Regarding the legitimacy of N1CM forex brokers, it provides VFSC and WikiBit, .

Is N1CM safe?

Pros

Cons

Is N1CM markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Number One Capital Markets Limited

Effective Date:

2019-10-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

POT 615/304 Rock Terrace Building, Kumul Highway,Port Vila, VanuatuPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is N1CM A Scam?

Introduction

N1CM, or Number One Capital Markets, is a forex and CFD broker that has positioned itself in the competitive landscape of online trading since its establishment in 2017. Operating from Vanuatu, it aims to provide traders with access to various financial instruments, including forex, commodities, and cryptocurrencies. However, as with any trading platform, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with N1CM. The forex market is rife with both legitimate brokers and potential scams, making it essential for traders to discern the trustworthiness of their chosen platforms.

This article aims to provide an objective analysis of N1CM by examining its regulatory status, company background, trading conditions, and customer experiences. The assessment is based on a combination of qualitative insights and quantitative data gathered from various reputable sources, including regulatory bodies, user reviews, and industry analysis. Through this investigation, we seek to determine whether N1CM is a reliable trading partner or if it raises red flags that warrant caution.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its legitimacy and safety for traders. N1CM claims to be regulated by the Vanuatu Financial Services Commission (VFSC), which is an offshore regulatory body. While this provides some level of oversight, it is important to note that the VFSC's regulatory standards are not as stringent as those of top-tier regulators like the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 15035 | Vanuatu | Active but limited oversight |

The VFSC requires brokers to adhere to certain legal and financial standards, but it lacks the robust enforcement mechanisms found in more reputable jurisdictions. This means that while N1CM is technically regulated, the protections offered to traders may be limited. Additionally, there have been reports of the VFSC revoking licenses from brokers that fail to comply with its standards, raising concerns about the reliability of brokers operating under this jurisdiction.

N1CM's regulatory status should prompt traders to consider the potential risks associated with trading with a broker that operates under an offshore license. The lack of strong regulatory oversight can expose traders to higher risks, including the possibility of fraud or mismanagement of funds. Therefore, it is advisable for potential clients to weigh these factors carefully before committing to N1CM.

Company Background Investigation

N1CM, officially known as Number One Capital Markets Limited, was founded in 2017 and is based in Vanuatu. The company operates under the VFSC's regulations, but its history and ownership structure raise questions about its transparency and reliability. While it markets itself as a global broker, detailed information about its management team and ownership is scarce, which can be a red flag for potential investors.

The management teams background is crucial in assessing the broker's credibility. Unfortunately, there is limited publicly available information regarding the experience and qualifications of N1CM's leadership. This lack of transparency can lead to skepticism among traders who prefer to know the credentials of those managing their funds. Transparency in company operations and management is essential for building trust, and N1CM's vague disclosures may deter potential clients.

Moreover, the company's website does not provide comprehensive information about its operational history, which further complicates efforts to gauge its reliability. A broker's willingness to disclose its history, ownership, and management team can be indicative of its overall transparency and commitment to ethical practices. In this case, the lack of such information may suggest that N1CM is not as forthcoming as it should be, leading to concerns about its legitimacy.

Trading Conditions Analysis

When evaluating a broker, the trading conditions offered—such as fees, spreads, and commissions—are critical factors that can significantly impact a traders profitability. N1CM presents a competitive trading environment with low minimum deposit requirements and high leverage options. However, a closer examination of its fee structure reveals some potential issues.

N1CM offers several account types, including Cent, Standard, and ECN accounts, each with varying spreads and commissions. The overall fee structure is designed to be appealing, especially for novice traders. However, traders should be cautious of any hidden fees or unfavorable terms that may not be immediately apparent.

| Fee Type | N1CM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.9 pips | 1.0 - 1.5 pips |

| Commission Model | $2.5 per lot (ECN) | $3 - $7 per lot |

| Overnight Interest Range | Varies (typically higher) | Varies (typically lower) |

While N1CM claims to offer competitive spreads starting from 0.9 pips, it is essential to verify these claims against actual trading conditions. Additionally, the commission for ECN accounts, while relatively low, may still be higher than some other brokers in the market. Traders should also be aware of the potential for increased overnight interest rates, which can eat into profits, especially for those who hold positions for extended periods.

Moreover, the lack of clarity regarding non-trading fees, such as withdrawal fees or inactivity fees, can lead to unexpected costs for traders. A transparent fee structure is critical for maintaining trust, and any ambiguity in this area can be a cause for concern.

Customer Funds Security

The security of customer funds is paramount when choosing a forex broker. N1CM claims to implement several security measures, including segregated accounts and negative balance protection. Segregated accounts are essential as they ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security in case of insolvency.

However, the level of investor protection offered by N1CM is limited due to its offshore regulation. Unlike brokers regulated by top-tier authorities, N1CM does not provide a compensation scheme to protect clients in the event of financial difficulties. This lack of a safety net can be a significant drawback for traders who prioritize the security of their investments.

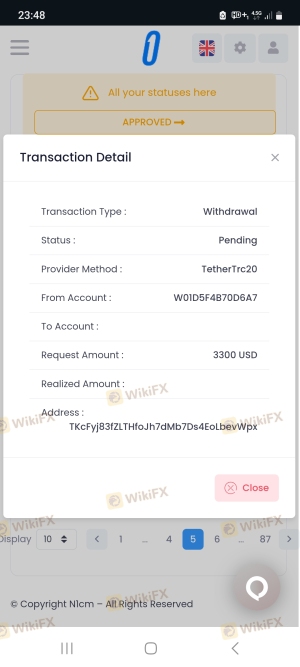

Additionally, while N1CM claims to have negative balance protection, which prevents clients from losing more than their deposited funds, the effectiveness of these measures relies heavily on the broker's operational integrity. Historical issues regarding fund security and withdrawal delays have been reported, raising concerns about the broker's reliability in safeguarding client assets.

Customer Experience and Complaints

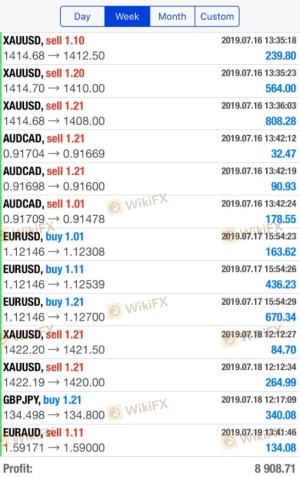

Customer feedback is a crucial indicator of a broker's reliability and service quality. N1CM has garnered mixed reviews from users, with some praising its user-friendly platform and competitive trading conditions, while others raise concerns over withdrawal issues and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response to inquiries |

| Account Management Issues | Medium | Inconsistent support quality |

| Fee Discrepancies | Medium | Lack of clarity in communication |

Common complaints include difficulties in withdrawing funds and slow customer service responses. Some users have reported that their withdrawal requests were delayed or faced additional fees that were not clearly communicated. Such issues can significantly impact a trader's experience, leading to frustration and distrust.

For instance, one user reported a prolonged withdrawal process, stating that their funds were held for an extended period without clear communication from the support team. This type of experience can deter potential customers from trusting the broker with their investments.

Platform and Trade Execution

The trading platform's performance is a critical aspect of a broker's service offering. N1CM utilizes the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their robust features and user-friendly interfaces. However, the execution quality, including slippage and order rejection rates, is equally important for traders.

While many users report satisfactory execution speeds, there are concerns regarding occasional slippage during high volatility periods. Such occurrences can affect trading outcomes, especially for those employing scalping strategies. Additionally, any indication of platform manipulation, such as frequent re-quotes or sudden price changes, could raise serious concerns about the broker's integrity.

Risk Assessment

Engaging with N1CM entails certain risks that traders should be aware of before proceeding. The lack of strong regulatory oversight, combined with the potential for withdrawal issues and unclear fee structures, presents a risk profile that may not be suitable for all traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight |

| Financial Risk | Medium | Potential for withdrawal issues and hidden fees |

| Operational Risk | Medium | Concerns over platform performance and support |

To mitigate these risks, traders should consider starting with a small investment to test the platform's reliability. Additionally, maintaining clear records of all transactions and communications can provide a layer of protection in case of disputes.

Conclusion and Recommendations

In conclusion, while N1CM presents itself as a viable option for forex and CFD trading, several aspects warrant caution. The offshore regulatory status, combined with mixed customer feedback and potential withdrawal issues, raises concerns about the broker's reliability and trustworthiness.

For traders considering N1CM, it is essential to weigh the risks against the potential benefits. Beginners or those with limited trading experience may want to explore more reputable brokers with stronger regulatory oversight. Alternatives such as brokers regulated by the FCA or ASIC may offer more robust protections and a higher level of customer service.

Ultimately, due diligence is crucial when selecting a trading partner. Traders should thoroughly research and assess their options to ensure they are making informed decisions that align with their trading goals and risk tolerance.

Is N1CM a scam, or is it legit?

The latest exposure and evaluation content of N1CM brokers.

N1CM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

N1CM latest industry rating score is 2.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.