Regarding the legitimacy of InstaForex forex brokers, it provides FSC and WikiBit, .

Is InstaForex safe?

Business

License

Is InstaForex markets regulated?

The regulatory license is the strongest proof.

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

InstaFinance Ltd

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is InstaForex Safe or Scam?

Introduction

InstaForex, founded in 2007, has established itself as a significant player in the forex market, boasting over 7 million clients globally. With its headquarters in the British Virgin Islands, it offers a range of trading services, including forex, CFDs, commodities, and cryptocurrencies. However, the rapid growth of online trading has led to an influx of brokers, making it crucial for traders to carefully evaluate their options. The question of whether a broker is safe or a scam is paramount, as it directly impacts the security of traders' investments.

This article aims to provide a thorough assessment of InstaForex, focusing on its regulatory status, company background, trading conditions, and customer experiences. By analyzing various sources and user feedback, we will determine whether InstaForex is a trustworthy broker or if there are underlying concerns that potential traders should be aware of.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in assessing its legitimacy. InstaForex is regulated by the Financial Services Commission (FSC) of the British Virgin Islands, under the license number SIBA/L/14/1082. This regulation is essential as it ensures that the broker adheres to specific operational standards and provides a level of protection for its clients.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSC | SIBA/L/14/1082 | British Virgin Islands | Verified |

While the FSC provides a regulatory framework, it is important to note that the British Virgin Islands is often considered an offshore jurisdiction. This raises concerns about the robustness of the regulatory oversight compared to top-tier regulators such as the FCA in the UK or the SEC in the US. Although InstaForex has been operational for over a decade under this regulation, potential traders should be aware of the inherent risks associated with offshore brokers.

Company Background Investigation

InstaForex was established by the InstaFintech Group, which has successfully expanded its services to millions of clients worldwide. The company has a diverse ownership structure and a management team with extensive experience in the financial markets. The transparency of the company is reflected in its regular updates and communications with clients, as well as its participation in various financial forums and expos.

Despite its positive reputation, the fact that it operates primarily under offshore regulation may raise red flags for some traders. The company claims to maintain high standards of transparency and information disclosure, but potential clients should conduct their own research to ensure they are comfortable with the broker's operational jurisdiction.

Trading Conditions Analysis

InstaForex offers a variety of trading conditions, including competitive spreads and leverage options. The broker provides multiple account types, catering to different trading preferences and experience levels. However, the overall fee structure can be complex, with some accounts featuring higher spreads than industry averages.

| Fee Type | InstaForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 - 7 pips | 1 - 2 pips |

| Commission Model | 0 | Varies |

| Overnight Interest Range | -1.15% to 0.3% | Varies |

The spreads offered by InstaForex, particularly on standard accounts, can be considered high compared to other brokers. While the absence of commission on certain accounts may seem appealing, the higher spreads can significantly affect overall trading costs. Additionally, the broker imposes inactivity fees, which can deter long-term traders or those who prefer to trade infrequently.

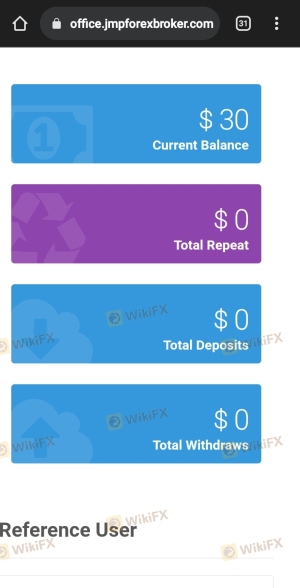

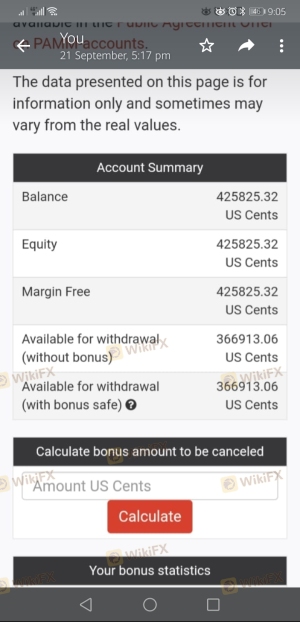

Client Funds Safety

The safety of client funds is paramount when evaluating a broker's reliability. InstaForex employs several measures to protect client deposits, including the use of segregated accounts. This means that client funds are kept separate from the broker's operational funds, providing a layer of security in the event of financial difficulties.

InstaForex also offers negative balance protection, ensuring that traders cannot lose more than their deposited amount. Furthermore, the broker is a member of the Investor Compensation Fund, which provides additional protection for clients in case of insolvency.

Despite these safety measures, potential traders should be aware of any historical issues related to fund security. While there have been no significant reports of fund mismanagement, the broker's offshore status may lead some to question the effectiveness of these safeguards.

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability. Reviews of InstaForex indicate a mixed experience among users. While many clients praise the broker for its user-friendly platform and responsive customer support, others have raised concerns about withdrawal issues and the quality of service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Account Verification Issues | Medium | Inconsistent support |

| Trading Platform Stability | Low | Generally stable |

Typical complaints revolve around withdrawal delays, with some users reporting difficulties in accessing their funds. While InstaForex's customer support team is generally responsive, there have been instances where clients experienced longer wait times for resolution. Overall, the feedback suggests that while many traders have positive experiences, there are notable concerns that prospective clients should consider.

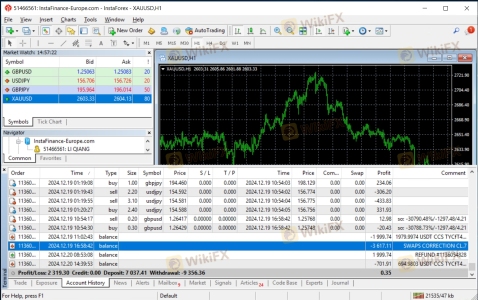

Platform and Trade Execution

The performance of a trading platform is critical to a trader's success. InstaForex primarily uses the MetaTrader 4 (MT4) platform, which is widely regarded for its reliability and user-friendly interface. However, some users have reported intermittent freezing of the trading terminal, which could impact trading performance during critical market movements.

In terms of order execution, InstaForex claims to offer fast execution speeds. However, instances of slippage and requotes have been reported, particularly during periods of high volatility. These factors may affect the overall trading experience, especially for scalpers and high-frequency traders.

Risk Assessment

When considering a broker like InstaForex, it is essential to evaluate the risks involved. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may lack robustness. |

| Fund Safety Risk | Medium | Segregated accounts and compensation fund provide some protection, but risks remain. |

| Trading Cost Risk | Medium | Higher spreads can erode profitability. |

| Customer Service Risk | Medium | Mixed reviews on responsiveness and issue resolution. |

To mitigate these risks, traders should ensure they fully understand the broker's terms and conditions, utilize demo accounts to test the platform, and maintain a diversified trading strategy.

Conclusion and Recommendations

In conclusion, is InstaForex safe? The broker is regulated by the British Virgin Islands FSC, which provides a level of oversight, but it operates in an offshore jurisdiction that may not offer the same protections as top-tier regulators. While InstaForex has a solid reputation and many satisfied clients, potential traders should be aware of the higher spreads, occasional withdrawal issues, and the risks associated with offshore brokers.

For traders seeking a reliable broker, it is advisable to consider alternatives that are regulated by more stringent authorities, such as FCA or ASIC-regulated brokers. Overall, while InstaForex may be suitable for some traders, those looking for stronger regulatory protections and lower trading costs might want to explore other options.

Is InstaForex a scam, or is it legit?

The latest exposure and evaluation content of InstaForex brokers.

InstaForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

InstaForex latest industry rating score is 1.68, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.68 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.