IVY Markets 2025 Review: Everything You Need to Know

Summary

This complete ivy markets review gives a fair look at IVY Markets Limited. This forex broker has created mixed reactions in the trading community since it started in 2018. IVY Markets offers trading services across multiple types of assets including forex, commodities, cryptocurrencies, and stocks through the MT5 platform.

The broker has some good features that stand out. It requires only $50 as a minimum deposit and offers high leverage up to 1:400, making it easy for traders to enter the forex market with limited money. IVY Markets supports various popular payment methods and works under the regulation of MWALI INTERNATIONAL SERVICES AUTHORITY with license number BFX2024013.

However, this review shows several worrying issues that potential traders should think about carefully. According to ForexBrokerz reports, there are five red flags linked to ivy-markets.com, and industry experts have questioned the regulatory status. User feedback shows mixed experiences, with an average rating of 3/5 across various review platforms.

The broker mainly targets traders who want low-barrier entry to forex markets. This especially includes beginners and those with smaller trading budgets. While the company offers different trading tools and accepts small initial deposits, questions about regulatory oversight and customer service quality need careful thought before opening an account.

Important Notice

This ivy markets review uses publicly available information and user feedback collected from various sources as of 2025. Readers should know that regulatory requirements and trading conditions may vary a lot across different areas, which could affect user experience and available services.

The review method used here includes data from multiple industry sources. These include regulatory databases, user review platforms, and broker comparison websites. All information presented should be checked independently, and potential traders are strongly advised to do their own research before making any investment decisions.

Rating Framework

Broker Overview

IVY Markets Limited started in 2018 as a global trading services provider. The company placed itself in the competitive online brokerage market with registration number HT00124001 and focuses on delivering multi-asset trading solutions to retail and institutional clients worldwide. According to available company information, IVY Markets has built its business model around providing easy trading conditions for various experience levels.

The broker's main business approach centers on offering different trading opportunities across four major asset categories. These include foreign exchange, commodities, cryptocurrencies, and equity markets. This ivy markets review found that the company focuses on low-barrier entry strategies, particularly targeting traders who may be new to financial markets or those working with smaller amounts of money.

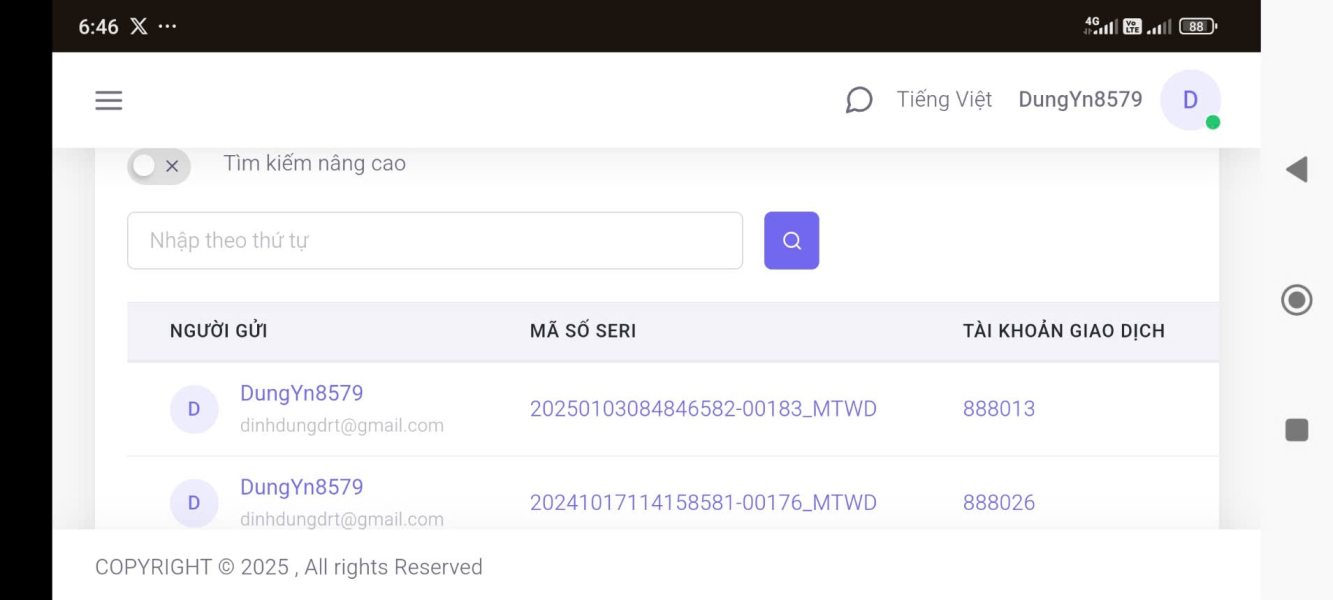

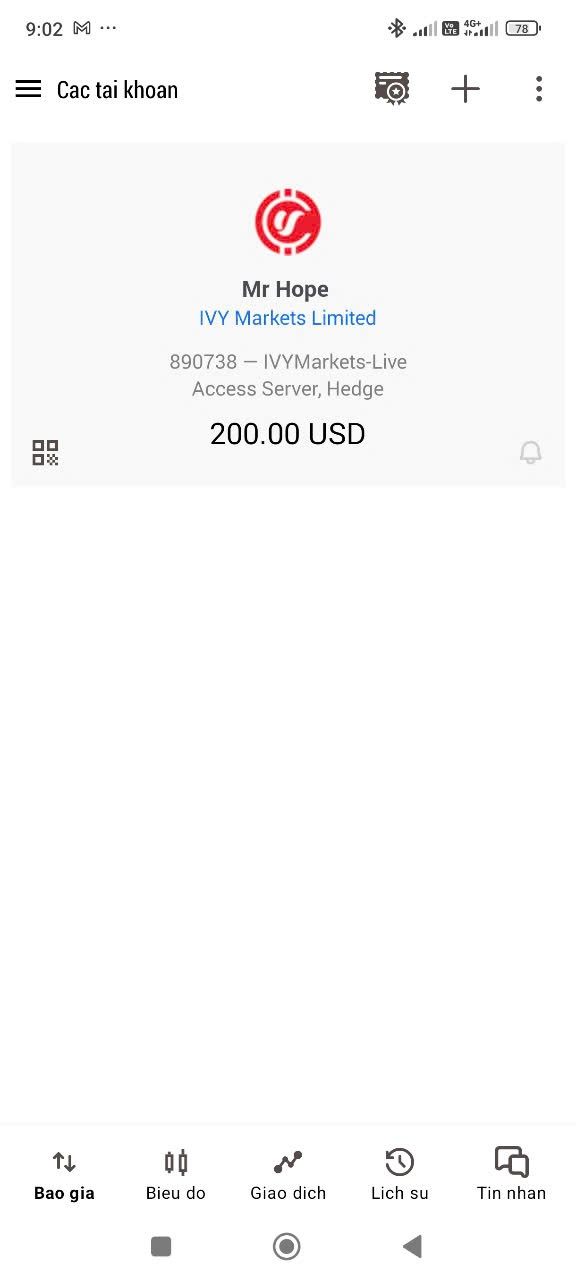

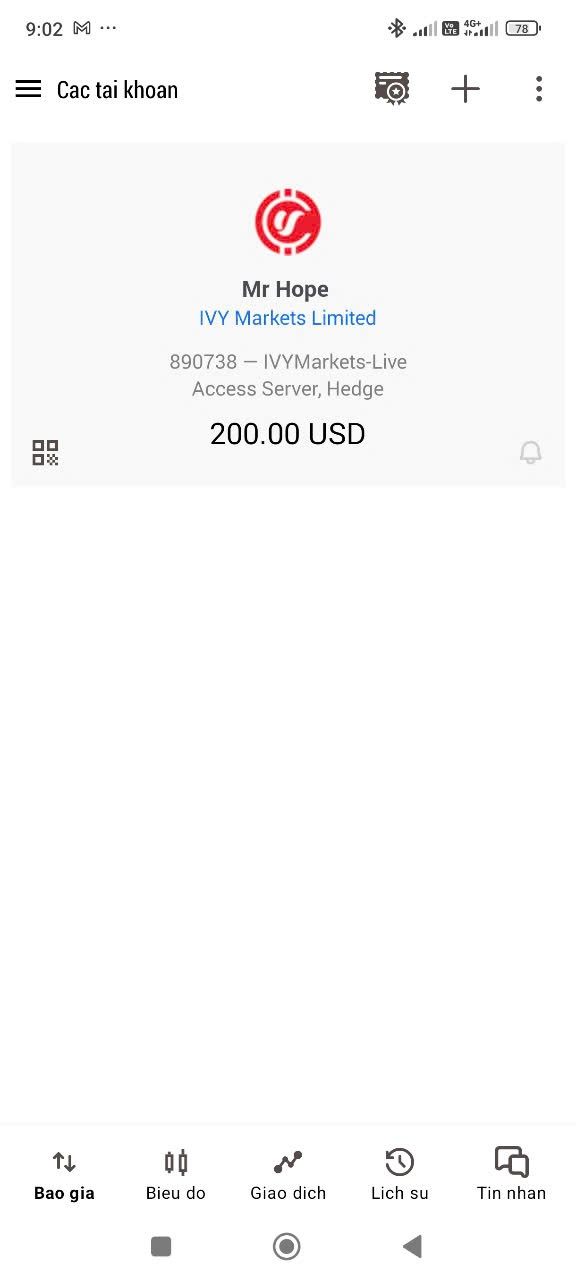

IVY Markets works mainly through the MetaTrader 5 (MT5) platform. This serves as the backbone of its trading system. The platform choice shows the company's focus on providing complete charting tools, technical analysis capabilities, and automated trading support. Under the regulatory oversight of MWALI INTERNATIONAL SERVICES AUTHORITY, the broker maintains its operational license BFX2024013, though industry analysts have raised questions about how good this regulatory framework really is.

The company's market position suggests a focus on accessibility and user-friendly trading conditions. However, user feedback shows mixed experiences regarding service quality and platform reliability.

Regulatory Status

IVY Markets operates under the regulation of MWALI INTERNATIONAL SERVICES AUTHORITY with license number BFX2024013. However, industry sources including WikiFX have shown concerns about the regulatory status, describing it as "abnormal" in their assessments.

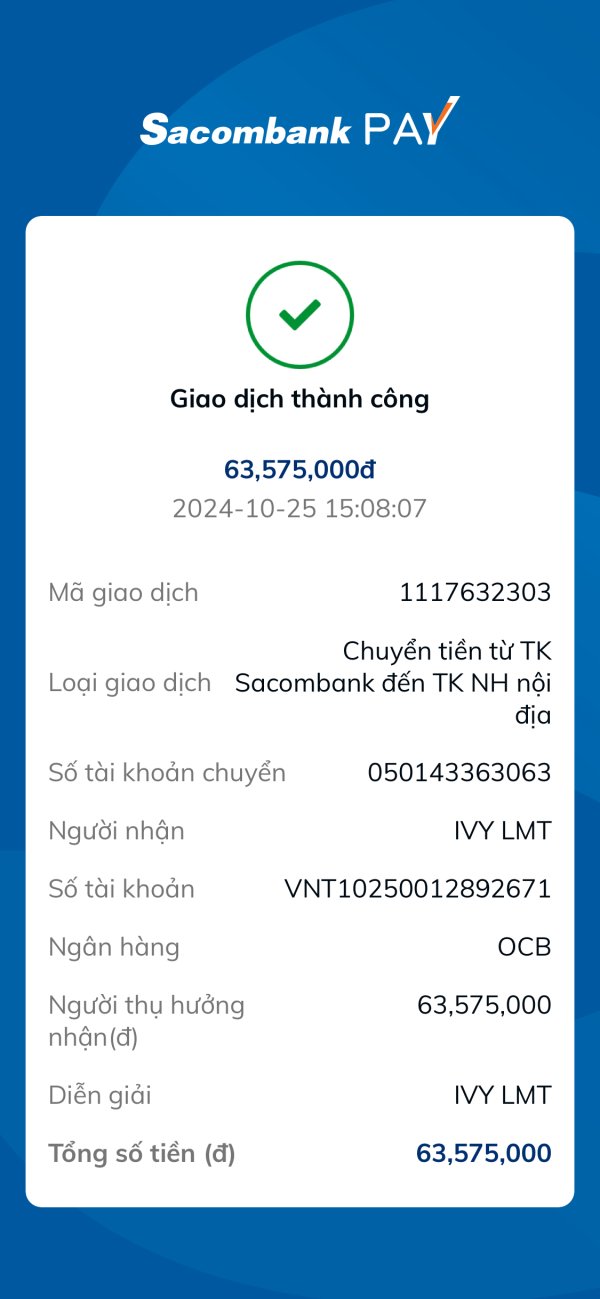

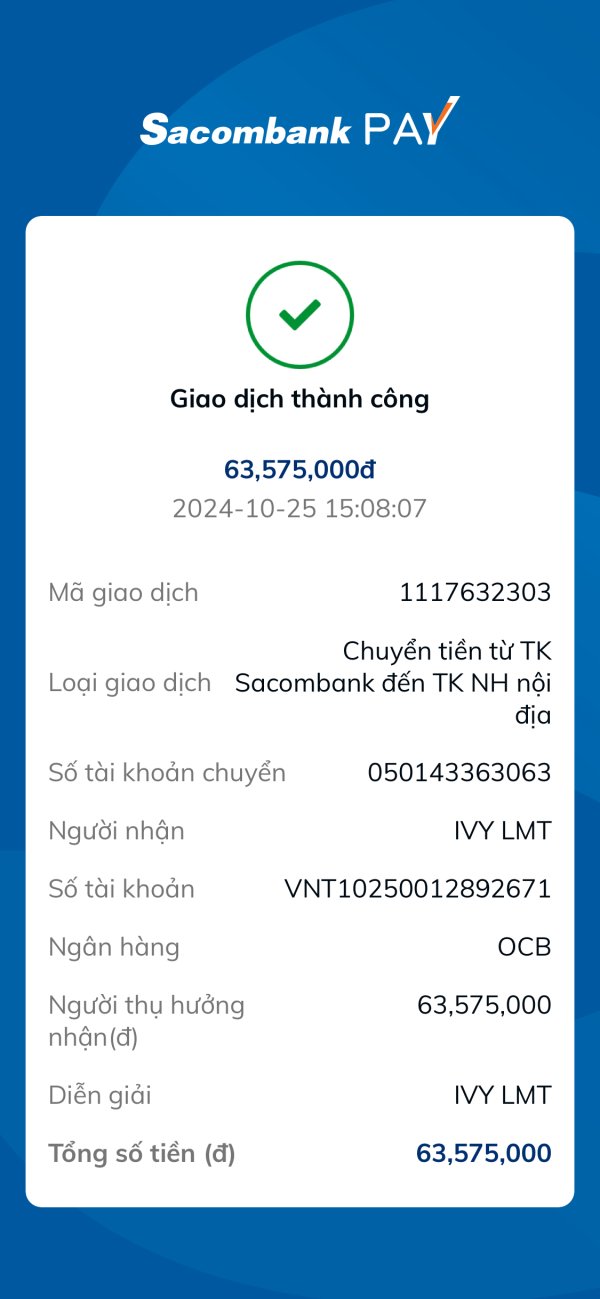

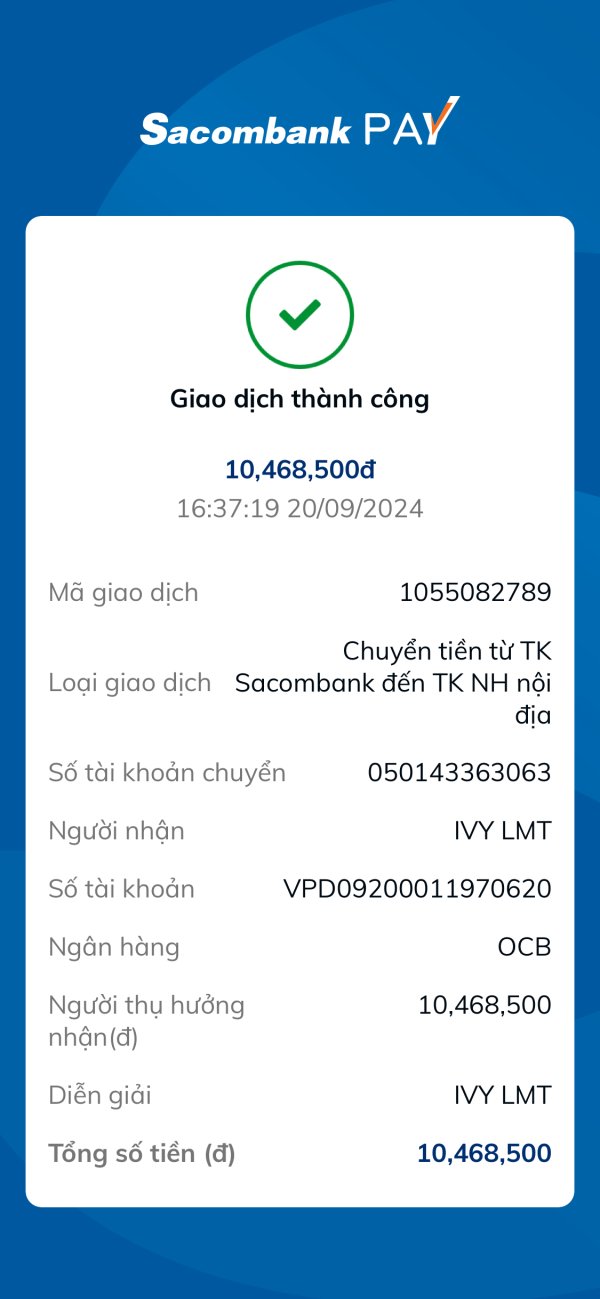

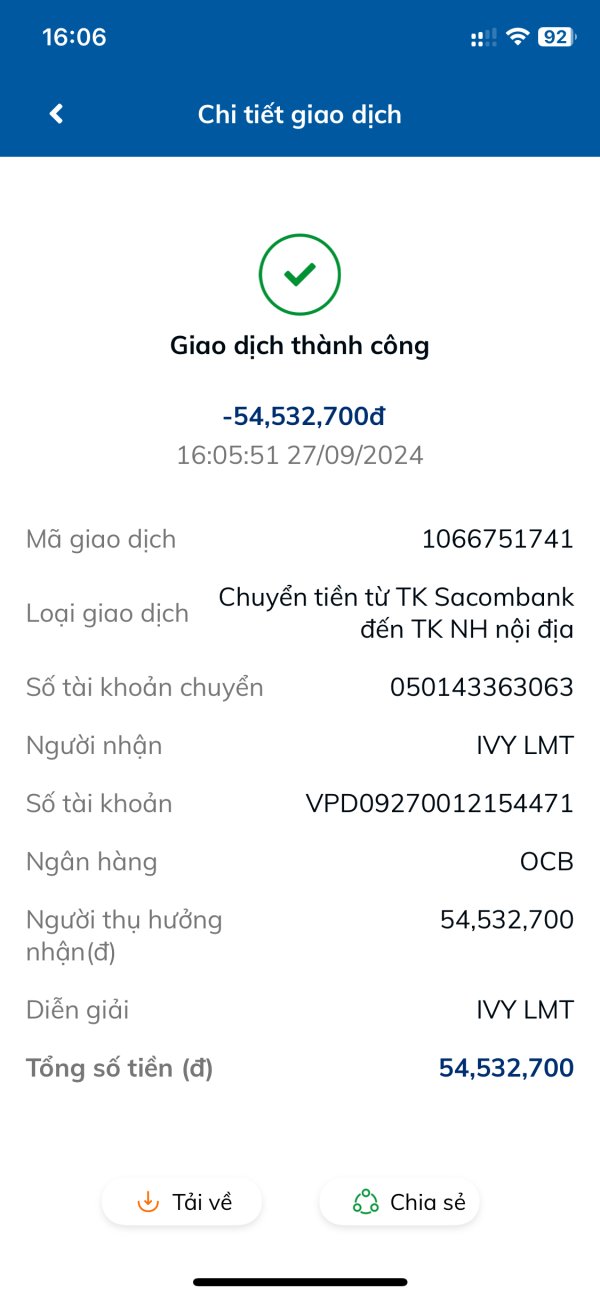

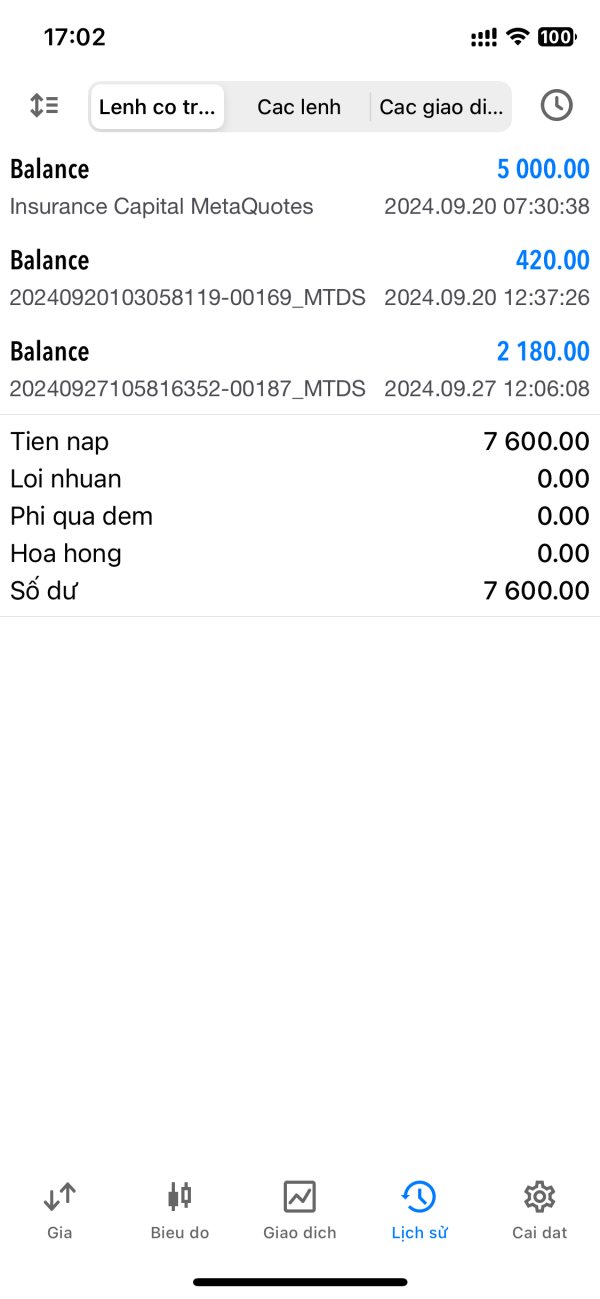

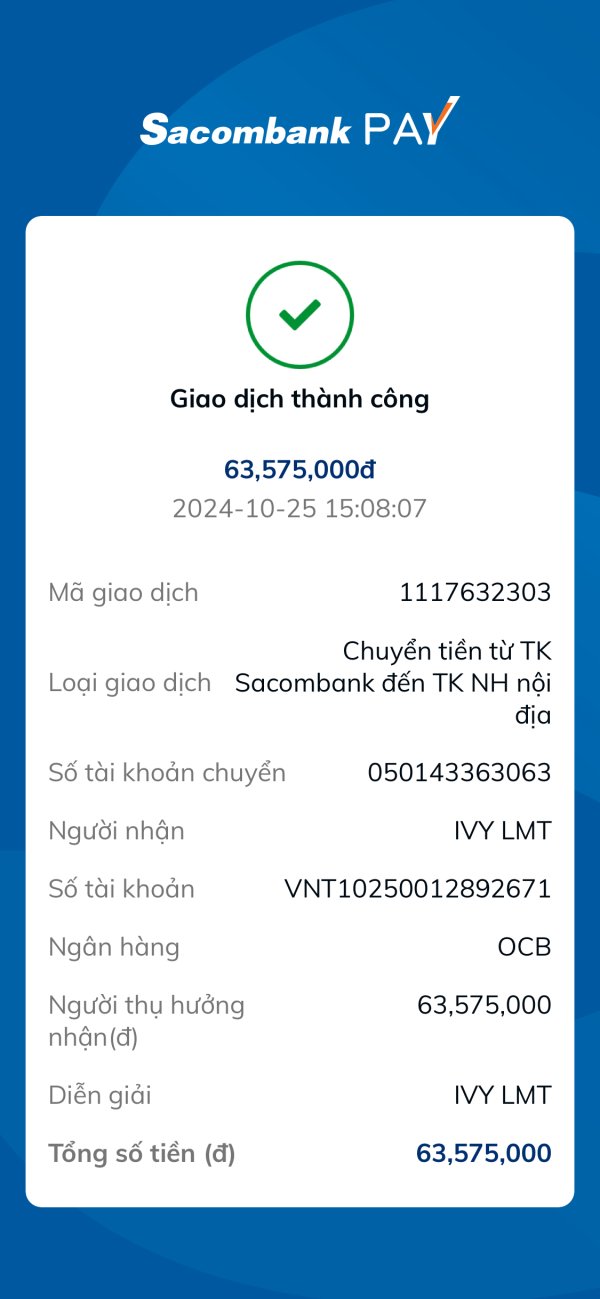

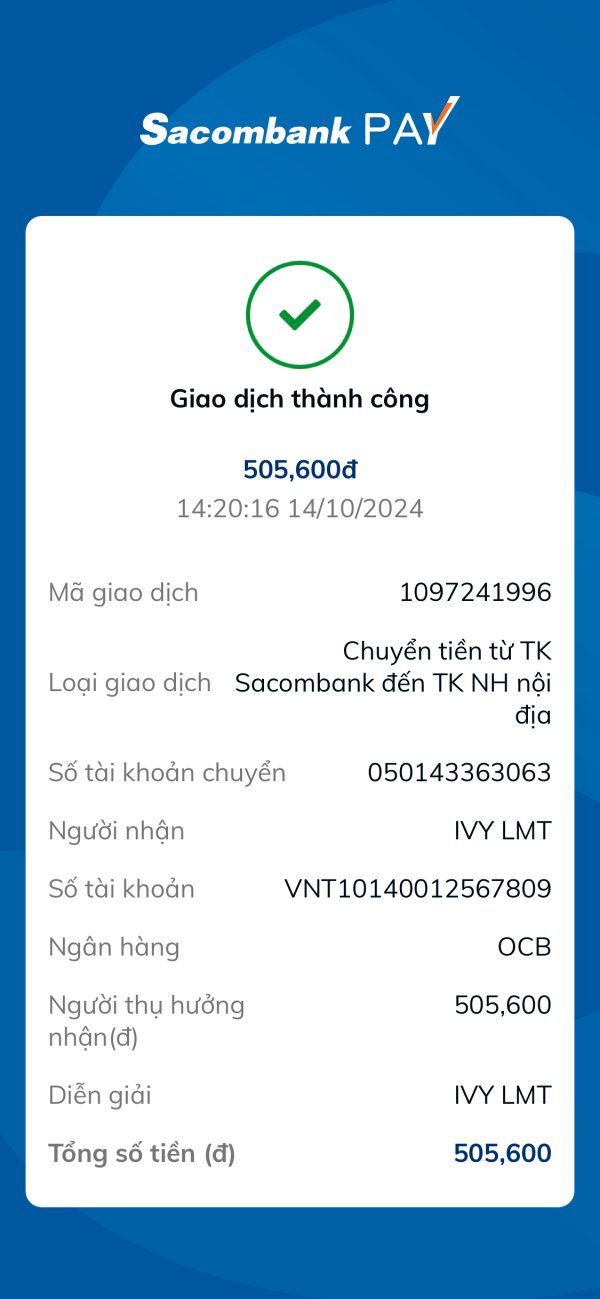

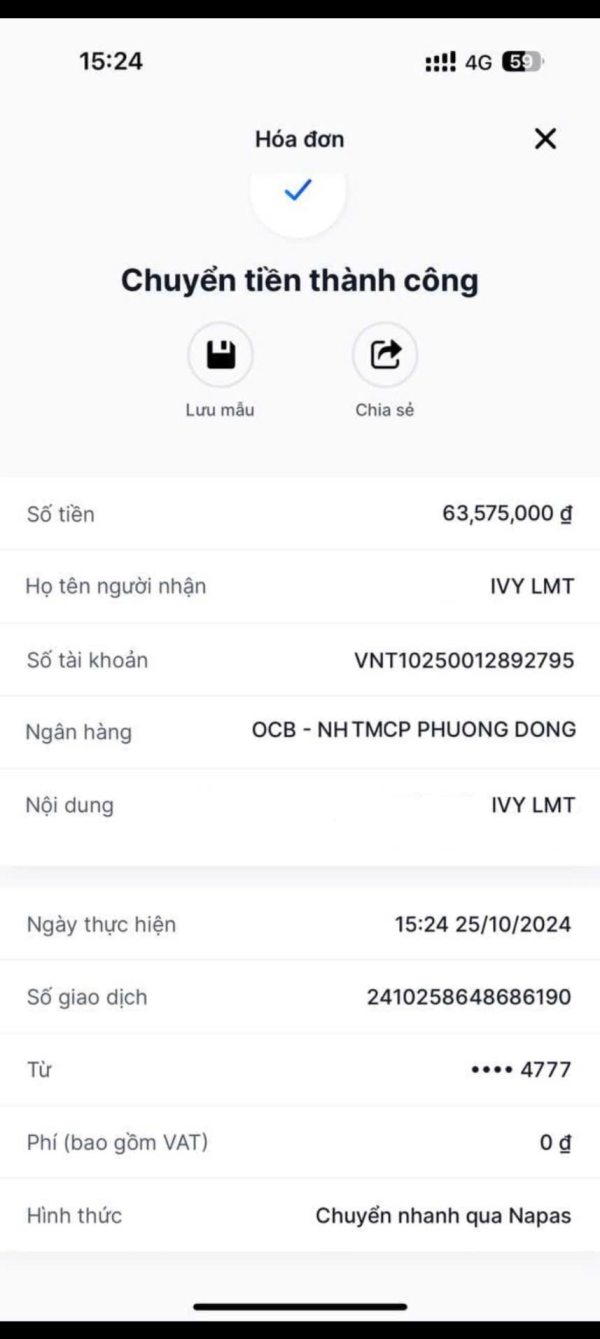

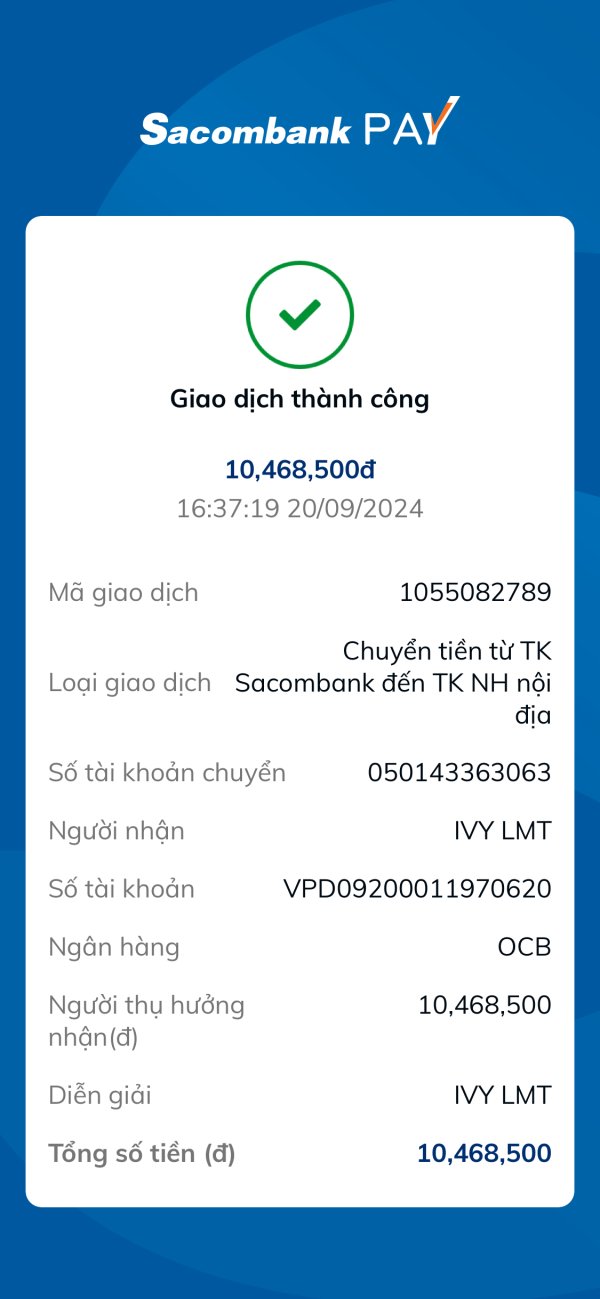

Deposit and Withdrawal Methods

The broker supports multiple popular payment methods for deposits and withdrawals. Specific details about processing times and fees are not well documented in available materials. The variety of payment options aims to help traders from different regions.

Minimum Deposit Requirements

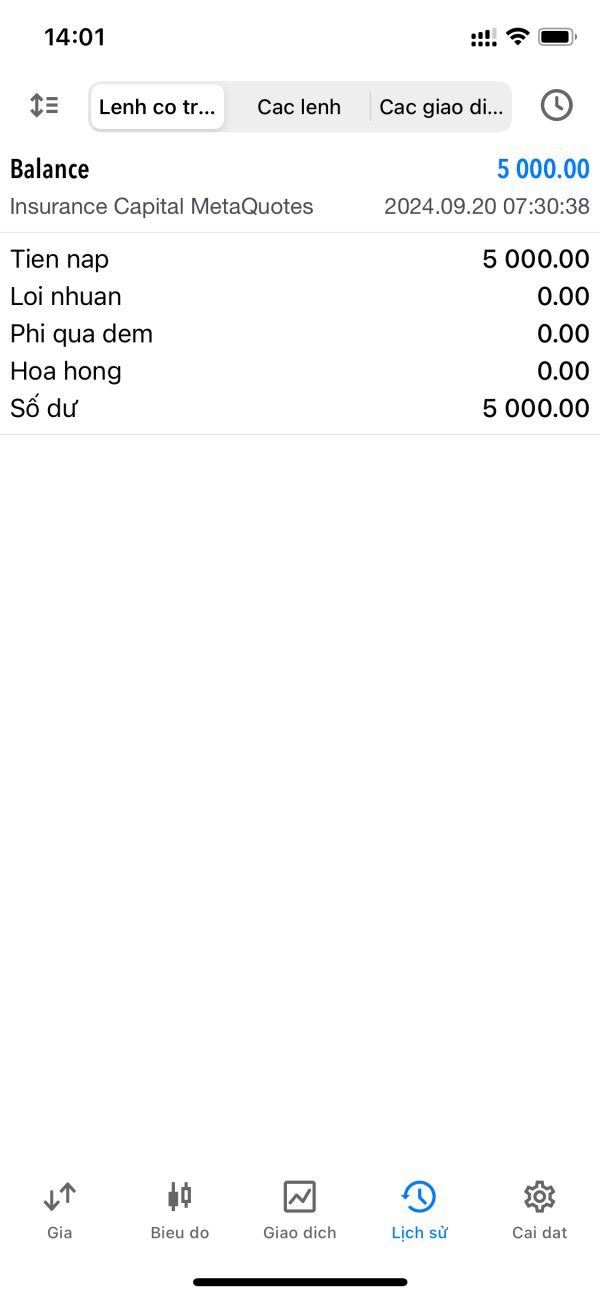

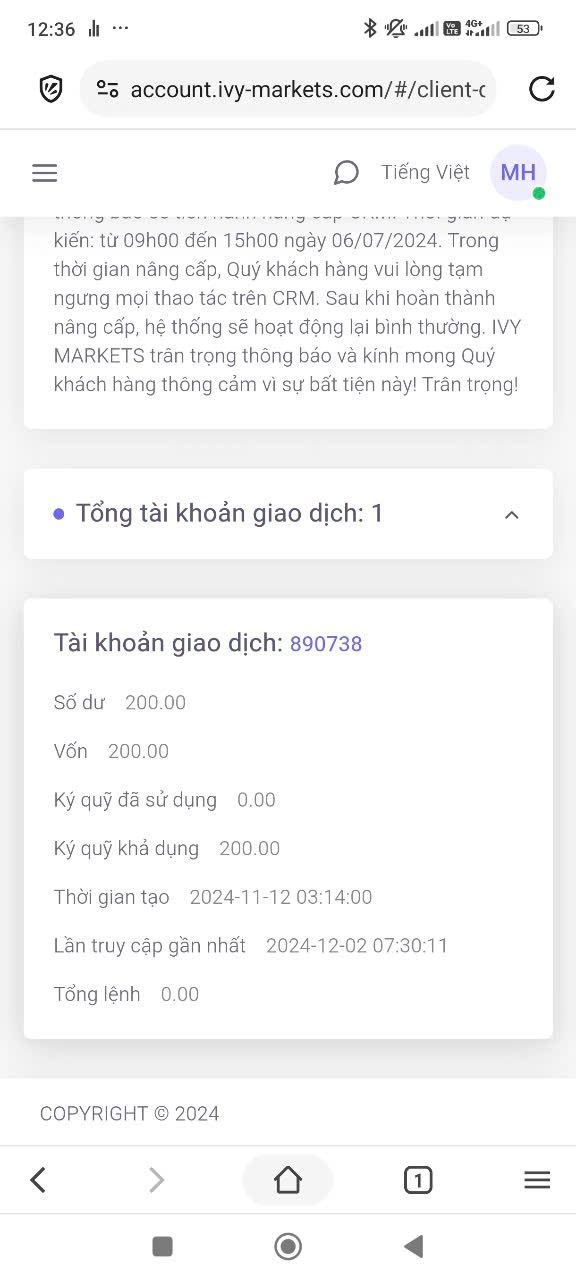

IVY Markets maintains a minimum deposit requirement of $50. This positions it as accessible to traders with limited starting capital. This low threshold makes the platform particularly attractive to beginner traders and those testing new strategies.

Current promotional offerings and bonus structures are not detailed in available information sources. This suggests either limited promotional activities or insufficient public disclosure of such programs.

Tradeable Assets

The platform provides access to four major asset categories. These include foreign exchange pairs, commodity markets, cryptocurrency trading, and stock market instruments. This variety allows traders to build different portfolios across different market sectors.

Cost Structure

Specific information regarding spreads, commissions, and other trading costs remains unclear in available documentation. This lack of transparency in pricing structure represents a significant information gap for potential clients.

Leverage Ratios

IVY Markets offers maximum leverage up to 1:400. This is considered high by industry standards and may appeal to traders seeking amplified market exposure, though such leverage levels also increase risk significantly.

The primary trading platform is MetaTrader 5 (MT5). This provides users with advanced charting capabilities, technical analysis tools, and automated trading support through Expert Advisors.

Regional Restrictions

Information regarding specific regional restrictions or availability limitations is not well detailed in current documentation.

Customer Support Languages

Available customer support languages and communication channels are not well documented in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

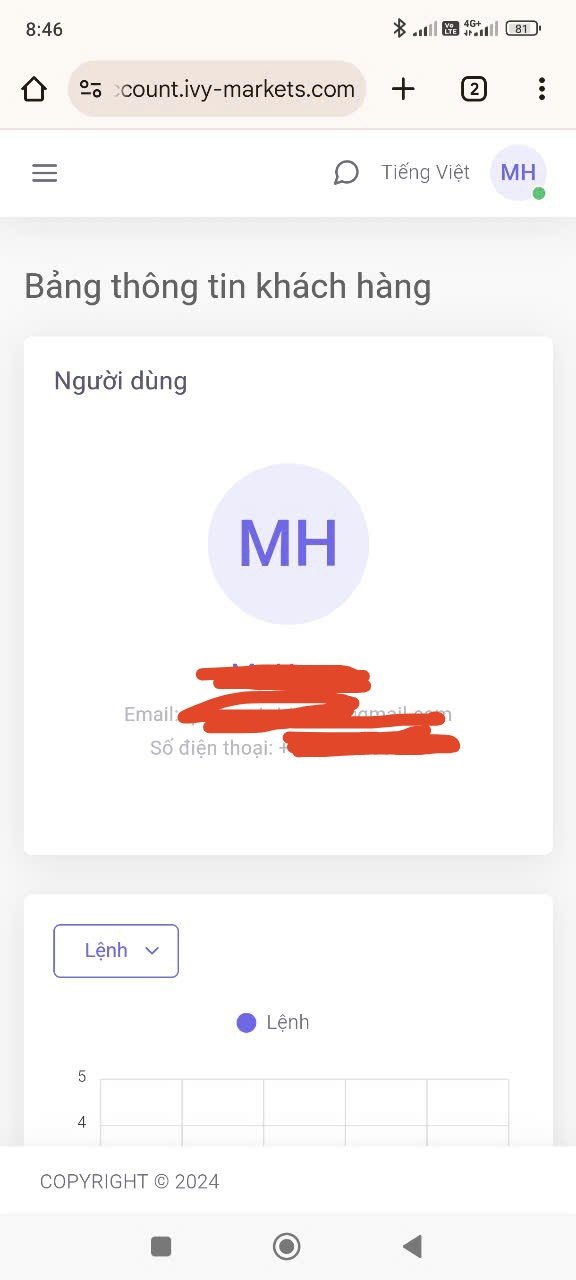

The account structure at IVY Markets shows both strengths and limitations that need careful consideration. The broker offers two primary account types: Standard and PRO accounts, though detailed specifications for each tier are not well documented in available materials. The ivy markets review process revealed that while the $50 minimum deposit requirement is notably competitive and accessible, the lack of detailed information about account features and benefits creates uncertainty for potential traders.

The account opening process appears to follow standard industry practices, though it's not well detailed in available documentation. However, user feedback suggests that verification procedures and account activation timelines may vary significantly. The low minimum deposit threshold represents a clear advantage for traders with limited starting capital, particularly when compared to brokers requiring $500 or more for account activation.

Special account features and benefits remain unclear based on available information. This represents a significant transparency gap. The absence of detailed information about account-specific spreads, commission structures, and additional services makes it challenging for traders to make informed decisions about which account type best suits their needs.

User feedback regarding account conditions has been mixed. Some traders appreciate the low entry barrier while others express concerns about the lack of comprehensive account information and unclear fee structures.

IVY Markets' platform offering centers around MetaTrader 5. This provides a strong foundation for trading activities across multiple asset classes. The MT5 platform delivers comprehensive charting capabilities, advanced technical analysis tools, and support for automated trading through Expert Advisors. This ivy markets review found that the platform choice represents one of the broker's stronger aspects, given MT5's reputation for reliability and functionality.

The trading tools available through MT5 include over 80 technical indicators, multiple timeframes, and advanced order types that work with various trading strategies. The platform supports both manual and automated trading approaches, allowing traders to implement complex strategies or rely on algorithmic solutions. However, proprietary tools and additional resources beyond the standard MT5 offering appear limited based on available information.

Research and analysis resources are not well documented in available materials. This suggests either limited provision of market analysis or insufficient public disclosure of such services. Educational resources, which are crucial for beginner traders, also lack detailed documentation, representing a potential gap in the broker's service offering.

User feedback regarding platform performance has been generally positive. Traders appreciate the familiar MT5 interface and functionality. However, some users have reported connectivity issues and platform stability concerns during high-volatility market periods.

Customer Service and Support Analysis (Score: 5/10)

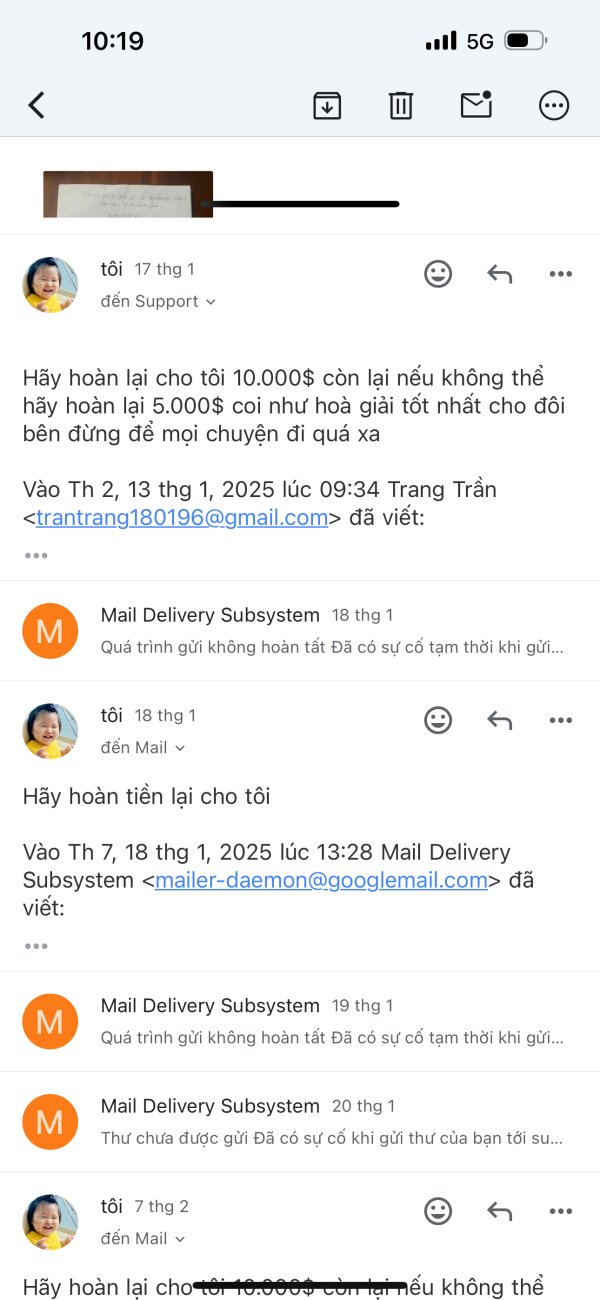

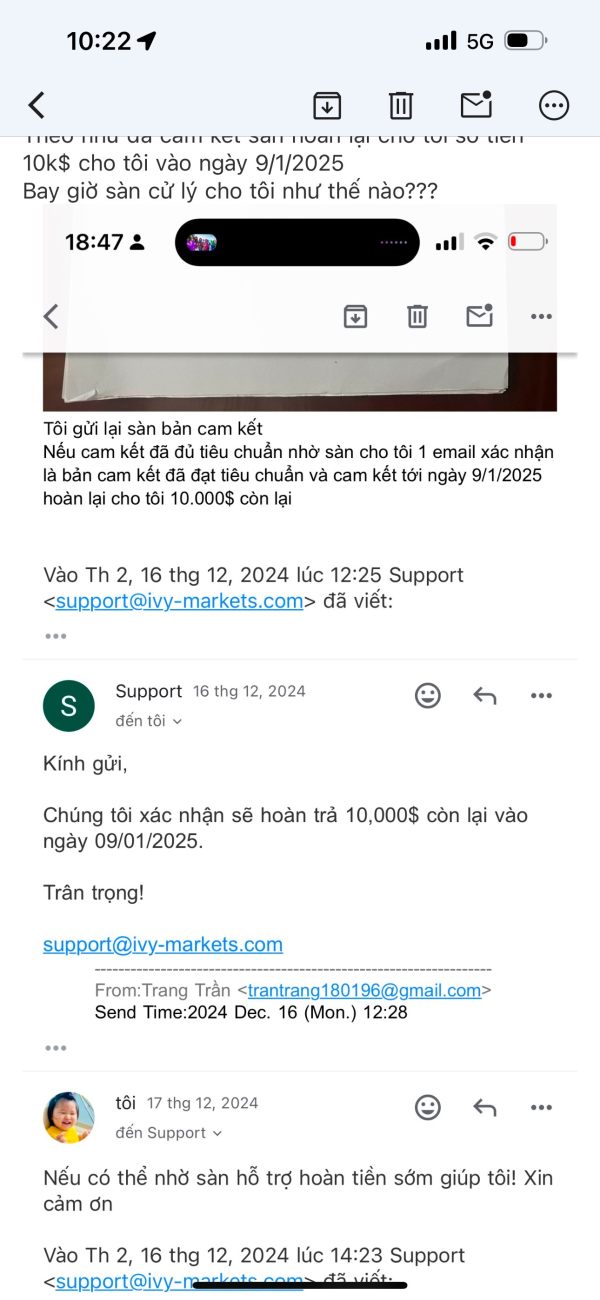

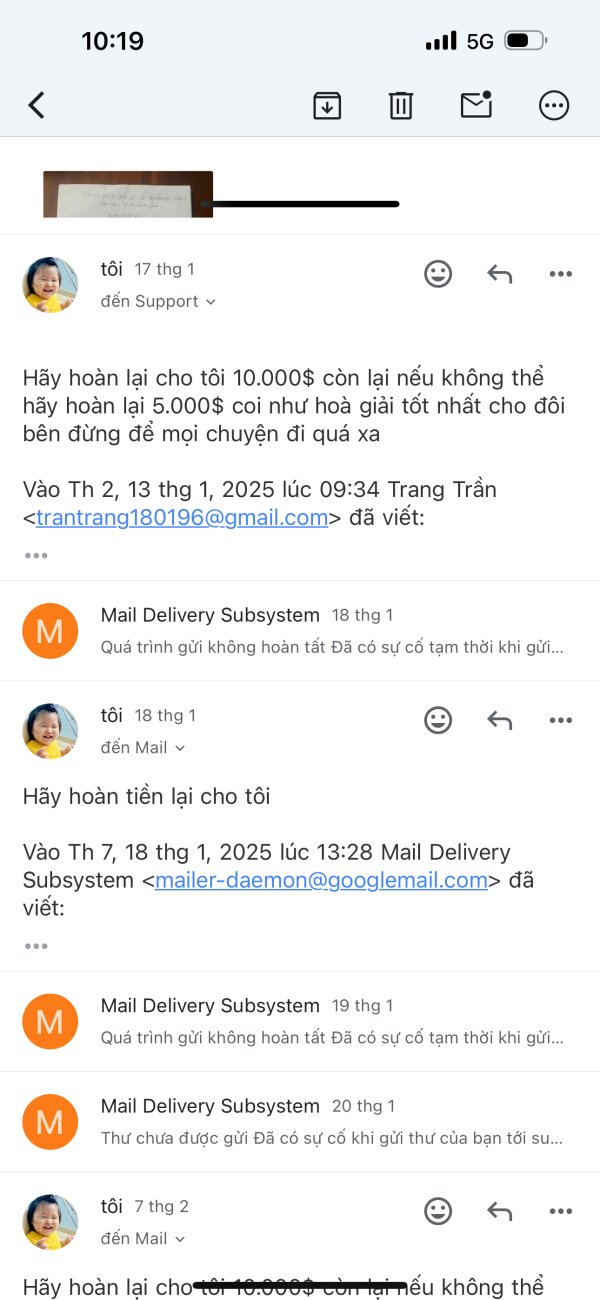

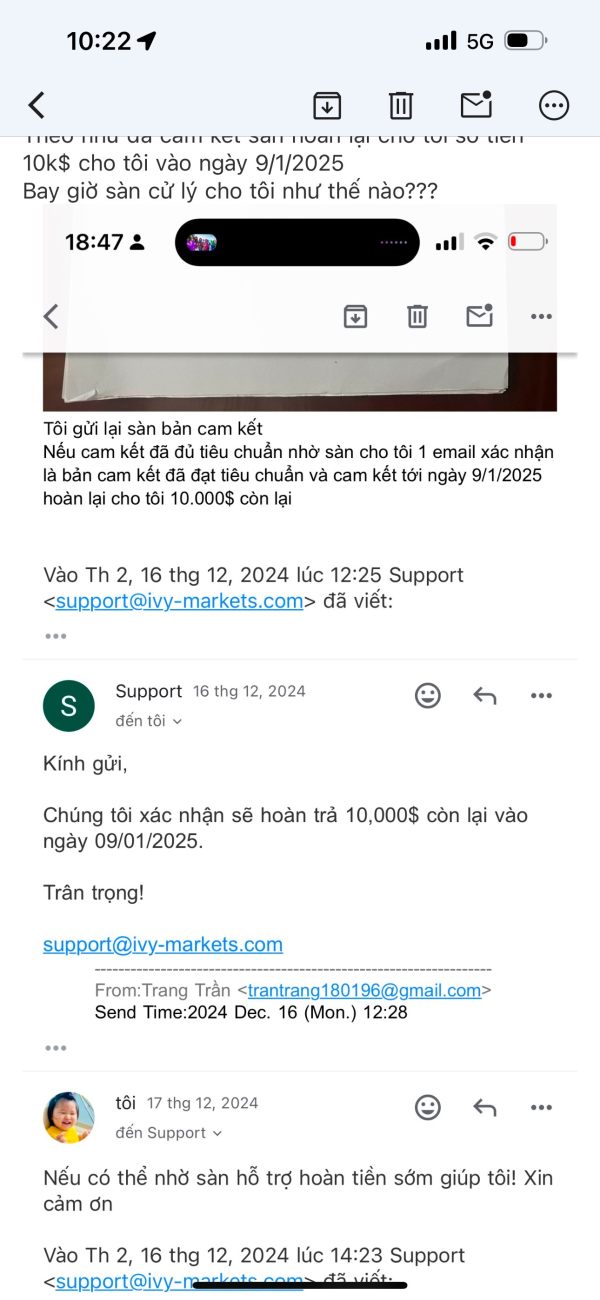

Customer service represents a significant area of concern based on available user feedback and industry assessments. The ivy markets review process revealed that user ratings average 3/5 across various review platforms, indicating moderate satisfaction levels with notable room for improvement. Response times and service quality appear inconsistent based on user reports.

Available customer service channels are not well detailed in public documentation. This creates uncertainty about accessibility and support options. This lack of transparency regarding customer service infrastructure raises questions about the broker's commitment to client support and problem resolution.

User feedback indicates varying experiences with customer service quality. Some traders report satisfactory assistance while others express frustration with response times and problem resolution effectiveness. Language support options and availability hours are not clearly documented, potentially limiting accessibility for international clients.

The absence of comprehensive customer service information, combined with mixed user feedback, suggests that potential traders should carefully consider their support needs and expectations before committing to the platform. Industry best practices typically include multiple communication channels, extended availability hours, and multilingual support, areas where IVY Markets appears to have documentation gaps.

Trading Experience Analysis (Score: 6/10)

The trading experience at IVY Markets centers around the MT5 platform. This provides a familiar and generally reliable trading environment. Platform stability appears adequate for most trading activities, though user feedback suggests occasional connectivity issues during peak market hours. The MT5 infrastructure supports various order types and execution methods, providing flexibility for different trading strategies.

Order execution quality remains a critical factor that lacks comprehensive documentation in available materials. Specific information about slippage rates, execution speeds, and order fill quality is not well detailed, making it difficult to assess the broker's performance in this crucial area. User feedback provides mixed signals regarding execution quality, with some traders reporting satisfactory performance while others note concerns about slippage during volatile market conditions.

The platform's functionality includes comprehensive charting tools, technical analysis capabilities, and support for automated trading systems. Mobile trading options through MT5 mobile applications provide flexibility for traders who need market access while away from their primary trading stations.

Trading environment factors such as spreads, liquidity provision, and market depth are not well documented. This represents significant information gaps that potential traders should investigate independently before committing to the platform.

Trustworthiness Analysis (Score: 4/10)

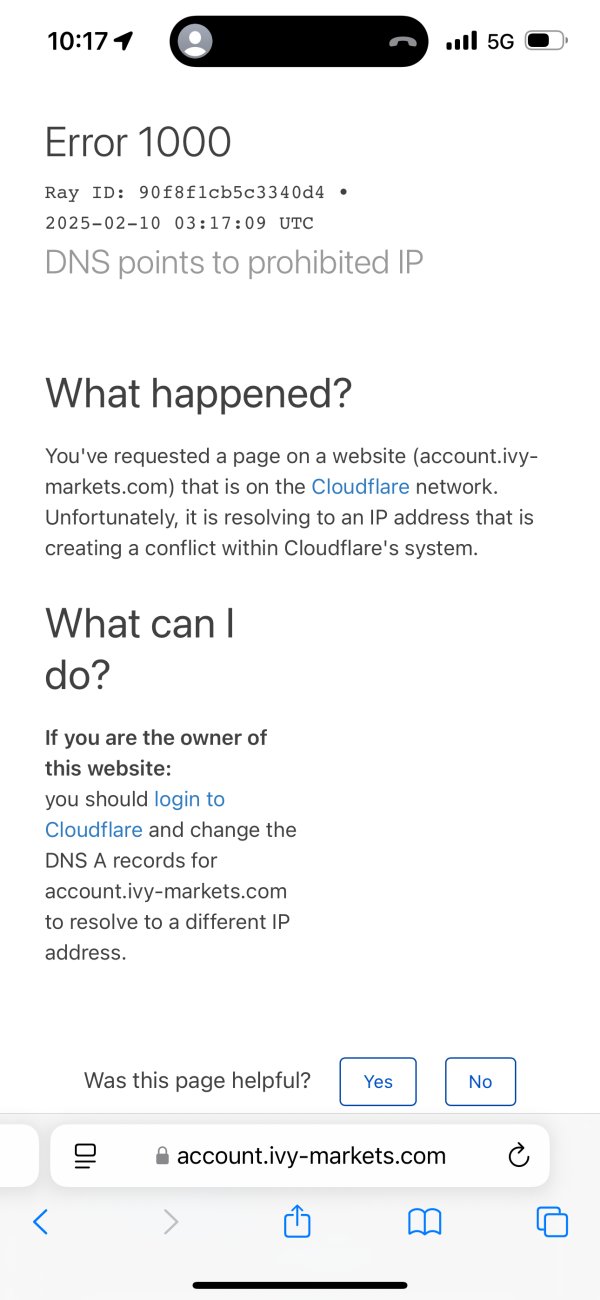

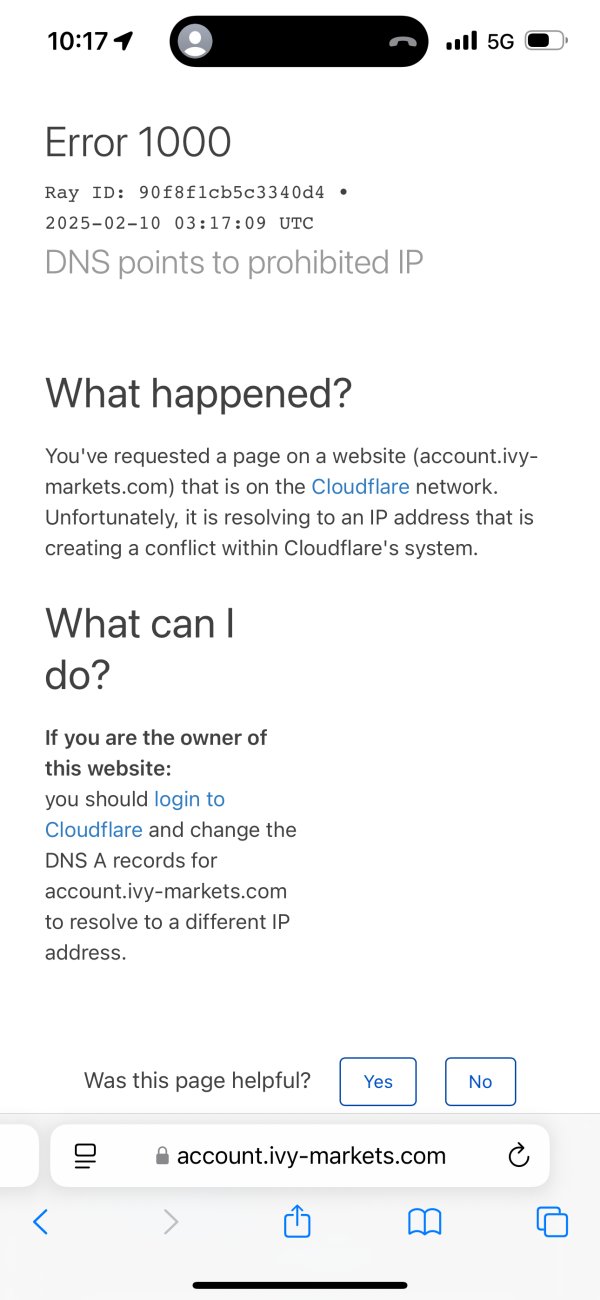

Trustworthiness represents the most significant concern area identified in this ivy markets review. The broker operates under MWALI INTERNATIONAL SERVICES AUTHORITY regulation with license BFX2024013, but industry analysts have questioned the adequacy and recognition of this regulatory framework. WikiFX assessments describe the regulatory status as "abnormal," raising serious questions about oversight and client protection.

ForexBrokerz reports identify five specific red flags associated with ivy-markets.com. The detailed nature of these concerns requires further investigation by potential traders. These warnings suggest potential issues with operational transparency, regulatory compliance, or business practices that warrant careful consideration.

Fund safety measures and client protection protocols are not well documented in available materials. This creates uncertainty about asset security and segregation practices. Industry best practices typically include client fund segregation, insurance coverage, and transparent reporting of safety measures, areas where IVY Markets lacks sufficient public documentation.

Company transparency regarding ownership, financial status, and operational procedures appears limited based on available information. The absence of comprehensive corporate disclosure, combined with regulatory concerns and red flag warnings, significantly impacts the trustworthiness assessment.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with IVY Markets reflects the mixed nature of feedback across various review platforms. An average rating of 3/5 indicates moderate satisfaction levels. User experiences vary significantly, suggesting inconsistent service delivery and platform performance across different client segments.

Interface design and usability primarily depend on the MT5 platform. This generally provides a user-friendly experience for traders familiar with MetaTrader environments. However, users new to MT5 may face a learning curve, and the absence of comprehensive educational resources may compound this challenge.

Registration and account verification processes are not well detailed in available documentation. User feedback suggests varying experiences with onboarding efficiency. Some traders report straightforward account opening procedures, while others mention delays and documentation requirements that extend the activation timeline.

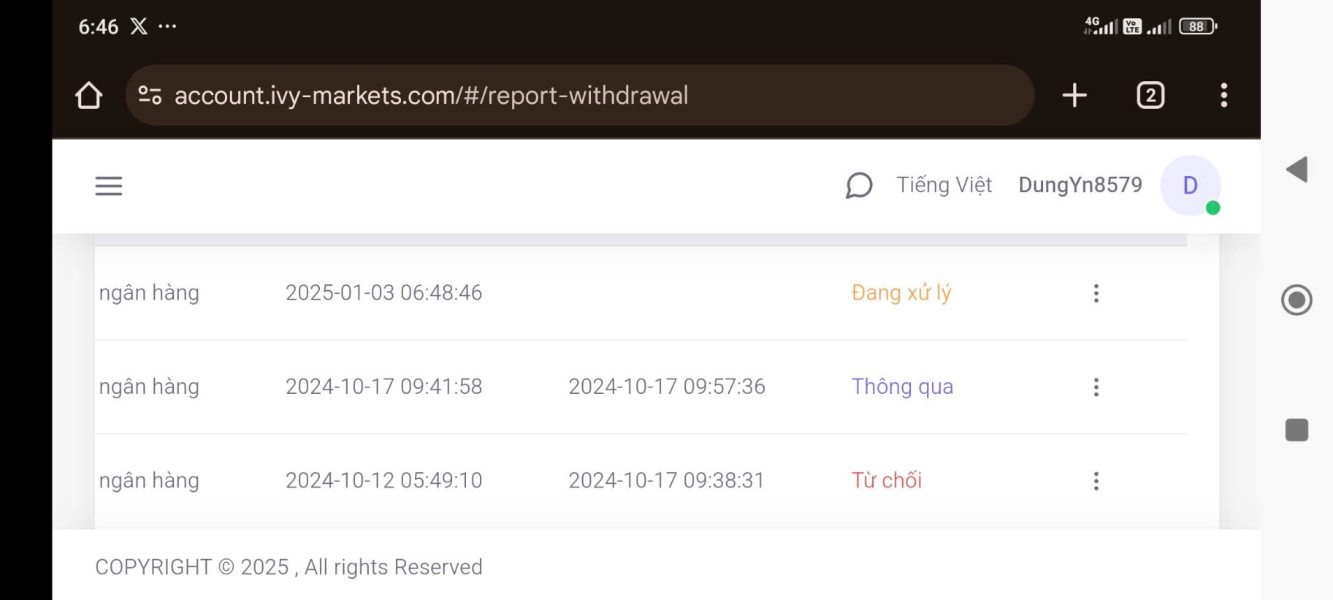

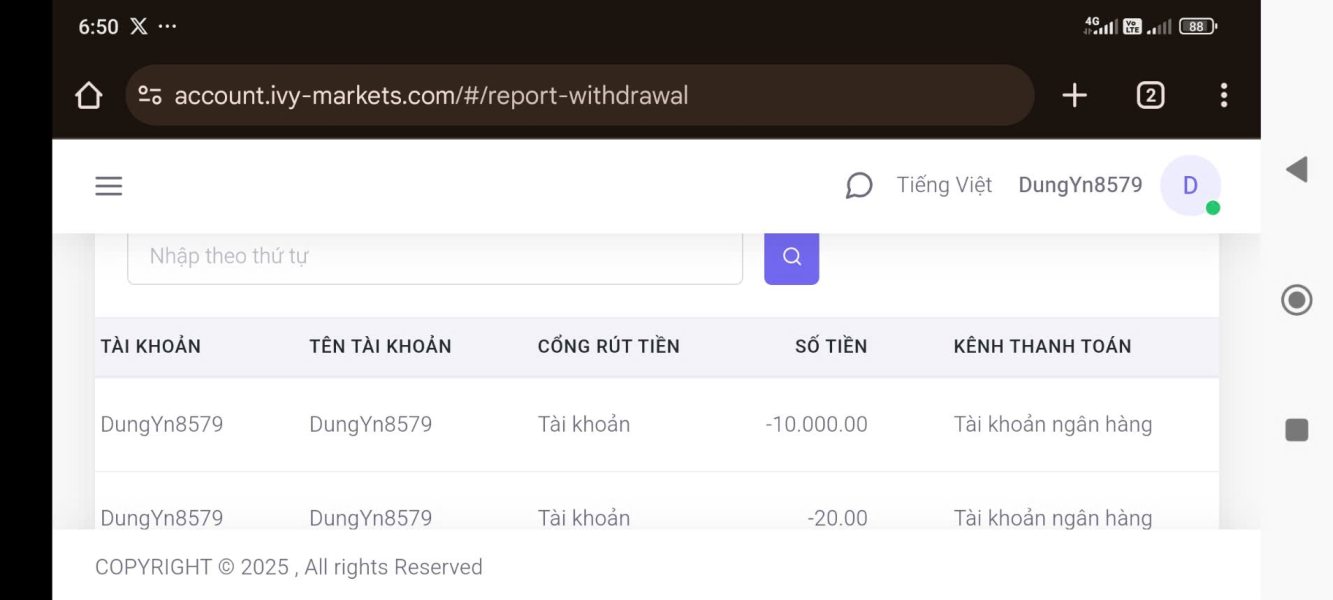

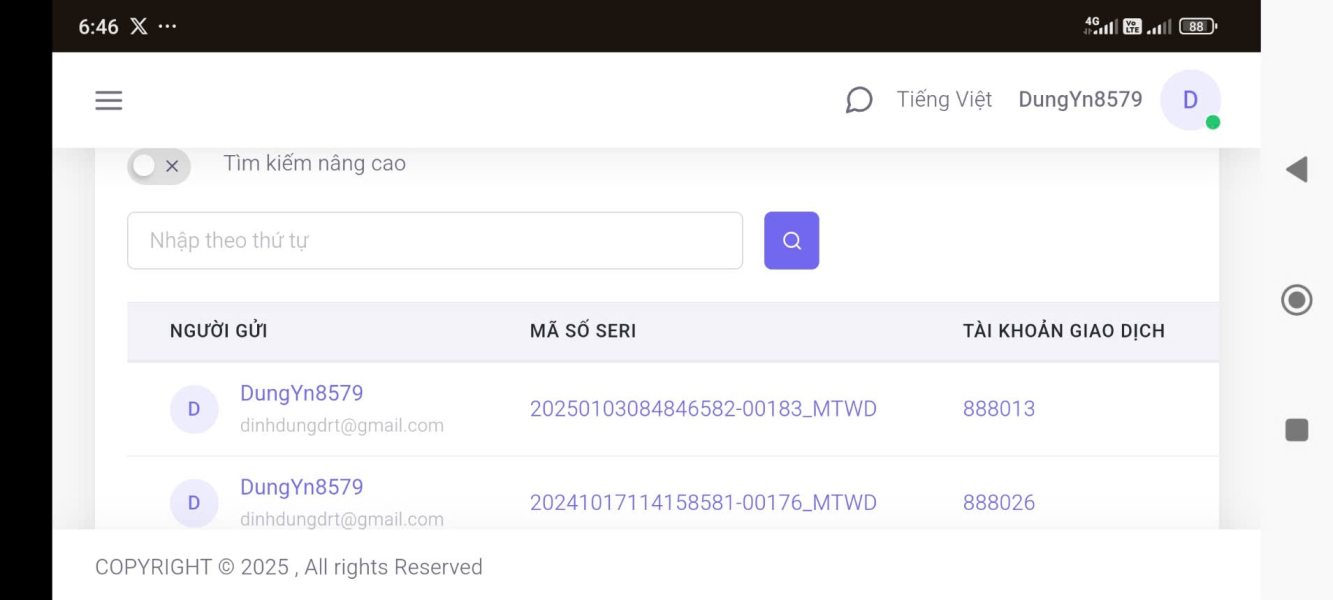

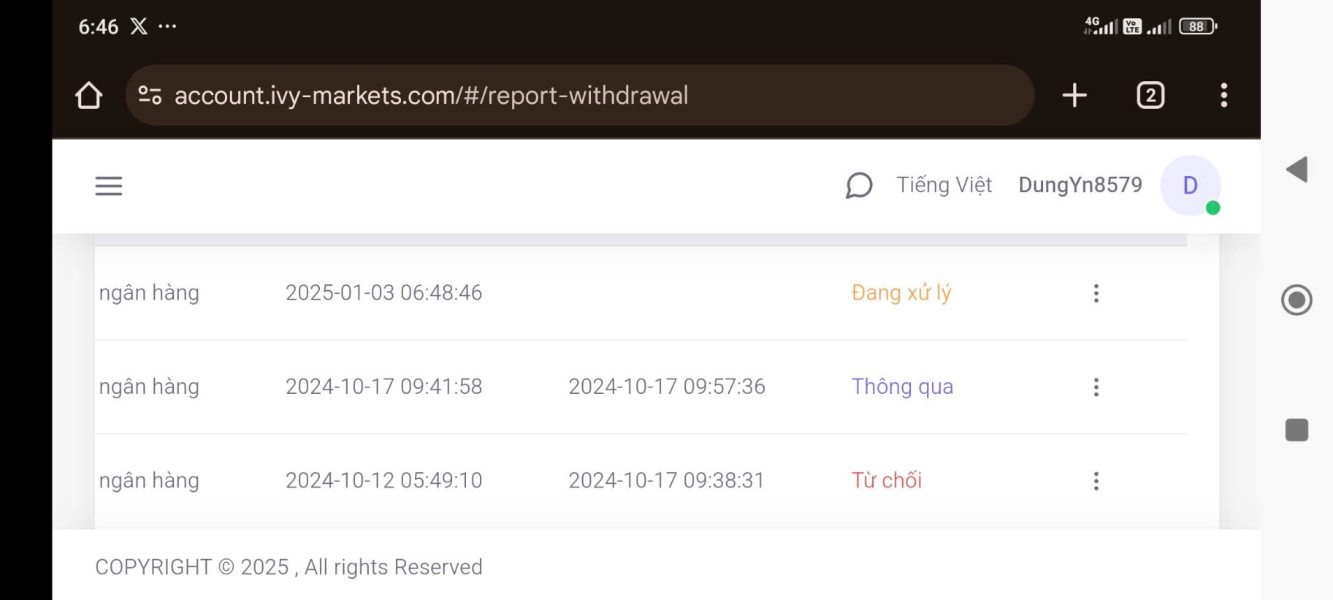

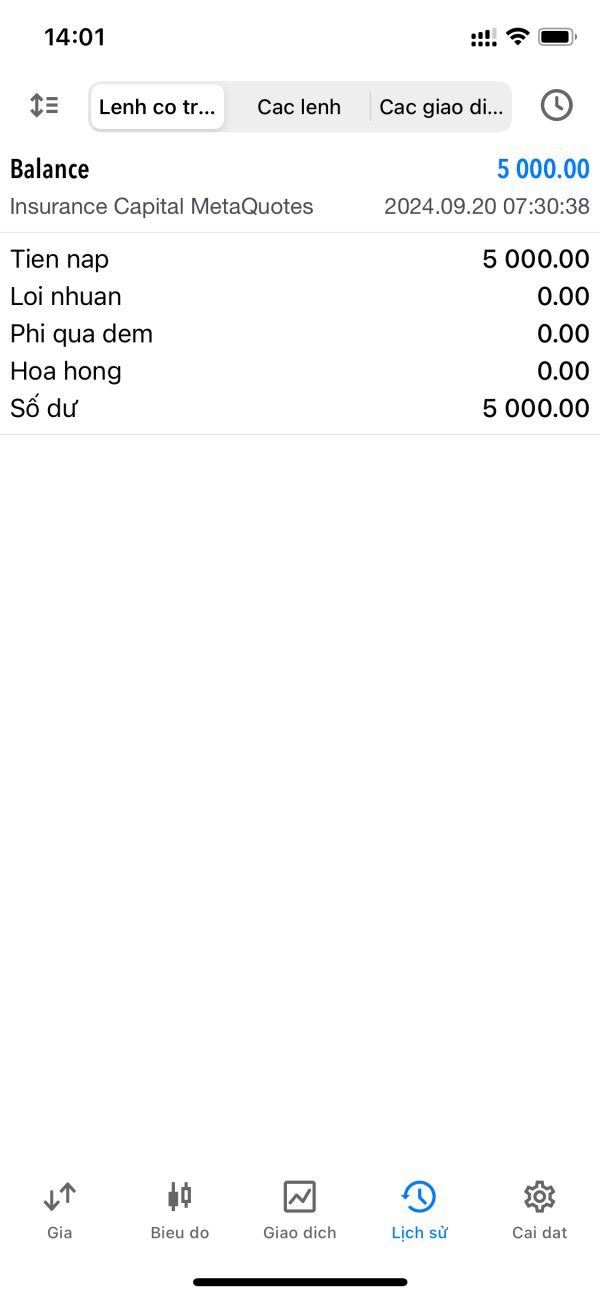

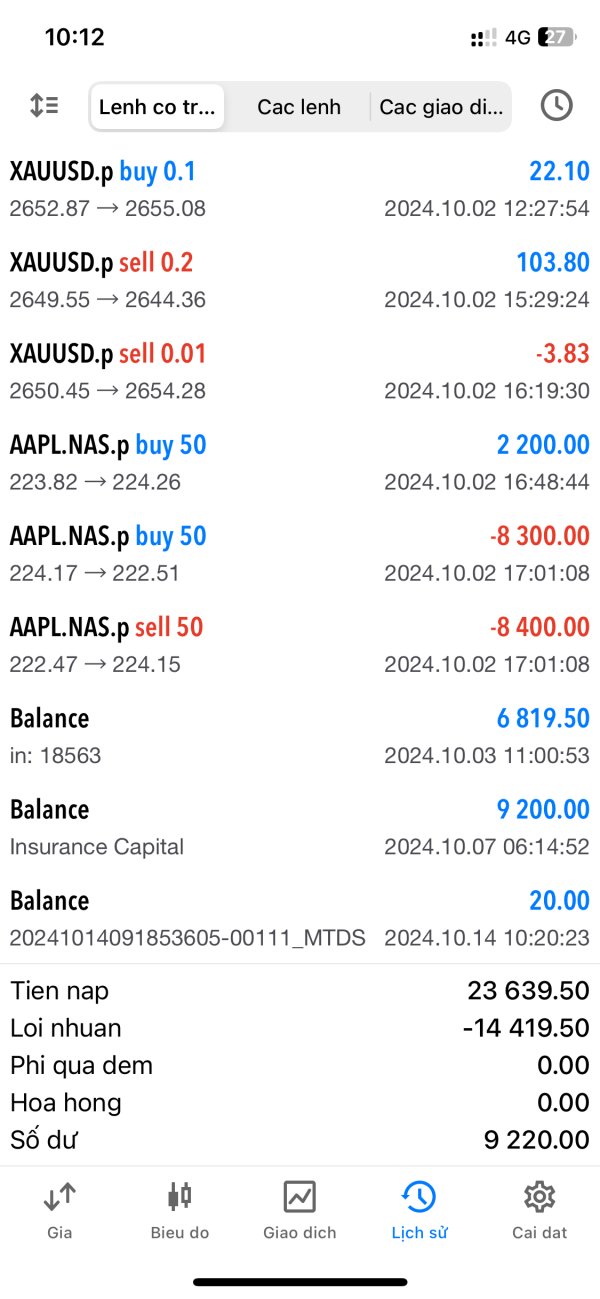

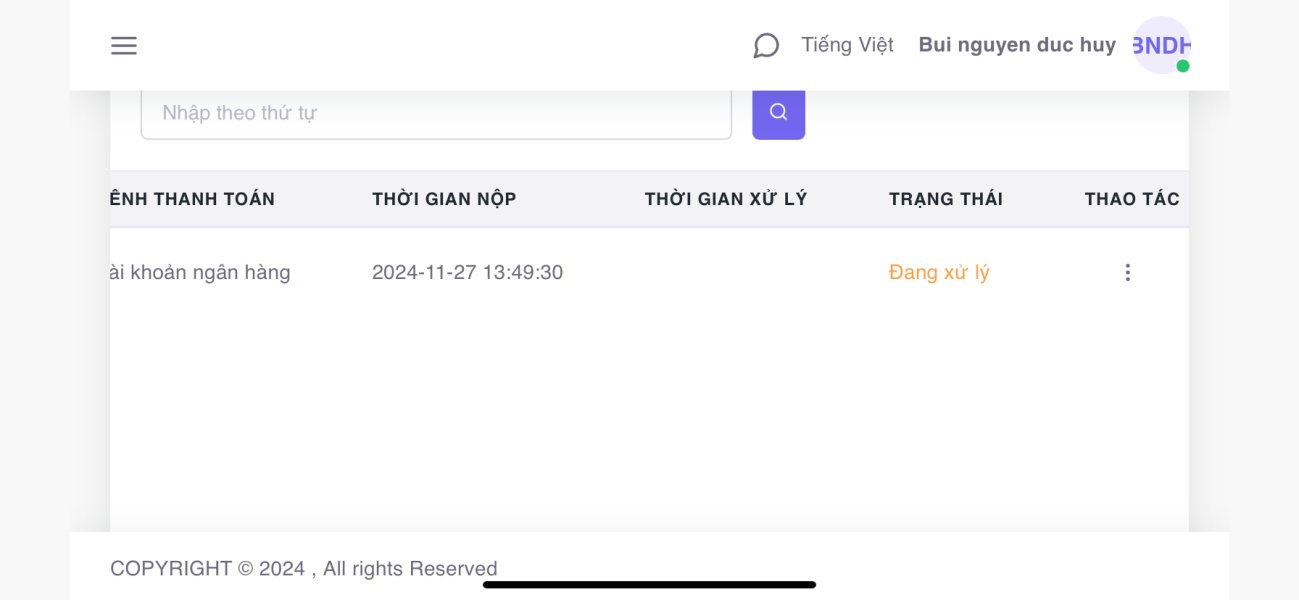

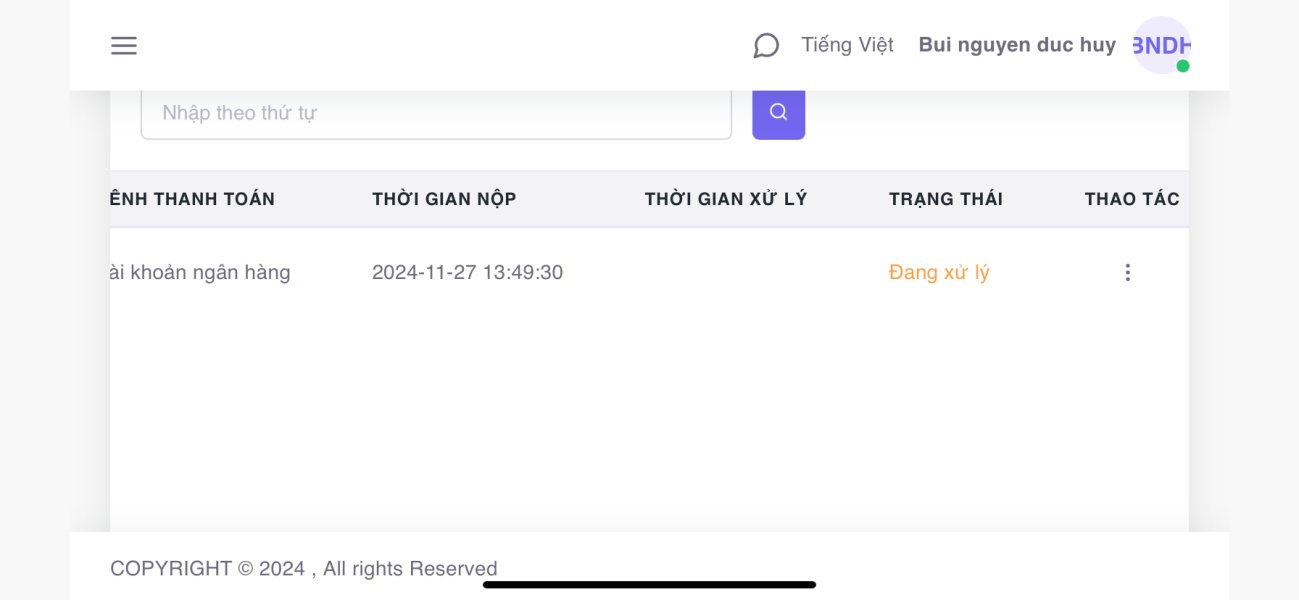

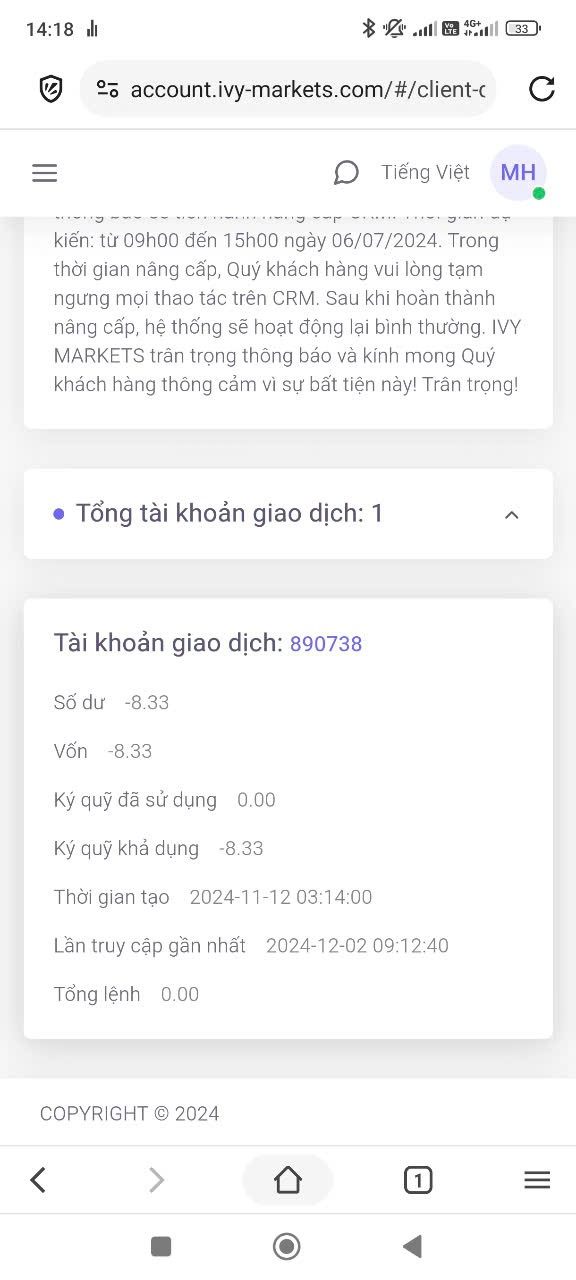

Fund operation experiences, including deposit and withdrawal processes, receive mixed feedback from users. While multiple payment methods are supported, specific information about processing times, fees, and potential restrictions remains unclear in available materials.

Common user complaints center around customer service responsiveness, platform connectivity issues, and lack of transparency regarding trading conditions and fees. These concerns align with the overall assessment of areas requiring improvement in the broker's service delivery.

Conclusion

This comprehensive ivy markets review reveals a broker with both opportunities and significant concerns that potential traders must carefully weigh. IVY Markets offers accessible entry conditions with a low $50 minimum deposit and high leverage up to 1:400, making it potentially suitable for beginner traders and those with limited starting capital. The MT5 platform provides solid trading infrastructure with comprehensive tools and multi-asset access.

However, substantial concerns regarding regulatory oversight, transparency, and service quality cannot be overlooked. The presence of five red flags identified by ForexBrokerz, combined with questions about regulatory adequacy and mixed user feedback, suggests that traders should exercise considerable caution when considering this broker.

IVY Markets may be most appropriate for experienced traders who can navigate potential service limitations and are comfortable with the regulatory framework. It's less suitable for beginners who might benefit from more established and transparent brokerage relationships. Potential clients should conduct thorough independent research and consider alternative options before making final decisions.