Is IFA safe?

Business

License

Is IFA Safe or Scam?

Introduction

International Finance Asia (IFA) is a forex brokerage that claims to offer a wide range of financial instruments, including currency pairs, commodities, and CFDs. Operating primarily in the Southeast Asian market, IFA positions itself as a platform that provides access to global trading opportunities at low costs. However, as with any financial service, traders must exercise caution when evaluating the credibility of forex brokers. The potential for scams in the industry is significant, and thus, it is crucial for traders to thoroughly investigate the regulatory status, company background, trading conditions, and customer experiences associated with IFA. This article aims to provide an objective assessment of whether IFA is a safe trading option or a potential scam by analyzing various aspects of the broker based on multiple sources.

Regulation and Legitimacy

One of the first indicators of a broker's trustworthiness is its regulatory status. Regulation serves as a protective measure for traders, ensuring that brokers adhere to established standards and practices. Unfortunately, IFA is an unregulated broker, which raises significant red flags regarding its legitimacy. The following table summarizes the regulatory information available for IFA:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that IFA does not fall under the scrutiny of any financial authority, which could lead to a lack of accountability and transparency. Reports indicate that IFA claims to be registered in Labuan, Malaysia, but there is no evidence of a valid license upon checking the local financial authority's database. This lack of oversight can put traders' funds at risk, as unregulated brokers can operate without the same stringent requirements that regulated firms must meet. As such, when evaluating the question, "Is IFA safe?" the answer leans heavily towards caution.

Company Background Investigation

Examining the company background is essential for assessing the reliability of IFA. The broker is said to be operated by International Finance Asia Ltd, which is located in Labuan, Malaysia. However, there is limited information available about the company's history, ownership structure, and management team. A lack of transparency in this area is concerning, as it raises questions about who is behind the operations and whether they have the necessary qualifications and experience to manage a financial services firm.

Moreover, the absence of information regarding the management team and their professional backgrounds further complicates the assessment of IFA's credibility. Without knowing the individuals responsible for the company's operations, it becomes difficult for potential clients to trust the broker. In light of these factors, it is prudent to conclude that the overall transparency and information disclosure levels at IFA are inadequate, leading to increased skepticism about its safety.

Trading Conditions Analysis

When evaluating a broker like IFA, understanding its trading conditions is crucial. Unfortunately, IFA does not provide detailed information regarding its fee structure, which can lead to unexpected costs for traders. The following table offers a comparison of core trading costs, although the specific details from IFA are lacking:

| Fee Type | IFA | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Not Available | 1.0 - 2.0 pips |

| Commission Model | Not Available | Varies |

| Overnight Interest Range | Not Available | Varies |

The lack of transparency in fees can be a significant issue for traders, as unexpected charges can erode profitability. Additionally, the absence of information about spreads, commissions, and overnight interest rates raises concerns about potential hidden costs that could impact trading outcomes. This ambiguity contributes to the overall assessment of whether IFA is safe, as traders may find themselves facing unexpected financial burdens.

Client Funds Safety

The safety of client funds is paramount when selecting a forex broker. However, IFA's lack of regulation raises serious concerns about the security measures in place for safeguarding client assets. Regulated brokers typically implement strict policies regarding fund segregation, investor protection, and negative balance protection. Unfortunately, IFA does not provide any information about these critical safety measures.

The absence of clear policies regarding fund safety can lead to potential risks for traders. Unregulated brokers like IFA can potentially misuse client funds without facing any repercussions, which is a significant concern for anyone considering trading with them. Historical issues related to fund security, such as withdrawal difficulties or fund misappropriation, further exacerbate these concerns. Therefore, when asking, "Is IFA safe?" the answer is decidedly negative, as the risks associated with fund safety are alarmingly high.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. In the case of IFA, various reviews and reports indicate a pattern of complaints from users. Common issues include withdrawal difficulties, lack of communication, and unresponsive customer support. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Unresponsive Customer Support | High | Poor |

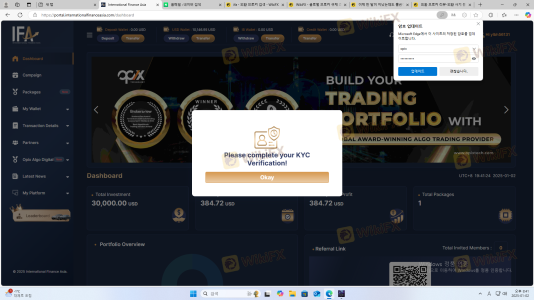

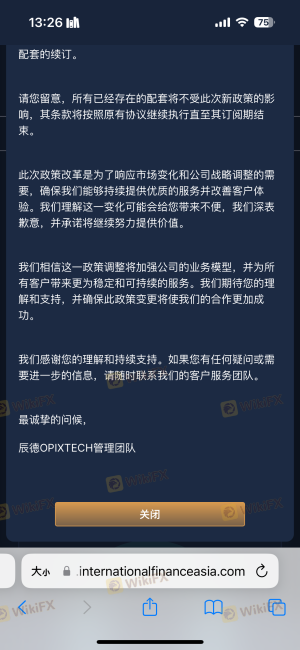

Two notable cases highlight the challenges faced by IFA clients. In one instance, a trader reported being unable to withdraw funds after multiple requests, with the broker citing KYC verification as the reason for the delay. In another case, a user claimed that after initially receiving profits, they were subsequently unable to access their funds, leading them to suspect a scam. These experiences raise significant concerns about the quality of customer service and the overall reliability of IFA. Thus, the evidence suggests that IFA may not be a safe option for traders.

Platform and Execution

The performance of a trading platform is another critical factor to consider. While IFA claims to offer a trading platform, there is limited information available regarding its performance, stability, and user experience. Traders have reported issues such as slippage and order rejections, which can significantly impact trading outcomes. Without access to a robust trading platform, traders may find themselves at a disadvantage.

Moreover, any signs of platform manipulation or unfair practices can further diminish trust in the broker. In light of these factors, the question "Is IFA safe?" becomes increasingly complex, as the lack of a reliable trading platform can expose traders to significant risks.

Risk Assessment

Evaluating the overall risk associated with trading with IFA is essential for prospective clients. The following risk scorecard summarizes key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation, leading to potential fund mismanagement. |

| Financial Transparency | High | Lack of transparency in fees and company information. |

| Fund Safety | High | No clear policies on fund segregation or protection. |

| Customer Support | High | Poor response to complaints and withdrawal issues. |

Given the high-risk levels in multiple categories, it is crucial for potential clients to exercise extreme caution when considering IFA as a trading option. Traders should be aware of the potential for significant financial losses and consider seeking alternatives that offer better security and transparency.

Conclusion and Recommendations

In conclusion, the investigation into IFA raises serious concerns about its legitimacy and safety. The lack of regulation, transparency, and adequate customer support all point to a high level of risk for potential traders. Therefore, it is advisable to approach IFA with caution and consider alternative brokers that are regulated and have a proven track record of reliability.

For traders seeking safer options, it is recommended to explore brokers that are regulated by reputable authorities such as the FCA (UK) or ASIC (Australia). These brokers typically offer better protections for client funds and more transparent trading conditions. Ultimately, when asking, "Is IFA safe?" the evidence strongly suggests that it is not a reliable choice for traders looking to engage in forex trading.

Is IFA a scam, or is it legit?

The latest exposure and evaluation content of IFA brokers.

IFA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IFA latest industry rating score is 1.35, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.35 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.