Is April Asia safe?

Pros

Cons

Is April Asia Safe or Scam?

Introduction

April Asia is a relatively new player in the forex market, established in 2021 and based in Hong Kong. It positions itself as a brokerage firm catering primarily to the Chinese market, offering a range of financial derivatives, including currency pairs and commodities. As the forex market continues to grow, traders are increasingly vigilant about evaluating the legitimacy and safety of their brokers. With numerous scams reported in this sector, it is essential for traders to conduct thorough due diligence before committing funds. This article investigates whether April Asia is safe or a scam, utilizing various sources, including regulatory information, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

A crucial aspect of assessing any forex broker is its regulatory status. Regulation serves as a protective measure for traders, ensuring that brokers adhere to specific standards and practices. Unfortunately, April Asia currently lacks any evidence of being regulated by recognized financial authorities. This absence of regulation is a significant red flag, as it implies that traders' funds are not protected under any legal framework.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulatory oversight raises concerns about the safety of funds and the potential for fraudulent activities. Investing with an unregulated broker like April Asia means that traders may have limited recourse in case of disputes or fund mismanagement. The absence of a legitimate regulatory body overseeing operations indicates a higher risk level for traders, making it imperative to be cautious when engaging with this broker.

Company Background Investigation

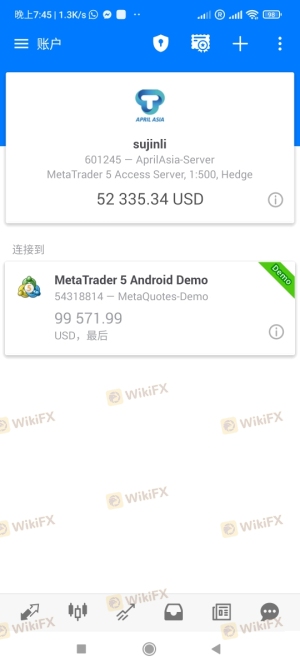

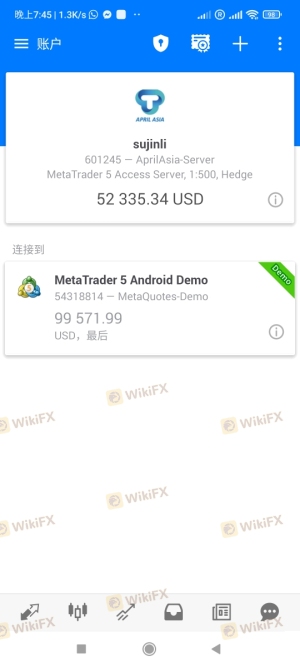

April Asia, officially known as April Asia Holding Group Co., Limited, was incorporated in 2021. The company claims to offer a variety of financial products tailored to the needs of its clients. However, the lack of detailed information regarding its ownership structure and management team raises questions about its transparency.

The management teams professional experience is not well-documented, which is concerning for potential investors. A transparent company typically provides information about its executives, their backgrounds, and their qualifications. Without this information, it becomes challenging to evaluate the credibility and expertise of those running the brokerage. Overall, the limited company history and lack of transparency contribute to the skepticism surrounding whether April Asia is safe.

Trading Conditions Analysis

April Asia claims to offer competitive trading conditions, but without regulatory oversight, it is essential to scrutinize its fee structure and trading costs carefully. Traders must be aware of any unusual fees that could affect their profitability.

| Fee Type | April Asia | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies (typically 1-2 pips) |

| Commission Model | N/A | Varies (often 0-10 USD) |

| Overnight Interest Range | N/A | Varies (typically 0.5-2%) |

Unfortunately, the lack of specific information on spreads and commissions for April Asia indicates potential opacity in its pricing model. Traders should be wary of hidden fees or unfavorable terms that could impact their trading experience. Without clear information on trading costs, it becomes challenging to determine whether April Asia offers a competitive edge or is merely masking unfavorable trading conditions.

Client Fund Safety

The safety of client funds is paramount when assessing any forex broker. April Asia's lack of regulation raises significant concerns about the measures it has in place to protect client deposits. Typically, regulated brokers are required to segregate client funds from their operational funds, ensuring that traders' money is safeguarded against misappropriation.

Moreover, the absence of investor protection schemes means that clients of April Asia may not have any recourse in case of insolvency or fraud. Historical reports of negative experiences from traders indicate that there have been instances where clients faced difficulties in withdrawing their funds. Such issues further highlight the risks associated with trading with an unregulated broker like April Asia.

Customer Experience and Complaints

Customer feedback is invaluable in determining the reliability of a broker. Recent reviews of April Asia reveal a concerning pattern of negative experiences from users. Many traders have reported issues related to fund withdrawals, claiming that their requests were either delayed or outright denied.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

| Transparency of Fees | High | Poor |

Typical complaints include difficulties in accessing funds and inadequate customer support. These issues raise serious concerns about whether April Asia is safe for traders. The overall sentiment among users suggests a lack of trust in the company, further underscoring the importance of choosing a broker with a solid reputation and positive customer feedback.

Platform and Execution

The trading platform's performance and execution quality are essential factors for traders. A reliable platform should offer stable connectivity, quick order execution, and minimal slippage. However, there is limited information available regarding April Asia's trading platform, which raises concerns about its reliability.

Without detailed analysis or user feedback on execution quality, it is challenging to ascertain whether traders will experience favorable trading conditions. Any signs of platform manipulation or excessive slippage would be significant red flags, indicating a lack of integrity in trading practices.

Risk Assessment

Using April Asia presents several risks that traders should carefully consider. The lack of regulation, negative customer feedback, and unclear trading conditions collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | No investor protection measures. |

| Execution Risk | Medium | Limited information on platform performance. |

To mitigate these risks, potential traders should conduct thorough research and consider starting with a demo account or minimal investment to assess the broker's reliability before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that April Asia is not a safe broker for forex trading. The lack of regulation, negative customer experiences, and insufficient transparency raise serious concerns about the legitimacy of this brokerage. Traders should exercise caution and consider alternative options that offer regulatory oversight and a proven track record of customer satisfaction.

For those seeking reliable forex brokers, consider options that are regulated by reputable authorities, have positive user feedback, and demonstrate transparency in their operations. By prioritizing safety and reliability, traders can better protect their investments and enhance their trading experience.

Is April Asia a scam, or is it legit?

The latest exposure and evaluation content of April Asia brokers.

April Asia Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

April Asia latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.