Regarding the legitimacy of EZINVEST forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is EZINVEST safe?

Software Index

License

Is EZINVEST markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

WGM Services Ltd

Effective Date:

2013-06-14Email Address of Licensed Institution:

info@wgmservices.comSharing Status:

Website of Licensed Institution:

www.ezinvest.com, www.ezinvest.com/eu, www.marches-financiers.fr, www.stockstp.com, www.phoenixmarkets.com, www.phoenixmarkets.fr, eu.ezinvest.comExpiration Time:

--Address of Licensed Institution:

Ellinas House 5th Floor, 85 Limassol Avenue, Aglantzia 2121, Nicosia, CyprusPhone Number of Licensed Institution:

22000878Licensed Institution Certified Documents:

Is EZInvest A Scam?

Introduction

EZInvest is a forex broker based in Cyprus, operating under the name of WGM Services Ltd. Established in 2008, it positions itself as a platform for trading various financial instruments, including forex, commodities, stocks, and cryptocurrencies. Given the rapid growth of online trading, it is essential for traders to carefully evaluate the credibility of brokers before committing their funds. The forex market is rife with potential risks, including scams and unregulated entities, making due diligence crucial for safeguarding investments. This article will investigate EZInvest's legitimacy by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The analysis utilizes information gathered from multiple reputable sources to provide a comprehensive overview of the broker's standing in the industry.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining a broker's credibility. EZInvest is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a reputable regulatory body in the European Union. CySEC's role is to ensure that financial firms operate fairly and transparently, providing a level of security for traders. The following table summarizes the core regulatory information for EZInvest:

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 203/13 | Cyprus | Verified |

The importance of regulation cannot be overstated. It ensures that brokers adhere to strict operational guidelines, including maintaining segregated accounts for client funds, which protects investors in the event of financial difficulties. EZInvest's compliance with CySEC regulations indicates a commitment to maintaining high standards and transparency in its operations. Additionally, the broker is subject to the Markets in Financial Instruments Directive (MiFID II), which provides further investor protections across the European Economic Area (EEA). Overall, EZInvest's regulatory status lends credibility to its operations, although potential investors should remain vigilant and monitor any changes in its compliance history.

Company Background Investigation

EZInvest, operated by WGM Services Ltd, has a history that dates back to 2008. The company is headquartered in Nicosia, Cyprus, and has grown significantly over the years, catering to a diverse clientele across various markets. The ownership structure of the company is straightforward, with WGM Services Ltd being the sole entity responsible for its operations. This clarity in ownership is a positive sign for potential investors, as it indicates that the broker is not part of a complex web of companies that can obscure accountability.

The management team at EZInvest is composed of professionals with extensive backgrounds in finance and trading. Their experience in the industry contributes to the broker's reputation and operational effectiveness. Furthermore, the company has made efforts to enhance transparency by providing detailed information about its services and trading conditions on its website.

In terms of information disclosure, EZInvest maintains a relatively high level of transparency. The broker provides access to educational resources, market analysis, and customer support, which are essential for both novice and experienced traders. However, as with any broker, it is advisable for traders to conduct their own research and verify the information provided to ensure it aligns with their trading needs.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is vital. EZInvest offers a range of trading accounts, with varying minimum deposit requirements and trading costs. The broker employs a commission-free model for most transactions, which can be appealing to traders looking to maximize their profits. Below is a summary of the core trading costs associated with EZInvest:

| Cost Type | EZInvest | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1.5 - 2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While EZInvest advertises commission-free trading, the spreads can be higher than the industry average, particularly on basic accounts. This could impact profitability, especially for high-frequency traders. Additionally, traders should be aware of any additional fees that may apply, such as inactivity fees, which can be a concern for those who do not trade regularly.

Overall, while EZInvest offers competitive trading conditions, prospective clients should carefully consider the implications of the spread and any hidden fees that may arise during their trading activities.

Client Fund Safety

Client fund safety is a paramount concern for any trader. EZInvest employs several measures to ensure the security of its clients' funds. One of the key safety features is the segregation of client accounts, which means that client funds are kept separate from the company's operational funds. This practice is crucial in protecting investors' assets in the event of financial difficulties faced by the broker.

Furthermore, EZInvest is a member of the Investor Compensation Fund (ICF), which provides additional protection for clients. In the unlikely event that the broker becomes insolvent, the ICF compensates eligible clients up to a certain limit. This adds another layer of security for traders using the platform.

However, it is important to note that EZInvest does not currently offer negative balance protection. This means that in volatile market conditions, traders could potentially lose more than their initial deposit. While the broker has not reported any significant historical issues regarding fund safety, traders should remain cautious and be aware of the risks involved in leveraged trading.

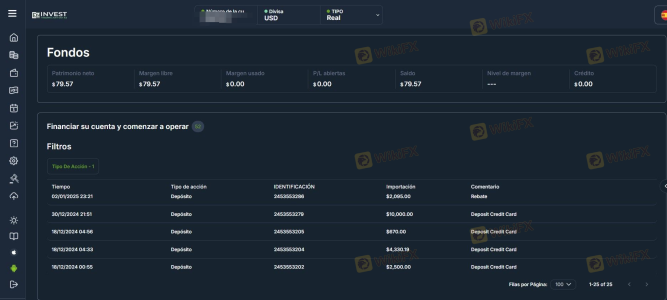

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall experience of traders using a particular broker. EZInvest has received mixed reviews from its clients. While many users appreciate the platform's user-friendly interface and responsive customer support, there are notable complaints regarding withdrawal processes and account management practices.

The following table summarizes the primary types of complaints received about EZInvest:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Mixed responses |

| Account Management | Medium | Generally responsive |

| Customer Support Delays | Low | Generally positive |

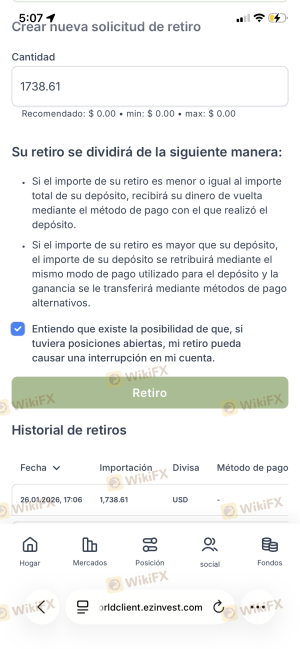

One common complaint revolves around the difficulty some clients have experienced when attempting to withdraw funds from their accounts. Several users have reported delays and lack of communication from the support team during these processes. For instance, one trader mentioned that they faced significant challenges in retrieving their funds, leading to frustration and dissatisfaction with the broker's services.

While EZInvest has shown responsiveness to certain complaints, the prevalence of withdrawal issues raises concerns that potential traders should consider before opening an account.

Platform and Trade Execution

The trading platform's performance is a critical factor for any trader. EZInvest offers several platforms, including the widely used MetaTrader 4 (MT4) and its proprietary Sirix web trader. Both platforms are designed to provide a seamless trading experience, with features that cater to both novice and experienced traders.

In terms of order execution, EZInvest claims to offer quick and efficient processing of trades. However, some users have reported instances of slippage and rejected orders, particularly during periods of high market volatility. It is essential for traders to be aware of these potential issues, as they can significantly impact trading outcomes.

The broker's platform does not appear to exhibit any overt signs of manipulation, but traders should remain vigilant and monitor their trades closely. The overall user experience on the platform has been rated positively, with many users appreciating the range of tools and resources available to assist in their trading activities.

Risk Assessment

Using EZInvest comes with a range of risks that traders should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Subject to CySEC regulations but with room for improvements. |

| Fund Safety | Medium | Segregated accounts and ICF membership provide some protection, but no negative balance protection. |

| Withdrawal Issues | High | Reports of delays and communication issues during withdrawal processes. |

| Trading Costs | Medium | Higher spreads than average could impact profitability. |

To mitigate these risks, traders are advised to conduct thorough research before committing funds, utilize demo accounts to familiarize themselves with the platform, and maintain a diversified trading strategy to manage exposure effectively.

Conclusion and Recommendations

In conclusion, while EZInvest is regulated by CySEC and offers a range of trading options, there are several areas of concern that potential traders should consider. The mixed customer feedback, particularly regarding withdrawal issues, raises red flags about the broker's reliability. Additionally, the higher-than-average spreads and lack of negative balance protection could pose risks for traders.

For those considering using EZInvest, it is crucial to proceed with caution. New traders may benefit from starting with a demo account to better understand the platform's features and functionalities before committing real funds. It is also advisable to explore alternative brokers that offer more robust customer support and lower trading costs.

If you are looking for reliable alternatives, consider brokers such as AvaTrade or IG, which have established reputations and offer competitive trading conditions. Ultimately, the decision to trade with EZInvest should be based on a careful evaluation of the risks and benefits involved.

Is EZINVEST a scam, or is it legit?

The latest exposure and evaluation content of EZINVEST brokers.

EZINVEST Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EZINVEST latest industry rating score is 2.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.