Regarding the legitimacy of FAIR MARKETS forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is FAIR MARKETS safe?

Software Index

License

Is FAIR MARKETS markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

TRIVE FINANCIAL SERVICES AUSTRALIA PTY LTD

Effective Date: Change Record

2012-07-24Email Address of Licensed Institution:

horatio.wheeler@trive.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 26 1-7 BLIGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

61288233544Licensed Institution Certified Documents:

Is Fair Markets A Scam?

Introduction

Fair Markets is a forex and CFD broker that has emerged in the competitive landscape of online trading. Established in 2012, it offers a variety of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. The broker aims to provide a user-friendly trading environment, leveraging popular platforms like MetaTrader 4 and 5. However, as with any financial service, it is crucial for traders to conduct thorough due diligence before entrusting their funds. The forex market is rife with both legitimate and fraudulent entities, making it essential for traders to evaluate brokers carefully to ensure their safety and security.

This article employs a comprehensive investigative approach, analyzing Fair Markets through a multi-faceted framework. We will explore its regulatory standing, company background, trading conditions, customer fund safety, user feedback, platform performance, and overall risk assessment. By synthesizing this information, we aim to provide a balanced view of whether Fair Markets is a trustworthy broker or potentially a scam.

Regulatory and Legitimacy

The regulatory environment in which a broker operates is one of the most critical factors in determining its legitimacy. Fair Markets claims to be regulated by two entities: the Australian Securities and Investments Commission (ASIC) and the Mauritius Financial Services Commission (FSC). Regulation by ASIC, a tier-one regulator, is particularly significant as it imposes stringent requirements on brokers, including maintaining client funds in segregated accounts and adhering to strict operational standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 424122 | Australia | Verified |

| FSC | GB21026295 | Mauritius | Verified |

ASIC's oversight ensures that Fair Markets is held to high standards of transparency and accountability. However, it's important to note that while ASIC is known for rigorous regulatory frameworks, the FSC does not have the same reputation. The regulatory quality of the FSC has been questioned in the past, leading to concerns about the level of investor protection it can provide.

Fair Markets has not faced any significant regulatory actions or sanctions under ASIC, which is a positive indicator of its compliance history. However, the lack of a robust investor protection scheme in Mauritius raises some concerns. Traders should be aware that while Fair Markets is regulated, the level of protection may not be as comprehensive as with other tier-one regulators.

Company Background Investigation

Fair Markets is operated by Fairmarkets Trading Pty Ltd, which is based in Australia. The company has a relatively short history, having been founded in 2012. It was acquired by Trive Investment B.V., a Netherlands-based firm, which adds a layer of complexity to its ownership structure. This acquisition may provide some credibility, given that Trive operates multiple fintech companies.

The management team behind Fair Markets consists of individuals with experience in finance and trading, although detailed information about their backgrounds is somewhat limited. The company's transparency regarding its management team and operational practices could be improved, as potential clients often seek assurance from experienced and reputable leadership.

In terms of information disclosure, Fair Markets provides basic details about its services and regulatory status on its website. However, the lack of comprehensive educational resources or detailed company history may deter some traders who prioritize transparency. This opacity can lead to skepticism among potential clients, as transparency is a crucial factor in establishing trust in the financial services industry.

Trading Conditions Analysis

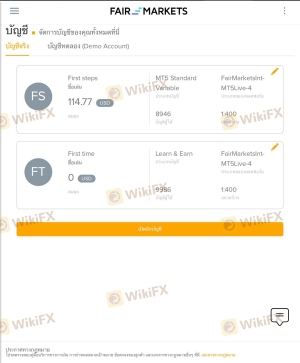

When evaluating a broker, understanding the trading conditions they offer is essential. Fair Markets provides various account types, including standard fixed, standard variable, VIP variable, and raw zero accounts. Each account type has different fee structures, catering to a wide range of trading preferences.

The overall cost structure is competitive, with spreads starting from 0.0 pips on the raw zero account, although a commission of $10 per lot applies. This is attractive for high-volume traders who can benefit from lower spreads. However, for standard accounts, spreads can start from 1.8 pips, which is relatively high compared to industry averages.

| Fee Type | Fair Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 - 5.0 pips | 0.5 - 1.5 pips |

| Commission Model | $10 per lot (raw zero) | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads and commissions are competitive, some users have reported discrepancies between advertised and actual trading costs, particularly during volatile market conditions. Traders should be cautious and factor in potential slippage, which can significantly impact profitability.

Customer Fund Safety

The safety of customer funds is paramount when choosing a broker. Fair Markets claims to adhere to best practices regarding fund safety, including the segregation of client funds from company operational funds. This is a regulatory requirement under ASIC, which serves to protect traders in the event of a broker's insolvency.

Additionally, Fair Markets offers negative balance protection, which ensures that traders cannot lose more than their deposited funds. This is a crucial feature for risk management, especially in the highly volatile forex market. However, the lack of a robust investor compensation scheme, particularly under the FSC regulations, raises concerns about the recourse available to clients in the event of financial disputes.

Historically, Fair Markets has not faced significant issues regarding fund safety, but potential clients should remain vigilant and conduct their own research. The absence of any high-profile scandals or fund mismanagement is a positive sign, yet the overall safety of funds still relies heavily on the regulatory environment in which the broker operates.

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reliability. Reviews of Fair Markets reveal a mixed bag of experiences among traders. Some users praise the broker for its competitive spreads and user-friendly platforms, while others express dissatisfaction regarding withdrawal processes and customer service responsiveness.

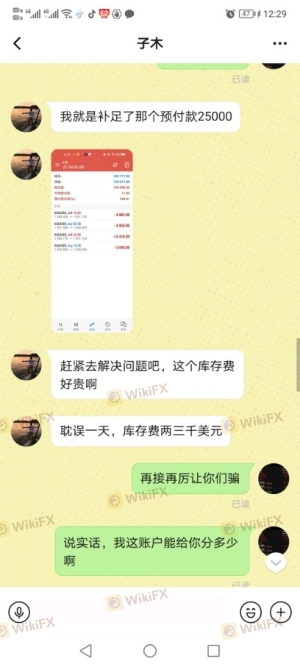

Common complaints include delayed withdrawals, with some traders reporting weeks of waiting for their funds to be processed. The lack of 24/7 customer support is also a recurring theme, which can be frustrating for traders operating in different time zones.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Service Quality | Medium | Mixed feedback |

| Platform Performance Issues | High | No clear resolution |

One notable case involved a trader who experienced significant delays in withdrawing profits, leading to frustration and negative reviews. The company's response was deemed inadequate, as the trader felt their concerns were not addressed promptly.

Platform and Execution

The trading platform is a critical aspect of the trading experience. Fair Markets offers both MetaTrader 4 and MetaTrader 5, which are widely regarded as industry standards. These platforms provide robust features, including advanced charting tools, automated trading capabilities, and a user-friendly interface.

However, some users have reported issues with order execution quality, including slippage and occasional rejections of orders. While these issues are not uncommon in the forex industry, any signs of platform manipulation or execution delays could be a red flag for potential traders.

Overall, while Fair Markets provides a solid trading platform, users should remain cautious and monitor their trading experiences closely. The quality of execution can significantly impact trading outcomes, and any inconsistencies should be reported to customer service for resolution.

Risk Assessment

Engaging with any broker carries inherent risks, and Fair Markets is no exception. The following risk assessment summarizes key areas of concern for potential traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Operates under dual regulation, but FSC is less stringent. |

| Operational Risk | Medium | Complaints about withdrawal delays and execution quality. |

| Market Risk | High | Forex trading is inherently volatile and can lead to significant losses. |

| Transparency Risk | Medium | Limited information on management and company history. |

To mitigate these risks, traders should consider using smaller position sizes, remain aware of market conditions, and ensure they fully understand the broker's fee structure. Engaging in continuous education about trading practices and risk management strategies is also advisable.

Conclusion and Recommendations

In conclusion, Fair Markets presents itself as a regulated broker offering a variety of trading instruments and competitive conditions. However, potential clients should exercise caution. While the broker is regulated by ASIC, the oversight from the FSC raises concerns about the level of investor protection.

The mixed customer feedback regarding withdrawal processes and platform performance further complicates the picture, suggesting that while Fair Markets is not outright a scam, it may not fully meet the expectations of all traders.

Traders looking for a reliable and transparent trading experience may want to consider alternatives with stronger regulatory frameworks and better customer service records. Brokers like IG or AvaTrade, which are well-regarded for their regulatory compliance and customer support, could be more suitable options for those prioritizing security and reliability.

Ultimately, it is essential for traders to conduct their own research and carefully weigh the pros and cons before making any decisions regarding their trading activities with Fair Markets.

Is FAIR MARKETS a scam, or is it legit?

The latest exposure and evaluation content of FAIR MARKETS brokers.

FAIR MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FAIR MARKETS latest industry rating score is 2.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.