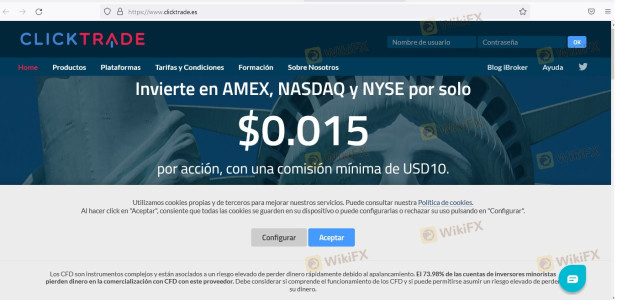

Regarding the legitimacy of CLICKTRADE forex brokers, it provides CNMV and WikiBit, .

Is CLICKTRADE safe?

Pros

Cons

Is CLICKTRADE markets regulated?

The regulatory license is the strongest proof.

CNMV Market Making License (MM)

Comisión Nacional del Mercado de valores

Comisión Nacional del Mercado de valores

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

IBROKER GLOBAL MARKETS, S.V., S.A.

Effective Date:

2016-05-13Email Address of Licensed Institution:

defensorcliente@ibroker.comSharing Status:

No SharingWebsite of Licensed Institution:

www.ibroker.esExpiration Time:

--Address of Licensed Institution:

C/ CALERUEGA 102-104, PLANTA BAJA A - 28033 MADRID (MADRID)Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Click Trade A Scam?

Introduction

Click Trade is a forex broker that has positioned itself in the online trading market since its establishment in 2018. Based in Seychelles, this broker offers a variety of trading instruments, including forex, commodities, and cryptocurrencies, with claims of competitive spreads and high leverage. However, the forex market is rife with potential risks, and traders must exercise caution when evaluating brokers. Many brokers, especially those operating offshore, may lack the necessary regulatory oversight, leading to concerns about their legitimacy and safety. This article aims to provide an objective analysis of Click Trade's credibility by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is vital for ensuring the safety of traders' funds and the legitimacy of the trading operations. Click Trade is regulated by the Seychelles Financial Services Authority (FSA), which has garnered mixed reviews regarding its effectiveness as a regulatory body. Below is a summary of Click Trade's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 020 | Seychelles | Verified |

While having a license from the Seychelles FSA provides some level of oversight, it is essential to note that this jurisdiction is often criticized for its lenient regulations compared to more established authorities like the FCA in the UK or ASIC in Australia. The lack of stringent regulatory measures raises questions about the broker's ability to protect traders effectively. Furthermore, Click Trade does not appear to have a history of compliance issues, but the offshore nature of its regulation may pose risks for traders seeking a more secure trading environment.

Company Background Investigation

Click Trade operates under the ownership of KW Investments Limited, which is registered in Cyprus. The company's relatively short history in the trading industry raises concerns about its long-term viability and reliability. The management team behind Click Trade is not widely publicized, and there is limited information about their professional backgrounds. This lack of transparency can be a red flag for potential investors who prefer to know the expertise and experience of those managing their funds.

Additionally, the company's information disclosure practices appear to be minimal. While the broker provides some details on its website, it lacks comprehensive information about its financial practices and operational history. This opacity can lead to skepticism among traders about the broker's intentions and reliability. In an industry where trust is paramount, the absence of clear and accessible information can deter potential clients from engaging with Click Trade.

Trading Conditions Analysis

When assessing a broker's credibility, it's crucial to analyze the trading conditions they offer. Click Trade has a minimum deposit requirement of $1,000, which is relatively high compared to many other brokers that allow traders to start with lower amounts. The broker claims to offer competitive spreads and zero commissions, but a detailed examination of their fee structure reveals potential issues.

Below is a comparison of Click Trade's core trading costs:

| Fee Type | Click Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Variable | 0.5% - 2.5% |

The average spread for major currency pairs at Click Trade is 1.8 pips, which is higher than the industry average. This discrepancy in trading costs can significantly impact a trader's profitability, especially for those engaging in high-frequency trading. Additionally, the broker charges a monthly inactivity fee of $30 for accounts that do not execute trades within 90 days, which can further erode profits for less active traders.

Customer Funds Security

The safety of customer funds is a critical concern for any trader. Click Trade claims to implement several measures to ensure the security of its clients' funds. However, the broker's reliance on an offshore regulatory framework raises questions about the effectiveness of these measures. Click Trade does maintain segregated accounts for client funds, which is a positive aspect, as it helps protect traders' assets in the event of the broker's insolvency.

Moreover, the broker offers negative balance protection, ensuring that traders cannot lose more than their initial investment. This feature is essential for risk management, particularly in the volatile forex market. However, there have been no significant historical incidents reported regarding fund security issues, which may indicate a level of operational stability. Nonetheless, traders should remain vigilant and conduct thorough due diligence before entrusting their funds to any broker.

Customer Experience and Complaints

Customer feedback is an invaluable resource when evaluating a broker's reliability. Click Trade has received a mix of reviews from users, with some praising its trading platform and customer support, while others express dissatisfaction regarding withdrawal processes and account management. Common complaints include difficulties in withdrawing funds, lack of responsiveness from customer support, and issues related to account blocking after profitable trades.

Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Blocking | Medium | Unresolved |

| Customer Support Delay | Medium | Average response |

One notable case involved a trader who reported that their account was blocked shortly after making a profit, leading to frustrations in attempting to contact customer support for resolution. This incident highlights the importance of assessing a broker's responsiveness and reliability in handling customer issues.

Platform and Trade Execution

The performance of a broker's trading platform is crucial for a seamless trading experience. Click Trade offers its proprietary WebTrader platform alongside the popular MetaTrader 5 (MT5). Users have reported that the platforms are user-friendly and provide essential trading tools, including advanced charting capabilities and market analysis features. However, there are concerns regarding order execution quality, with reports of slippage and occasional rejections of orders during volatile market conditions.

The execution speed is a critical factor for traders, especially in fast-paced environments. While Click Trade claims to offer instant execution, the presence of slippage has raised concerns about potential manipulation or inefficiencies in the trading process. Traders should remain aware of these issues when considering Click Trade as their broker.

Risk Assessment

Using Click Trade comes with inherent risks, primarily due to its offshore regulatory status and the associated concerns regarding fund security and transparency. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack adequate oversight. |

| Fund Security Risk | Medium | Segregated accounts provide some protection, but concerns remain. |

| Trading Cost Risk | Medium | Higher spreads and fees may impact profitability. |

| Customer Service Risk | Medium | Mixed reviews on responsiveness and issue resolution. |

To mitigate these risks, traders should consider diversifying their investments and not allocating more than they can afford to lose. Additionally, thorough research and continuous monitoring of the broker's performance and regulatory status are advisable.

Conclusion and Recommendations

In conclusion, Click Trade presents a mixed picture regarding its legitimacy and safety. While it is regulated by the Seychelles FSA, the quality of this regulation raises concerns about the protection of traders' funds. The broker's high minimum deposit requirements and average trading costs may deter new traders, while its mixed reviews on customer service and withdrawal processes warrant caution.

Overall, Click Trade may not be the best choice for novice traders or those seeking a highly regulated environment. For traders who prioritize low minimum deposits and competitive spreads, it may be wise to explore alternative brokers with stronger regulatory frameworks. Some recommended alternatives include brokers regulated by the FCA or ASIC, which can provide a more secure trading experience.

In light of the findings, it is essential for potential clients to conduct their due diligence and carefully weigh the risks before engaging with Click Trade.

Is CLICKTRADE a scam, or is it legit?

The latest exposure and evaluation content of CLICKTRADE brokers.

CLICKTRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CLICKTRADE latest industry rating score is 1.69, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.69 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.