Renhe 2025 Review: Everything You Need to Know

Summary

This renhe review shows a troubling picture of a broker that has faced harsh criticism from traders. Renhe International was established in 2019 and has its headquarters in Beijing with registration in the Bahamas, offering financial investment services that include forex, precious metals, indices, commodities, and cryptocurrencies. The broker's main features include maximum leverage of up to 1:1000. They also claim to provide complete financial investment services. However, user feedback shows serious problems with the platform. These problems include claims of scam behavior and trading disruptions. Multiple user reports say that trading activities have been stopped since February 2025. Traders describe the company as "scammers." The broker mainly targets investors who want high-leverage trading opportunities. But the overwhelming negative feedback suggests major operational and trustworthiness concerns that potential clients should carefully consider before using this platform.

Important Notice

This review uses publicly available information and user feedback from various sources. Renhe International is registered in the Bahamas under the Securities Commission of the Bahamas (SCB) regulatory framework. This may differ from other jurisdictions' regulatory standards. Potential traders should know that regulatory protection and recourse mechanisms may vary greatly between different regulatory regions. The information in this evaluation reflects the most current available data. However, the dynamic nature of the forex industry means that broker conditions, services, and regulatory status can change rapidly. We strongly advise conducting independent research and due diligence before making any investment decisions.

Rating Overview

Broker Overview

Renhe International entered the forex market in 2019. It positions itself as an online brokerage company based in Beijing, China, while keeping its regulatory registration in the Bahamas. The company presents itself as a complete financial services provider. It offers trading opportunities across multiple asset classes including foreign exchange, precious metals, various indices, commodities, and cryptocurrency markets. The broker's business model focuses on providing high-leverage trading opportunities to attract traders who want amplified market exposure.

The company operates under the regulatory oversight of the Securities Commission of the Bahamas (SCB). However, specific licensing details remain unclear in available documentation. Renhe offers trading across diverse financial instruments. It targets both retail and potentially institutional clients through its online platform. However, the broker's operational transparency and specific platform details are notably limited in publicly available information. This raises questions about the company's commitment to client education and market transparency that characterizes reputable financial service providers.

Regulatory Region: Renhe International operates under the Securities Commission of the Bahamas (SCB) jurisdiction. However, specific license numbers and regulatory compliance details are not clearly disclosed in available materials.

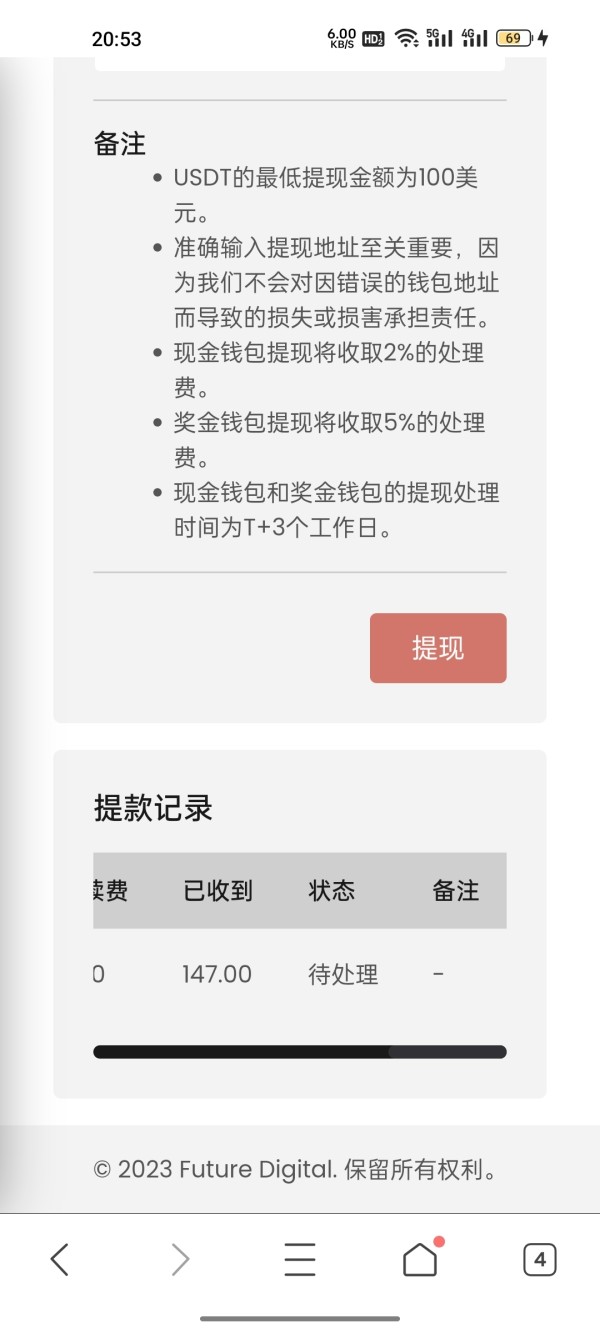

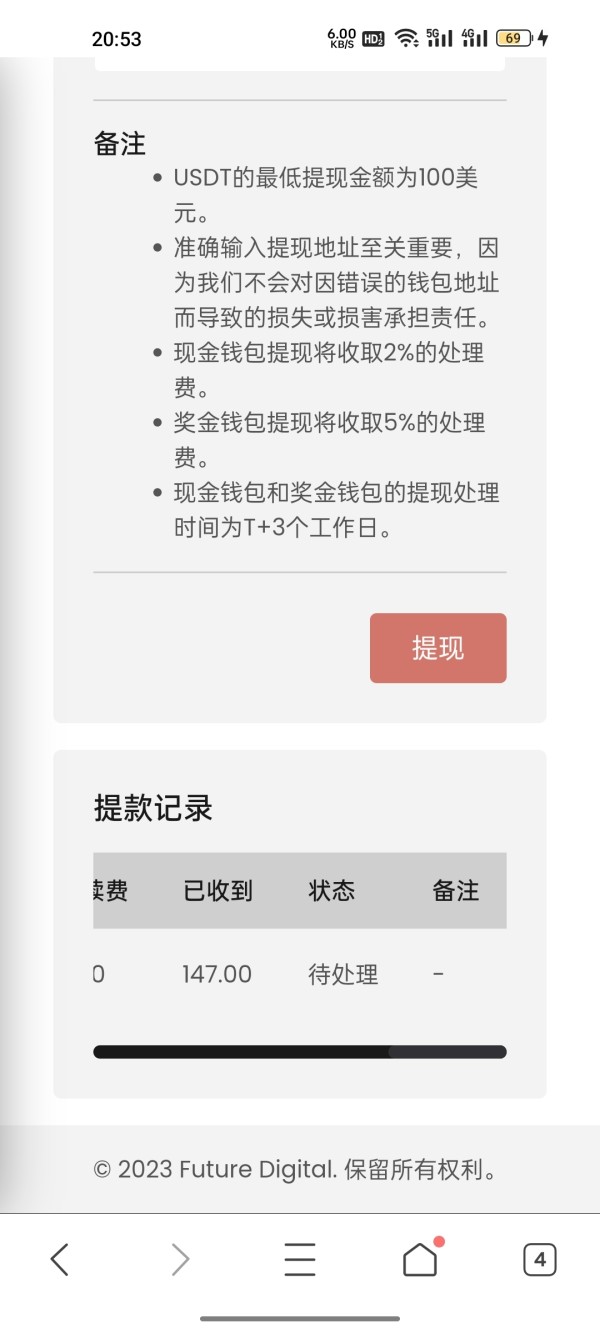

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods, processing times, and associated fees is not detailed in available documentation. This represents a significant transparency gap.

Minimum Deposit Requirements: The minimum deposit requirements for different account types are not specified in accessible broker information. This makes it difficult for potential clients to plan their initial investment.

Bonuses and Promotions: Current promotional offers, welcome bonuses, or trading incentives are not mentioned in available materials. This suggests either absence of such programs or poor marketing transparency.

Tradeable Assets: The broker provides access to forex pairs, precious metals trading, stock indices, various commodities, and cryptocurrency markets. It offers a reasonably diverse portfolio for traders interested in multiple asset classes.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available. This significantly hampers traders' ability to assess the true cost of trading with this renhe review subject.

Leverage Ratios: The broker offers maximum leverage of up to 1:1000. This represents extremely high leverage that carries substantial risk for inexperienced traders.

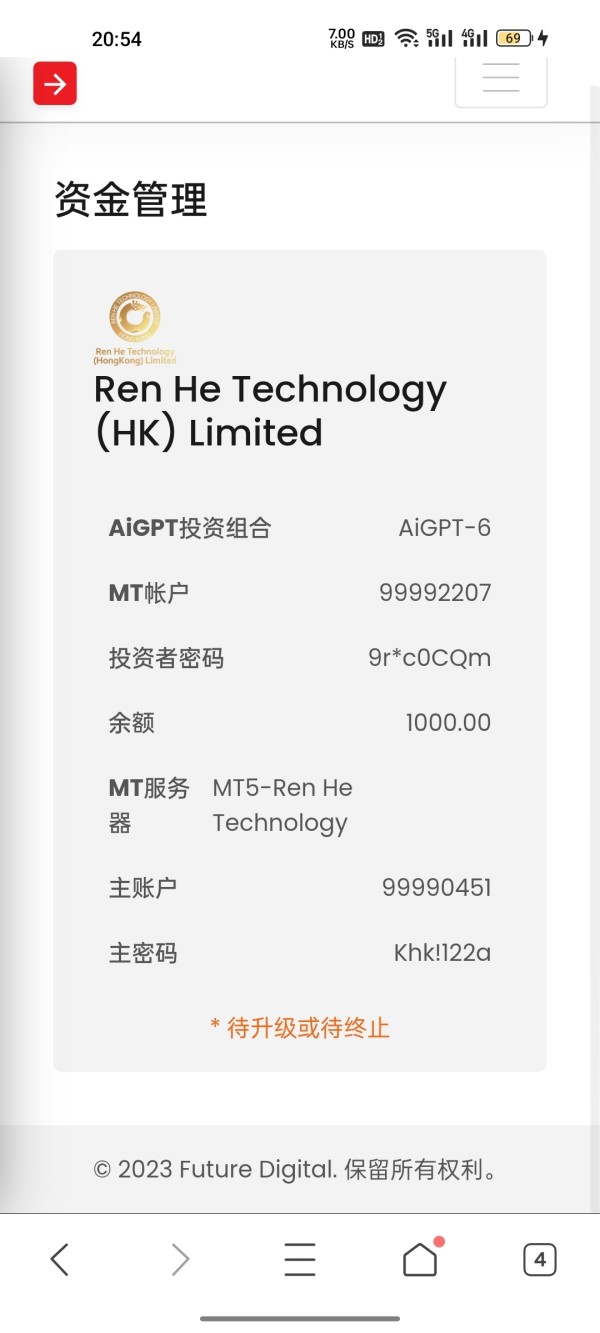

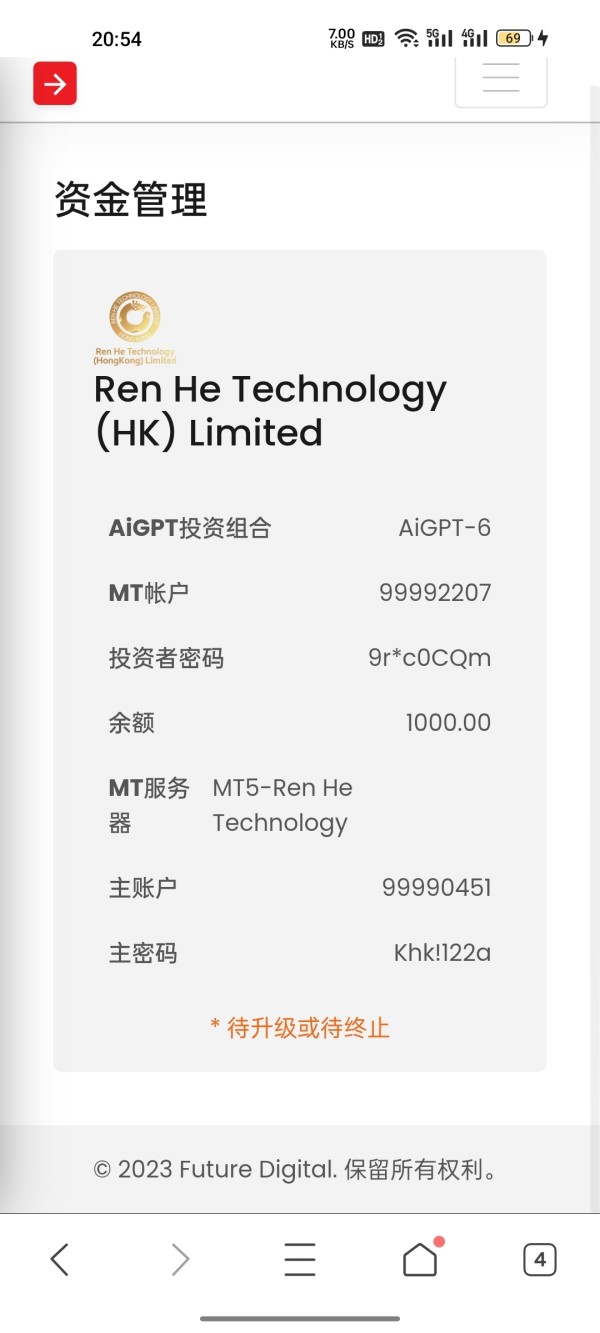

Platform Options: Specific trading platform information is not detailed in available documentation. This includes whether the broker uses MetaTrader, proprietary platforms, or other solutions.

Regional Restrictions: Information about geographical restrictions and jurisdictional limitations is not clearly specified in accessible materials.

Customer Service Languages: Available customer support languages and communication options are not detailed in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Renhe International show several concerning gaps in transparency and clarity. Available information fails to specify the different account types available to traders. It also doesn't mention their respective features or the minimum deposit requirements for each tier. This lack of transparency makes it extremely difficult for potential clients to understand what they're signing up for. It also makes it hard to compare offerings with other brokers in the market.

The absence of clear information about account opening procedures, verification requirements, and account maintenance conditions represents a significant red flag. This is especially true in the modern forex industry, where transparency is increasingly expected by both regulators and traders. User feedback suggests dissatisfaction with account conditions. However, specific details about account features, benefits, or limitations are not readily available. The broker's failure to provide comprehensive account information contrasts sharply with industry standards. Detailed account specifications are considered essential for informed decision-making in the industry. This renhe review finds that the lack of account transparency significantly undermines trader confidence. It also suggests poor operational standards.

Renhe International's trading tools and resources present a mixed picture with significant information gaps. The broker mentions providing a financial calendar. This is a basic but useful tool for traders tracking market-moving events. However, the absence of detailed information about specific trading platforms, analytical tools, charting capabilities, and technical indicators represents a substantial weakness in their offering.

The company claims to provide investor education. But specific details about educational resources, webinars, tutorials, or market analysis are not readily available in public documentation. This lack of detailed information about research and analysis resources makes it difficult for traders to assess whether the broker provides adequate support for informed trading decisions. The absence of information about automated trading support, expert advisors, or algorithmic trading capabilities further limits the appeal for more sophisticated traders. User feedback suggests that the available tools may not meet trader expectations. However, specific complaints about tool functionality are not detailed in available reports.

Customer Service and Support Analysis (Score: 2/10)

Customer service represents one of Renhe International's most significant weaknesses. This is based on available user feedback and documentation. Multiple user reports indicate serious issues with customer support responsiveness. Traders express frustration about delayed responses and inadequate problem resolution. The lack of clearly specified customer service channels, operating hours, and support languages creates additional barriers for traders seeking assistance.

User complaints specifically mention poor service quality and inadequate support during critical trading situations. The absence of detailed information about customer service infrastructure suggests either poor service organization or lack of transparency about available support options. This includes whether the broker offers live chat, phone support, email support, or help desk tickets. Reports of trading disruptions since February 2025, combined with apparent inadequate customer service responses, have contributed to growing user dissatisfaction. The customer service issues appear to be systematic rather than isolated incidents. This indicates fundamental problems with the broker's support infrastructure and client relationship management.

Trading Experience Analysis (Score: 3/10)

The trading experience with Renhe International has been significantly compromised according to user reports and available feedback. Multiple users report that trading activities have been suspended since February 2025. This represents a catastrophic failure in basic broker functionality. This suspension of trading services, if accurate, would constitute a fundamental breach of the broker's primary service obligation to clients.

User feedback indicates dissatisfaction with order execution quality. However, specific details about execution speeds, slippage, or fill rates are not provided in available documentation. The lack of detailed information about trading platform stability, server uptime, or technical performance metrics makes it difficult to assess the broker's technological capabilities under normal operating conditions. The absence of mobile trading platform information also suggests potential limitations in trading accessibility. The renhe review reveals that the combination of reported trading suspensions and user complaints about execution quality creates a highly concerning picture. This affects the overall trading environment provided by this broker.

Trustworthiness Analysis (Score: 2/10)

Trustworthiness represents perhaps the most critical concern in this evaluation of Renhe International. User reports explicitly describe the broker as engaging in "scam" behavior. This represents the most serious allegation that can be made against a financial service provider. While the broker claims regulatory oversight from the Securities Commission of the Bahamas (SCB), the absence of specific license numbers or easily verifiable regulatory information raises questions about the depth and authenticity of this oversight.

The lack of detailed information about client fund protection measures, segregated accounts, or financial transparency represents additional trust concerns. User reports of suspended trading activities, combined with allegations of fraudulent behavior, suggest potential issues with client fund security and operational integrity. The broker's limited transparency about its operations, management team, and financial standing contrasts sharply with industry standards for reputable financial service providers. Third-party evaluations and industry recognition appear to be absent. This further undermines confidence in the broker's legitimacy and operational standards.

User Experience Analysis (Score: 3/10)

The overall user experience with Renhe International is predominantly negative based on available feedback and reports. User satisfaction appears to be severely compromised by operational issues, service disruptions, and the reported suspension of trading activities. The lack of detailed information about user interface design, platform usability, and navigation suggests either poor platform development or inadequate marketing transparency.

User complaints focus primarily on trading disruptions and service failures rather than interface or usability issues. This indicates that fundamental operational problems overshadow any potential platform design strengths. The absence of information about registration and verification processes makes it difficult to assess the onboarding experience for new clients. User feedback suggests that the broker is not suitable for traders seeking reliable, stable trading environments. This applies regardless of their experience level or trading objectives. The predominance of negative reviews and the severity of user complaints suggest systematic issues with the broker's service delivery and client relationship management. These issues extend beyond typical market-related trading challenges.

Conclusion

This renhe review reveals a broker that cannot be recommended to traders seeking reliable, secure, and professional forex trading services. The overwhelming negative user feedback, allegations of scam behavior, and reported suspension of trading activities since February 2025 represent fundamental failures in broker operations. While the broker offers high leverage up to 1:1000, this single potential advantage is completely overshadowed by serious concerns about operational integrity, customer service quality, and trustworthiness. The lack of transparency in account conditions, trading costs, and regulatory details further undermines confidence in this broker. Traders, regardless of their experience level or risk tolerance, would be well-advised to seek alternative brokers. They should look for brokers with stronger regulatory oversight, transparent operations, and positive user feedback track records.