EZInvest 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive ezinvest review looks at one of the online trading platforms that has gotten mixed reactions from the trading community. Based on user feedback and available public information, EZInvest presents a neutral evaluation profile, with approximately 42% of reviewers recommending the platform while significant concerns persist among other users. EZInvest operates as a Cyprus-based online brokerage firm, offering access to different asset classes through both mobile and desktop trading platforms.

The broker positions itself mainly toward investors seeking to engage in forex market trading, with particular appeal to beginning traders who are exploring their initial steps in the financial markets. The platform's key highlights include its provision of multiple asset categories and cross-device accessibility, allowing traders to manage their positions from various locations. However, this ezinvest review reveals that the broker faces notable challenges in customer service delivery and withdrawal processing, which have contributed to mixed user experiences and moderate recommendation rates among its client base.

Important Notice

Investors should be aware that different regional entities may provide varying regulatory frameworks and service experiences depending on their geographical location. The regulatory landscape for EZInvest differs across jurisdictions, and potential clients should verify the specific regulatory status applicable to their region before engaging with the platform.

This evaluation is conducted based on user feedback collected from various review platforms and publicly available information about the broker's services. The analysis incorporates direct user experiences, regulatory data, and observable platform features to provide a balanced assessment of EZInvest's offerings and limitations.

Rating Framework

Broker Overview

EZInvest operates as an online brokerage platform headquartered in Cyprus, with its registered address at Themistokli Dervi 48. The company focuses on providing forex trading services alongside access to other financial assets. While specific founding information was not detailed in available sources, the broker has established its presence in the competitive online trading sector by targeting retail investors seeking exposure to currency markets.

The company's business model centers on making online trading easier through digital platforms, emphasizing accessibility across multiple device types. EZInvest aims to serve individual traders by providing market access through user-friendly interfaces, though the specific technological infrastructure details remain limited in public documentation. The broker offers trading capabilities through both mobile and desktop platforms, though the exact platform specifications (such as MetaTrader 4 or MetaTrader 5 integration) are not clearly specified in available materials.

EZInvest provides access to multiple asset categories, enabling traders to diversify their portfolios beyond traditional forex pairs. The company operates under regulatory oversight from the Cyprus Securities and Exchange Commission (CySEC), holding license number 203/13, which provides a foundation for regulatory compliance within the European Union framework. This ezinvest review finds that while the broker maintains proper regulatory standing, the limited transparency regarding specific platform features and trading conditions may present challenges for traders seeking detailed operational information before account opening.

Regulatory Status: EZInvest operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC) with license number 203/13. This regulatory framework provides European Union-compliant oversight and investor protection measures standard to CySEC-regulated entities.

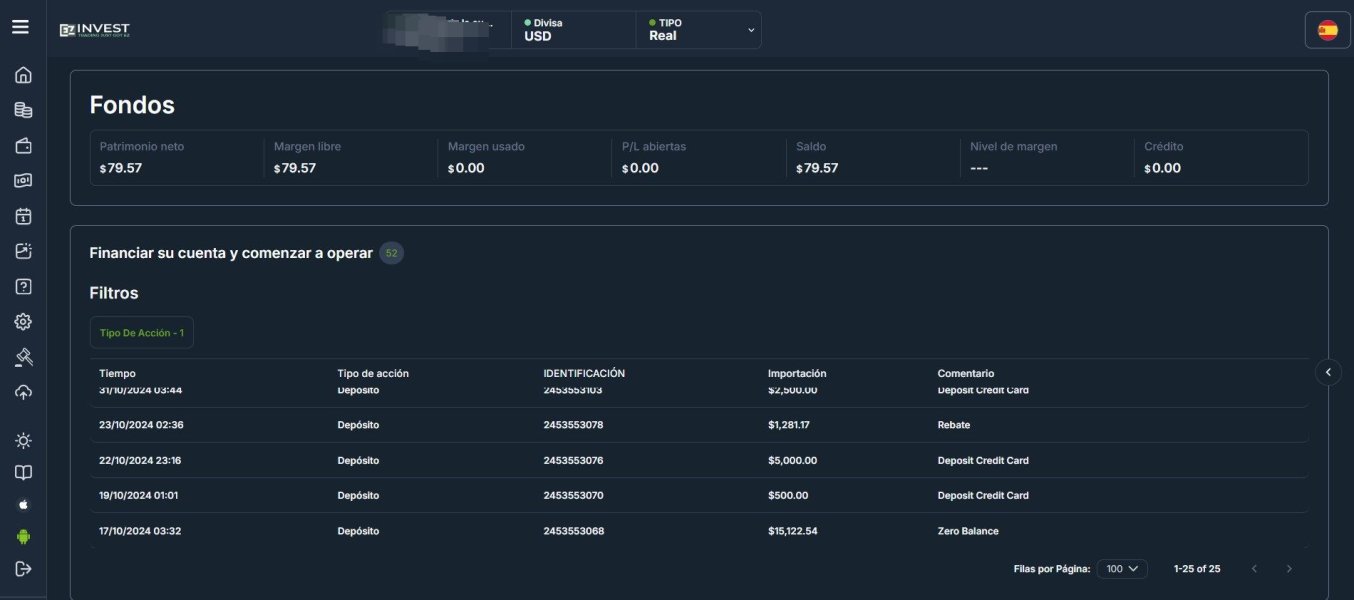

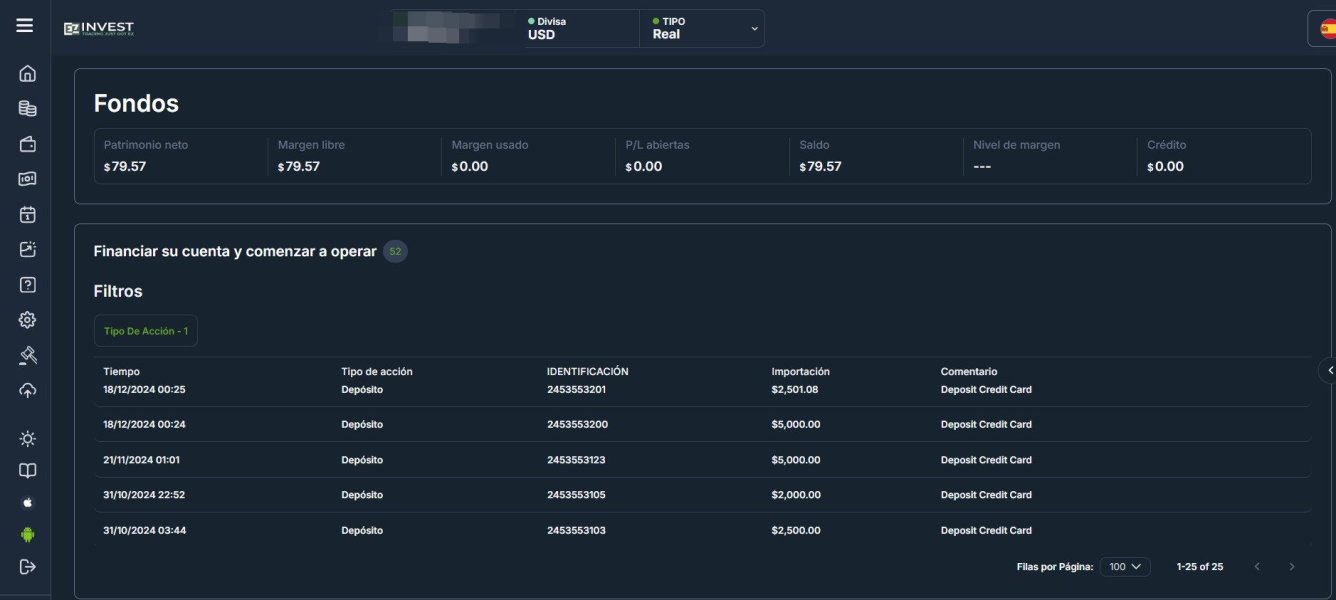

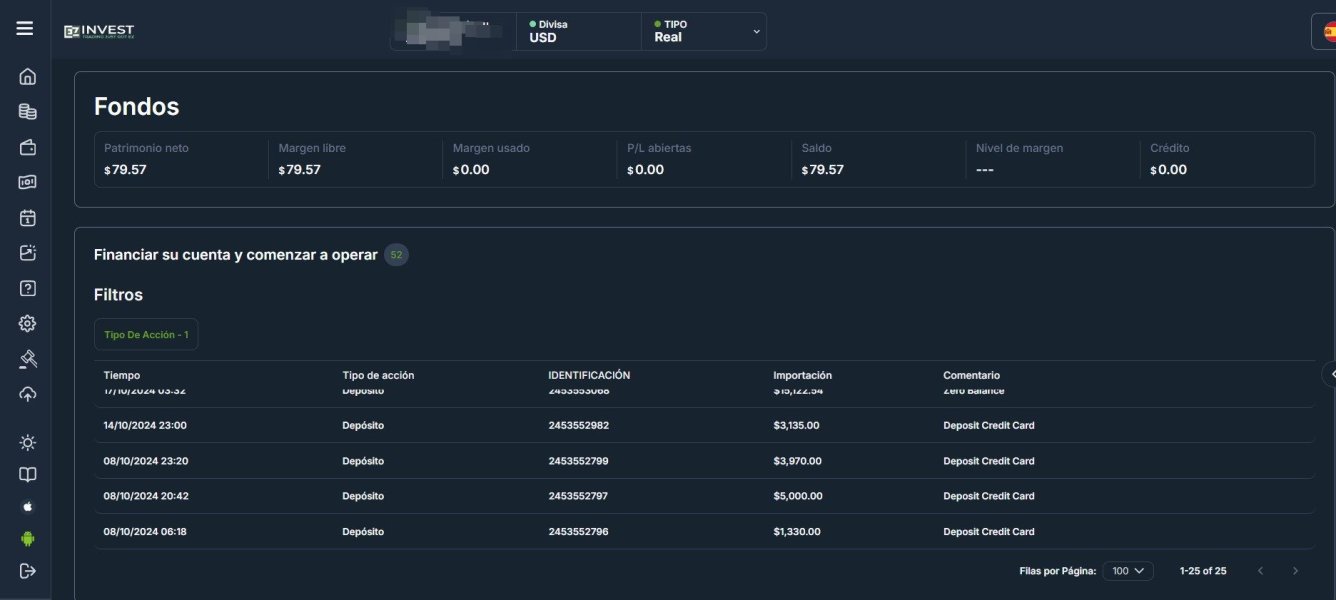

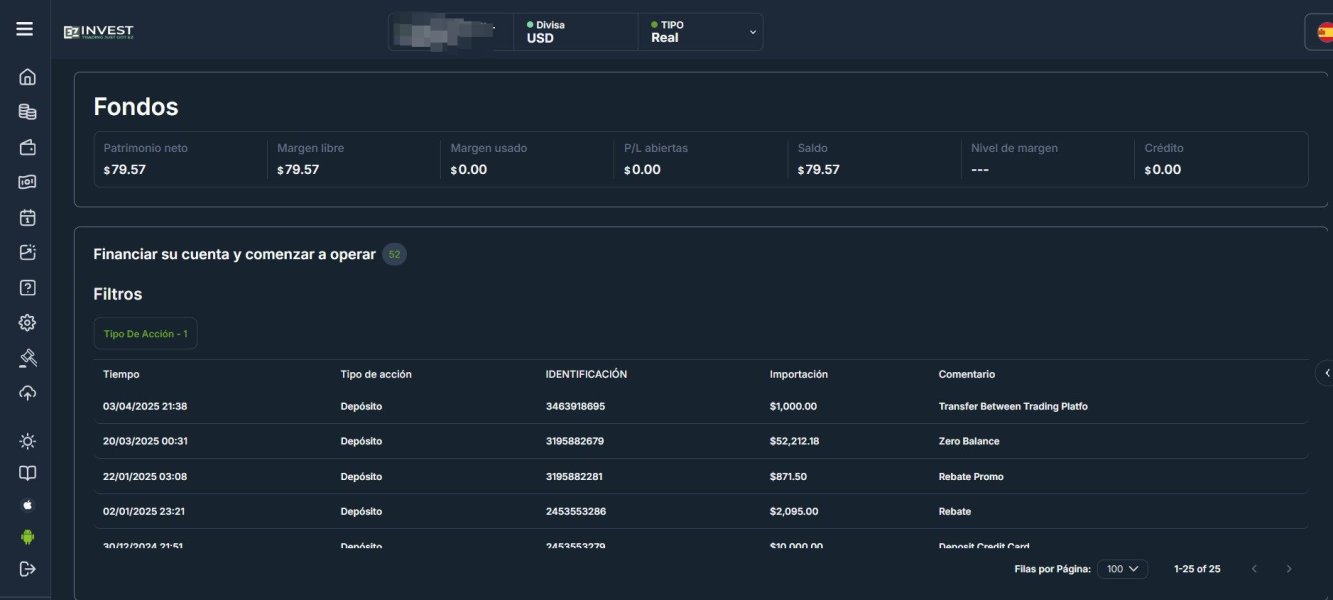

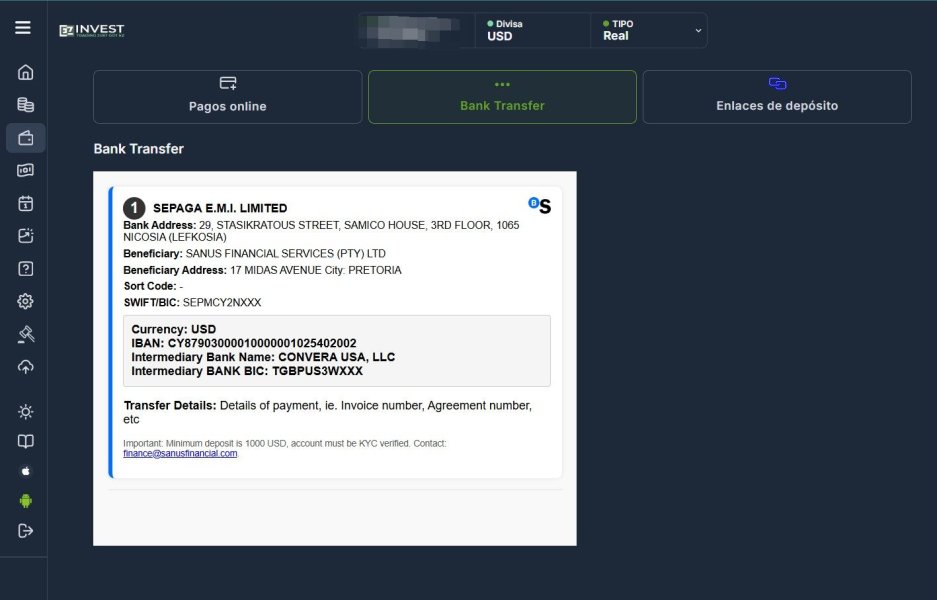

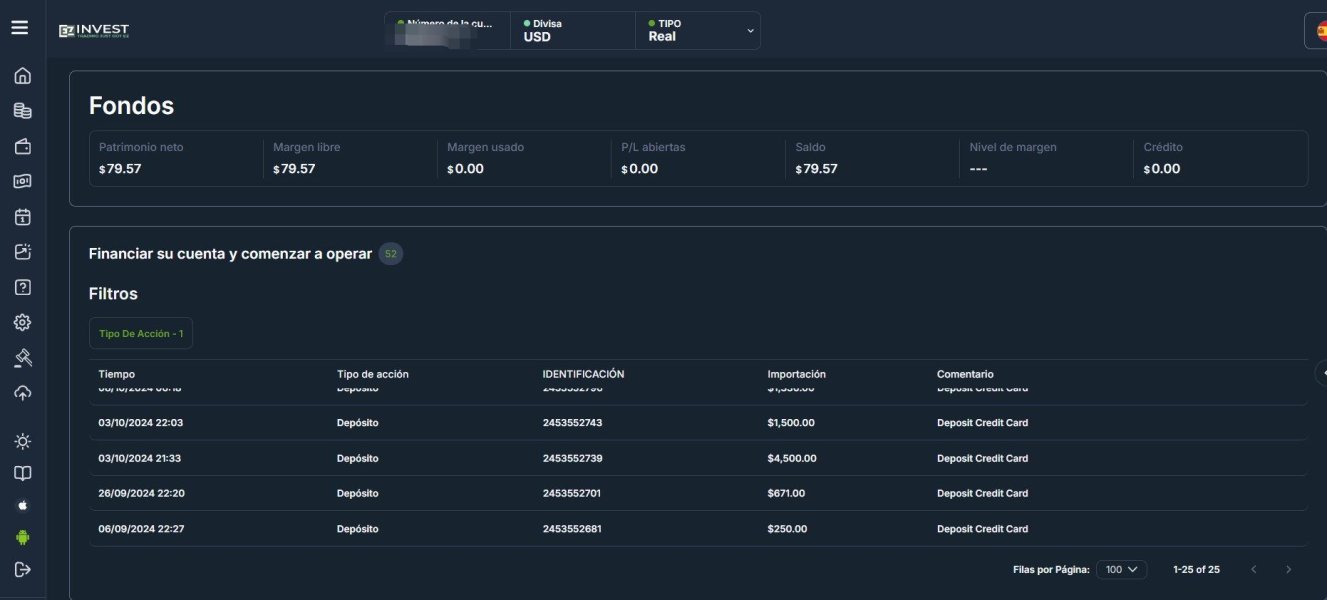

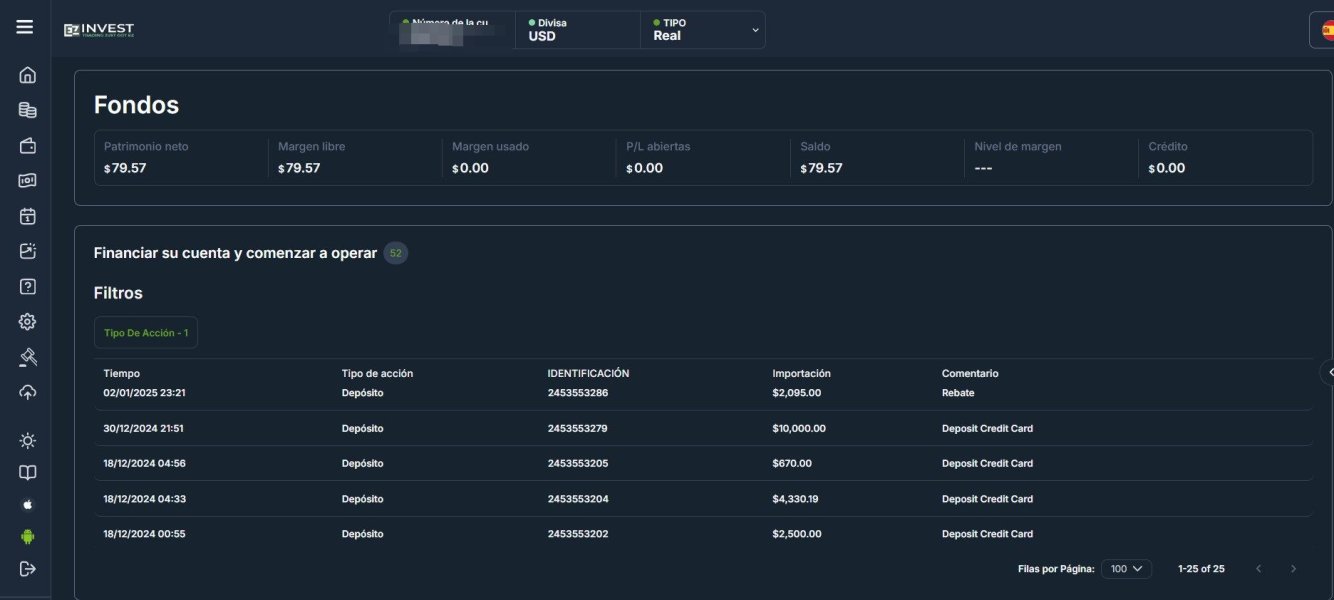

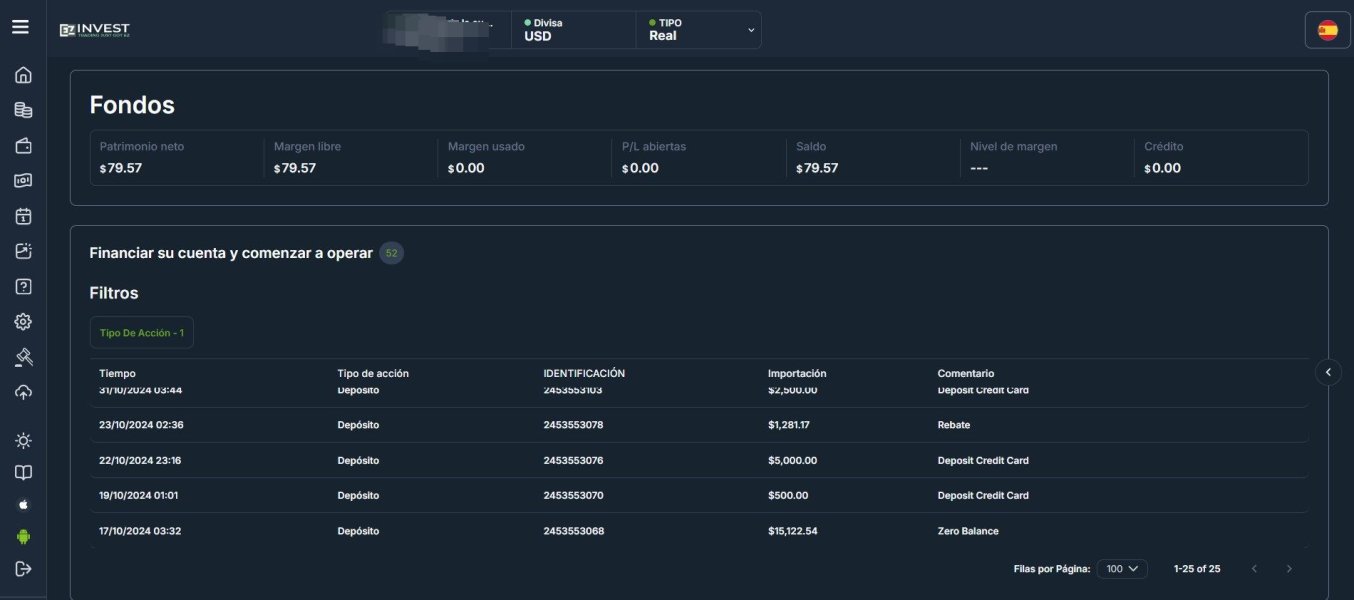

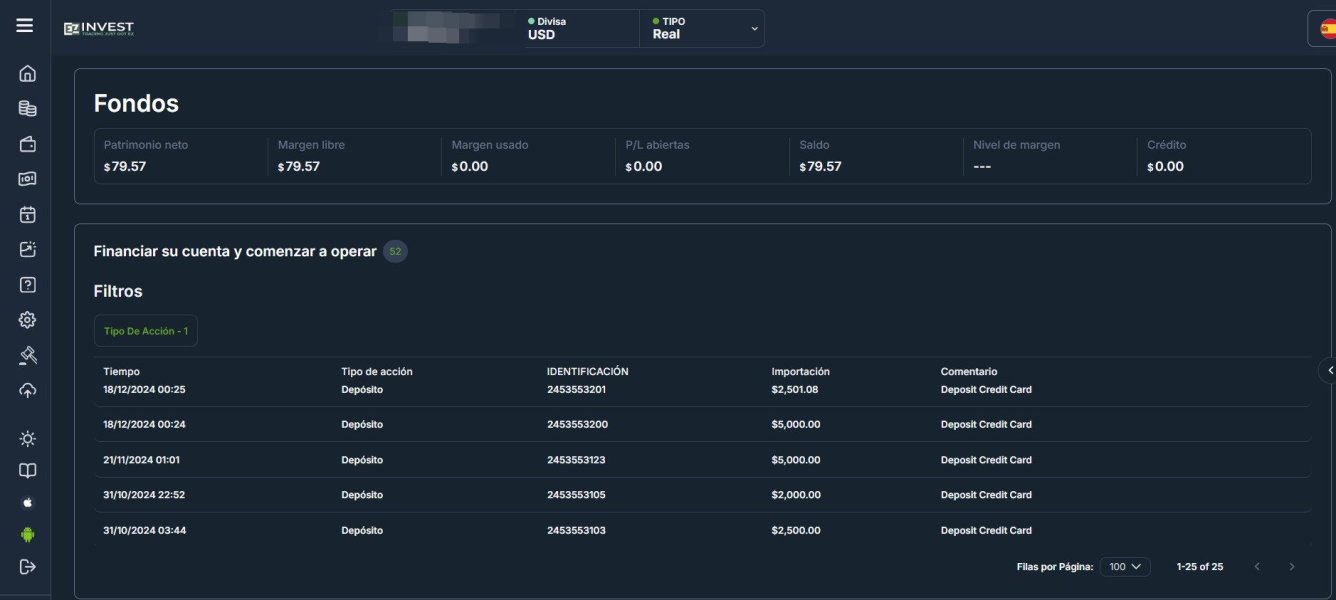

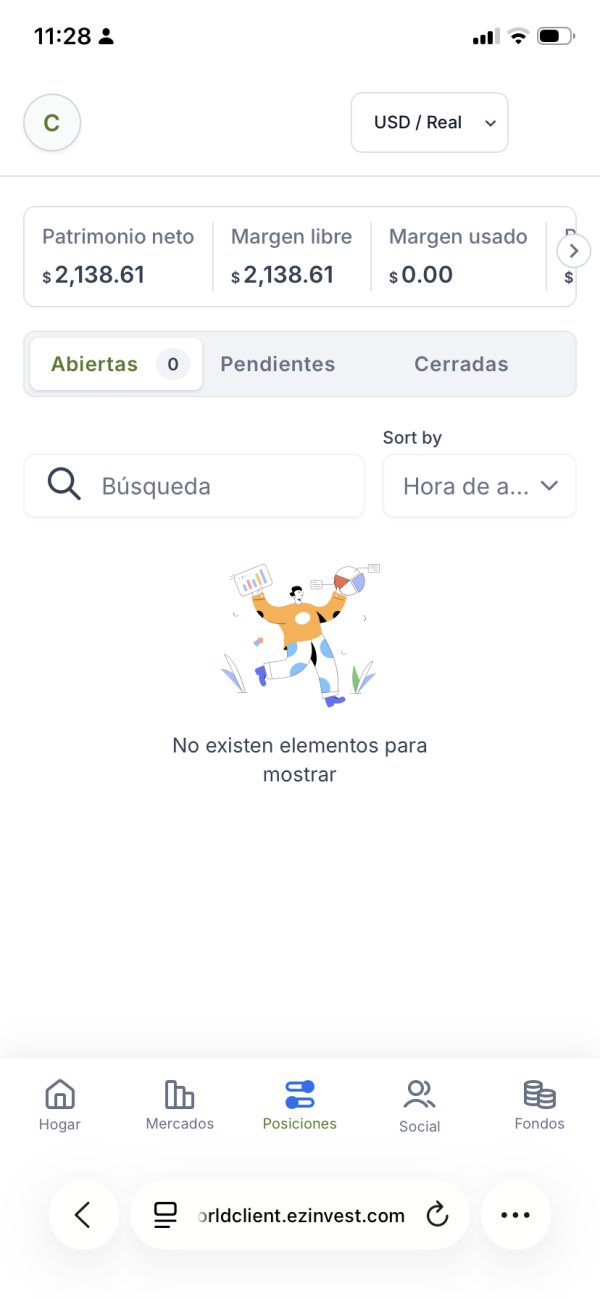

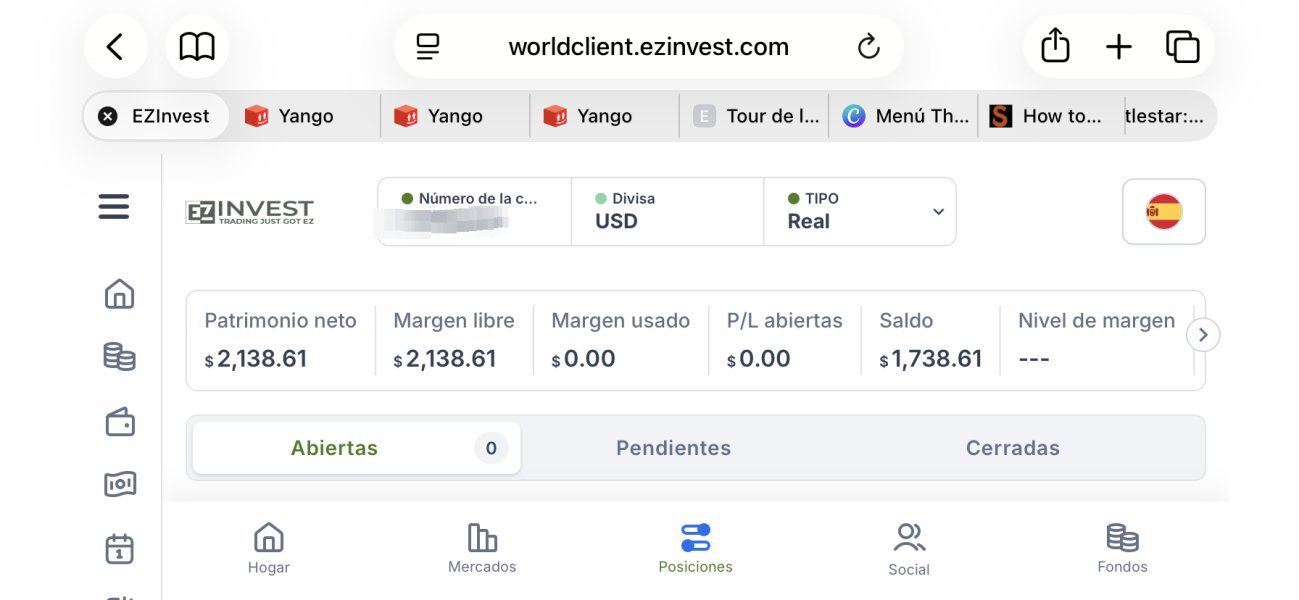

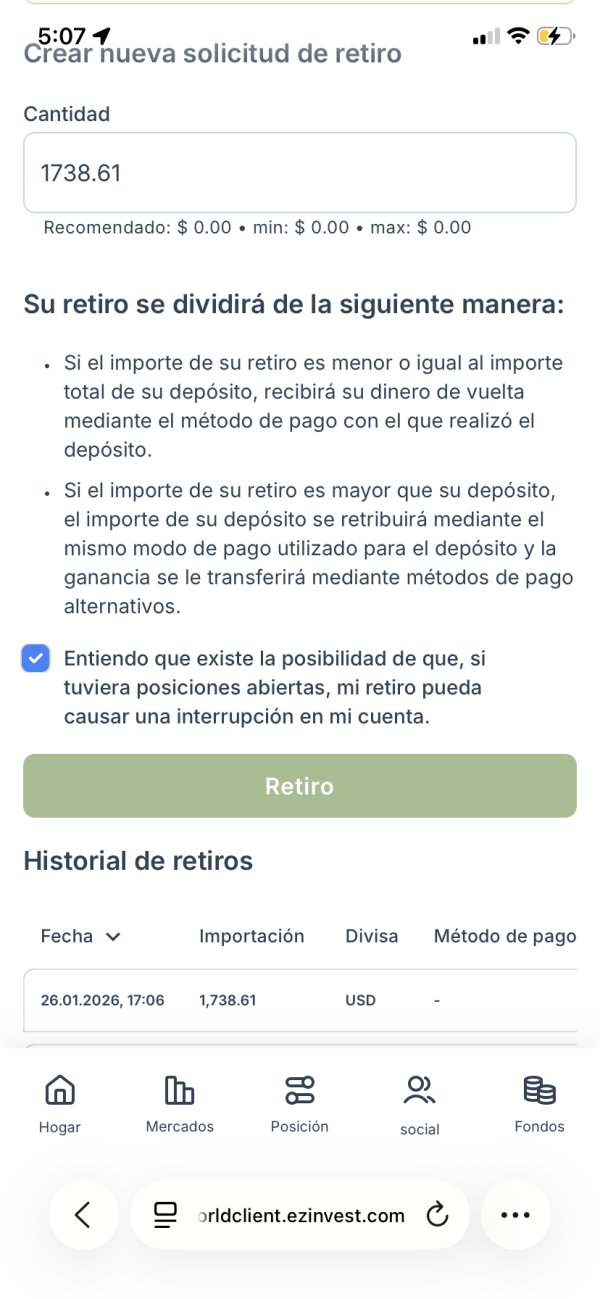

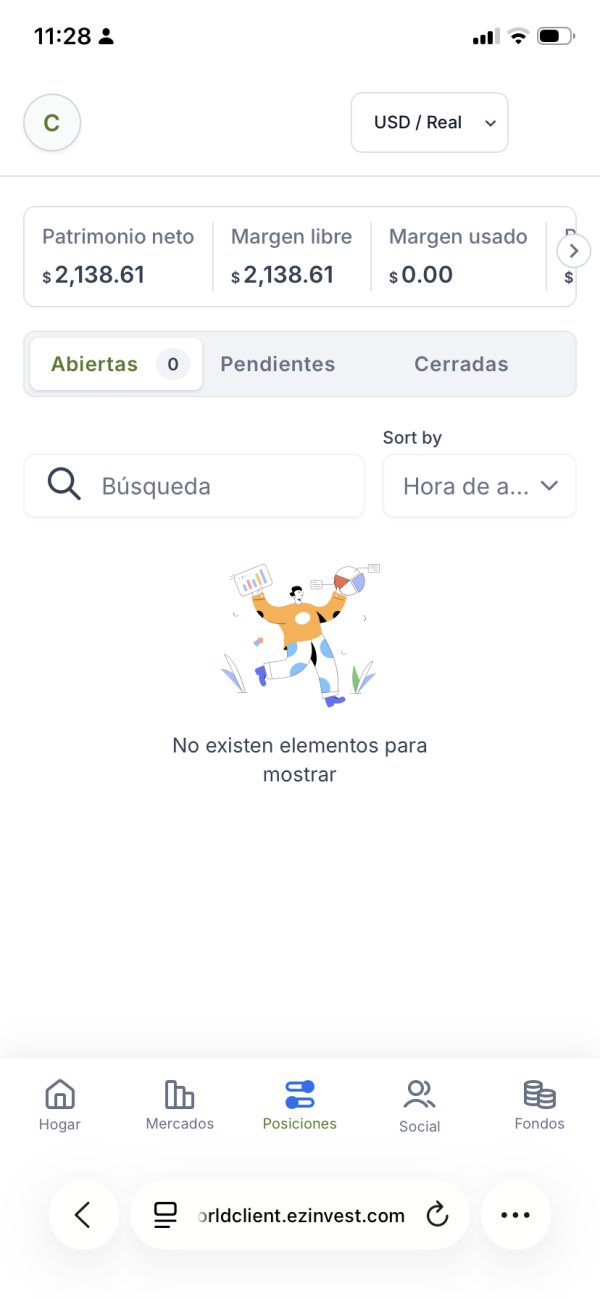

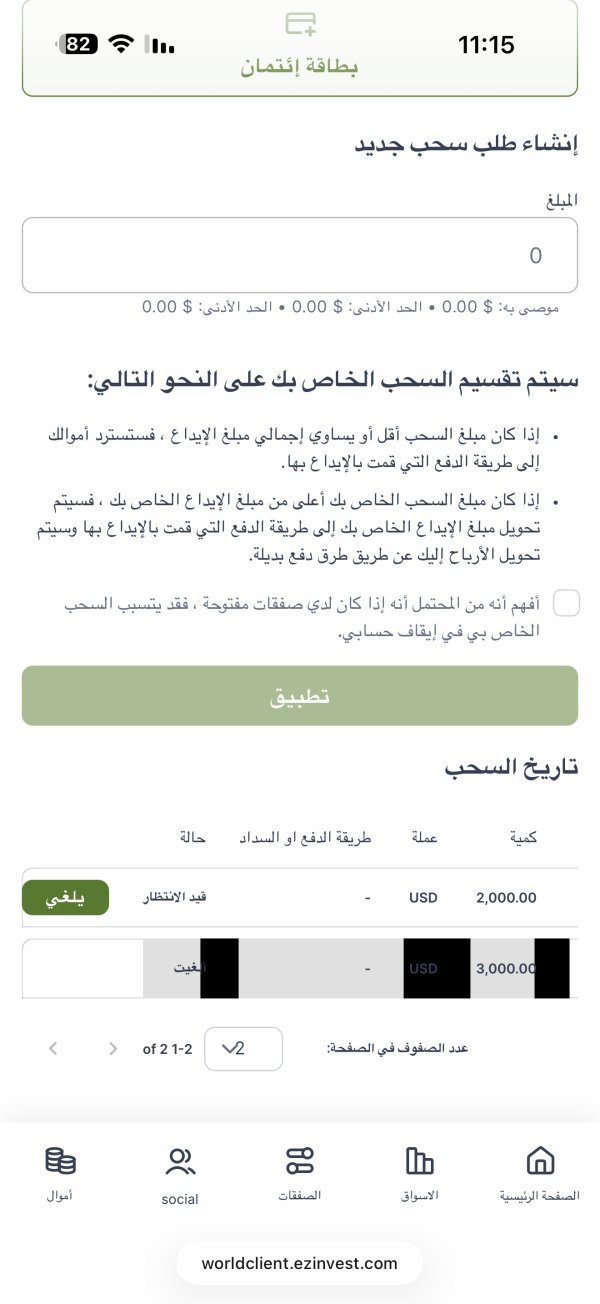

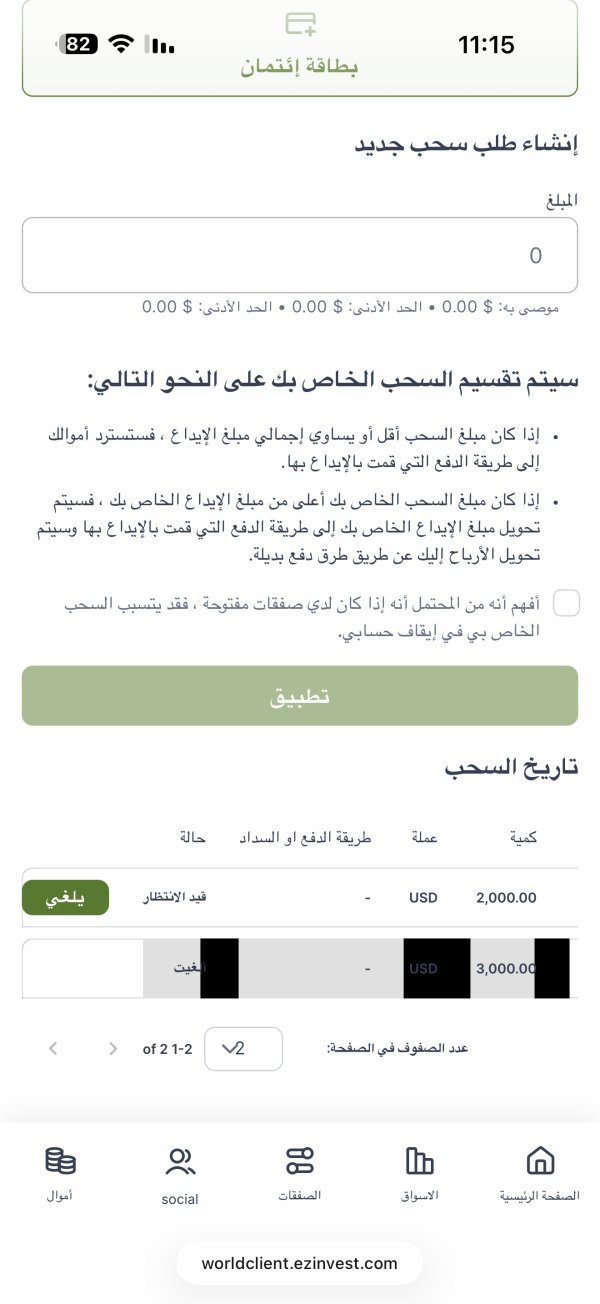

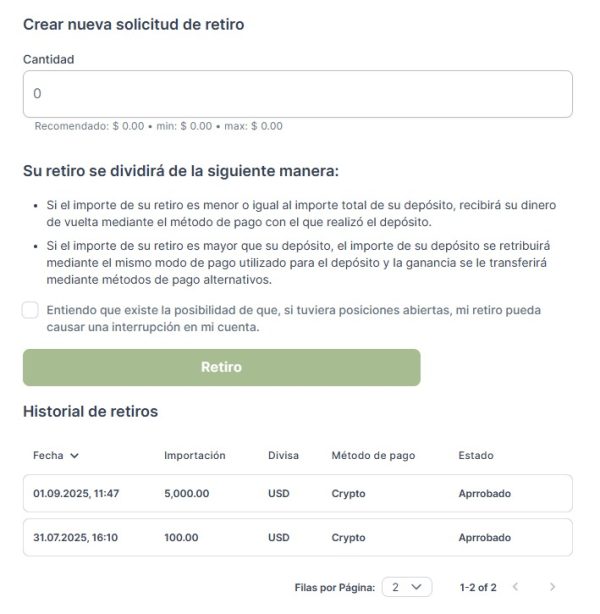

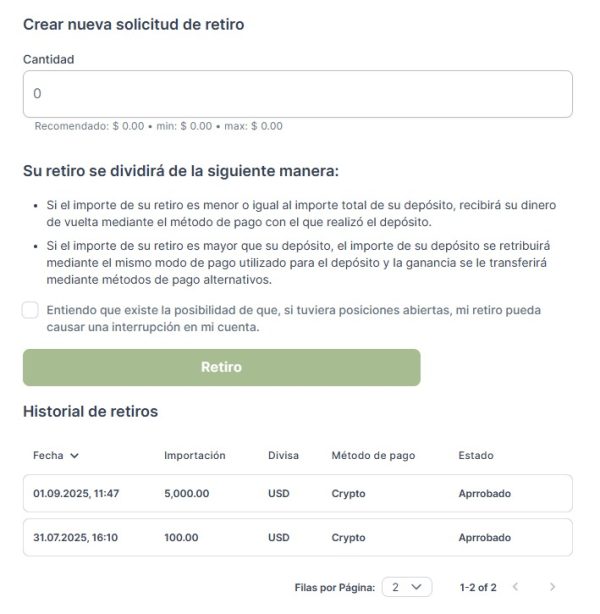

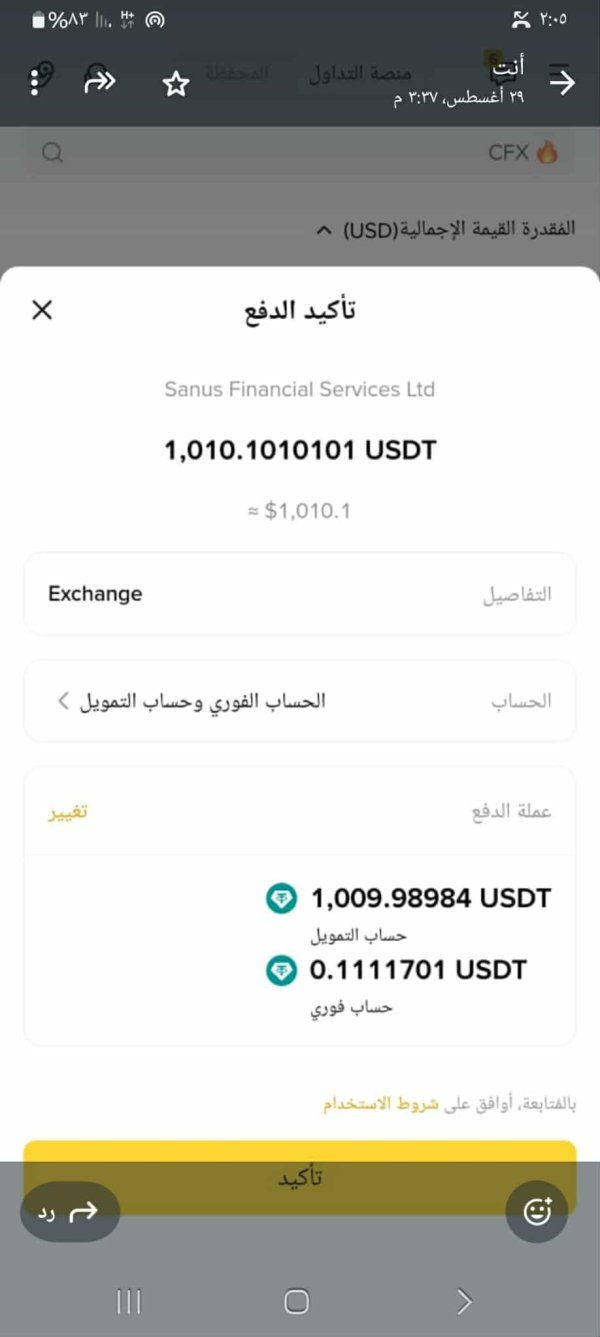

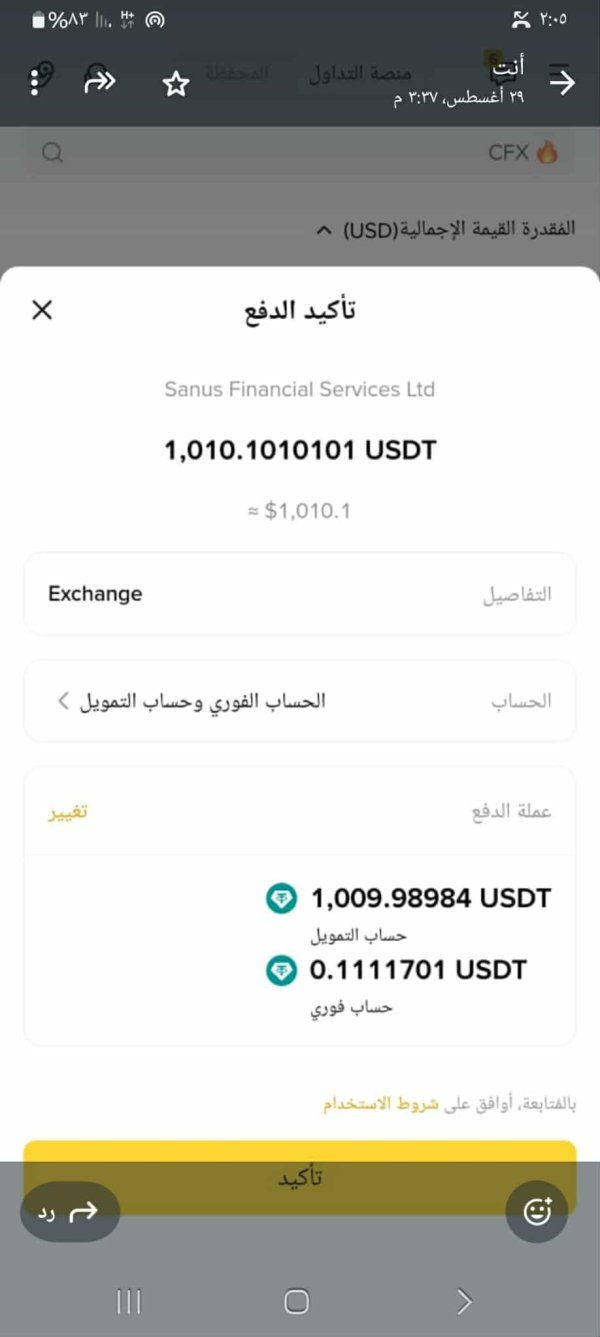

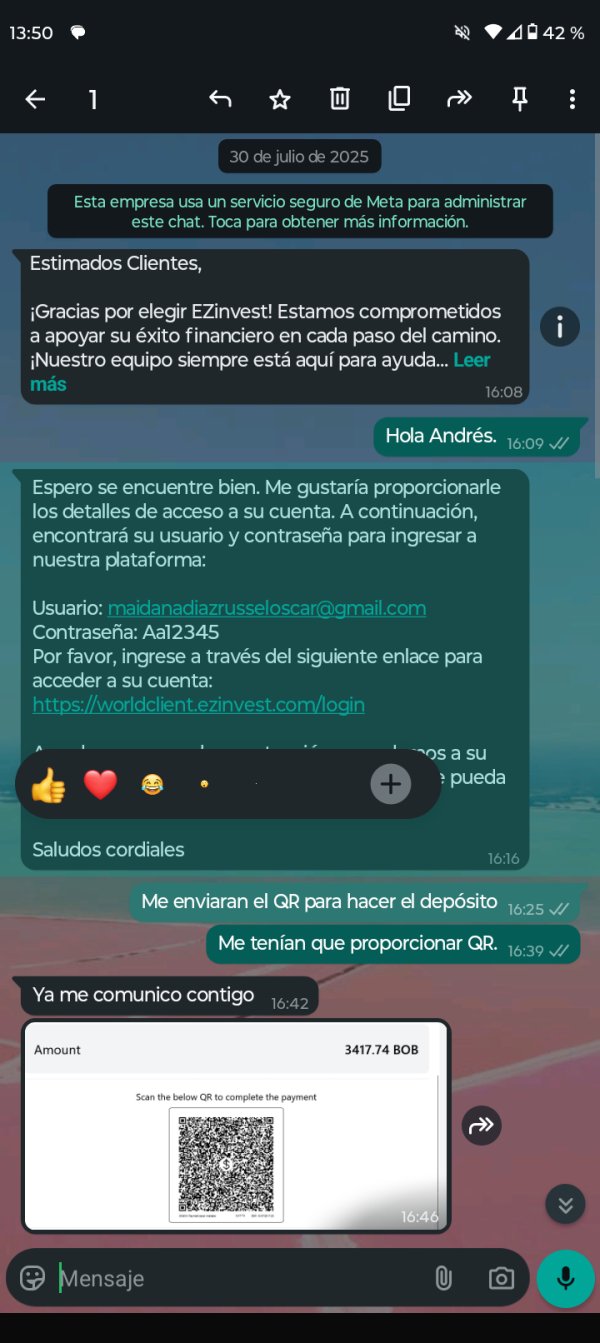

Deposit and Withdrawal Methods: Specific information regarding available payment methods, processing times, and associated fees for deposits and withdrawals was not detailed in available source materials, representing a significant information gap for potential clients. The exact minimum deposit amounts for different account types were not specified in the reviewed materials, making it difficult for prospective traders to assess entry-level investment requirements.

Bonus and Promotional Offers: Available documentation did not include information about current promotional campaigns, welcome bonuses, or ongoing incentive programs that might be available to new or existing clients.

Tradeable Assets: EZInvest provides access to different asset categories, though the specific instruments, currency pairs, commodities, indices, or other financial products available for trading were not comprehensively detailed in source materials. Critical information regarding spreads, commission structures, overnight financing costs, and other trading-related fees was not available in the reviewed sources, creating transparency concerns for cost-conscious traders.

Leverage Ratios: Specific leverage offerings for different asset classes and account types were not mentioned in available documentation, which is essential information for risk management planning.

Platform Options: The broker offers both mobile and desktop platform access, though the specific trading software, charting capabilities, and advanced trading features remain unspecified in current materials. This ezinvest review identifies significant information gaps that may impact trader decision-making processes.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The account conditions evaluation for EZInvest reveals substantial information limitations that impact the overall assessment. Available sources do not provide comprehensive details about the various account types offered, their specific features, or the differences between service levels that might be available to traders with different experience levels or investment capacities.

The absence of clear minimum deposit requirements creates uncertainty for potential clients attempting to understand the financial commitment required to begin trading. This lack of transparency extends to account opening procedures, verification requirements, and the timeline for account activation, which are crucial factors for traders planning their market entry. Furthermore, specialized account features such as Islamic accounts for Sharia-compliant trading, professional account classifications, or institutional service offerings were not documented in available materials.

The evaluation also lacks information about account maintenance fees, inactivity charges, or other ongoing costs that might affect long-term trading relationships. User feedback regarding account opening experiences and ongoing account management appears limited in available reviews, suggesting either a smaller user base or limited engagement in sharing detailed account-related experiences. This ezinvest review concludes that the lack of transparent account condition information significantly impacts the broker's accessibility to informed decision-making by potential clients.

EZInvest's tools and resources offering demonstrates moderate capabilities with notable limitations in available information. The broker provides access to different asset classes through both mobile and desktop platforms, indicating a basic commitment to multi-device accessibility that meets contemporary trading expectations.

However, the specific quality and range of trading tools remain unclear from available documentation. Essential features such as advanced charting capabilities, technical analysis indicators, automated trading support, and risk management tools lack detailed specification. The absence of information about proprietary trading tools or third-party integrations limits the ability to assess the platform's competitive positioning.

Research and analysis resources, including market commentary, economic calendars, daily market updates, and expert analysis, were not detailed in reviewed materials. Educational resources such as trading guides, webinar programs, video tutorials, or comprehensive learning centers also lack documentation, which could significantly impact the broker's appeal to beginning traders. The platform's support for automated trading systems, expert advisors, or algorithmic trading capabilities remains unspecified.

Additionally, information about mobile app functionality, offline capabilities, and synchronization between devices was not available for evaluation. These limitations suggest that while basic trading access is provided, the depth and sophistication of available tools may not meet the requirements of more advanced or demanding traders.

Customer Service and Support Analysis (Score: 4/10)

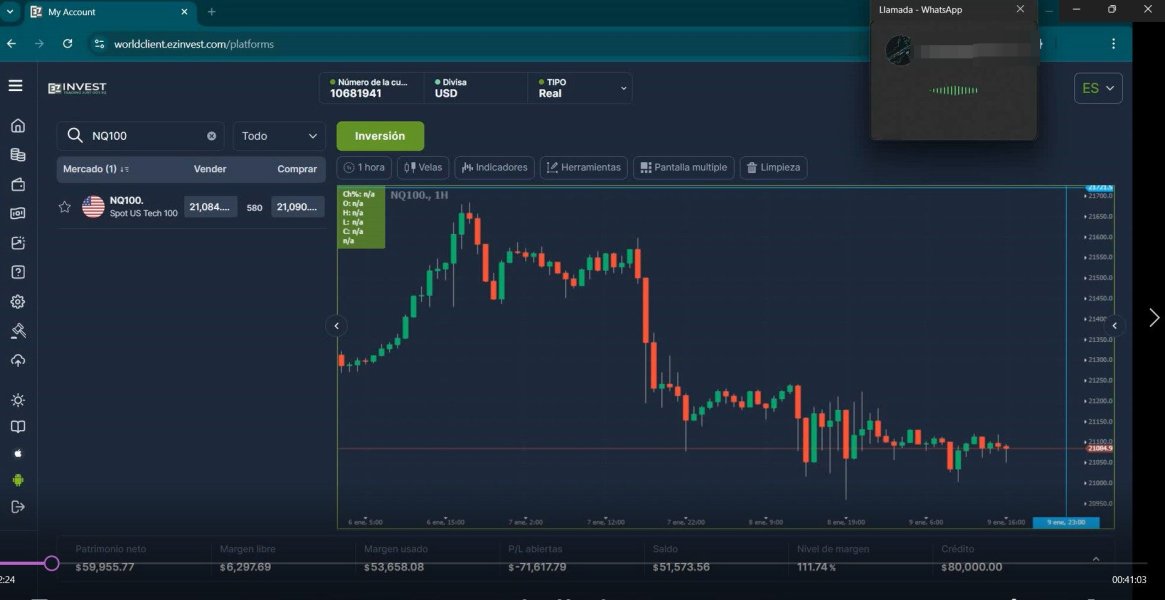

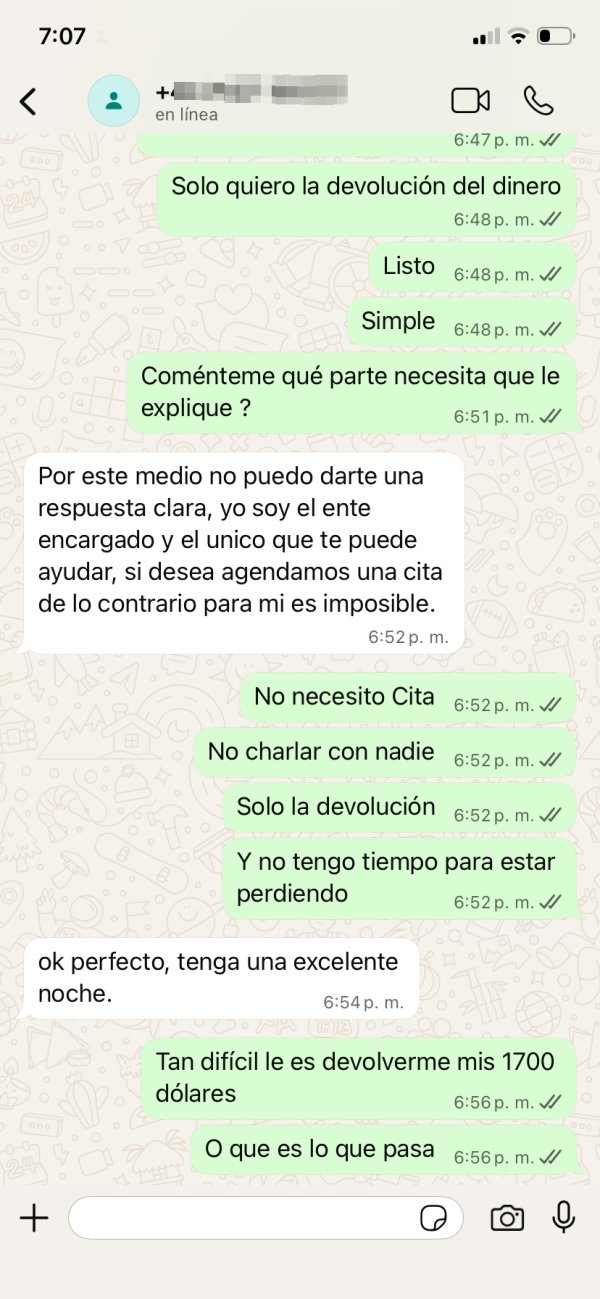

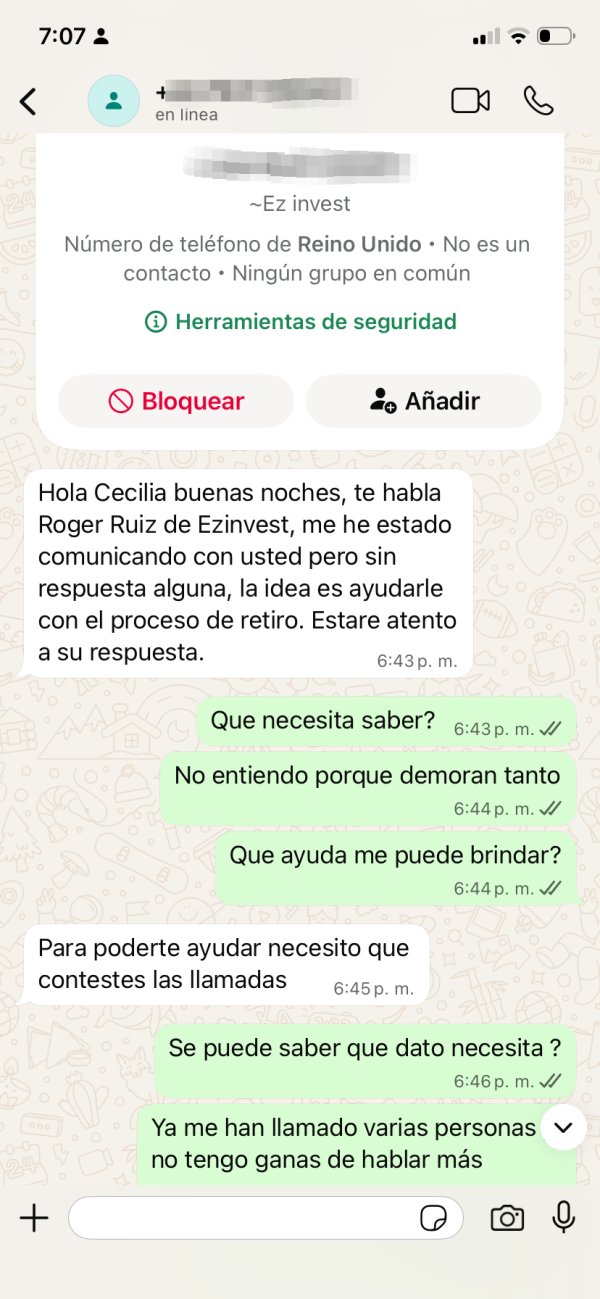

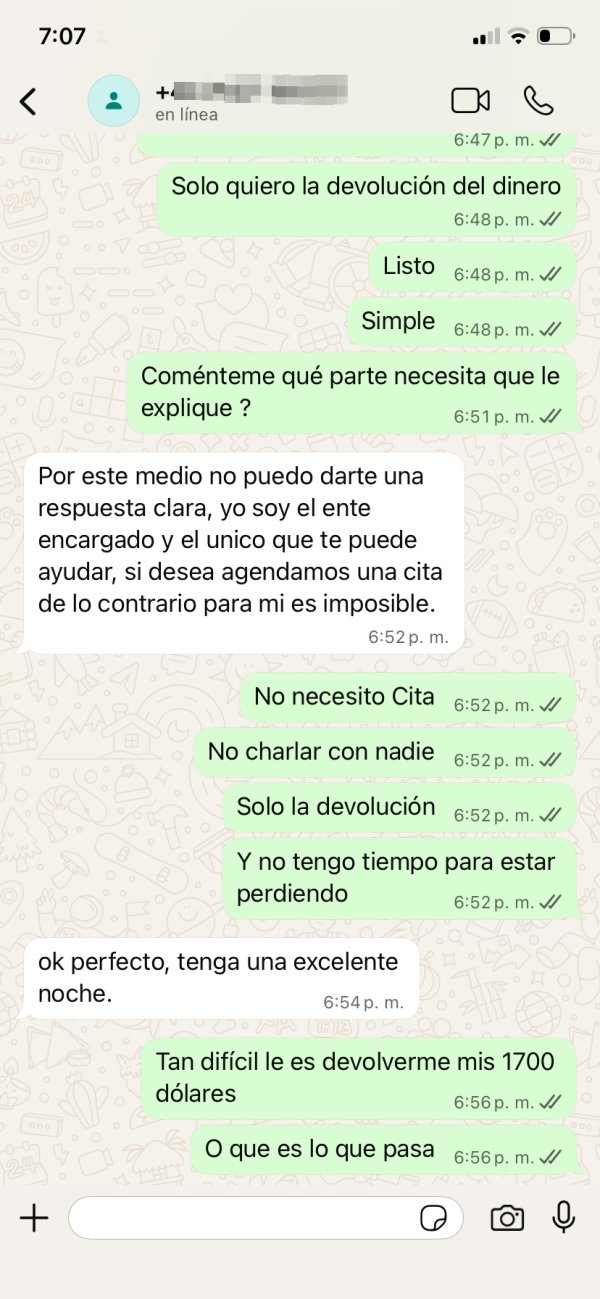

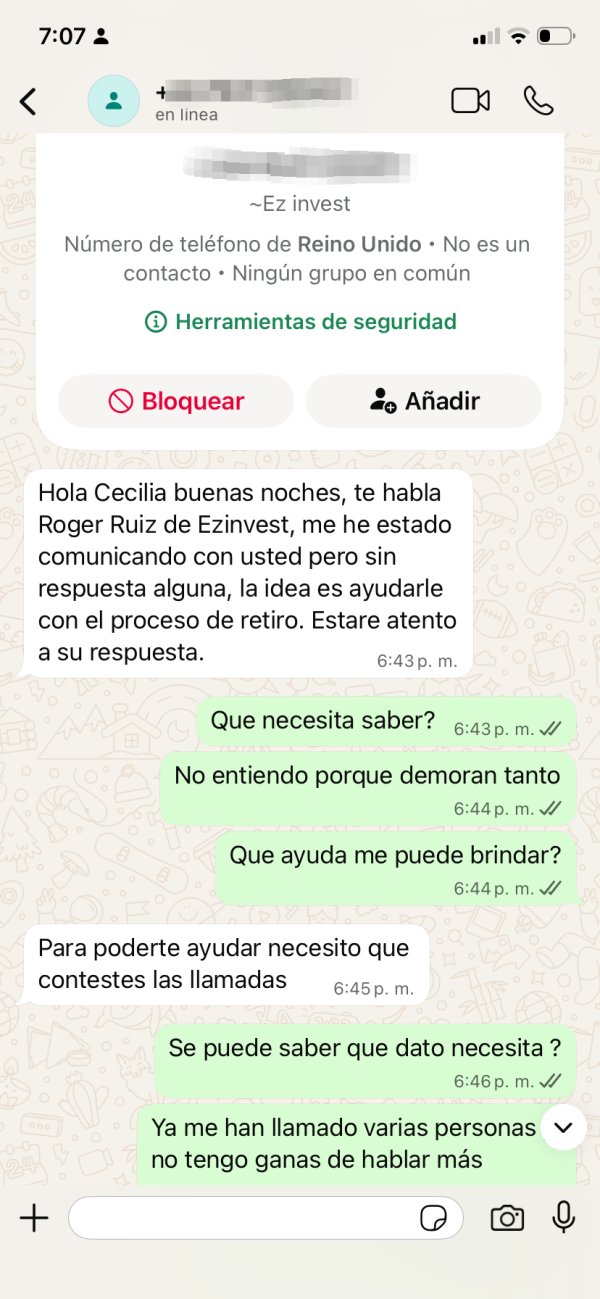

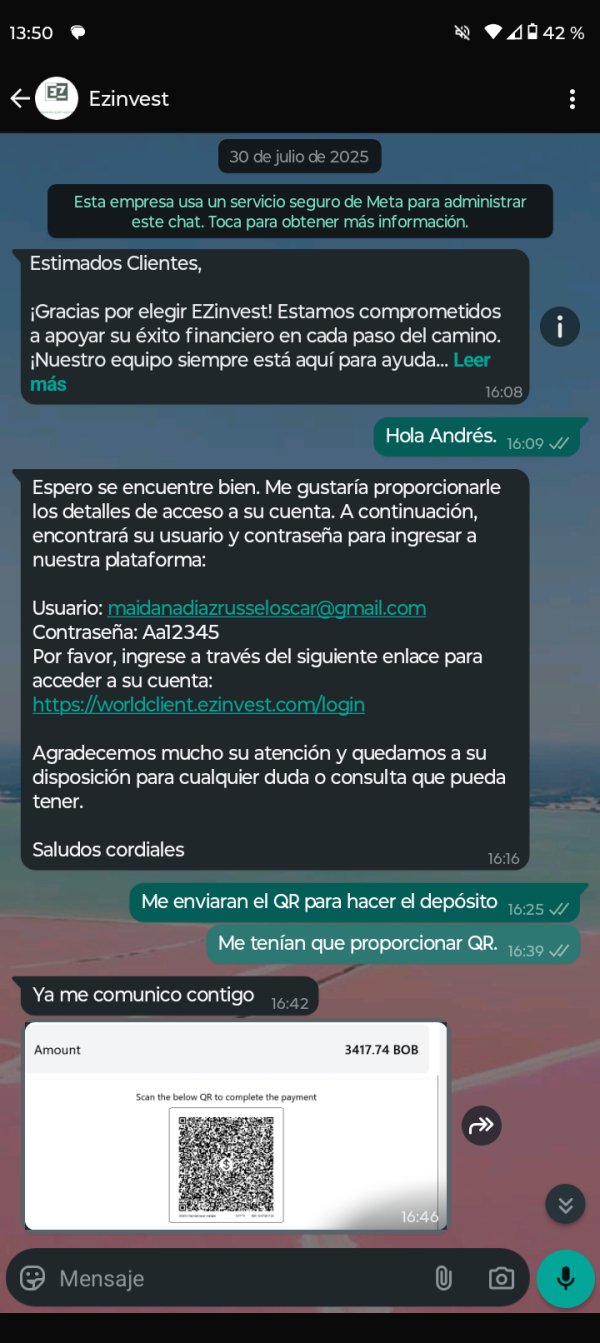

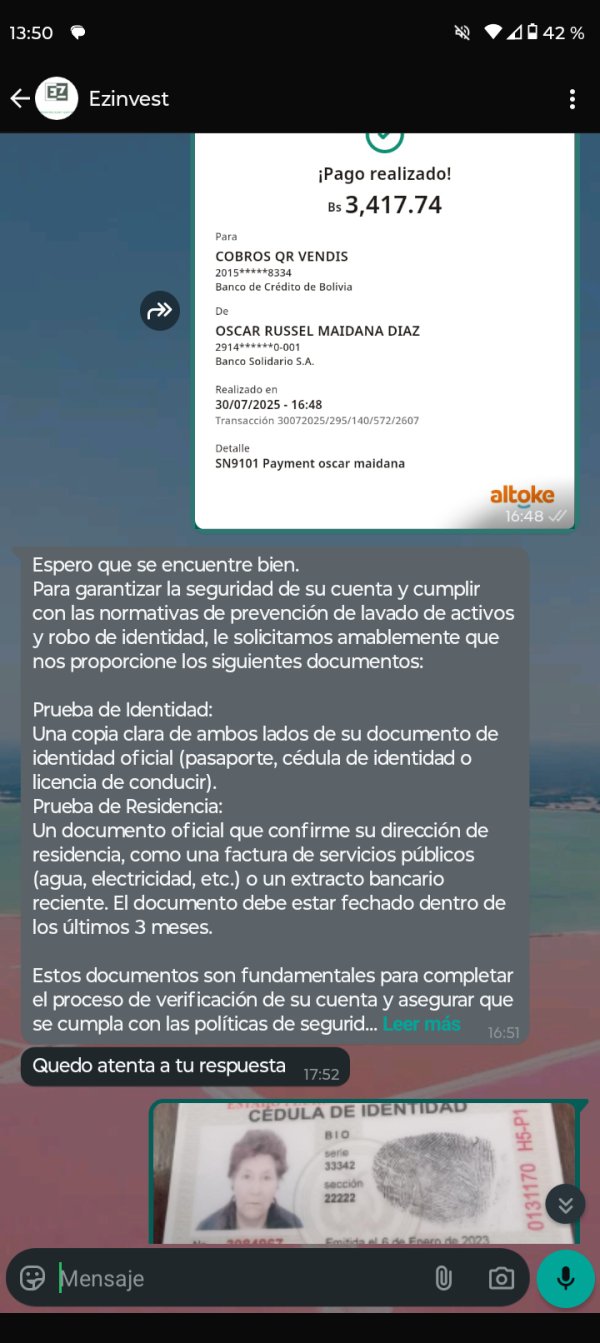

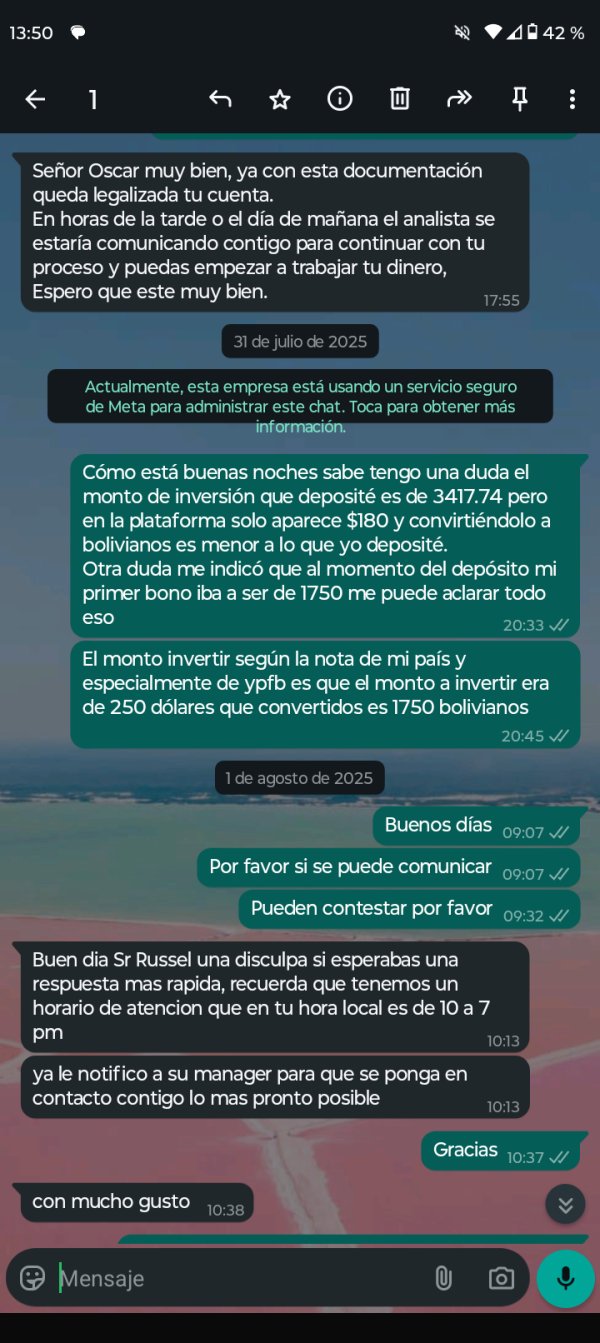

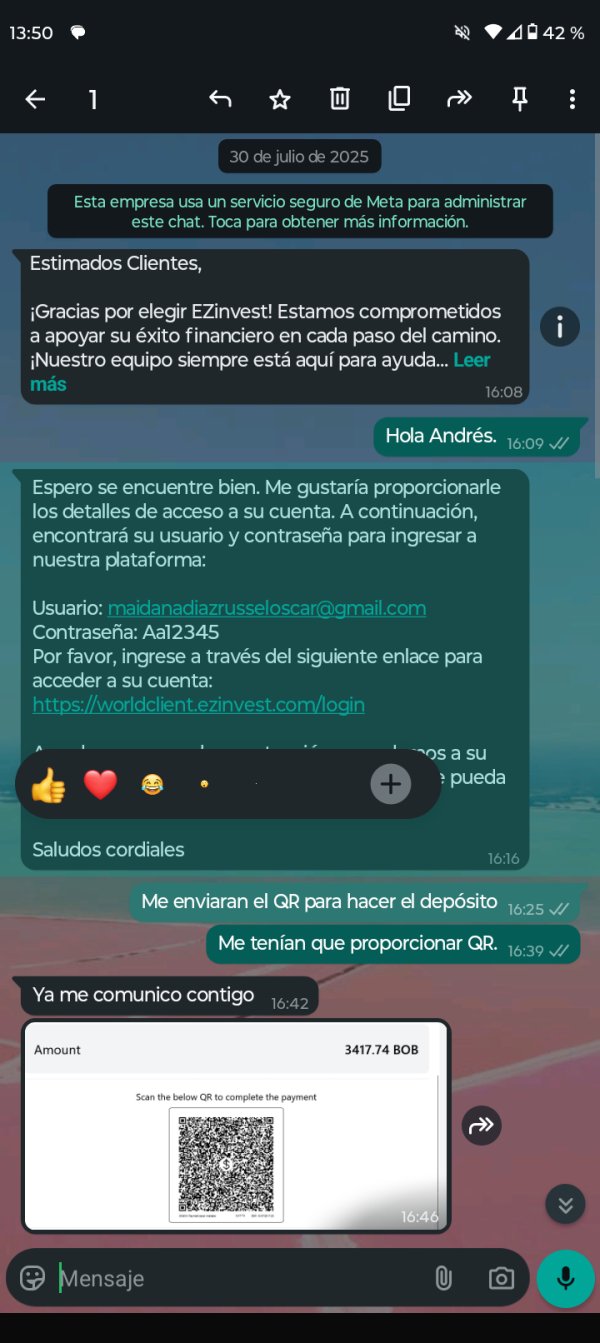

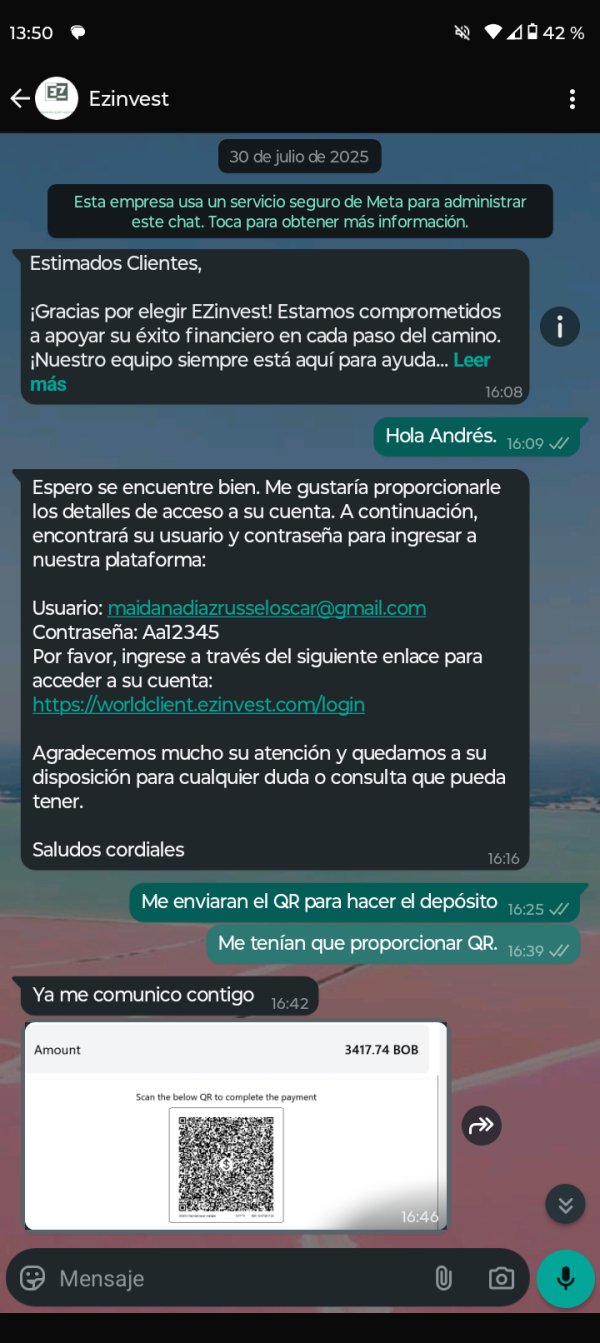

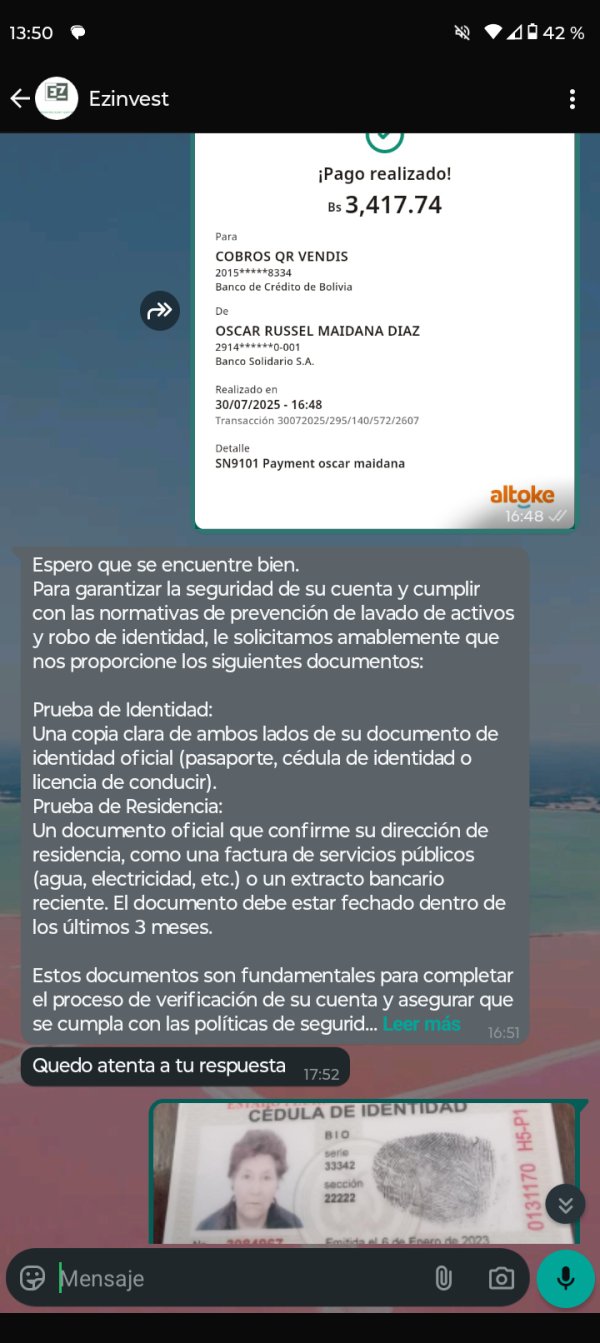

Customer service represents one of EZInvest's most significant challenges based on available user feedback and documented experiences. Multiple user reports indicate substantial difficulties in obtaining responsive and effective customer support, particularly regarding withdrawal processing and account-related inquiries.

User testimonials reveal prolonged response times to email inquiries, with some clients reporting complete lack of response to withdrawal requests and support communications. The support chat functionality appears to experience frequent operational issues, creating additional barriers for clients seeking immediate assistance with time-sensitive trading or account matters. The quality of support interactions, when they do occur, appears to lack the professional expertise and problem-solving capabilities expected in the competitive brokerage sector.

Users have reported frustration with support staff's ability to resolve withdrawal difficulties and provide clear explanations for account restrictions or processing delays. Available documentation does not specify the customer service channels offered, operating hours, or multilingual support capabilities, creating additional uncertainty about service accessibility. The absence of comprehensive FAQ sections, self-service capabilities, or detailed support documentation compounds the challenges faced by clients seeking independent problem resolution.

These customer service limitations significantly impact user satisfaction and create substantial concerns about the broker's commitment to client relationship management and operational excellence.

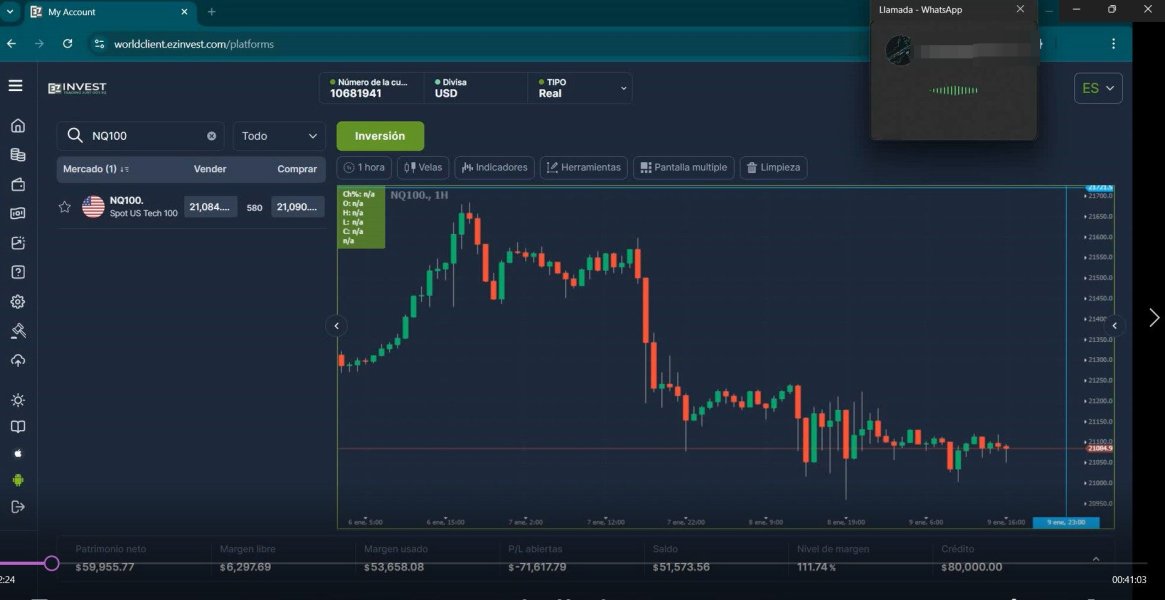

Trading Experience Analysis (Score: 5/10)

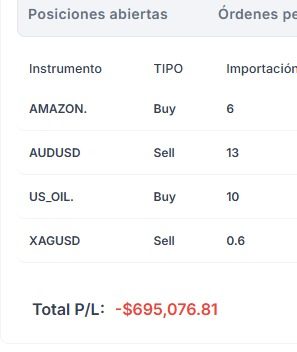

The trading experience evaluation for EZInvest faces significant limitations due to insufficient information about platform performance, execution quality, and user interface design. Available sources do not provide detailed insights into order execution speed, slippage rates, or platform stability during high-volatility market conditions.

Platform functionality details, including advanced order types, one-click trading capabilities, customizable interfaces, and real-time data quality, remain unspecified in available documentation. The absence of information about platform downtime, system maintenance schedules, or technical support for platform-related issues creates uncertainty about operational reliability. Mobile trading experience specifics, including app performance, feature parity with desktop platforms, and offline capabilities, lack detailed documentation.

The integration between mobile and desktop platforms, data synchronization, and cross-device functionality remain unclear from available sources. Trading environment factors such as market depth information, price transparency, and execution methodology (market maker vs. ECN) were not detailed in reviewed materials. Additionally, information about trading restrictions, position sizing limitations, and scalping policies was not available for assessment.

User feedback specifically addressing trading experience appears limited, suggesting either restricted user engagement or limited platform adoption. This ezinvest review concludes that the lack of comprehensive trading experience information significantly impacts the ability to assess platform suitability for different trading styles and requirements.

Trustworthiness Analysis (Score: 5/10)

EZInvest's trustworthiness assessment reveals a mixed profile combining regulatory legitimacy with concerning user feedback patterns. The broker maintains proper regulatory standing through its Cyprus Securities and Exchange Commission (CySEC) license number 203/13, providing a foundation of regulatory compliance and investor protection within the European Union framework.

However, this regulatory foundation is undermined by documented user complaints and negative experiences, particularly regarding withdrawal processing and customer service responsiveness. The presence of unresolved user complaints about fund access and communication difficulties raises questions about operational integrity and client relationship management. The company's transparency regarding business operations, fee structures, and service limitations appears inadequate based on available public information.

The lack of comprehensive disclosure about trading conditions, cost structures, and operational procedures creates concerns about operational transparency and client information access. Industry reputation assessment is complicated by the limited availability of third-party evaluations and professional reviews beyond user-generated feedback. The absence of industry awards, professional recognition, or peer acknowledgment suggests either limited market presence or insufficient industry engagement.

Fund safety measures, client money segregation practices, and investor compensation scheme participation were not detailed in available documentation, creating additional uncertainty about client asset protection beyond basic regulatory requirements.

User Experience Analysis (Score: 6/10)

User experience evaluation for EZInvest reflects moderate satisfaction levels with significant areas for improvement. The 42% user recommendation rate indicates that while some clients find value in the platform's services, a substantial portion of users experience sufficient difficulties to discourage recommendation to others.

Positive user feedback appears to focus on the platform's accessibility across mobile and desktop devices and the availability of different trading assets. Beginning traders may appreciate the straightforward approach to market access, though specific user interface design and navigation experiences lack detailed documentation. However, negative user experiences significantly impact overall satisfaction, with withdrawal difficulties representing the most frequently cited concern.

Users report frustration with processing delays, communication gaps, and resolution timeframes for fund access requests, which directly affect the practical usability of the platform. The account opening and verification process experiences were not comprehensively documented in available user feedback, limiting the assessment of onboarding efficiency and user-friendliness. Similarly, ongoing platform navigation, trade execution procedures, and account management experiences lack detailed user insights.

Common user complaints center on customer service responsiveness and financial transaction processing, suggesting that operational efficiency improvements could significantly enhance overall user satisfaction. The platform appears to serve beginning traders adequately, though more experienced users may find limitations in advanced features and professional service levels.

Conclusion

This comprehensive ezinvest review reveals a broker that maintains regulatory compliance through CySEC oversight while facing significant operational challenges that impact user satisfaction. EZInvest operates as a legitimate, regulated entity providing access to different financial markets through multi-device platforms, making it potentially suitable for beginning traders seeking basic market access.

The broker's primary strengths include its regulatory standing, multi-asset accessibility, and cross-platform trading capabilities. However, substantial weaknesses in customer service delivery, withdrawal processing efficiency, and operational transparency create significant concerns for potential clients. The 42% user recommendation rate reflects these mixed experiences, indicating moderate satisfaction among some users while highlighting persistent problems for others.

EZInvest may be most appropriate for novice traders willing to accept limited customer service capabilities in exchange for regulated market access and basic trading functionality. However, traders requiring responsive customer support, transparent fee structures, or advanced trading tools may find better alternatives in the competitive brokerage market.