Ridge 2025 Review: Everything You Need to Know

Executive Summary

Ridge Capital Markets has emerged as a topic of considerable discussion in the forex trading community, though not for positive reasons. This comprehensive ridge review reveals that Ridge Capital Markets is not considered a trustworthy broker due to its lack of regulation by stringent financial regulatory authorities. The broker primarily targets forex traders by offering MT4 and MT Mobile trading platforms, positioning itself as a convenient solution for those seeking accessible trading tools.

Despite providing popular trading platforms, the absence of proper regulatory oversight raises significant concerns about trader protection and fund security. Ridge Capital Markets appears to focus on attracting traders with its platform offerings, but the fundamental lack of regulatory compliance undermines its credibility in the competitive forex brokerage landscape. This ridge review will examine all aspects of the broker to provide traders with the essential information needed to make informed decisions about their trading partnerships.

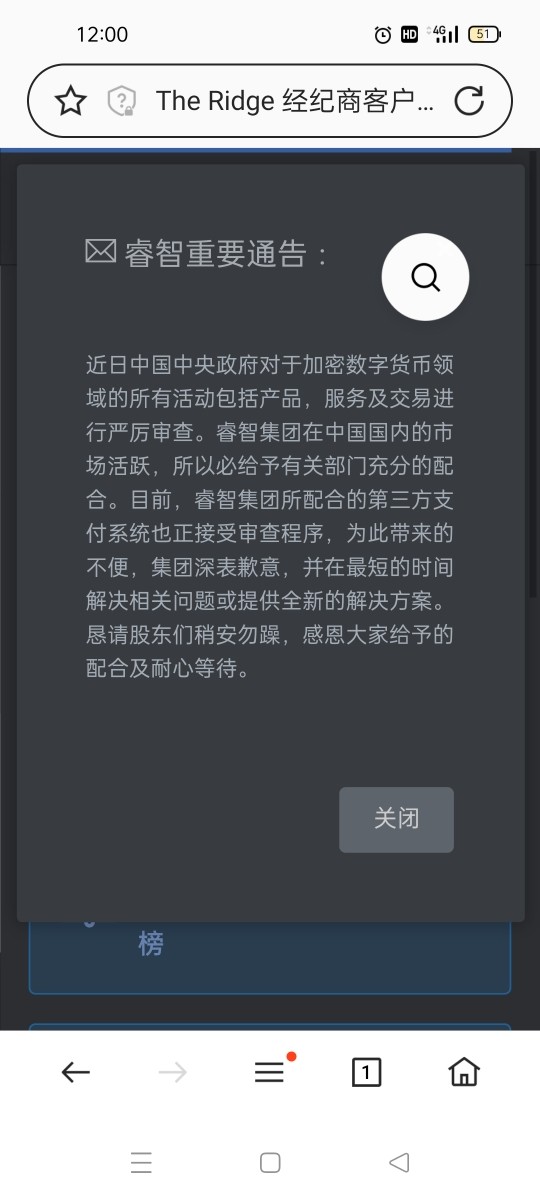

Important Notice

Traders should be aware that Ridge Capital Markets does not provide specific regulatory information across different jurisdictions, which may indicate potential compliance risks across various regions. The broker's lack of transparency regarding regulatory status creates uncertainty for international traders seeking legitimate, regulated trading environments.

This review is based on available information and user feedback collected from various sources. Given the limited regulatory disclosures from Ridge Capital Markets, traders are advised to exercise extreme caution and thoroughly research regulatory requirements in their respective jurisdictions before considering any engagement with this broker.

Rating Framework

Broker Overview

Ridge Capital Markets operates in the competitive forex trading space, though its corporate background appears to be intertwined with Ridge Real Estate Partners, a real estate private equity company that invests in rental housing, industrial, and life sciences assets. This connection raises questions about the broker's primary focus and expertise in financial services, as the parent company's core competencies lie in real estate rather than financial markets.

The broker's main business model centers around providing forex and related financial product trading services to retail and potentially institutional clients. Ridge Capital Markets positions itself as a platform provider, focusing on delivering trading access rather than comprehensive financial services. However, the lack of detailed information about the company's founding date, leadership team, and corporate structure creates transparency concerns that potential clients should carefully consider.

Ridge Capital Markets offers trading access through MT4 and MT Mobile platforms, targeting traders who prioritize platform familiarity and mobile accessibility. While the broker claims to provide forex trading services, specific information about CFD offerings, asset diversity, and trading conditions remains largely undisclosed. The absence of clear regulatory oversight from recognized financial authorities represents a significant concern for traders prioritizing security and regulatory protection. This ridge review emphasizes the importance of regulatory compliance in broker selection.

Regulatory Regions: Ridge Capital Markets has not disclosed specific regulatory regions or licensing authorities in available materials. This lack of regulatory transparency represents a significant red flag for potential clients seeking properly supervised trading environments.

Deposit and Withdrawal Methods: Specific deposit and withdrawal methods have not been detailed in available information, creating uncertainty about funding processes and potential restrictions.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit requirements, making it difficult for traders to assess accessibility and account opening costs.

Bonuses and Promotions: No specific information about bonuses or promotional offerings has been provided by Ridge Capital Markets in available materials.

Tradeable Assets: The broker primarily focuses on forex trading, though specific details about currency pairs, CFDs, commodities, or other asset classes remain undisclosed in available documentation.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs has not been made available, preventing accurate cost analysis for potential clients.

Leverage Ratios: Specific leverage offerings and maximum leverage ratios have not been disclosed in available materials.

Platform Options: Ridge Capital Markets supports MT4 and MT Mobile platforms, providing traders with familiar and widely-used trading interfaces.

Regional Restrictions: Specific geographical restrictions or prohibited jurisdictions have not been clearly outlined in available information.

Customer Service Languages: Available customer service languages have not been specified in accessible materials.

This ridge review highlights the concerning lack of detailed information across multiple critical areas that traders typically require for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis

Ridge Capital Markets has not provided comprehensive information about its account types, structures, or specific features in available materials. The absence of clear account tier descriptions, minimum deposit requirements, and account-specific benefits creates significant uncertainty for potential clients attempting to evaluate suitability for their trading needs.

Without disclosed minimum deposit requirements, traders cannot assess the broker's accessibility or determine whether the platform caters to retail traders, high-net-worth individuals, or institutional clients. The lack of information about account opening procedures, required documentation, and verification processes further complicates the evaluation process.

Special account features such as Islamic accounts, demo accounts, or professional trading accounts have not been mentioned in available materials. This absence of detailed account information suggests either limited product offerings or poor transparency in marketing communications. The lack of clear account conditions makes it impossible to compare Ridge Capital Markets with established, regulated brokers that provide comprehensive account information.

This ridge review cannot provide a meaningful evaluation of account conditions due to insufficient disclosed information, representing a significant transparency concern for potential clients.

Ridge Capital Markets provides access to MT4 and MT Mobile trading platforms, which represents its primary strength in terms of trading tools and resources. MetaTrader 4 remains one of the most popular and widely-used trading platforms globally, offering comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors.

The MT Mobile platform extends trading accessibility to smartphones and tablets, allowing traders to monitor positions, execute trades, and access basic analytical tools while away from desktop computers. These platform offerings suggest that Ridge Capital Markets recognizes the importance of providing familiar, user-friendly trading interfaces.

However, available information does not detail specific research and analysis resources, such as market commentary, economic calendars, trading signals, or educational materials. The absence of proprietary analytical tools, third-party research partnerships, or educational resources limits the broker's value proposition beyond basic platform access.

Advanced trading tools, such as VPS services, advanced charting packages, or institutional-grade analytical resources, have not been mentioned in available materials. This suggests that Ridge Capital Markets may focus primarily on platform provision rather than comprehensive trading support services.

Customer Service and Support Analysis

Ridge Capital Markets has not provided detailed information about its customer service channels, availability hours, or support quality in accessible materials. The absence of clear customer service information raises concerns about the broker's commitment to client support and problem resolution.

Without disclosed customer service channels, potential clients cannot determine whether the broker offers phone support, live chat, email assistance, or other communication methods. Response time expectations, service level agreements, and escalation procedures remain unknown, creating uncertainty about support quality during critical trading situations.

Multilingual support capabilities have not been specified, which may limit accessibility for international traders who require assistance in their native languages. The lack of information about customer service hours, holiday schedules, and timezone coverage further complicates support expectations.

User feedback regarding customer service quality, response times, and problem resolution effectiveness has not been available in source materials. This absence of service quality indicators makes it impossible to assess whether Ridge Capital Markets provides adequate support for its trading platform users.

The lack of comprehensive customer service information represents a significant concern for traders who prioritize responsive, professional support services.

Trading Experience Analysis

Available information does not provide specific details about Ridge Capital Markets' trading experience, including platform stability, execution speed, or order processing quality. The absence of performance metrics, uptime statistics, or execution quality data prevents meaningful assessment of the actual trading environment.

Platform functionality completeness, beyond basic MT4 and MT Mobile access, has not been detailed in available materials. Information about advanced order types, one-click trading, algorithmic trading support, or platform customization options remains undisclosed.

Mobile trading experience specifics, including app features, mobile-exclusive tools, or mobile platform limitations, have not been comprehensively described. While MT Mobile access is mentioned, the quality and functionality of the mobile trading experience cannot be evaluated from available information.

Trading environment characteristics, such as market depth, liquidity provision, slippage management, or execution models (market maker vs. ECN), have not been disclosed. This lack of transparency about trading conditions prevents traders from understanding the actual execution environment they would encounter.

Without user feedback about trading experience, platform performance, or execution quality, this ridge review cannot provide meaningful insights into the practical aspects of trading with Ridge Capital Markets.

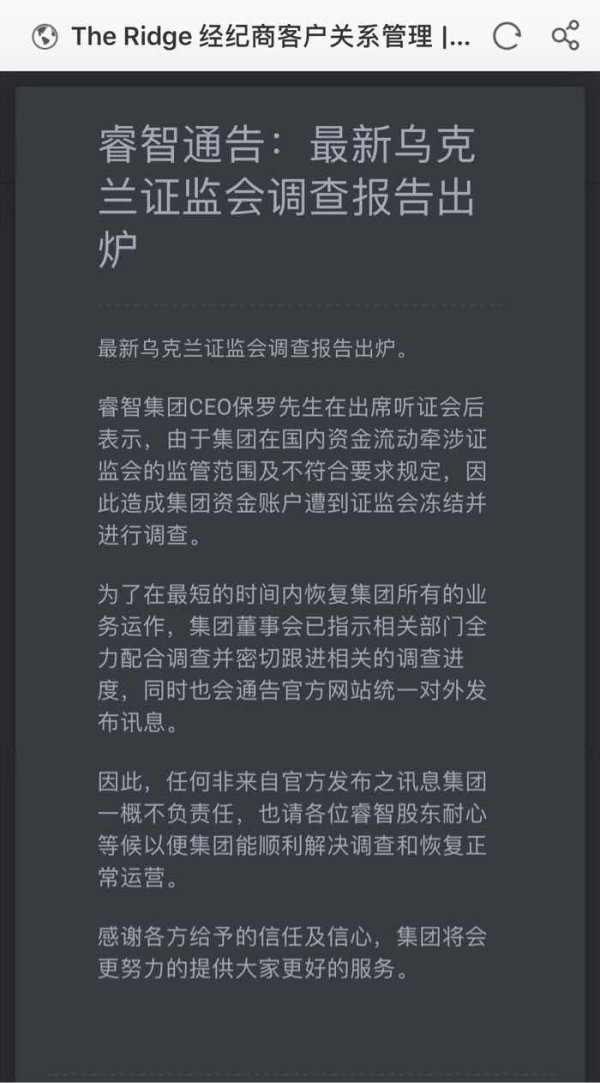

Trust and Reliability Analysis

Ridge Capital Markets faces significant trust and reliability concerns due to its admitted lack of regulation by stringent financial regulatory authorities. According to available information, "Ridge Capital Markets is not considered a trustworthy broker because it is not regulated by strict standard financial regulatory authorities."

The absence of regulatory oversight from recognized authorities such as the FCA, CySEC, ASIC, or other tier-one regulators eliminates crucial investor protections, including segregated client funds, compensation schemes, and regulatory complaint procedures. This regulatory gap represents the most significant concern for potential clients considering Ridge Capital Markets.

Fund security measures, such as segregated client accounts, insurance coverage, or third-party fund custody, have not been disclosed in available materials. Without regulatory requirements mandating these protections, clients face elevated risks regarding fund safety and recovery procedures.

Corporate transparency regarding ownership structure, management team, financial statements, or business operations remains limited. The connection to Ridge Real Estate Partners adds complexity to the corporate structure without providing clear benefits for trading clients.

Industry reputation, regulatory actions, or negative incidents involving Ridge Capital Markets have not been detailed in available materials, though the fundamental lack of regulation significantly impacts overall trustworthiness regardless of specific incidents.

User Experience Analysis

Comprehensive user experience information for Ridge Capital Markets has not been made available in source materials, preventing detailed analysis of client satisfaction levels, interface design quality, or overall platform usability beyond basic MT4 and MT Mobile access.

Registration and verification processes, including required documentation, approval timeframes, and onboarding procedures, have not been detailed. This lack of information creates uncertainty about the ease of account opening and the time required to begin trading.

Fund operation experiences, including deposit processing times, withdrawal procedures, and potential restrictions or delays, remain undisclosed. Without clear information about funding processes, traders cannot assess the practical aspects of account management.

Common user complaints or satisfaction indicators have not been available in source materials, though the fundamental concern about regulatory status likely represents a primary user concern for security-conscious traders.

The primary user concern identified relates to the lack of regulatory oversight, which affects trust and confidence rather than specific platform functionality issues. This ridge review emphasizes that regulatory concerns overshadow other user experience factors.

Conclusion

This comprehensive ridge review reveals that Ridge Capital Markets presents significant concerns for traders prioritizing security, transparency, and regulatory protection. While the broker offers access to popular MT4 and MT Mobile trading platforms, the fundamental lack of regulation by recognized financial authorities undermines its credibility and trustworthiness.

Ridge Capital Markets is not suitable for traders who value regulatory oversight, fund protection, and transparent business practices. The broker's failure to provide comprehensive information about account conditions, costs, and services further compounds trust concerns.

The main advantages include familiar trading platform access, while the critical disadvantages encompass regulatory absence, limited transparency, and insufficient disclosure of essential trading conditions. Traders seeking reliable, regulated forex brokers should consider alternatives with proper regulatory oversight and comprehensive service transparency.