Is Ridder Trader safe?

Pros

Cons

Is Ridder Trader A Scam?

Introduction

Ridder Trader is a brokerage firm that positions itself within the foreign exchange (Forex) market, claiming to offer a variety of trading services including Forex, commodities, and shares. Founded in 2020, it operates with an emphasis on providing competitive trading conditions and access to advanced trading platforms. However, the rise of online trading has also led to an increase in fraudulent schemes, making it imperative for traders to conduct thorough evaluations of brokerage firms before committing their funds. This article aims to assess the legitimacy of Ridder Trader by analyzing its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The evaluation is based on various sources, including user reviews, regulatory information, and expert analyses.

Regulation and Legitimacy

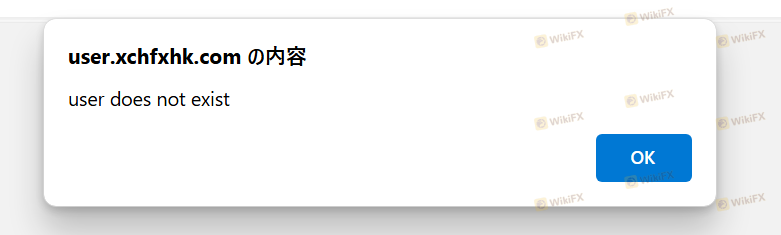

One of the primary indicators of a brokerage's reliability is its regulatory status. A well-regulated broker is typically more trustworthy, as it is subject to oversight by financial authorities that enforce compliance with industry standards. Ridder Trader claims to be regulated by the Financial Services Commission (FSC) in Mauritius, as well as the Australian Securities and Investments Commission (ASIC). However, upon closer inspection, significant discrepancies arise regarding these claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Revoked |

| FSC | GB 23201566 | Mauritius | Unverified |

The lack of a valid ASIC license is particularly concerning, as ASIC is known for its stringent regulatory requirements. Furthermore, while Ridder Trader claims to be regulated by the FSC, verification attempts have shown no records to substantiate this assertion. This lack of credible regulation raises red flags regarding the safety of trader funds and the legitimacy of the broker's operations.

The quality of regulation is paramount in assessing a broker's credibility. Regulatory bodies like ASIC and the Financial Conduct Authority (FCA) in the UK impose strict guidelines to protect investors. Ridder Traders claims of regulation appear to be misleading, suggesting a potential attempt to create a façade of legitimacy.

Company Background Investigation

Ridder Trader is registered as Ridder Trader Ltd and claims to operate from Mauritius. However, details regarding its ownership structure and management team are scant. The company was established in 2020, and while it boasts a global reach, the lack of transparency regarding its operational history is alarming.

A reliable broker typically provides information about its founders and management team, including their qualifications and experience in the financial industry. Unfortunately, Ridder Trader does not publicly disclose such information, which raises concerns about its accountability and operational transparency.

Transparency in a brokerage is vital for building trust with clients. A lack of clear information regarding the company's ownership and management can indicate potential issues, including a lack of oversight and accountability. Furthermore, the absence of detailed disclosures about the company's financial health and operational practices can lead to skepticism among potential clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial, as these directly impact the trading experience. Ridder Trader claims to provide a range of account types with varying spreads and leverage options. However, the absence of clear information regarding fees and minimum deposit requirements is a significant concern.

| Fee Type | Ridder Trader | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.8 pips | 0.1 - 1.5 pips |

| Commission Model | Up to $43 per lot | $0 - $10 per lot |

| Overnight Interest Rate Range | Not specified | 2% - 5% |

The spreads offered by Ridder Trader, which range from 0.0 pips to 1.8 pips, seem competitive at first glance. However, the commission structure, which can go as high as $43 per lot for certain pairs, is significantly higher than the industry average. This discrepancy could result in increased trading costs for clients, making the overall trading conditions less favorable.

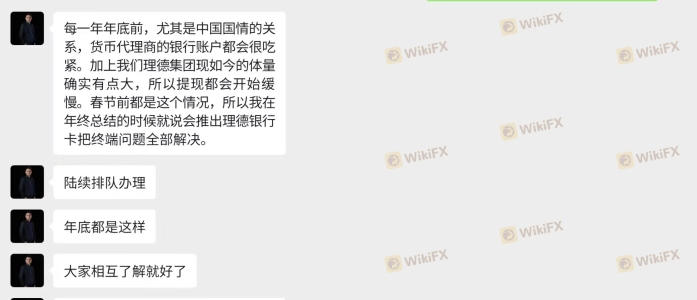

Additionally, the lack of clarity regarding overnight interest rates and other potential fees further complicates the assessment of Ridder Traders trading conditions. Traders should be wary of brokers that do not provide comprehensive information about their fee structures, as this can lead to unexpected costs and diminished profitability.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Ridder Trader claims to implement various measures to protect client funds, including the use of segregated accounts. However, the lack of regulatory oversight significantly undermines these claims.

Segregation of client funds is a standard practice among reputable brokers, ensuring that client funds are kept separate from the broker's operational funds. This practice is essential for protecting traders in the event of the broker's insolvency. However, without credible regulation, there is no guarantee that Ridder Trader adheres to such practices.

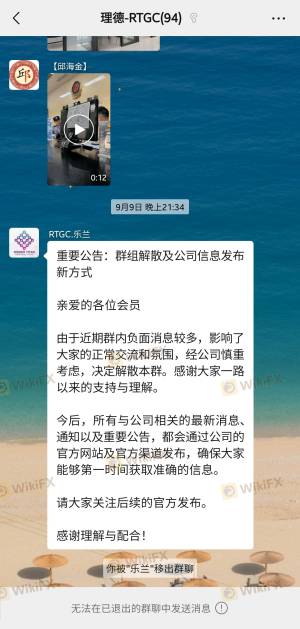

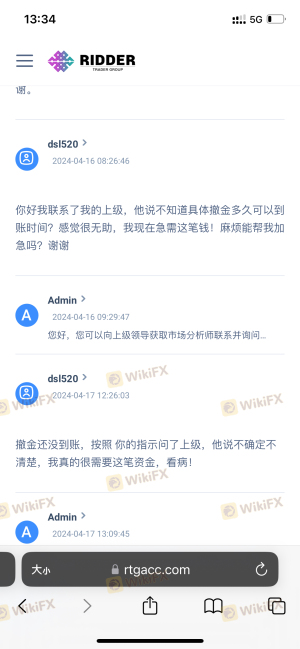

Moreover, the absence of investor protection schemes, such as compensation funds offered by regulated brokers, poses a further risk to traders. In the event of a dispute or financial crisis, clients may find themselves without recourse to recover their funds. Historical issues related to fund safety, such as delayed withdrawals and unresponsive customer support, have been reported by users, adding to the skepticism surrounding Ridder Trader.

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing a broker's reputation. Ridder Trader has received a mix of reviews, with many users expressing dissatisfaction with their experiences. Common complaints include issues with fund withdrawals, lack of transparency regarding fees, and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Lack of Transparency | Medium | Limited Response |

| Poor Customer Support | High | Unresolved |

One notable case involves a trader who reported being unable to withdraw funds for several months, highlighting a serious issue with the broker's operations. Another common grievance pertains to the unclear fee structure, which left many traders feeling misled. The company's responses to these complaints have often been insufficient, leading to frustration among clients.

The overall sentiment from users suggests a pattern of negative experiences, which is a significant red flag for potential clients. A broker's ability to address and resolve complaints is essential for maintaining a trustworthy reputation, and Ridder Traders shortcomings in this area are concerning.

Platform and Trade Execution

The performance of a trading platform is vital for a successful trading experience. Ridder Trader claims to offer the MetaTrader 5 (MT5) platform, known for its advanced features and user-friendly interface. However, user reviews indicate that the platform may not perform as expected.

Traders have reported issues with order execution, including slippage and instances of rejected orders. Such problems can severely impact trading outcomes, especially in a volatile market. Additionally, there are concerns about potential manipulation, with some users alleging that the broker may engage in practices that disadvantage traders.

The overall stability and reliability of the trading platform are critical factors in a trader's success. A platform that frequently experiences downtime or execution issues can lead to significant losses and frustration.

Risk Assessment

Using Ridder Trader presents several risks that potential clients should consider. The lack of regulatory oversight, coupled with negative customer feedback and questionable trading conditions, raises significant concerns.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated, potential for fraud |

| Financial Risk | High | High fees and unclear costs |

| Operational Risk | Medium | Platform issues and poor execution |

To mitigate these risks, traders should conduct thorough research before engaging with Ridder Trader. It is advisable to start with small investments and to test the withdrawal process to gauge the broker's reliability. Additionally, seeking out more established and regulated brokers may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ridder Trader exhibits several characteristics commonly associated with scam brokers. The lack of credible regulation, coupled with numerous negative customer experiences and questionable trading conditions, raises significant concerns about the safety and legitimacy of this brokerage.

Traders are advised to exercise extreme caution when considering Ridder Trader for their trading activities. It is recommended to explore alternative brokers that are well-regulated and have a proven track record of reliability and transparency. Options such as brokers regulated by ASIC or FCA, which offer robust investor protection and better trading conditions, may be more suitable for traders seeking a secure trading environment.

In summary, while Ridder Trader may present itself as a viable trading option, the associated risks and lack of transparency warrant serious consideration before proceeding.

Is Ridder Trader a scam, or is it legit?

The latest exposure and evaluation content of Ridder Trader brokers.

Ridder Trader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ridder Trader latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.