Aether Capital 2025 Review: Everything You Need to Know

Summary

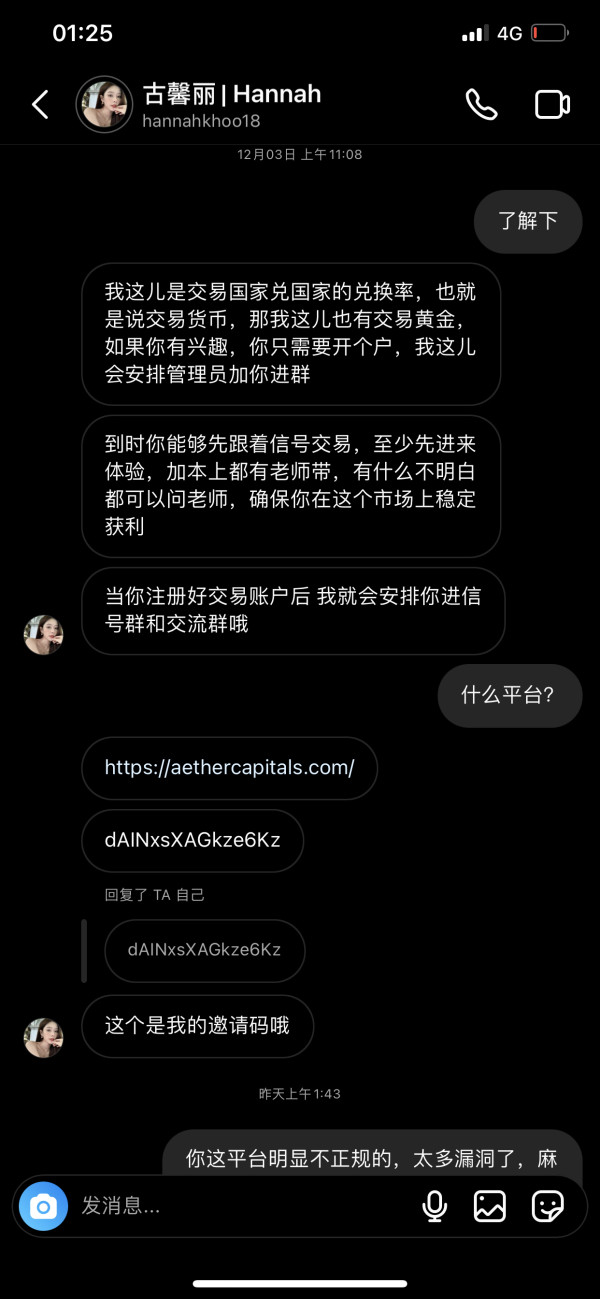

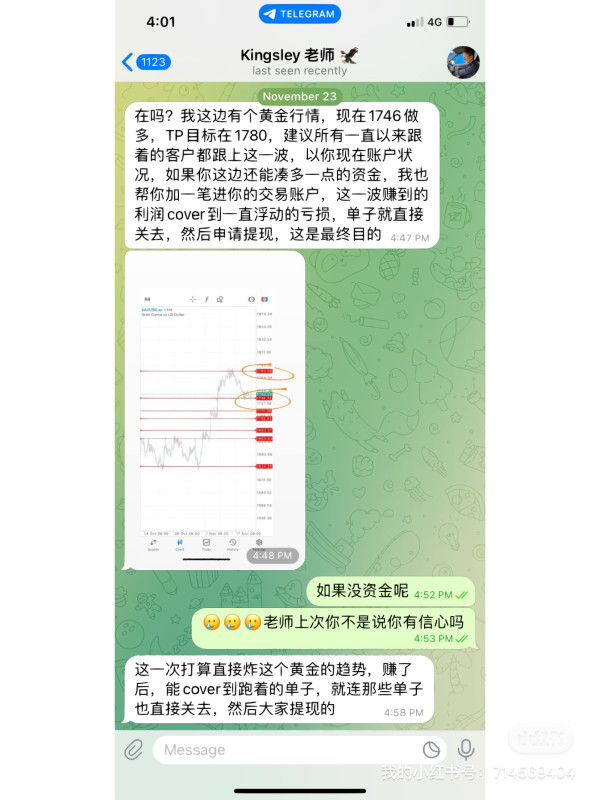

This aether capital review looks at an unregulated forex broker that has received mixed feedback from traders. Aether Capital operates without oversight from major financial regulatory authorities, which raises significant concerns about trader protection and operational transparency.

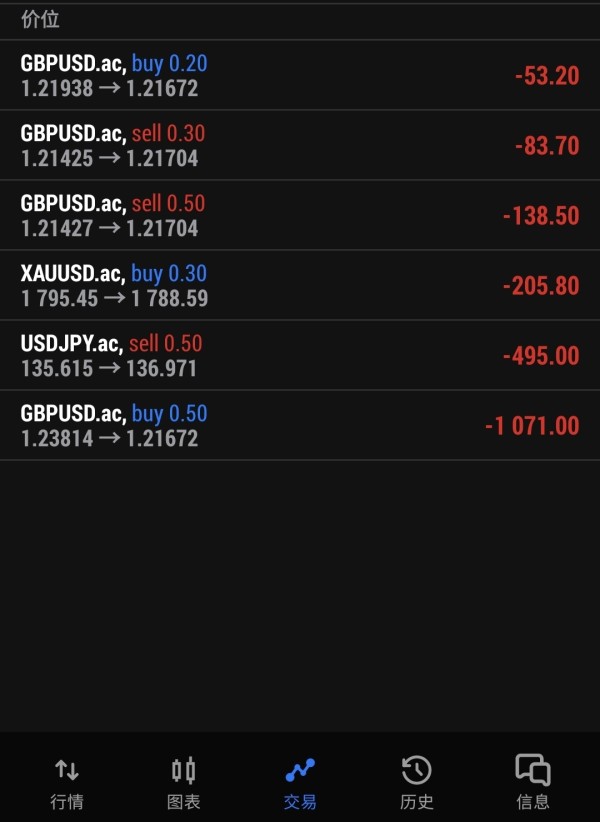

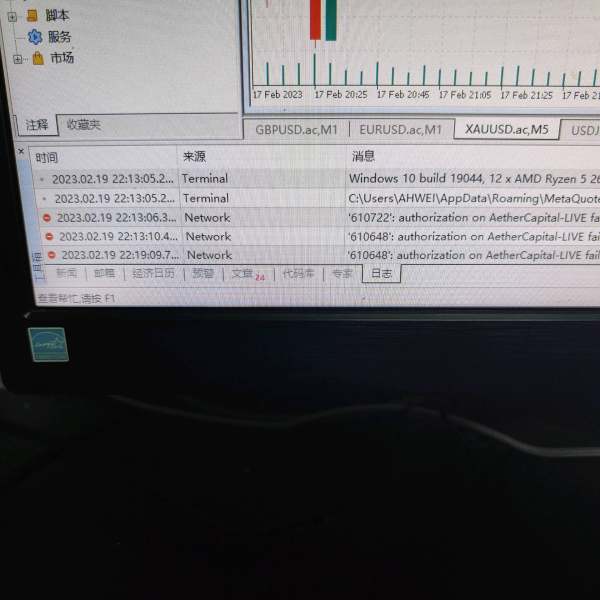

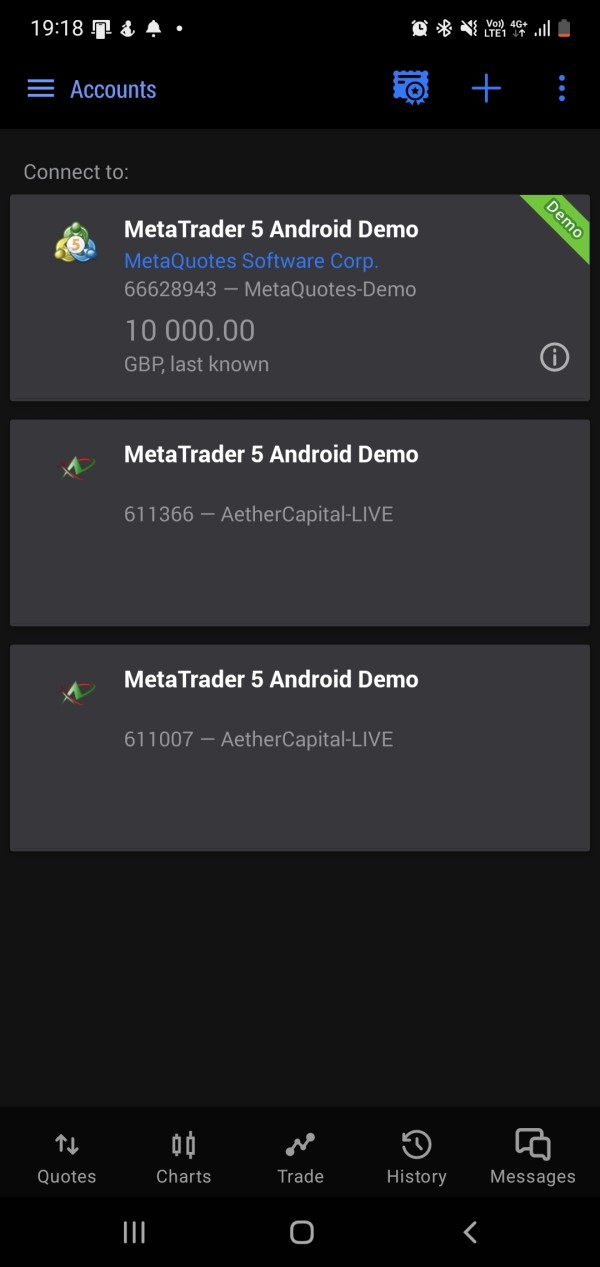

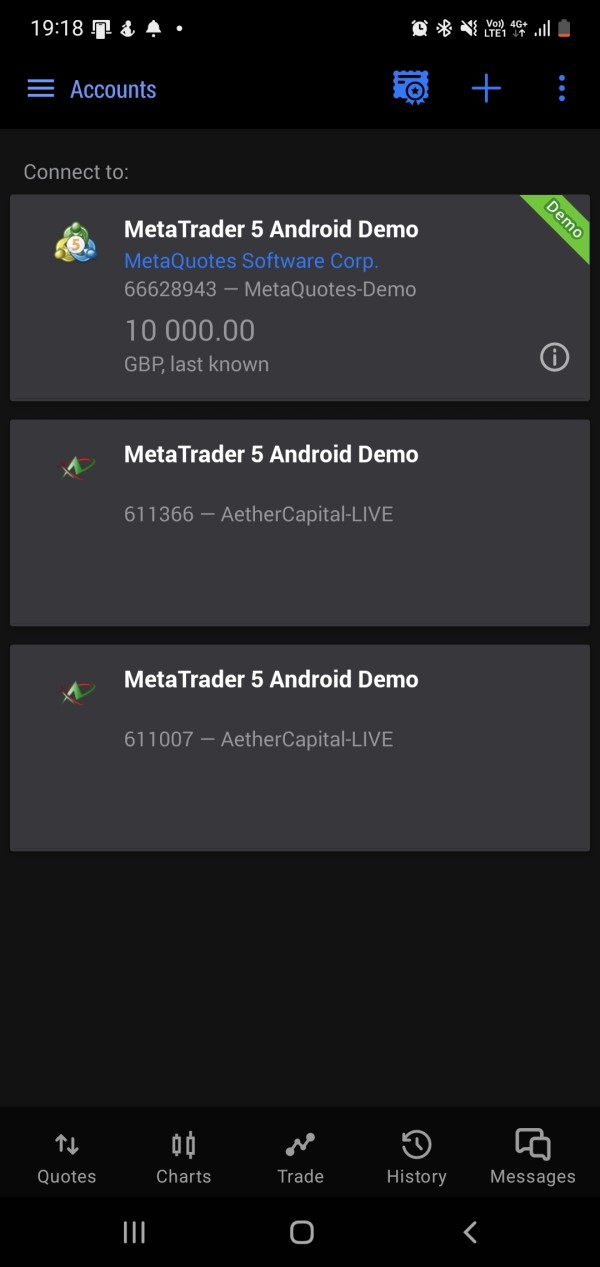

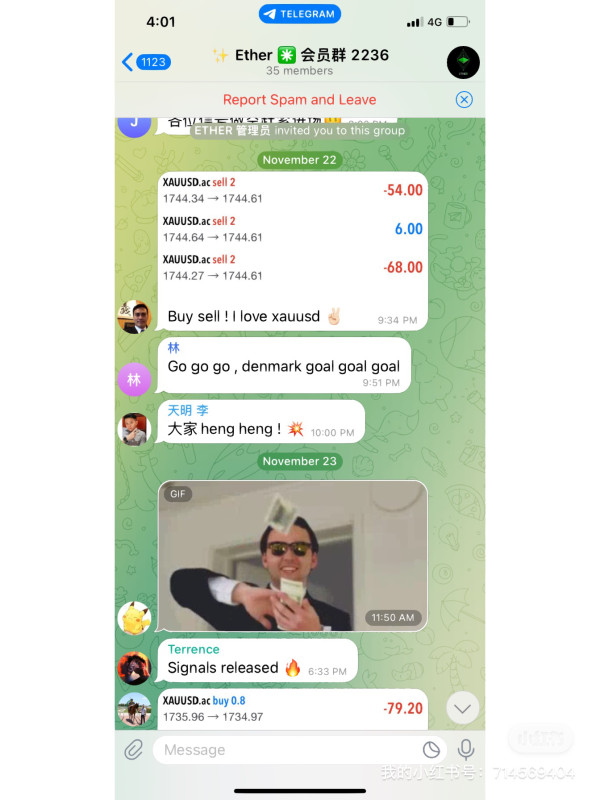

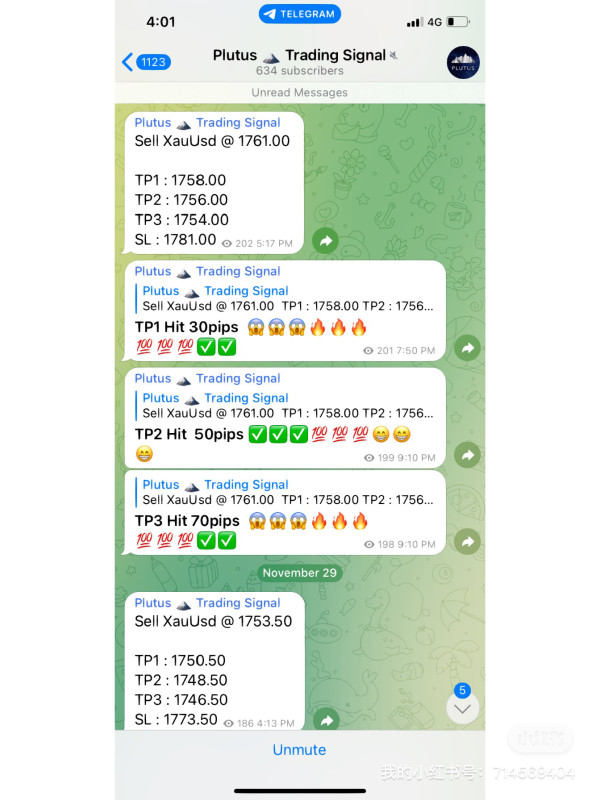

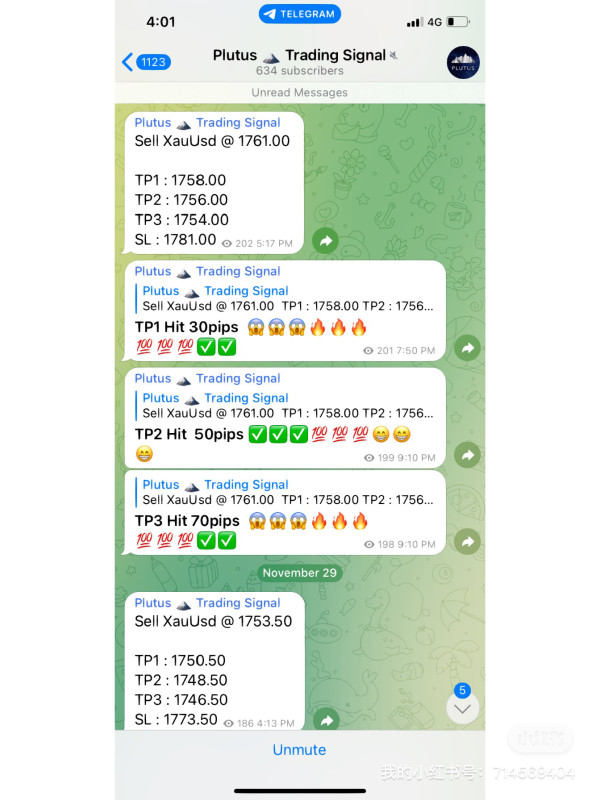

User feedback consistently highlights issues with execution speed and slippage problems that can impact trading performance and profitability. Despite these concerns, Aether Capital offers leverage up to 1:500 and utilizes the popular MT5 trading platform, providing access to multiple trading assets including forex pairs and CFDs.

The broker appears to target active traders seeking high-leverage opportunities, though the lack of regulatory oversight presents substantial risks. The platform's main appeal lies in its high leverage ratios and the robust MT5 trading environment.

However, reports of execution delays, slippage issues, and slow customer service response times have created skepticism within the trading community. Some users have questioned the broker's legitimacy due to its unregulated status and operational practices.

Given these factors, potential clients should exercise extreme caution when considering Aether Capital for their trading activities. The combination of regulatory absence and negative user experiences suggests significant risks that may outweigh potential benefits for most traders.

Important Notice

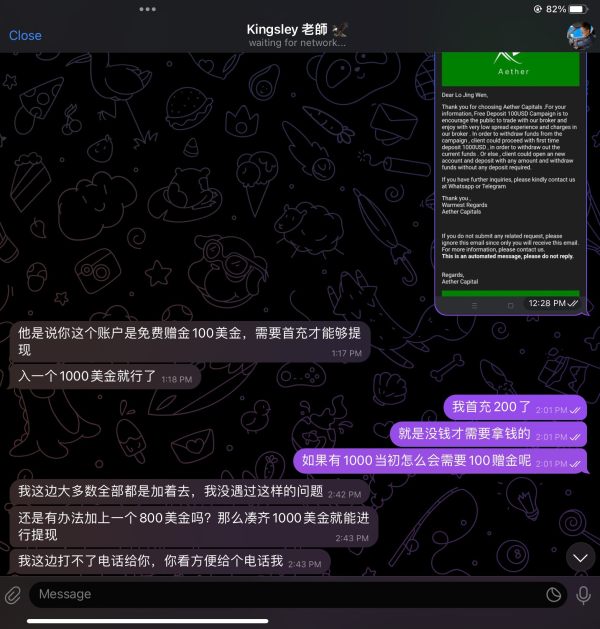

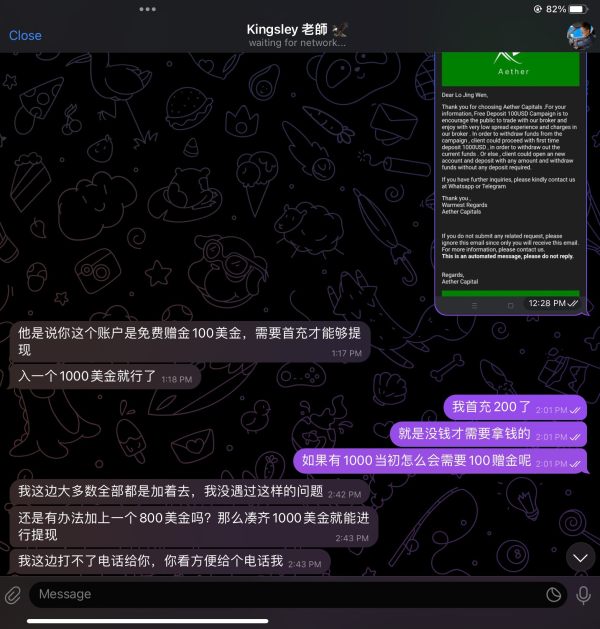

Regulatory Warning: Aether Capital is not registered with any major financial regulatory authority, including the UK Financial Conduct Authority or Hong Kong Securities and Futures Commission. This unregulated status significantly impacts the broker's legitimacy and transparency across different jurisdictions, potentially leaving traders without adequate protection.

This review is based on available public information and user feedback collected from various sources. Individual trading experiences may vary, and the information presented may not reflect every user's specific situation.

The lack of comprehensive regulatory oversight means that standard investor protections may not apply to accounts with this broker.

Rating Framework

Broker Overview

Aether Capital was established in 2015 and operates from Australia, positioning itself as an online forex broker providing trading services to international clients. The company presents a dual business model, functioning both as a forex broker and describing itself as a private lending company focused on real estate investments.

This mixed approach raises questions about the company's primary focus and expertise in financial markets. The broker's headquarters in Australia might suggest regulatory oversight, but investigations reveal that Aether Capital operates without proper licensing from Australian Securities and Investments Commission or other major regulatory bodies.

This regulatory gap creates uncertainty about the company's compliance with international trading standards and client protection protocols. In this comprehensive aether capital review, we examine how the broker's unregulated status affects its service delivery and client relationships.

The company offers forex trading services alongside CFD products, utilizing the MT5 platform to facilitate market access. However, the lack of transparent information about company ownership, financial backing, and operational procedures continues to concern potential clients seeking reliable trading partnerships.

Regulatory Status: Aether Capital operates without regulation from major financial authorities, creating significant compliance and safety concerns for potential traders.

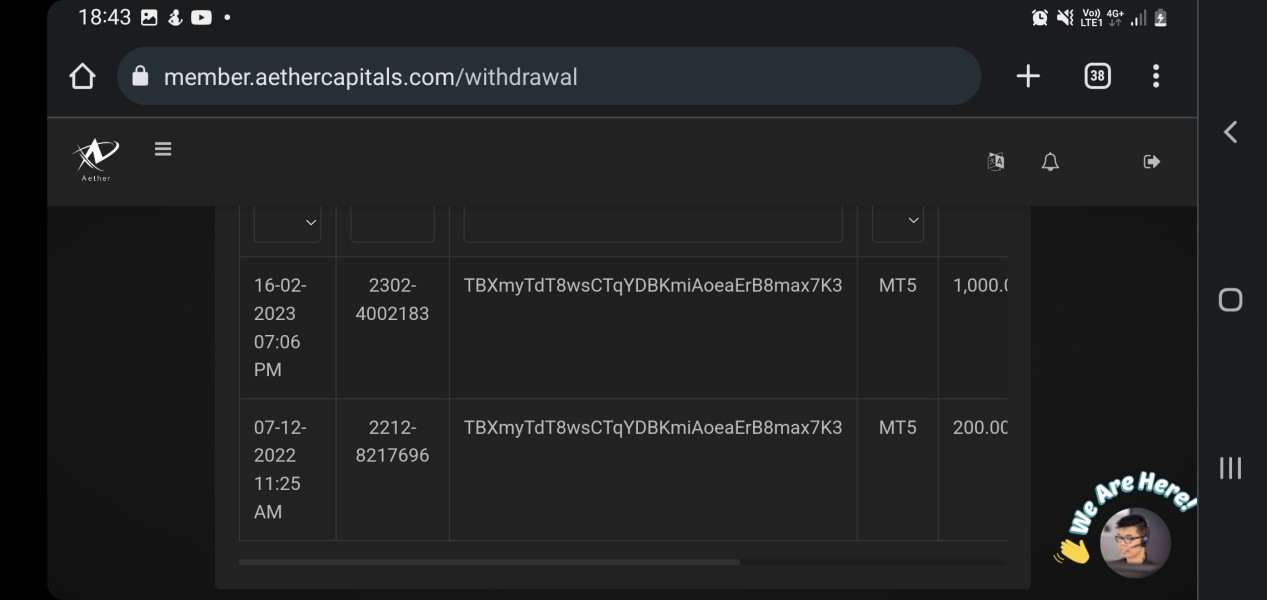

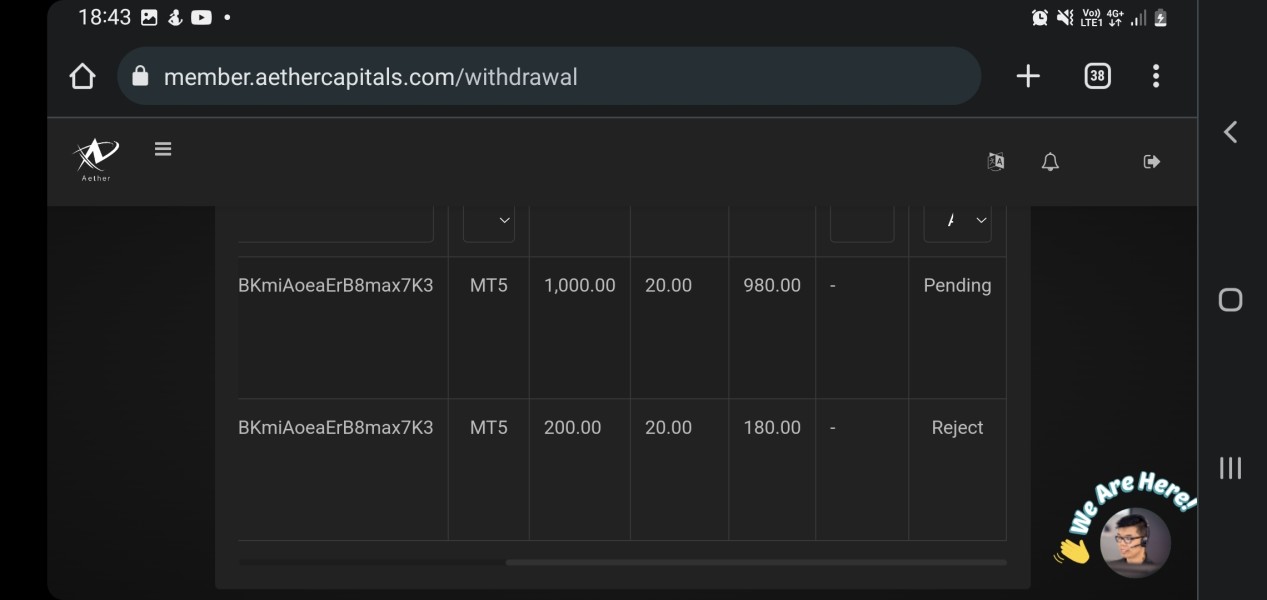

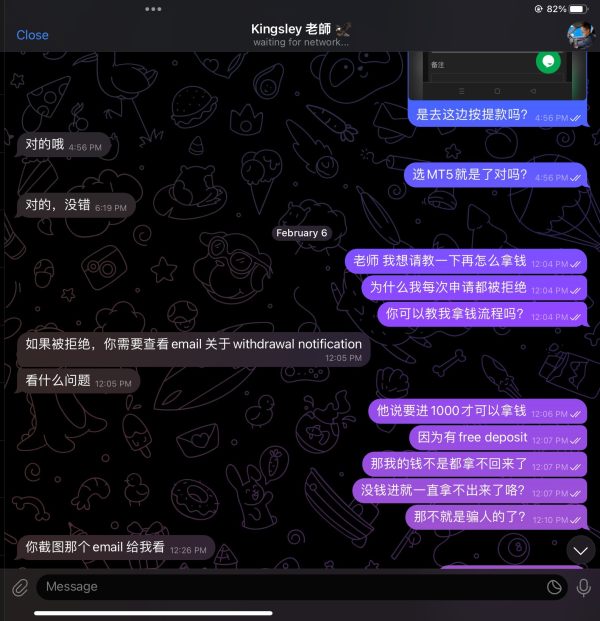

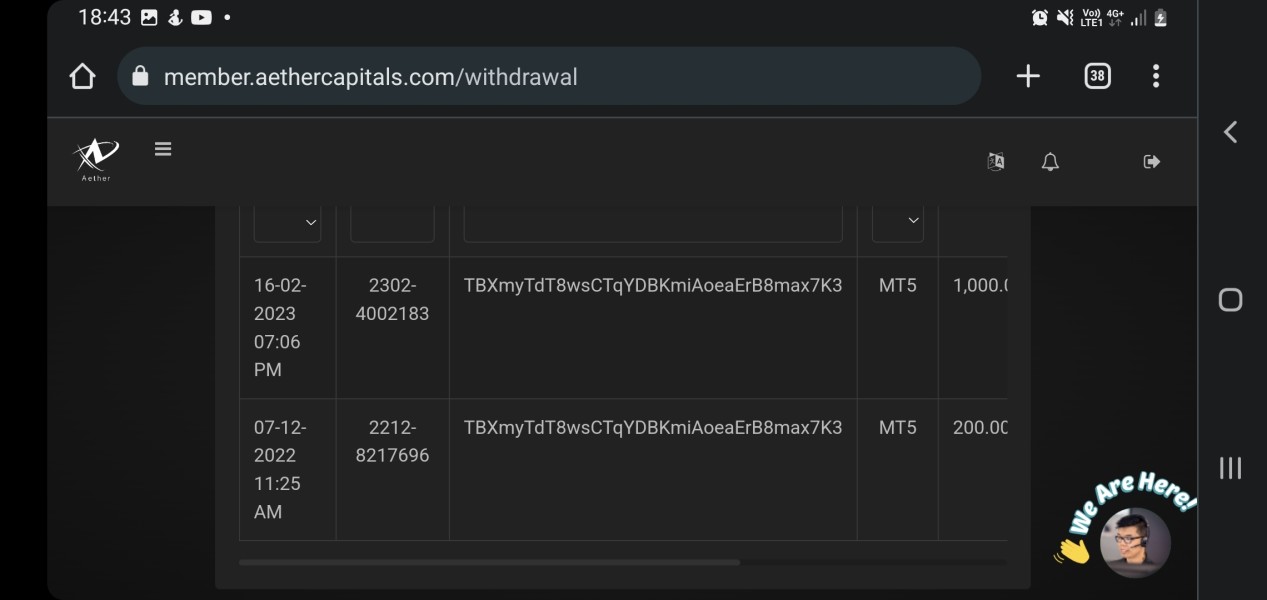

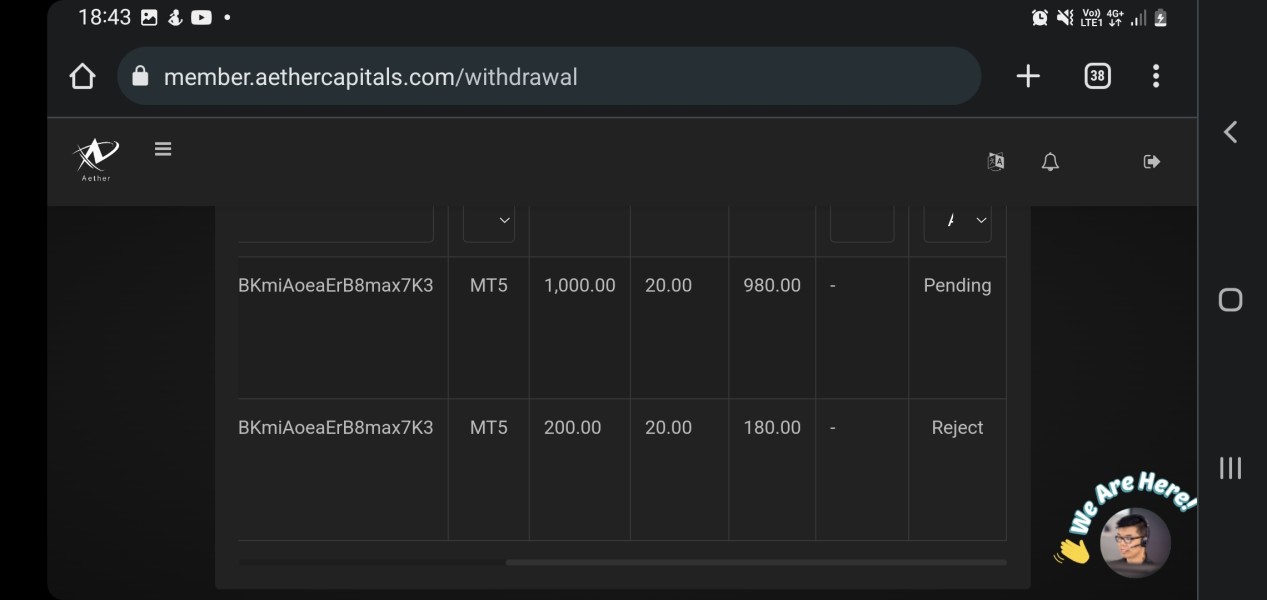

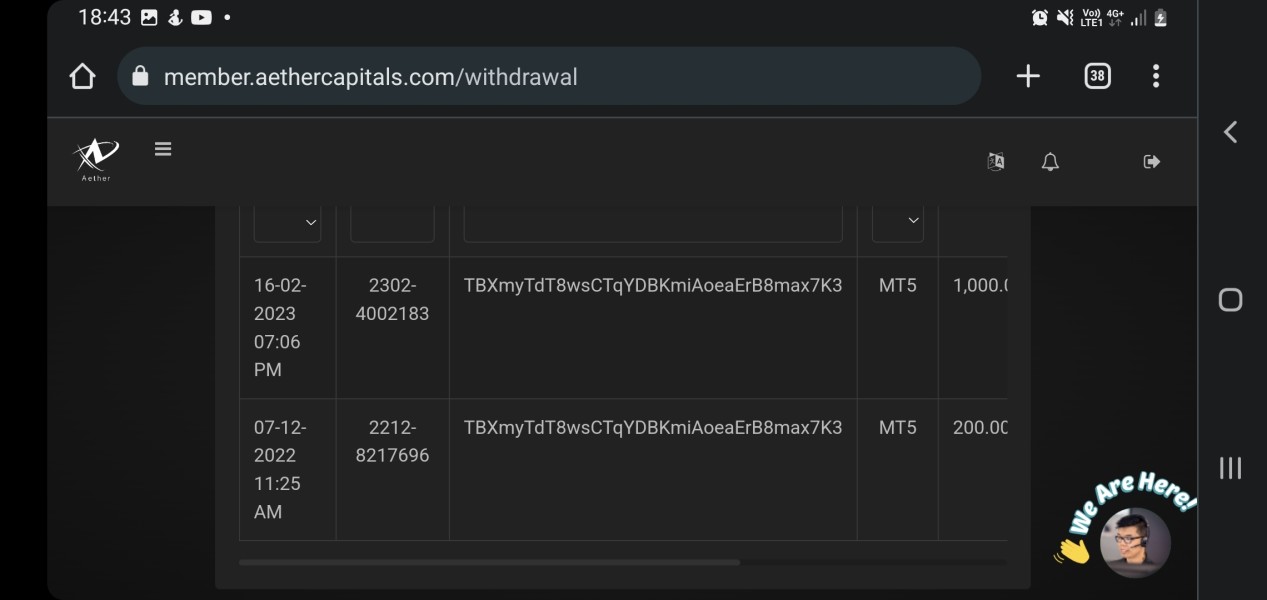

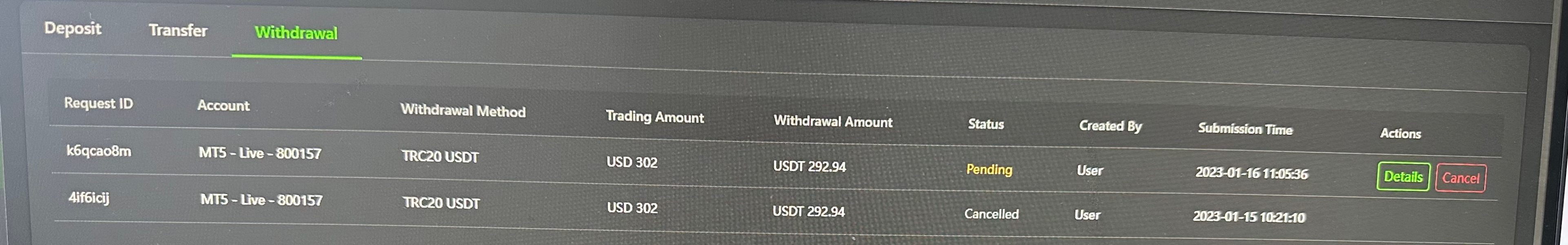

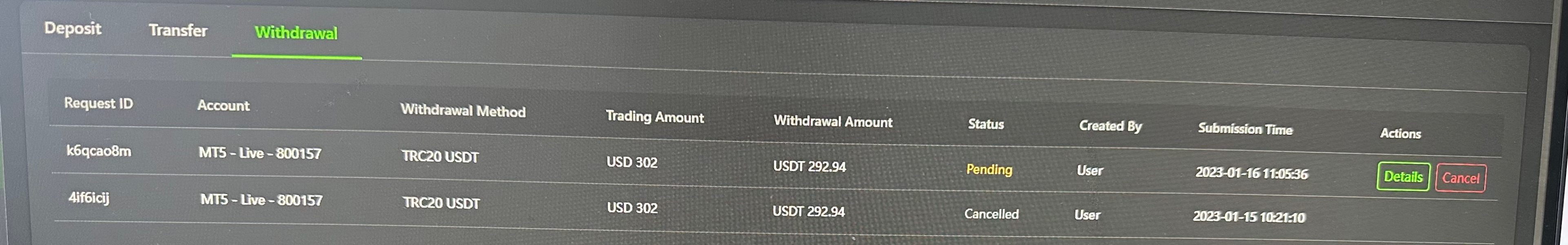

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available sources, which itself raises transparency concerns. The broker has not disclosed minimum deposit requirements in publicly available information, making it difficult for potential clients to assess accessibility.

Minimum Deposit Requirements: No specific information about promotional offers or bonus structures is available in current sources, suggesting limited marketing incentives.

Bonus and Promotions: The platform provides access to multiple trading instruments including forex currency pairs and CFD products across various asset classes. Detailed information about spreads, commissions, and other trading costs is not comprehensively available, hampering cost comparisons with regulated alternatives.

Available Trading Assets: Maximum leverage reaches 1:500, appealing to traders seeking high-leverage opportunities but also increasing risk exposure significantly.

Cost Structure: The broker utilizes the MT5 trading platform, which is recognized for its advanced features and analytical capabilities. Specific regional limitations for account opening are not clearly outlined in available documentation.

Leverage Ratios: This aether capital review reveals concerning gaps in basic operational transparency that regulated brokers typically provide as standard practice.

Platform Options: Geographic restrictions for account opening are not clearly outlined in available documentation.

Geographic Restrictions: This aether capital review reveals concerning gaps in basic operational transparency that regulated brokers typically provide as standard practice.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Aether Capital's account conditions present significant transparency issues that negatively impact potential client assessment. The broker fails to provide clear information about available account types, their specific features, or the benefits associated with different account tiers.

This lack of disclosure prevents traders from making informed decisions about which account structure best suits their trading style and capital requirements. The absence of clearly stated minimum deposit requirements further complicates the evaluation process for potential clients.

Most reputable brokers provide detailed account specifications, including deposit thresholds, account benefits, and upgrade pathways. Aether Capital's failure to provide this basic information suggests either poor operational organization or deliberate opacity.

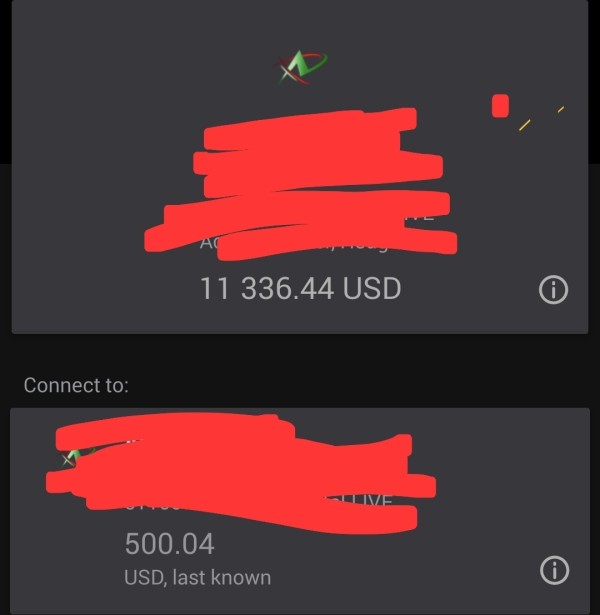

User feedback regarding account conditions remains limited due to the broker's relatively small client base and questionable operational practices. The high leverage offering of 1:500 represents the primary attractive feature, but this benefit is overshadowed by the lack of comprehensive account information and regulatory protection.

In this aether capital review, the account conditions receive a below-average rating due to insufficient transparency and missing essential information that traders require for informed decision-making.

The MT5 trading platform represents Aether Capital's strongest offering, providing users with advanced charting capabilities, automated trading support, and comprehensive market analysis tools. MT5's reputation for stability and functionality offers some reassurance to traders concerned about platform reliability, though this advantage is diminished by the broker's overall operational concerns.

However, beyond the MT5 platform, information about additional trading tools, educational resources, or market analysis services remains unclear. Established brokers typically provide comprehensive educational materials, market research, daily analysis, and trading calculators to support client success.

The absence of detailed information about these supplementary resources suggests limited investment in client development and support. The platform's mobile accessibility and web-based trading options are standard MT5 features, but specific customizations or enhancements provided by Aether Capital are not documented.

This lack of platform differentiation makes it difficult to assess the broker's commitment to providing superior trading technology or user experience improvements.

Customer Service Analysis (Score: 3/10)

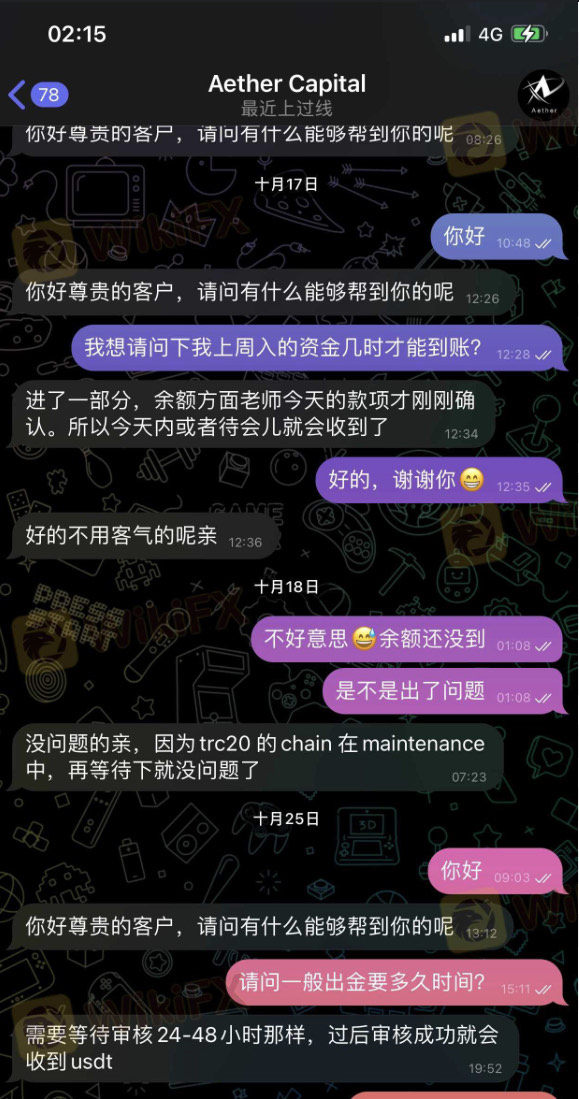

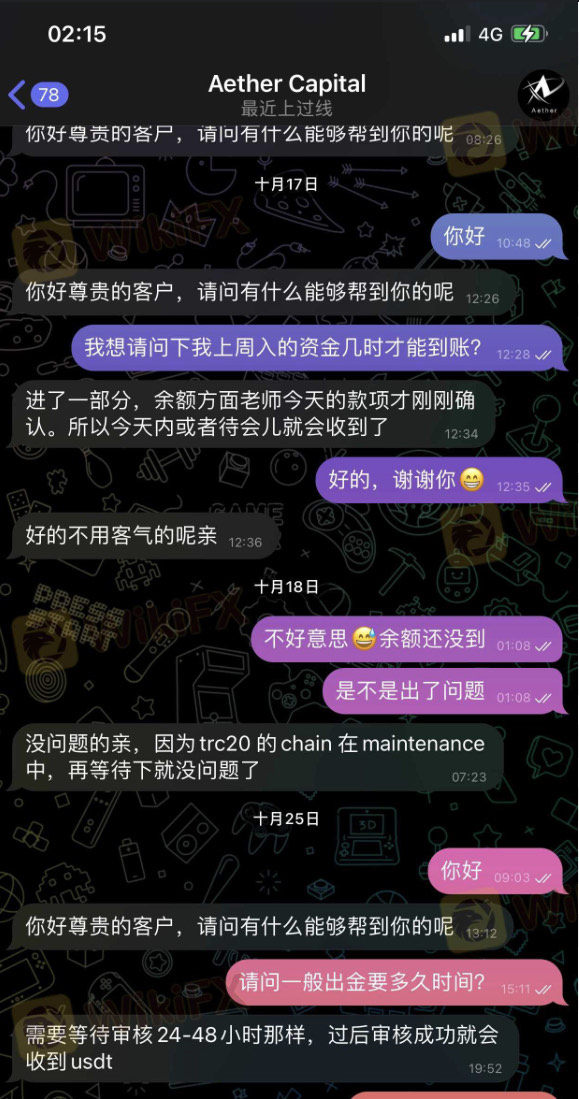

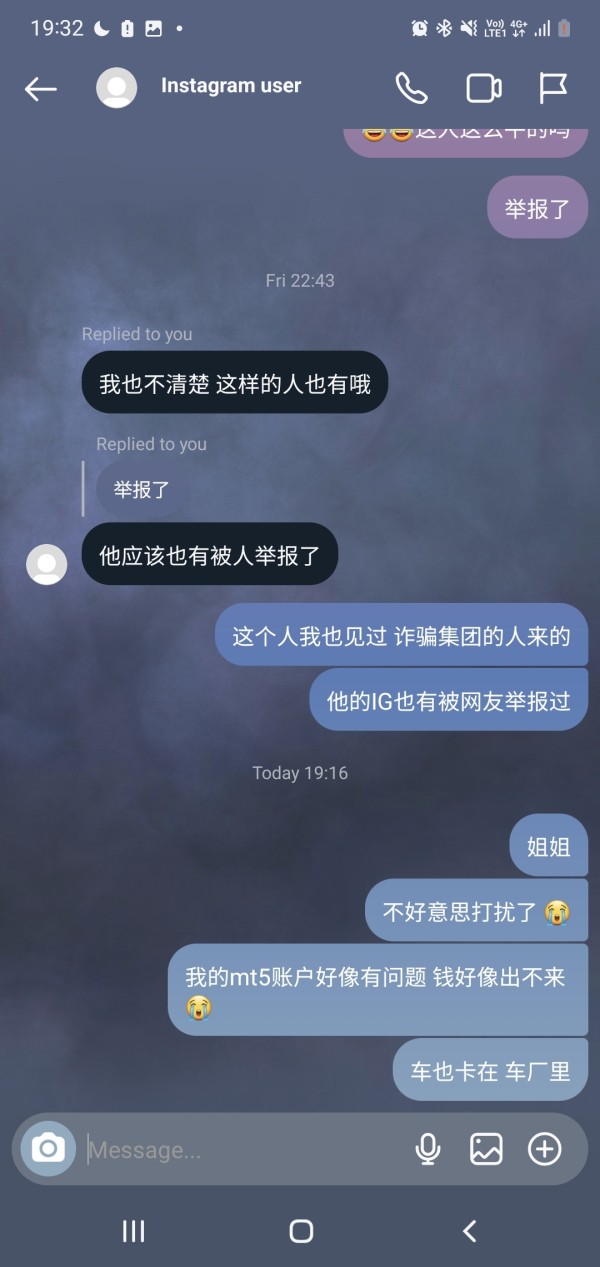

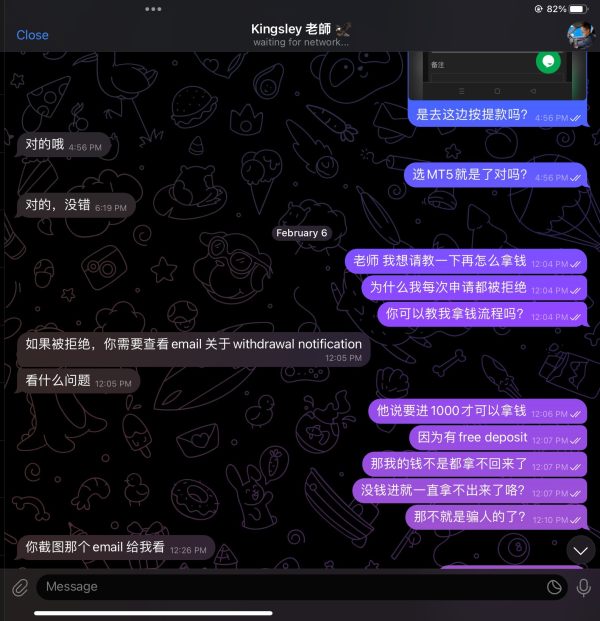

Customer service quality represents a significant weakness in Aether Capital's operations, with user feedback consistently highlighting slow response times and inadequate problem resolution capabilities. The lack of comprehensive customer support channels and extended response delays create frustration for traders requiring timely assistance with technical issues or account-related inquiries.

Available information does not specify the customer service hours, available communication channels, or support team expertise levels. Professional forex brokers typically offer 24/5 support through multiple channels including live chat, phone, and email with guaranteed response times.

Aether Capital's apparent deficiencies in these areas significantly impact client satisfaction and operational reliability. The absence of multilingual support options and unclear escalation procedures for complex issues further compound customer service problems.

Traders requiring immediate assistance during volatile market conditions may find themselves without adequate support, potentially resulting in missed opportunities or unresolved technical problems affecting their trading performance.

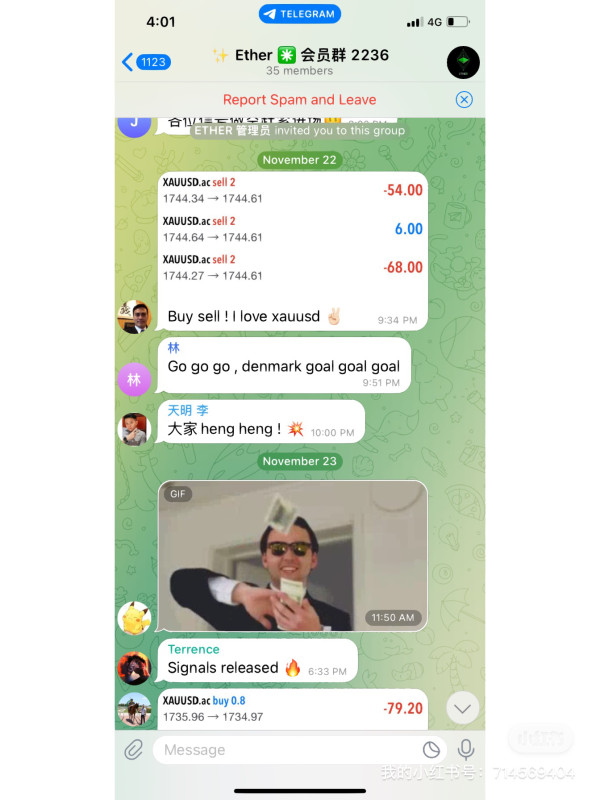

Trading Experience Analysis (Score: 4/10)

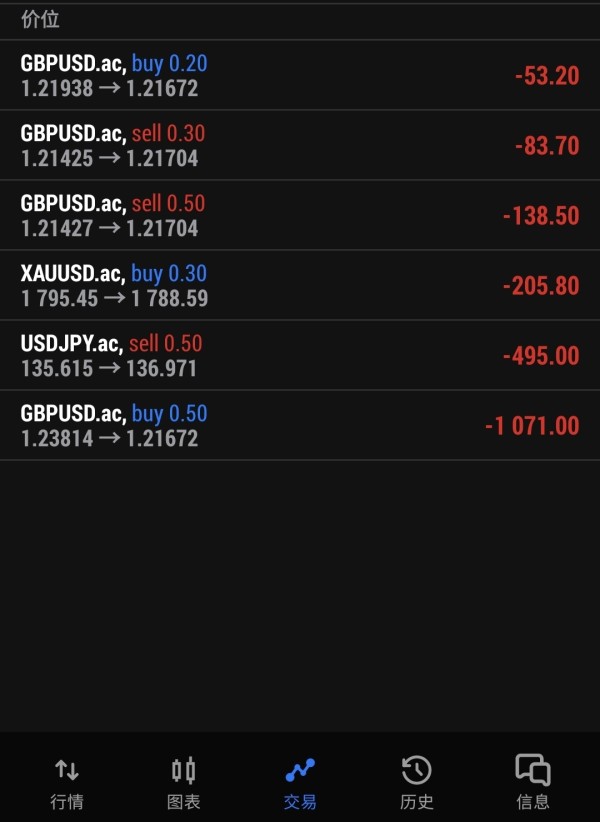

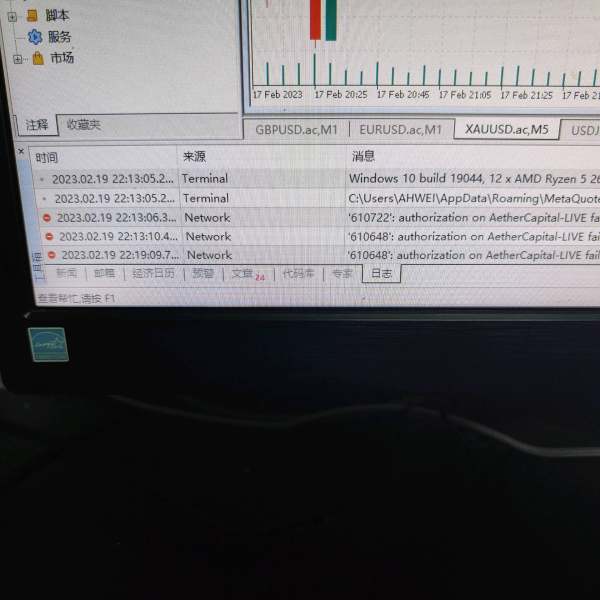

User feedback consistently identifies execution speed and slippage issues as primary concerns affecting trading experience quality. These technical problems can significantly impact trading profitability, particularly for scalping strategies or during high-volatility market conditions where precise execution timing becomes critical for success.

The MT5 platform's inherent capabilities provide solid foundation for trading activities, but server quality, liquidity provision, and order execution infrastructure appear to fall short of professional standards. Traders report delays in order processing and unexpected slippage that suggests inadequate technological investment or poor liquidity arrangements with market makers.

Mobile trading functionality and platform stability information remains limited in available sources, making it difficult to assess the complete trading experience across different devices and market conditions. The lack of detailed performance metrics or third-party execution quality assessments further hampers objective evaluation of the trading environment.

In this aether capital review, trading experience receives below-average ratings due to documented execution problems and insufficient information about platform performance improvements or technological investments.

Trust and Safety Analysis (Score: 2/10)

The absence of regulatory oversight represents the most significant trust and safety concern for Aether Capital clients. Operating without licenses from major financial authorities means traders lack access to compensation schemes, regulatory complaint procedures, and standard investor protection mechanisms that regulated brokers must provide.

Fund segregation practices, insurance coverage, and financial auditing procedures remain undisclosed, creating uncertainty about client money protection and company financial stability. Reputable brokers typically provide detailed information about their banking relationships, audit procedures, and regulatory compliance measures to build client confidence.

The mixed business model combining forex brokerage with real estate lending raises additional questions about operational focus and potential conflicts of interest. This diversification might indicate unstable revenue streams or unclear business priorities that could affect service quality and long-term viability.

User concerns about legitimacy and operational transparency reflect the broader trust issues created by unregulated status and limited disclosure practices.

User Experience Analysis (Score: 5/10)

Overall user satisfaction appears mixed, with platform interface receiving neutral feedback while operational issues significantly impact the overall experience. The registration and verification processes lack clear documentation, potentially creating confusion for new clients attempting to establish trading accounts.

Account management features and user interface customization options are not well-documented, making it difficult to assess the platform's user-friendliness beyond basic MT5 functionality. Professional brokers typically invest in user experience improvements including streamlined onboarding, intuitive account management, and comprehensive platform tutorials.

The limited positive feedback available suggests some users appreciate the high leverage availability and MT5 platform access, but these benefits are consistently overshadowed by execution problems and customer service deficiencies. Long-term user retention appears problematic given the documented operational issues and trust concerns.

Conclusion

Aether Capital faces significant challenges as an unregulated forex broker, with user trust and execution quality representing primary areas of concern. The broker's unregulated status creates substantial risks for traders seeking reliable market access and adequate investor protection.

While the 1:500 leverage ratio may attract active traders seeking high-leverage opportunities, these benefits are overshadowed by documented operational deficiencies and regulatory absence. The combination of execution problems, slow customer service, and lack of transparency makes Aether Capital unsuitable for most traders, particularly those prioritizing safety and reliability.

Potential clients should carefully consider regulated alternatives that provide comprehensive investor protection and transparent operational practices before committing funds to unregulated platforms.