Is FXCESS safe?

Pros

Cons

Is FXCESS A Scam?

Introduction

FXCESS is an online forex and CFD broker that positions itself in the competitive landscape of the financial trading market. Established in 2019, it claims to offer a wide range of trading instruments, including forex pairs, commodities, indices, and shares. As the forex market continues to attract a growing number of traders, it's crucial for individuals to carefully evaluate the brokers they choose to work with. The potential for scams and fraudulent activities in the industry necessitates a thorough assessment of a broker's legitimacy, regulatory compliance, and overall reputation.

This article aims to investigate FXCESS's credibility by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and associated risks. The evaluation will be based on a combination of qualitative analysis and quantitative data derived from various reputable sources, ensuring a comprehensive understanding of FXCESS's operational integrity.

Regulation and Legitimacy

The regulatory environment in which a broker operates is vital for ensuring the safety of traders' funds and adherence to industry standards. FXCESS claims to be registered in Bermuda under the company name Notesco Limited, but there are significant concerns regarding its regulatory status. The broker is reportedly not licensed by any major financial authority, which raises questions about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Bermuda Monetary Authority | N/A | Bermuda | Not Verified |

The absence of a valid license from recognized regulatory bodies such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) is alarming. While FXCESS claims to be regulated in Bermuda, there are no records confirming this with the Bermuda Monetary Authority (BMA). This lack of oversight can leave traders vulnerable to potential fraud and malpractice, as unregulated brokers are not held accountable for their actions.

Furthermore, the broker has been flagged as a clone of other suspicious entities, particularly those linked to scams. This pattern of behavior underscores the importance of exercising caution when considering FXCESS as a trading partner. A broker's regulatory status is a critical indicator of its trustworthiness, and the lack of credible oversight should raise red flags for potential clients.

Company Background Investigation

FXCESS operates under the ownership of Notesco Limited, a company that claims to be registered in Bermuda. However, the details surrounding its establishment and operational history are murky at best. Although the broker has been active since 2019, its lack of transparency regarding its management team and their professional backgrounds is concerning.

The absence of detailed information about the individuals behind FXCESS raises questions about the company's accountability and commitment to ethical trading practices. A reputable broker typically provides information about its management team, highlighting their expertise and experience in the financial markets. In contrast, FXCESS's vague disclosures can lead to skepticism about its operational integrity.

Additionally, the company's transparency regarding its financial practices and disclosures is minimal, which can hinder traders' ability to make informed decisions. The level of transparency in a broker's operations is crucial for establishing trust, and FXCESS's shortcomings in this area may deter potential clients from engaging with the platform.

Trading Conditions Analysis

FXCESS claims to offer competitive trading conditions, including low spreads and high leverage. However, a closer examination reveals potential pitfalls in its fee structure and trading policies. The broker offers two primary account types: Classic and ECN, with varying features that cater to different trading styles.

| Fee Type | FXCESS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips (Classic) / 0 pips (ECN) | 1.0 - 1.5 pips |

| Commission Model | None (Classic) / $4.5 per lot (ECN) | $5.0 - $10.0 per lot |

| Overnight Interest Range | Variable | Variable |

While the spreads offered by FXCESS appear attractive, especially the 0 pip spreads on the ECN account, traders should be cautious about the potential for hidden fees and unfavorable trading conditions. The lack of clarity regarding overnight interest rates and other fees can lead to unexpected costs for traders. Additionally, the high leverage of up to 1:1000 can be enticing for traders looking to maximize their positions, but it also significantly increases the risk of substantial losses.

The overall fee structure of FXCESS may not align with industry standards, and the potential for hidden costs should prompt traders to conduct thorough due diligence before committing their capital. Understanding the complete fee landscape is essential for making informed trading decisions and avoiding unnecessary financial pitfalls.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. FXCESS claims to implement various safety measures to protect traders' investments, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's lack of regulation.

FXCESS asserts that client funds are held in segregated accounts, which is a standard practice among reputable brokers. This means that the funds are kept separate from the broker's operational funds, ensuring that clients' money is protected in the event of financial difficulties. Additionally, the negative balance protection policy is designed to prevent traders from losing more than their initial investment, which is particularly beneficial for novice traders.

Despite these claims, the absence of regulatory oversight raises concerns about the actual implementation of these safety measures. Without the scrutiny of a regulatory body, there is no assurance that FXCESS adheres to industry standards for fund protection. Furthermore, any historical issues related to fund safety or disputes with clients could indicate potential vulnerabilities in the broker's operations.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall experience of traders with FXCESS. Reviews and ratings from various platforms reveal a mixed bag of experiences, with some clients expressing satisfaction while others voice significant concerns.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Account Verification Delays | Medium | Inconsistent communication |

| Lack of Transparency | High | Minimal information provided |

Common complaints include difficulties with fund withdrawals, delays in account verification, and a general lack of transparency regarding fees and trading conditions. These issues can erode trust and lead to frustration among traders, particularly those who may be new to the forex market.

Several users have reported challenges in retrieving their funds, with some experiencing prolonged delays or unresponsive customer service. Such complaints are concerning, as they highlight potential weaknesses in FXCESS's operational processes and customer support. A broker's ability to address client concerns promptly and effectively is crucial for maintaining a positive reputation in the industry.

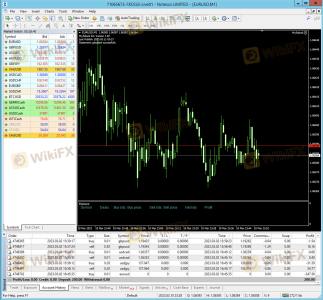

Platform and Trade Execution

The trading platform is a critical component of the overall trading experience, and FXCESS utilizes the widely recognized MetaTrader 4 (MT4) platform. While MT4 is known for its stability and user-friendly interface, the performance of FXCESS's implementation of the platform must be evaluated.

Traders have reported mixed experiences with order execution, including instances of slippage and rejected orders. These issues can significantly impact trading outcomes, particularly for those employing scalping strategies or relying on precise entry and exit points. The presence of any platform manipulation or discrepancies in trade execution can raise serious concerns about the broker's integrity.

Furthermore, the overall user experience on the FXCESS platform, including its mobile app, should be assessed to determine its reliability and functionality. A seamless trading experience is essential for traders, and any shortcomings in this area could deter potential clients from using the broker's services.

Risk Assessment

Engaging with FXCESS involves inherent risks that traders should be aware of before opening an account. The lack of regulation, coupled with the broker's questionable practices, raises several red flags.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from major authorities |

| Fund Safety Risk | High | Lack of verified protection measures |

| Withdrawal Risk | Medium | Reports of delays and issues |

| Transparency Risk | High | Minimal disclosure of key information |

Given the high-risk factors associated with FXCESS, potential clients should exercise caution. It is advisable to thoroughly research and consider alternative brokers with established regulatory frameworks and a proven track record of client satisfaction. Traders should also implement risk mitigation strategies, such as starting with a demo account and limiting exposure until they are confident in the broker's reliability.

Conclusion and Recommendations

In conclusion, FXCESS presents several concerning indicators that suggest it may not be a reliable trading partner. The absence of credible regulation, coupled with mixed customer experiences and potential issues with fund safety, raises significant doubts about the broker's legitimacy. While FXCESS offers attractive trading conditions, the risks associated with its operations cannot be overlooked.

For traders seeking a trustworthy forex broker, it is advisable to consider alternatives with established regulatory oversight and positive reputations in the industry. Brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC are typically better equipped to provide a secure trading environment. Ultimately, due diligence and careful consideration of the risks involved are essential for making informed trading decisions.

Is FXCESS a scam, or is it legit?

The latest exposure and evaluation content of FXCESS brokers.

FXCESS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXCESS latest industry rating score is 2.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.