Is IVY MARKETS safe?

Pros

Cons

Is Ivy Markets A Scam?

Introduction

Ivy Markets is a relatively new player in the forex trading arena, having been established in 2018. As a broker offering contracts for difference (CFDs) on various financial instruments, including forex, commodities, and cryptocurrencies, it aims to cater to a diverse range of traders. However, the increasing number of fraudulent activities in the online trading space necessitates that traders exercise caution when selecting a broker. It is essential to thoroughly evaluate the credibility and safety of any trading platform before committing funds. This article investigates Ivy Markets' legitimacy by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and potential risks associated with trading on its platform.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining a broker's reliability. A well-regulated broker is typically subject to strict oversight, which helps protect traders' interests. Unfortunately, Ivy Markets operates without a valid license from any recognized financial authority, raising significant red flags.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The lack of regulation means that Ivy Markets does not adhere to the standards set by reputable financial authorities, which can expose traders to potential risks, including fraud and mismanagement of funds. Furthermore, the absence of a verifiable physical office location is a common tactic employed by scam brokers to avoid accountability. The overall lack of transparency regarding its regulatory status and operations makes it difficult to trust Ivy Markets as a legitimate trading platform.

Company Background Investigation

Ivy Markets claims to have been founded in 2018 and is registered in the Comoros. However, information regarding its ownership structure, management team, and operational history is scant. The absence of detailed disclosures about the company's management raises concerns about its transparency.

The management team's background and professional experience are crucial indicators of a broker's reliability. Unfortunately, Ivy Markets does not provide sufficient information about its leadership, making it challenging to assess their qualifications and industry experience. This lack of clarity can lead to doubts about the broker's intentions and overall credibility.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for assessing its suitability for traders. Ivy Markets offers a range of trading instruments, but its fee structure remains ambiguous. Reports suggest that the broker employs high-pressure sales tactics to encourage deposits, which can lead to unexpected costs for traders.

| Fee Type | Ivy Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Structure | No | Varies |

| Overnight Interest Range | Variable | 0.5% - 2.0% |

The spread for major currency pairs is not clearly defined, and the commission structure is reportedly nonexistent. This lack of transparency can lead to unexpected costs, making it difficult for traders to accurately assess their potential profitability. Furthermore, any unusual fees or charges could significantly impact a trader's bottom line.

Customer Fund Security

The safety of customer funds is paramount in the trading industry. Ivy Markets claims to prioritize client fund security; however, their lack of regulatory oversight raises concerns. The broker does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies.

Without proper regulatory frameworks, traders may find themselves vulnerable to losing their entire investment without any recourse. Historical issues related to fund security, including reports of delayed withdrawals and blocked accounts, further exacerbate concerns about Ivy Markets' reliability as a broker.

Customer Experience and Complaints

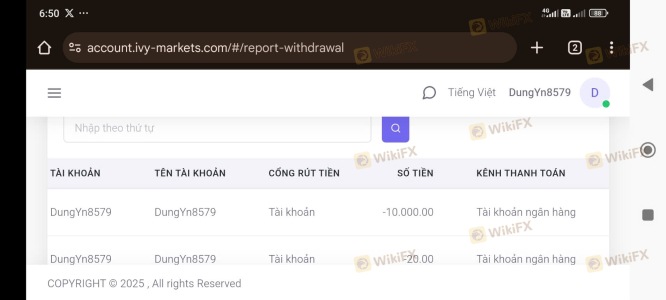

Customer feedback is a valuable resource for assessing a broker's performance. Numerous reviews indicate that traders have encountered significant issues with Ivy Markets, including difficulties in withdrawing funds and receiving inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | High | Poor |

Common complaints revolve around delayed or denied withdrawals, with many users reporting that their accounts were blocked after they attempted to withdraw funds. These issues suggest a troubling pattern that raises questions about the broker's practices and customer service.

Case Studies

- One user reported depositing $10,000 and successfully trading to a profit of $4,000. However, when attempting to withdraw $5,000, the broker claimed their account had violated certain rules, leading to a complete account lockout.

- Another trader shared that after depositing $70,000 and generating significant profits, they faced numerous obstacles when trying to withdraw their funds. The broker's lack of communication and support left them feeling scammed.

Platform and Execution

The trading platform offered by Ivy Markets is an essential aspect of the trading experience. While the broker claims to provide a user-friendly interface with fast execution speeds, the overall performance and reliability of the platform remain questionable. Reports of slippage and order rejections have surfaced, indicating potential issues with trade execution quality.

Signs of Platform Manipulation

There are indications that Ivy Markets may engage in manipulative practices, which could further jeopardize traders' experiences. The combination of poor execution quality and high-pressure sales tactics raises concerns about the broker's ethical standards.

Risk Assessment

Trading with Ivy Markets presents several risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of clear fund protection policies. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Support Risk | High | Poor response to user complaints. |

To mitigate these risks, traders should conduct thorough research before engaging with Ivy Markets. It is advisable to consider using well-regulated brokers with a proven track record.

Conclusion and Recommendations

In light of the evidence presented, Ivy Markets raises several red flags that suggest it may not be a trustworthy broker. The lack of regulation, poor customer feedback, and questionable trading practices indicate potential fraud. Traders should exercise extreme caution when considering this platform for their trading activities.

For those seeking reliable alternatives, it is advisable to explore brokers that are well-regulated and have a solid reputation in the industry. Options may include brokers regulated by the FCA, ASIC, or CySEC, which provide a safer trading environment and better customer protection. Overall, it is crucial for traders to prioritize their safety and conduct comprehensive due diligence before investing their funds.

Is IVY MARKETS a scam, or is it legit?

The latest exposure and evaluation content of IVY MARKETS brokers.

IVY MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IVY MARKETS latest industry rating score is 1.89, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.89 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.