Regarding the legitimacy of FXPRIMUS forex brokers, it provides CYSEC, FSCA, VFSC and WikiBit, (also has a graphic survey regarding security).

Is FXPRIMUS safe?

Software Index

License

Is FXPRIMUS markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 22

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Primus Global Ltd

Effective Date:

2014-12-22Email Address of Licensed Institution:

info@fxprimus.euSharing Status:

No SharingWebsite of Licensed Institution:

www.fxprimus.euExpiration Time:

--Address of Licensed Institution:

25 Kolonakiou Street, Zavos Kolonakiou Center, Suite 101, 4103 Limassol CyprusPhone Number of Licensed Institution:

+357 25 262 084Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

PRIMUS AFRICA (PTY) LTD

Effective Date:

2016-03-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2022-01-18Address of Licensed Institution:

4TH FLOOR 4 STAN ROAD SANDTON 2196PPhone Number of Licensed Institution:

010 5001893Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Primus Markets INTL Limited

Effective Date:

2022-10-03Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

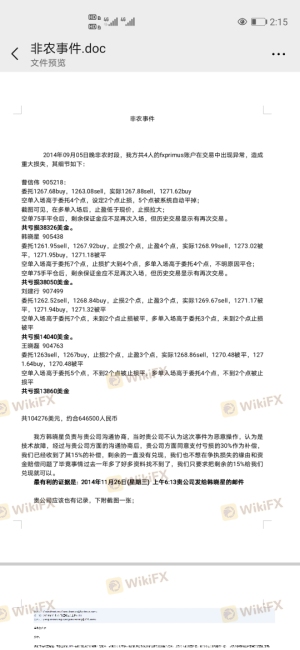

Is FXPrimus A Scam?

Introduction

FXPrimus, established in 2009, positions itself as a reliable online forex and CFD broker, catering to a diverse clientele across the globe. With its headquarters in Cyprus and additional offices in Vanuatu and South Africa, FXPrimus offers a range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. In a market saturated with brokers, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy of any trading platform they consider using. This article aims to provide an objective analysis of FXPrimus, focusing on its regulatory status, company background, trading conditions, and overall client experience. The investigation is based on a comprehensive review of available online resources, including regulatory filings, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy and safety for traders. FXPrimus is regulated by several authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 261/14 | Cyprus | Verified |

| VFSC | 14595 | Vanuatu | Verified |

| FSCA | 46675 | South Africa | Verified |

FXPrimus operates under the stringent regulations of CySEC, which is known for its rigorous compliance requirements, including the safeguarding of client funds in segregated accounts and the provision of negative balance protection. This regulatory oversight offers a level of assurance to traders regarding the safety of their investments. However, the VFSC is considered a less stringent regulator, often associated with offshore entities that may not provide the same level of investor protection. Despite this, FXPrimuss dual regulation by CySEC and VFSC enhances its credibility in the eyes of many traders.

Company Background Investigation

FXPrimus was founded by a team of experienced traders and financial professionals with the aim of creating a secure and user-friendly trading environment. Over the years, the company has expanded its services and now boasts over 300,000 active traders globally. The management team comprises individuals with extensive backgrounds in finance and trading, contributing to the broker's reputation for reliability and professionalism.

The transparency of FXPrimus is evident in its commitment to providing clear information about its operations and regulatory compliance. The broker regularly updates its clients on changes in regulations and trading conditions. Additionally, FXPrimus offers a range of educational resources, including webinars and tutorials, aimed at enhancing traders' knowledge and skills. This level of transparency and the availability of information can be seen as a positive indicator of the company's legitimacy.

Trading Conditions Analysis

FXPrimus offers competitive trading conditions, but it is essential to scrutinize its fee structure closely. The broker provides several account types, including the Primus Classic, Primus Pro, and Primus Zero accounts, each with different fee structures. Below is a comparison of core trading costs:

| Fee Type | FXPrimus | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0-1.5 pips |

| Commission Model | $5 - $10 per lot | $5 - $15 per lot |

| Overnight Interest Range | Varies | Varies |

While the Primus Classic account offers commission-free trading with spreads starting at 1.5 pips, the Primus Zero account features spreads from 0 pips but incurs a commission of $5 per lot. This flexibility allows traders to choose an account type that best suits their trading style. However, some users have reported concerns regarding hidden fees and the overall cost of trading, particularly for less experienced traders who may be unaware of the implications of high leverage and trading costs.

Client Fund Security

The security of client funds is a critical aspect of any brokerage. FXPrimus employs several measures to ensure the safety of its clients' investments. Client funds are held in segregated accounts, separate from the broker's operational funds, which helps protect traders' capital in the event of financial difficulties faced by the broker. Additionally, FXPrimus offers negative balance protection, ensuring that clients cannot lose more than their deposited amounts.

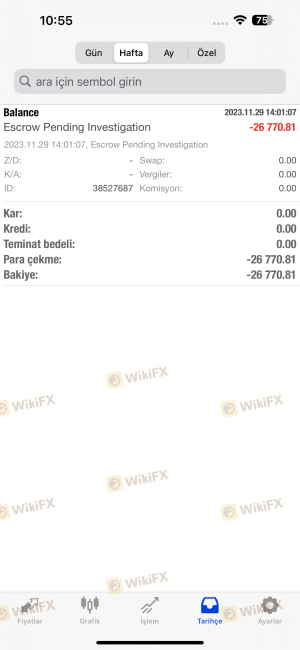

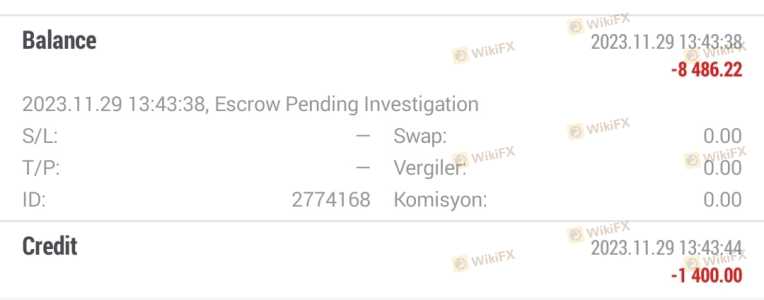

The broker also provides insurance coverage for client funds up to €2.5 million, which adds an extra layer of security. However, it is essential to note that the insurance coverage is only applicable under certain conditions and may not be available to all clients. Despite these robust security measures, there have been isolated incidents and complaints regarding fund withdrawals and account management, which raises questions about the overall reliability of the broker.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reputation of a broker. Reviews of FXPrimus reveal a mixed bag of experiences. While many users commend the broker for its competitive spreads and responsive customer service, others have voiced concerns about withdrawal issues and the quality of the trading platform. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Platform Stability Issues | Medium | Addressed but ongoing |

| Lack of Educational Resources | Low | Limited offerings |

One notable case involved a trader who experienced significant delays in fund withdrawals, leading to frustration and distrust. While FXPrimus eventually resolved the issue, the experience highlighted potential weaknesses in the broker's operational efficiency. Another user reported issues with platform stability during peak trading hours, raising concerns about the reliability of the trading environment.

Platform and Trade Execution

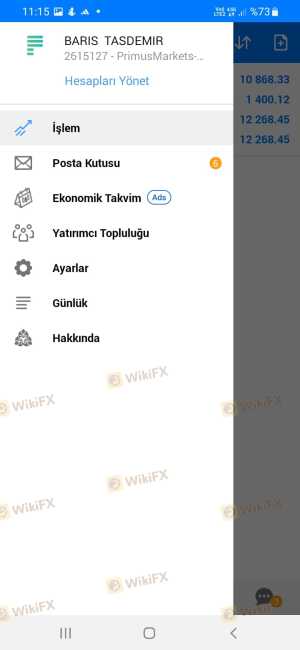

FXPrimus provides access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely recognized for their user-friendly interfaces and advanced trading features. The broker also offers its proprietary web trading platform, which allows users to trade directly from their browsers without the need for downloads.

The quality of order execution is generally regarded as satisfactory, with many traders reporting minimal slippage and a low rate of rejected orders. However, some users have noted occasional discrepancies in pricing during high volatility periods, which can be concerning for active traders. Overall, the platform's performance and execution quality are critical factors that contribute to the overall trading experience.

Risk Assessment

Trading with FXPrimus does come with inherent risks, as with any brokerage. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation but offshore entity |

| Financial Stability Risk | Low | Insured funds and segregated accounts |

| Operational Risk | Medium | Complaints regarding withdrawals |

Traders should be aware of the potential risks associated with high leverage, which can amplify both gains and losses. It is advisable to approach trading with caution, especially for those new to the market. Utilizing risk management strategies, such as setting stop-loss orders and managing position sizes, can help mitigate potential losses.

Conclusion and Recommendations

In conclusion, FXPrimus appears to be a legitimate broker with a solid regulatory foundation and a commitment to client safety. While there are no overt signs of fraud, potential traders should remain vigilant and consider the mixed reviews regarding customer service and platform reliability. Given the broker's dual regulation, it is generally deemed safe for clients from regulated regions, but caution is advised for those trading under the Vanuatu entity.

For traders seeking reliable alternatives, brokers such as FXCM and IG Markets, which offer robust regulatory oversight and comprehensive educational resources, may be preferable. Ultimately, the choice of broker should align with individual trading goals and risk tolerance.

Is FXPRIMUS a scam, or is it legit?

The latest exposure and evaluation content of FXPRIMUS brokers.

FXPRIMUS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXPRIMUS latest industry rating score is 2.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.