Is THE RIDGE safe?

Software Index

License

Is Ridge Safe or a Scam?

Introduction

Ridge Capital Markets, often referred to simply as Ridge, positions itself as an online forex broker catering to a diverse range of traders. With promises of competitive spreads and a user-friendly trading platform, Ridge aims to attract both novice and experienced traders alike. However, the forex market is notorious for its potential pitfalls, making it essential for traders to conduct thorough evaluations of their chosen brokers. Is Ridge safe? This question is paramount, as the lack of proper scrutiny can lead to significant financial losses.

In this article, we will investigate Ridge's regulatory status, company background, trading conditions, and customer experiences to determine whether it operates as a legitimate broker or poses risks to its clients. Our assessment will be based on a combination of qualitative analysis and quantitative data derived from various credible sources.

Regulation and Legitimacy

The first aspect to consider when evaluating the safety of a broker like Ridge is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and protect client funds. Unfortunately, Ridge Capital Markets is not regulated by any recognized financial authority, which raises significant red flags.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation means that there is no oversight to protect traders from potential fraud or mismanagement. Top-tier regulators, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US, impose stringent requirements on brokers, ensuring transparency and accountability. Ridges lack of affiliation with such authorities suggests that it does not meet the necessary standards for operational integrity.

The implications of being unregulated are serious. Traders using Ridge may find themselves without recourse if issues arise, such as withdrawal delays or disputes over trading conditions. The historical compliance of a broker is also crucial in assessing its legitimacy. Ridge has faced numerous complaints regarding its operations, further complicating its credibility. Therefore, the question remains: Is Ridge safe? Given its unregulated status, traders should approach this broker with caution.

Company Background Investigation

Understanding the company behind a broker is vital in assessing its trustworthiness. Ridge Capital Markets claims to have been in operation since 2013, with its headquarters situated in Dominica. However, the lack of detailed information about its ownership structure and management team raises concerns about transparency.

The management team's background is crucial in determining the broker's reliability. Unfortunately, there is little publicly available information regarding their qualifications or previous experience in the financial sector. This lack of transparency may indicate a broader issue concerning the broker's operational ethics.

Additionally, the absence of a clear mission statement or commitment to regulatory compliance further complicates the assessment of Ridge‘s credibility. Traders are often advised to seek brokers that openly disclose their management and operational strategies, as this fosters trust and accountability. In Ridge’s case, the lack of such disclosures raises further doubts about its legitimacy. Thus, is Ridge safe? The answer leans towards skepticism, given the opaque nature of its corporate structure.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly influence a trader's experience. Ridge Capital Markets advertises competitive spreads and a variety of account types, which may initially attract traders. However, a closer examination reveals potential issues within its fee structure and trading conditions.

| Fee Type | Ridge Capital Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 0.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 2% | 1.5% |

While Ridge claims to offer zero commission on trades, the spreads are notably higher than the industry average, which could diminish overall profitability for traders. Additionally, the overnight interest rates appear elevated, potentially leading to unexpected costs for traders holding positions overnight.

Furthermore, the absence of a demo account limits new traders' ability to practice and familiarize themselves with the trading platform before committing real funds. This lack of flexibility may deter novice traders from engaging with Ridge, leading to a less inclusive trading environment. Therefore, the overall trading conditions at Ridge raise questions regarding its commitment to providing a fair and transparent trading experience. The answer to Is Ridge safe? becomes more complex, as the trading conditions may not align with industry standards.

Client Fund Security

The safety of client funds is a critical consideration when evaluating a forex broker. Ridge Capital Markets does not provide adequate information regarding its fund security measures. Effective fund protection typically includes segregated accounts, investor compensation schemes, and negative balance protection. Unfortunately, Ridge lacks transparency in these areas, which is concerning for potential traders.

Segregated accounts are essential as they ensure that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency. Without such measures, traders risk losing their deposits if the broker encounters financial difficulties. Moreover, the absence of an investor compensation scheme means that traders have no safety net should Ridge fail to meet its obligations.

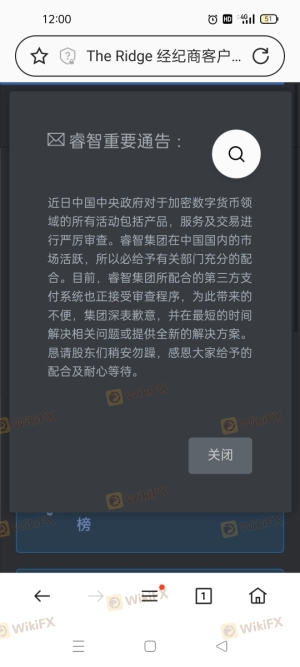

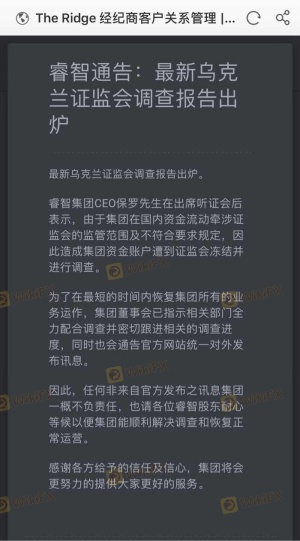

Additionally, historical complaints regarding withdrawal issues suggest that Ridge may not prioritize client fund security. Numerous reports indicate that clients have experienced difficulties in accessing their funds, raising alarms about the broker's operational integrity. Consequently, the question Is Ridge safe? is met with skepticism, as the broker does not appear to prioritize the security of its clients' investments.

Customer Experience and Complaints

Analyzing customer feedback is essential to understand the real-world experiences of traders using Ridge Capital Markets. Unfortunately, the reviews and testimonials available online paint a troubling picture. Many clients have reported issues related to fund withdrawals, slow customer support responses, and overall dissatisfaction with the trading experience.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Average |

| Misleading Promotions | High | Poor |

Common complaints include the inability to withdraw funds, with some clients stating that their requests were met with delays or outright refusals. This behavior is alarming and raises questions about the broker's reliability. In one case, a trader reported that after making an initial deposit, they were unable to access their funds for several weeks, leading to frustration and distrust.

The company's response to these complaints has been generally poor, with many clients feeling ignored or dismissed. This lack of effective customer service can exacerbate issues and lead to a negative trading experience. Therefore, the question Is Ridge safe? is met with a resounding no, as the broker's handling of customer complaints indicates a lack of accountability and support.

Platform and Trade Execution

The performance of a trading platform is crucial for any forex trader. Ridge Capital Markets offers access to popular platforms like MetaTrader 4, which is known for its robust features and user-friendly interface. However, the actual execution quality and reliability of the platform have come under scrutiny.

Traders have reported issues such as slippage during high volatility periods, leading to unfavorable trade executions. Additionally, some users have claimed that their orders were rejected without clear explanations, raising concerns about potential manipulation. Such issues can significantly impact trading outcomes and lead to financial losses.

Moreover, the platform's stability has been questioned, with reports of downtime during critical trading hours. This lack of reliability can hinder a trader's ability to react to market changes, further complicating their trading strategy. Thus, the question Is Ridge safe? is answered with caution, as the platform's execution quality appears to be inconsistent.

Risk Assessment

Evaluating the overall risk associated with trading with Ridge Capital Markets is essential for potential clients. Several factors contribute to the risk profile of this broker, including its lack of regulation, poor customer service, and questionable trading conditions.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Customer Service Risk | High | Poor response to complaints. |

| Trading Conditions Risk | Medium | Unfavorable spreads and fees. |

The absence of regulatory oversight poses a significant risk to traders, as they have no protection against potential fraud or mismanagement. Furthermore, the high level of customer service complaints suggests that traders may struggle to receive support when problems arise.

To mitigate these risks, traders should conduct thorough research before engaging with Ridge. Seeking alternative brokers that are regulated and have positive customer feedback can provide a safer trading environment. Therefore, the ultimate answer to Is Ridge safe? leans towards a negative assessment, as the risks associated with this broker appear considerable.

Conclusion and Recommendations

In conclusion, the investigation into Ridge Capital Markets raises significant concerns about its legitimacy and safety for traders. The lack of regulation, poor customer service, and troubling trading conditions suggest that this broker may not be a reliable choice for forex trading.

For traders seeking a safe and secure trading environment, it is advisable to consider alternative brokers that are regulated by reputable financial authorities. Brokers such as eToro, Plus500, and XM are examples of companies that offer robust regulatory oversight and positive customer experiences.

In summary, the evidence indicates that Ridge is not safe for traders, and caution is strongly advised when considering this broker for forex trading activities.

Is THE RIDGE a scam, or is it legit?

The latest exposure and evaluation content of THE RIDGE brokers.

THE RIDGE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

THE RIDGE latest industry rating score is 2.00, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.00 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.