Is EOS Global safe?

Pros

Cons

Is Eos Global Safe or a Scam?

Introduction

Eos Global, also known as Eos Global Investing Limited, positions itself as an independent forex broker based in the United Kingdom. With a focus on offering a wide range of trading instruments, including forex, CFDs, and commodities, it aims to attract both novice and experienced traders. However, the forex market is fraught with risks, making it crucial for traders to conduct thorough evaluations of any broker before committing their funds. This article aims to assess whether Eos Global is a safe trading option or if it raises red flags that suggest otherwise. Our investigation is based on a comprehensive analysis of regulatory status, company background, trading conditions, client experiences, and overall risk assessments.

Regulation and Legitimacy

One of the most critical aspects to consider when evaluating a forex broker is its regulatory status. Eos Global claims to operate under a common financial services license, but it lacks valid regulation from any recognized regulatory authority. This absence of oversight poses significant risks for potential traders. Below is a summary of Eos Global's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unauthorized |

The lack of regulation is concerning, as it means that Eos Global does not adhere to any established financial standards or consumer protections. Historically, unregulated brokers have been associated with various compliance issues, including fraudulent activities and poor customer service. The absence of a regulatory body to oversee operations raises the question of how secure traders' funds would be and whether they would have recourse in case of disputes.

Company Background Investigation

Eos Global was established approximately 2 to 5 years ago, with its operations based in the UK. However, the companys ownership structure and management team remain opaque, as there is limited information available about its founders or key personnel. This lack of transparency can be a significant red flag for potential investors. A reputable brokerage typically provides information about its management team, including their professional backgrounds and qualifications. In Eos Global's case, the absence of such details may indicate a lack of accountability.

Moreover, customer service contact information is limited, with no physical address provided on their website. While they do offer support via email and telephone, the lack of a physical presence can further erode trust. Transparency and information disclosure are essential for building credibility in the financial services industry, and Eos Global's shortcomings in this area warrant caution.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider the overall cost structure, including spreads, commissions, and overnight fees. Eos Global advertises a variety of trading instruments but provides limited information on specific trading costs. Heres a comparison of core trading costs:

| Cost Type | Eos Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1-3 pips |

| Commission Structure | Not Specified | Varies |

| Overnight Interest Range | Not Specified | 1-3% |

The lack of clarity regarding fees can be problematic, as traders may face unexpected costs that could impact their profitability. Additionally, the absence of specified spreads raises questions about how competitive Eos Global's trading conditions are compared to industry standards. Traders should be cautious of brokers that do not provide transparent fee structures, as this can often lead to hidden charges.

Client Funds Security

The security of client funds is paramount in the forex trading landscape. Eos Global's website does not provide detailed information about its client fund protection measures. Typically, reputable brokers implement strict policies for fund segregation and offer investor protection schemes. However, Eos Global's lack of regulatory oversight raises concerns about how securely client funds are managed.

In terms of fund safety, here are some key aspects to consider:

- Fund Segregation: It is unclear whether Eos Global segregates client funds from its operational funds.

- Investor Protection: The absence of regulatory backing means that there are likely no investor protection schemes in place.

- Negative Balance Protection: There is no information available about whether Eos Global offers negative balance protection, which is crucial for safeguarding traders from losing more than their invested capital.

Given these uncertainties, traders should be wary of the potential risks associated with trading through Eos Global.

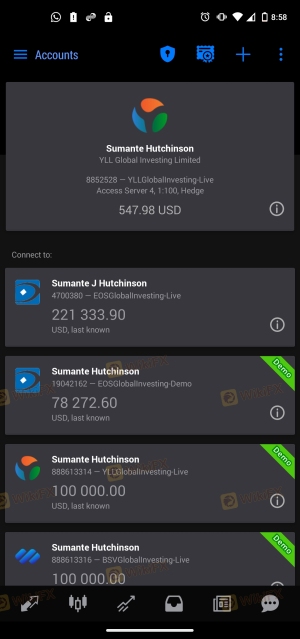

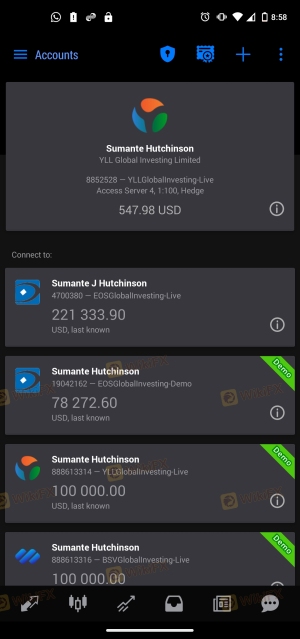

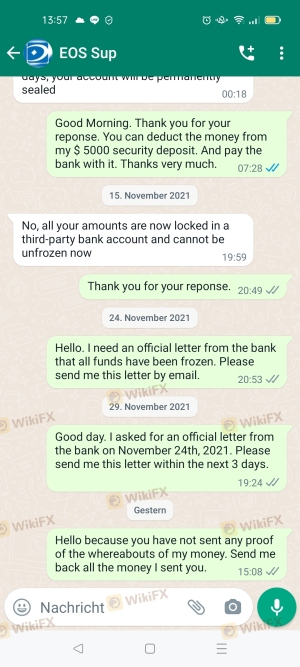

Customer Experience and Complaints

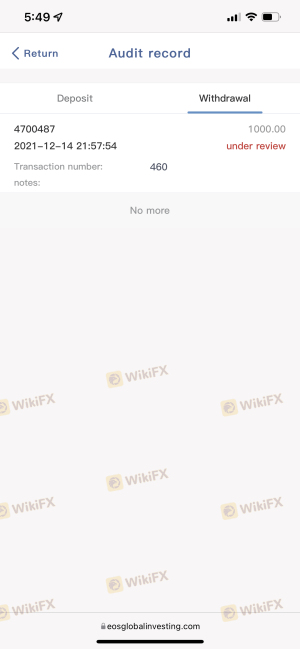

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Eos Global on platforms like WikiFX reveal a concerning pattern of complaints, particularly regarding withdrawal issues. Many users have reported difficulties in accessing their funds, with some alleging that their withdrawal requests were ignored or delayed. Heres a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Unclear Fee Structures | Medium | Unaddressed |

One notable case involved a trader who attempted to withdraw $1,000 but found their requests ignored, leading to frustration and loss of trust in the broker. Such complaints indicate a troubling trend that could impact the overall trading experience and raise concerns about the broker's legitimacy.

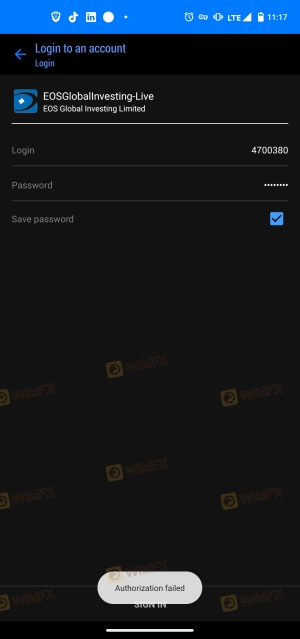

Platform and Trade Execution

The trading platform offered by Eos Global is the widely-used MetaTrader 5 (MT5), known for its advanced analytical tools and automated trading capabilities. However, user reviews suggest that the platform may experience issues related to stability and order execution. Traders have reported instances of slippage and order rejections, which can significantly affect trading outcomes.

Furthermore, any signs of platform manipulation or unfair practices should be taken seriously. The lack of transparency regarding execution quality raises questions about whether Eos Global operates fairly and ethically.

Risk Assessment

Engaging with Eos Global carries several risks that potential traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation in place. |

| Financial Risk | High | Lack of fund protection measures. |

| Operational Risk | Medium | Platform stability issues reported. |

| Customer Support Risk | High | Poor response to complaints. |

To mitigate these risks, traders should consider using regulated brokers with transparent practices and robust customer support systems. Conducting thorough research and reading reviews can also help in making informed decisions.

Conclusion and Recommendations

In conclusion, the investigation into Eos Global raises significant concerns regarding its safety and legitimacy as a forex broker. The lack of regulatory oversight, transparency issues, and negative customer feedback suggest that traders should exercise extreme caution when considering this broker. While Eos Global offers a range of trading instruments and a familiar trading platform, the associated risks, particularly in terms of fund safety and customer service, are substantial.

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated and have positive reputations in the industry. Options such as eToro, IC Markets, and Pepperstone are worth exploring, as they provide a safer trading environment with transparent practices and robust customer support. Ultimately, ensuring the safety of your investments should be a top priority in your trading journey.

Is EOS Global a scam, or is it legit?

The latest exposure and evaluation content of EOS Global brokers.

EOS Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EOS Global latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.