Is GLOBAL PRIME safe?

Pros

Cons

Is Global Prime Safe or a Scam?

Introduction

Global Prime is an Australian-based forex and CFD broker founded in 2010. Positioned as a provider of direct market access with a focus on transparency and competitive trading conditions, Global Prime aims to cater to both retail and institutional traders. As the forex market continues to grow, the importance of selecting a trustworthy broker has never been more critical. Traders must navigate a landscape filled with both reputable firms and potential scams, making it essential to assess each broker's credibility and operational integrity. This article will investigate the safety of Global Prime by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile.

To ensure a thorough evaluation, we will analyze data from various sources, including regulatory filings, user reviews, and expert assessments. This comprehensive approach will enable us to provide a balanced view of whether Global Prime is a safe trading option or if there are red flags that potential clients should be aware of.

Regulation and Legitimacy

When evaluating the safety of any forex broker, regulatory status is a pivotal factor. Global Prime is regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent requirements and oversight. Additionally, it holds licenses from the Vanuatu Financial Services Commission (VFSC) and the Seychelles Financial Services Authority (FSA). The presence of these regulatory bodies adds a layer of legitimacy to Global Prime's operations, as they are tasked with ensuring that brokers adhere to fair trading practices and maintain financial integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 385620 | Australia | Verified |

| VFSC | 40256 | Vanuatu | Verified |

| FSA | SD 057 | Seychelles | Verified |

ASIC's oversight is particularly significant, as it requires brokers to maintain client funds in segregated accounts and provides a framework for investor protection. However, it is essential to note that while ASIC regulation is robust, the VFSC and FSA are considered tier-2 and tier-3 regulators, respectively, which implies a lower level of scrutiny. Therefore, while Global Prime enjoys a solid regulatory foundation through ASIC, the existence of offshore entities introduces additional risks that traders should consider.

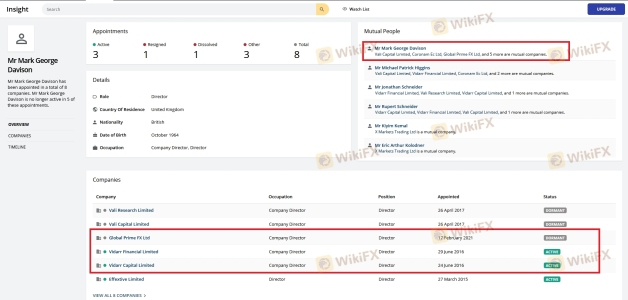

Company Background Investigation

Global Prime was established in 2010, and its operational headquarters is located in Sydney, Australia. The company is owned by Gleneagle Securities Pty Ltd, which adds credibility to its operations. The management team consists of professionals with extensive experience in the financial services industry, ensuring that the broker is well-equipped to handle the complexities of the forex market.

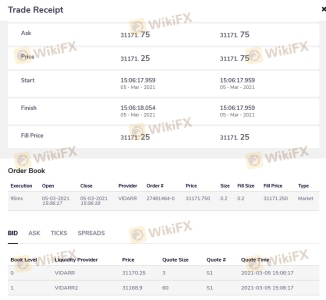

The company's commitment to transparency is evident in its practice of providing automated trade receipts, which show the liquidity provider that executed each trade. This level of disclosure is relatively rare in the industry and suggests that Global Prime does not engage in practices that conflict with clients' interests. Furthermore, the broker's website is informative, detailing its services and trading conditions, which reflects a commitment to keeping clients informed.

However, while Global Prime's management and operational history are commendable, the lack of comprehensive educational resources may pose challenges for novice traders. This aspect could limit the broker's appeal to beginners who may require more guidance and support in navigating the forex market.

Trading Conditions Analysis

Global Prime offers competitive trading conditions, which are crucial for traders looking to maximize their profits. The broker provides two primary account types: a commission-free account and a commission-based account. The commission-free account features spreads starting from 0.4 pips, while the commission-based account offers spreads as low as 0.0 pips with a commission of $7 per round turn.

| Fee Type | Global Prime | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.1 - 0.4 pips | 1.0 - 1.5 pips |

| Commission Model | $7 per lot | $5 - $10 per lot |

| Overnight Financing Range | Variable | Variable |

The trading fees at Global Prime are competitive compared to industry standards, particularly for high-volume traders who may benefit from the lower spreads offered on the commission-based accounts. However, it is important to note that the broker does not provide guaranteed stop-loss orders, which could be a concern for traders looking for additional risk management features.

Moreover, while the absence of deposit and withdrawal fees is a positive aspect, traders should be aware of potential costs associated with international wire transfers, which may incur charges from intermediary banks. Overall, Global Prime's trading conditions are favorable, but traders must remain vigilant regarding any unusual fees that could affect their overall profitability.

Customer Fund Security

The security of customer funds is paramount when evaluating a broker's reliability. Global Prime takes several measures to protect client funds, including maintaining segregated accounts at top-tier banks like HSBC and National Australia Bank. This practice ensures that client funds are not used for operational purposes, significantly reducing the risk of misappropriation.

Additionally, Global Prime offers negative balance protection, which prevents traders from losing more than their account balance. This feature is particularly beneficial for traders using leverage, as it safeguards against significant losses during volatile market conditions. However, it is essential to consider the historical context surrounding fund security; while there have been no major incidents reported involving Global Prime, the broker's offshore operations may present increased risks compared to those regulated solely by ASIC.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reputation. Global Prime has received mixed reviews from users, with many praising its responsive customer service and transparent trading practices. However, some complaints have surfaced regarding the withdrawal process, with users reporting delays in receiving their funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Generally responsive |

| Lack of Educational Resources | Low | No formal response |

One notable case involved a trader who experienced significant delays in withdrawing funds during a high-volume trading period. While Global Prime eventually resolved the issue, the incident raised concerns about the broker's ability to handle increased withdrawal requests during peak times. Overall, while most users report a positive experience, potential clients should be aware of these complaints and consider them when deciding whether to engage with Global Prime.

Platform and Trade Execution

Global Prime offers the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools. The platform provides access to various technical indicators, charting tools, and automated trading capabilities through Expert Advisors (EAs). Users generally report a stable trading environment with minimal downtime and fast execution speeds.

However, some traders have raised concerns regarding slippage and order rejection rates, particularly during periods of high volatility. While these issues are not uncommon in the forex market, the broker's commitment to transparency and trade execution quality is a positive aspect that may mitigate some of these concerns.

Risk Assessment

Using Global Prime comes with certain risks that traders should consider. The combination of tier-1 regulation and offshore entities creates a mixed risk profile, highlighting the importance of due diligence before engaging with the broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore entities may present increased risks. |

| Fund Safety | Low | Segregated accounts and negative balance protection are strong points. |

| Withdrawal Issues | Medium | Complaints regarding delays in fund withdrawals. |

To mitigate risks, traders should ensure they understand the broker's terms and conditions, maintain realistic expectations regarding withdrawal times, and consider using risk management tools such as stop-loss orders.

Conclusion and Recommendations

In conclusion, Global Prime is a reputable forex broker regulated by ASIC, providing a range of competitive trading conditions and robust security measures for client funds. While the broker demonstrates a commitment to transparency and customer service, potential clients should remain cautious about the risks associated with its offshore operations and the occasional withdrawal delays reported by users.

For traders seeking a reliable and transparent trading environment, Global Prime appears to be a safe option, provided they are aware of its limitations, particularly regarding educational resources and potential withdrawal issues. However, traders who prioritize comprehensive educational support or require direct access to U.S. stocks may wish to explore alternative brokers that better suit their needs.

Ultimately, as with any financial decision, conducting thorough research and considering personal trading goals will help ensure a positive trading experience with Global Prime or any other forex broker.

Is GLOBAL PRIME a scam, or is it legit?

The latest exposure and evaluation content of GLOBAL PRIME brokers.

GLOBAL PRIME Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GLOBAL PRIME latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.