Ridder Trader 2025 Review: Everything You Need to Know

Executive Summary

Ridder Trader shows many warning signs in the forex broker world. This ridder trader review finds that the broker offers some good features like leverage up to 1:1000 and many different trading options including forex, precious metals, indices, commodities, futures, and stocks, but it also carries big risks that should make traders very careful.

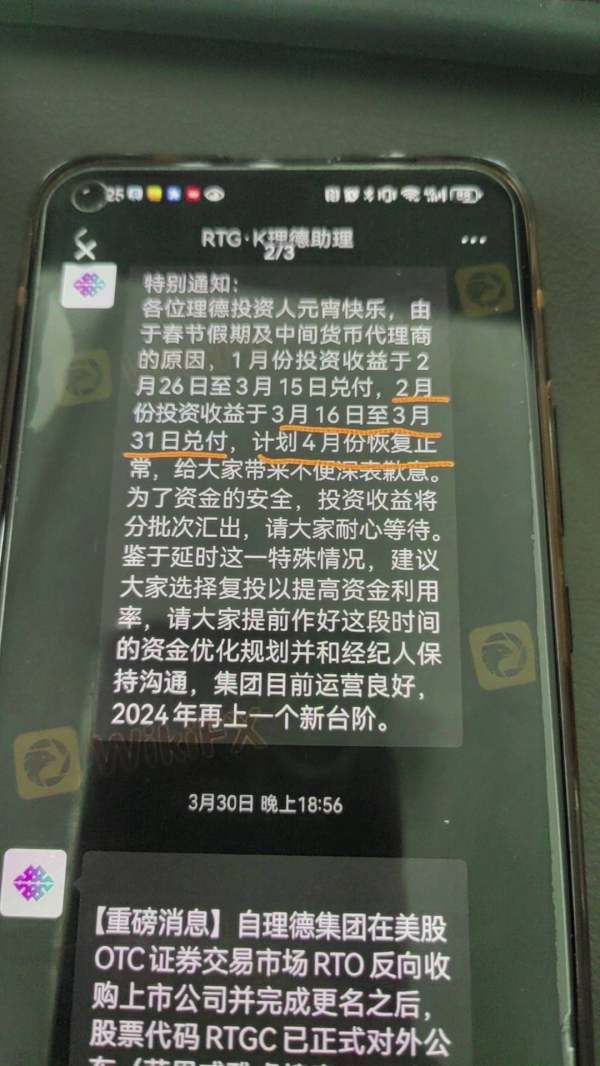

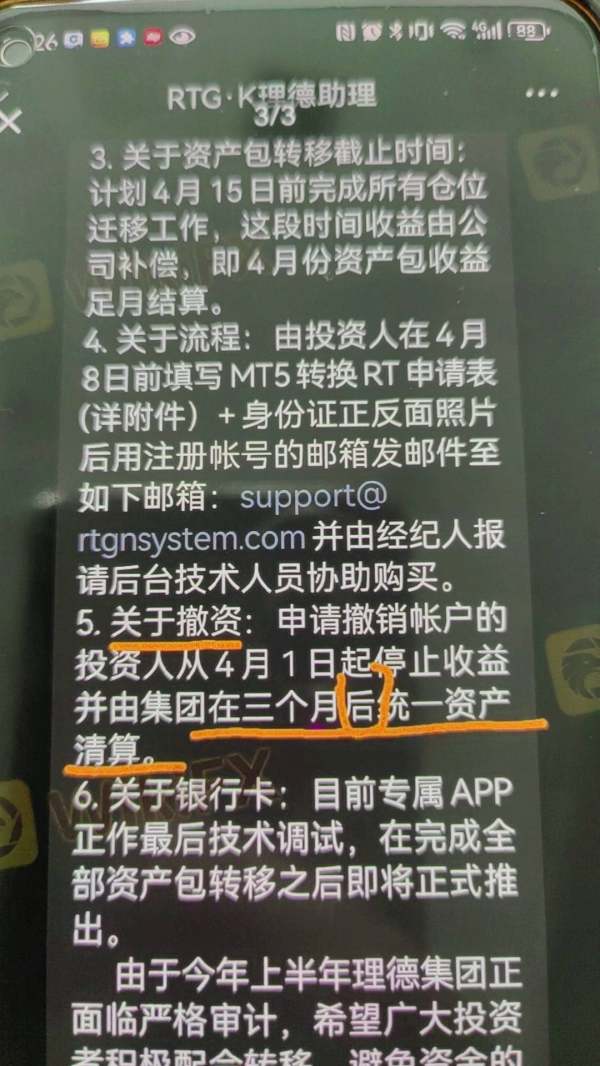

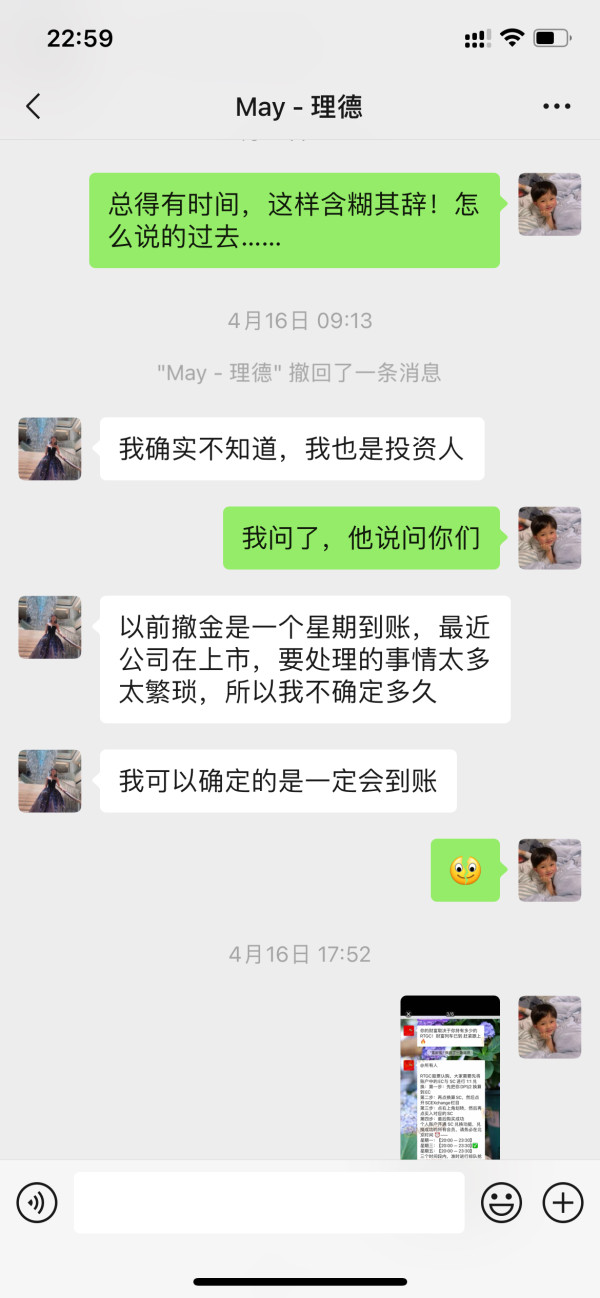

The company started in Mauritius in April 2023. Ridder Trader LTD says it follows rules from different countries, but research shows it might be running a Ponzi scheme. The broker wants traders who like high leverage and many trading choices, especially those outside restricted areas like the United States, Germany, and mainland China. However, the company hides important details about accounts, withdrawals, and real rule-following, which makes this platform bad for most regular traders.

Many industry sources, including TraderKnows and ForexBrokerz reports, say Ridder Trader shows high-risk signs typical of offshore brokers that work without proper oversight. This means potential clients need to be extremely careful.

Important Notice

Ridder Trader claims it registered in Mauritius and follows rules from the Mauritius Financial Services Commission (FSC) and Australian Securities and Investments Commission (ASIC). However, big questions exist about whether these regulatory claims are real. The broker works across multiple countries, which creates doubt about actual rule oversight and client protection.

This review uses public information, user feedback, and industry reports from 2025. Since regulatory investigations change quickly and operations can shift, information may become old. Readers should check facts on their own before making any trading choices.

Overall Rating Framework

Broker Overview

Company Background and Establishment

Ridder Trader LTD started in 2020 and registered in Mauritius on April 13, 2023. The company calls itself a global forex and CFD service provider. It operates from an offshore location, which right away makes people question rule oversight and client protection standards. ForexBrokerz reports say Ridder Trader Group works as an offshore broker with little transparency about how it operates and who really owns it.

The broker markets itself to clients worldwide while blocking specific areas. It notably excludes residents of the United States, Germany, and mainland China from its services. This careful approach to market access suggests the company knows about regulatory problems in major financial areas.

Trading Platform and Asset Coverage

Ridder Trader offers access to many asset types including foreign exchange pairs, precious metals, stock indices, commodities, futures contracts, and individual stocks. However, detailed information about the specific trading platforms used is notably missing from available documents. The broker's asset coverage looks complete on paper, but the lack of platform details raises concerns about execution quality and technology infrastructure.

The company's business model seems to focus on attracting traders with high leverage offers and diverse instrument access. Though this ridder trader review reveals big gaps in operational transparency that potential clients should carefully consider.

Regulatory Jurisdiction and Oversight

Ridder Trader claims regulatory oversight from the Mauritius Financial Services Commission (FSC) and the Australian Securities and Investments Commission (ASIC). However, industry investigations suggest these regulatory claims may not reflect actual oversight or client protection measures. The Mauritius registration serves mainly as an offshore incorporation rather than real financial regulation.

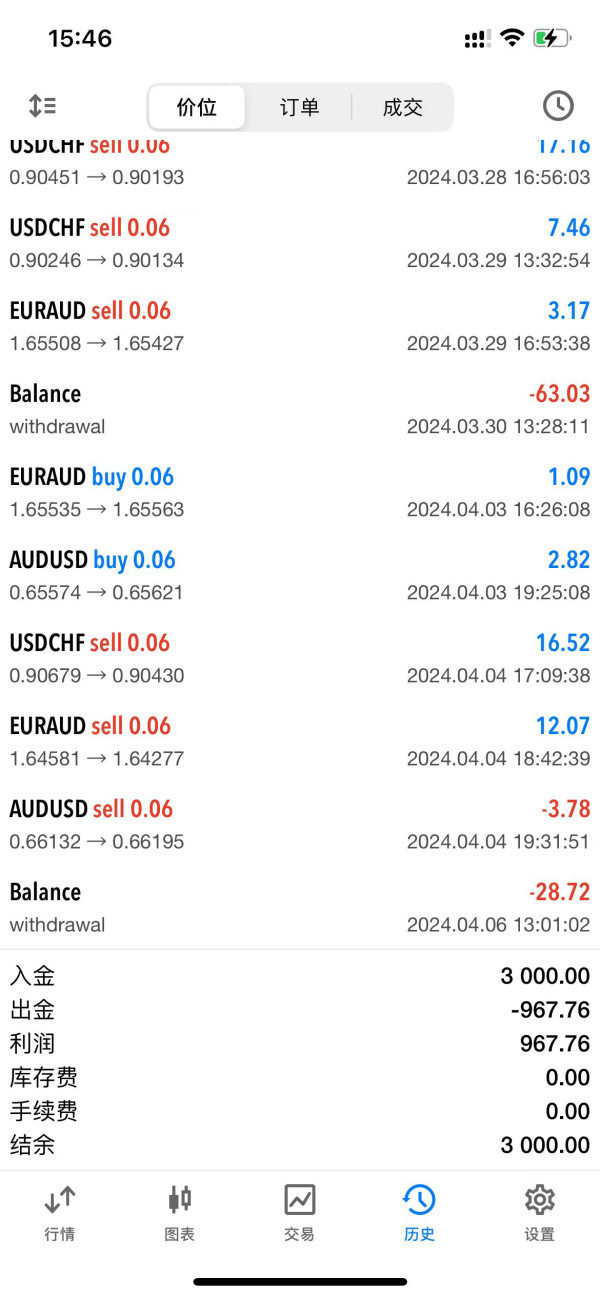

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods stays hidden in available documents. This lack of transparency about funding methods represents a big red flag for potential clients seeking reliable access to their trading capital.

Minimum Deposit Requirements

The broker has not published clear minimum deposit requirements. This makes it impossible for potential clients to assess entry barriers or account tier structures.

Promotional Offers and Bonuses

No specific bonus or promotional programs have been found in available documents. Though this may reflect the broker's focus on other attraction methods.

Available Trading Assets

The platform offers access to major forex pairs, precious metals including gold and silver, global stock indices, commodity futures, and individual equity positions. However, the absence of specific instrument lists or trading conditions limits evaluation of actual market access.

Cost Structure and Fees

Critical information about spreads, commissions, overnight financing costs, and withdrawal fees stays hidden. This lack of fee transparency makes cost assessment impossible and suggests potential hidden charges.

Leverage Ratios

Ridder Trader offers maximum leverage up to 1:1000. This significantly exceeds regulatory limits in most developed markets and indicates high-risk trading conditions.

Platform Technology

Specific trading platform information has not been disclosed. This raises questions about technology infrastructure and execution capabilities.

Geographic Restrictions

The broker clearly excludes residents of the United States, Germany, and mainland China. This suggests awareness of regulatory restrictions in major financial centers.

Customer Support Languages

Available customer support languages and communication channels have not been specified in accessible documents.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Account Structure and Types

Available documents provide no specific information about account types, tier structures, or different service levels. This basic lack of transparency about account offerings represents a big problem for any legitimate brokerage operation. Most established brokers clearly outline multiple account types with varying features, minimum deposits, and service levels.

Minimum Deposit Assessment

The absence of published minimum deposit requirements makes it impossible for potential clients to assess accessibility or budget for account opening. This information gap suggests either poor operational organization or deliberate hiding of entry requirements.

Account Opening Process

No detailed information exists about the account opening process, required documents, or verification procedures. Legitimate brokers typically provide clear guidance about KYC requirements and onboarding timelines.

Special Account Features

The lack of information about specialized account features, such as Islamic accounts, managed accounts, or institutional services, further shows the broker's limited operational transparency. This ridder trader review finds the account conditions documentation severely inadequate for informed decision-making.

Trading Instrument Diversity

Ridder Trader offers a reasonably complete range of trading instruments across multiple asset classes. The inclusion of forex pairs, precious metals, indices, commodities, futures, and stocks provides theoretical diversification opportunities for traders seeking multi-asset exposure.

Research and Analysis Resources

Available documents contain no information about market research, technical analysis tools, or fundamental analysis resources. Most legitimate brokers provide complete market analysis to support client trading decisions.

Educational Materials

No educational resources, training programs, or learning materials have been identified. The absence of educational support suggests limited commitment to client development and success.

Automated Trading Support

Information about automated trading capabilities, API access, or algorithmic trading support remains unavailable. This limits assessment of the platform's suitability for sophisticated trading strategies.

Customer Service and Support Analysis (Score: 4/10)

Support Channel Availability

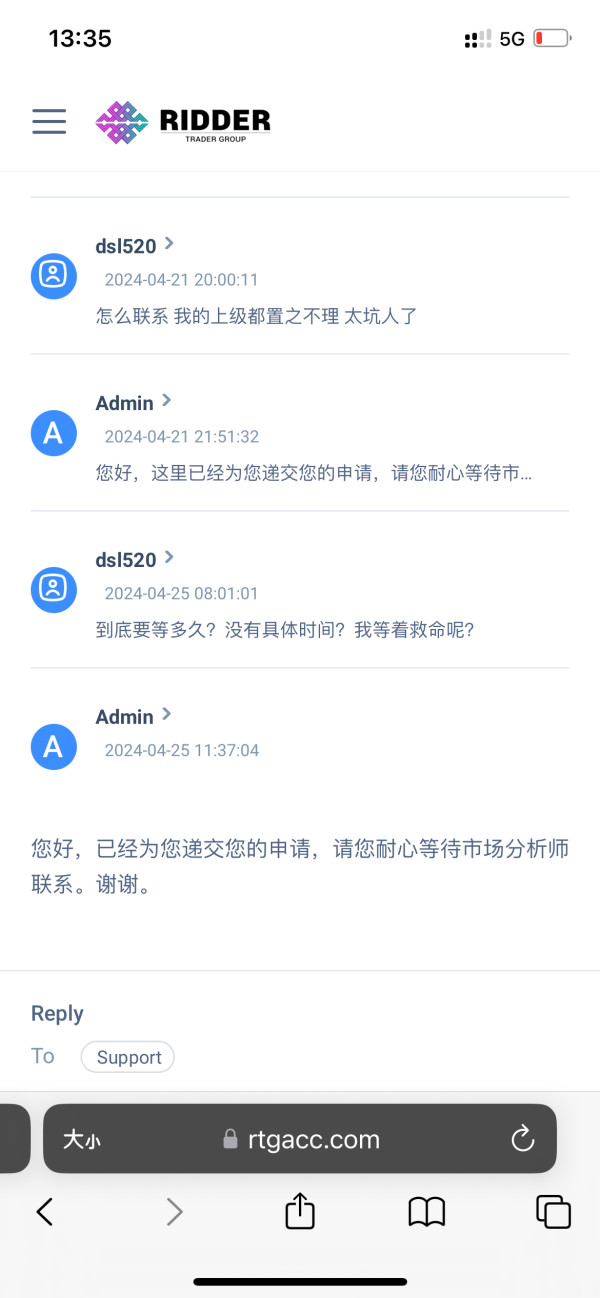

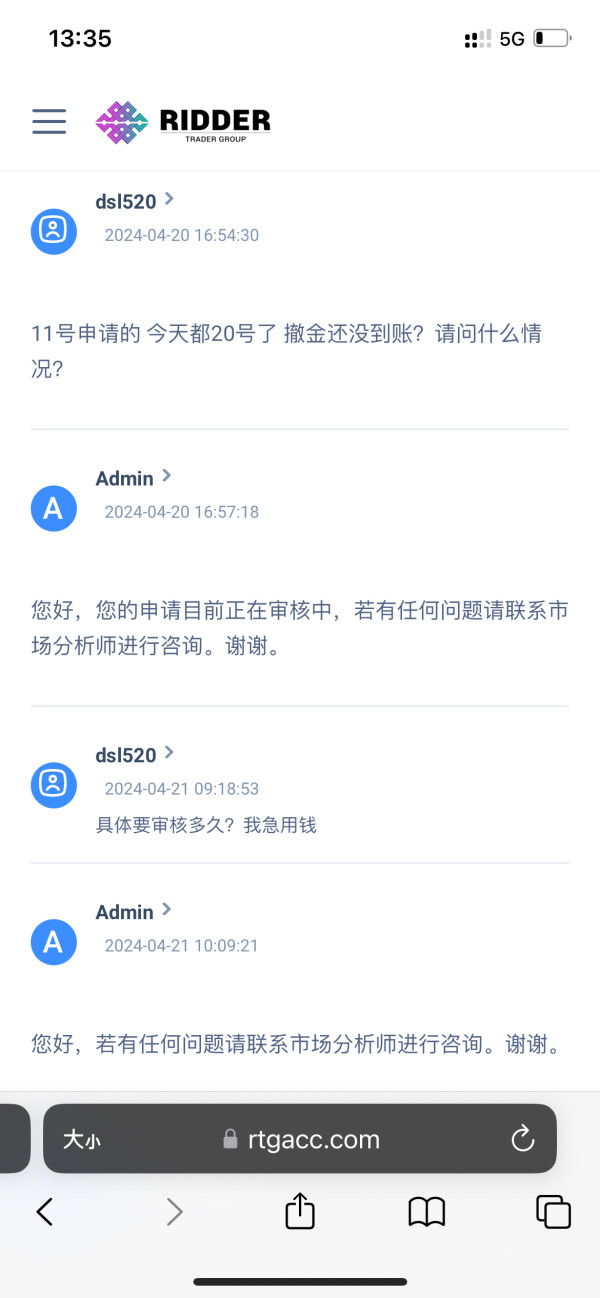

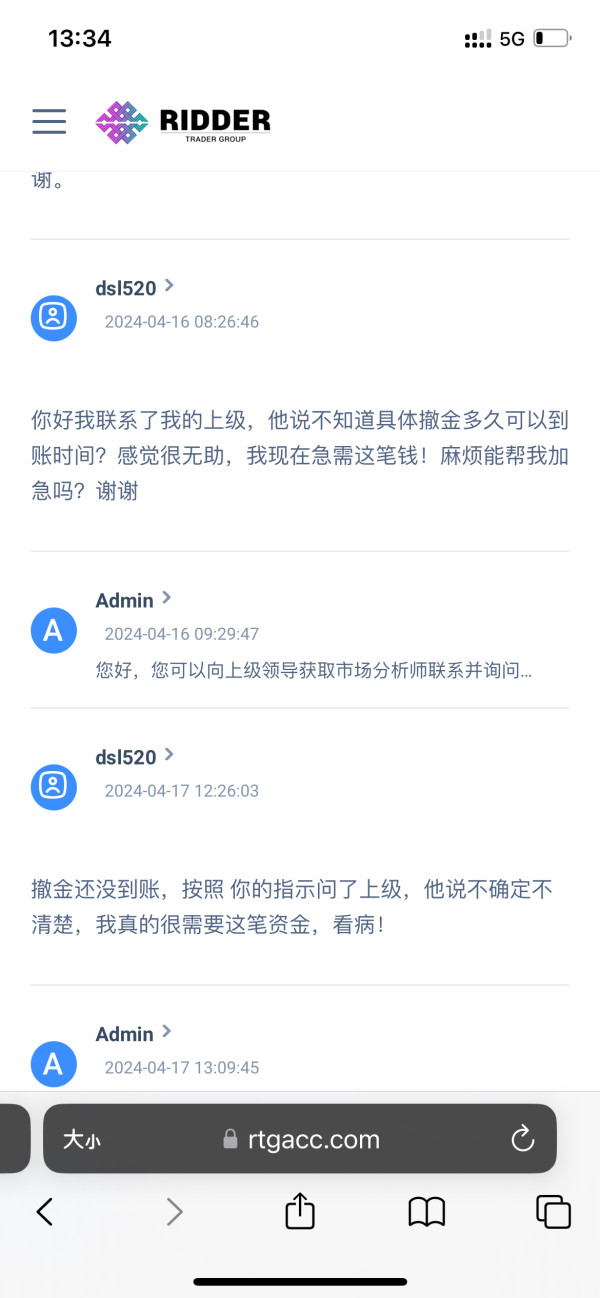

Specific information about customer service channels, including phone support, email assistance, or live chat capabilities, has not been disclosed. This basic service information gap raises serious concerns about client support accessibility.

Response Time Standards

No service level agreements or response time commitments have been published. This makes it impossible to assess support quality expectations.

Service Quality Indicators

The absence of customer service quality metrics, satisfaction surveys, or performance standards suggests limited focus on client experience management. Available information about multilingual support capabilities does not specify supported languages or regional customer service availability, potentially limiting accessibility for international clients.

Operating Hours

Customer service operating hours and timezone coverage remain unspecified. This creates uncertainty about support accessibility during critical trading periods.

Trading Experience Analysis (Score: 5/10)

Platform Stability and Performance

Without specific platform information, assessing trading infrastructure stability becomes impossible. User warnings about trading risks suggest potential execution or platform reliability issues, though specific technical problems remain undocumented.

Order Execution Quality

Available documents provide no information about execution speeds, slippage rates, or requote frequencies. These critical trading performance metrics remain unknown, preventing informed evaluation of execution quality.

Platform Functionality Completeness

The absence of detailed platform feature descriptions makes it impossible to assess charting capabilities, order types, or advanced trading tools availability. No information exists about mobile app availability, functionality, or performance across different devices and operating systems.

Trading Environment Assessment

The high leverage offering up to 1:1000 suggests a high-risk trading environment that may not be suitable for most retail traders. This ridder trader review notes that such extreme leverage levels often indicate targeting of inexperienced traders who may not understand associated risks.

Trust and Security Analysis (Score: 2/10)

Regulatory Compliance Status

Despite claims of regulation by the Mauritius FSC and ASIC, industry reports suggest these regulatory assertions may not reflect actual oversight or client protection. The lack of verifiable regulatory numbers or licenses raises serious authenticity concerns.

Client Fund Security Measures

No information exists about segregated client accounts, investor compensation schemes, or fund protection mechanisms. Legitimate brokers typically maintain clear separation between client funds and operational capital.

Company Transparency Standards

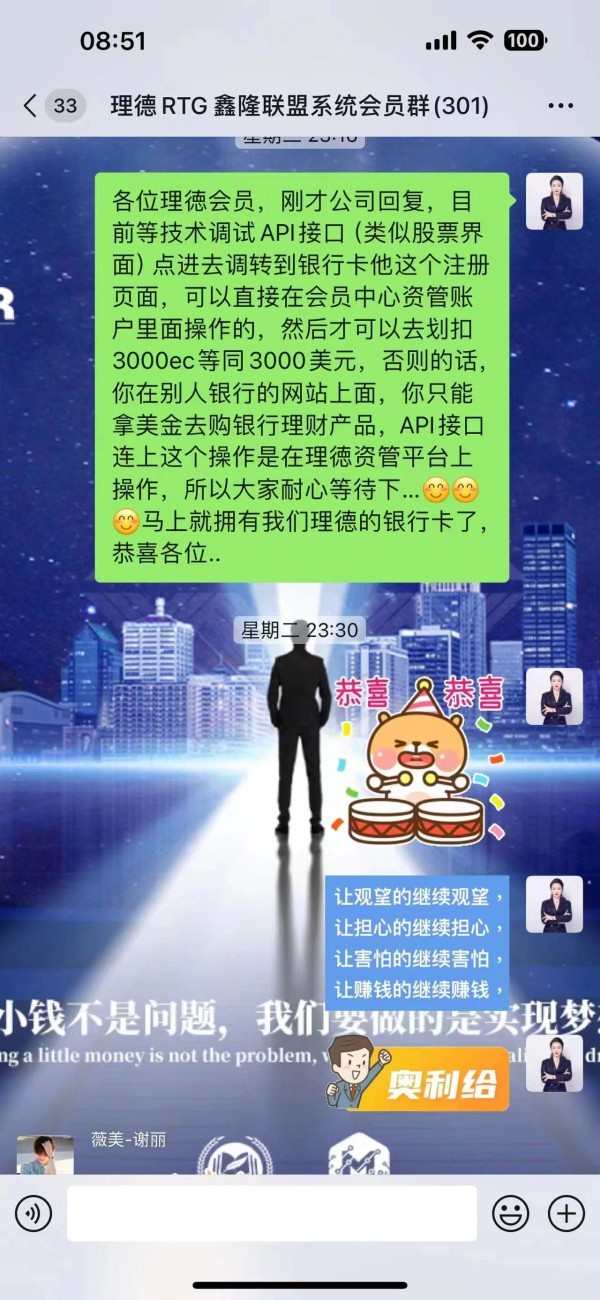

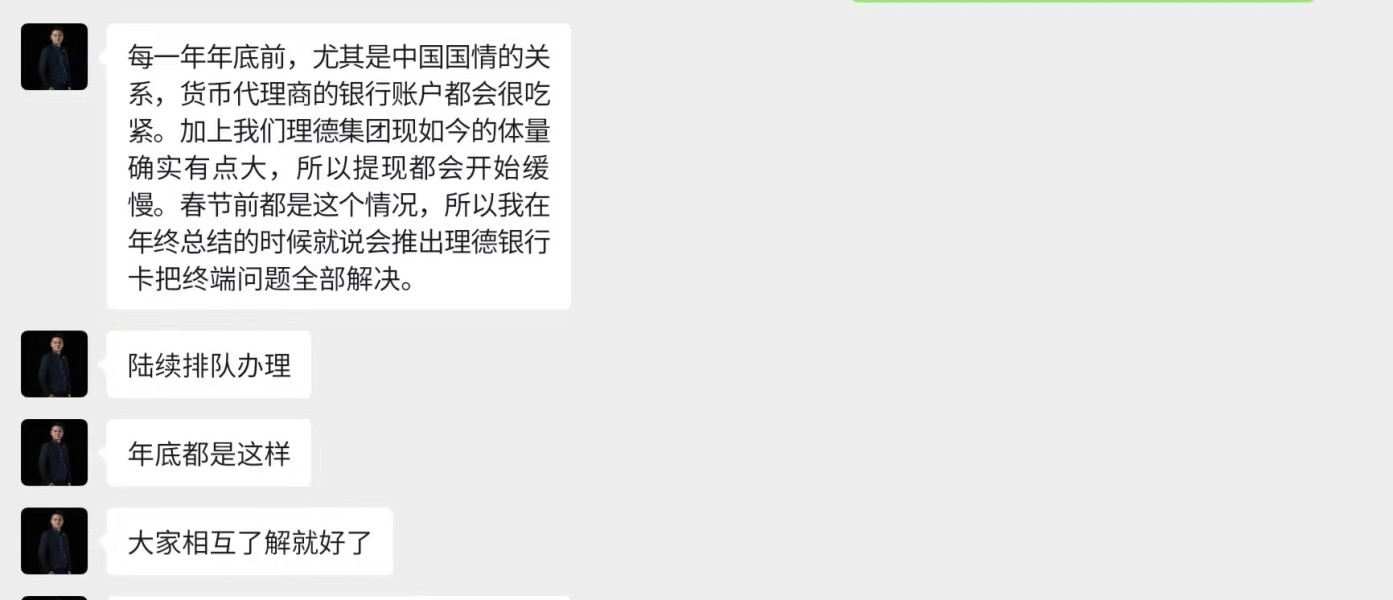

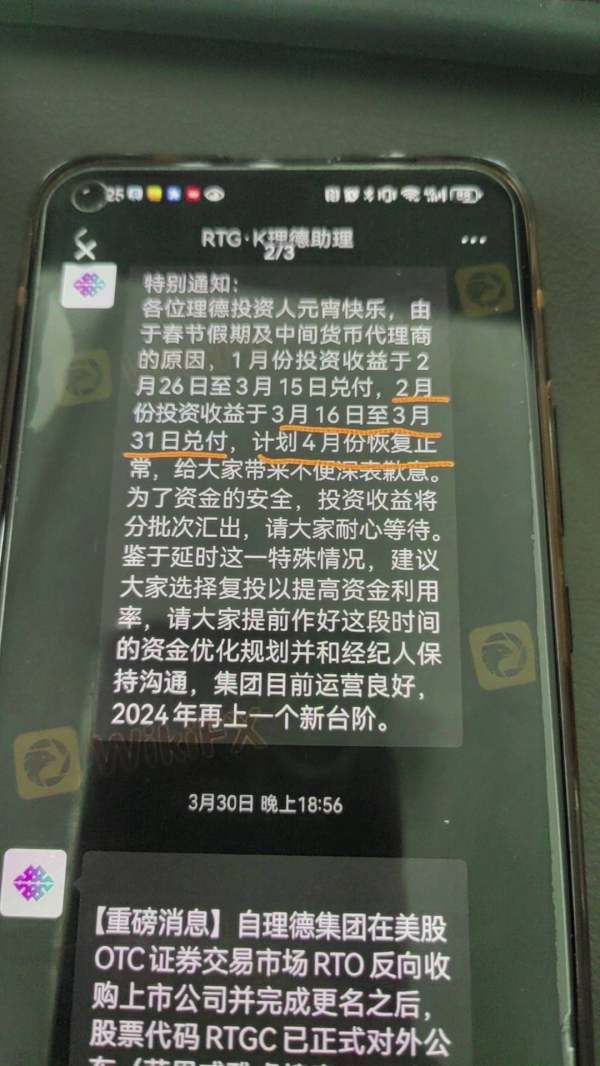

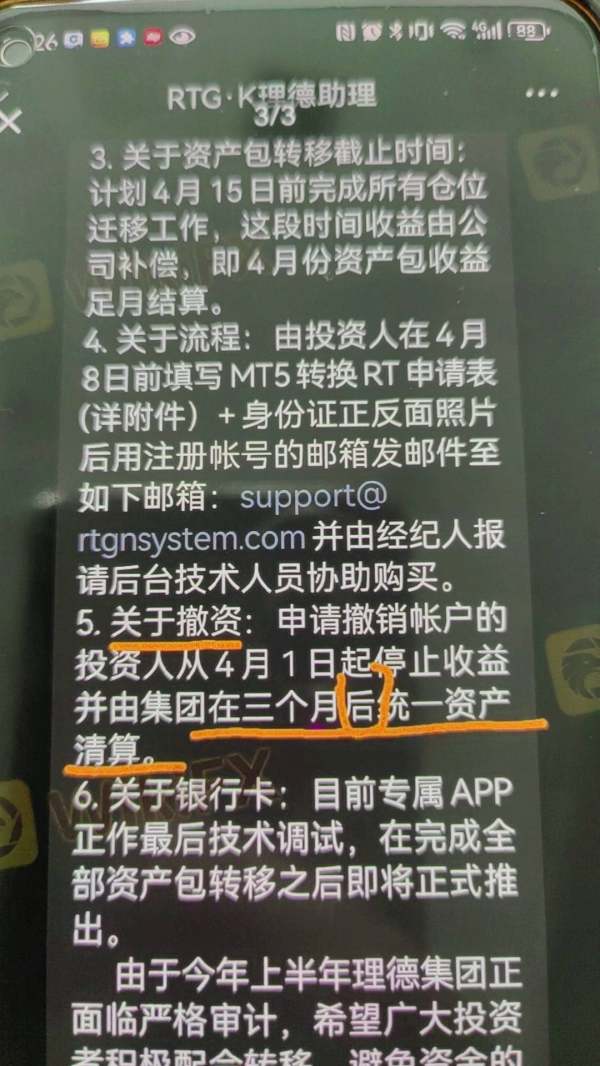

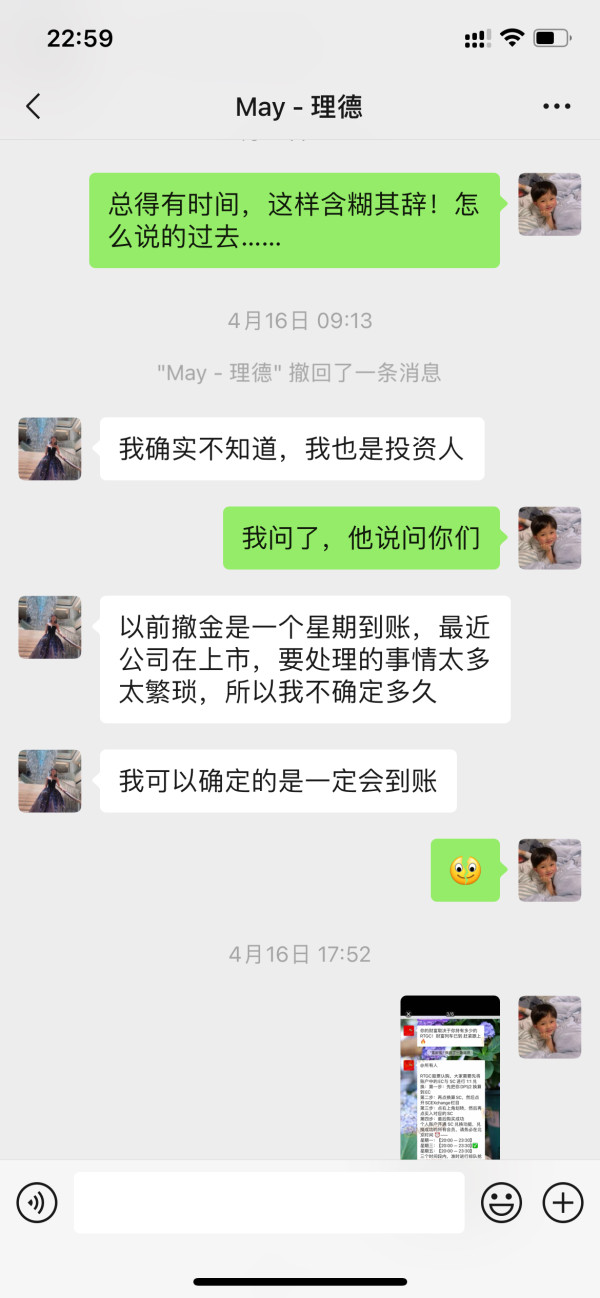

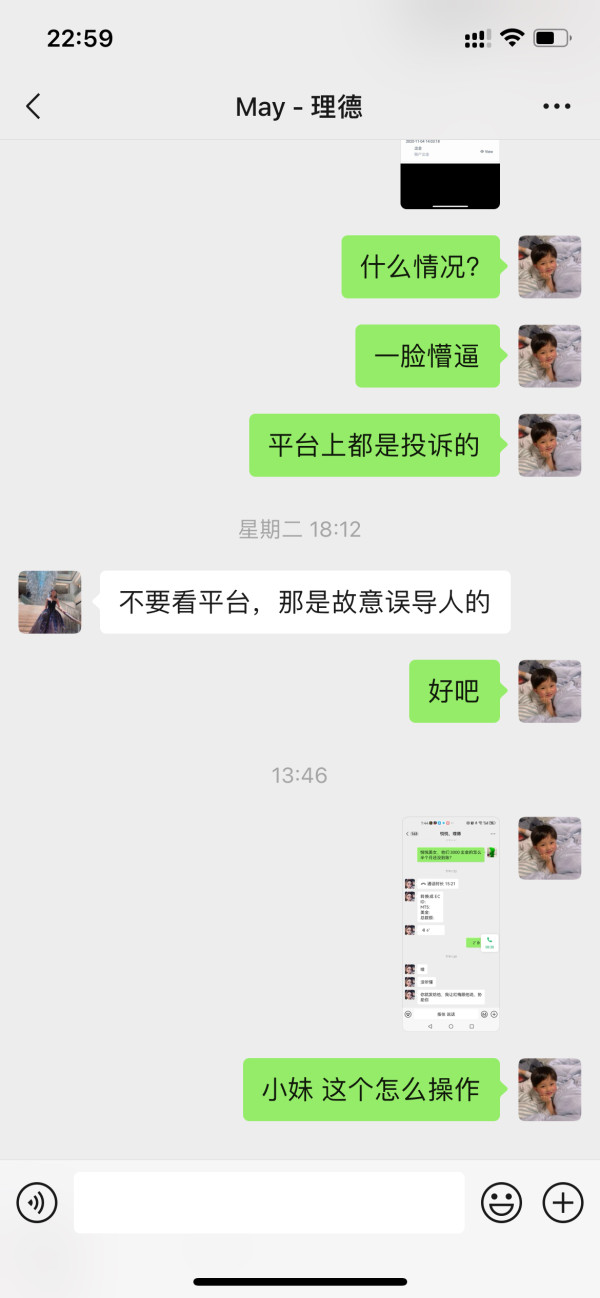

The absence of detailed company information, beneficial ownership disclosure, or financial reporting suggests limited commitment to operational transparency. Multiple industry sources, including TraderKnows, have identified Ridder Trader as a high-risk operation with potential Ponzi scheme characteristics. This negative industry recognition represents a critical trust factor.

Regulatory Action History

While specific regulatory actions remain undocumented, the general industry classification as high-risk suggests potential regulatory concerns or investigations.

User Experience Analysis (Score: 3/10)

Overall Client Satisfaction

Available user feedback suggests significant concerns about the broker's legitimacy and operational practices. The lack of positive user testimonials or satisfaction metrics indicates poor overall client experience.

Interface Design and Usability

Without specific platform information, assessing user interface quality or ease of use becomes impossible. This information gap itself represents a negative user experience factor.

Registration and Verification Process

The account opening process remains undocumented. This prevents assessment of onboarding convenience or efficiency.

Funding Operation Experience

The absence of detailed deposit and withdrawal information suggests potential difficulties in funding operations, which directly impacts user experience quality. Industry reports highlight high-risk characteristics and potential fraudulent activities as primary user concerns. The classification as a potential Ponzi scheme represents the most serious possible user experience issue.

Conclusion

This complete ridder trader review reveals a brokerage operation with significant red flags that make it unsuitable for most traders. While Ridder Trader offers attractive features like high leverage up to 1:1000 and diverse trading instruments, the basic lack of transparency, questionable regulatory claims, and industry warnings about potential Ponzi scheme activity create an unacceptable risk profile.

The broker might theoretically appeal to traders seeking extreme leverage and multi-asset access, but the risks far outweigh any potential benefits. The absence of basic operational information, including account conditions, platform details, and customer service specifications, shows a level of secrecy inconsistent with legitimate brokerage operations.

Key advantages include diverse asset class availability and high leverage options, while critical disadvantages include regulatory uncertainty, operational secrecy, and serious fraud allegations. Potential clients should exercise extreme caution and consider established, properly regulated alternatives for their trading activities.