mixed user experiences raise red flags.

Traders should be cautious when considering Harbor Fx, especially if they are new to the forex market. It may be advisable to explore more established brokers with a proven track record and robust regulatory oversight. Some alternative options could include brokers regulated by top-tier authorities like the FCA or ASIC, which typically offer higher levels of investor protection.

Ultimately, while Harbor Fx is not outright a scam, it does exhibit characteristics that warrant careful consideration. Traders should weigh the potential benefits against the associated risks before deciding to engage with this broker.

Is HARBOR FX a scam, or is it legit?

The latest exposure and evaluation content of HARBOR FX brokers.

HARBOR FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HARBOR FX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.