Is MEXn safe?

Pros

Cons

Is MEXn Safe or a Scam?

Introduction

MEXn is a Forex broker that positions itself as a global player in the online trading market, offering a variety of financial instruments, including foreign exchange and contracts for difference (CFDs). The allure of high leverage and advanced trading technology, such as AI-driven trading robots, attracts many traders looking for innovative solutions. However, the Forex market is rife with potential scams and unreliable brokers, making it essential for traders to conduct thorough evaluations before committing their capital. This article seeks to provide an objective analysis of MEXn by examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. We will utilize a combination of qualitative assessments and quantitative data to determine whether MEXn is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in assessing its legitimacy. Brokers that are regulated by reputable authorities are generally held to higher standards, which can provide a layer of protection for traders. MEXn, unfortunately, lacks valid regulatory oversight, which raises significant concerns regarding its operations and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that MEXn is not subject to the stringent compliance requirements that govern licensed brokers. This lack of oversight can lead to numerous issues, including the potential mismanagement of client funds and inadequate protection against fraud. Historically, brokers without proper regulation have been involved in scandals and have faced numerous complaints from traders regarding fund withdrawals and account management. Therefore, it is crucial to consider the implications of trading with an unregulated entity like MEXn when evaluating whether MEXn is safe.

Company Background Investigation

MEXn Limited was established in Hong Kong, but specific details about its history and ownership structure remain vague. The company claims to have developed advanced trading technologies, including AI-driven trading robots, but lacks transparency about its management team and their qualifications.

The absence of clear information regarding the company's founders and executive team raises questions about its credibility. A transparent company usually provides background information about its leadership, including their experience and qualifications in the finance and trading sectors. Unfortunately, MEXn does not disclose this information, making it difficult for potential clients to assess the competency and reliability of the management team.

In terms of transparency and information disclosure, MEXn falls short of industry standards. A reliable broker should be forthcoming about its operations, ownership, and management, which is essential for building trust with clients. This lack of transparency casts doubt on whether MEXn is safe for traders looking to invest their hard-earned money.

Trading Conditions Analysis

The trading conditions offered by MEXn, including fees and spreads, are essential for evaluating its overall attractiveness to traders. MEXn advertises various trading instruments and high leverage, but the specifics of its fee structure raise concerns.

| Fee Type | MEXn | Industry Average |

|---|---|---|

| Major Currency Pair Spread | ~0.3 pips | ~1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

While MEXn claims to offer competitive spreads, the lack of a clear commission structure and the mention of high overnight interest rates can deter traders. High fees can significantly impact profitability, especially for active traders. Additionally, the absence of transparency regarding commission rates and potential hidden fees is a red flag.

Traders should be cautious when dealing with brokers that do not clearly outline their fee structures, as this can lead to unexpected costs that diminish trading profits. Therefore, it is vital to consider these factors when determining whether MEXn is safe for trading.

Client Fund Safety

Client fund safety is a paramount concern for any trader. MEXn's lack of regulatory oversight raises significant questions about its fund security measures. Regulated brokers are typically required to keep client funds in segregated accounts, ensuring that client money is protected in the event of financial difficulties. However, MEXn does not provide information regarding its fund segregation practices.

Furthermore, the absence of investor protection schemes is concerning. Reputable brokers often participate in compensation schemes that protect clients' funds up to a certain amount in case of insolvency. MEXn's lack of such measures leaves traders vulnerable to significant losses, especially if the broker were to face financial issues.

Historically, companies without robust safety measures have faced allegations of fund mismanagement and have left clients unable to withdraw their funds. Therefore, it is crucial for traders to carefully consider whether MEXn is safe for their investments, given the potential risks involved.

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding the overall experience of trading with MEXn. Reviews and testimonials from existing clients provide insight into the broker's reliability and responsiveness. Unfortunately, MEXn has received a mix of reviews, with several users reporting issues related to fund withdrawals and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Management | Medium | Inadequate |

| Customer Service | High | Slow |

Common complaints include difficulties in withdrawing funds, which is often a significant red flag for potential scams. In some cases, traders have reported that their withdrawal requests were delayed or denied without sufficient explanation. The company's slow response to customer inquiries further exacerbates these issues, indicating a lack of commitment to customer service.

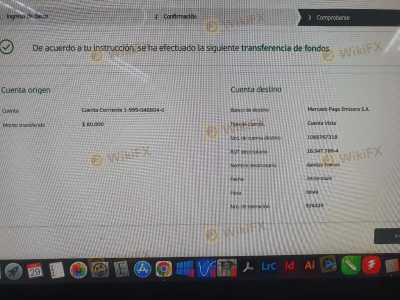

For instance, one trader reported being unable to withdraw their funds for several months, leading to frustration and distrust in the broker. Such experiences raise serious concerns about whether MEXn is safe for traders who may find themselves in similar situations.

Platform and Execution

The trading platform's performance and order execution quality are critical factors for any broker. MEXn offers a proprietary trading platform, but user reviews indicate that it may not be as reliable or efficient as other industry-standard platforms like MetaTrader 4 (MT4).

Traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading performance. A reliable platform should ensure accurate and timely order execution, as delays can result in missed opportunities and increased trading costs.

Moreover, any signs of platform manipulation, such as artificially widening spreads during volatile market conditions, should be scrutinized. Traders must assess whether the platform's performance aligns with their trading strategies and risk tolerance before determining if MEXn is safe.

Risk Assessment

When considering whether to trade with MEXn, it is essential to evaluate the overall risk involved. The lack of regulation, transparency, and customer complaints all contribute to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight. |

| Financial Risk | High | Potential mismanagement of funds. |

| Customer Service Risk | Medium | Poor response to client issues. |

To mitigate risks associated with trading with MEXn, traders should exercise caution. It is advisable to start with a small investment to test the platform and customer service before committing larger amounts. Additionally, traders should be prepared for potential challenges in withdrawing funds and managing their accounts.

Conclusion and Recommendations

In conclusion, the evidence suggests that MEXn poses significant risks for potential traders. The lack of regulation, transparency issues, and numerous customer complaints raise serious concerns about the broker's credibility and reliability. Therefore, it is essential for traders to approach MEXn with caution and consider alternative options.

For those seeking a reliable trading experience, it is advisable to explore regulated brokers with a proven track record of customer satisfaction and transparent practices. Brokers that are licensed by reputable regulatory authorities offer a greater level of protection and can provide a safer trading environment.

In summary, while MEXn may offer appealing trading conditions, the associated risks and lack of oversight make it crucial for traders to carefully evaluate whether MEXn is safe for their trading activities.

Is MEXn a scam, or is it legit?

The latest exposure and evaluation content of MEXn brokers.

MEXn Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MEXn latest industry rating score is 2.21, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.21 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.