Is DUHANI safe?

Pros

Cons

Is Duhani Capital A Scam?

Introduction

Duhani Capital is an online trading platform that has recently entered the forex market, positioning itself as a potential option for traders seeking investment opportunities. However, the influx of unregulated brokers in the forex space makes it imperative for traders to exercise caution when selecting a trading partner. The risks associated with unregulated trading platforms can lead to significant financial losses, making it essential to thoroughly assess the legitimacy and safety of brokers like Duhani Capital. This article aims to provide a comprehensive analysis of Duhani Capital by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. The evaluation is based on a review of multiple credible sources and user feedback to ensure a well-rounded perspective.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and reliability. Duhani Capital operates as an unregulated broker, raising red flags regarding its operational practices and the safety of client funds. The absence of oversight from reputable financial authorities means that there are no guarantees for traders regarding the security of their investments. Below is a summary of Duhani Capital's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation implies that Duhani Capital is not subject to the stringent oversight that governs licensed brokers, which typically includes requirements for transparency, capital reserves, and client fund protection. Unregulated entities can operate with minimal accountability, often leading to fraudulent practices. Historically, unregulated brokers have been associated with high risks, including the potential for fund misappropriation and the inability to withdraw funds. Therefore, the lack of regulatory oversight is a significant concern for potential investors considering Duhani Capital.

Company Background Investigation

Duhani Capital claims to have been established in 2023 and operates under the ownership of Duhani Capital LLC. The company lists its registered address in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory framework, making it a common location for many unregulated brokers. The ownership structure and history of Duhani Capital remain opaque, as there is little publicly available information about its founders or management team. This lack of transparency raises questions about the broker's credibility.

The management team's background is crucial for assessing a company's reliability. However, Duhani Capital does not provide detailed information about its executives or their professional experiences, which is a common practice among legitimate brokers. The absence of such information can be a warning sign, as it suggests a lack of accountability and transparency. Without a clear understanding of who is managing the broker, investors may find themselves in a precarious position should any issues arise.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions offered is essential. Duhani Capital presents itself as providing competitive trading conditions, but the specifics of its fee structure warrant scrutiny. The broker claims to offer low spreads and no commissions, but many unregulated brokers often misrepresent their trading costs. Below is a comparison of Duhani Capital's core trading costs against industry averages:

| Fee Type | Duhani Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 0.5 - 1.0 pips |

| Commission Model | None | Varies (0 - $10) |

| Overnight Interest Range | Not disclosed | Varies by broker |

While Duhani Capital advertises a spread of 1.2 pips for major currency pairs, this is higher than the industry average, which raises concerns about the broker's competitiveness. Additionally, the lack of transparency regarding overnight interest rates and other fees suggests that traders may encounter hidden costs that could significantly affect their profitability. Overall, the trading conditions at Duhani Capital do not appear to be favorable, and potential clients should be wary of the potential for undisclosed fees.

Customer Fund Safety

The safety of customer funds is paramount when assessing a broker's reliability. Duhani Capital does not provide clear information regarding its fund safety measures. Notably, the broker lacks segregated accounts for client funds, which is a standard practice among regulated brokers to ensure that client funds are kept separate from the broker's operational funds. This lack of segregation increases the risk of losing funds in the event of financial difficulties faced by the broker.

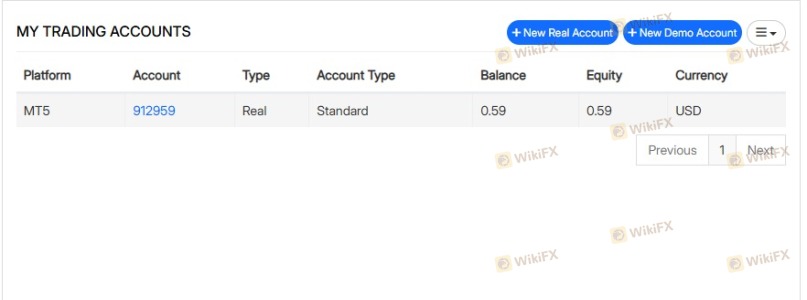

Additionally, Duhani Capital does not offer investor protection schemes, further endangering client investments. Without such protections, clients have limited recourse in the event of fraud or mismanagement. The absence of negative balance protection, which prevents clients from losing more than their initial investment, is another significant risk factor. Historical complaints from users regarding withdrawal issues and fund access further highlight the potential dangers associated with trading with Duhani Capital.

Customer Experience and Complaints

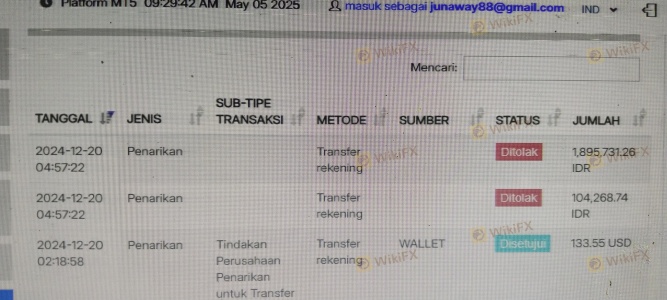

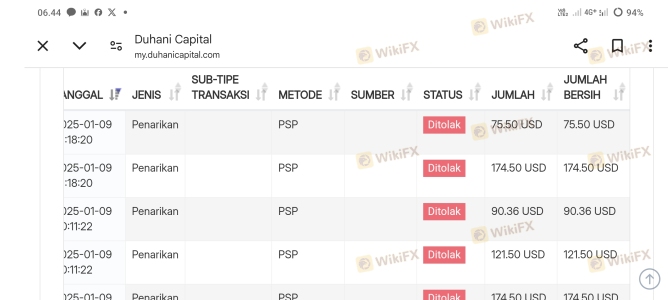

Analyzing customer feedback is crucial for understanding the user experience with a broker. Reviews and complaints about Duhani Capital indicate a troubling pattern of negative experiences among traders. Many users report difficulties in withdrawing their funds, with some claiming that the broker imposes unreasonable withdrawal conditions or simply ceases communication once funds are deposited.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | None |

| High-pressure Sales Tactics | High | Poor |

Two notable cases include users who reported being pressured to increase their deposits after initial investments, only to find themselves unable to access their funds later. These patterns of behavior are typical of unregulated brokers and raise serious concerns about Duhani Capital's business practices. Overall, the feedback from existing clients paints a concerning picture of the broker's reliability and responsiveness.

Platform and Execution

The trading platform is a critical component of any trading experience. Duhani Capital claims to offer a user-friendly platform, but the lack of detailed information about its performance and execution quality raises questions. Traders have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes.

Moreover, the absence of a demo account option further complicates the evaluation process, as potential clients cannot test the platform's capabilities before committing funds. The lack of transparency regarding the platform's operational stability and execution speed is concerning, especially given the high stakes involved in forex trading.

Risk Assessment

Engaging with Duhani Capital poses several risks that potential investors should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about accountability and fund safety. |

| Withdrawal Risk | High | Numerous complaints about withdrawal difficulties indicate potential issues. |

| Transparency Risk | High | Lack of information about fees, management, and operations increases uncertainty. |

| Platform Risk | Medium | Reports of execution issues and lack of demo account create doubts about reliability. |

To mitigate these risks, potential traders should conduct thorough research, consider using regulated brokers, and avoid making large deposits until they are confident in the broker's legitimacy.

Conclusion and Recommendations

Based on the comprehensive analysis of Duhani Capital, it is evident that this broker exhibits several characteristics commonly associated with scams. The lack of regulation, transparency, and numerous negative customer experiences raise significant red flags. Therefore, it is advisable for traders to exercise extreme caution and consider alternative options.

For those seeking reliable trading platforms, it is recommended to look for brokers that are regulated by reputable authorities, such as the FCA, ASIC, or CySEC. These brokers provide a higher level of security for client funds and generally offer better trading conditions. In conclusion, while Duhani Capital may present itself as a viable trading option, the associated risks and lack of regulatory oversight suggest that it is best avoided by prudent investors.

Is DUHANI a scam, or is it legit?

The latest exposure and evaluation content of DUHANI brokers.

DUHANI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DUHANI latest industry rating score is 1.98, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.98 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.