N1CM 2025 Review: Everything You Need to Know

N1CM, also known as Number One Capital Markets, has garnered a mixed reputation in the forex trading community. Established in 2017 and regulated by the Vanuatu Financial Services Commission (VFSC), it offers a range of trading instruments and high leverage options. However, user experiences vary widely, with some praising its low fees and fast withdrawal times, while others express concerns about its regulatory status and customer service.

Note: It's important to recognize that N1CM operates under different entities in various regions, which can affect the level of service and regulatory oversight. This review aims to provide a balanced view based on user experiences and expert analyses.

Rating Overview

How We Score Brokers: Our scoring is based on a thorough analysis of user reviews, expert opinions, and factual data regarding trading conditions.

Broker Overview

N1CM is a forex and CFD broker headquartered in Vanuatu. It was established in 2017 and is regulated by the VFSC under license number 15035. The broker primarily operates through the popular MetaTrader 4 and MetaTrader 5 platforms, providing access to a wide array of trading instruments, including over 50 forex pairs, commodities, indices, stocks, and cryptocurrencies.

Detailed Analysis

-

Regulated Regions: N1CM is regulated in Vanuatu, which is considered a low-tier regulatory environment. This means that while it adheres to basic legal standards, it lacks the stringent oversight typical of top-tier regulators like the FCA or ASIC.

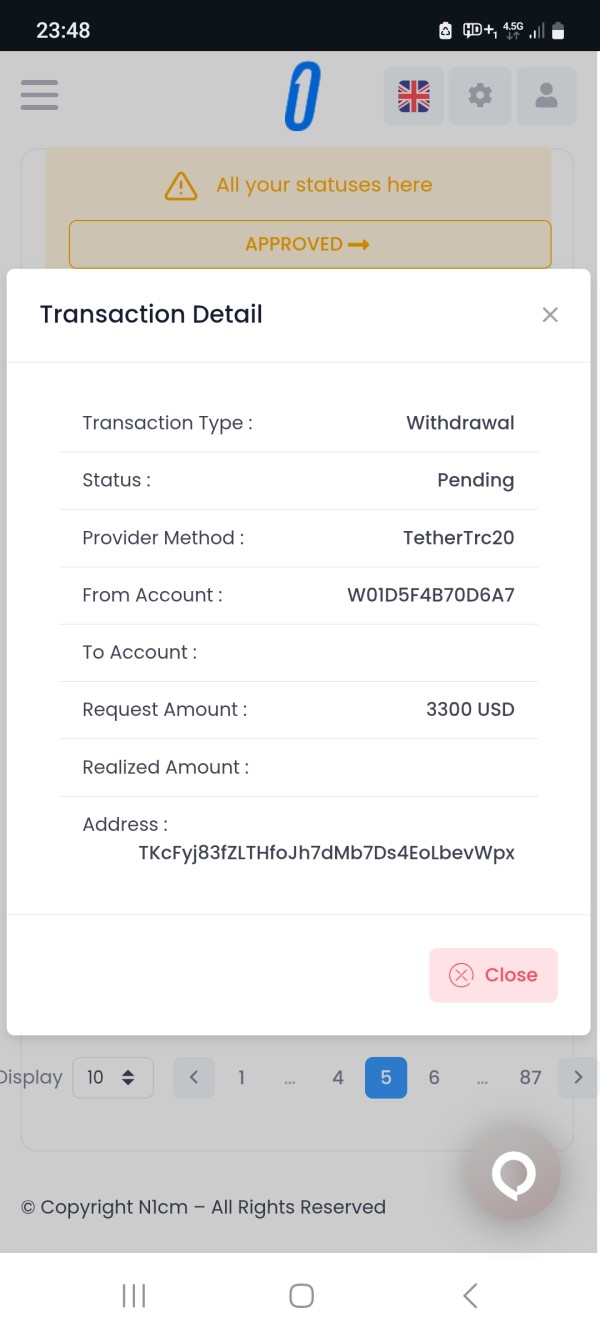

Deposit/Withdrawal Currencies/Cryptocurrencies: N1CM supports deposits in multiple currencies, including USD and various cryptocurrencies such as Bitcoin and Ethereum. However, withdrawals are primarily processed through e-wallets and cryptocurrencies, with no options for traditional bank transfers or credit card withdrawals.

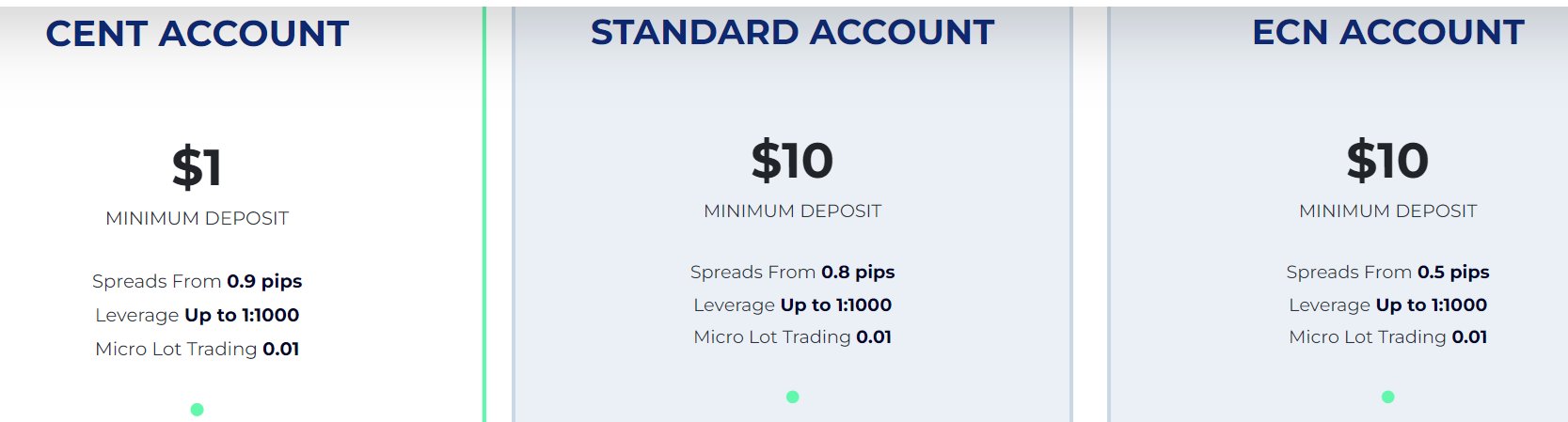

Minimum Deposit: The minimum deposit varies by account type. For the Cent account, it is as low as $1, while the Standard and ECN accounts require a minimum of $5 to $10.

Bonuses/Promotions: N1CM offers a welcome bonus of 35% on the first deposit and a 25% bonus on subsequent deposits, with a maximum bonus cap of $5,000. However, users should read the fine print, as these bonuses often come with strict withdrawal conditions.

Tradable Asset Categories: Traders can access a diverse range of assets, including forex, commodities, indices, stocks, and cryptocurrencies. This variety allows for portfolio diversification and the opportunity to capitalize on different market conditions.

Costs (Spreads, Fees, Commissions): N1CM offers competitive trading costs, with spreads starting from 0.5 pips for ECN accounts. There are no deposit or withdrawal fees, which is a significant advantage for traders looking to minimize costs.

Leverage: The broker offers high leverage of up to 1:1000, appealing to traders looking for greater exposure. However, this also raises the risk of significant losses, particularly for inexperienced traders.

Allowed Trading Platforms: N1CM operates on both MT4 and MT5 platforms, which are well-regarded in the trading community for their advanced features, including automated trading capabilities and extensive analytical tools.

Restricted Regions: N1CM does not accept clients from the United States, Canada, and several other jurisdictions with strict regulatory frameworks.

Available Customer Service Languages: Customer support is predominantly offered in English, with limited availability. Traders can reach out via live chat, WhatsApp, and email, but the support hours are limited to weekdays.

Detailed Breakdown

Account Conditions: N1CM provides several account types, including Cent, Standard, and ECN accounts, catering to both novice and experienced traders. The low minimum deposit requirement is attractive, but the lack of tier-one regulation raises concerns about safety.

Tools and Resources: While the trading platforms are robust, the educational resources are limited, primarily consisting of basic e-books and market analysis. This may not suffice for traders seeking comprehensive educational support.

Customer Service and Support: Customer service has received mixed reviews. Some users report prompt responses, while others have expressed frustration over limited availability and slow resolution times.

Trading Setup (Experience): Traders have noted that while the execution speed is generally fast, there have been occasional issues with slow quote updates and platform reliability during high volatility.

Trustworthiness: N1CM's regulatory status as an offshore broker is a significant concern. Despite some positive user reviews, the absence of stringent regulatory oversight may deter risk-averse traders.

User Experience: Overall, user experiences vary widely. Some traders appreciate the low fees and fast withdrawals, while others report issues with account management and communication with customer support.

In conclusion, N1CM presents a mixed bag of opportunities and risks for traders. While it offers high leverage and low entry costs, potential clients should carefully consider the implications of its offshore status and the varying user experiences before committing their funds.