Swiss Investment Review 1

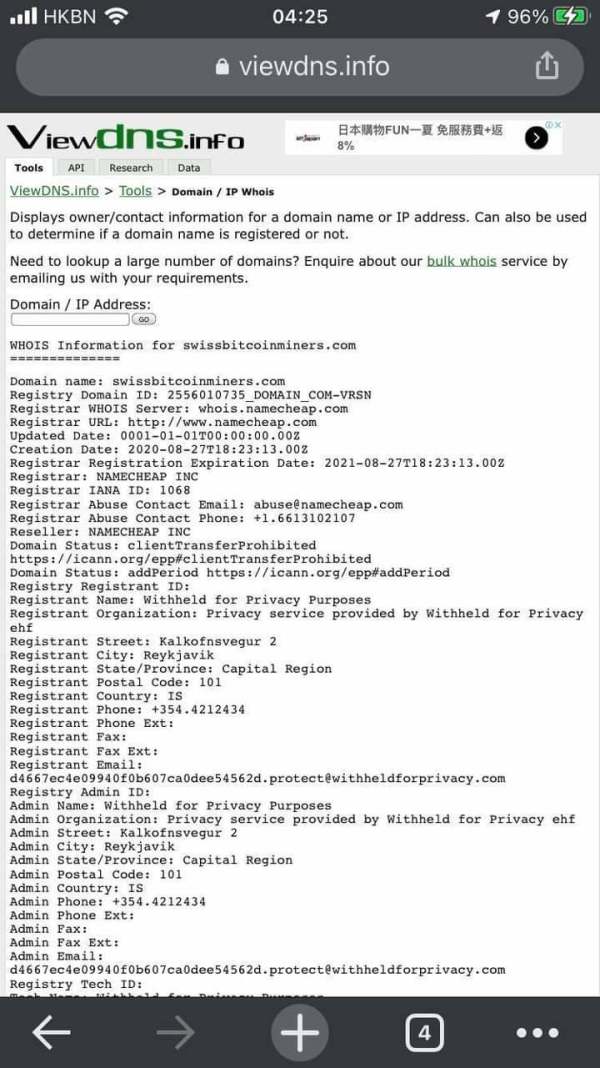

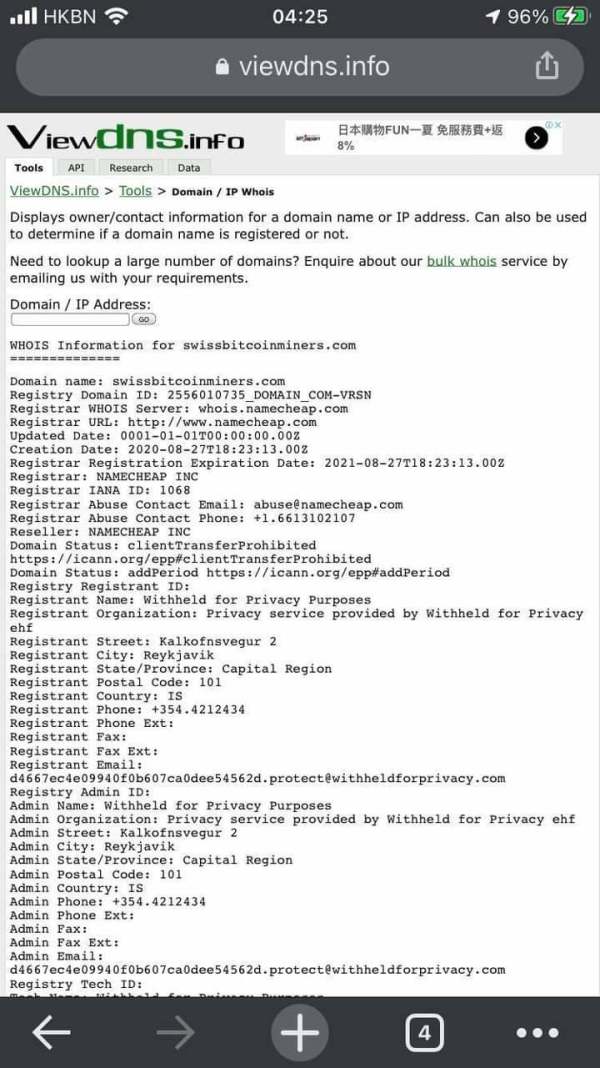

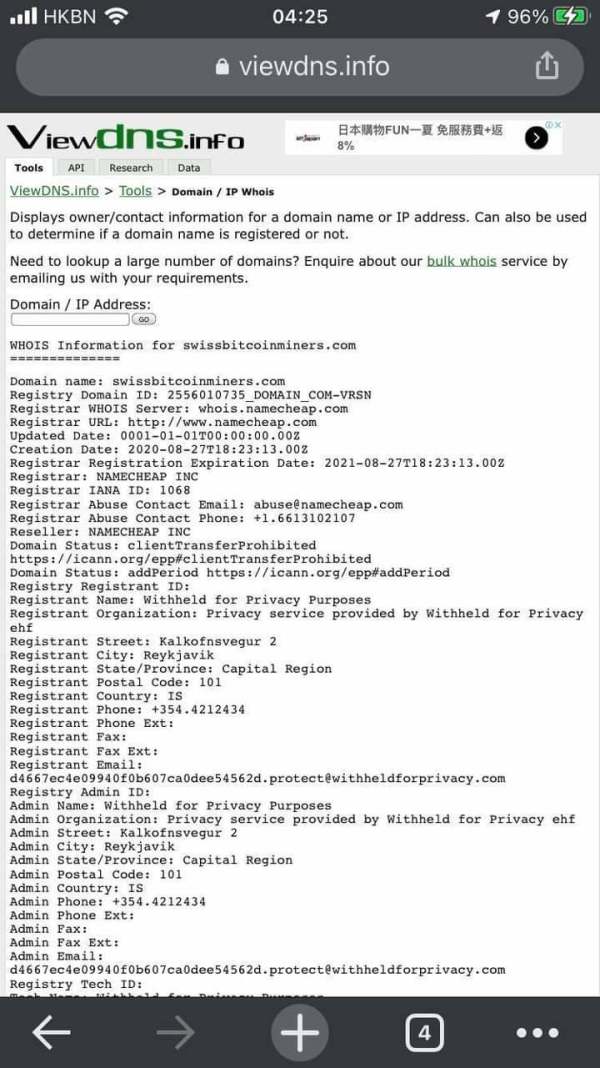

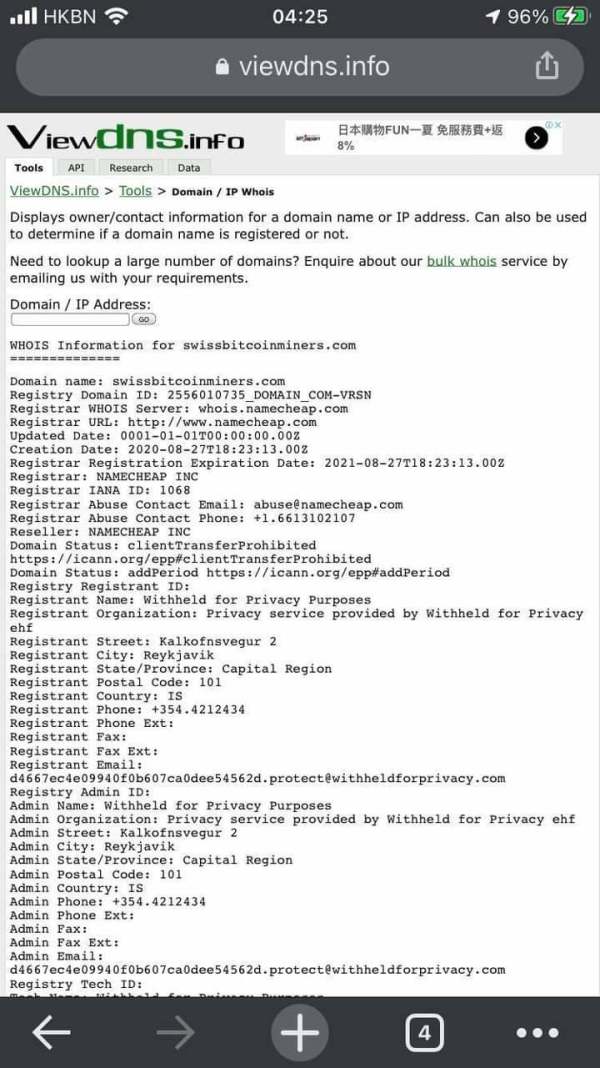

[d83d][dea8]scam alert I am issuing a scam warning on this fake investment platform called Swiss Bitcoin Miners. Reasons for issuing scam warning 1. Fake domain age. 2. No financial regulator registration. 3. Namecheap.

Swiss Investment Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

[d83d][dea8]scam alert I am issuing a scam warning on this fake investment platform called Swiss Bitcoin Miners. Reasons for issuing scam warning 1. Fake domain age. 2. No financial regulator registration. 3. Namecheap.

The Swiss Investment review reveals a predominantly negative perception of this broker, primarily due to its unregulated status and lack of transparency. While some users have noted basic features and account options, the overwhelming consensus is to exercise caution when considering investment with Swiss Investment, especially given its registration in the Marshall Islands and warnings from various regulatory bodies.

Note: Different entities operating under similar names can create confusion. This review focuses on the Swiss Investment Corporation Ltd., which is based in the Marshall Islands, and may not reflect the services of other brokers with similar names.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 4 |

| Tools and Resources | 5 |

| Customer Service and Support | 3 |

| Trading Setup (Experience) | 4 |

| Trustworthiness | 2 |

| User Experience | 3 |

We score brokers based on user feedback, expert opinions, and factual data from various sources.

Swiss Investment, established in 2010, operates under the umbrella of Swiss Investment Corporation Ltd. It is primarily known for offering cryptocurrency and CFD trading. The broker utilizes the widely recognized MetaTrader 4 (MT4) platform, allowing users to trade various asset classes, including forex, cryptocurrencies, and CFDs. However, it lacks regulation from any top-tier financial authority, raising significant concerns about its trustworthiness.

Swiss Investment is registered in the Marshall Islands, a jurisdiction known for minimal regulatory oversight. This lack of regulation is a significant red flag, as highlighted in multiple reviews. According to BrokerChooser, the absence of a strong regulatory framework means that investors have little recourse in case of disputes or issues.

The broker supports deposits and withdrawals primarily in USD, but specific details on additional currencies or cryptocurrencies are not well-documented. This lack of clarity can be a disadvantage for traders looking for flexibility in their transactions.

Swiss Investment requires a minimum deposit of $250 for its Micro account, which is relatively low compared to other brokers. However, the potential risks associated with trading through an unregulated broker may outweigh the benefits of a low entry point.

There is little information available regarding bonuses or promotions offered by Swiss Investment. Many reputable brokers provide incentives; the absence of such offerings may indicate a lack of competitive edge in attracting traders.

Swiss Investment allows trading in a variety of asset classes, including forex, cryptocurrencies, and CFDs. However, the limited range of assets compared to more established brokers may be a drawback for traders seeking diverse investment opportunities.

The specific costs associated with trading at Swiss Investment are not clearly outlined in the available reviews. This ambiguity can lead to unexpected expenses for traders, making it difficult to assess the overall cost-effectiveness of trading with this broker.

The leverage options provided by Swiss Investment are not explicitly stated in the available sources. Traders should approach this aspect with caution, as high leverage can amplify both gains and losses.

Traders can utilize the MT4 platform, which is a popular choice among forex traders for its user-friendly interface and robust features. However, the lack of additional platform options may limit the trading experience for users who prefer more advanced tools.

Swiss Investment does not appear to specify any restricted regions, but given its unregulated status, traders from certain jurisdictions may face challenges in using its services.

Customer support options are limited, with no clear indication of available languages. This lack of transparency can hinder effective communication for non-English speaking users.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 4 |

| Tools and Resources | 5 |

| Customer Service and Support | 3 |

| Trading Setup (Experience) | 4 |

| Trustworthiness | 2 |

| User Experience | 3 |

In conclusion, the Swiss Investment review paints a concerning picture of this broker. While it offers some basic trading features, the lack of regulation, transparency, and adequate customer support make it a less than ideal choice for investors. Caution is advised for anyone considering trading with Swiss Investment, as the potential risks may outweigh the benefits.

FX Broker Capital Trading Markets Review